DB Inc.

012030 KRX

Weekly Report

DB Inc. closed at 1637.0000 (0.00% WoW) . Data window ends Mon, 15 Sep 2025.

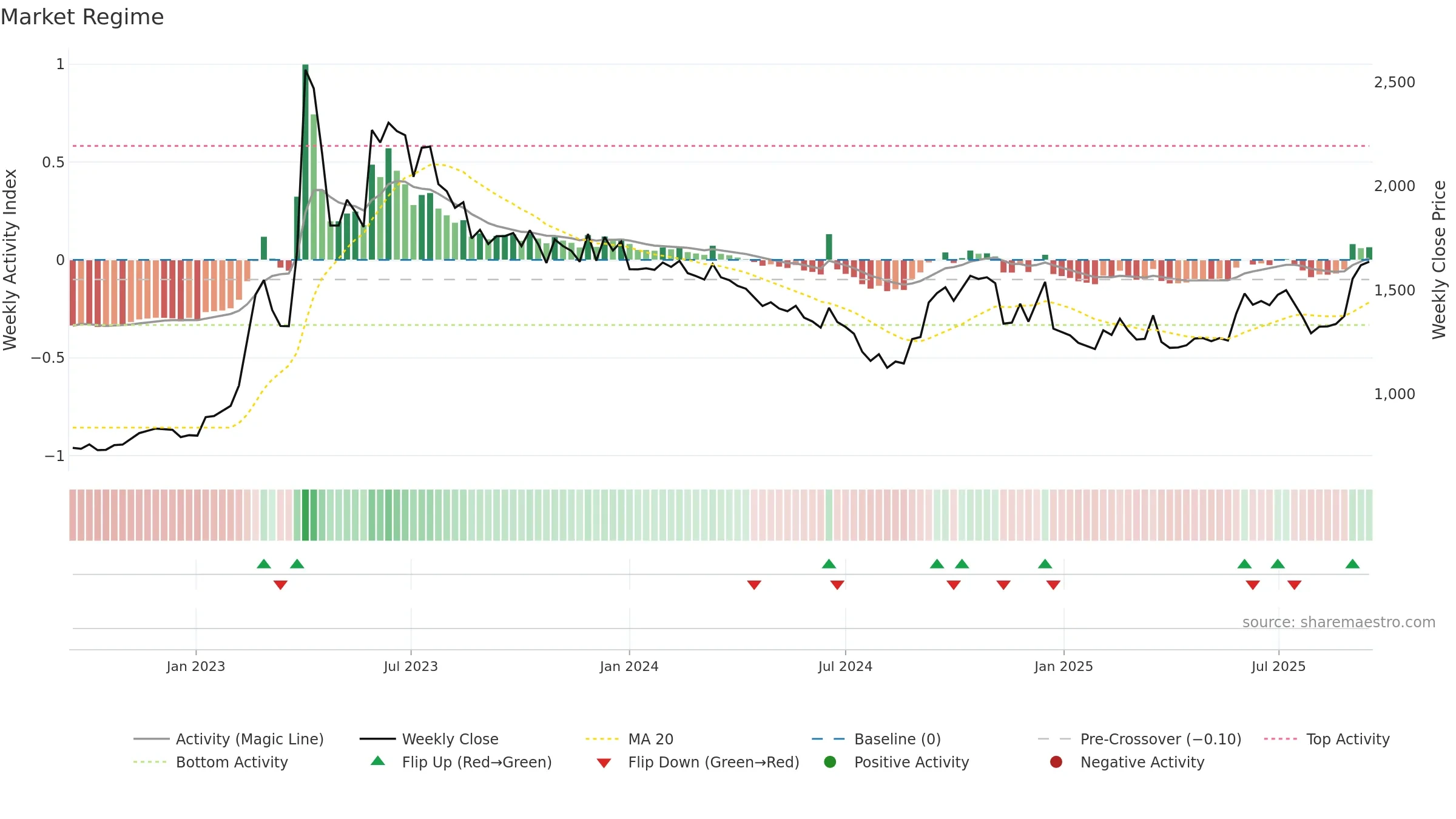

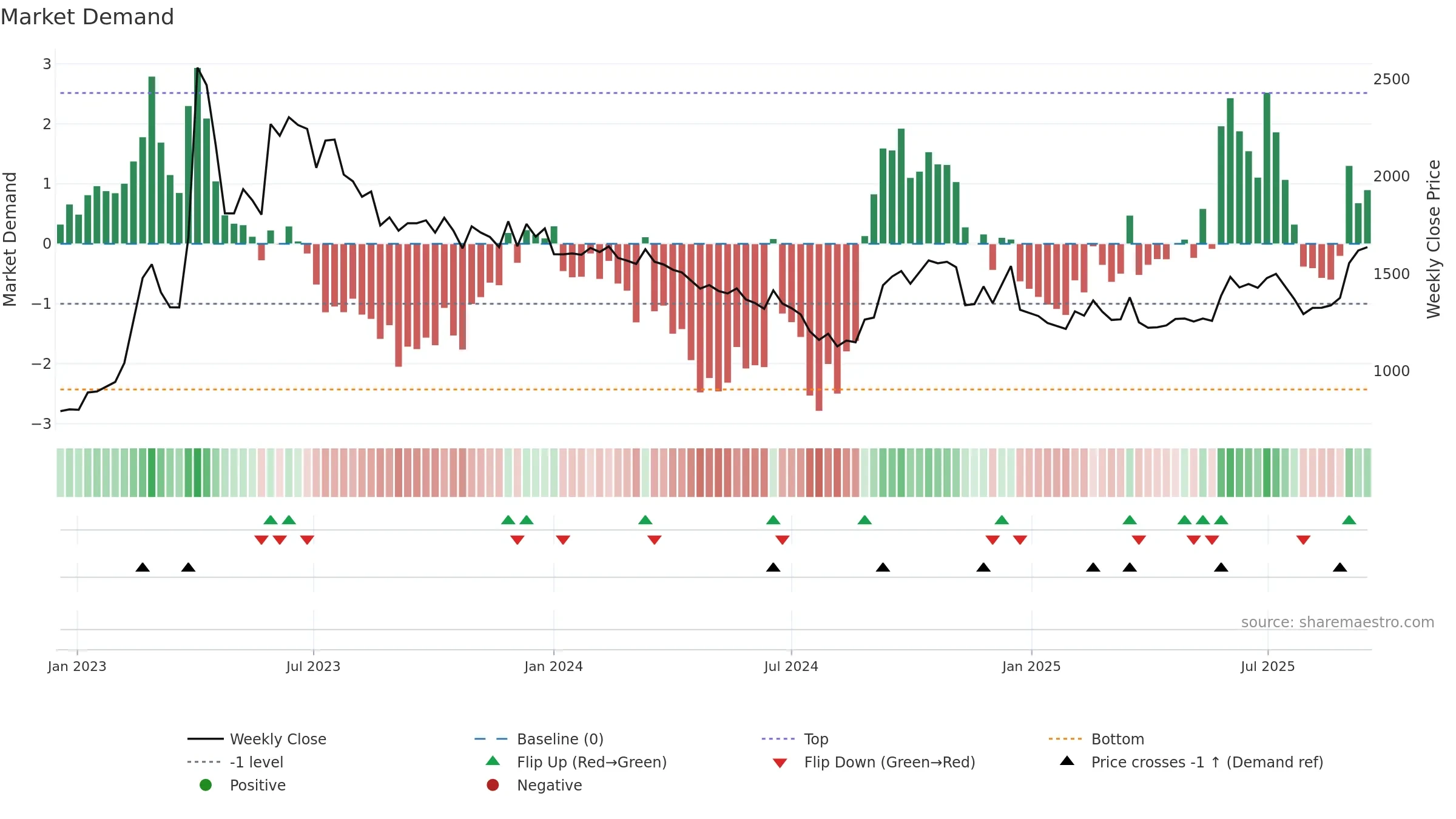

