Weekly Report

Bahl & Gaynor Small/Mid Cap Income Growth ETF closed at 29.3600 (-1.41% WoW) . Data window ends Mon, 15 Sep 2025.

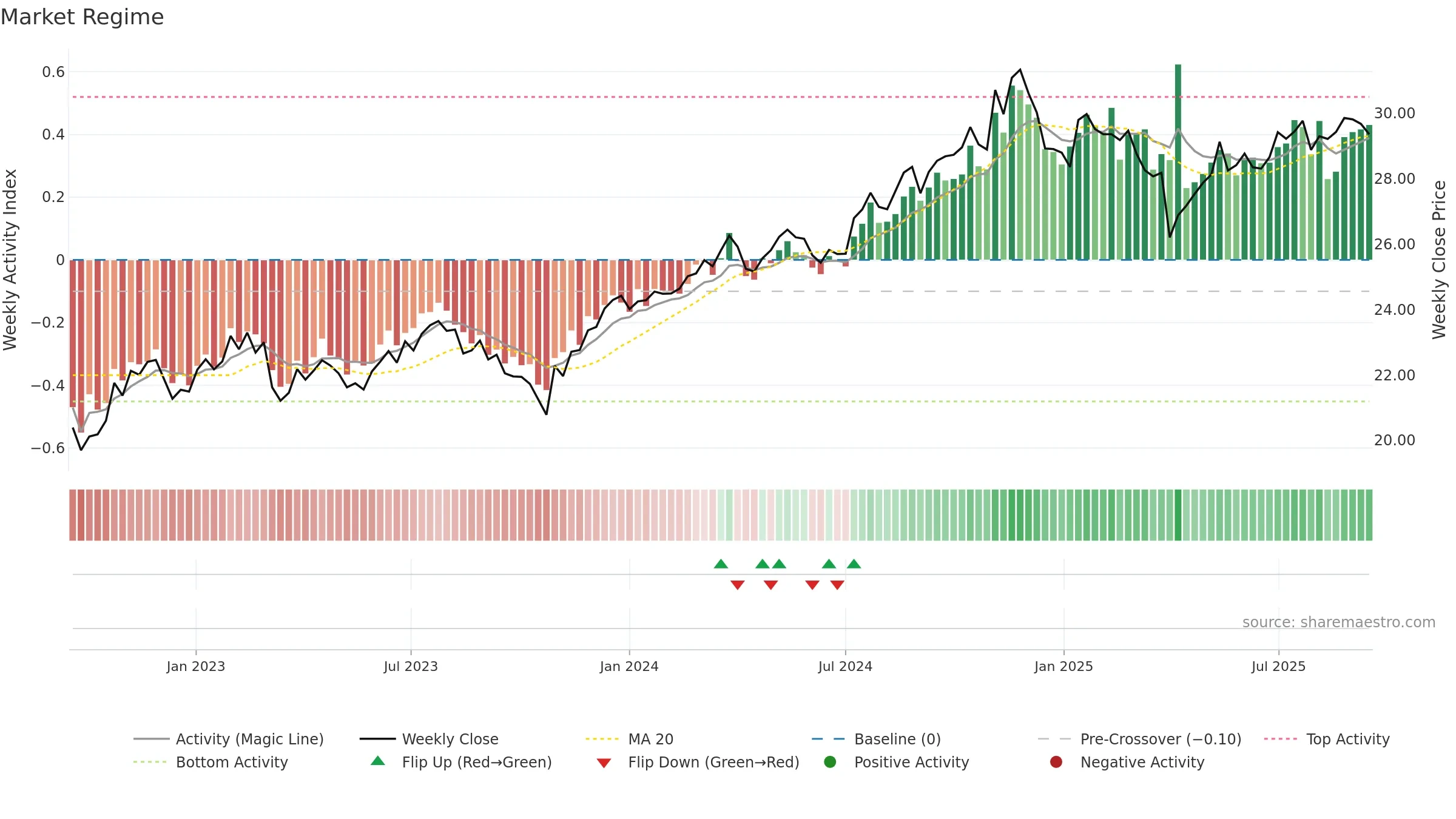

How to read this — Price slope is upward, indicating persistent buying over the window. Low weekly volatility favours steadier follow-through. Volume and price are moving in the same direction — a constructive confirmation. Distance to baseline is narrowing — reverting closer to its fair-value track. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm.

