Beamr Imaging Ltd.

BMR NASDAQ

Weekly Summary

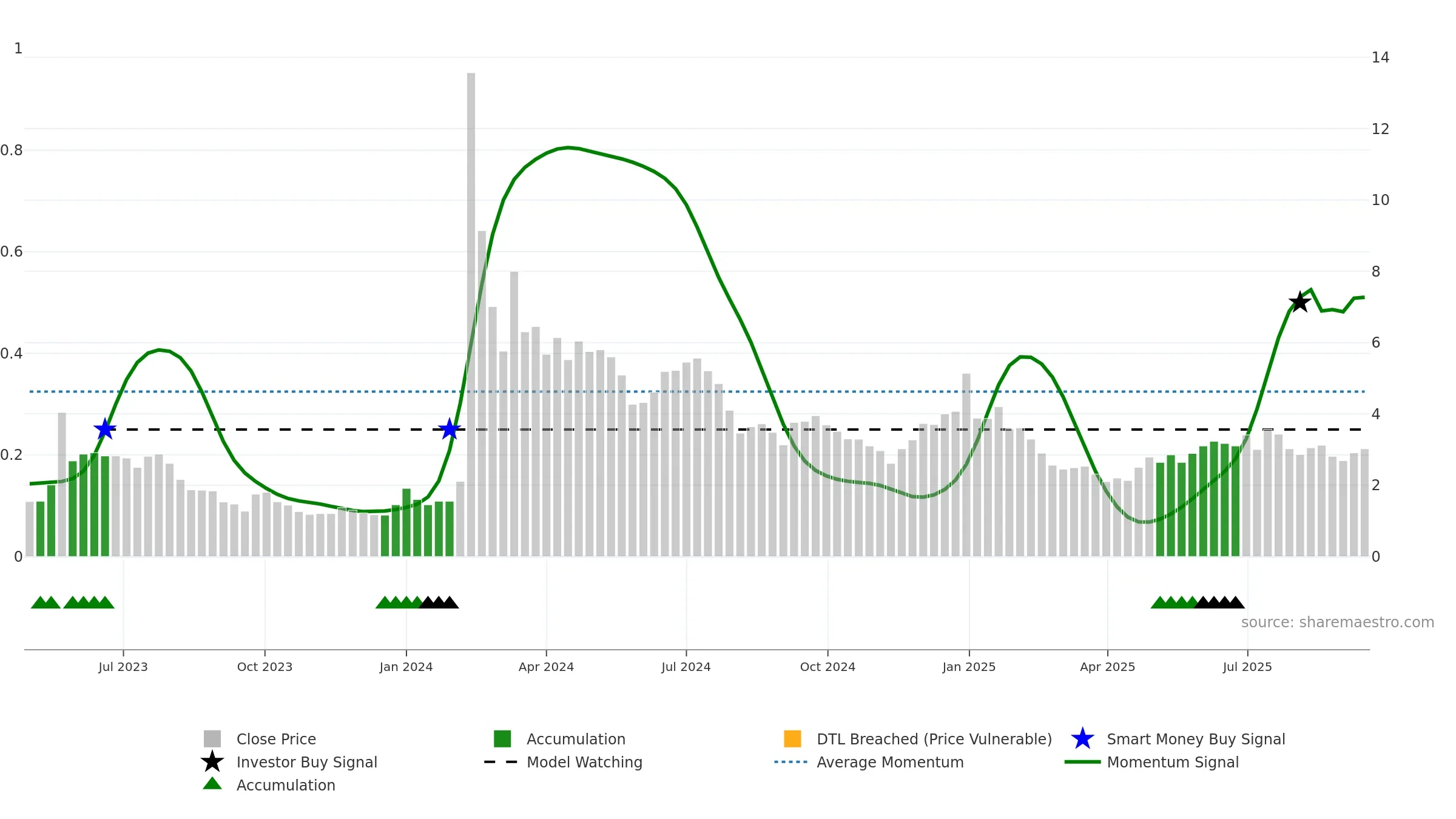

Beamr Imaging Ltd. closed at 3.0200 (4.86% WoW) . Data window ends Mon, 15 Sep 2025.

