Andhra Cements Limited

ACL NSE

Weekly Summary

Andhra Cements Limited closed at 94.1600 (0.00% WoW) . Data window ends Mon, 22 Sep 2025.

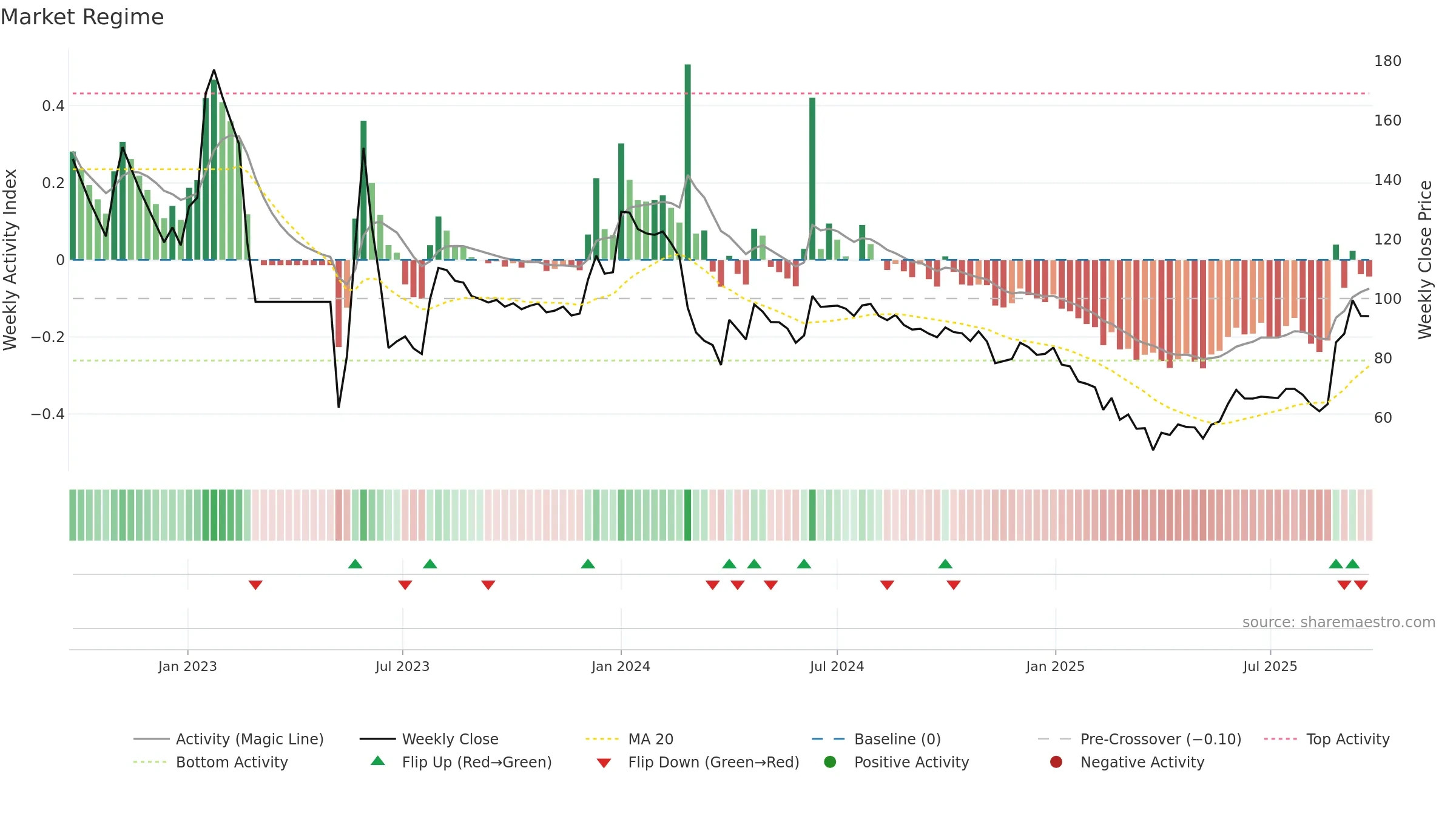

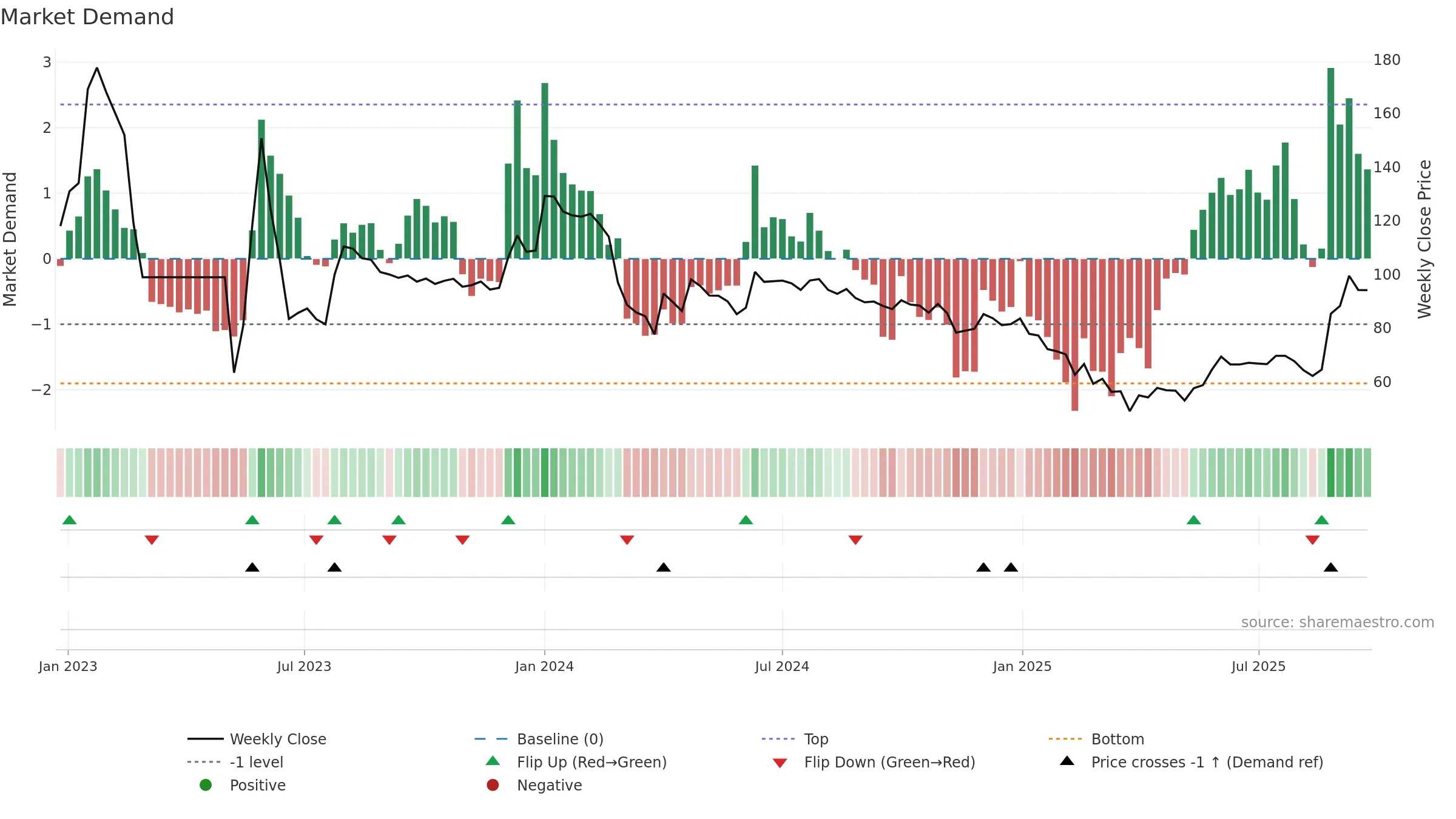

