IRIS Business Services Limited

IRIS NSE

Weekly Report

IRIS Business Services Limited closed at 308.2500 (1.72% WoW) . Data window ends Mon, 15 Sep 2025.

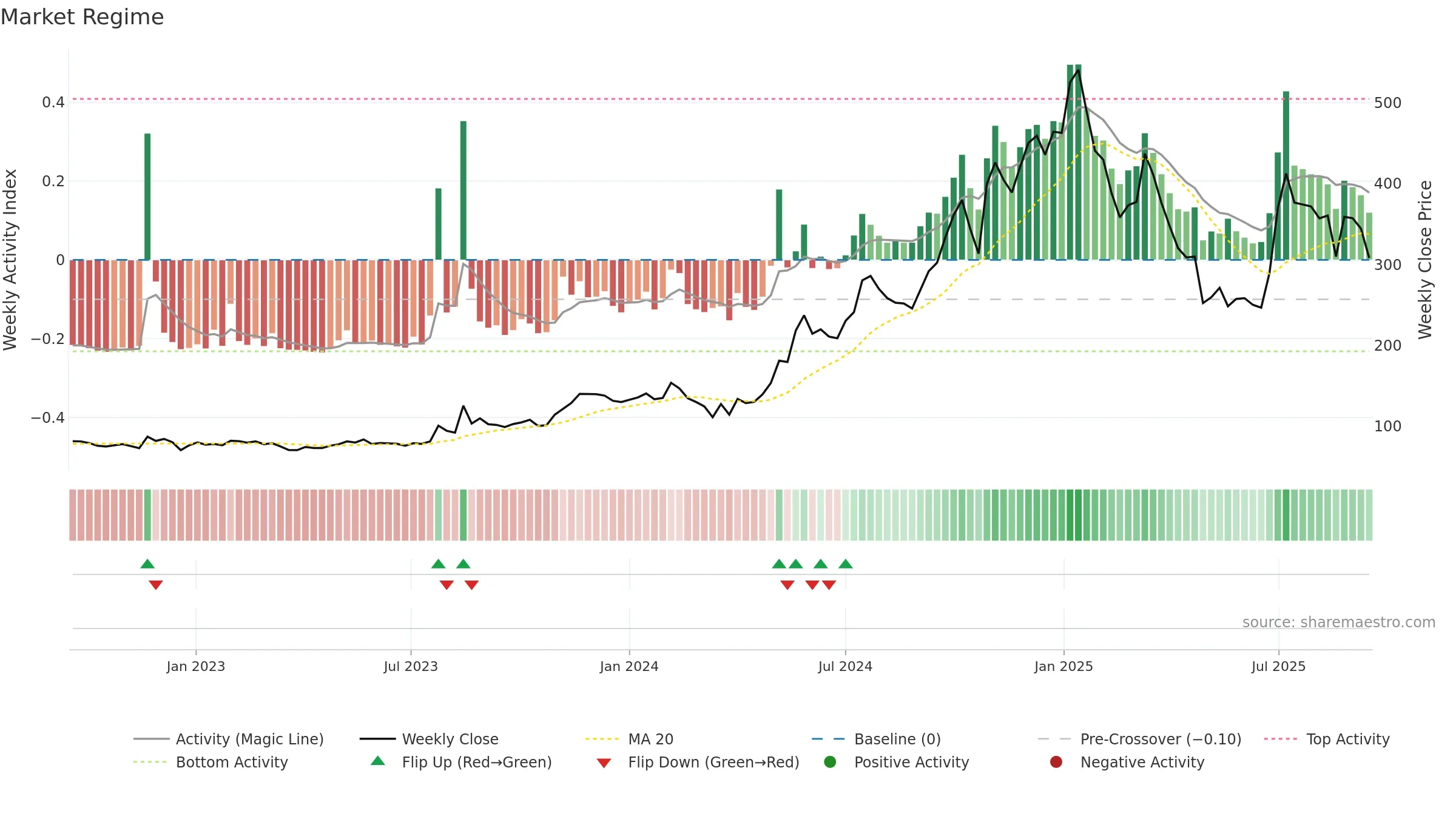

