PennantPark Investment Corporation

PNNT NYSE

Weekly Summary

PennantPark Investment Corporation closed at 6.9300 (-0.29% WoW) . Data window ends Fri, 19 Sep 2025.

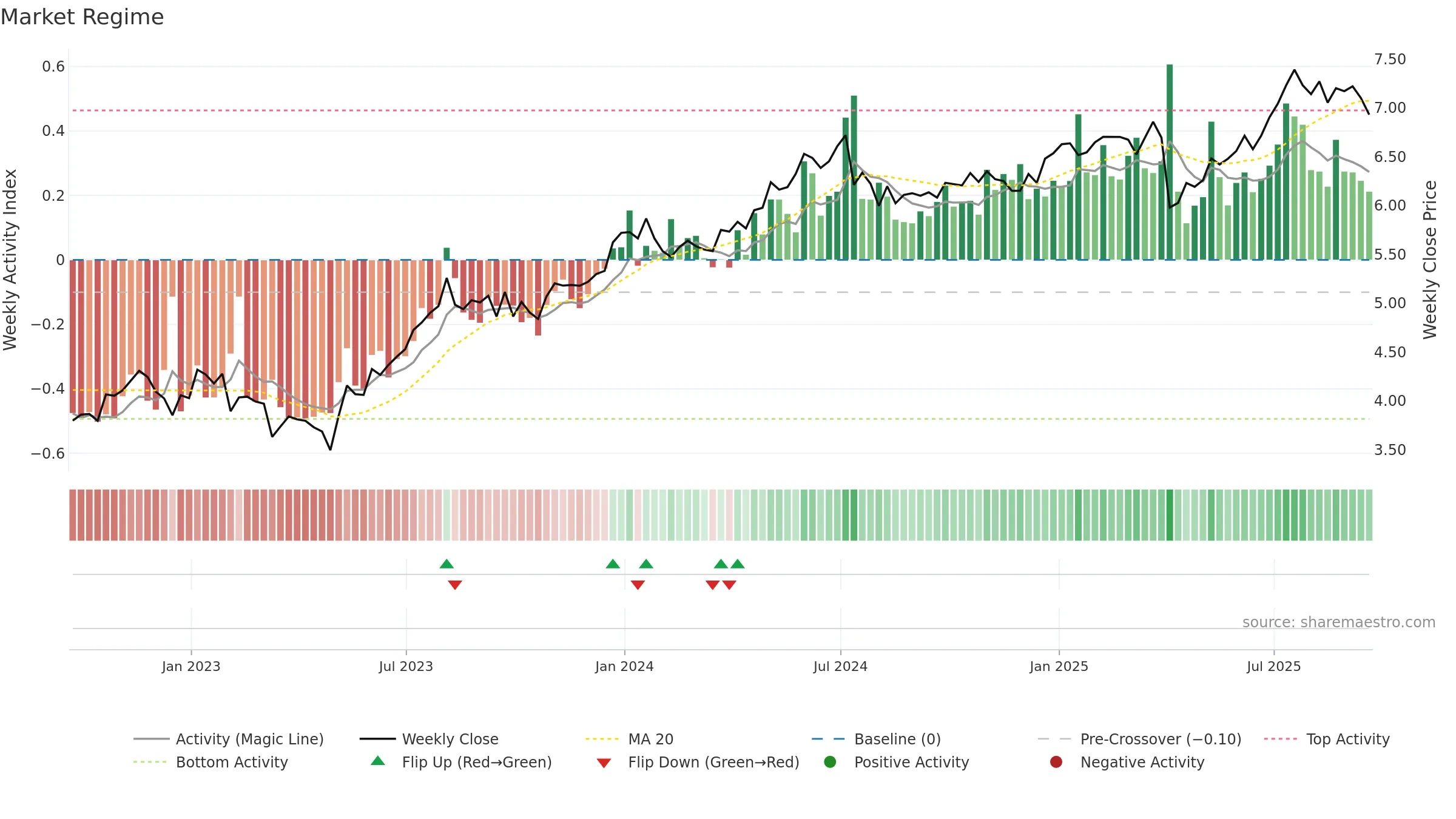

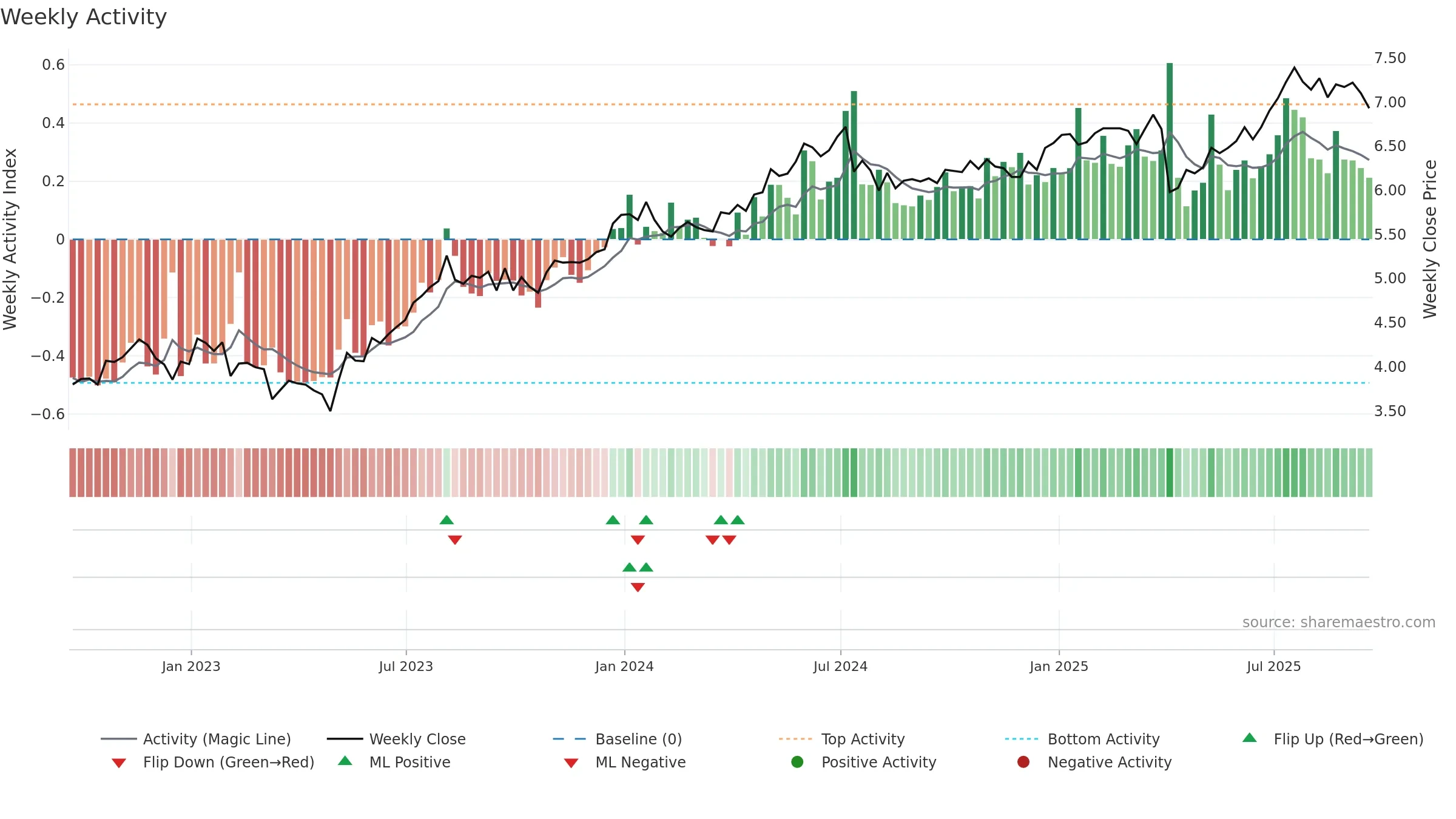

How to read this — Price slope is downward, indicating persistent supply pressure. Low weekly volatility favours steadier follow-through. Volume and price are moving in the same direction — a constructive confirmation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Distance to baseline is narrowing — reverting closer to its fair-value track.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