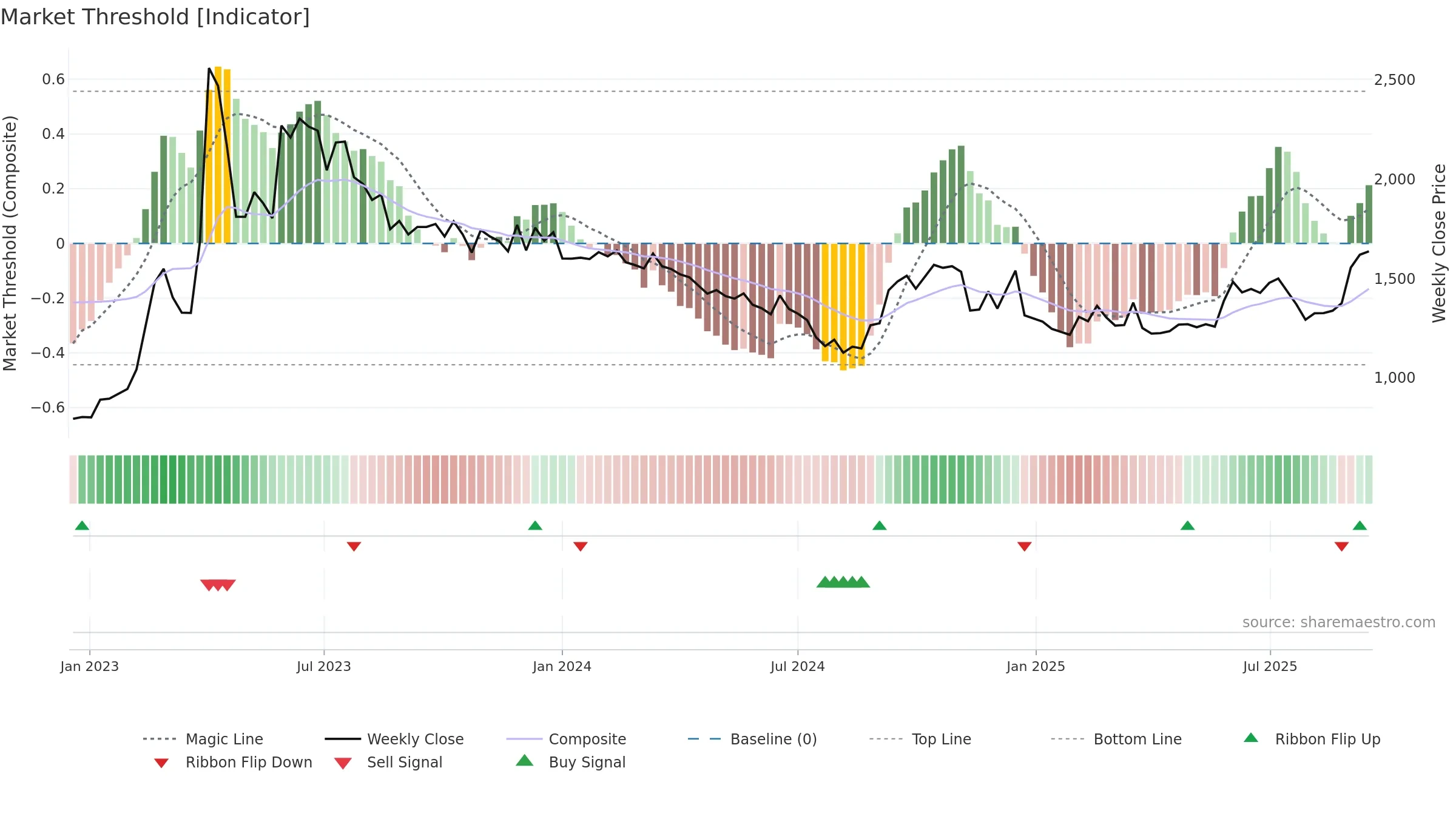

How to read this — Price slope is upward, indicating persistent buying over the window. Elevated weekly volatility increases whipsaw risk. Volume and price are moving in the same direction — a constructive confirmation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm.

Gauge maps the trend signal to a 0–100 scale.