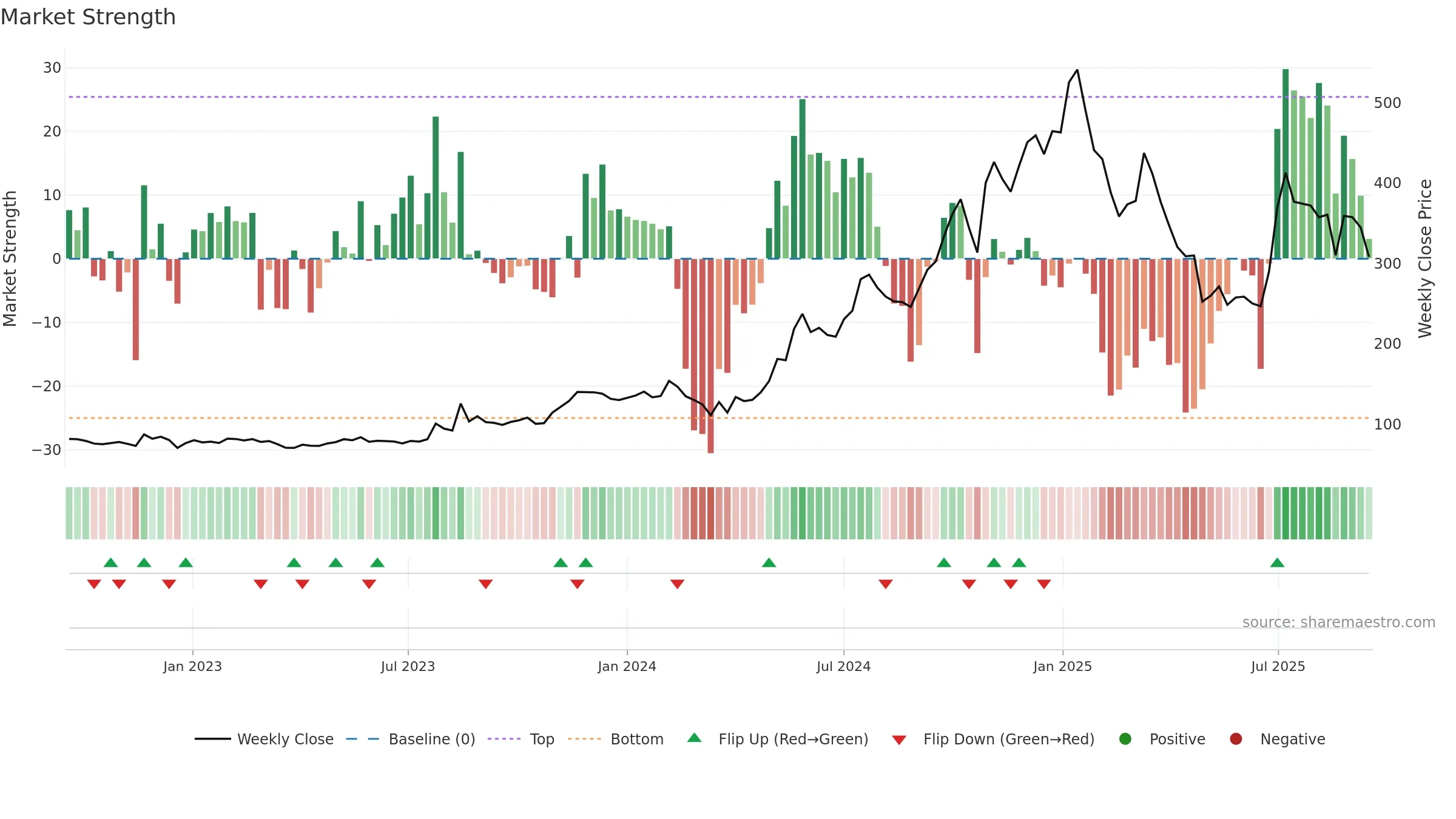

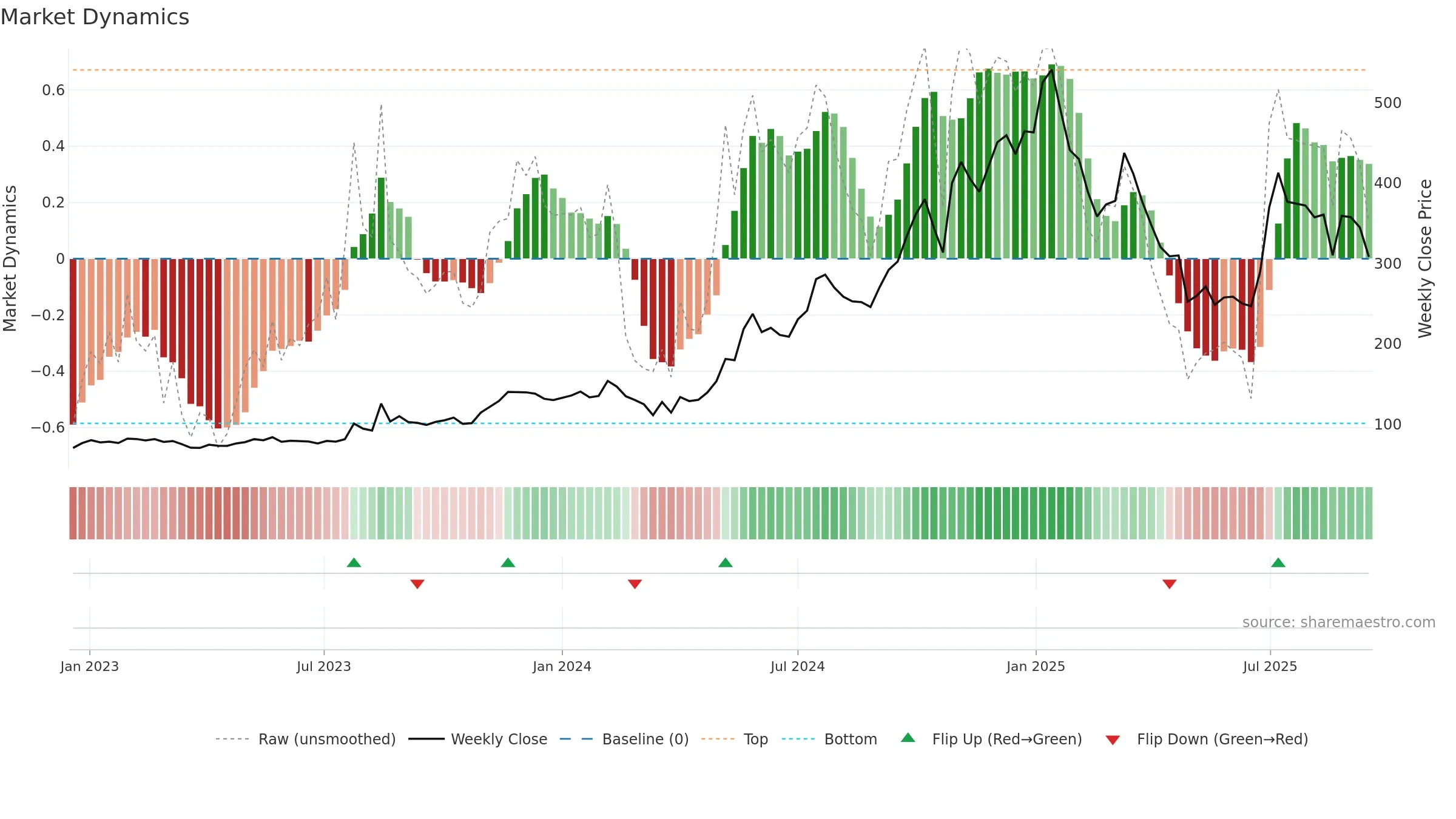

How to read this — Price slope is downward, indicating persistent supply pressure. Volume and price are moving in the same direction — a constructive confirmation. Distance to baseline is narrowing — reverting closer to its fair-value track. Price sits below key averages, keeping pressure on the tape.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

