Weekly Report

Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF closed at 13.2600 (-0.53% WoW) . Data window ends Fri, 19 Sep 2025.

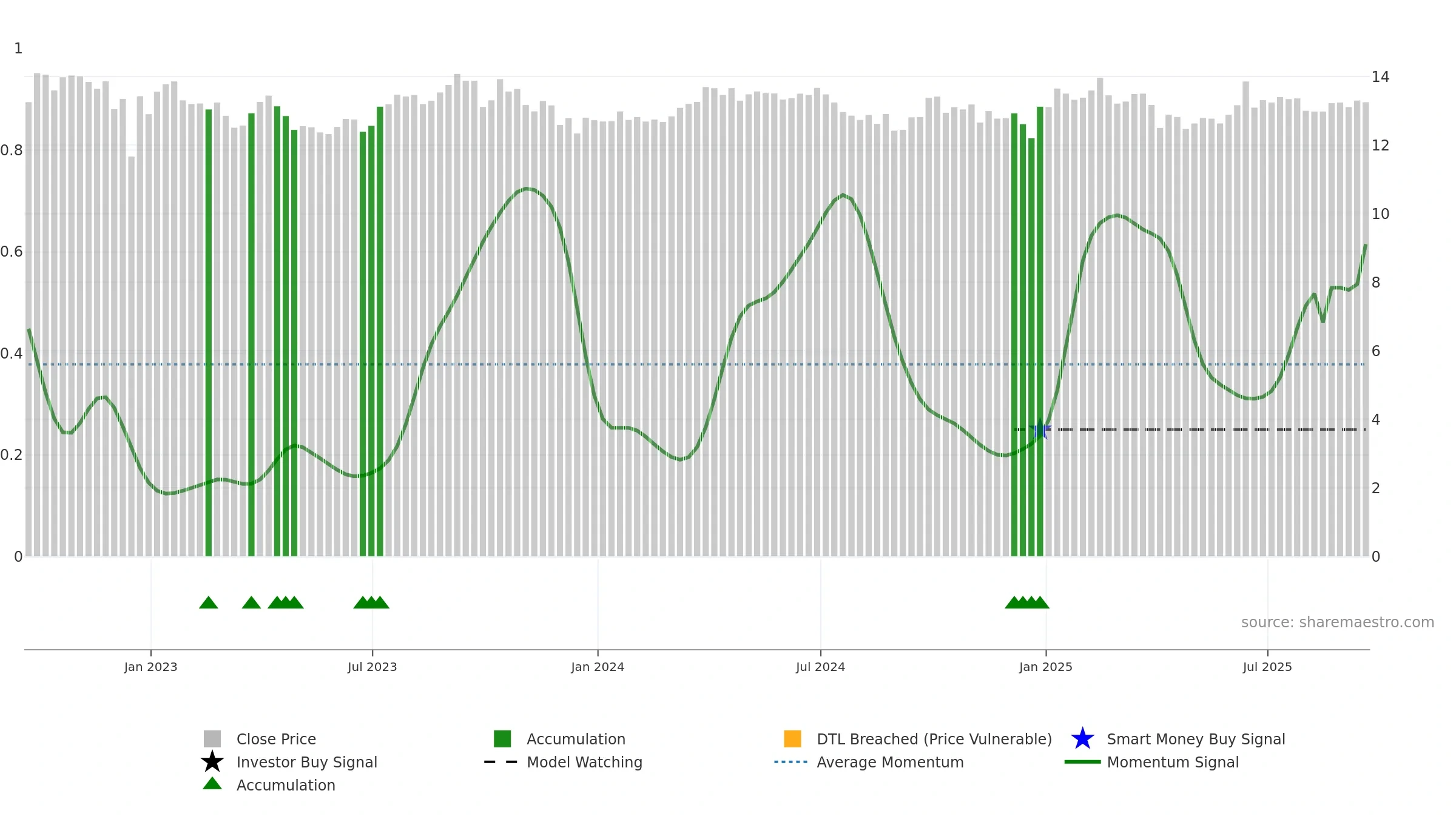

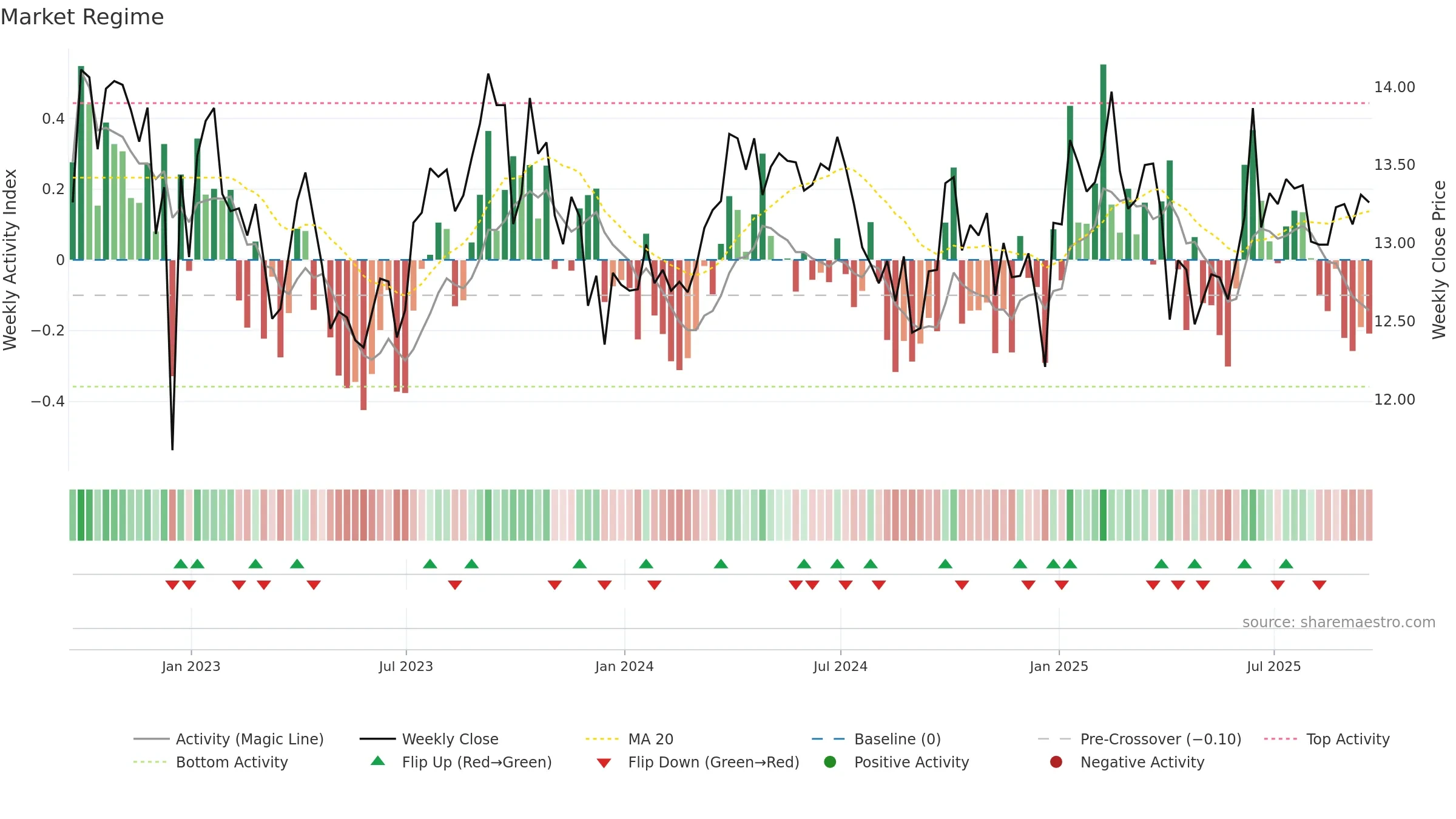

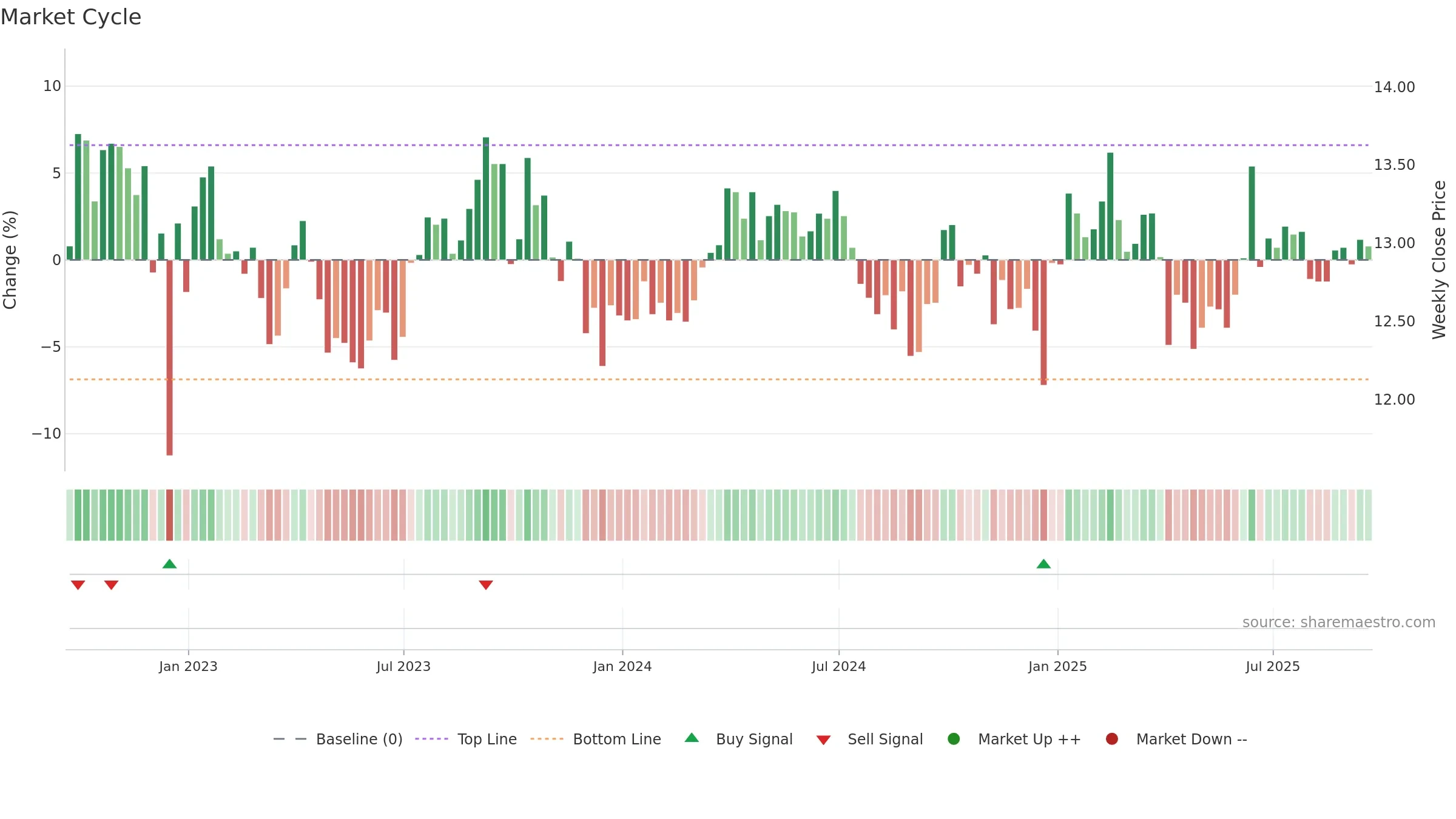

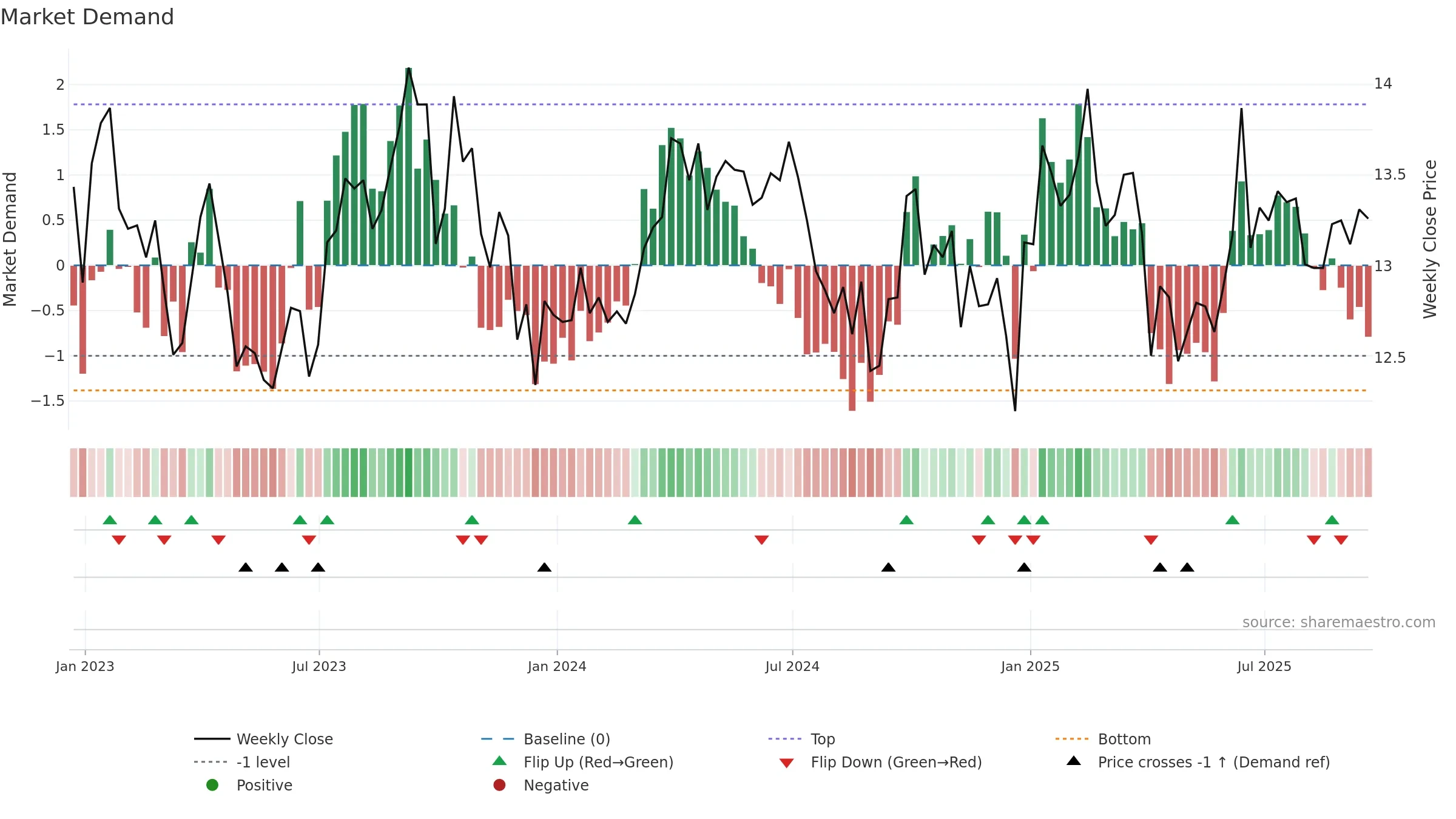

