Braemar Hotels & Resorts Inc.

BHR NYSE

Weekly Summary

Braemar Hotels & Resorts Inc. closed at 2.8800 (-5.57% WoW) . Data window ends Fri, 19 Sep 2025.

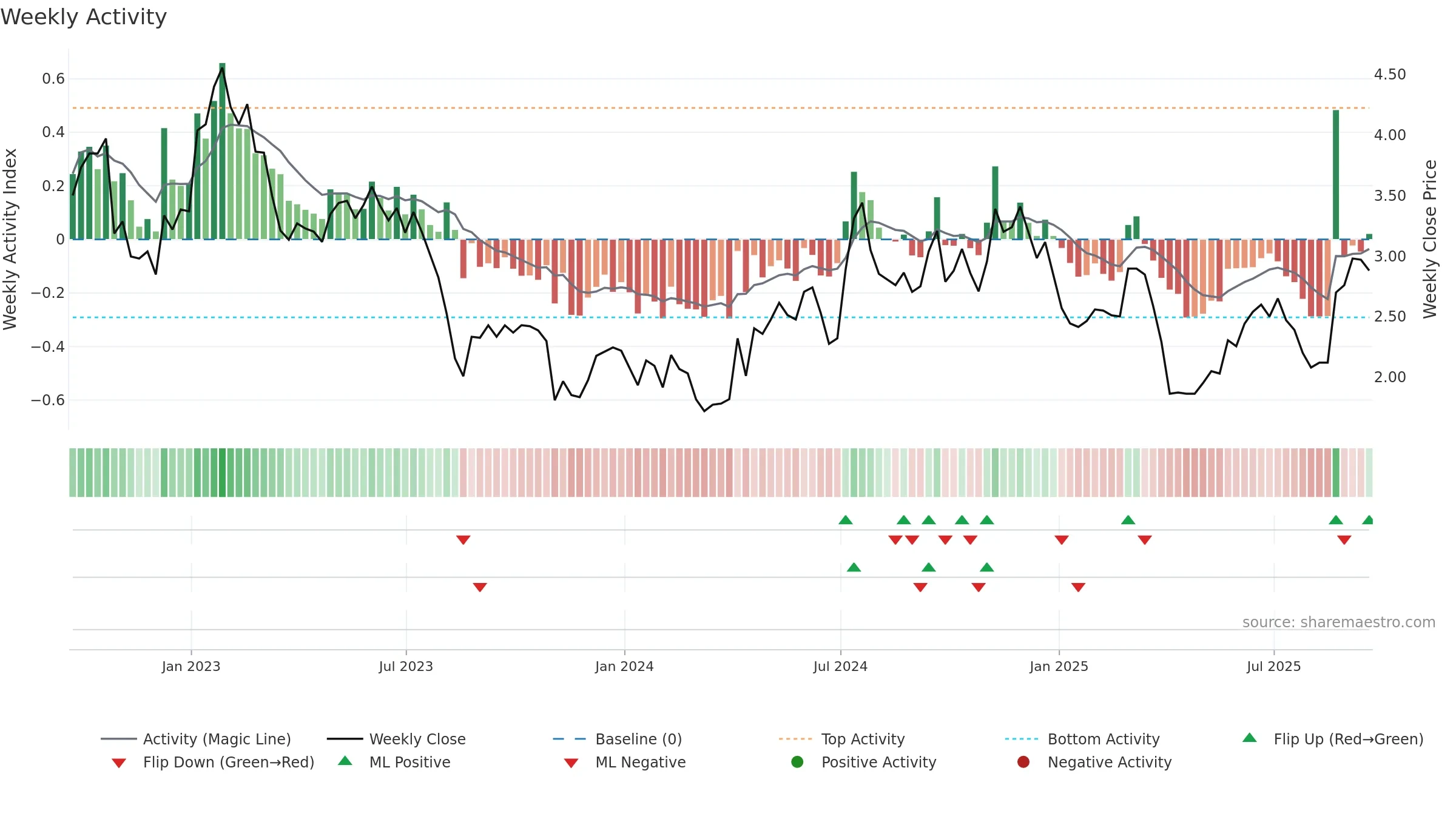

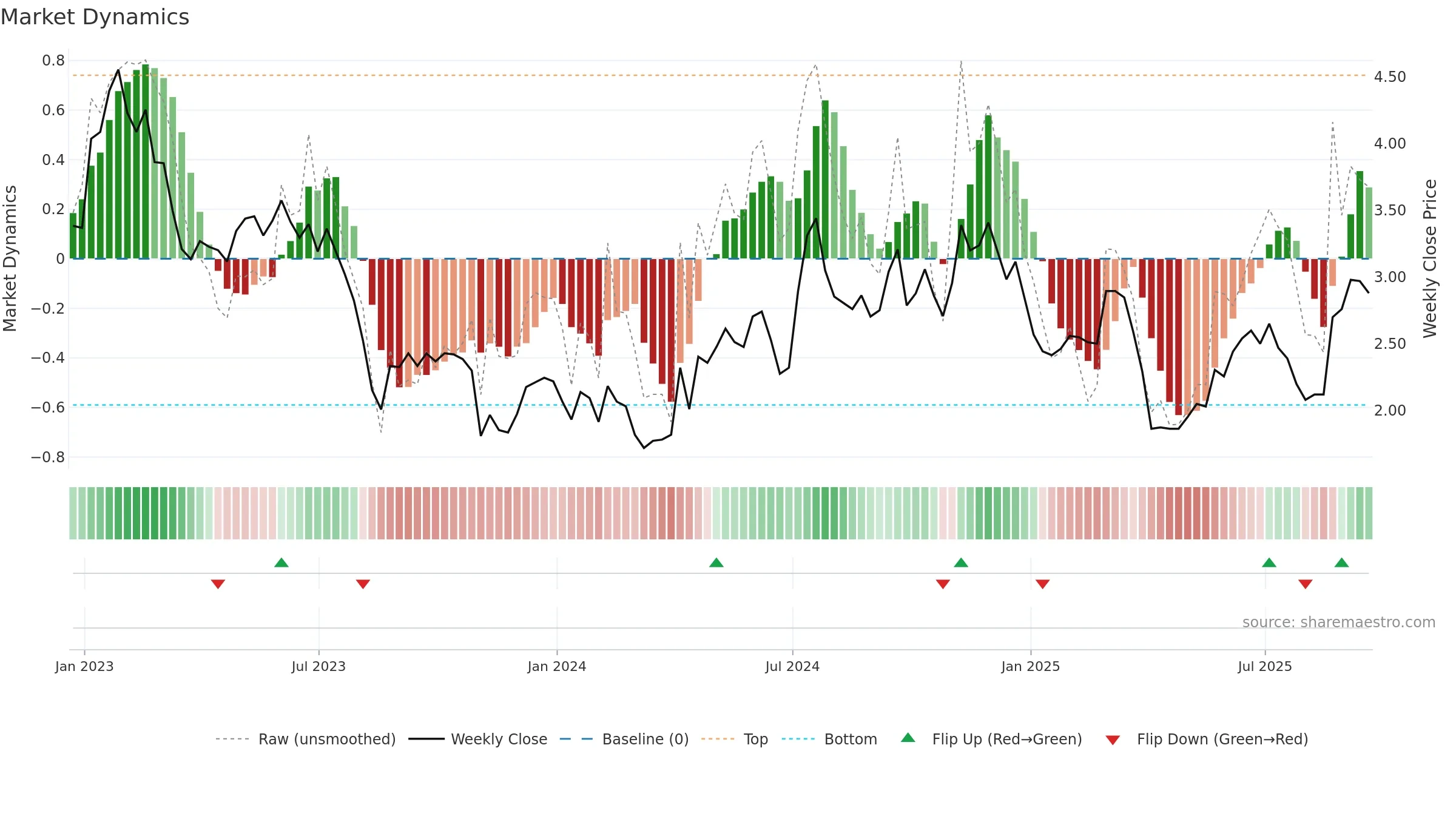

How to read this — Price slope is upward, indicating persistent buying over the window. Elevated weekly volatility increases whipsaw risk. Volume and price are moving in the same direction — a constructive confirmation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm.

Gauge maps the trend signal to a 0–100 scale.