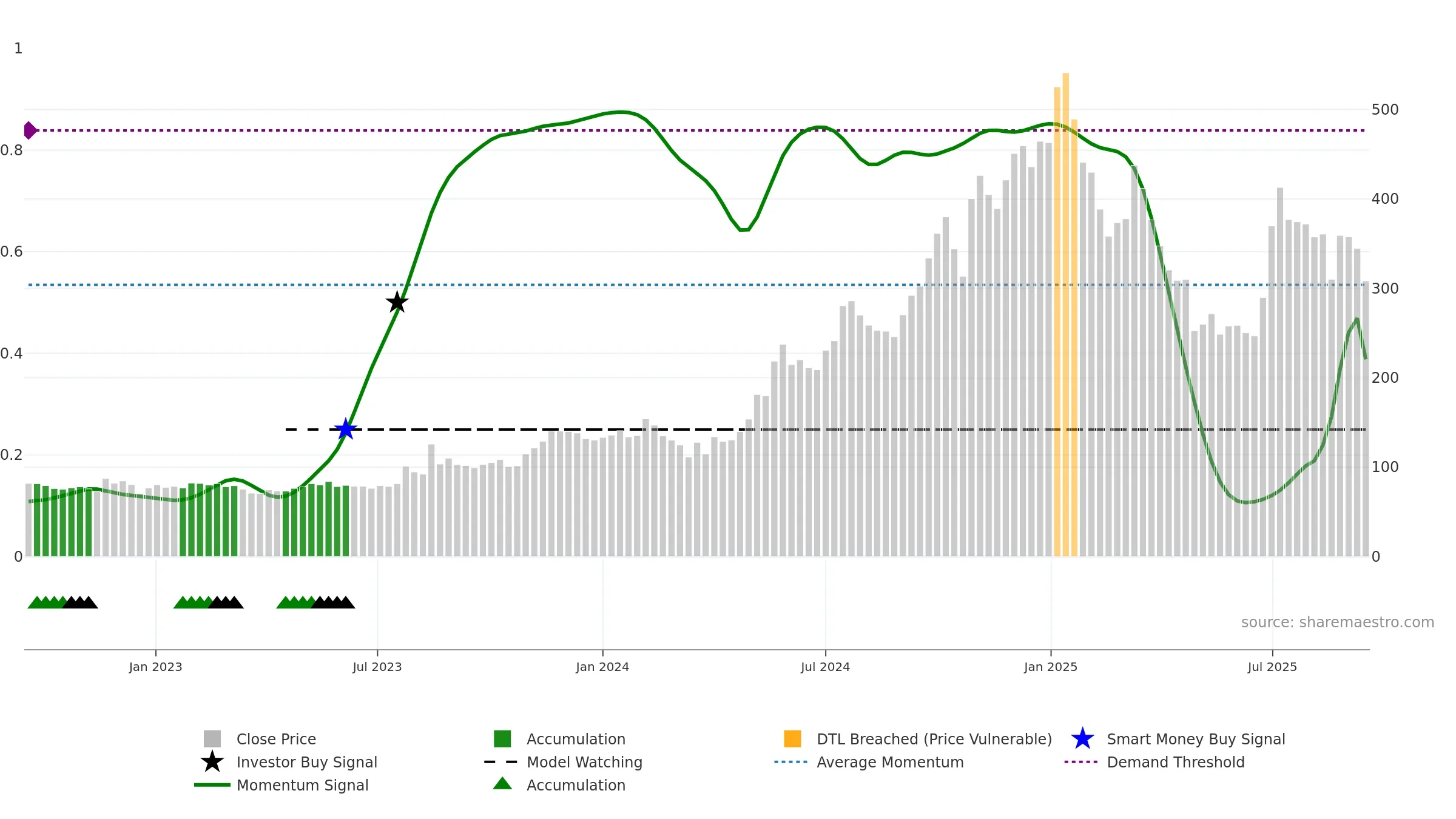

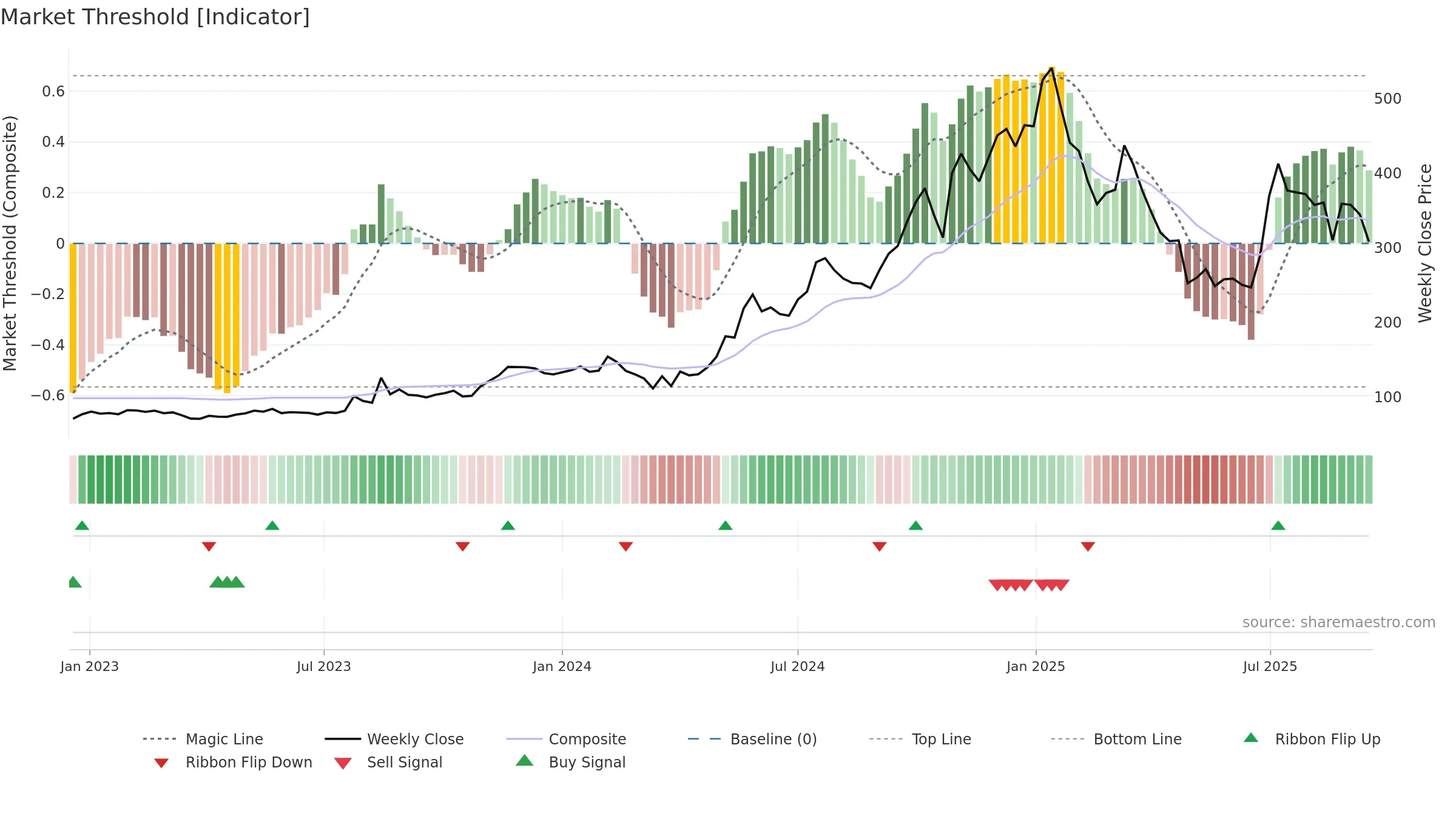

Gauge maps the trend signal to a 0–100 scale.