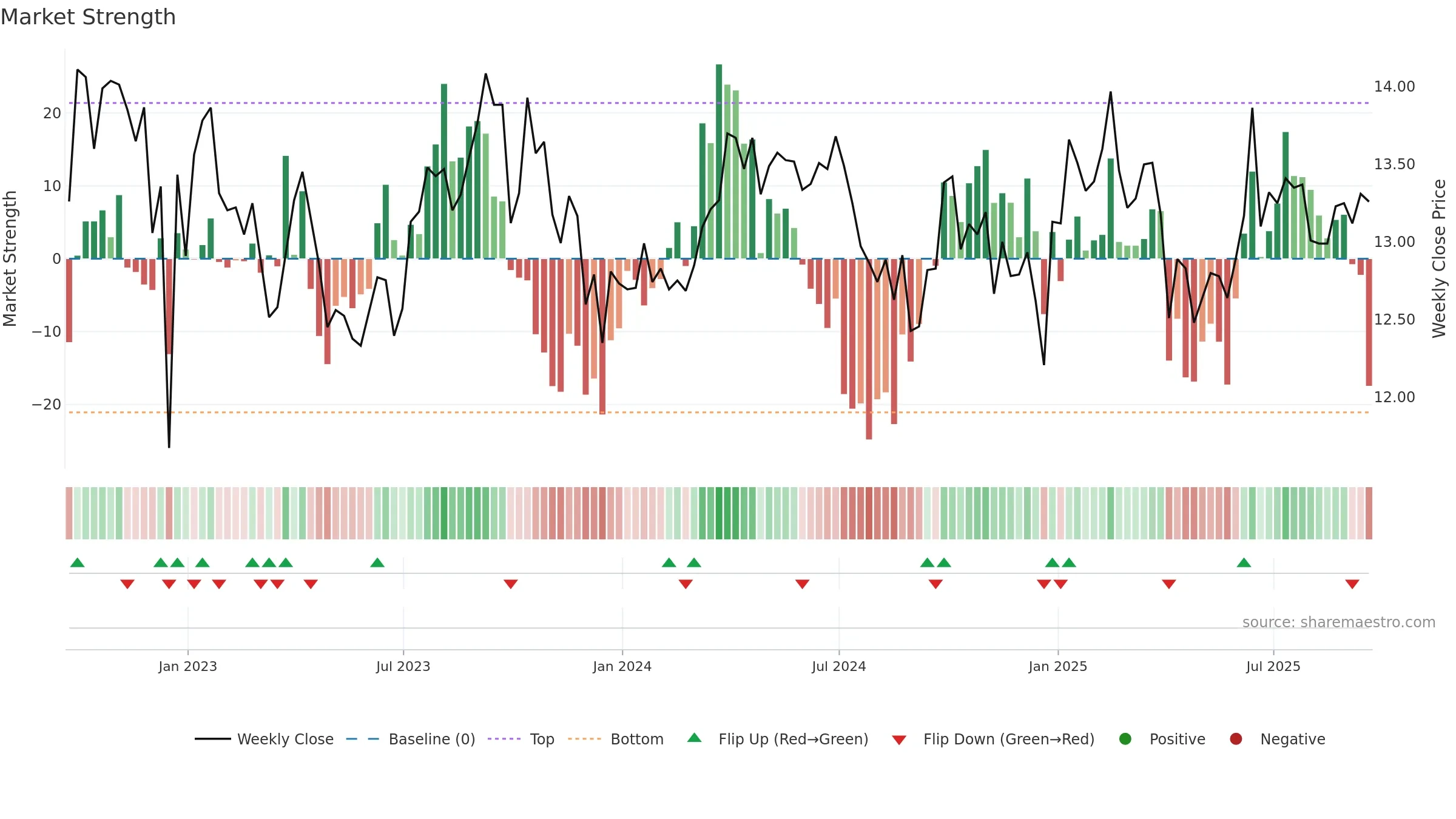

How to read this — Price slope is upward, indicating persistent buying over the window. Low weekly volatility favours steadier follow-through. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity. Accumulation weeks: 1; distribution weeks: 2. Distance to baseline is narrowing — reverting closer to its fair-value track. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

