Parpro Corporation

4916 TPE

Weekly Report

Parpro Corporation closed at 62.8000 (-0.32% WoW) . Data window ends Mon, 15 Sep 2025.

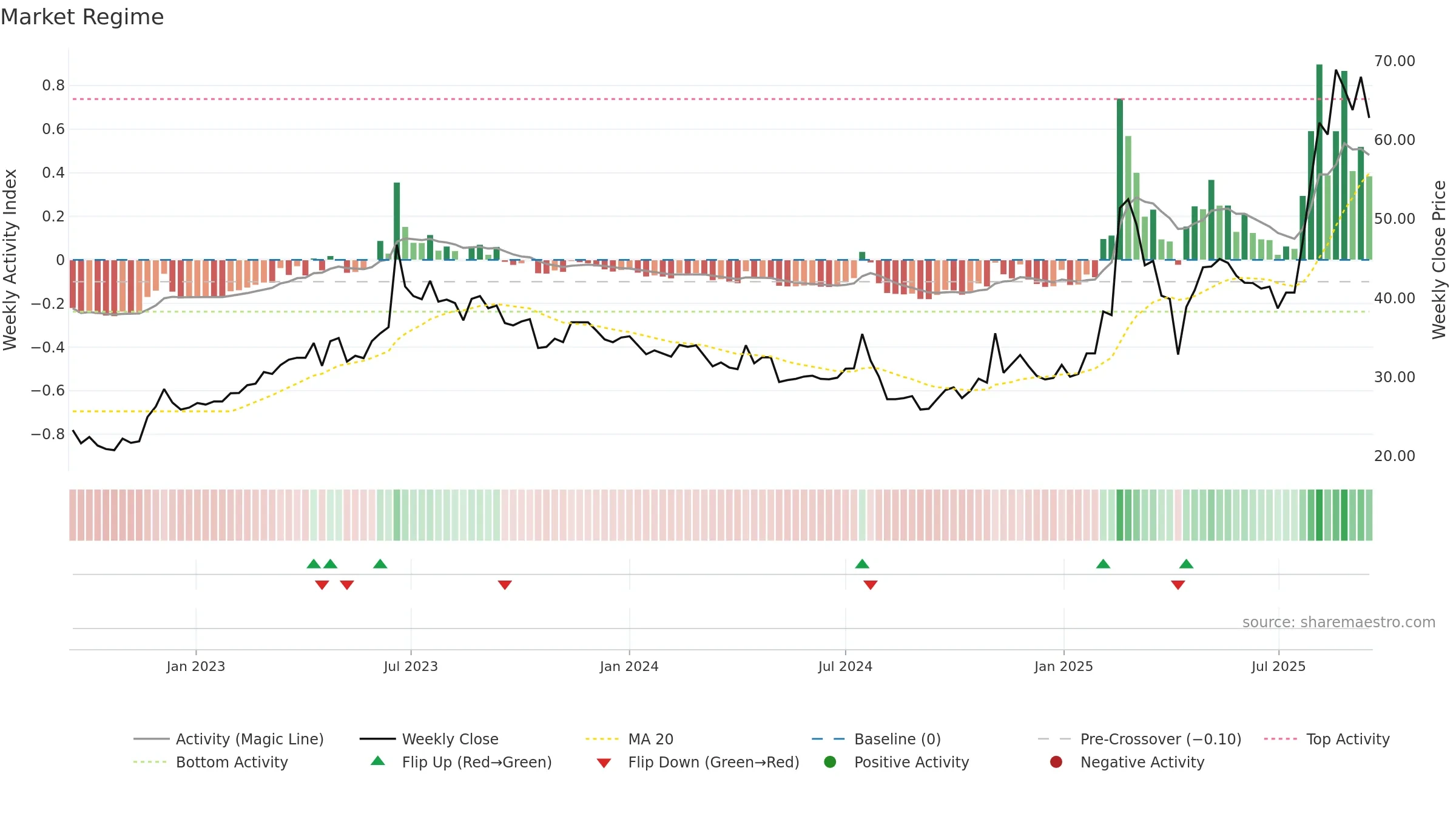

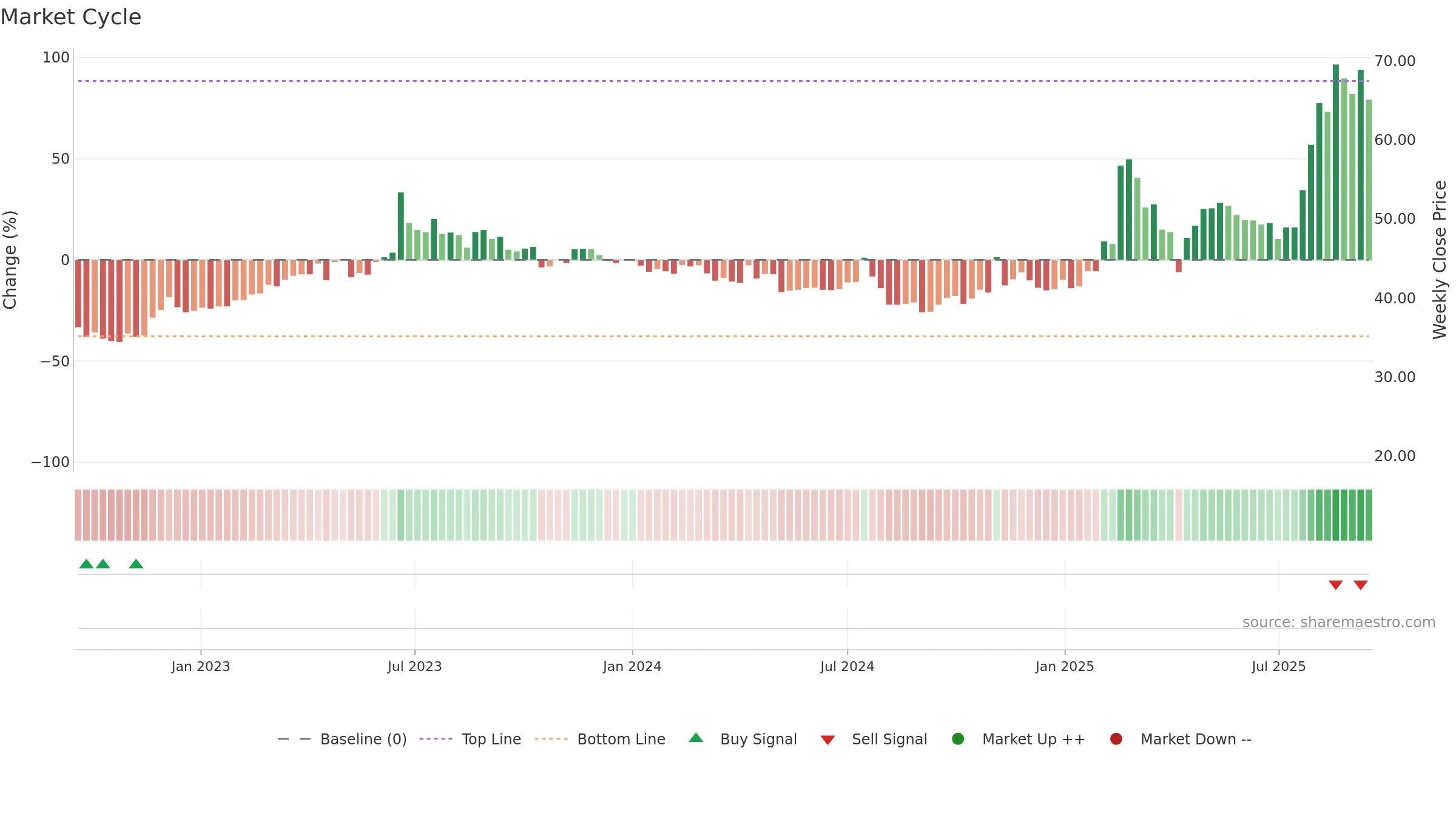

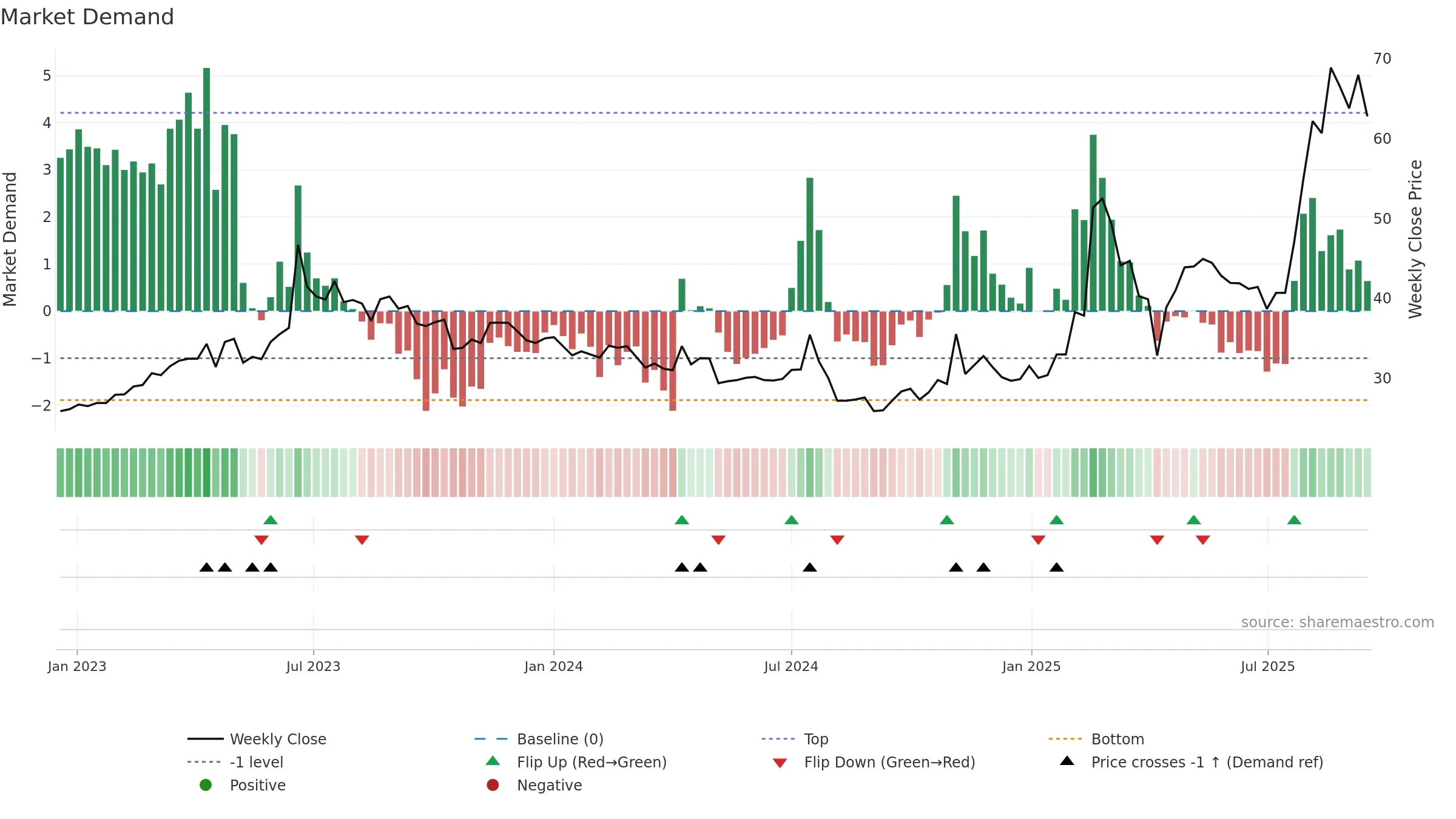