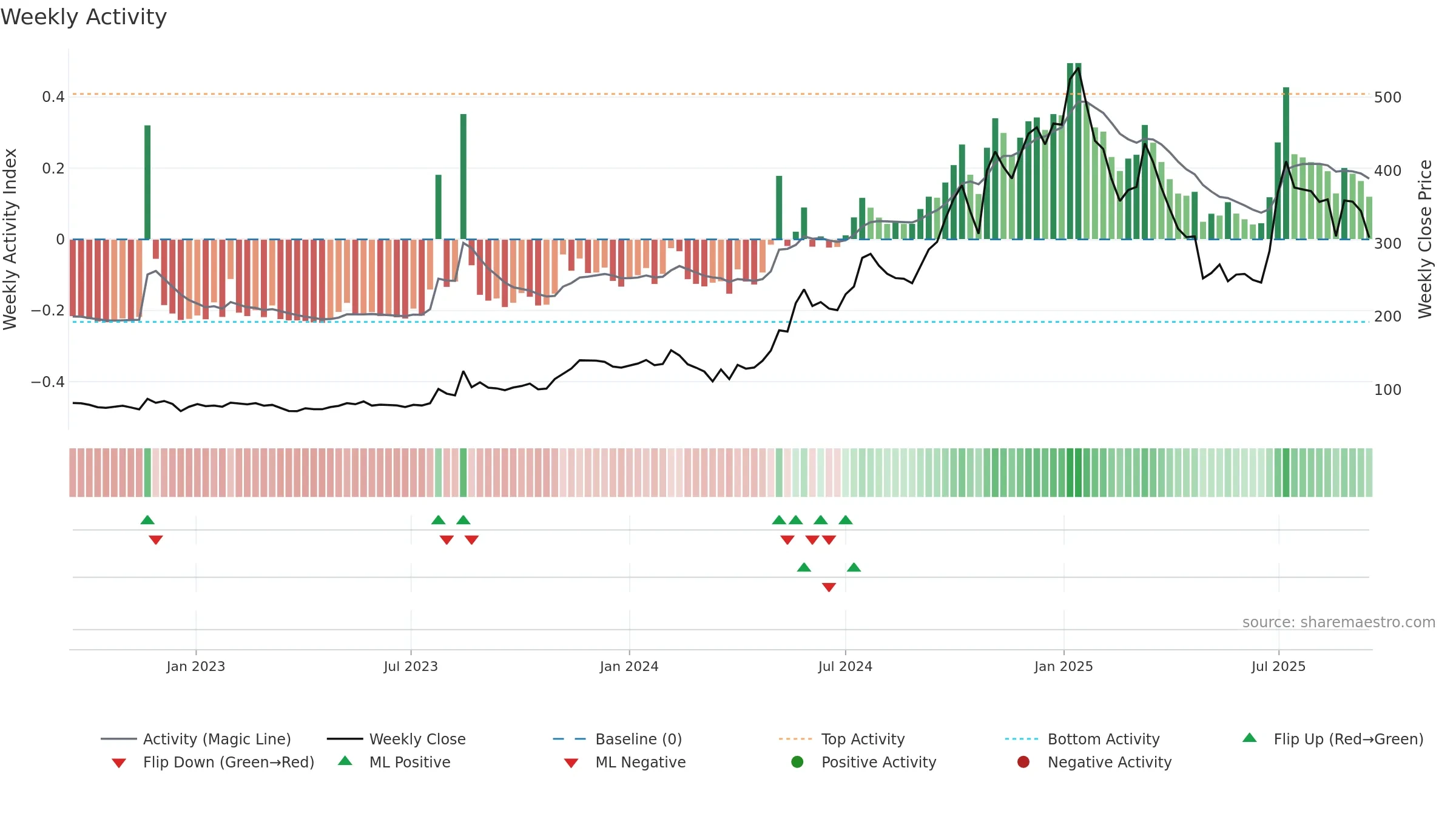

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges. Sub-0.40 print confirms downside control.

Wait for a directional break or improving acceleration.

Price is above fair value; upside may be capped without catalysts.

