John B. Sanfilippo & Son, Inc.

JBSS NASDAQ

Weekly Report

John B. Sanfilippo & Son, Inc. closed at 63.2400 (-2.03% WoW) . Data window ends Fri, 19 Sep 2025.

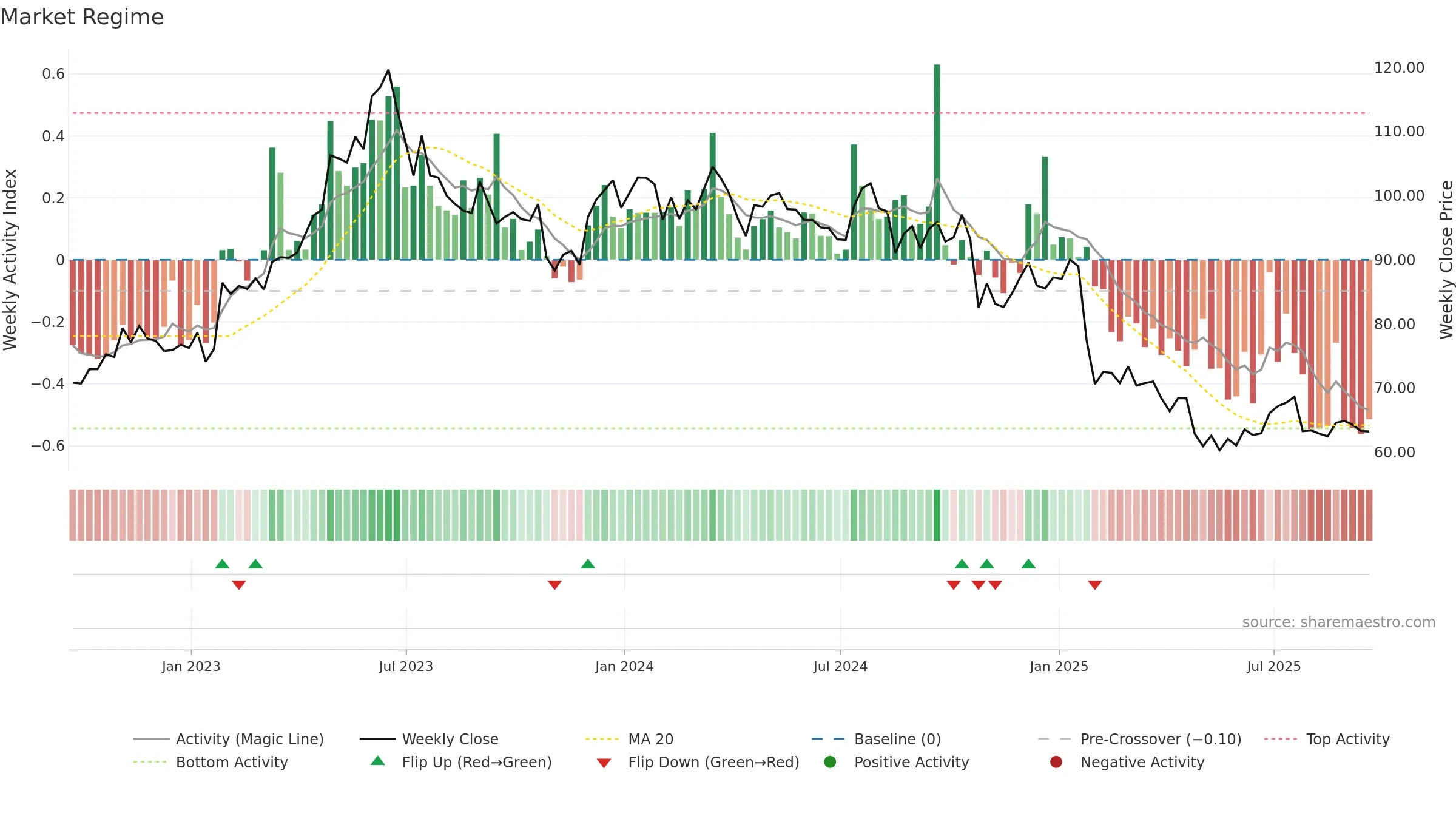

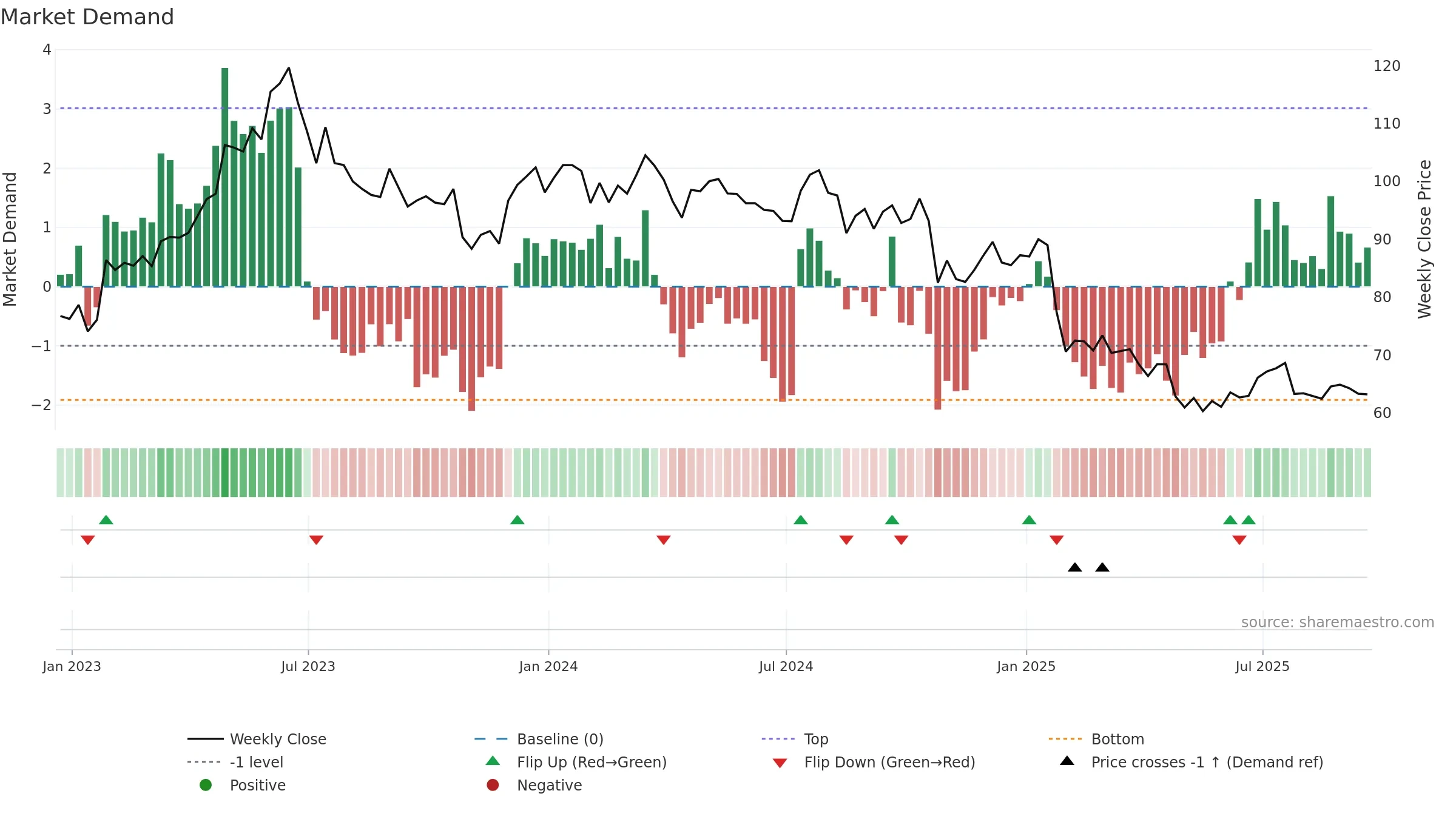

