Airo Lam Limited

AIROLAM NSE

Weekly Summary

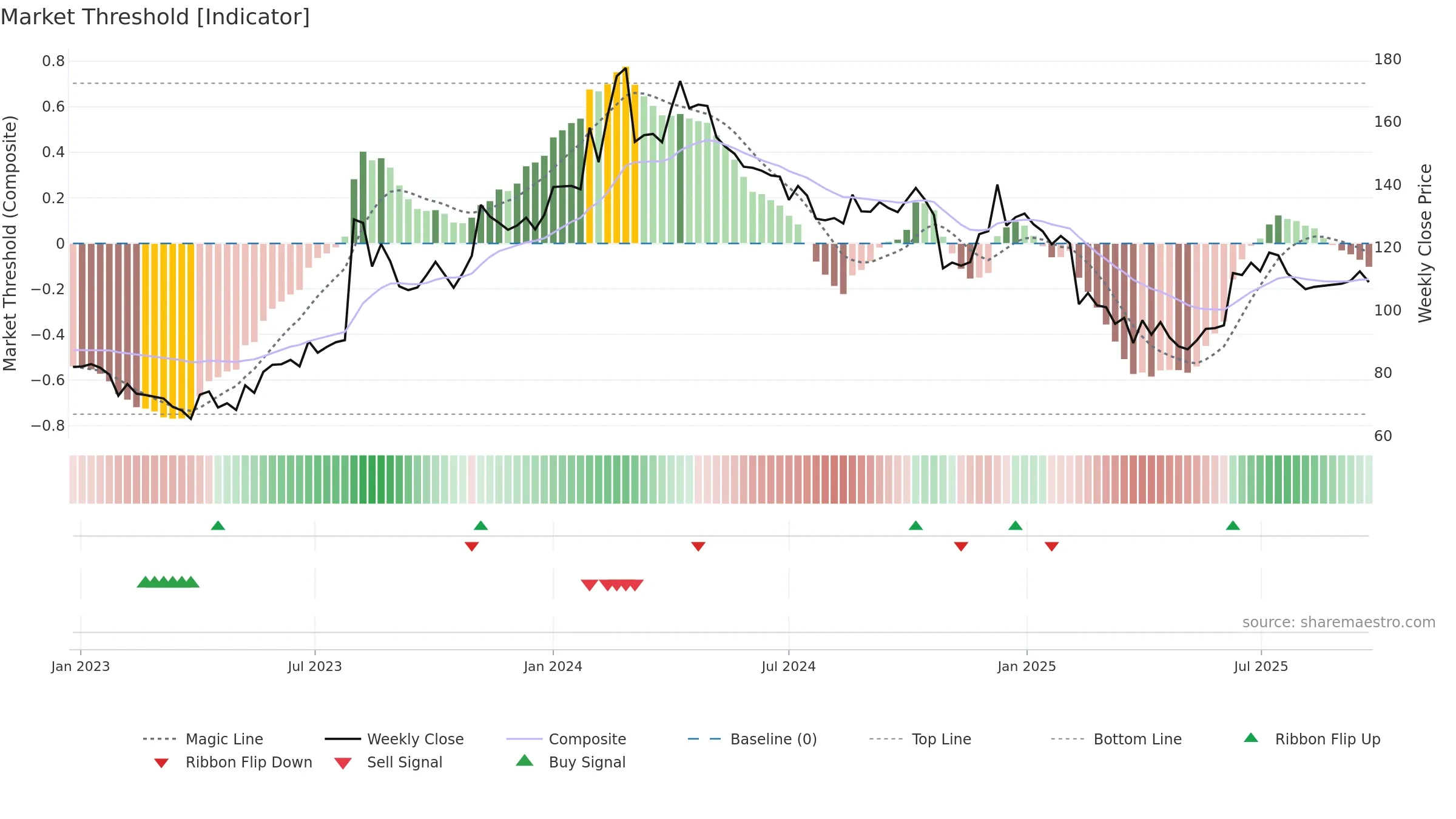

Airo Lam Limited closed at 108.9300 (-2.73% WoW) . Data window ends Mon, 22 Sep 2025.