Conclusion

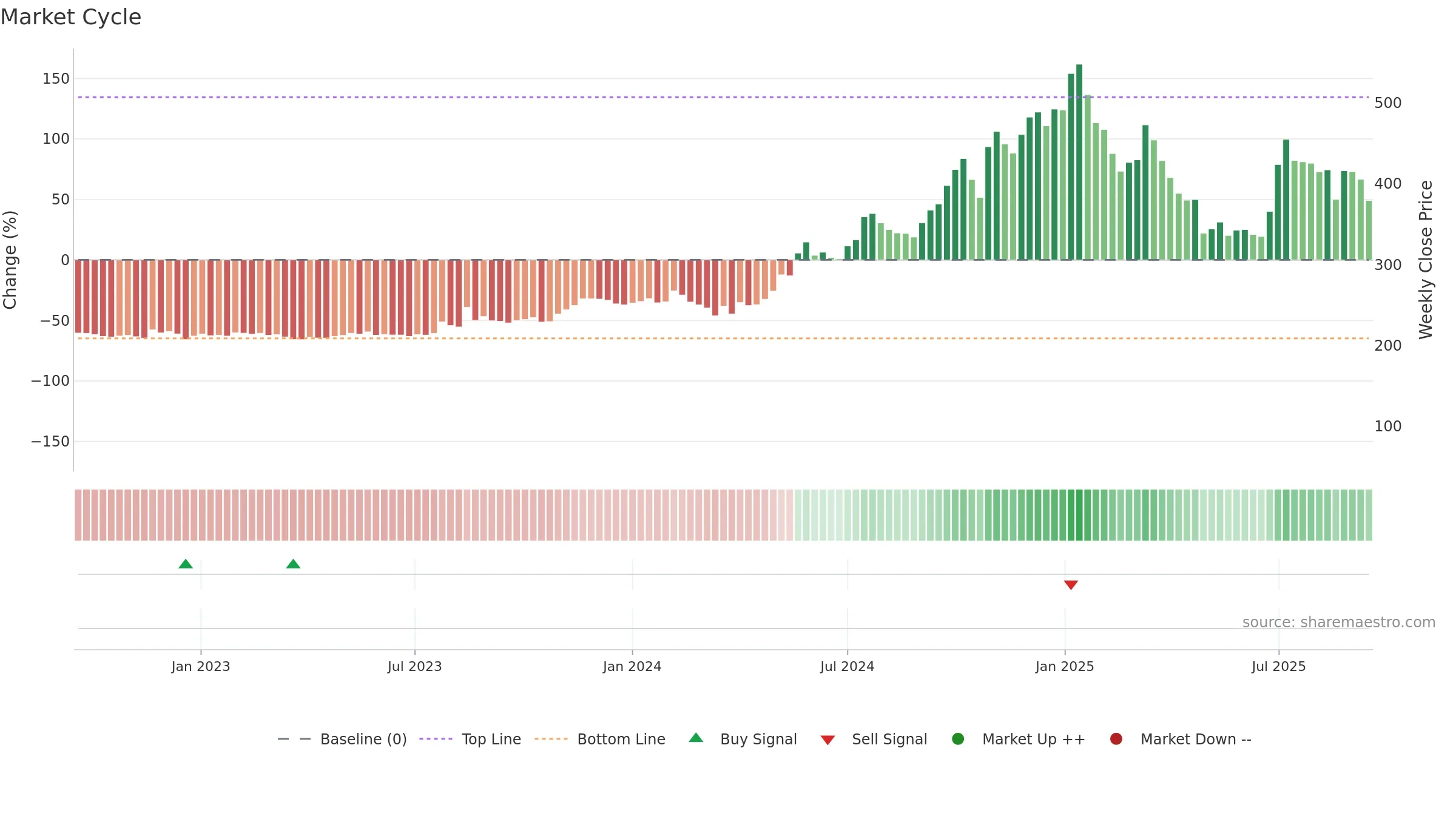

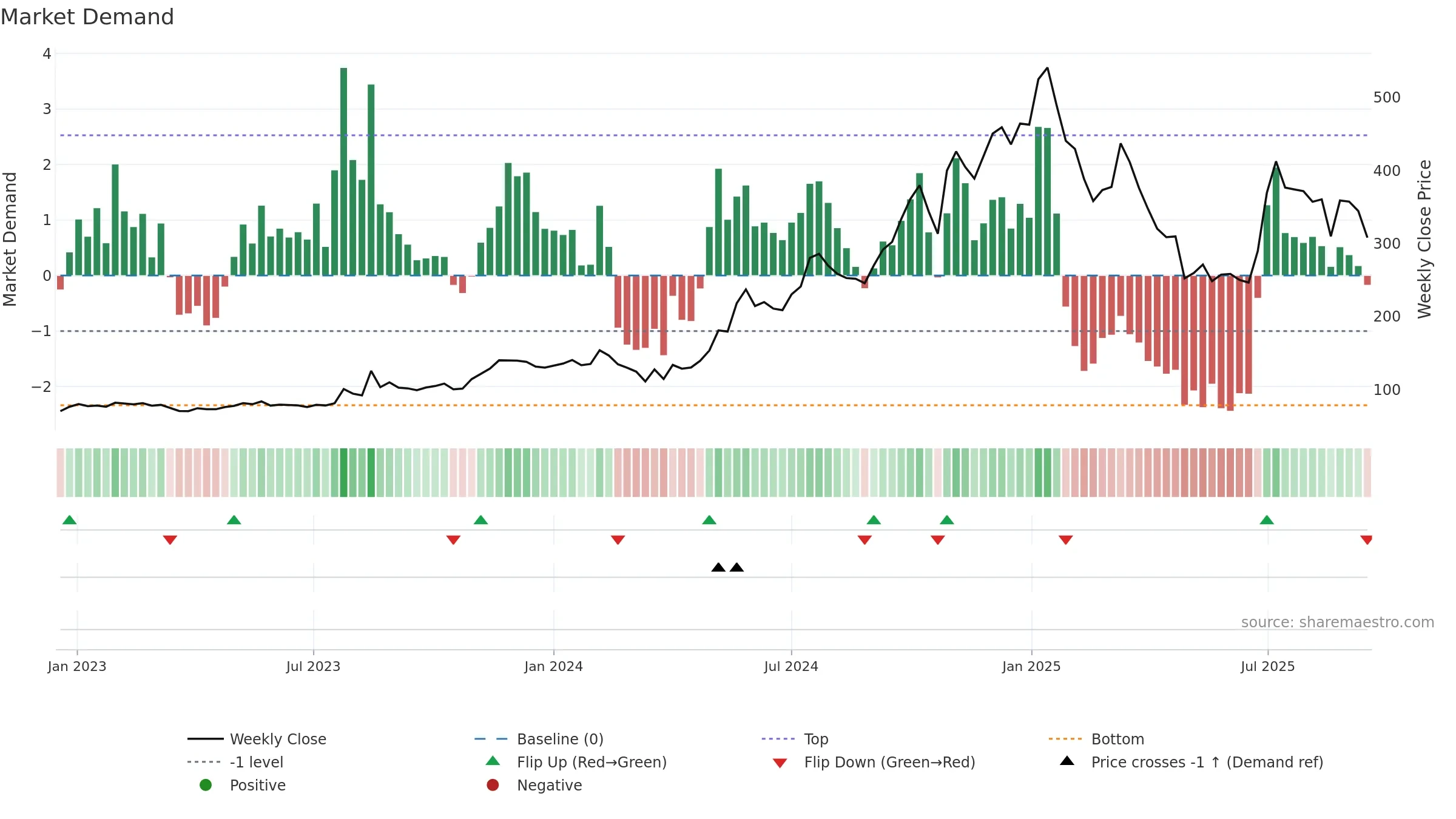

Neutral setup. ★★★☆☆ confidence. Price window: -17. Trend: Range / Neutral; gauge 38. In combination, liquidity confirms the move.

- Liquidity confirms the price trend

- Buyers step in at depressed levels (accumulation)

- Momentum is weak/falling

- Price is not above key averages

- Negative multi-week performance

- Sub-0.40 print confirms bear control

Why: Price window -17.14% over 8w. Close is -17.14% below the prior-window high. Volume trend falling. Liquidity convergence with price. Trend state range / neutral. Low-regime (≤0.25) upticks 3/3 (100.0%) • Accumulating. Momentum bearish and rising. Valuation limited upside without catalysts.

Tip: Most metrics include a hover tooltip where they appear in the report.