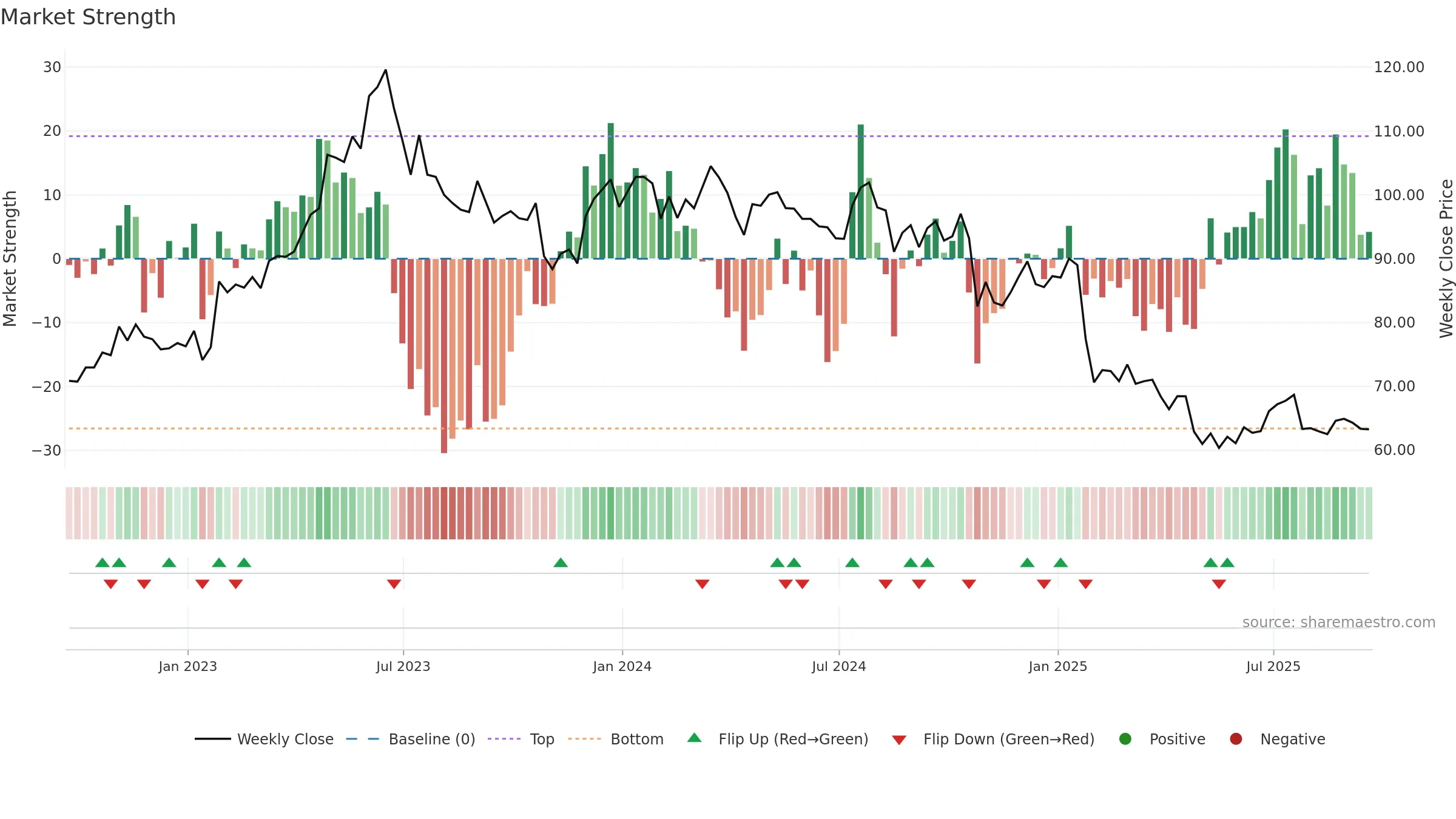

How to read this — Price slope is upward, indicating persistent buying over the window. Low weekly volatility favours steadier follow-through. Volume trend diverges from price — watch for fatigue or rotation. Price is extended below its baseline; rebounds can be sharp if demand improves. Distance to baseline is narrowing — reverting closer to its fair-value track. Price sits below key averages, keeping pressure on the tape.

