Pfizer Inc.

PFE NYSE

Weekly Summary

Pfizer Inc. closed at 24.0300 (-0.91% WoW) . Data window ends Fri, 19 Sep 2025.

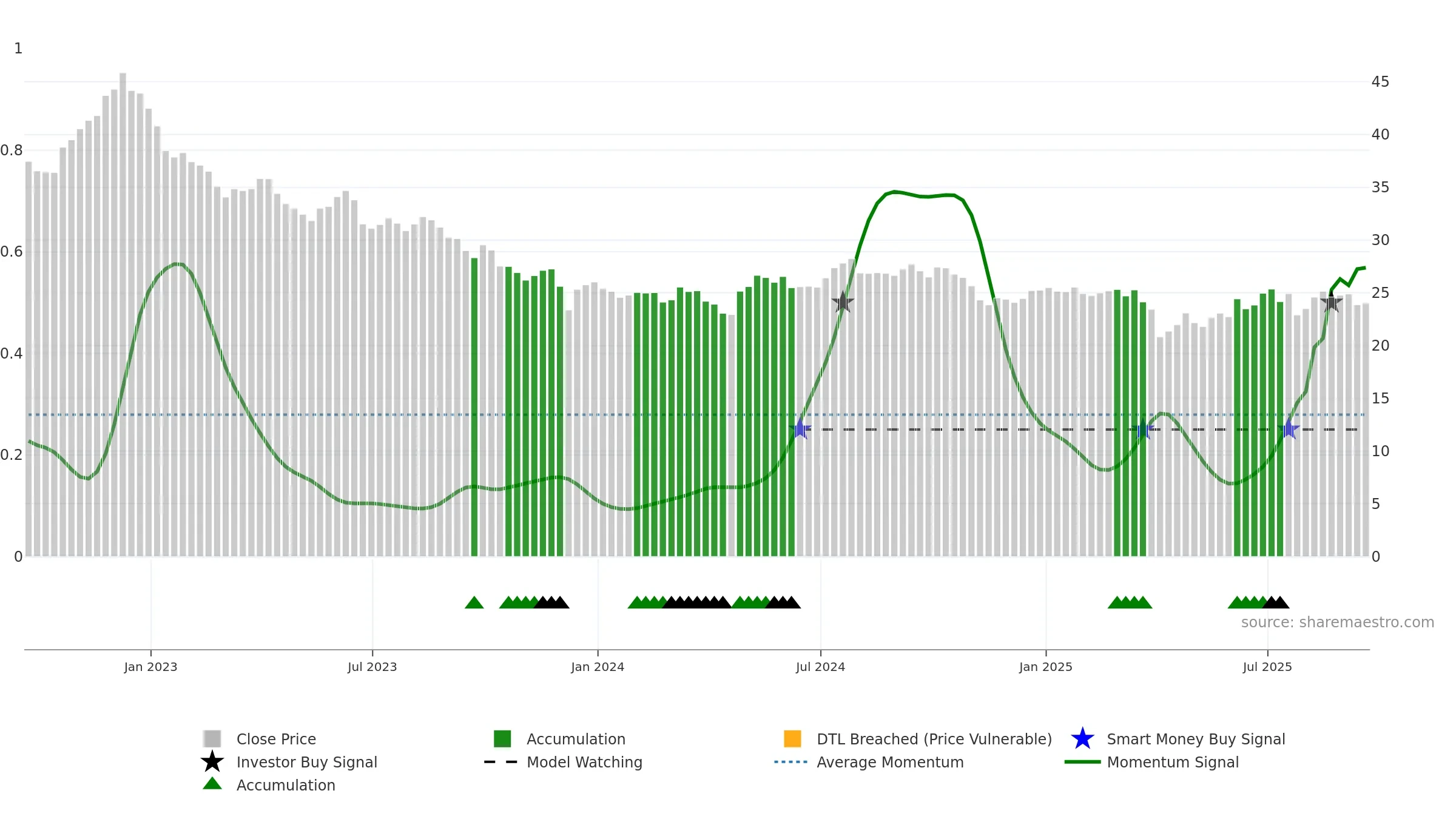

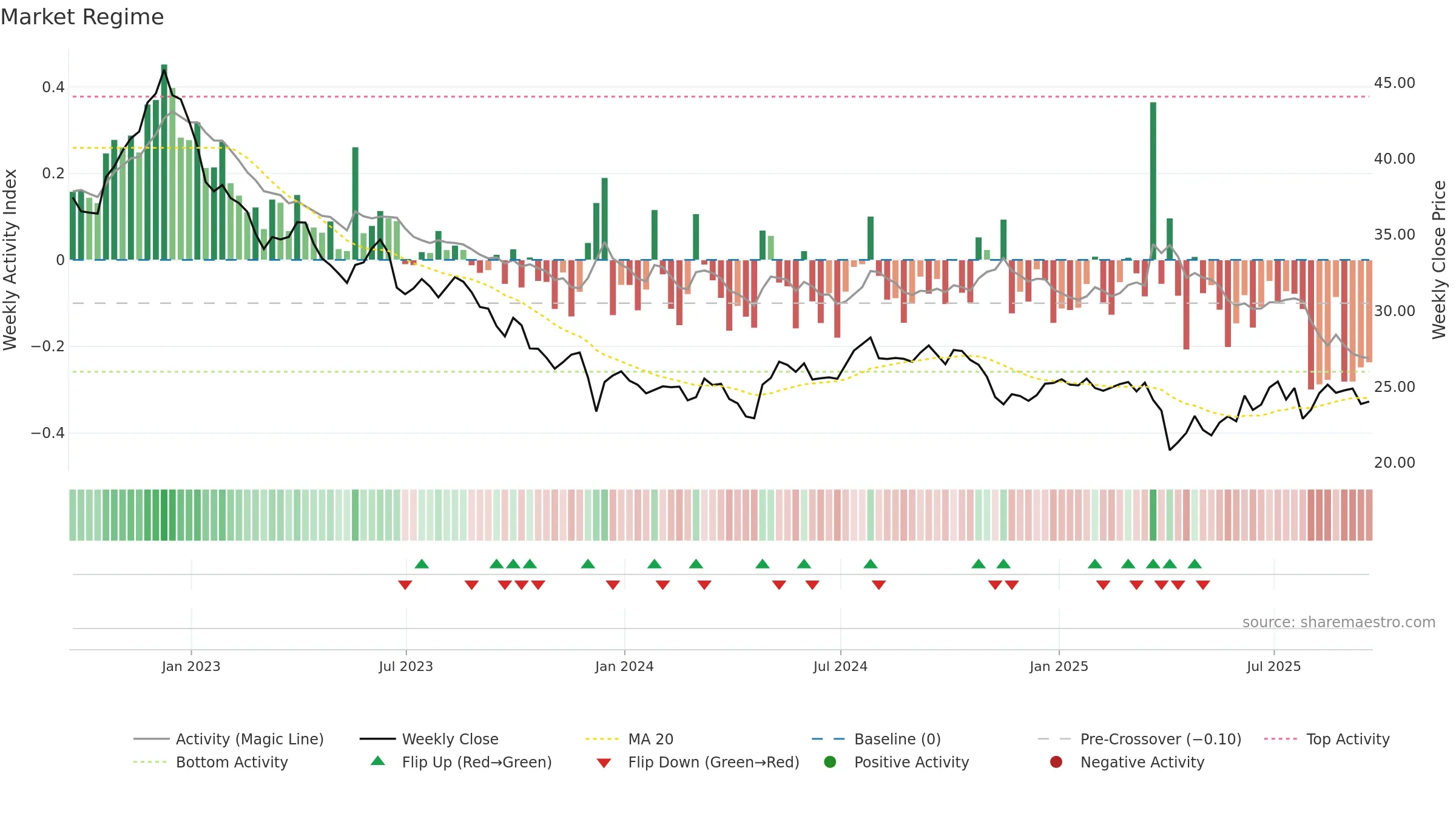

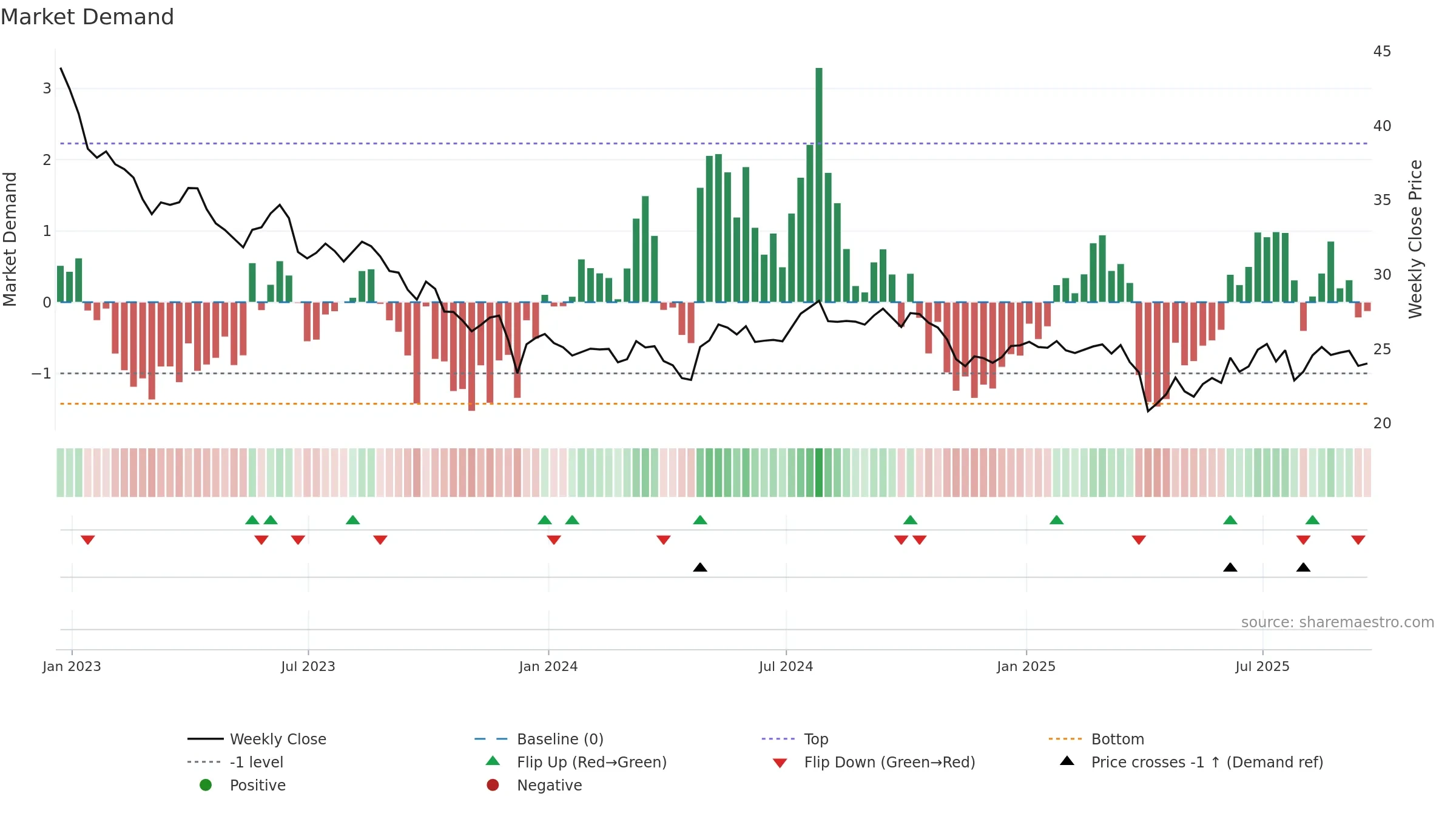