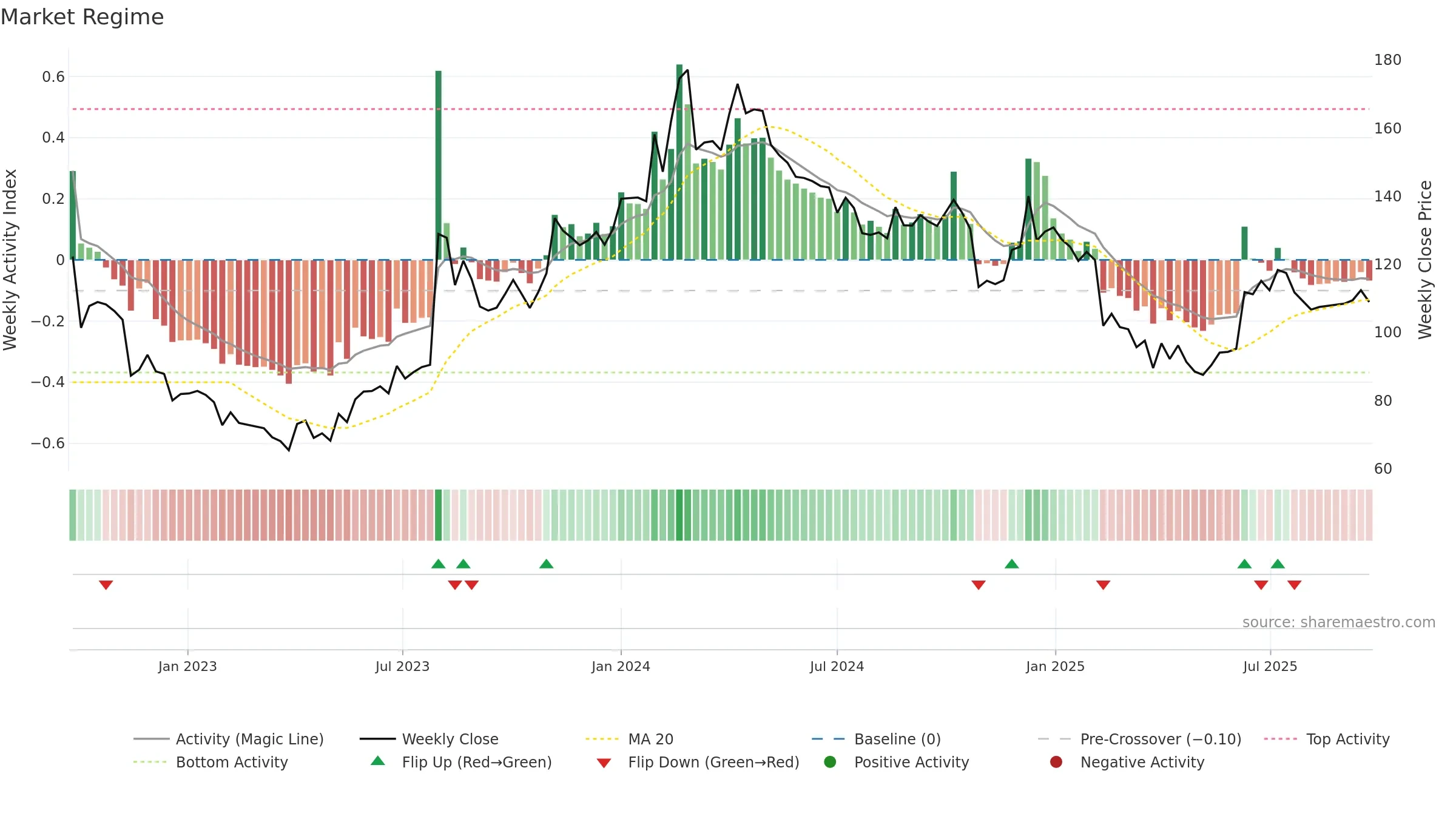

How to read this — Price slope is upward, indicating persistent buying over the window. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