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

Conclusion

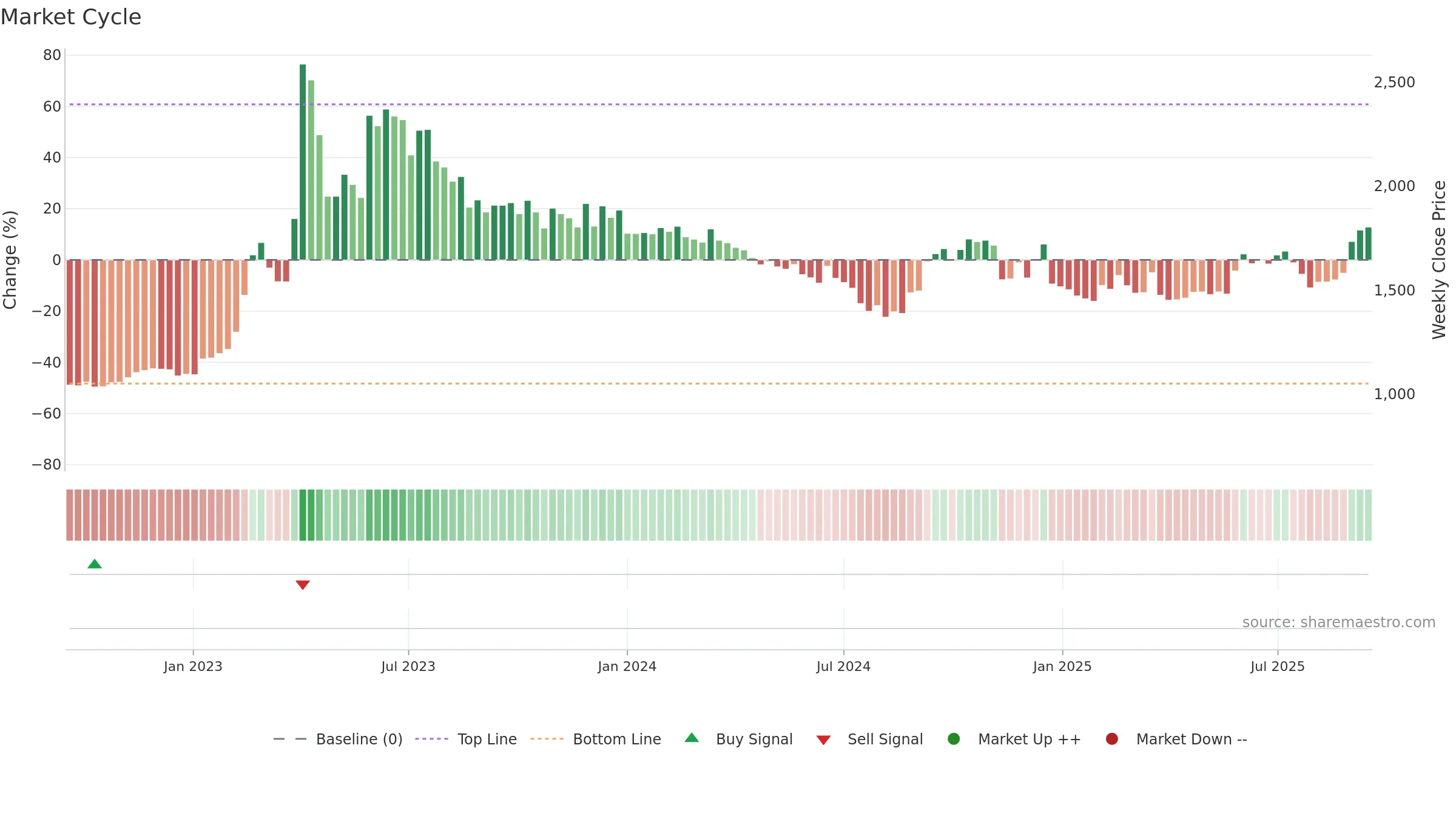

Neutral setup. ★★★☆☆ confidence. Price window: 26. Trend: Range / Neutral; gauge 68. In combination, liquidity confirms the move.