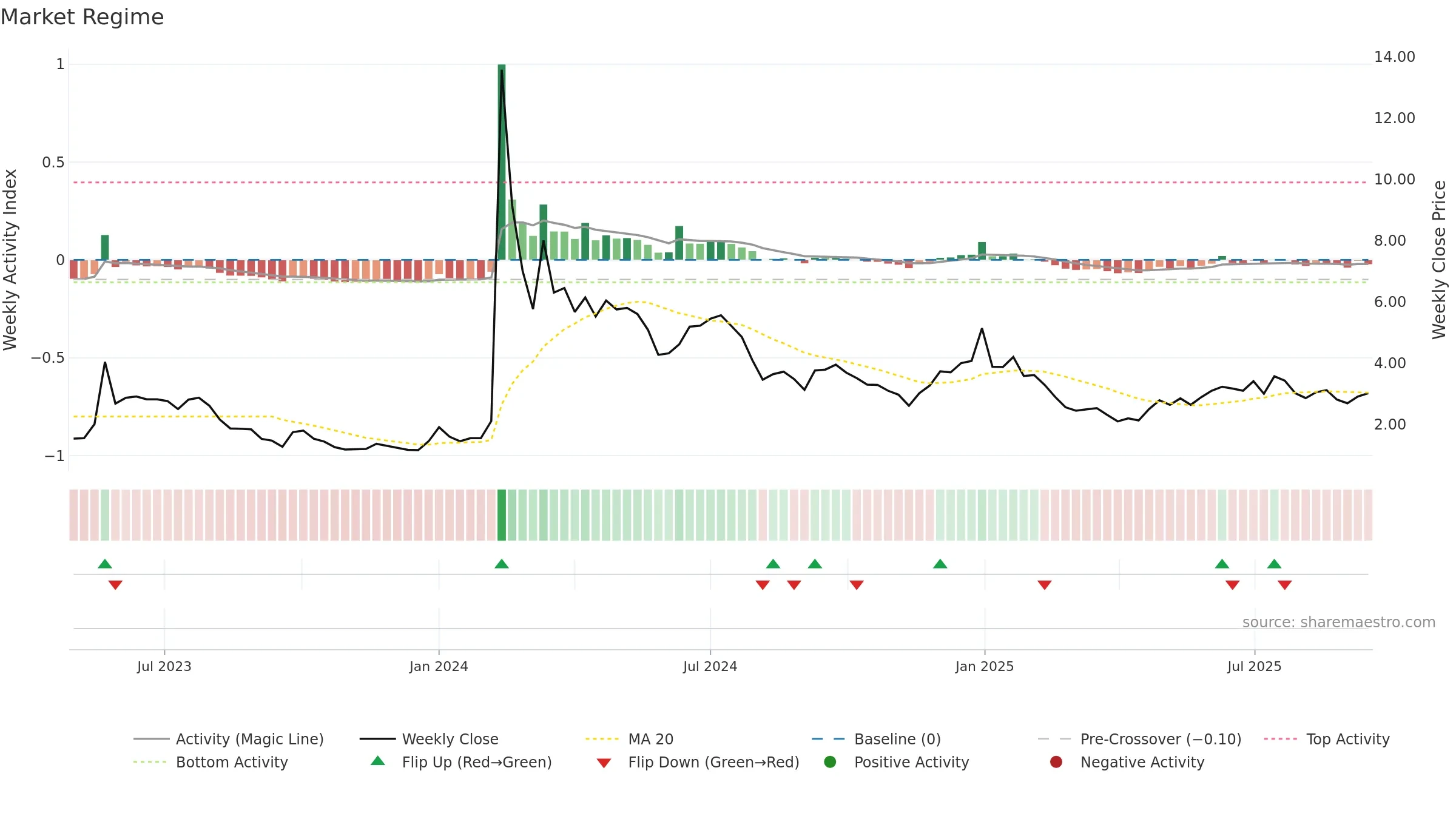

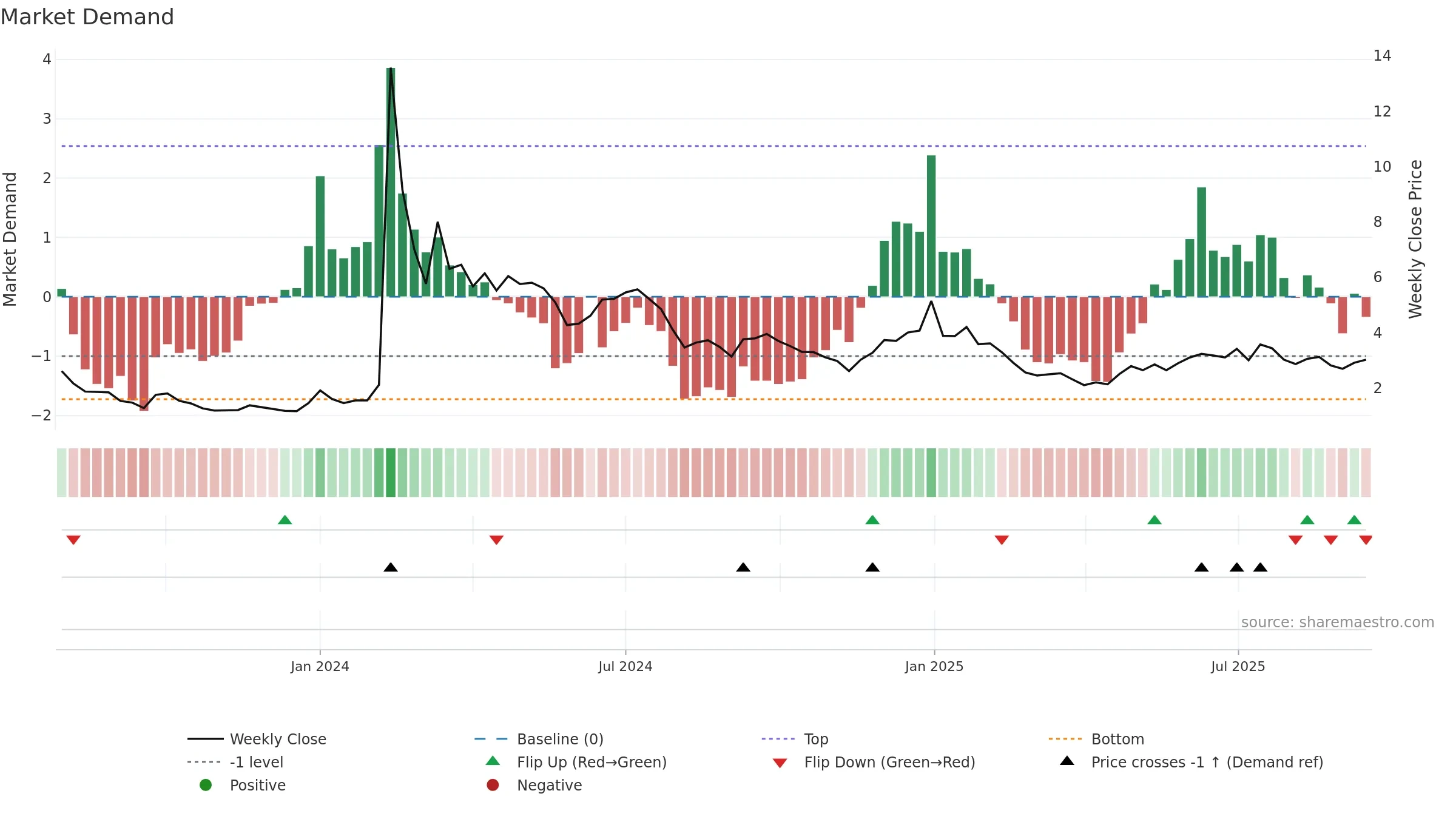

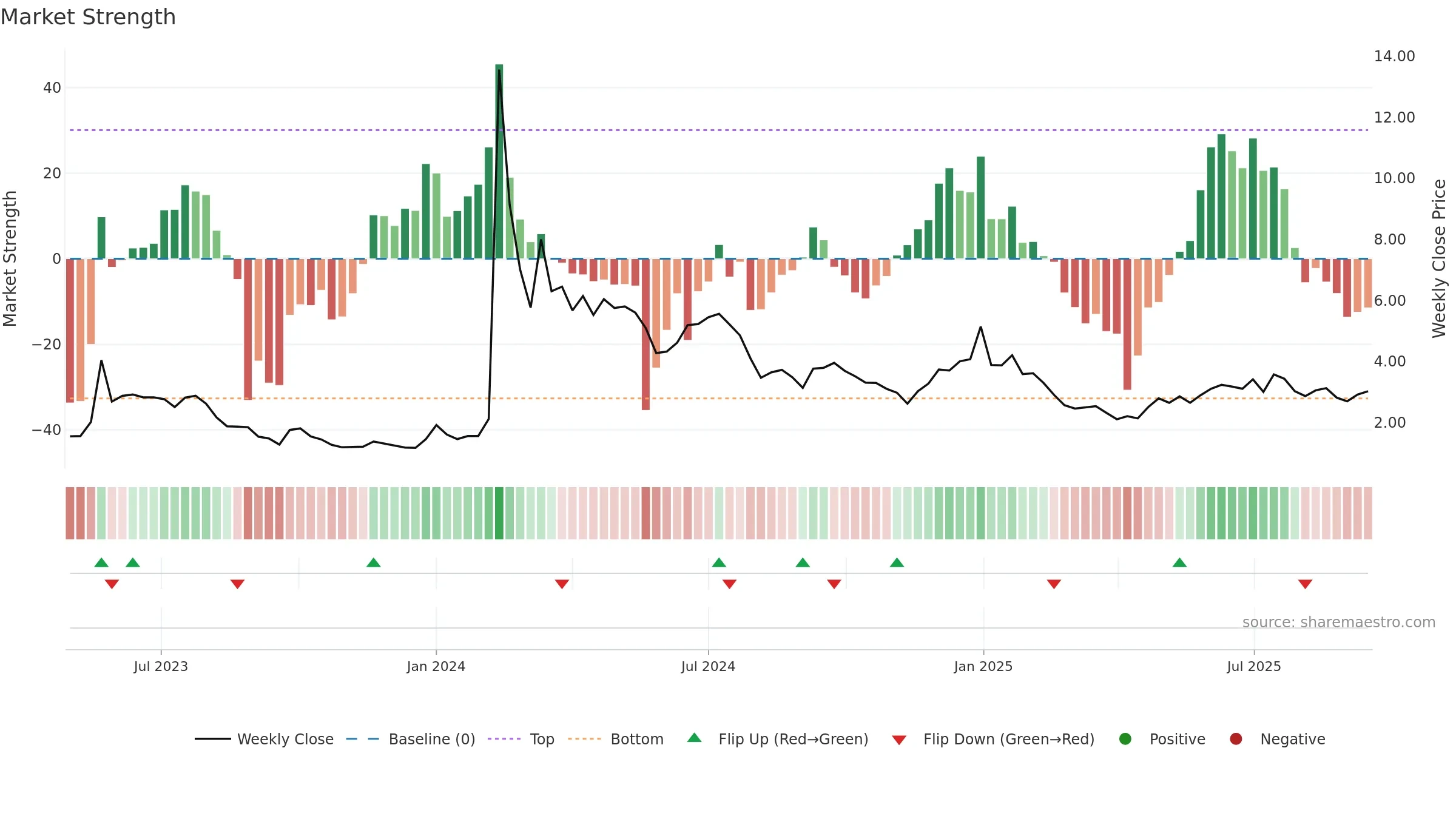