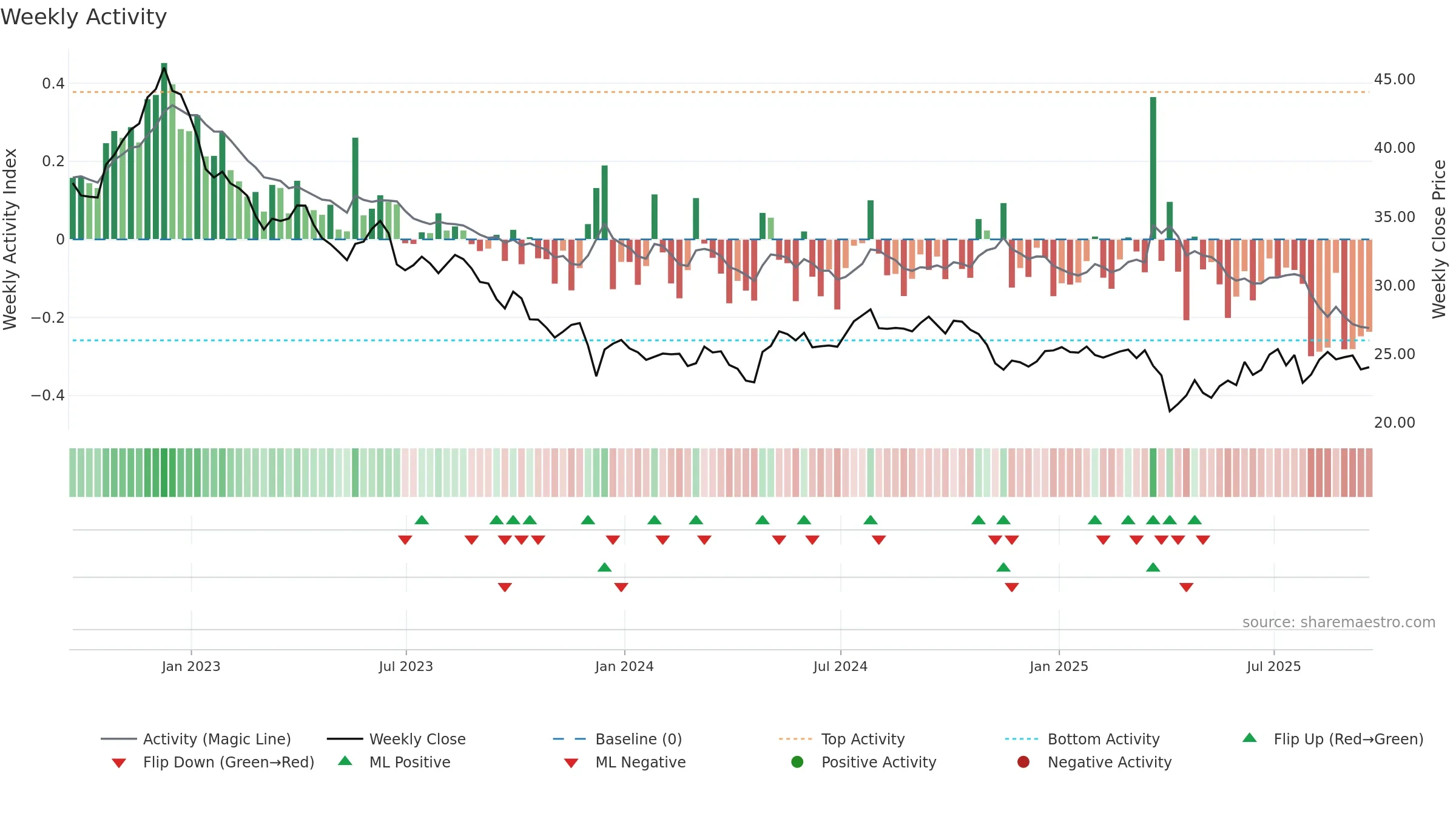

How to read this — Price slope is downward, indicating persistent supply pressure. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity. Fresh short-term downside crossover weakens near-term tone.

