Sprinklr, Inc.

CXM NYSE

Weekly Report

Sprinklr, Inc. closed at 7.7900 (0.26% WoW) . Data window ends Mon, 15 Sep 2025.

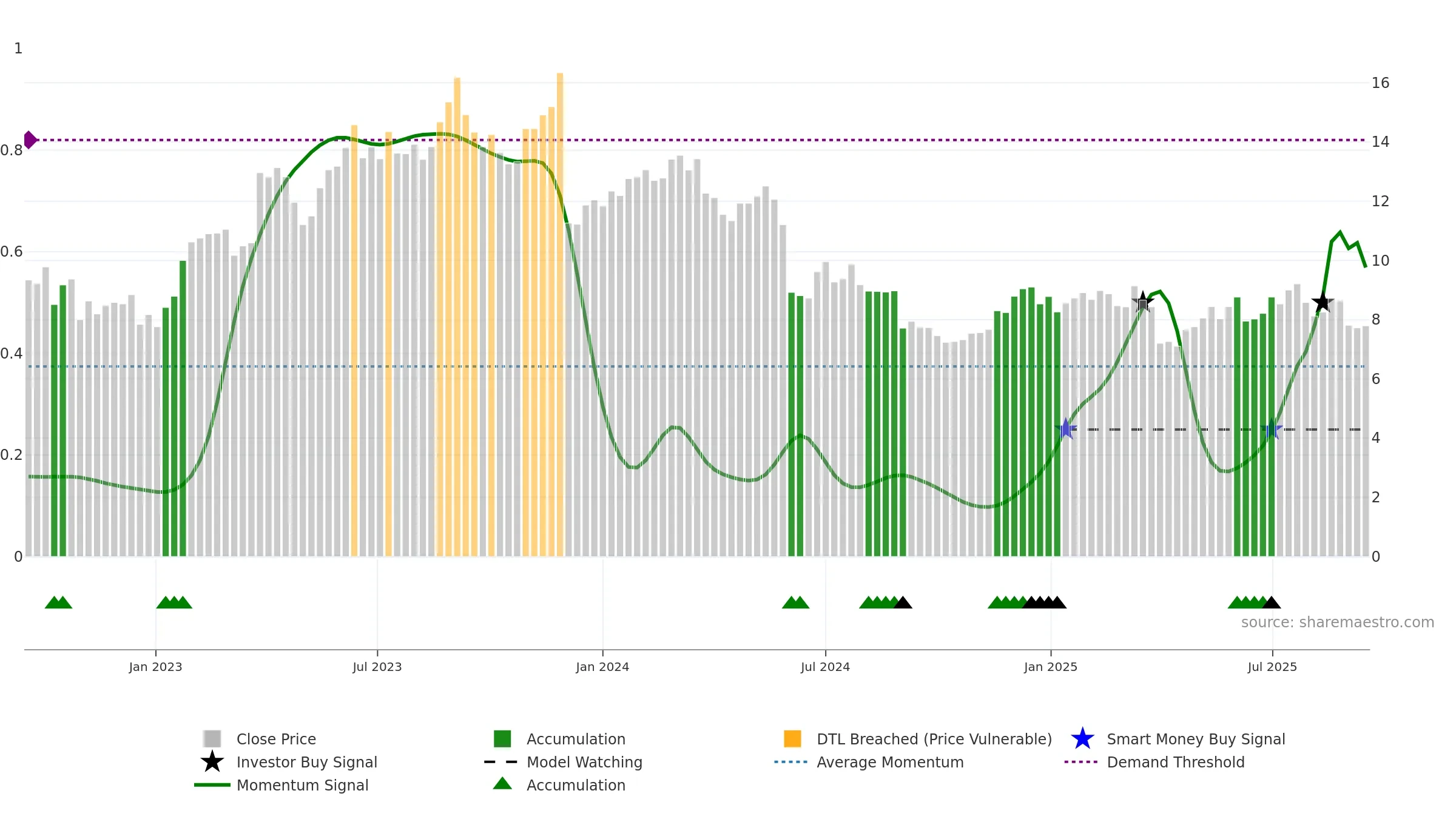

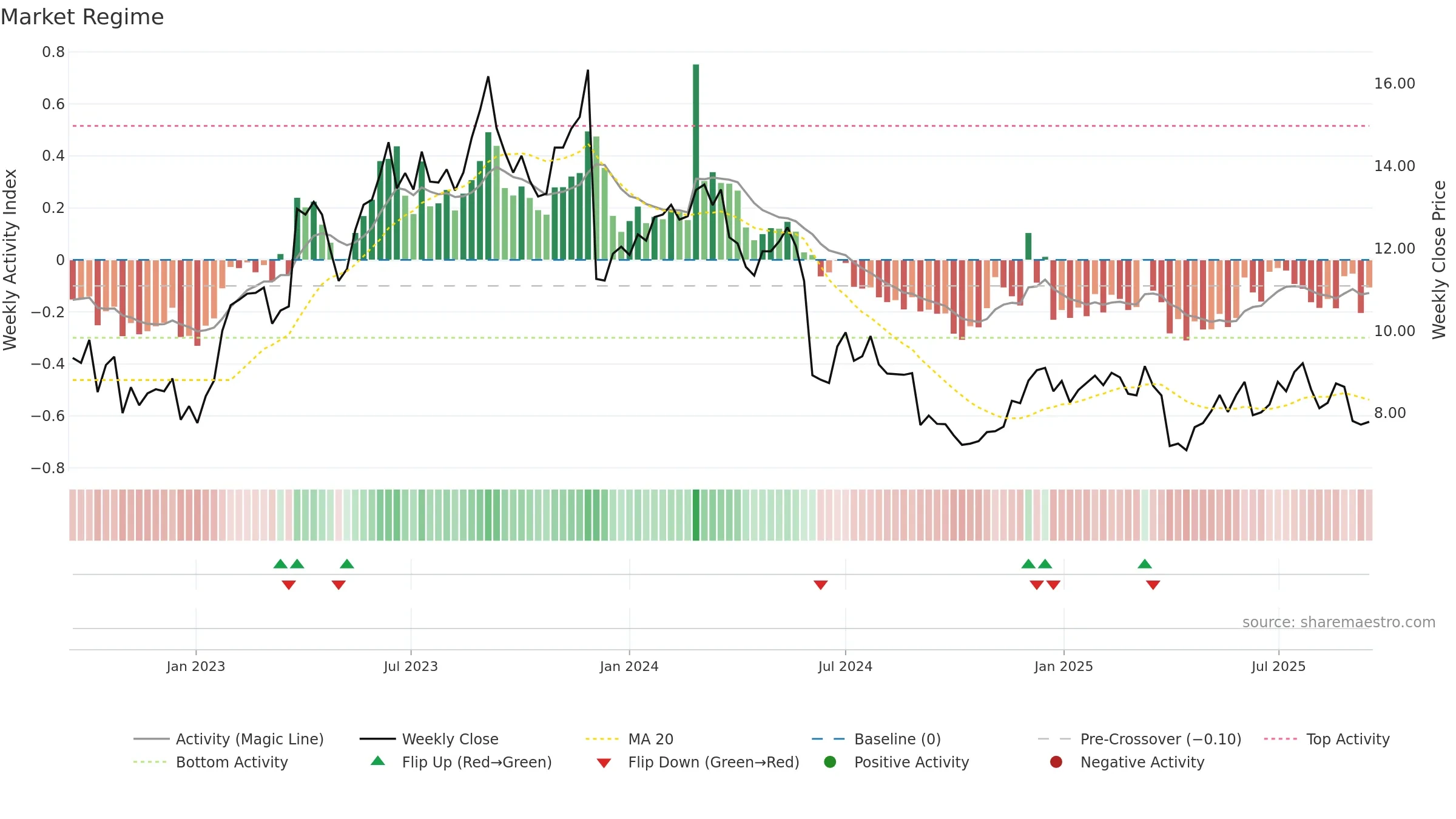

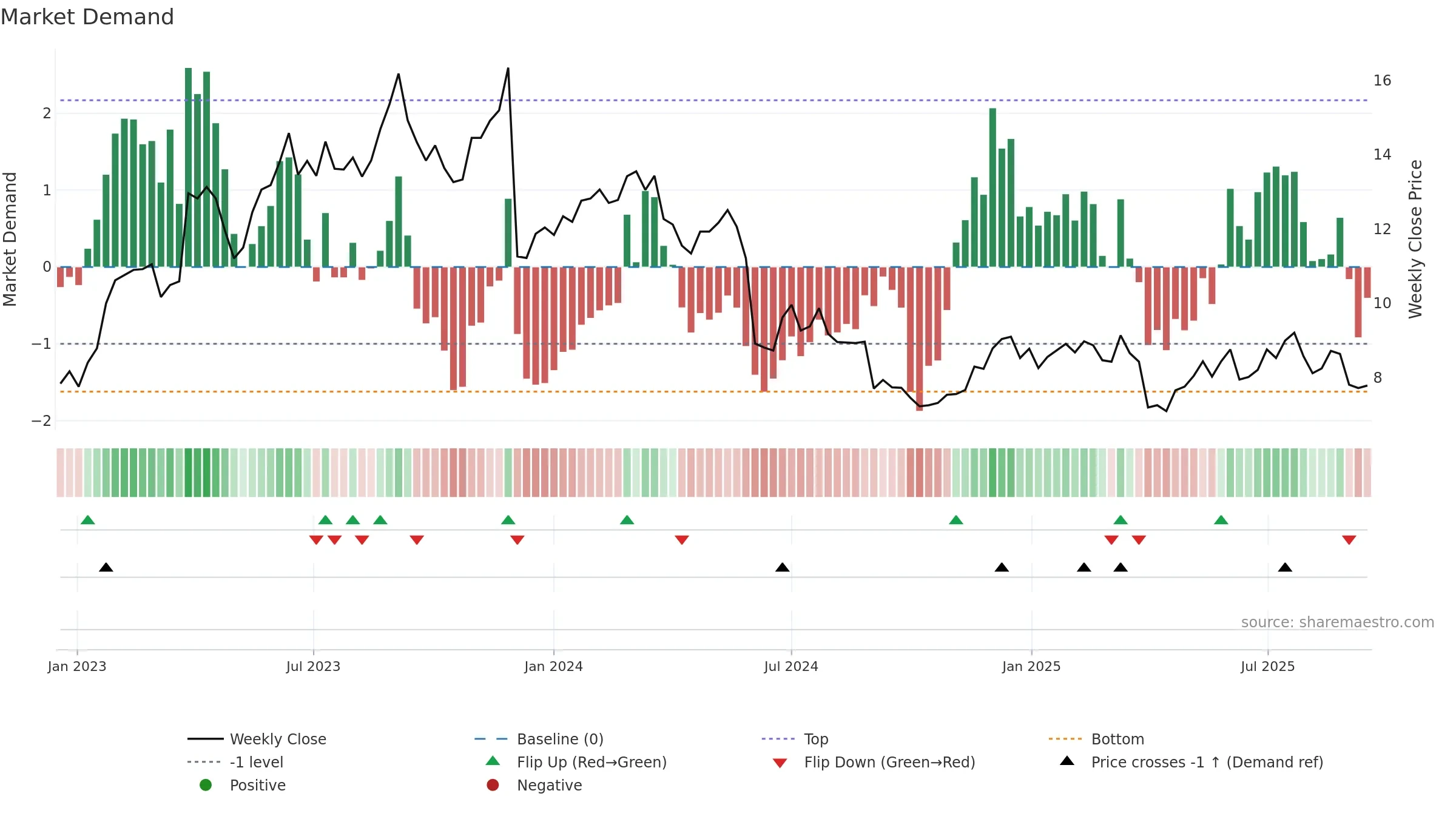

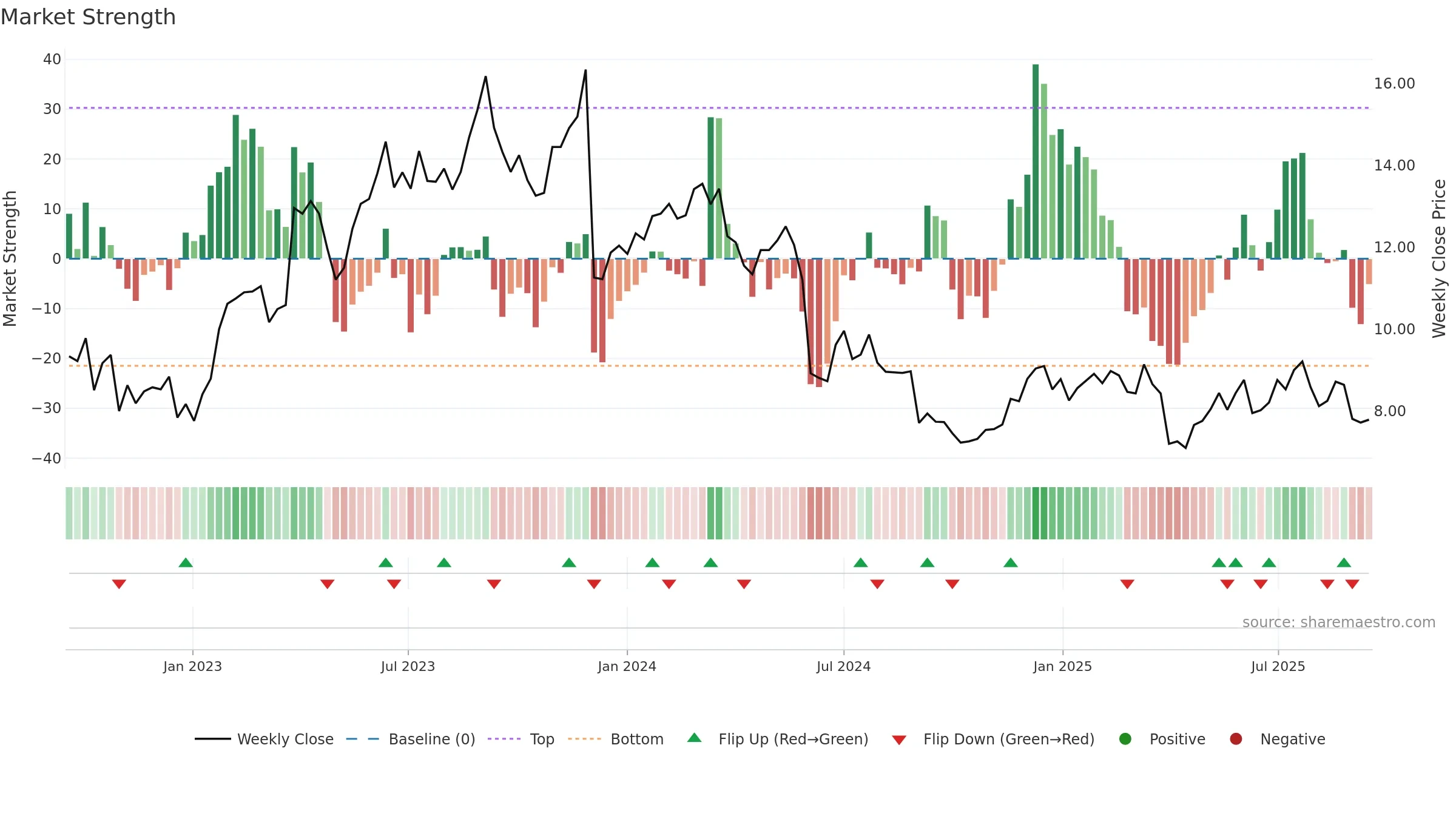