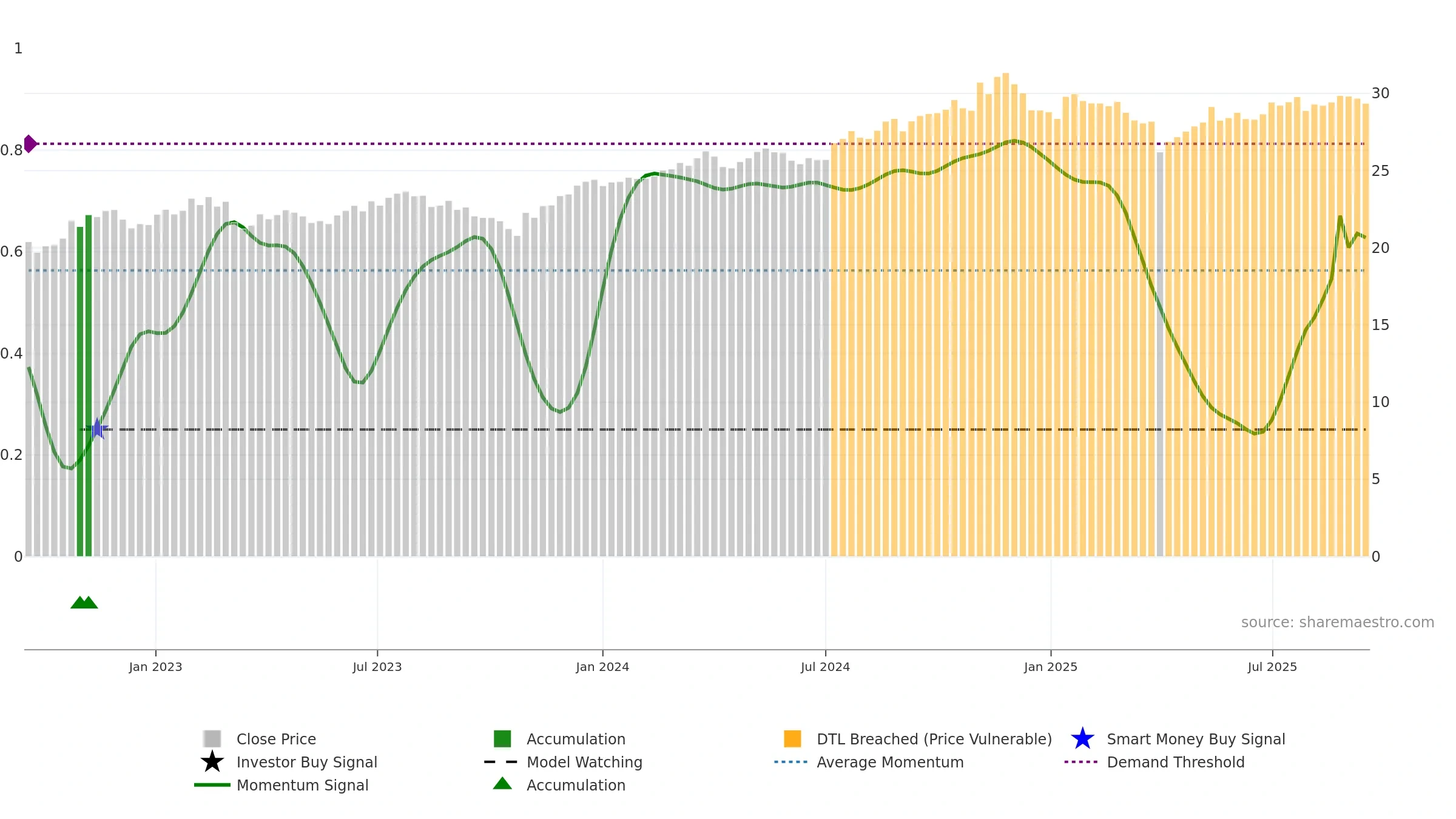

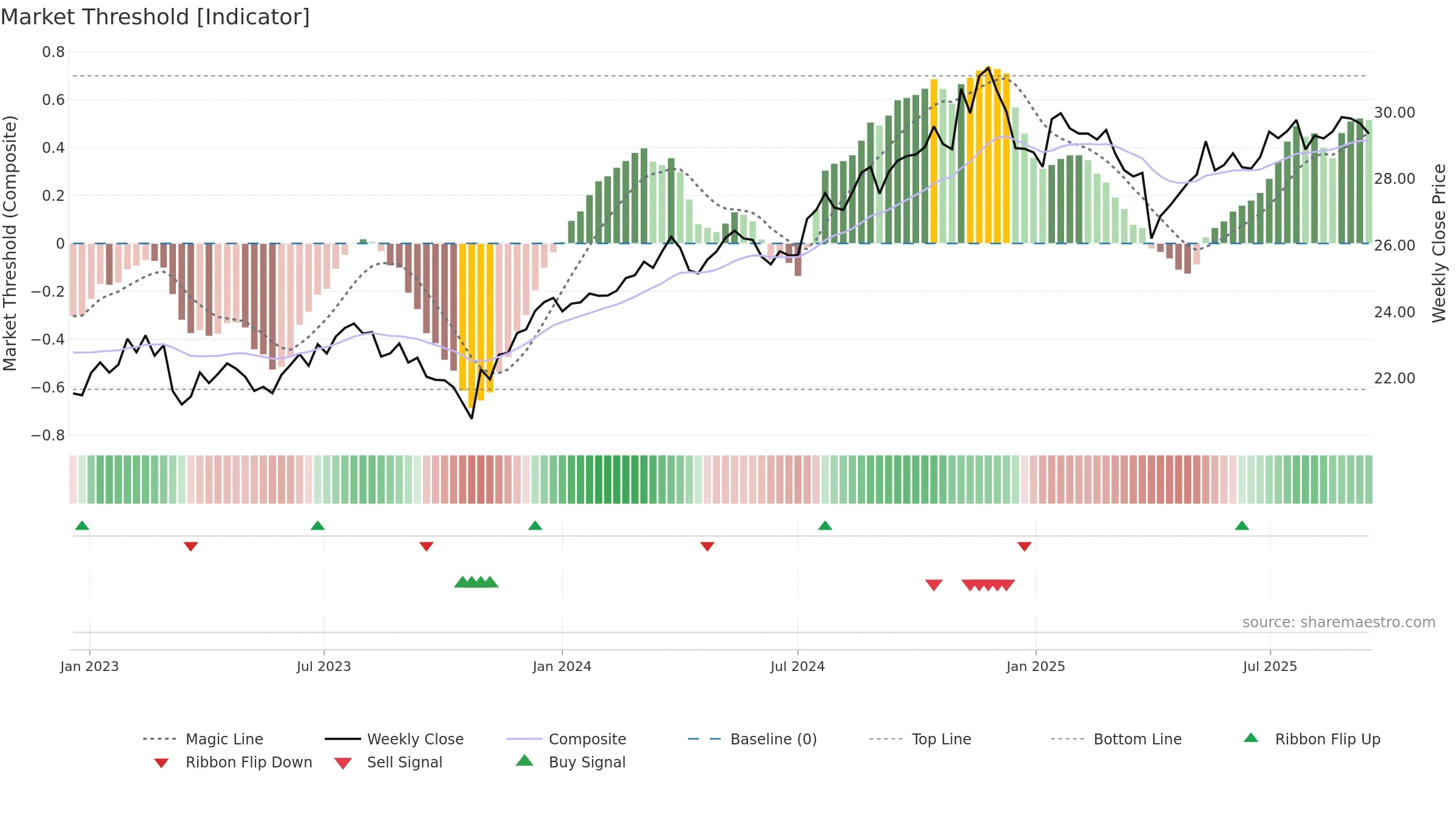

Gauge maps the trend signal to a 0–100 scale.

How to read this — Gauge is elevated but momentum is rolling over; topping risk is rising.