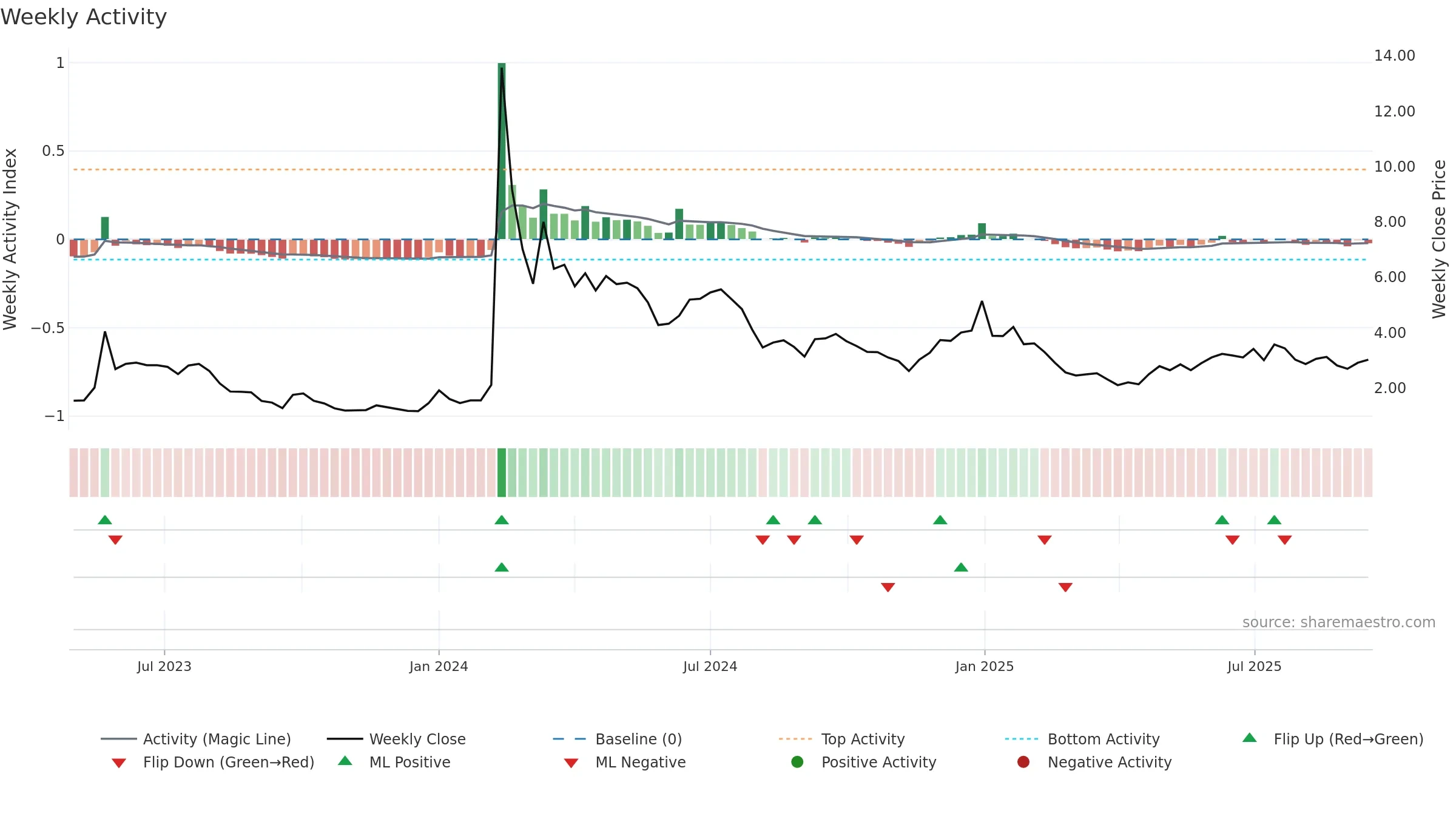

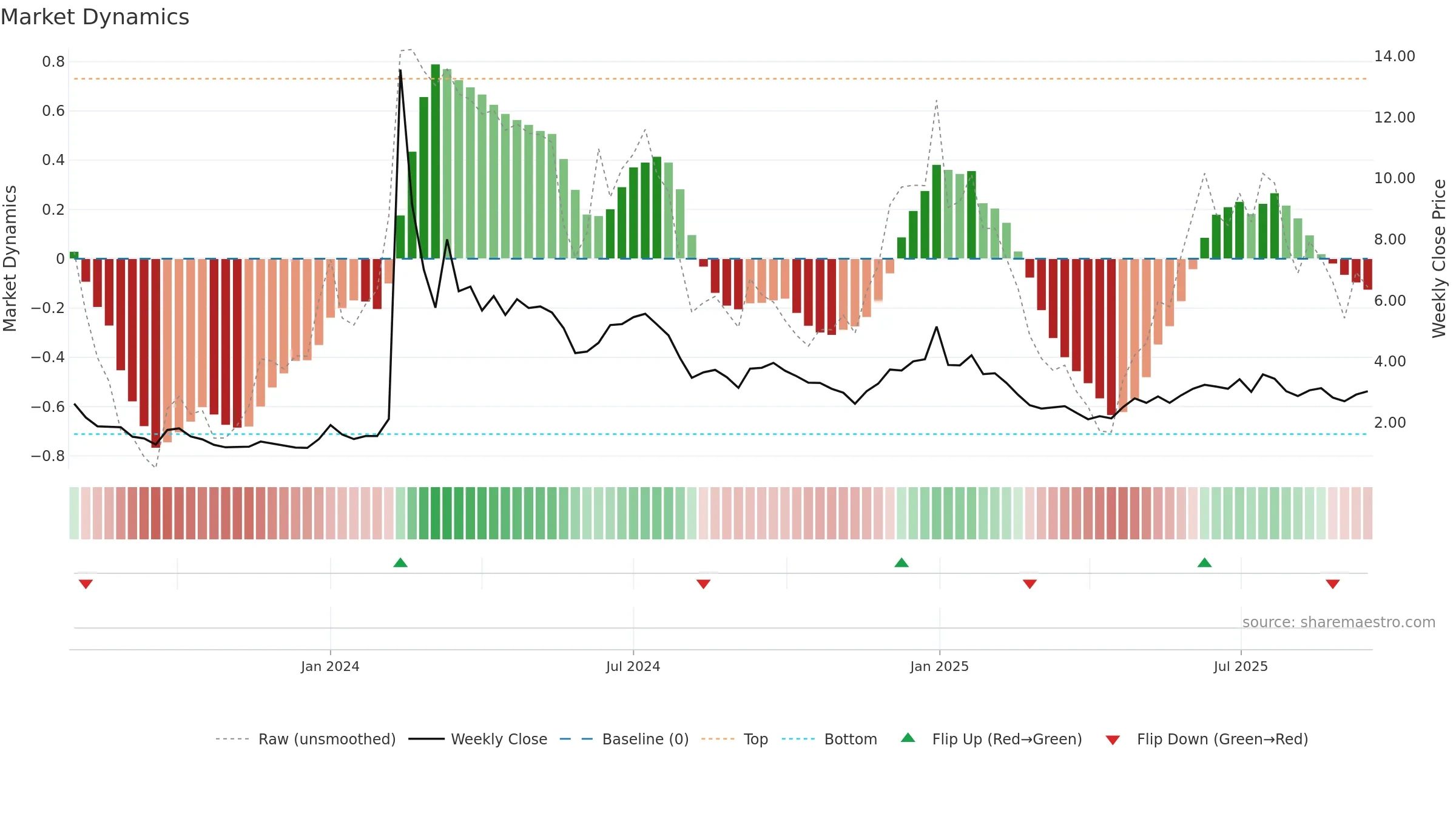

How to read this — Price slope is downward, indicating persistent supply pressure. Elevated weekly volatility increases whipsaw risk. Volume trend diverges from price — watch for fatigue or rotation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Price holds above key averages, indicating constructive participation.

Down-slope argues for patience; rallies can fade sooner unless participation improves. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

Gauge maps the trend signal to a 0–100 scale.