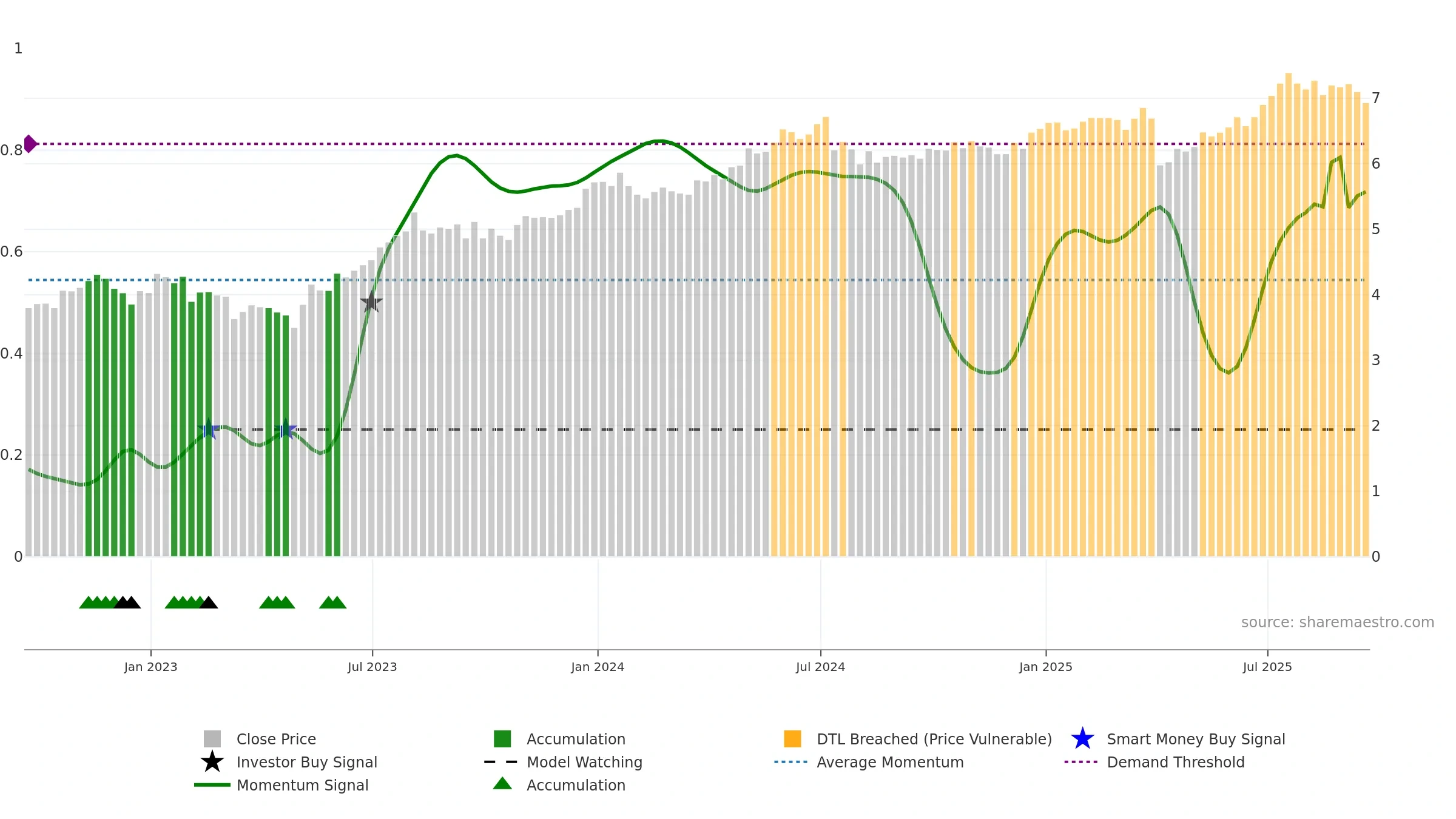

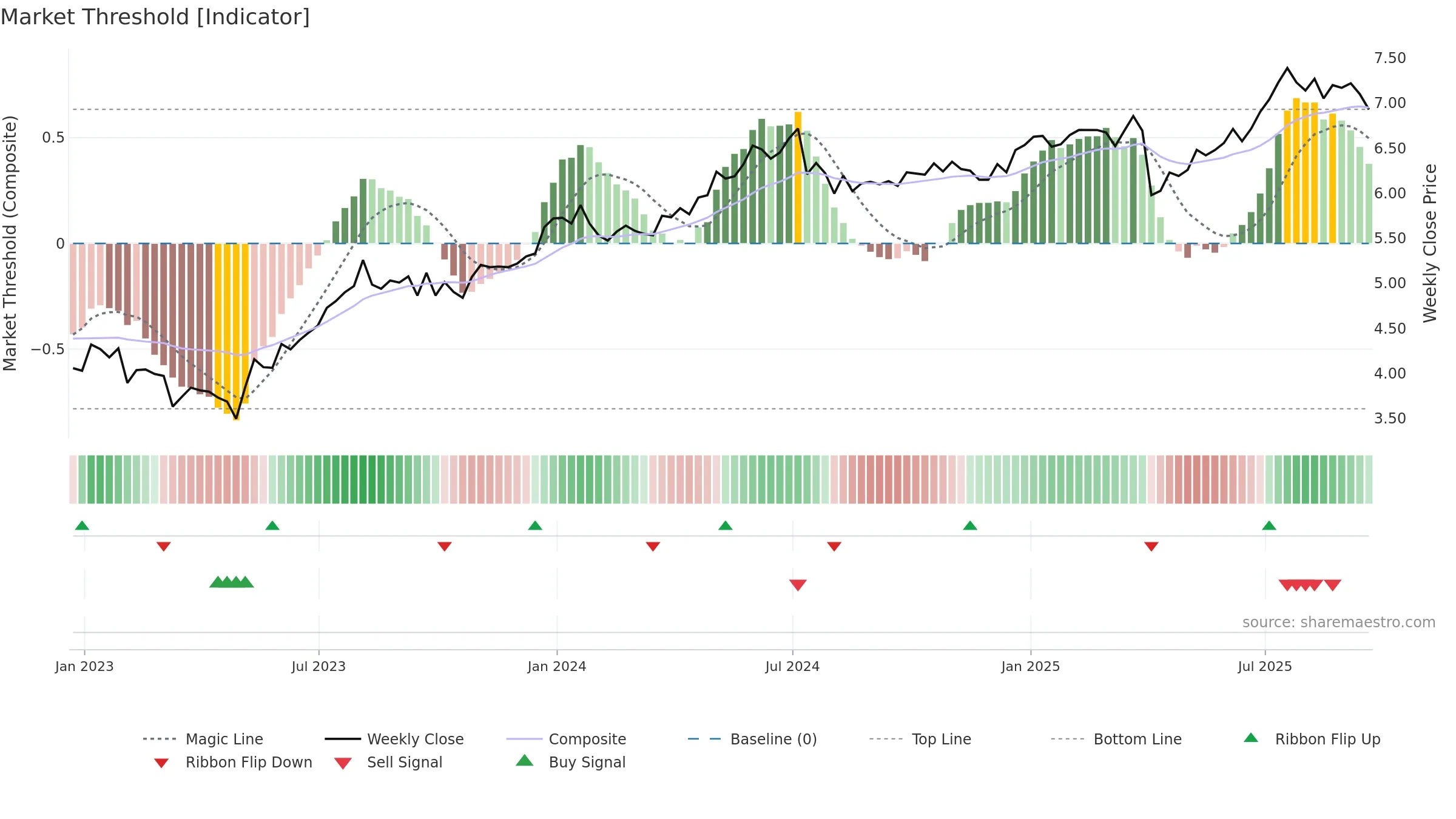

Gauge maps the trend signal to a 0–100 scale.

How to read this — Gauge is elevated but momentum is rolling over; topping risk is rising.

Stay alert: protect gains or seek confirmation before adding risk.