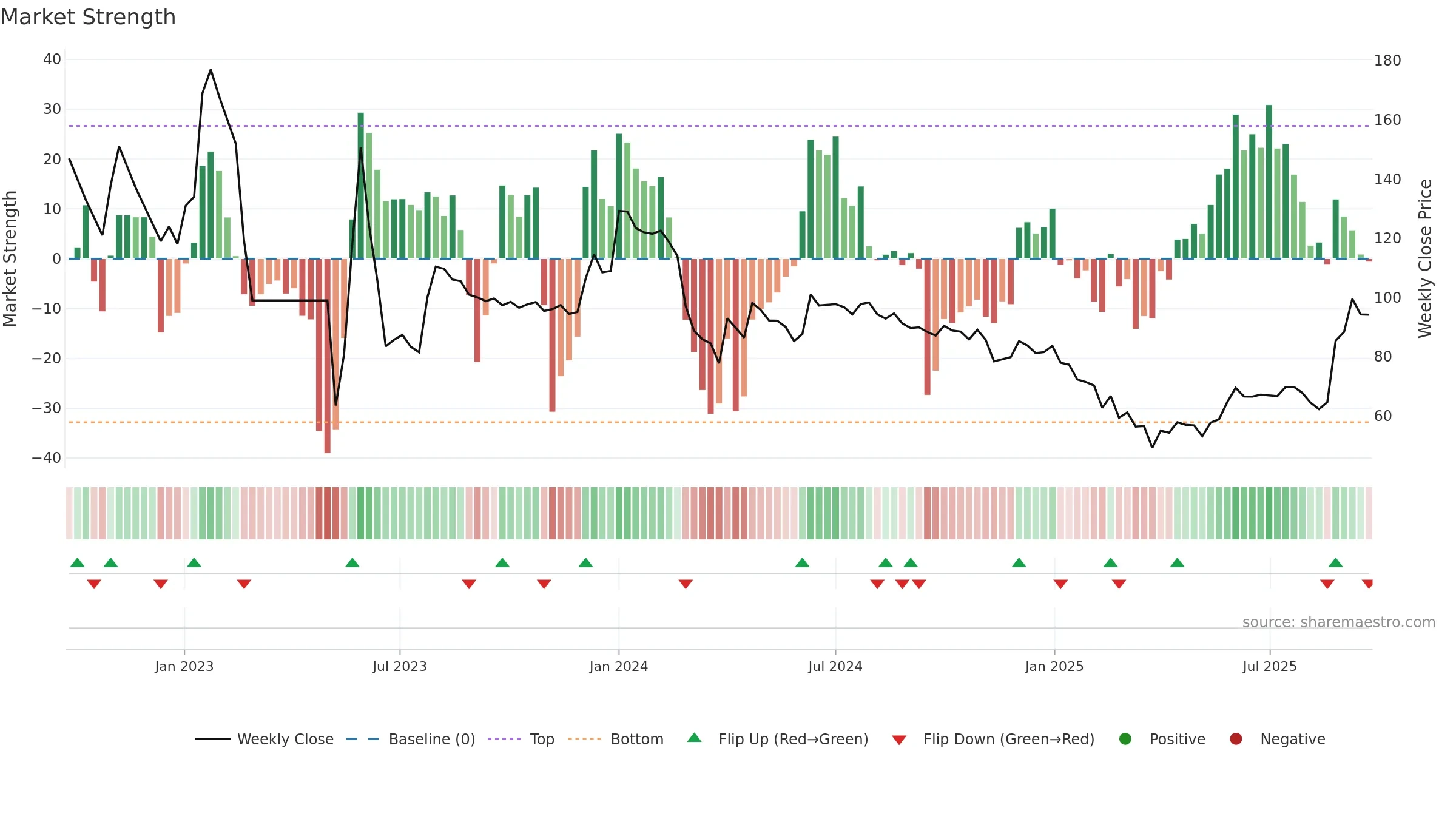

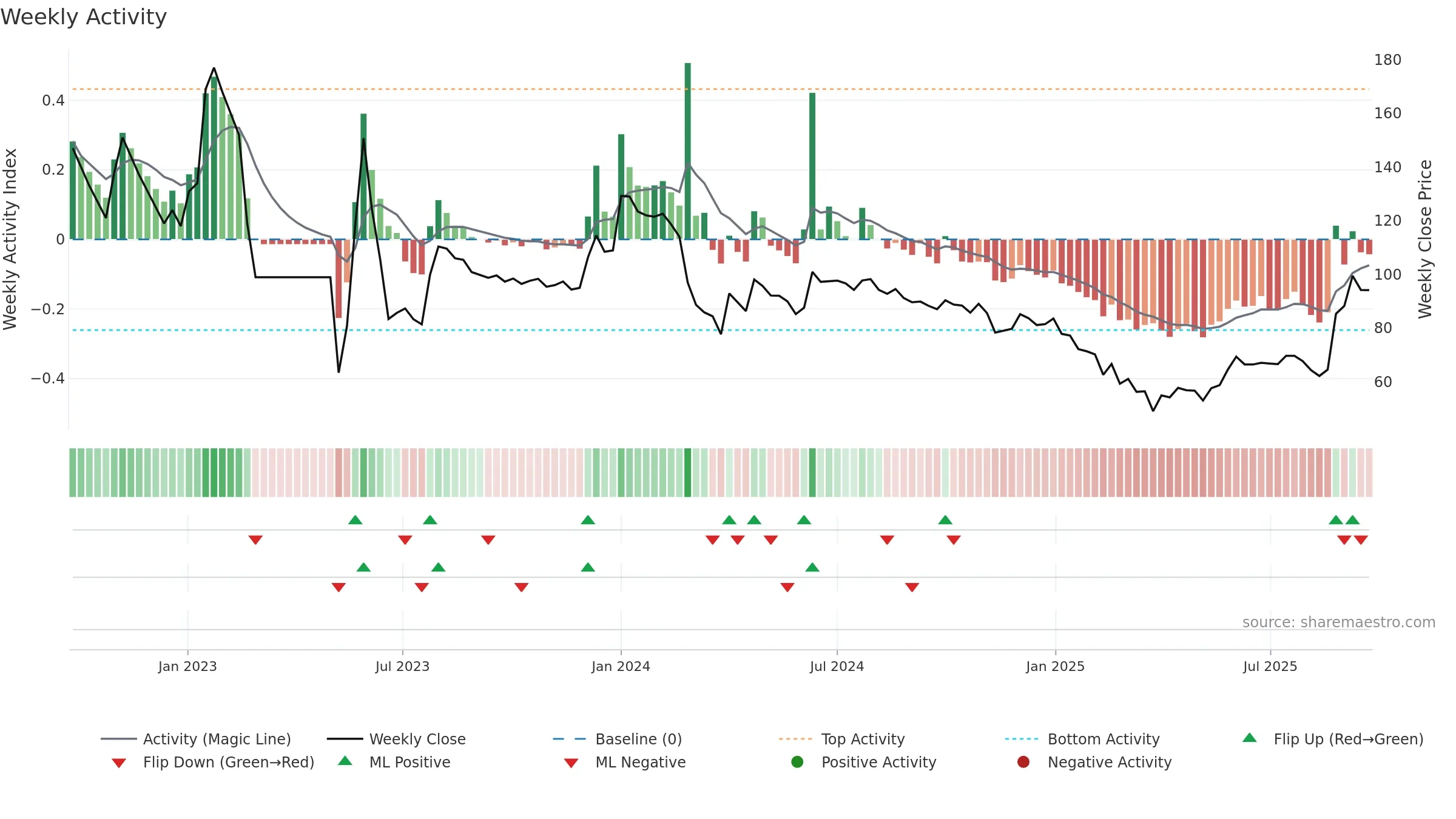

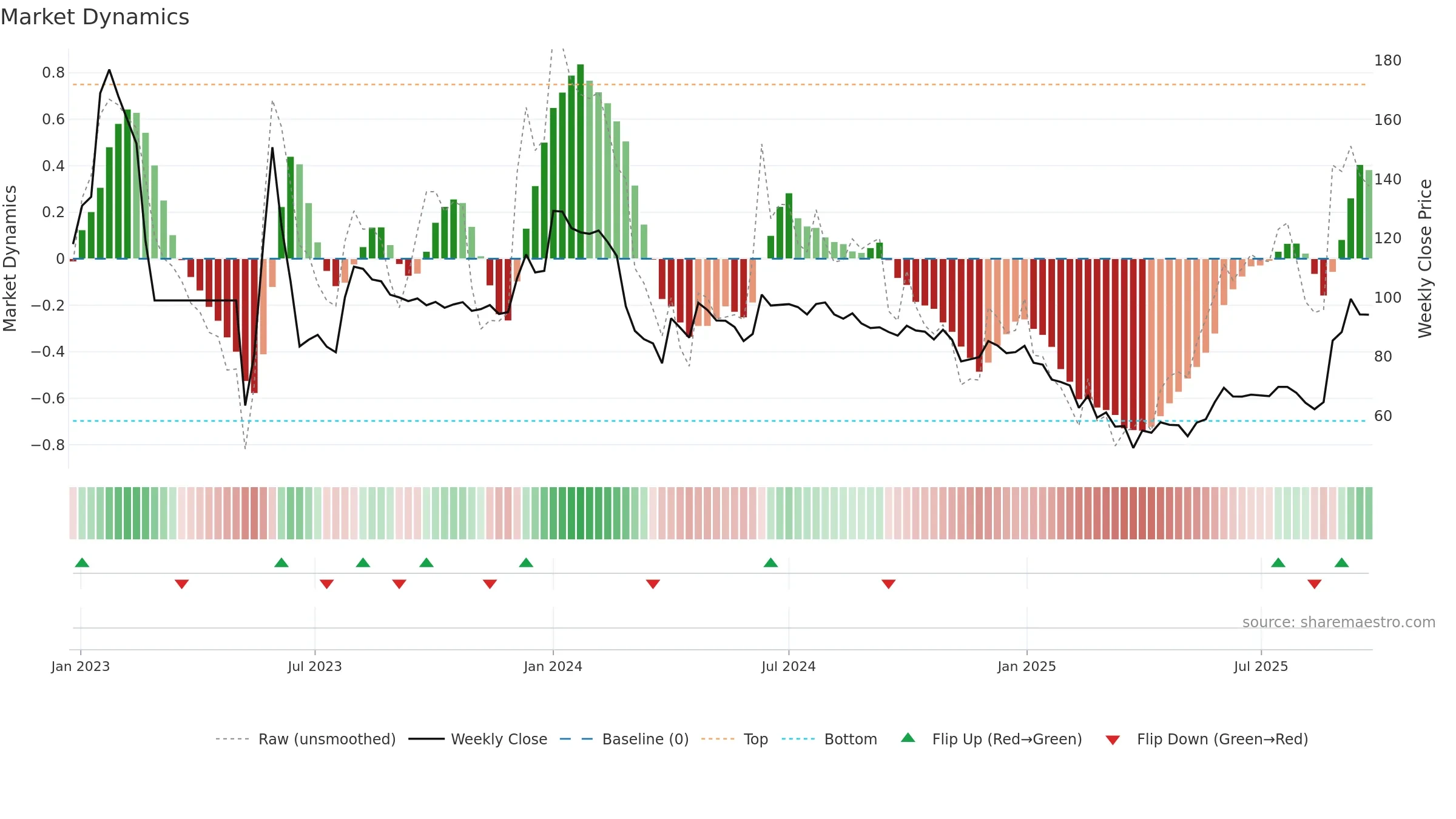

How to read this — Price slope is upward, indicating persistent buying over the window. Elevated weekly volatility increases whipsaw risk. Volume trend diverges from price — watch for fatigue or rotation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