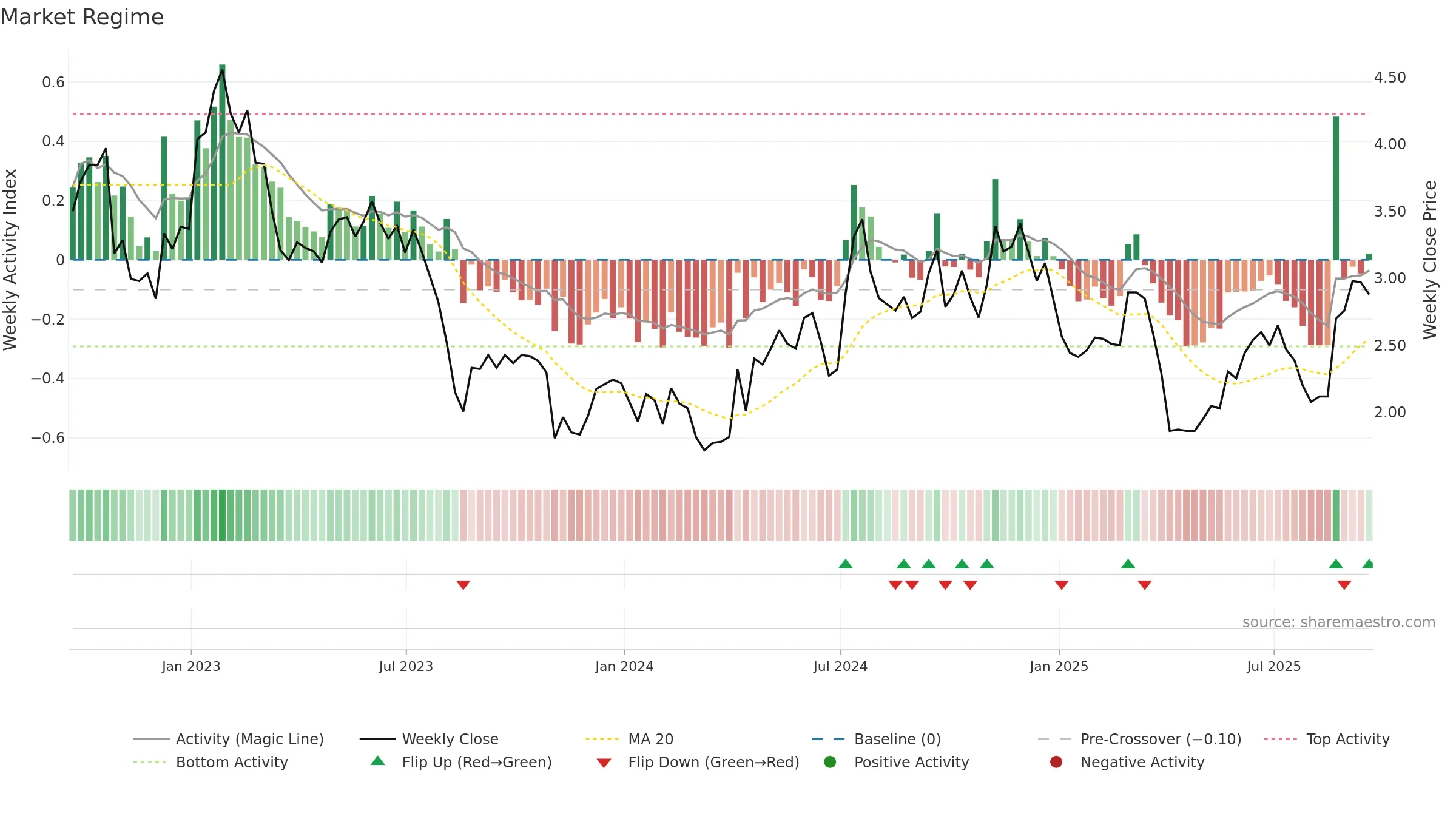

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

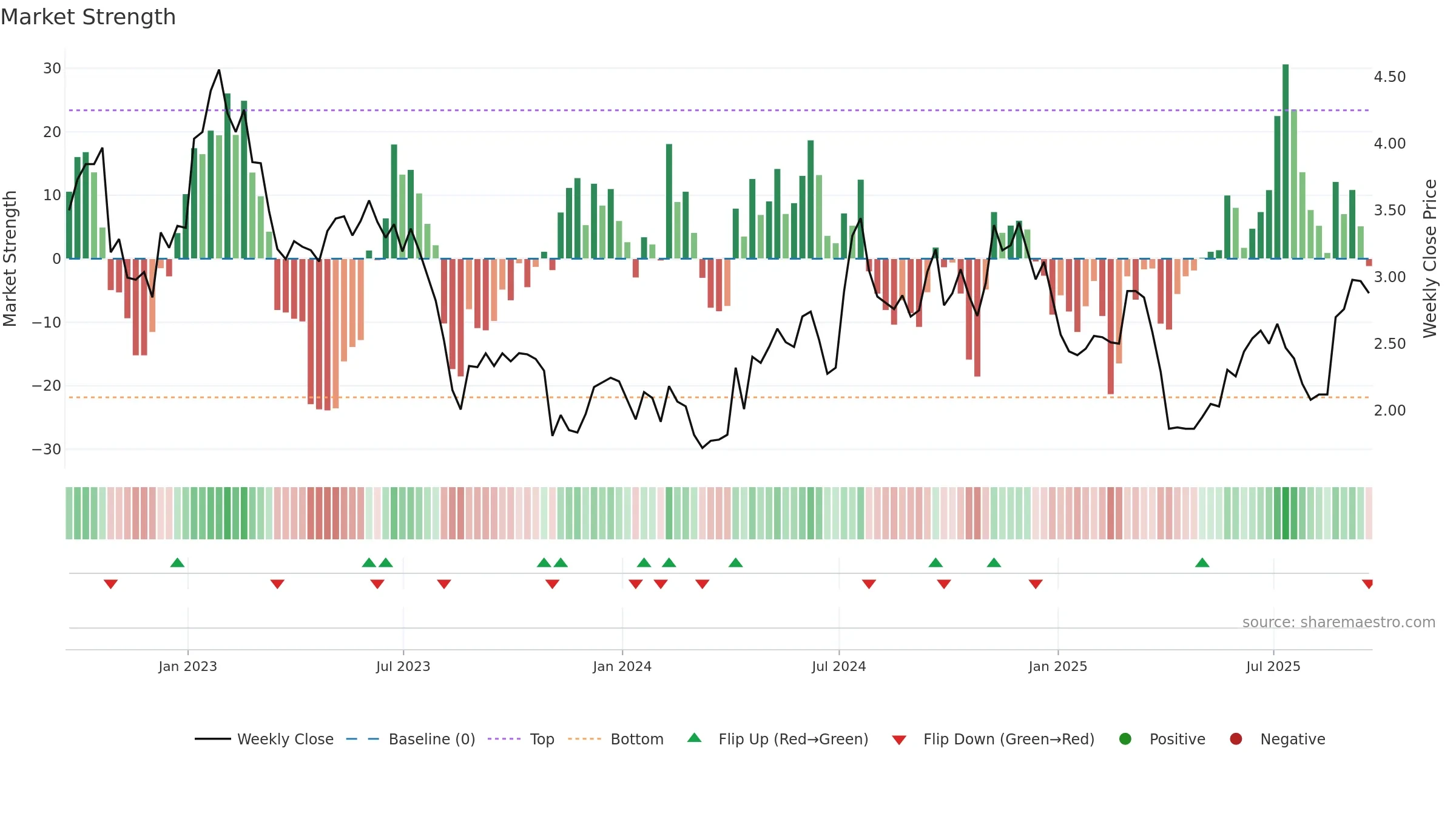

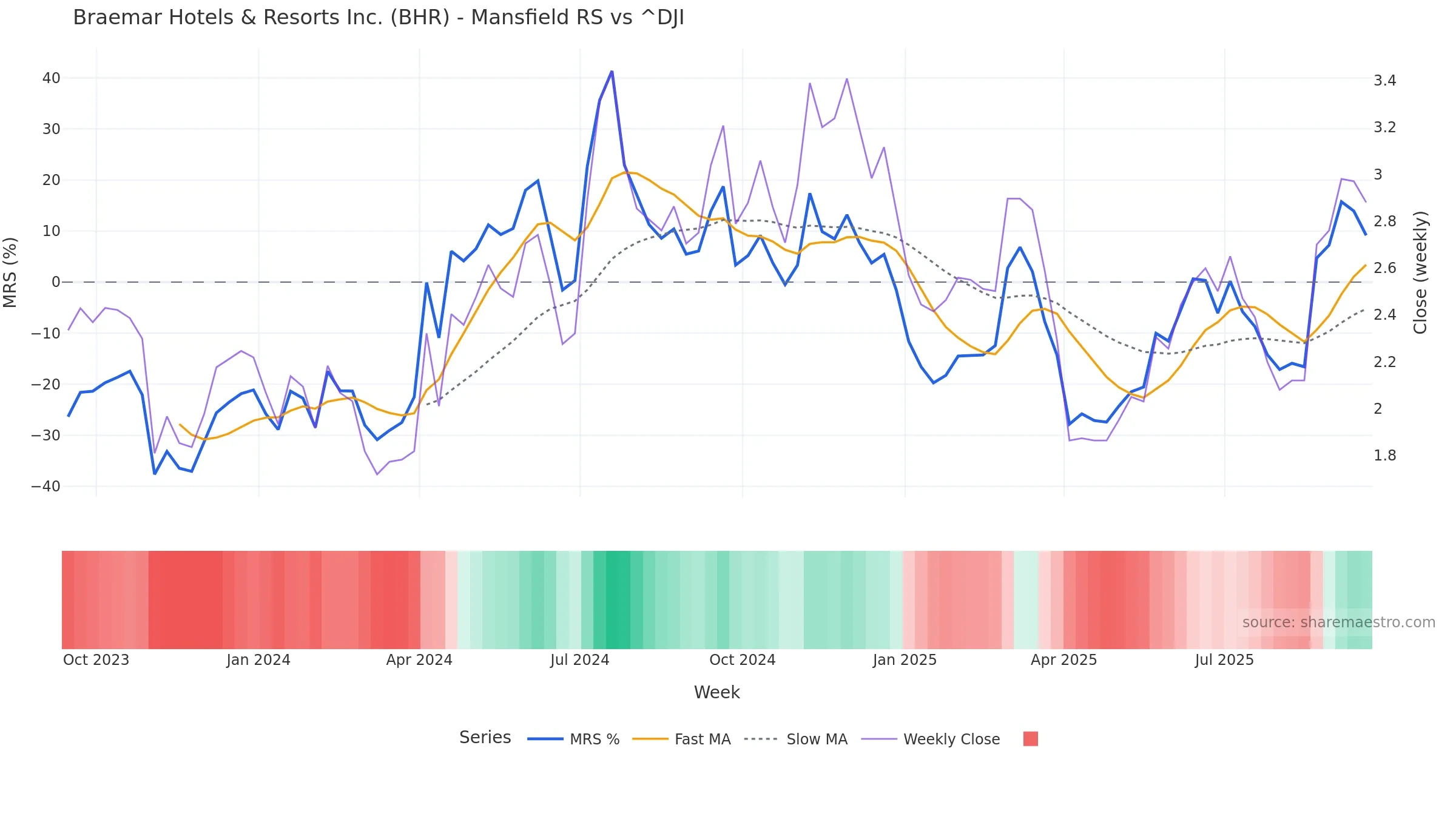

Relative strength is Positive

(> 0%, outperforming).

Latest MRS: 9.17% (week ending Fri, 19 Sep 2025).

Slope: Rising over 8w.

Notes:

- Holding above the zero line indicates relative bid.

- MRS slope rising over ~8 weeks.