Down-slope argues for patience; rallies can fade sooner unless participation improves. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

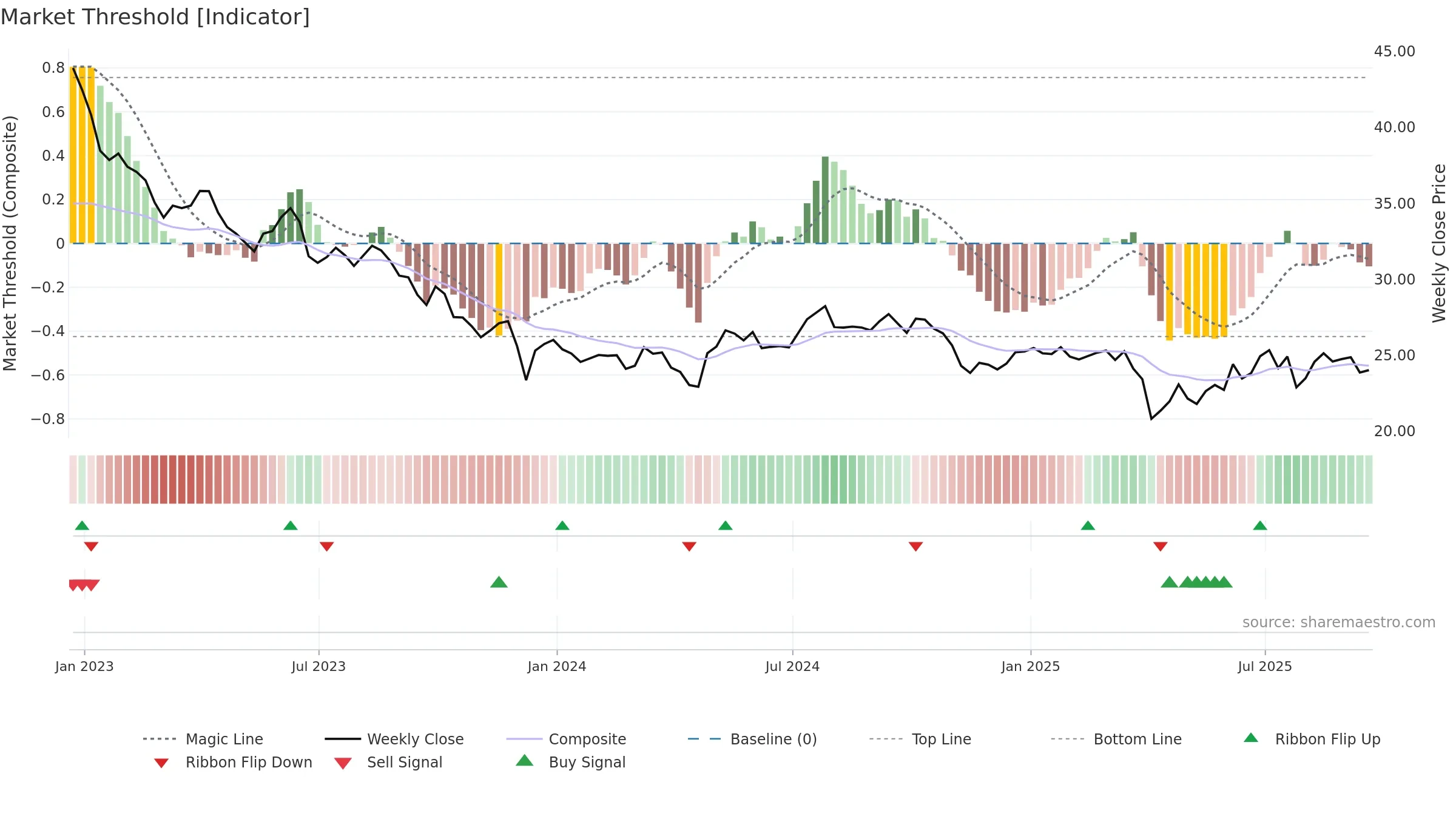

Gauge maps the trend signal to a 0–100 scale.