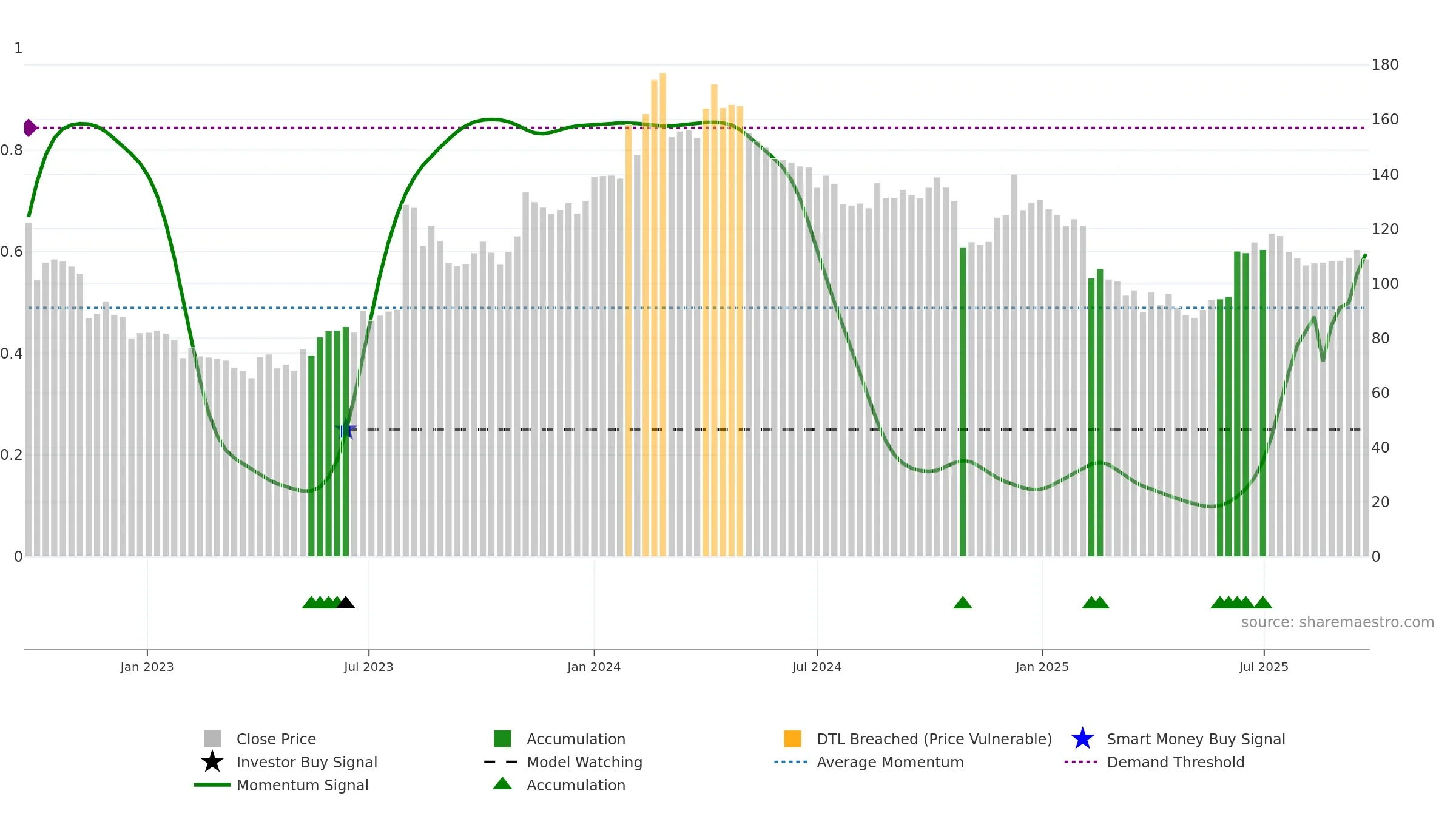

Gauge maps the trend signal to a 0–100 scale.