Conclusion

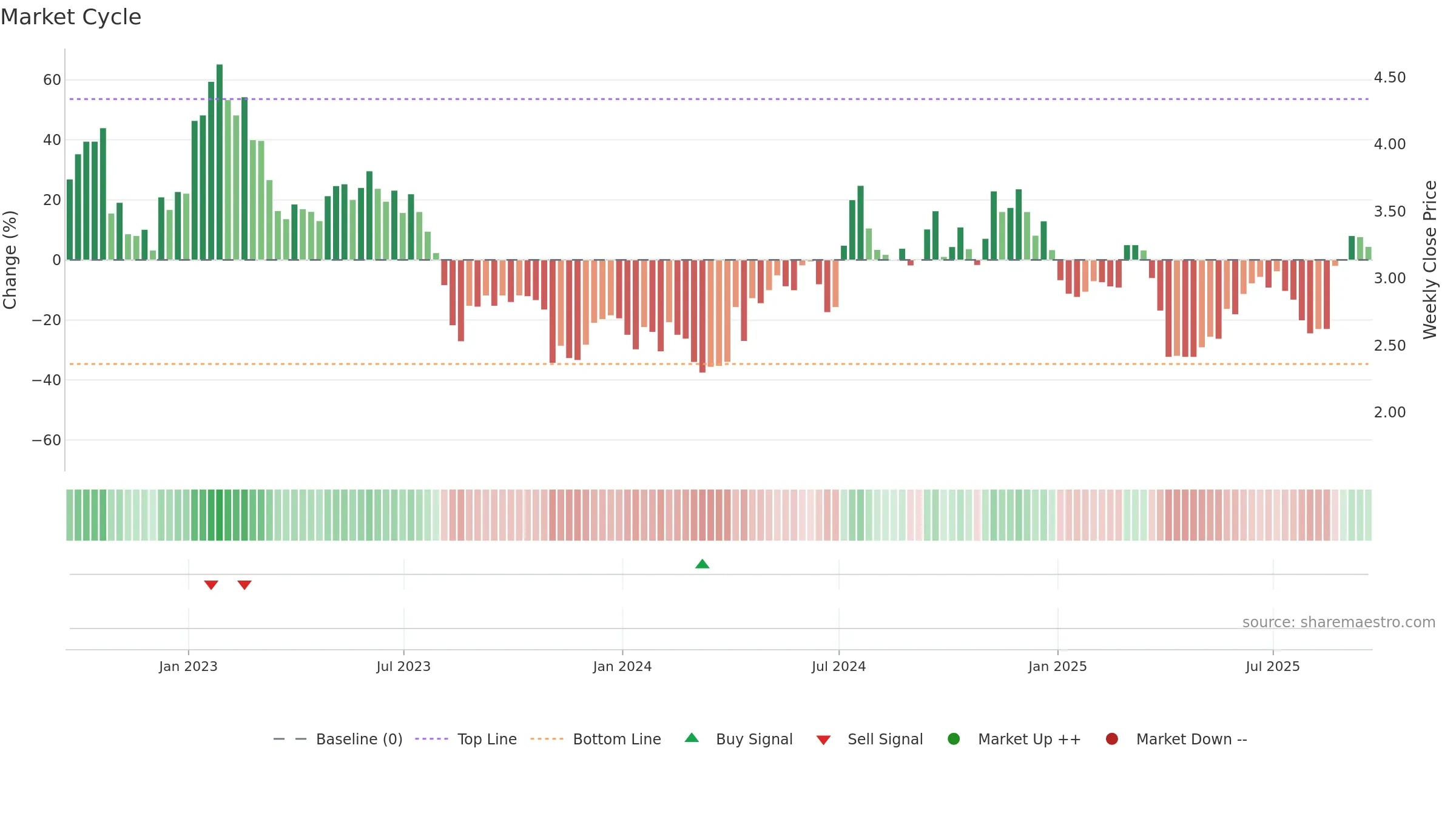

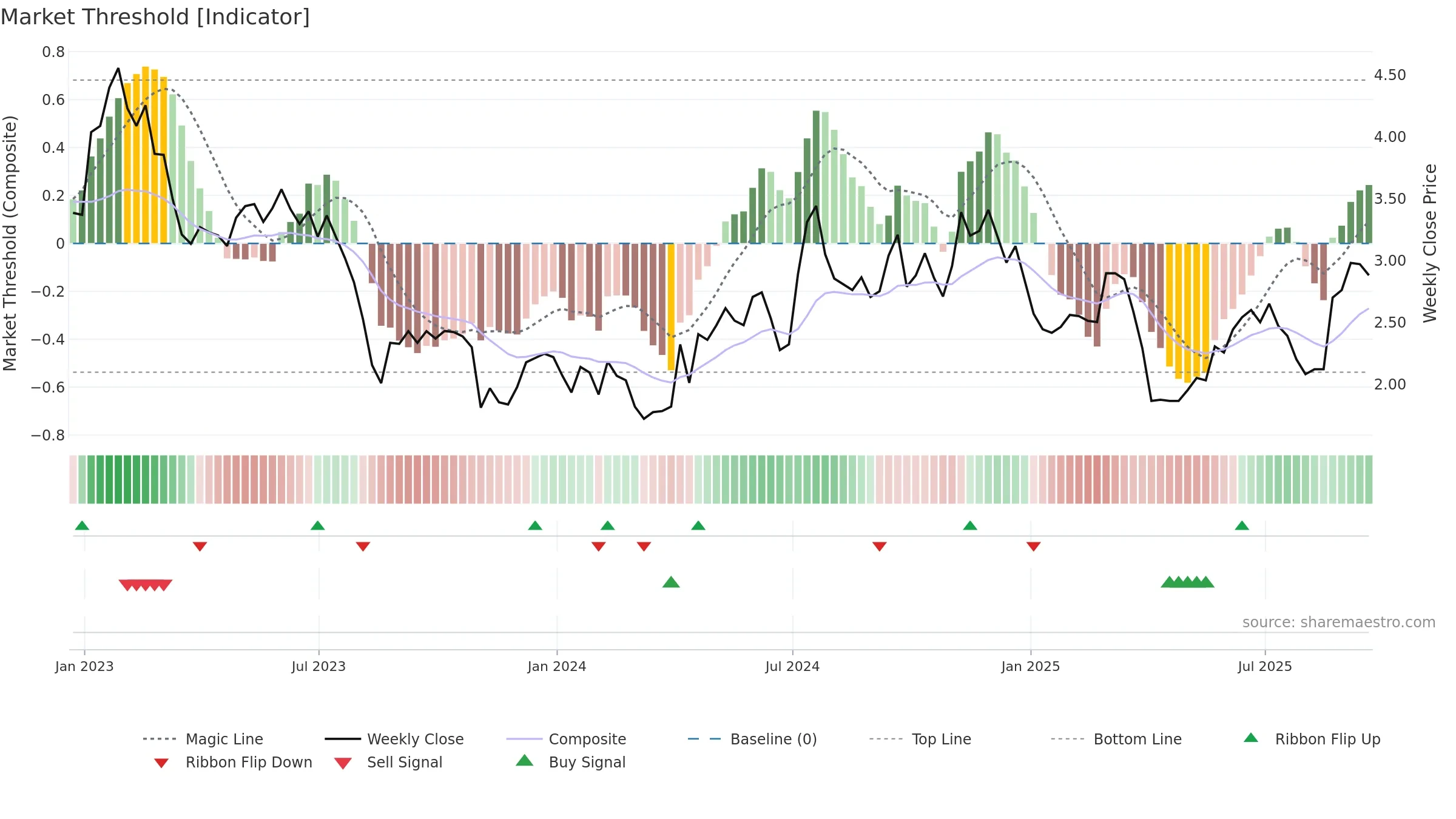

Positive setup. ★★★★⯪ confidence. Trend: Range / Neutral · 38.46% over window · vol 10.36% · liquidity convergence · posture above · RS outperforming