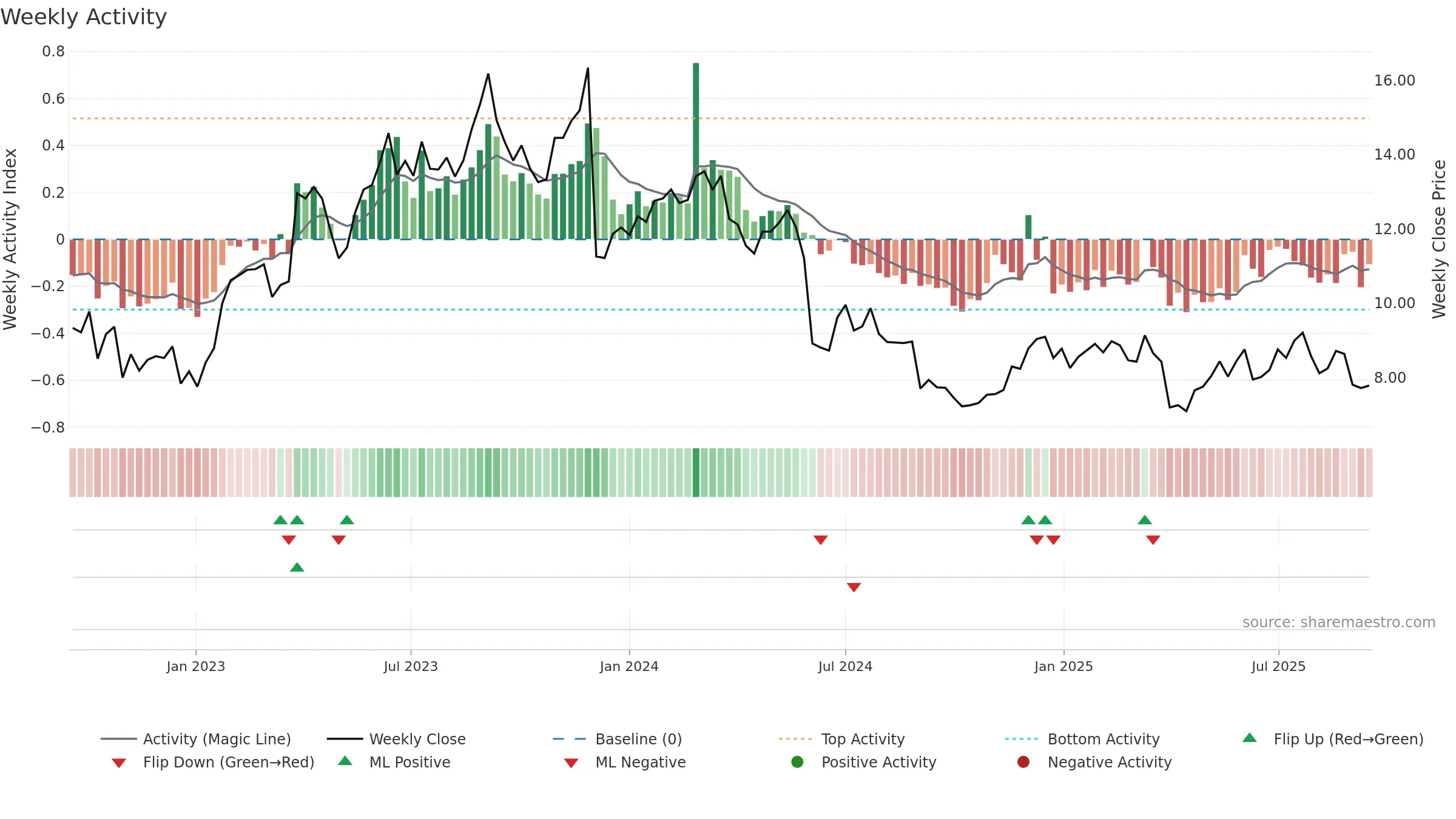

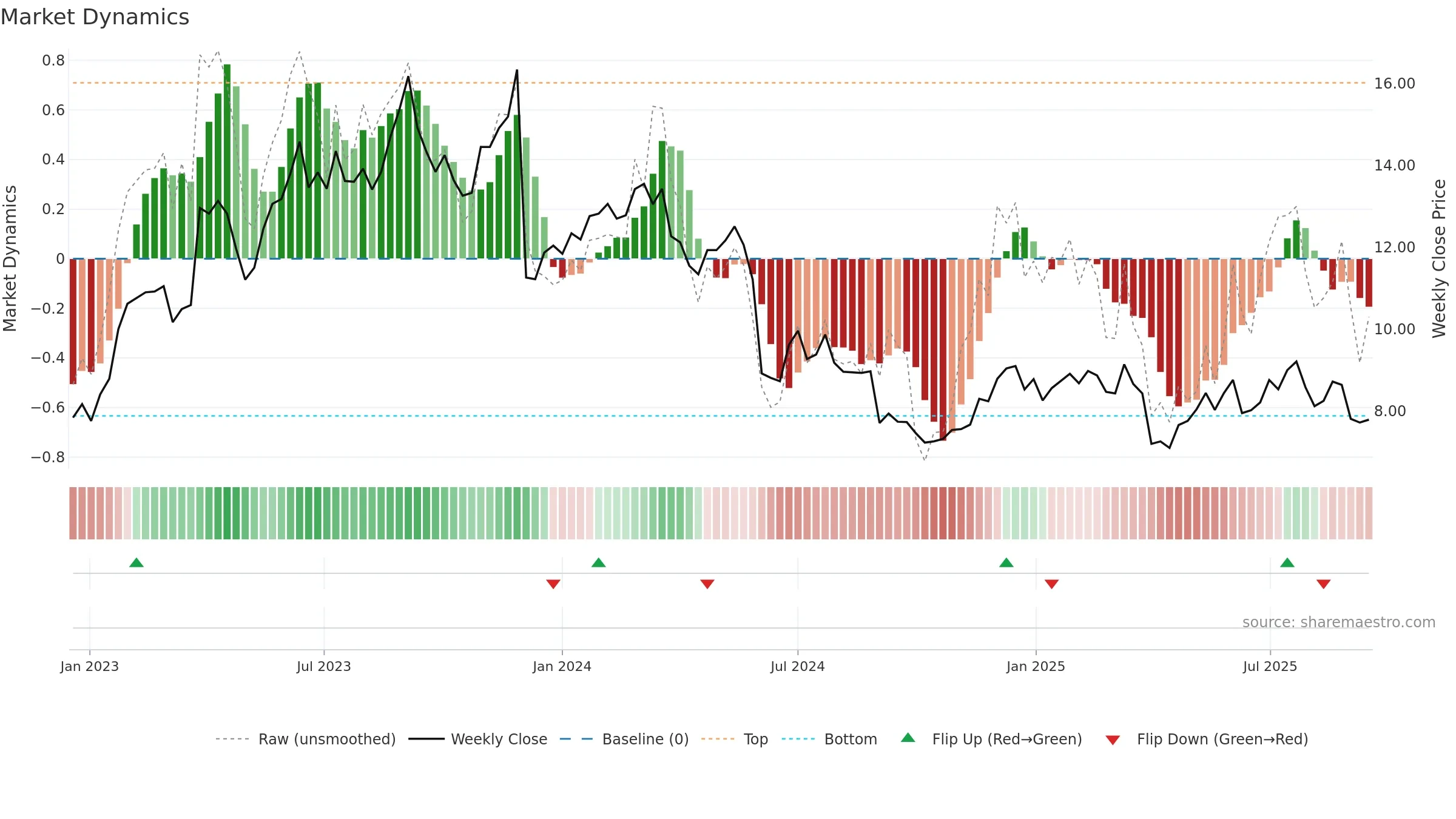

How to read this — Price slope is downward, indicating persistent supply pressure. Elevated weekly volatility increases whipsaw risk. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity. Price sits below key averages, keeping pressure on the tape.

Down-slope argues for patience; rallies can fade sooner unless participation improves. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

Gauge maps the trend signal to a 0–100 scale.