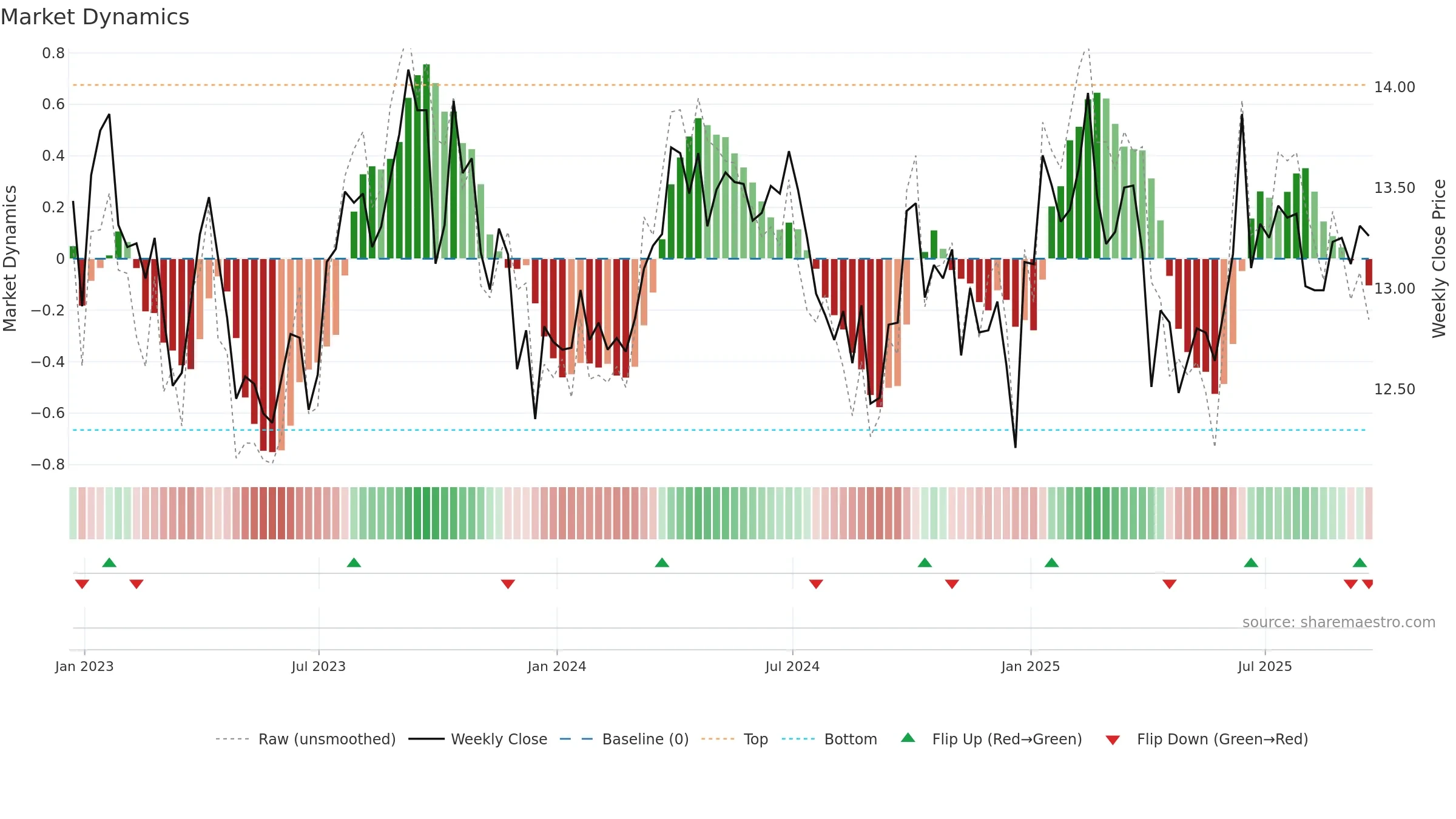

Gauge maps the trend signal to a 0–100 scale.

How to read this — Bullish gauge levels imply persistent upside pressure. A rising gauge shows momentum building rather than fading. Acceleration increases the odds of follow-through from week to week.

Constructive backdrop; dips are more likely to find support while the gauge stays high.