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

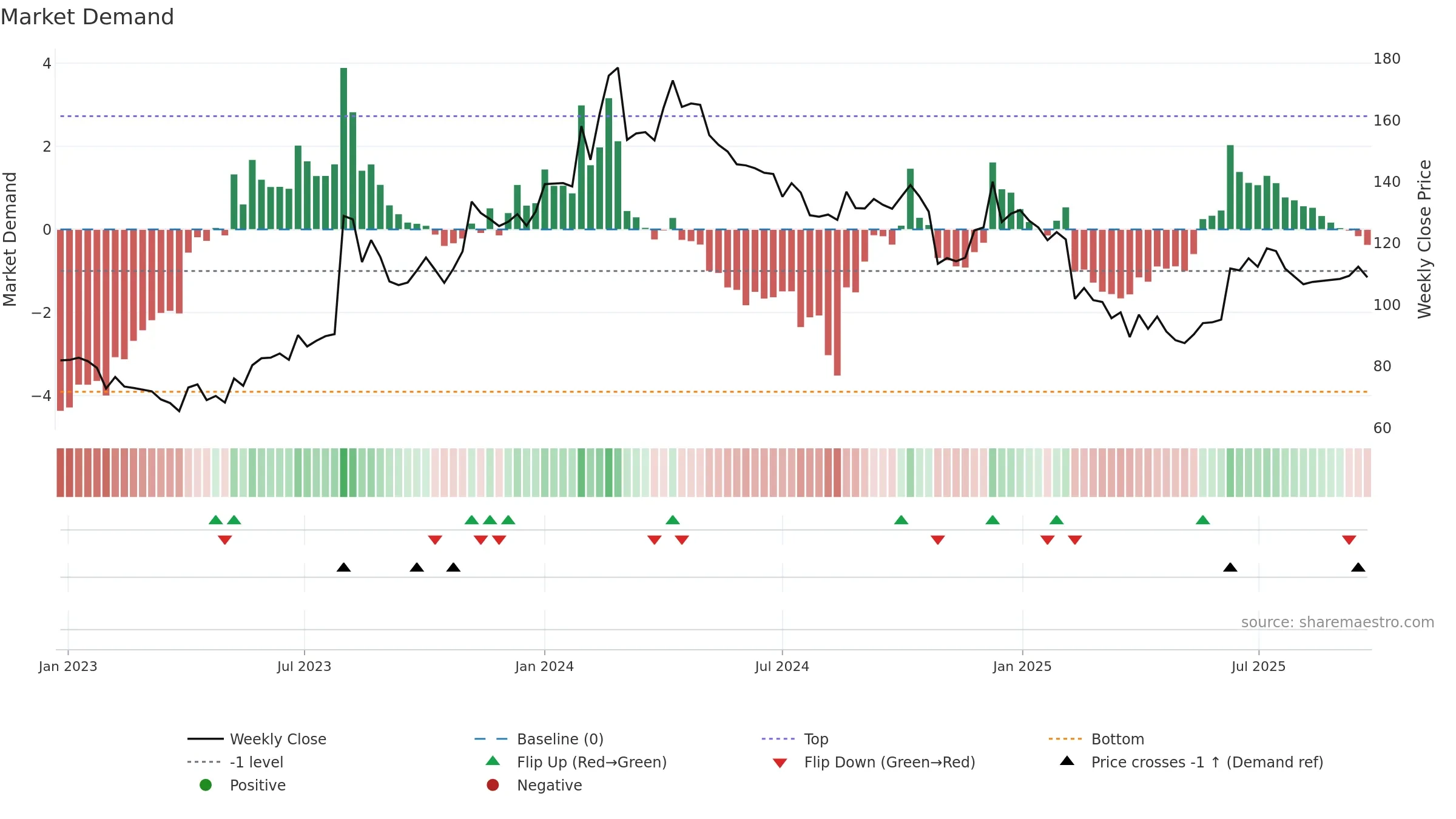

Relative strength is Positive

(> 0%, outperforming).

Latest MRS: 0.55% (week ending Fri, 19 Sep 2025).

Slope: Rising over 8w.

Notes:

- Holding above the zero line indicates relative bid.

- MRS slope rising over ~8 weeks.

Price is above fair value; upside may be capped without catalysts.