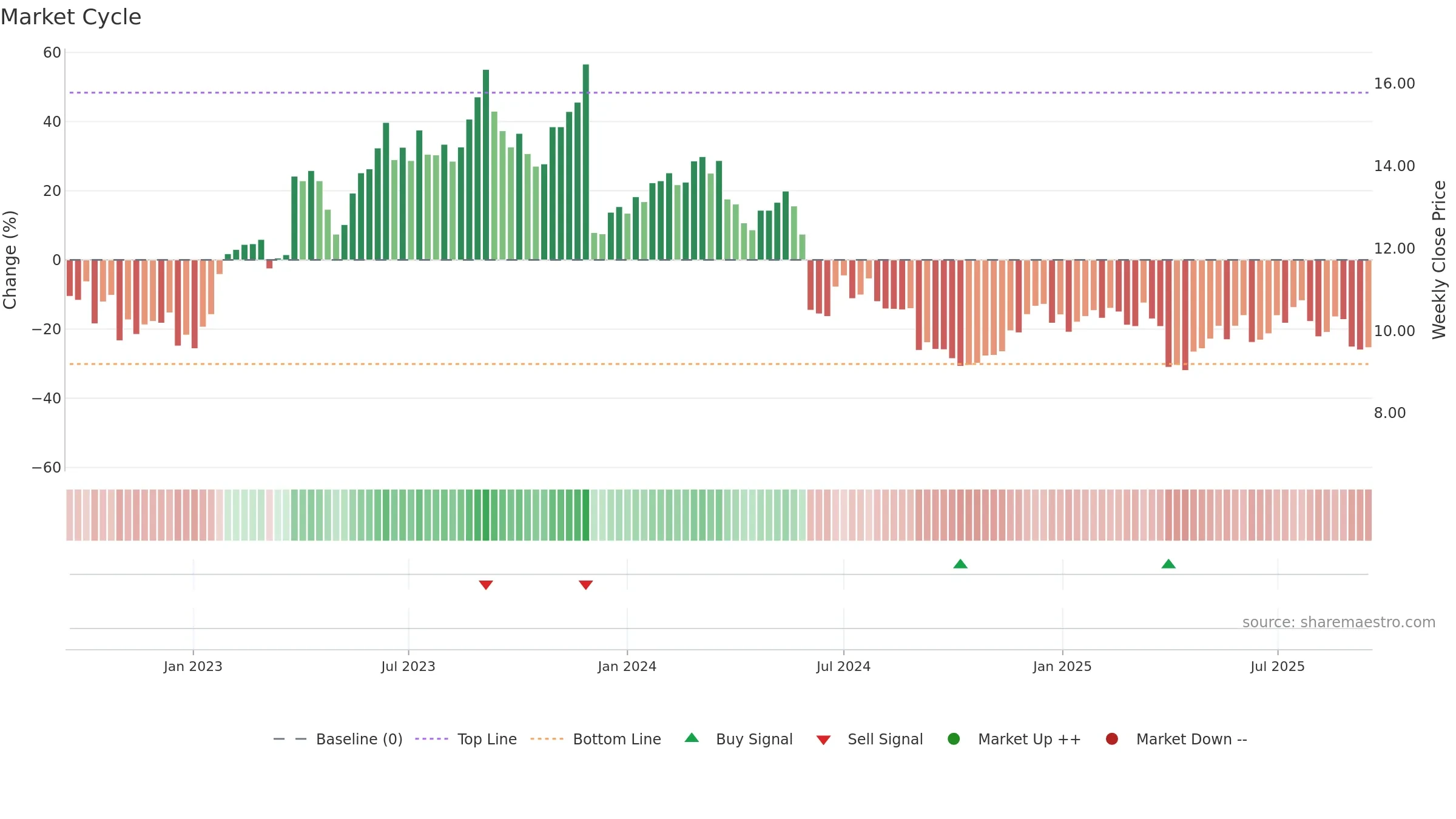

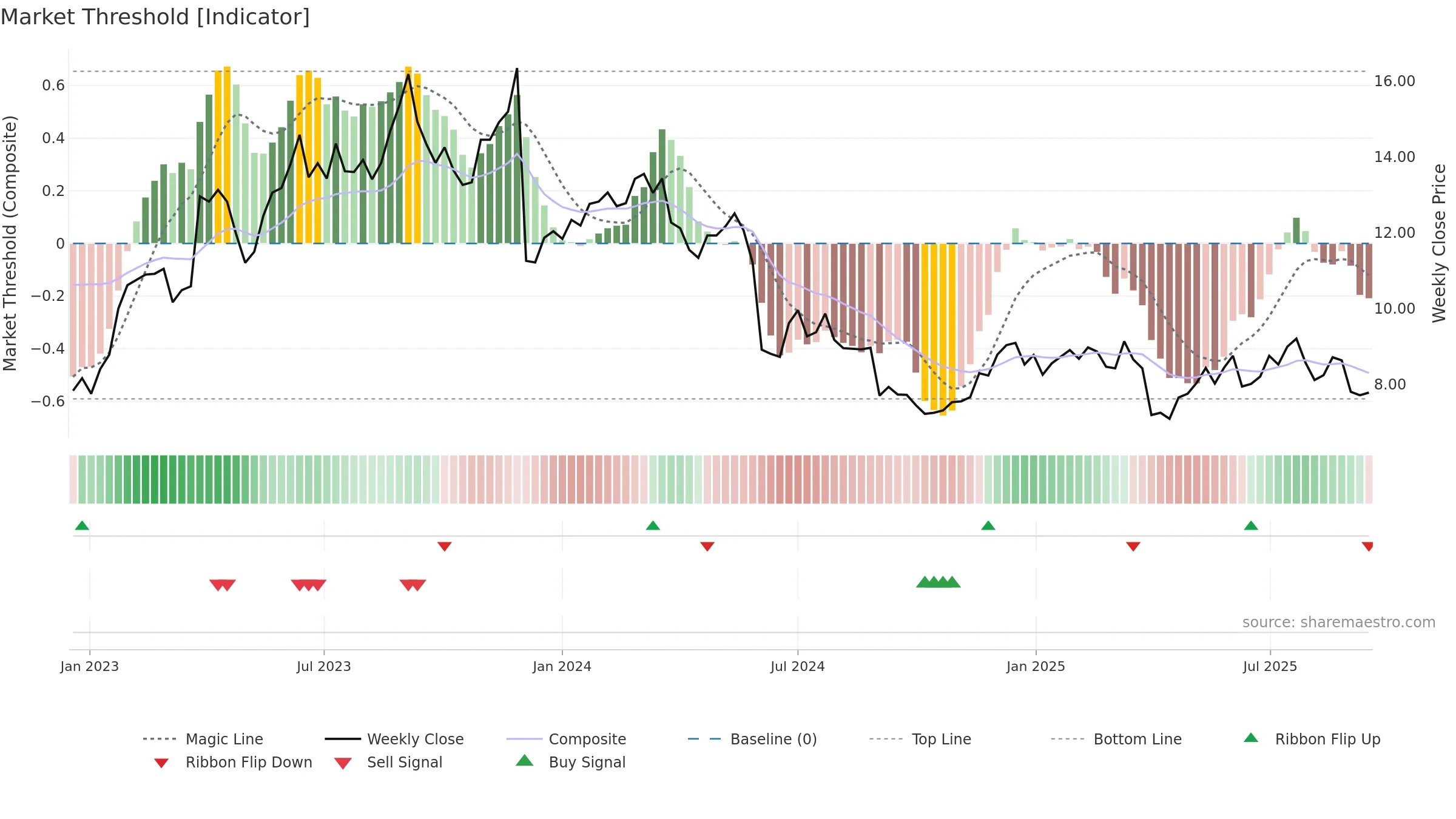

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

Price is above fair value; upside may be capped without catalysts.

Conclusion

Negative setup. ★★☆☆☆ confidence. Price window: -9. Trend: Range / Neutral; gauge 56. In combination, liquidity diverges from price.

- Price is not above key averages

- Liquidity diverges from price

- High return volatility raises whipsaw risk

- Negative multi-week performance

Why: Price window -9.21% over 8w. Close is -10.67% below the prior-window high. Return volatility 4.54%. Volume trend rising. Liquidity divergence with price. Trend state range / neutral. Momentum neutral and rising. Valuation limited upside without catalysts.

Tip: Most metrics include a hover tooltip where they appear in the report.