Conclusion

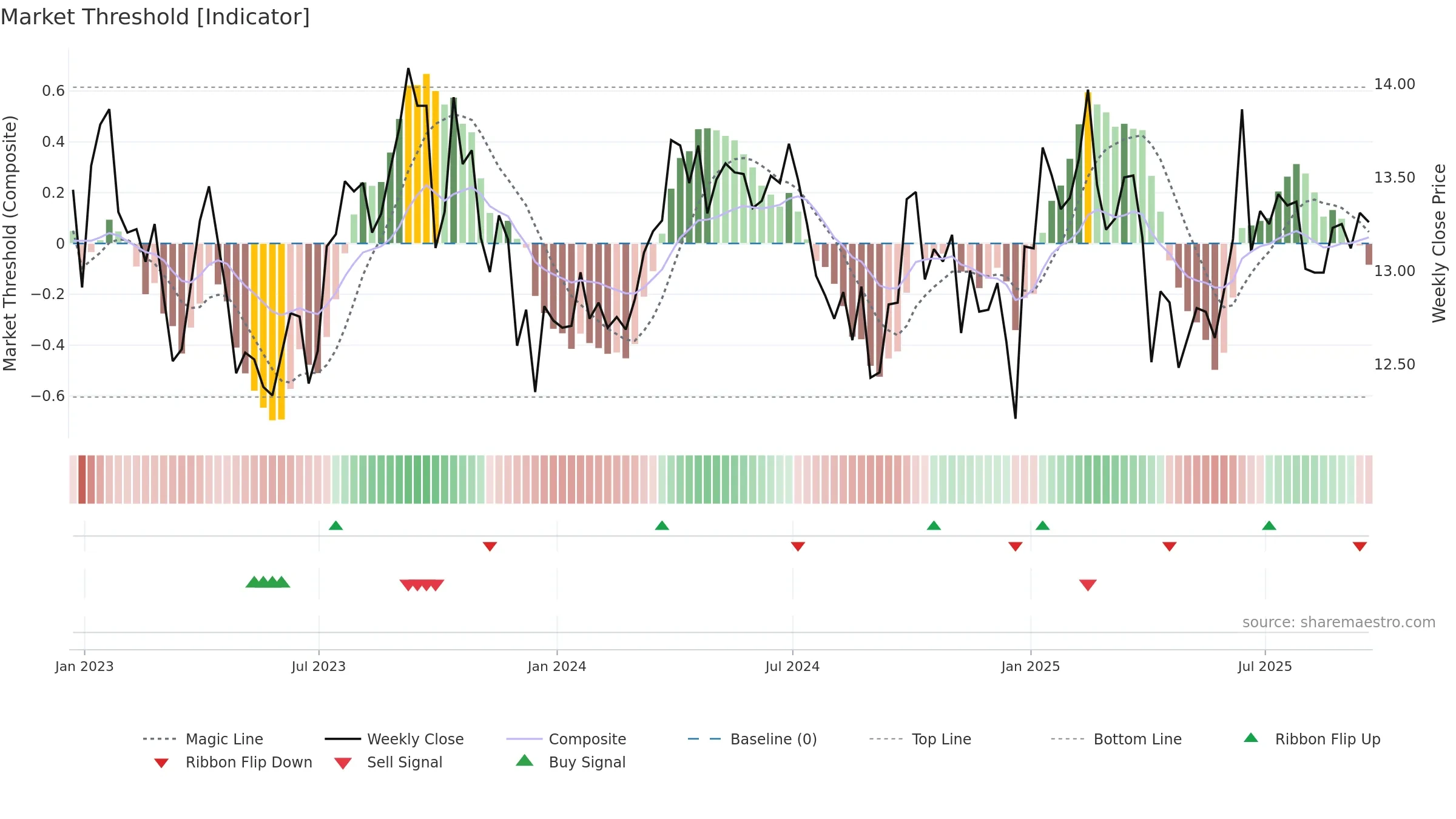

Positive setup. ★★★★☆ confidence. Price window: 1. Trend: Bullish @ 80. In combination, liquidity diverges from price.

Why: Price window 1.92% over 8w. Close is -0.38% below the window high. Return volatility 1.06%. Volume trend falling. Liquidity divergence with price. Accumulation 1; distribution 2. MA stack mixed. Baseline deviation 0.01% (narrowing). Momentum bullish and rising. Acceleration accelerating. Gauge volatility low.

Tip: Most metrics also include a hover tooltip where they appear in the report.