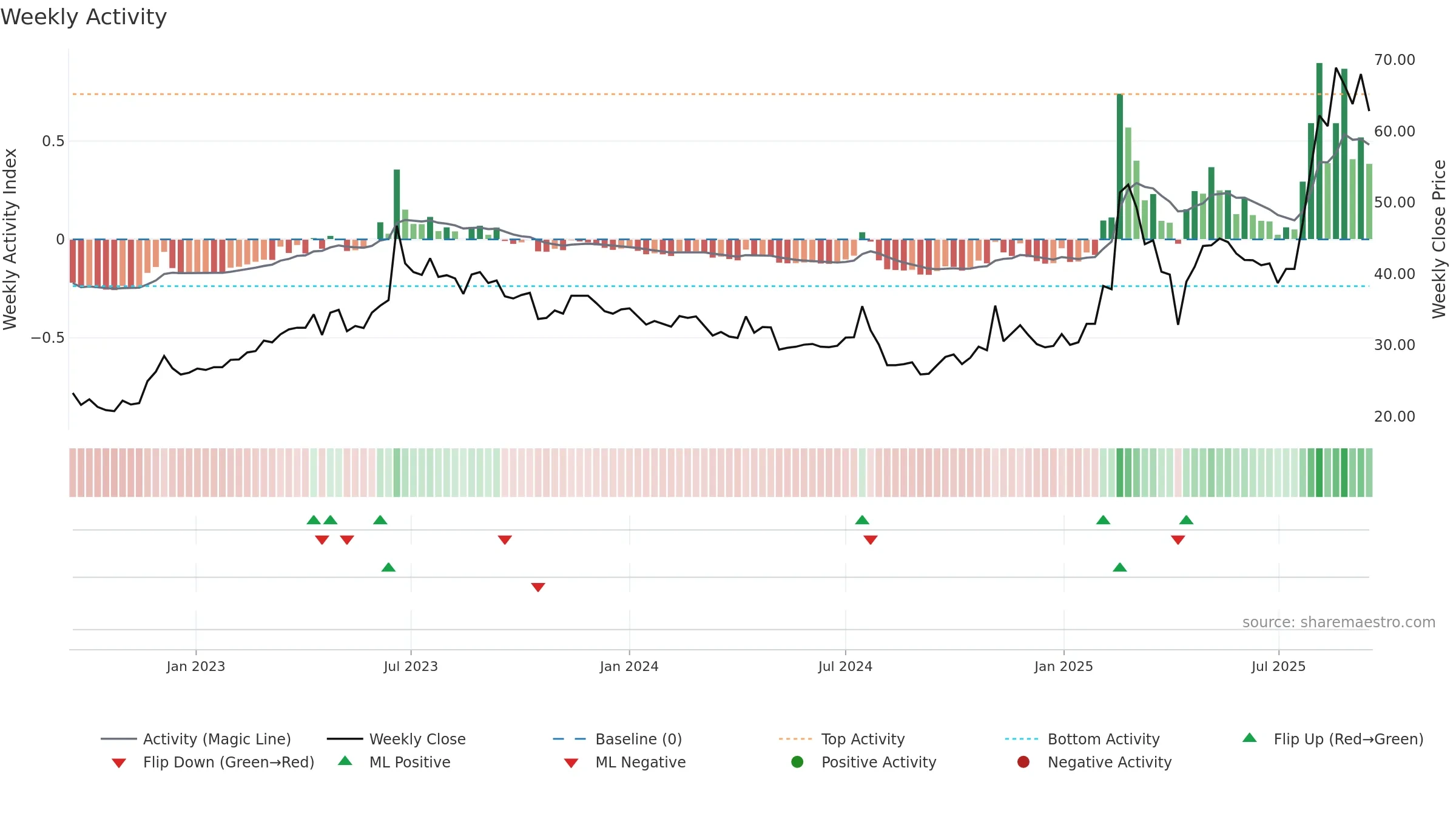

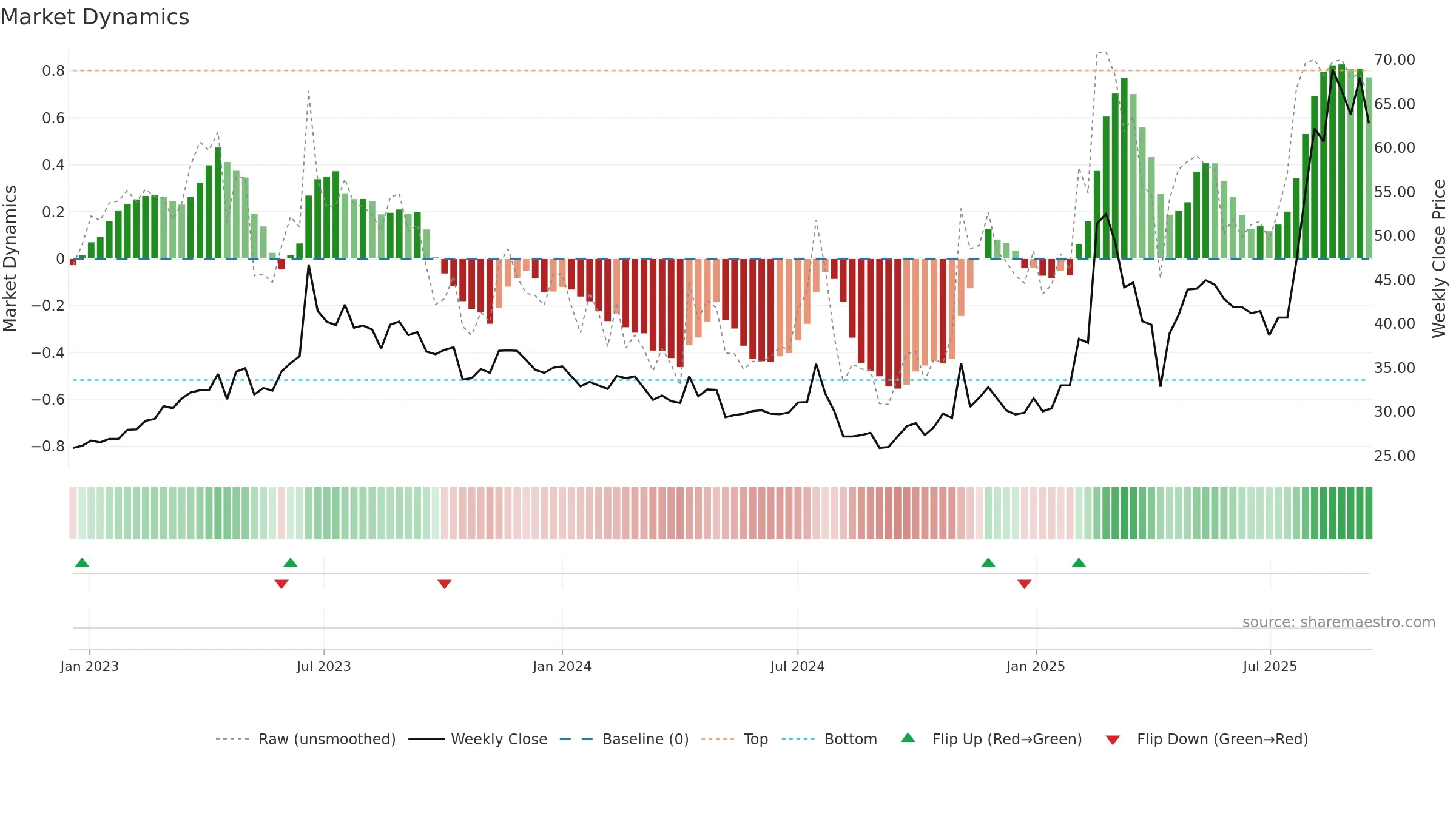

How to read this — Price slope is upward, indicating persistent buying over the window. Elevated weekly volatility increases whipsaw risk. Volume trend diverges from price — watch for fatigue or rotation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