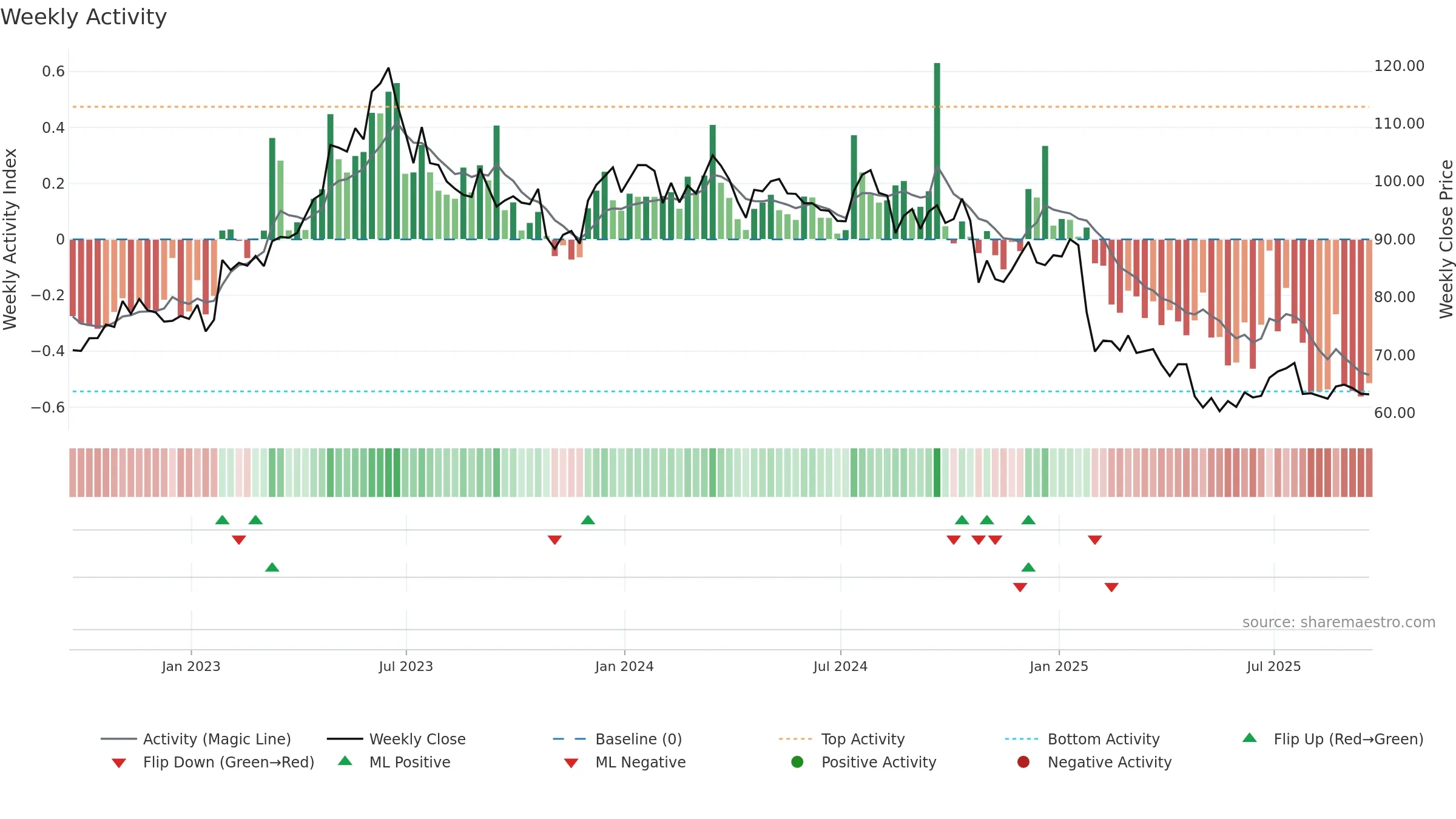

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