Stay alert: protect gains or seek confirmation before adding risk.

Conclusion

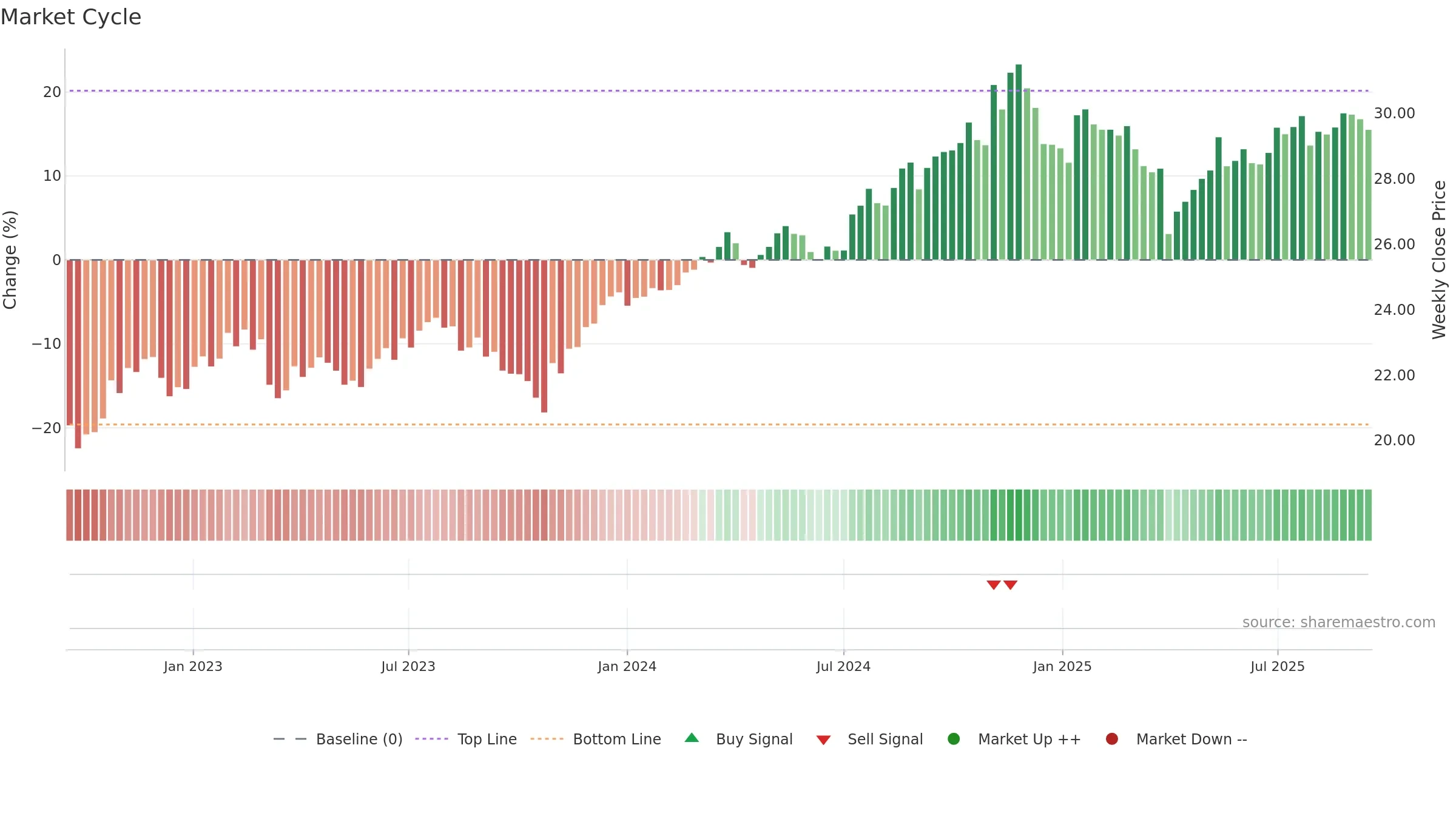

Neutral setup. ★★★☆☆ confidence. Price window: 1. Trend: Uptrend at Risk; gauge 62. In combination, liquidity confirms the move.