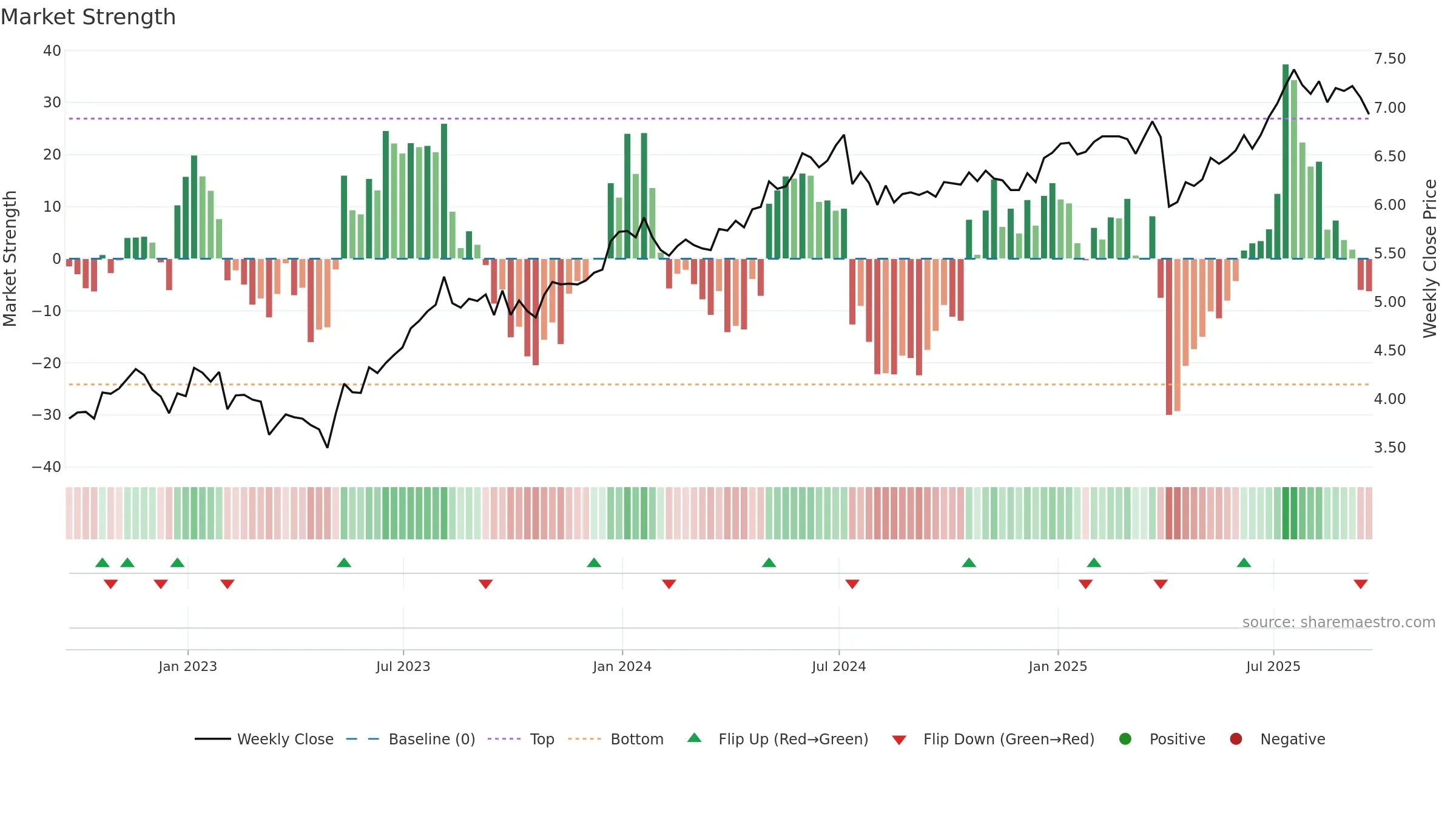

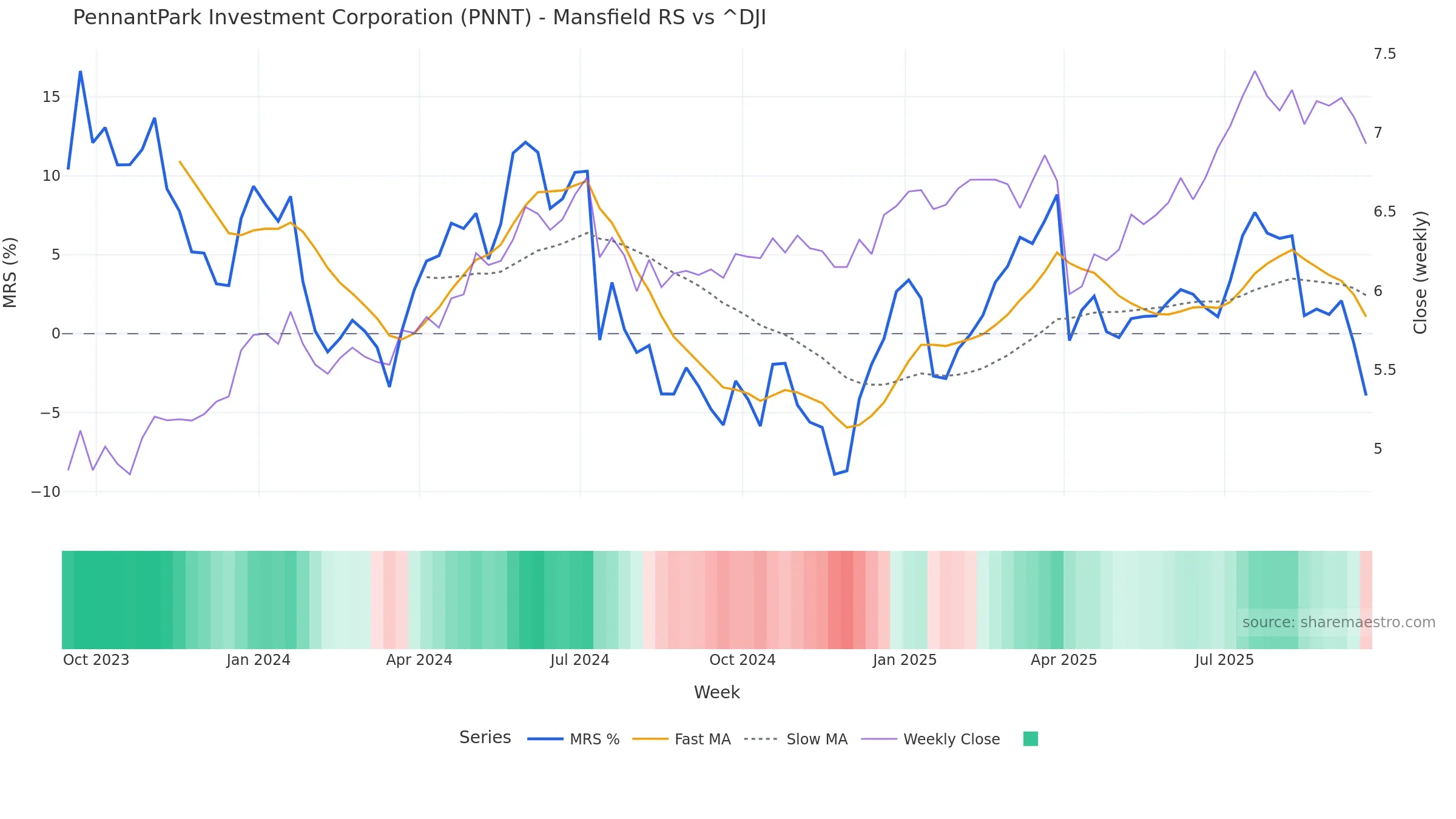

Relative strength is Negative

(< 0%, underperforming).

Latest MRS: -3.92% (week ending Fri, 19 Sep 2025).

Slope: Falling over 8w.

Notes:

- Below zero line indicates relative weakness vs benchmark.

- MRS slope falling over ~8 weeks.