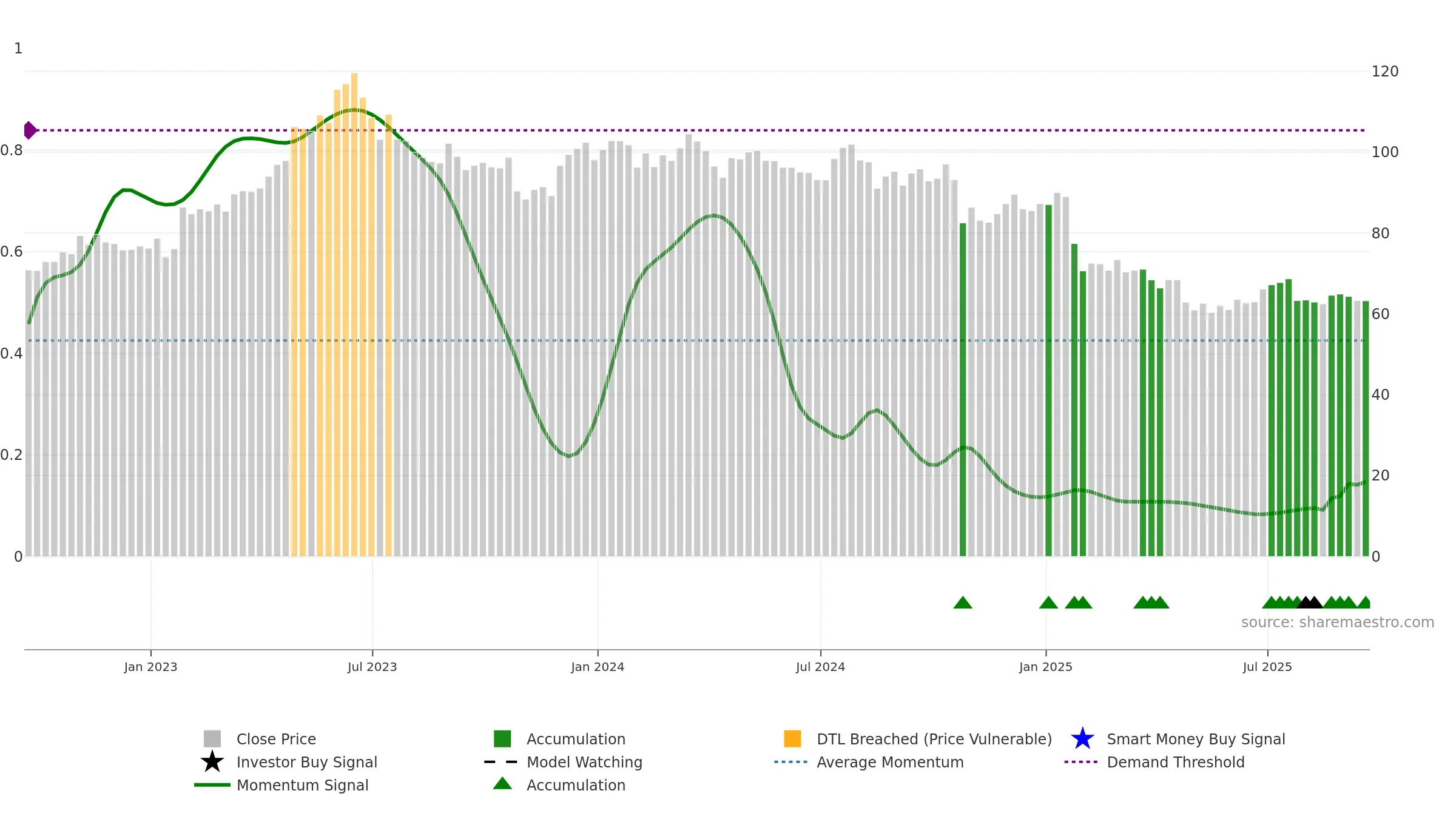