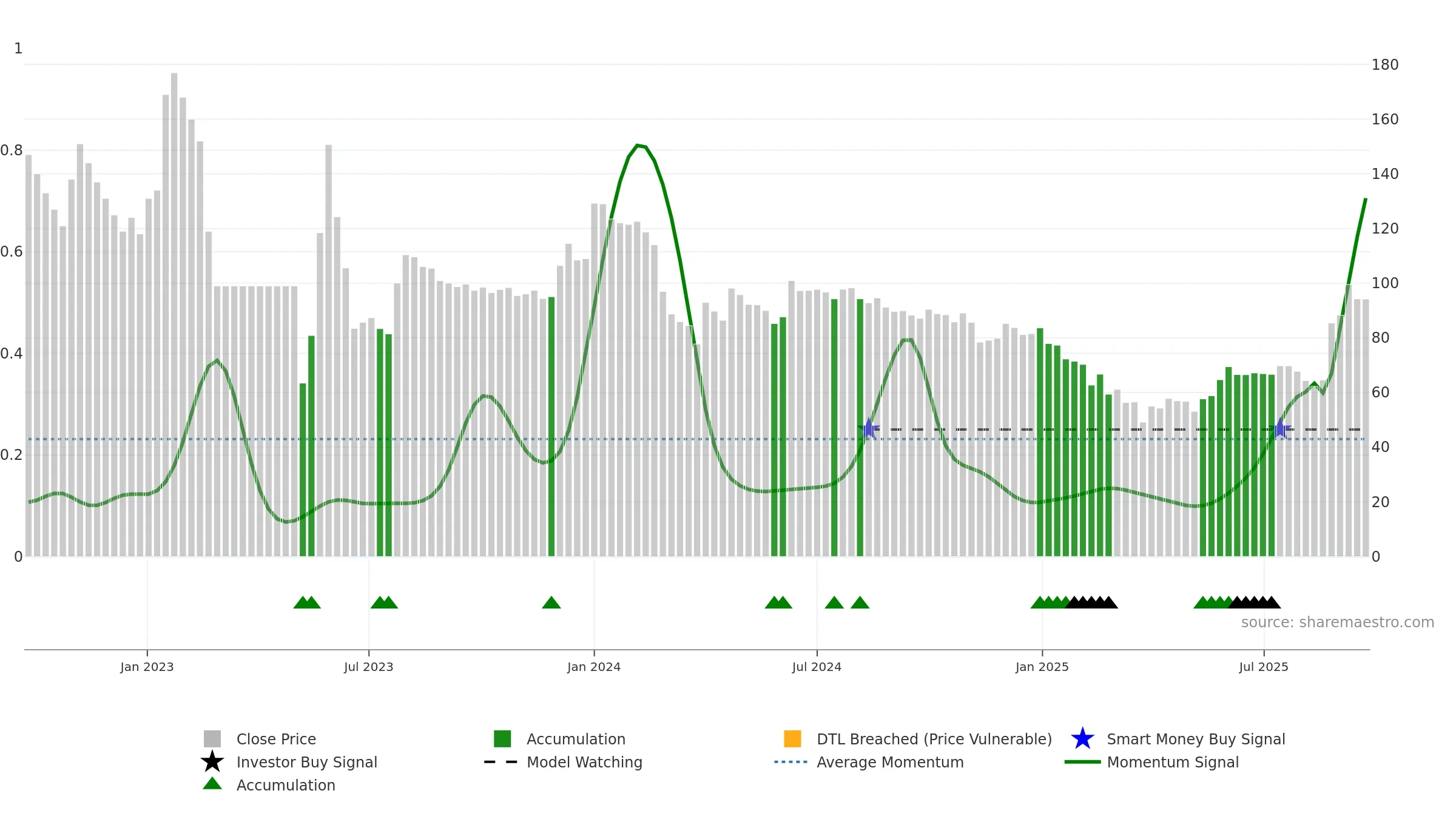

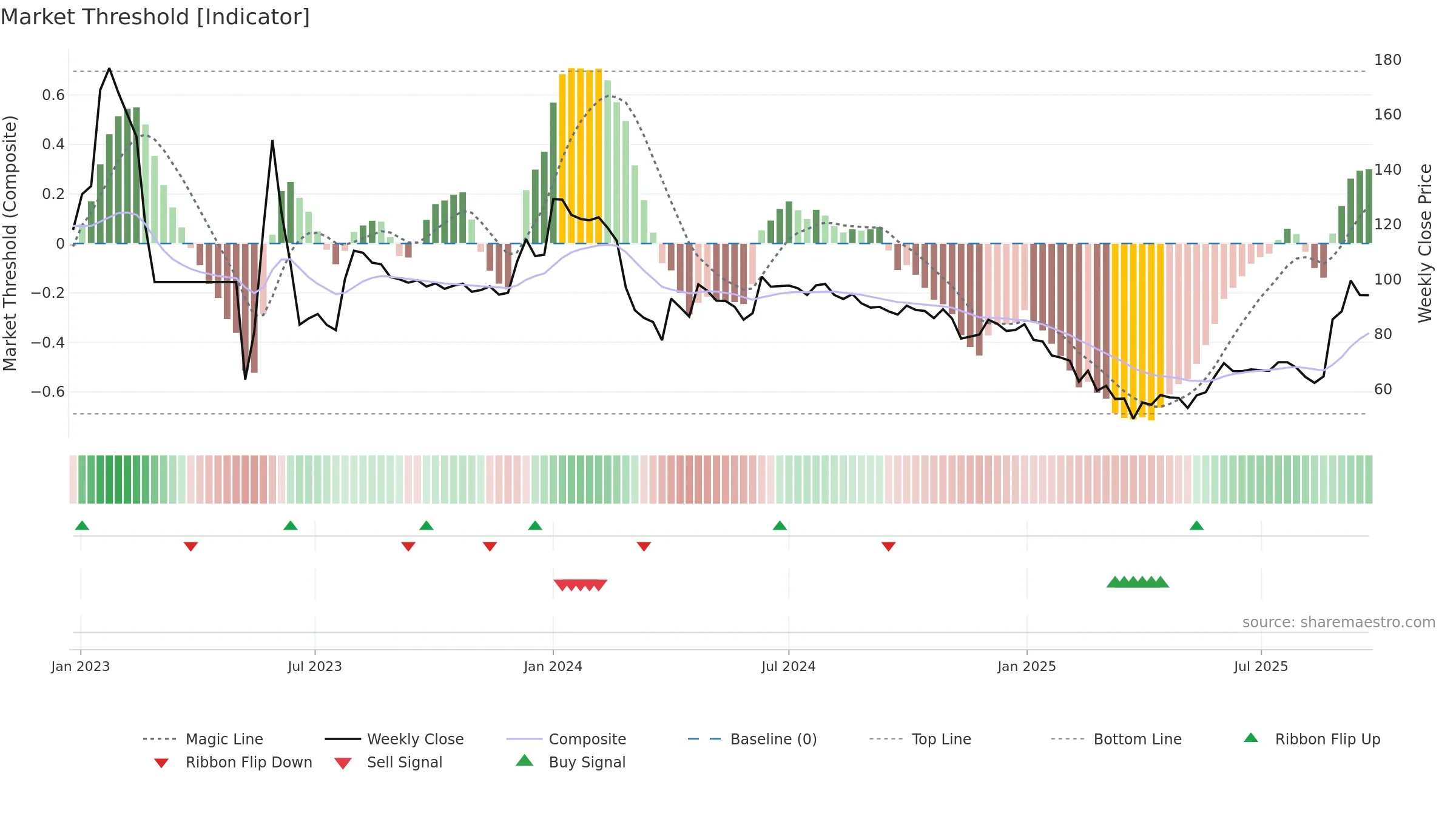

Gauge maps the trend signal to a 0–100 scale.

How to read this — High gauge and rising momentum — buyers in control.

Bias remains higher; pullbacks could be buyable if participation holds.

Relative strength is Positive

(> 0%, outperforming).

Latest MRS: 30.72% (week ending Fri, 19 Sep 2025).

Slope: Rising over 8w.

Notes:

- Holding above the zero line indicates relative bid.

- MRS slope rising over ~8 weeks.

Conclusion

Neutral setup. ★★★☆☆ confidence. Price window: 46. Trend: Strong Uptrend; gauge 70. In combination, liquidity diverges from price.

- High gauge with rising momentum (strong uptrend)

- Momentum is bullish and rising

- Price holds above 8w & 26w averages

- Constructive moving-average stack

- Liquidity diverges from price

- High return volatility raises whipsaw risk

Why: Price window 46.26% over 8w. Close is -5.39% below the prior-window high. Return volatility 6.44%. Volume trend falling. Liquidity divergence with price. Trend state strong uptrend. MA stack constructive. Momentum bullish and rising.

Tip: Most metrics include a hover tooltip where they appear in the report.