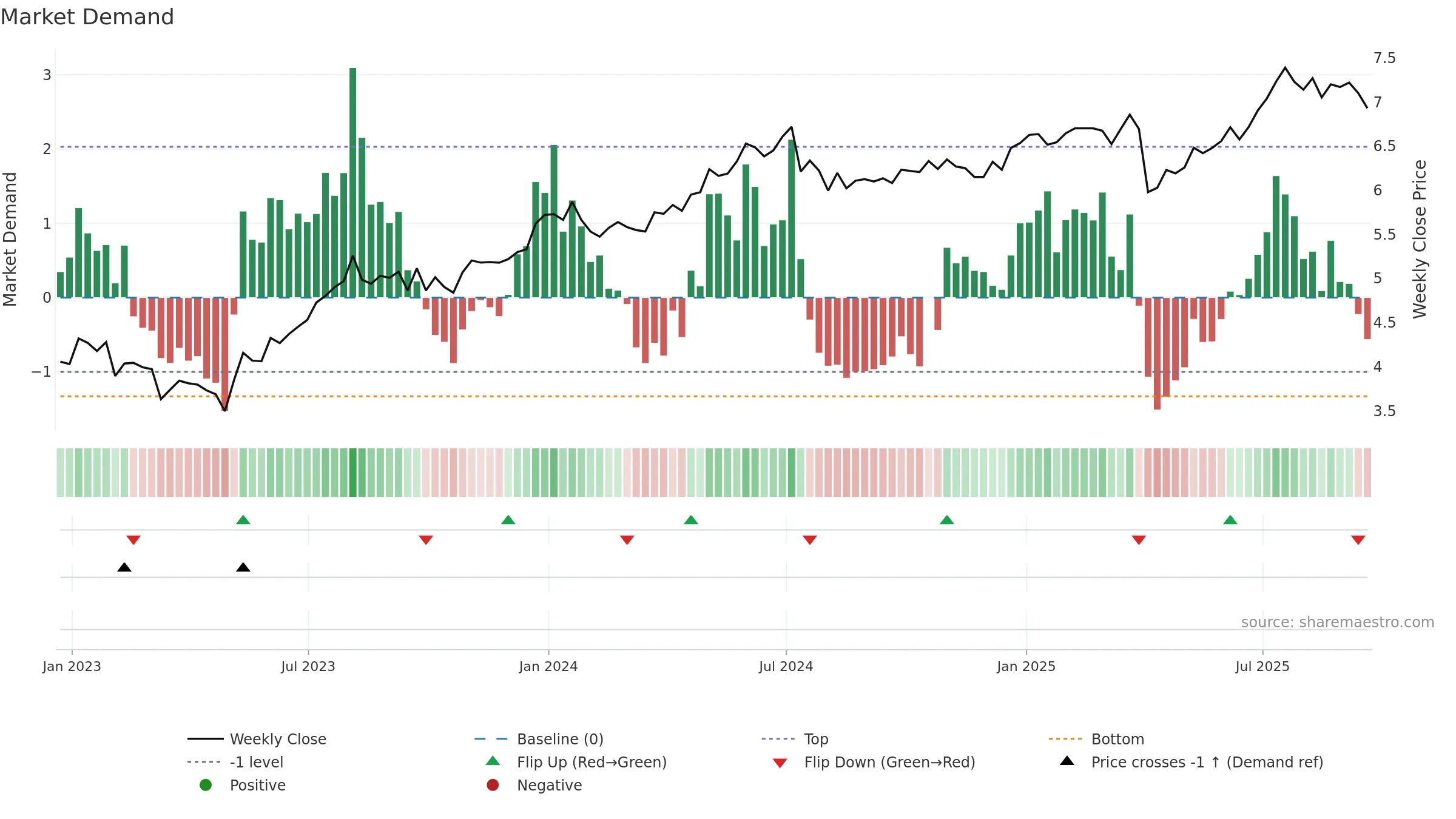

Price is below fair value; potential upside if momentum constructive.