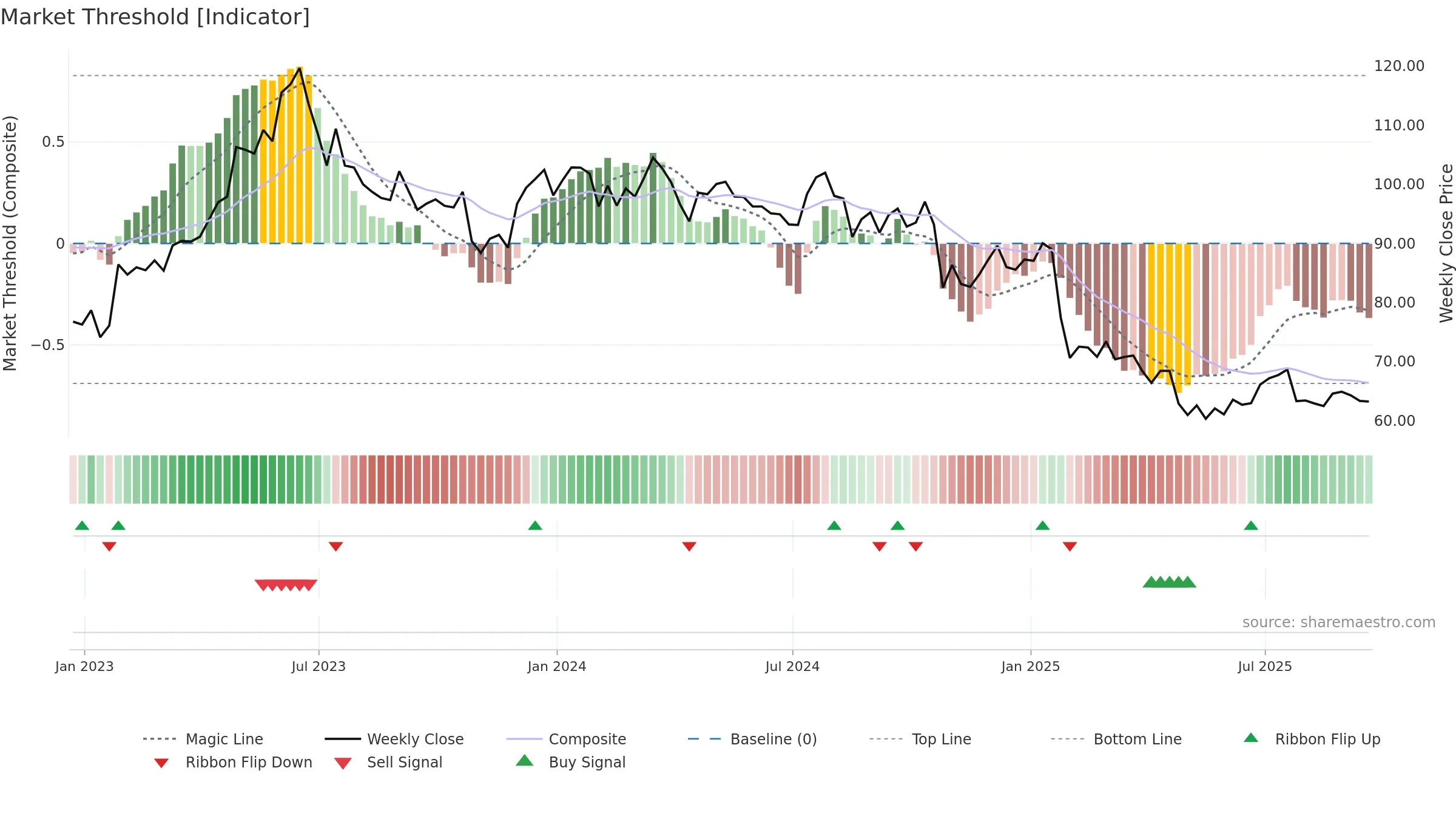

Gauge maps the trend signal to a 0–100 scale.