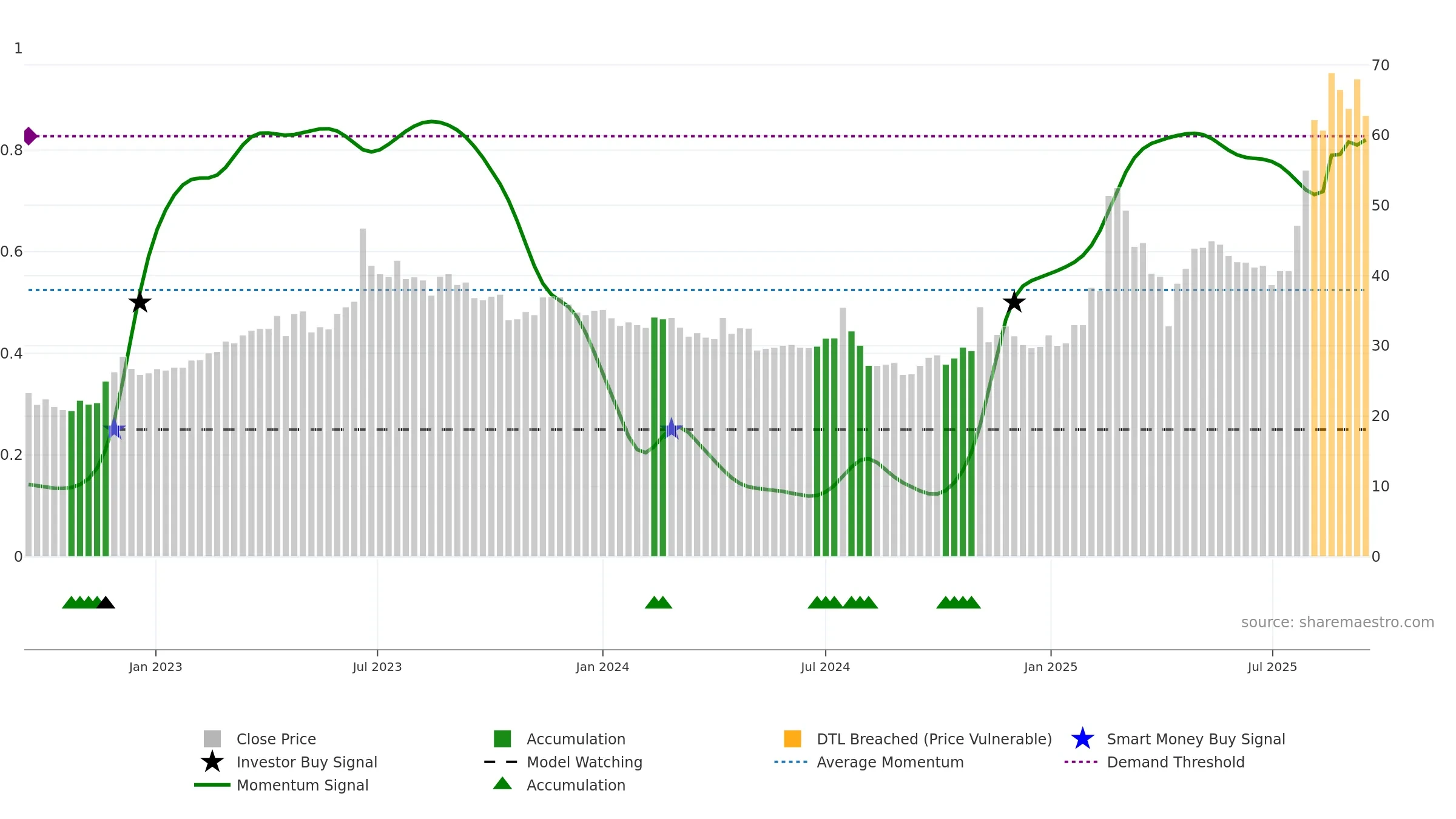

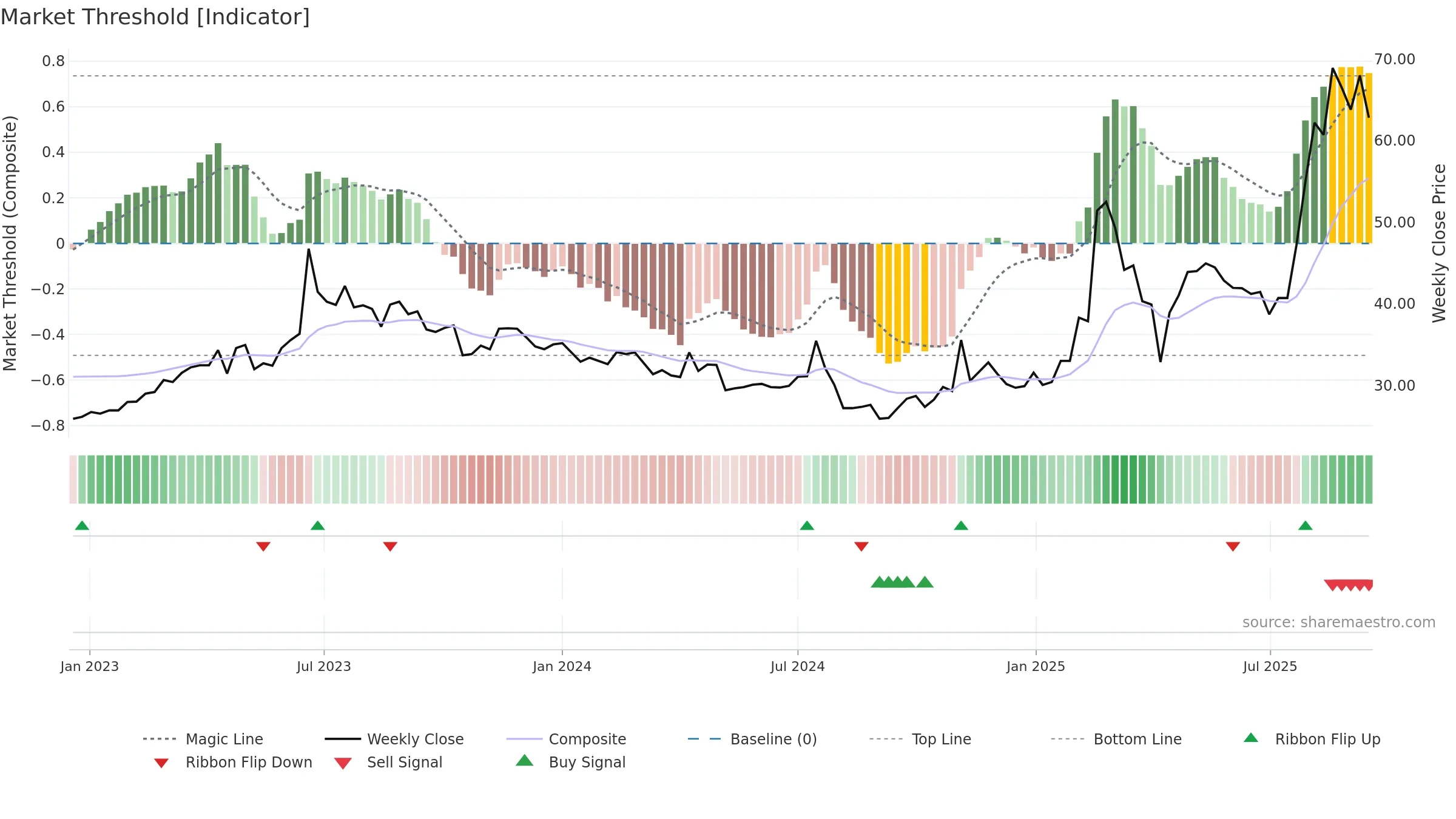

Gauge maps the trend signal to a 0–100 scale.

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

Price is below fair value; potential upside if momentum constructive.