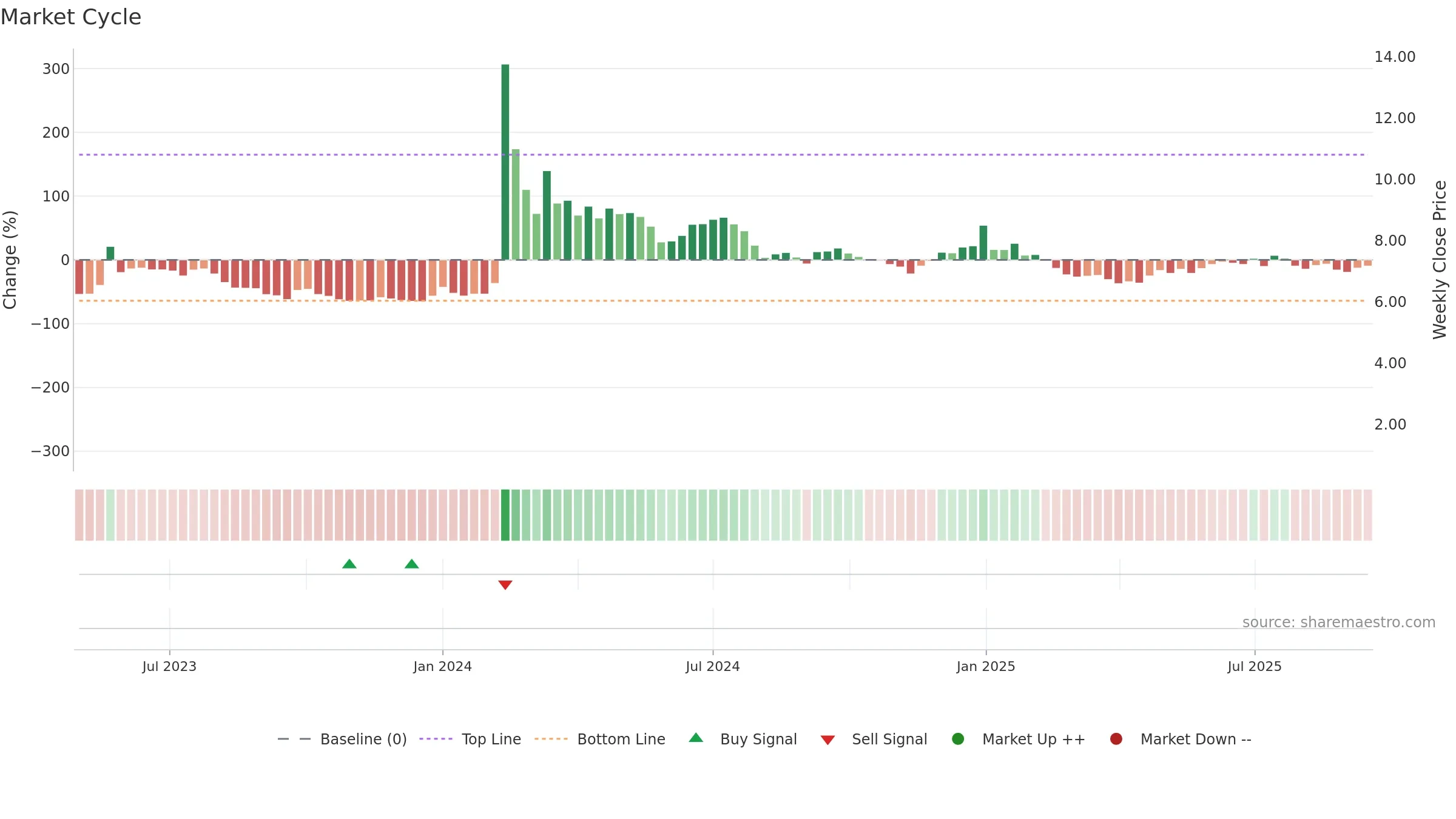

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

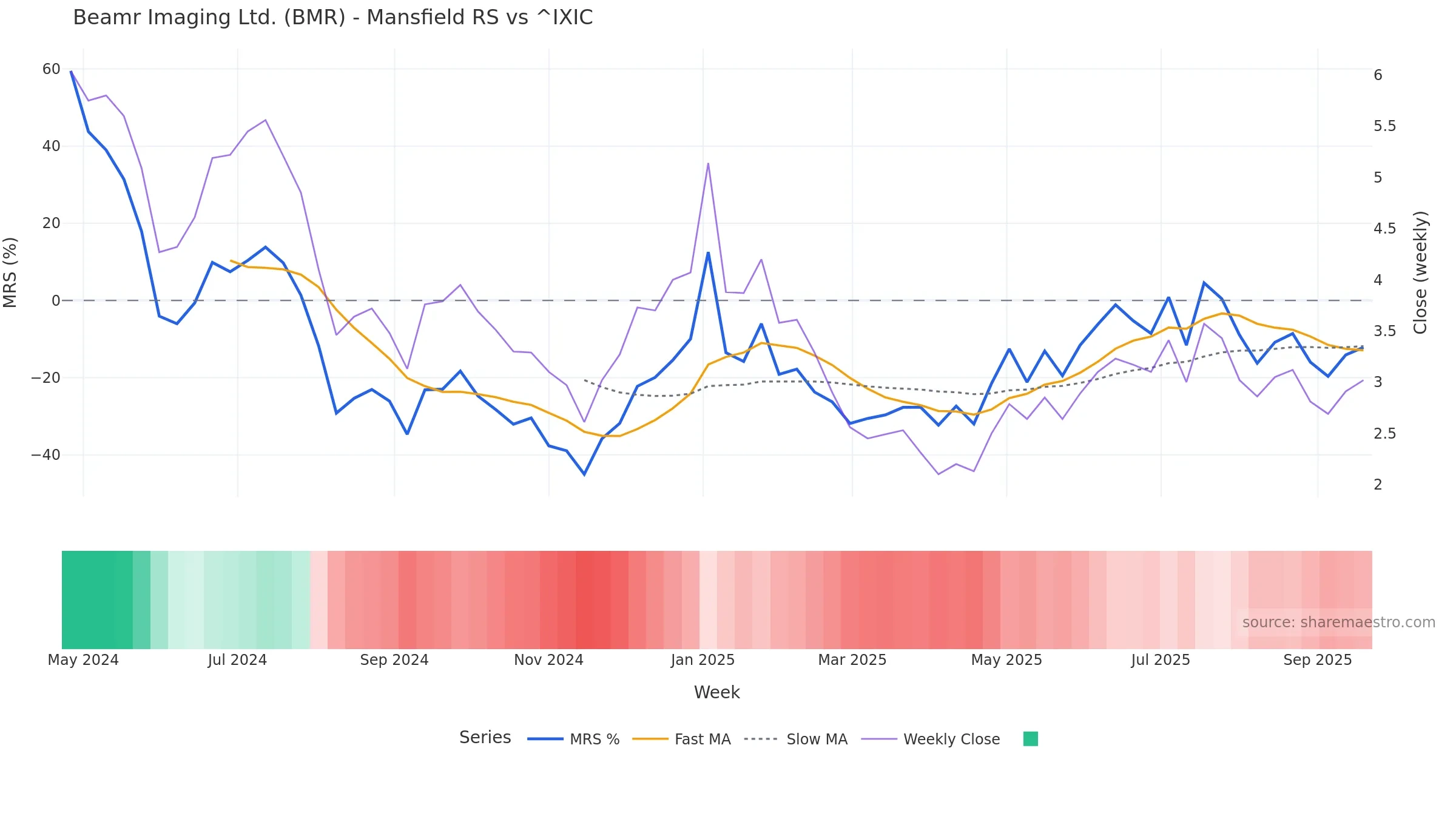

Relative strength is Negative

(< 0%, underperforming).

Latest MRS: -12.16% (week ending Fri, 19 Sep 2025).

Slope: Falling over 8w.

Notes:

- Below zero line indicates relative weakness vs benchmark.

- MRS slope falling over ~8 weeks.

Conclusion

Neutral setup. ★★★☆☆ confidence. Price window: 0. Trend: Range / Neutral; gauge 51. In combination, liquidity diverges from price.

- Price holds above 8w & 26w averages

- Liquidity diverges from price

- High return volatility raises whipsaw risk

Why: Close is -3.21% below the prior-window high. Return volatility 8.00%. Volume trend rising. Liquidity divergence with price. Trend state range / neutral. Momentum neutral and rising.

Tip: Most metrics include a hover tooltip where they appear in the report.