- Price holds above 8w & 26w averages

- Liquidity confirms the price trend

- Solid multi-week performance

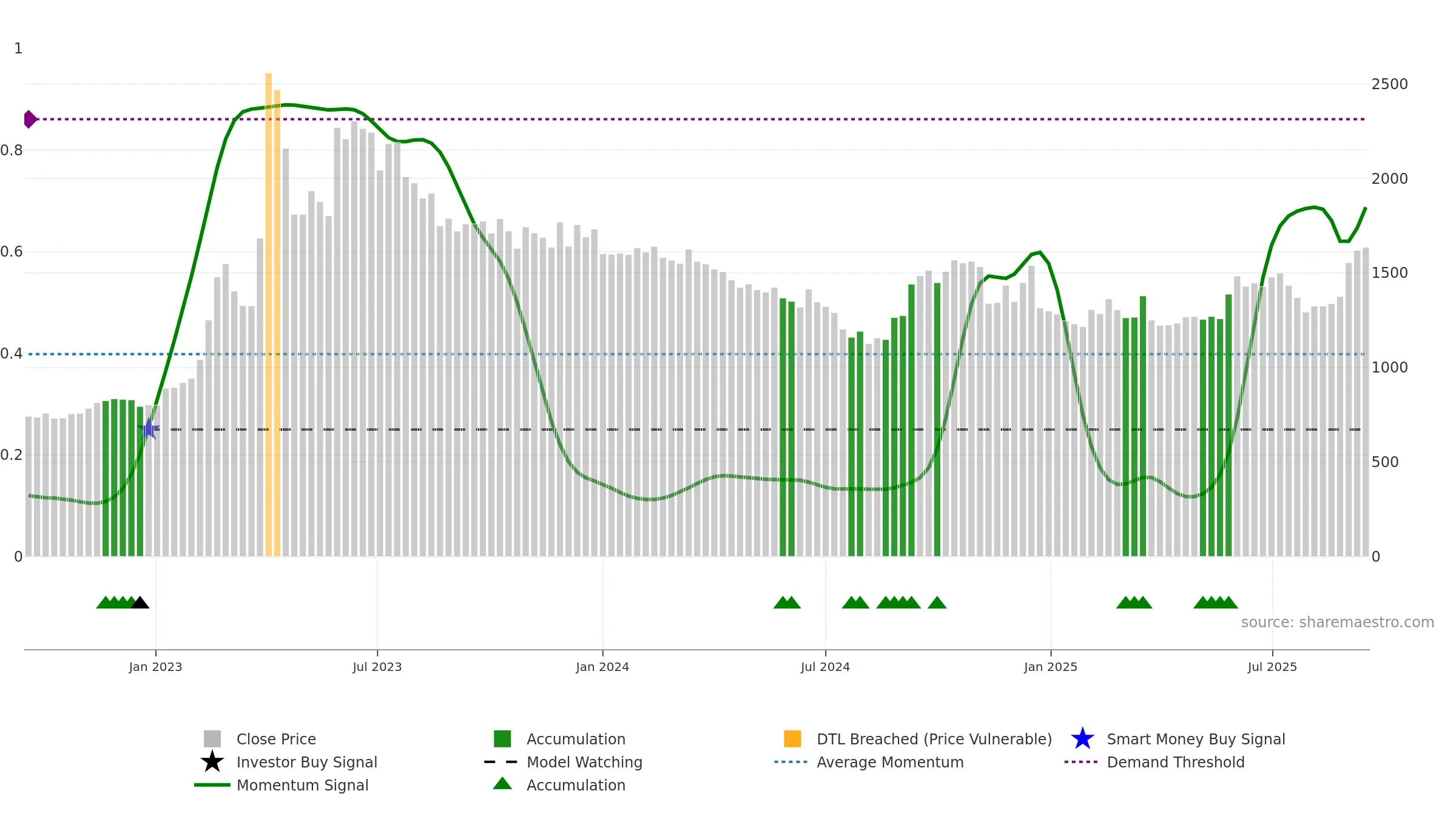

- Momentum is weak/falling

- High return volatility raises whipsaw risk

Why: Price window 26.60% over 8w. Close is 1.05% above the prior-window high. Return volatility 4.75%. Volume trend rising. Liquidity convergence with price. Trend state range / neutral. Momentum bullish and falling.

Tip: Most metrics include a hover tooltip where they appear in the report.