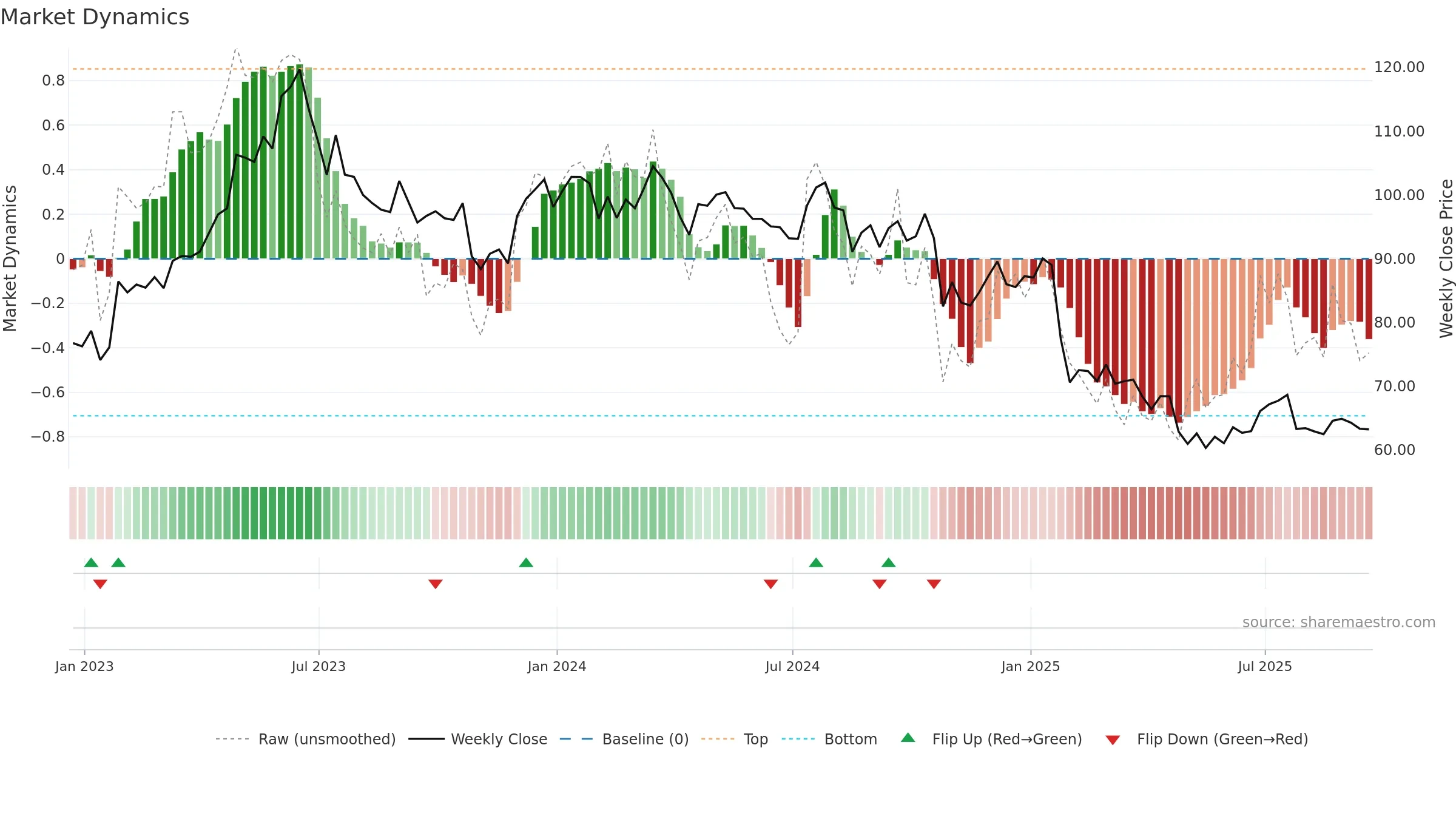

How to read this — Bearish backdrop but short-term momentum is improving; confirmation still needed.

Early improvement — look for a reclaim of 0.50→0.60 to validate.

Price is above fair value; upside may be capped without catalysts.

Conclusion

Neutral setup. ★★★☆☆ confidence. Price window: -0. Trend: Bottoming Attempt; gauge 14. In combination, liquidity diverges from price.