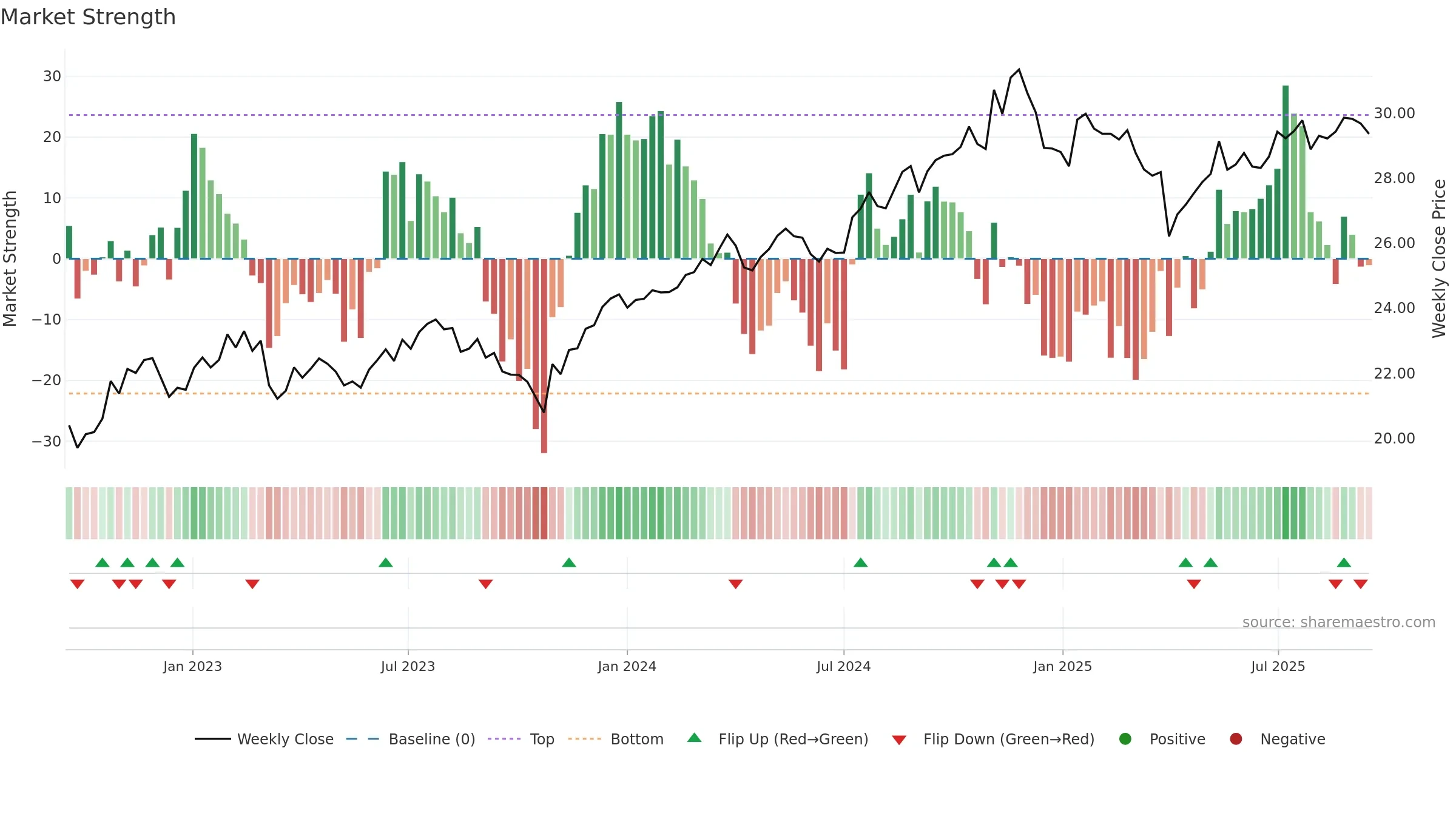

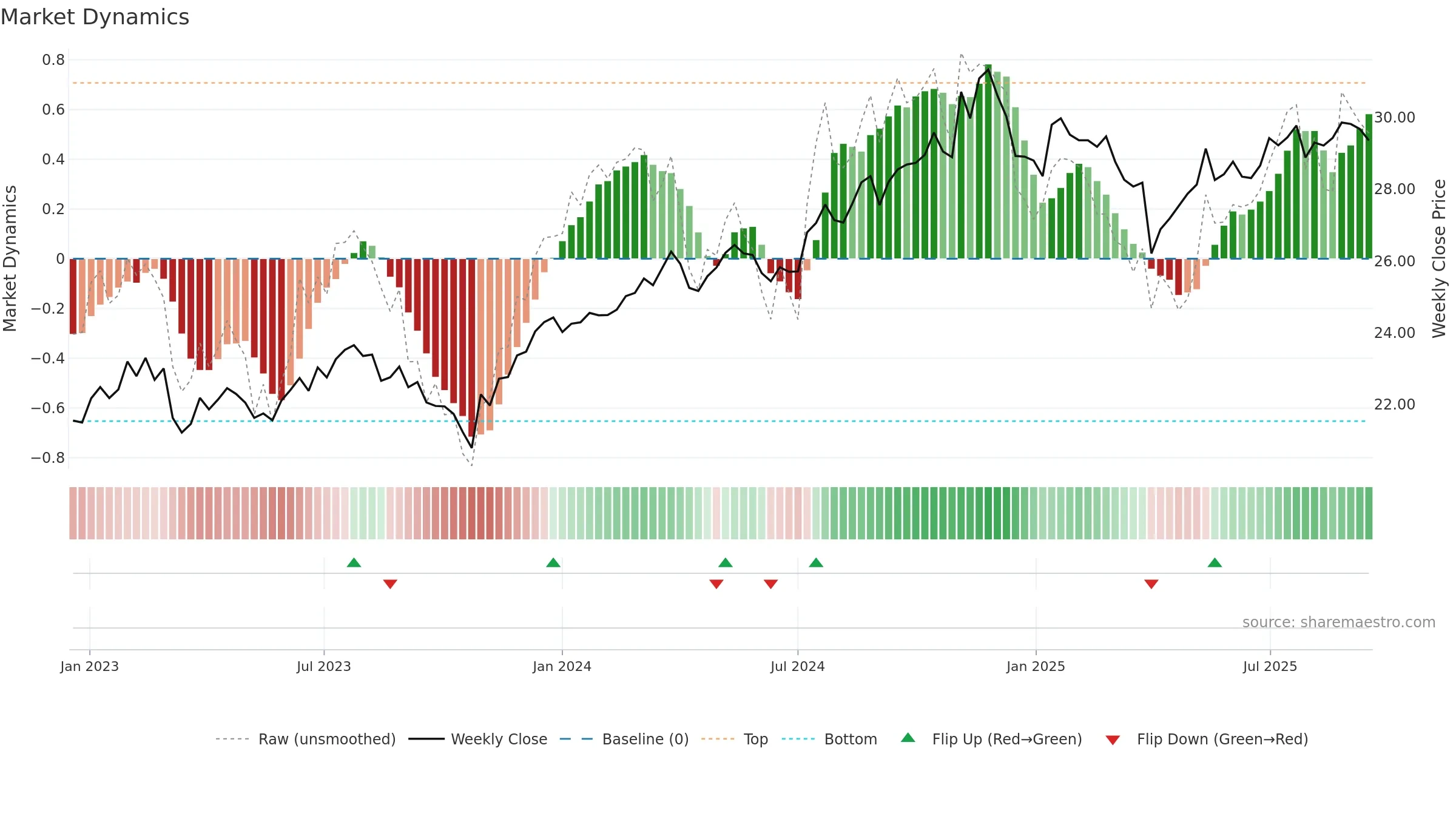

- Momentum is bullish and rising

- Constructive moving-average stack

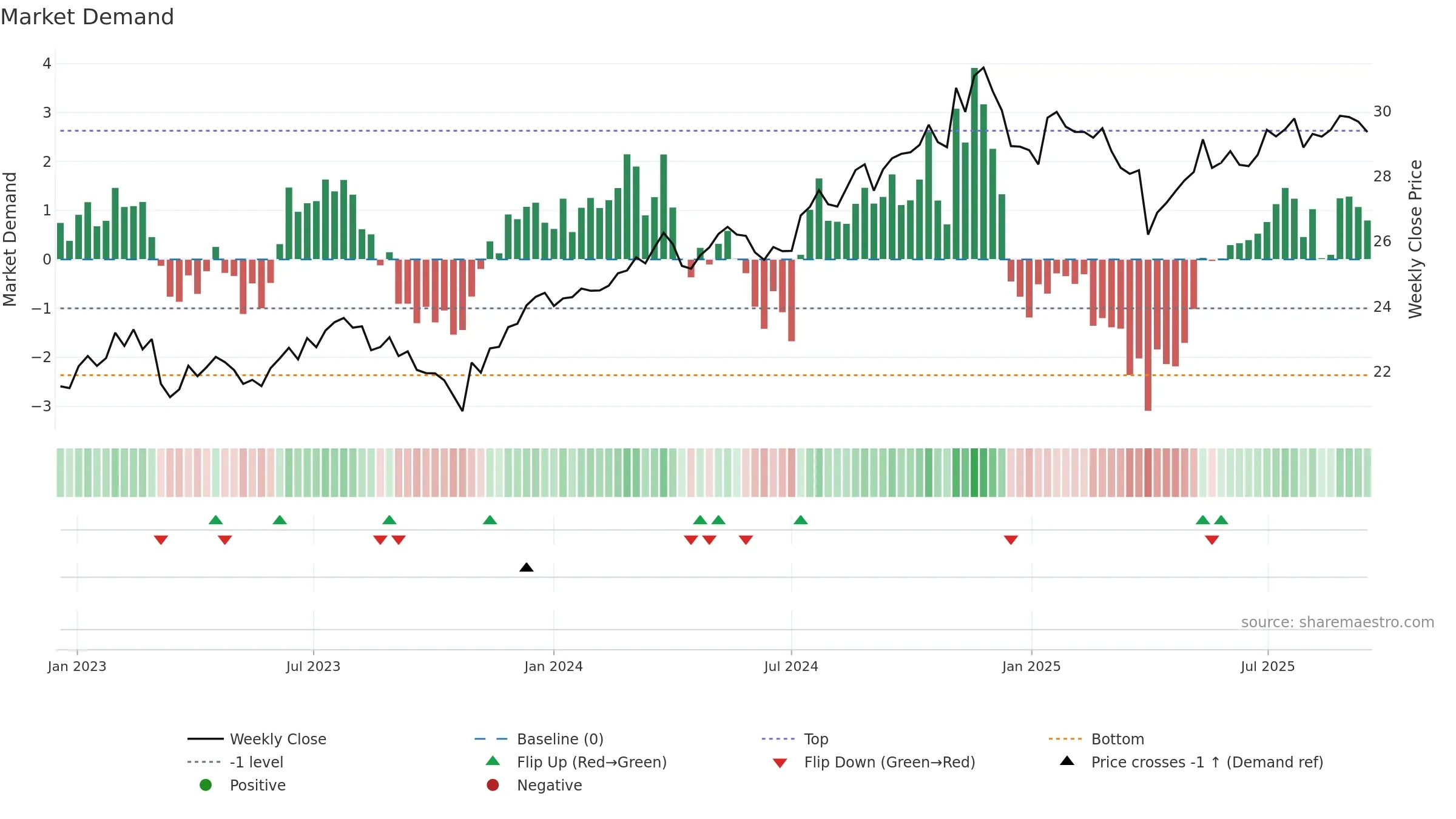

- Liquidity confirms the price trend

- Low return volatility supports durability

- High-level but rolling over (topping risk)

- Price is not above key averages

Why: Price window 1.64% over 8w. Close is -1.67% below the prior-window high. Return volatility 1.12%. Volume trend rising. Liquidity convergence with price. Trend state uptrend at risk. MA stack constructive. Momentum bullish and rising .

Tip: Most metrics also include a hover tooltip where they appear in the report.