- Price holds above 8–26 week averages

- Constructive moving-average stack

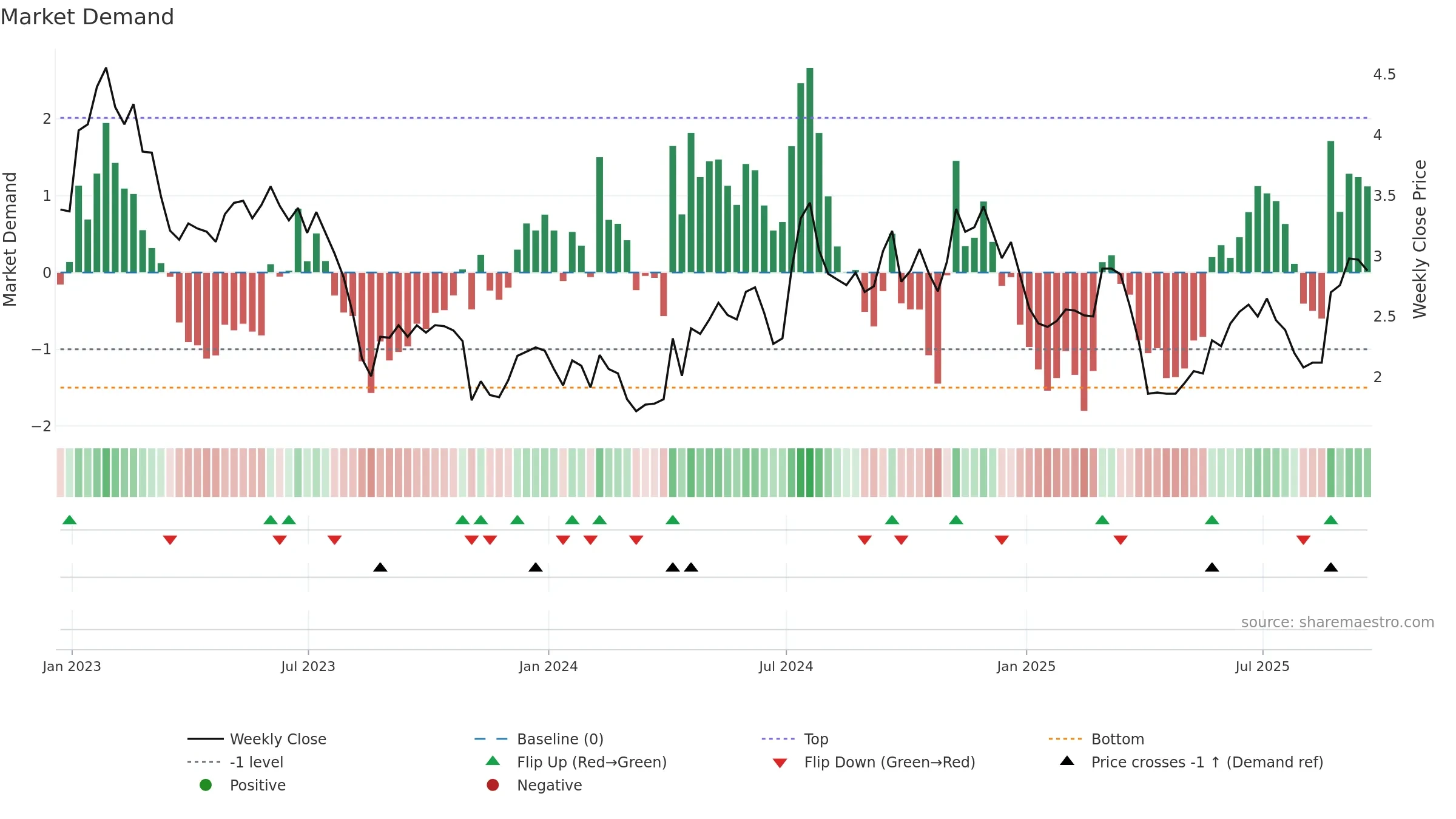

- Liquidity confirms the price trend

- Solid multi-week performance

- High return volatility raises whipsaw risk

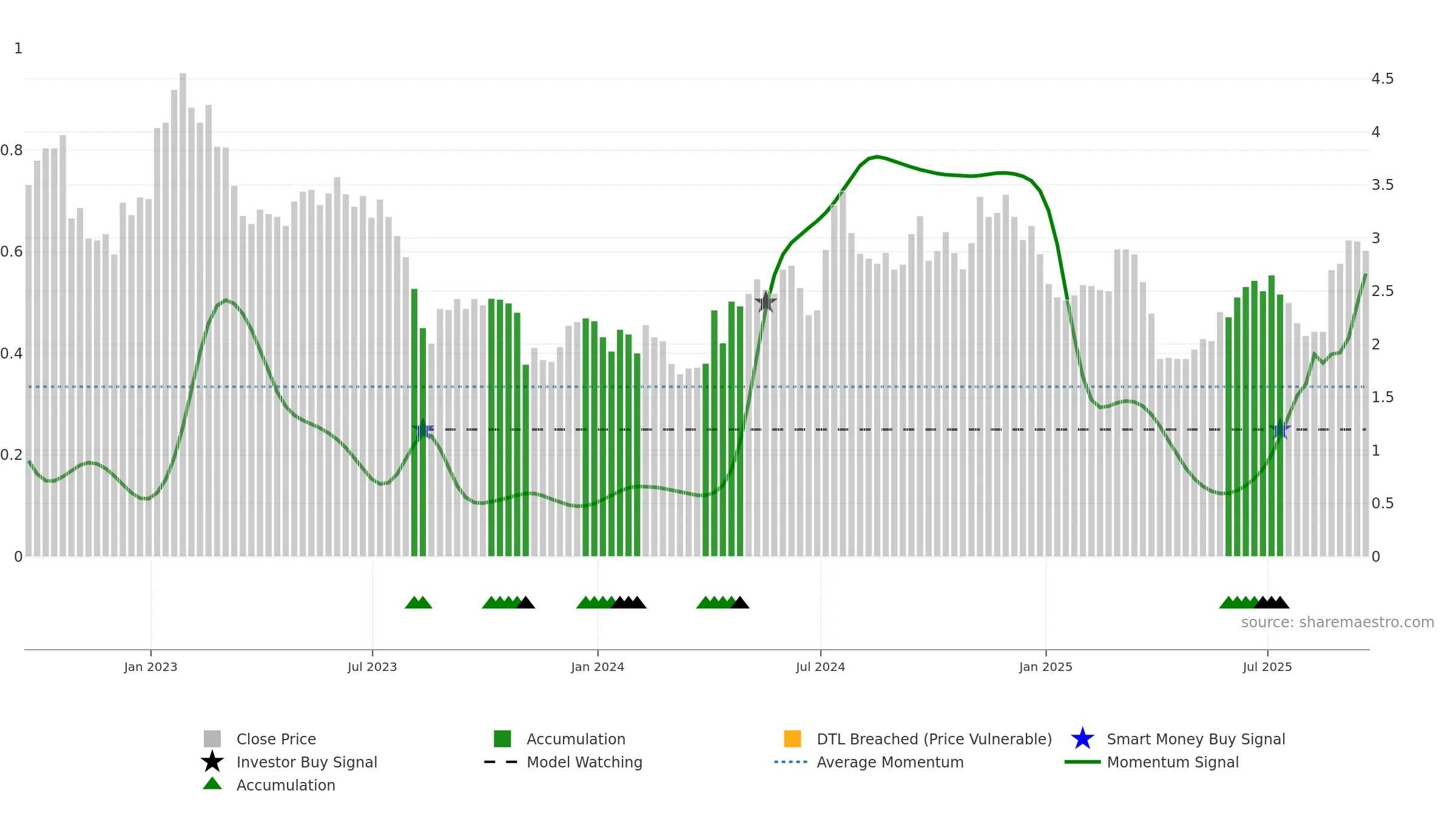

Why: Price window 38.46% over w. Close is -3.36% below the prior-window high. Return volatility 10.36%. Volume trend rising. Liquidity convergence with price. Trend state range / neutral. MA stack constructive. Momentum neutral and rising.

Tip: Most metrics include a hover tooltip where they appear in the report.