- Early improvement from bearish zone (bottoming attempt)

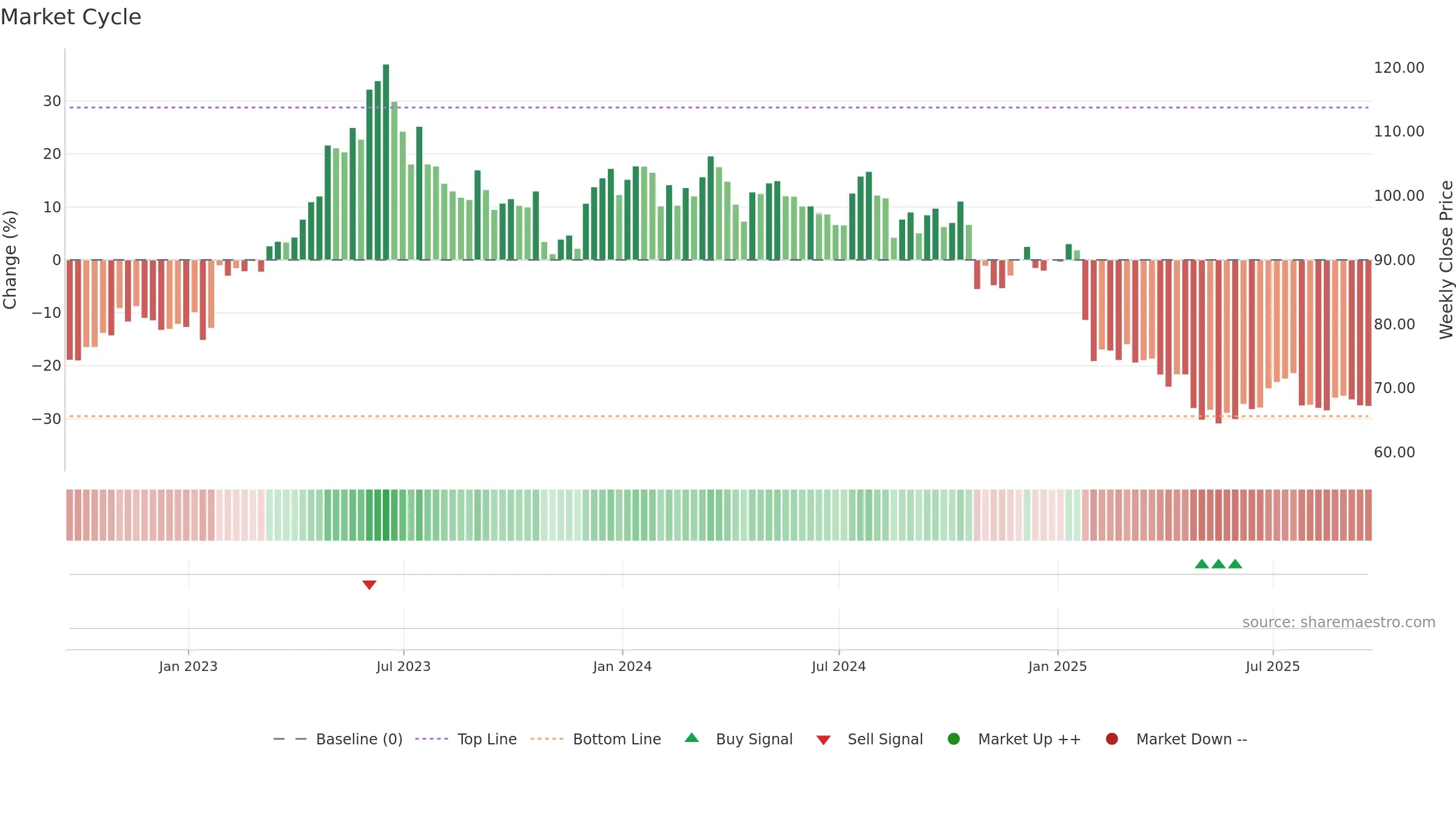

- Low return volatility supports durability

- Buyers step in at depressed levels (accumulation)

- Price is not above key averages

- Liquidity diverges from price

- Negative multi-week performance

Why: Price window -0.28% over 8w. Close is -2.56% below the prior-window high. Return volatility 0.96%. Volume trend falling. Liquidity divergence with price. Trend state bottoming attempt. Low-regime (≤0.25) upticks 5/7 (71.0%) • Accumulating. Momentum neutral and rising. Valuation limited upside without catalysts.

Tip: Most metrics include a hover tooltip where they appear in the report.