Conclusion

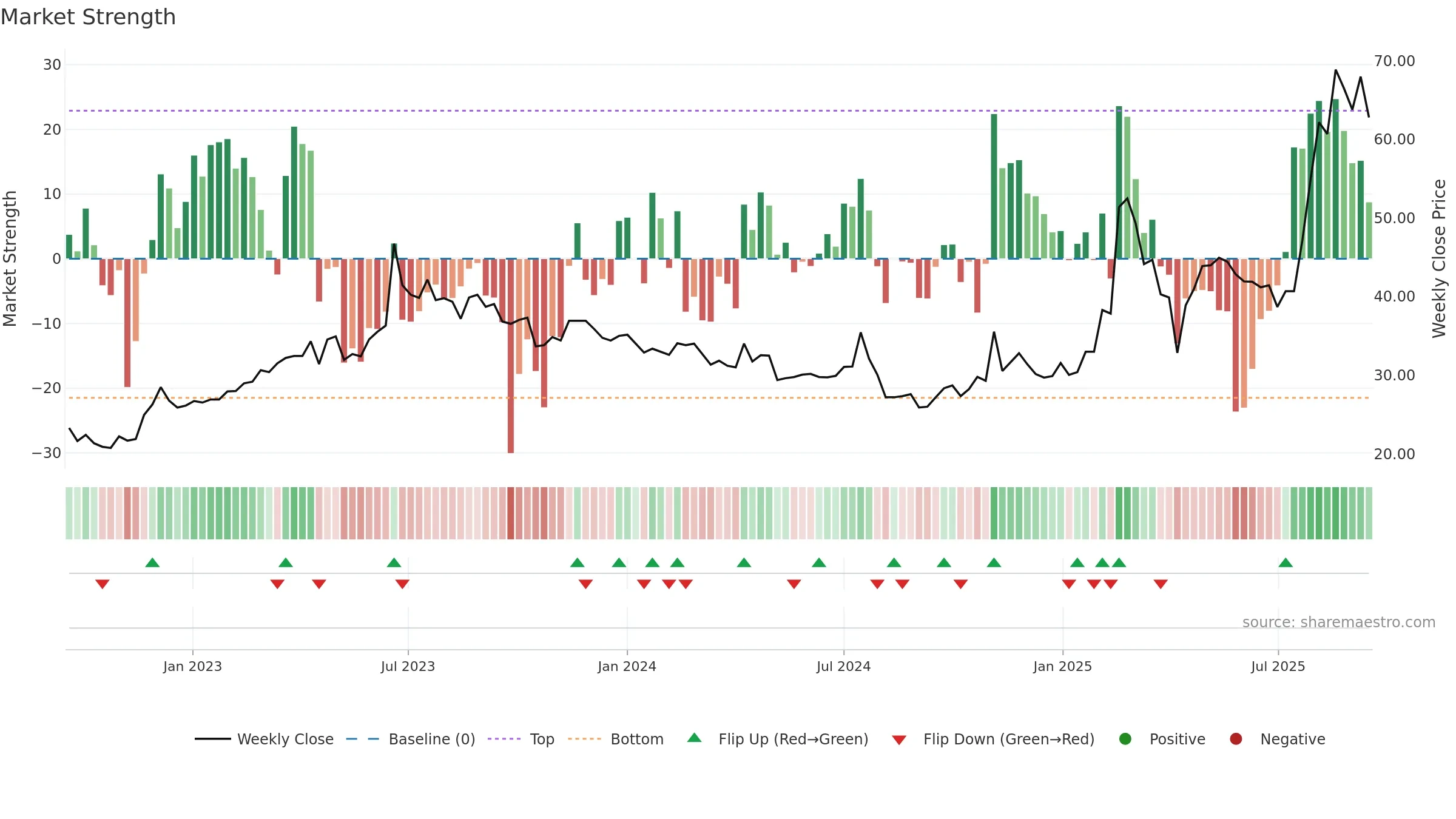

Negative setup. ★★☆☆☆ confidence. Price window: 14. Trend: Range / Neutral; gauge 82. In combination, liquidity diverges from price.

- Momentum is bullish and rising

- Constructive moving-average stack

- Solid multi-week performance

- Price is not above key averages

- Liquidity diverges from price

- High return volatility raises whipsaw risk

- Sellers active at elevated levels (distribution)

Why: Price window 14.18% over 8w. Close is -8.85% below the prior-window high. Return volatility 5.79%. Volume trend falling. Liquidity divergence with price. Trend state range / neutral. High-regime (0.80–1.00) downticks 1/2 (50.0%) • Accumulating. MA stack constructive. Momentum bullish and rising. Valuation supportive skew.

Tip: Most metrics include a hover tooltip where they appear in the report.