Conclusion

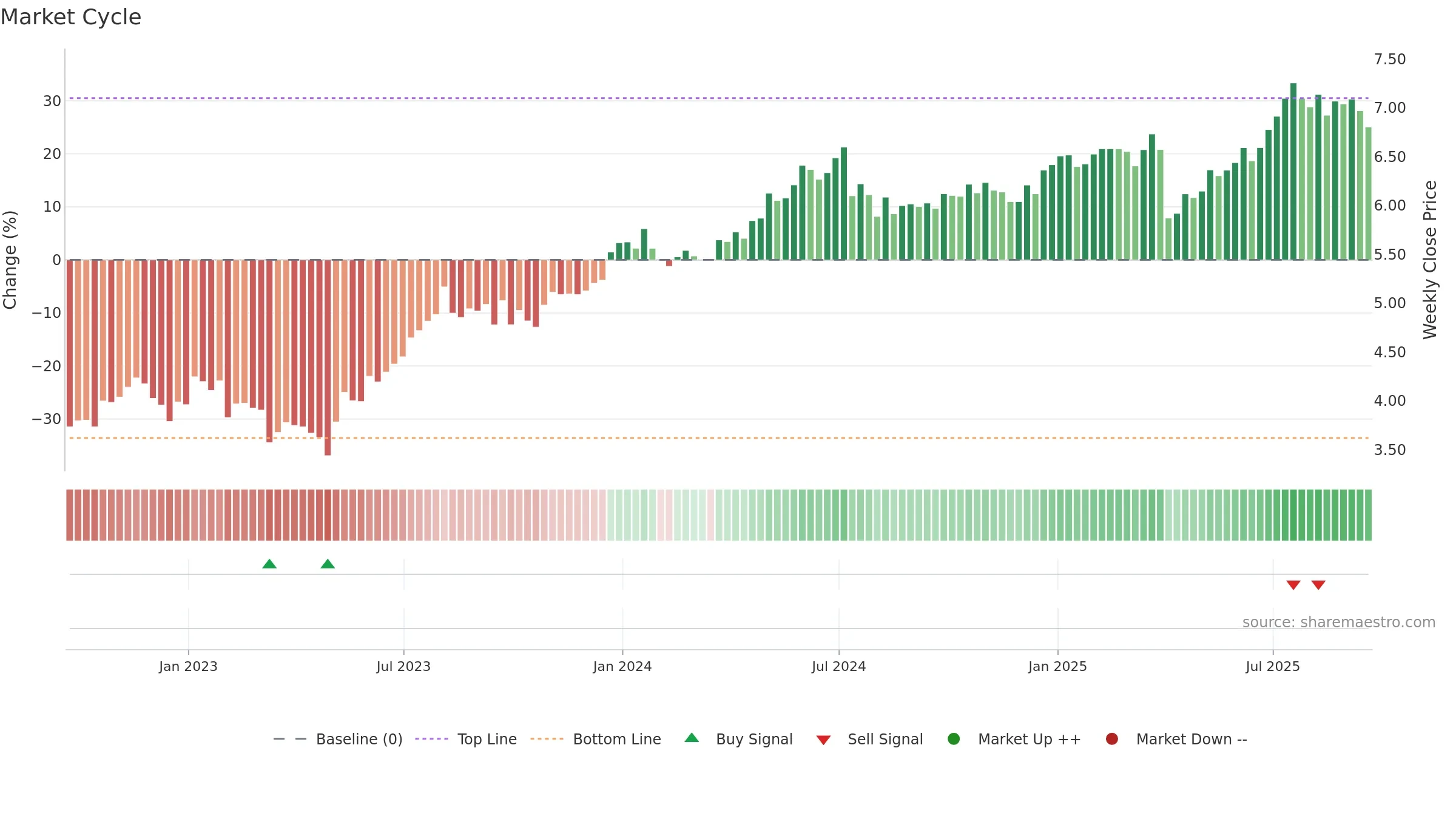

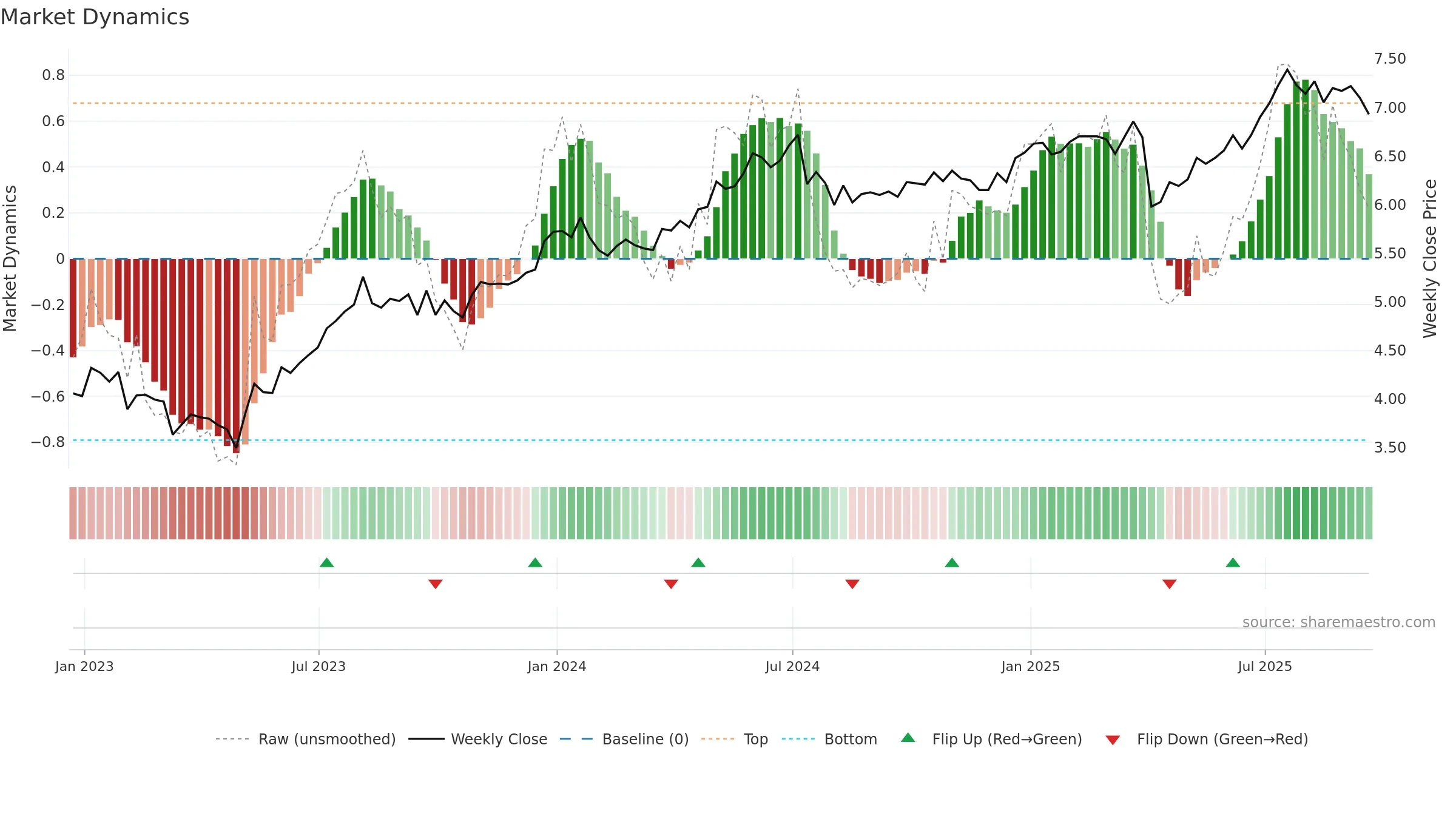

Neutral setup. ★★★☆☆ confidence. Price window: -2. Trend: Uptrend at Risk; gauge 71. In combination, liquidity confirms the move.

- Momentum is bullish and rising

- Liquidity confirms the price trend

- Low return volatility supports durability

- High-level but rolling over (topping risk)

- Price is not above key averages

- Negative multi-week performance

Why: Price window -2.94% over 8w. Close is -4.68% below the prior-window high. Return volatility 0.83%. Volume trend falling. Liquidity convergence with price. Trend state uptrend at risk. Momentum bullish and rising. Valuation supportive skew.

Tip: Most metrics include a hover tooltip where they appear in the report.