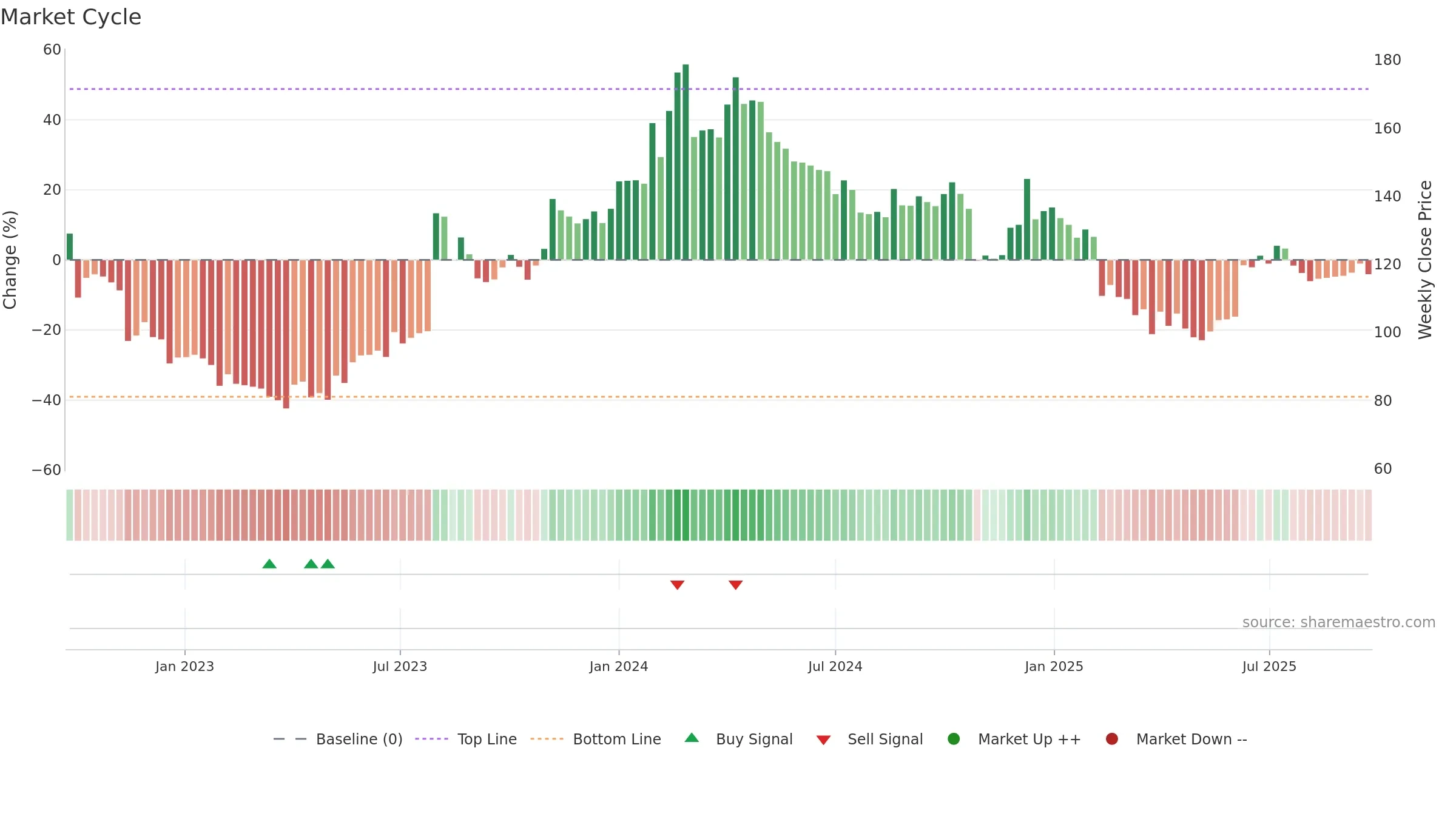

Conclusion

Neutral setup. ★★★⯪☆ confidence. Trend: Range / Neutral · 2.10% over window · vol 3.41% · liquidity divergence · posture above · RS outperforming · leaning positive

- Price holds above 8–26 week averages

- Mansfield RS: outperforming & rising

- Liquidity diverges from price

Why: Price window 2.10% over w. Close is -3.07% below the prior-window high. Volume trend falling. Liquidity divergence with price. Trend state range / neutral. Momentum neutral and rising. Valuation limited upside without catalysts.

Tip: Most metrics include a hover tooltip where they appear in the report.