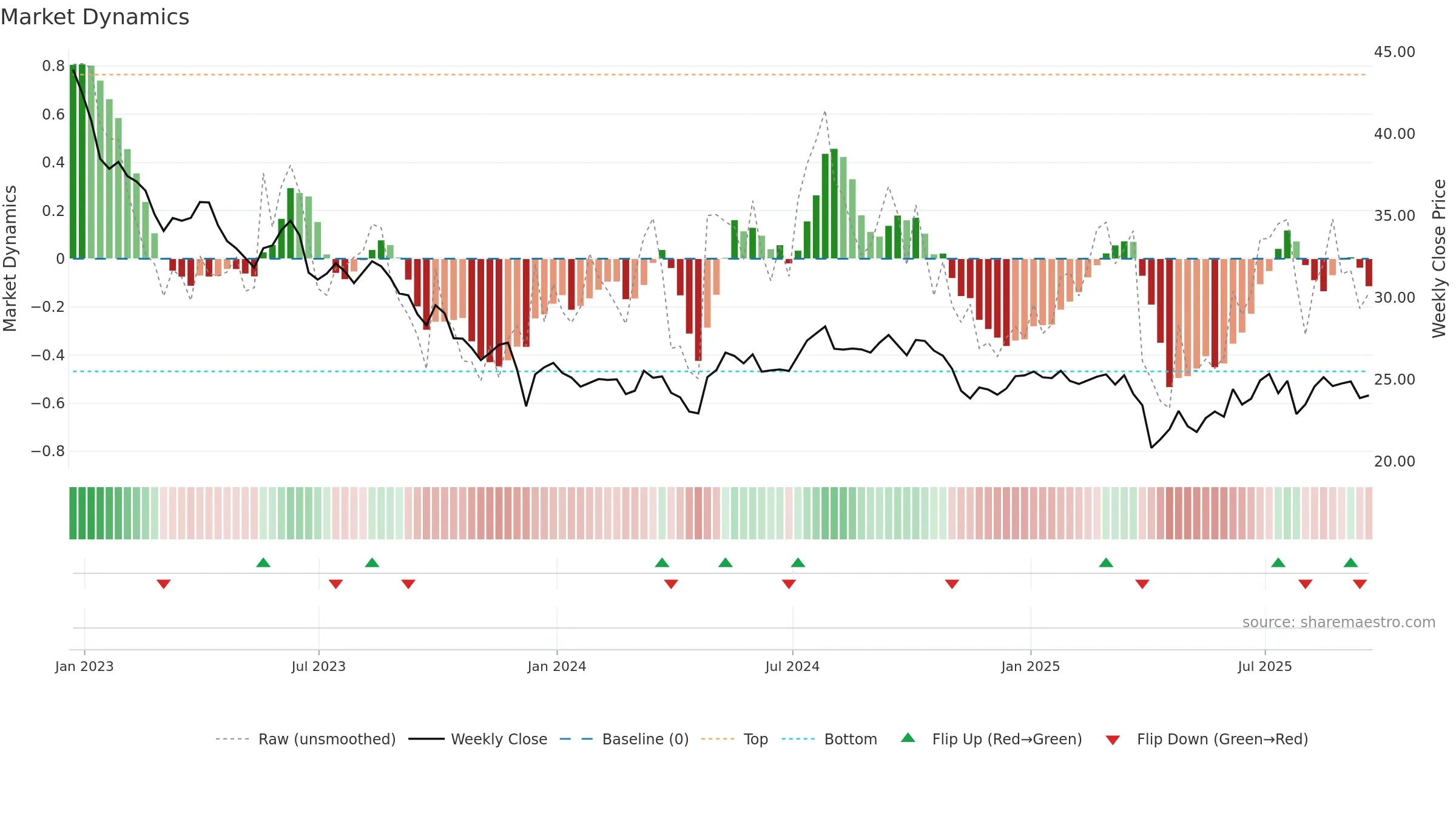

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

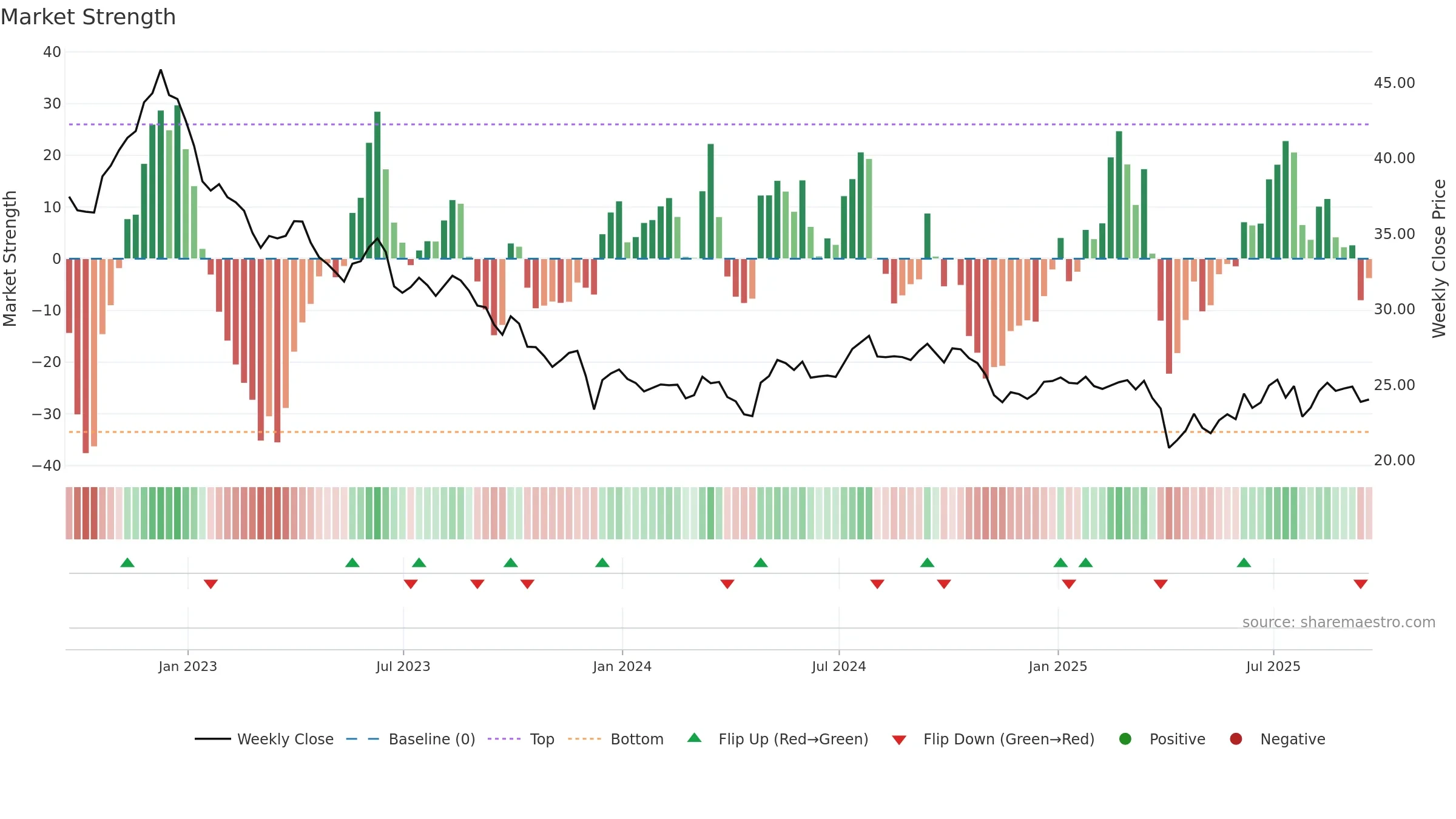

Relative strength is Negative

(< 0%, underperforming).

Latest MRS: -6.23% (week ending Fri, 19 Sep 2025).

Slope: Falling over 8w.

Notes:

- Below zero line indicates relative weakness vs benchmark.

- MRS slope falling over ~8 weeks.

Conclusion

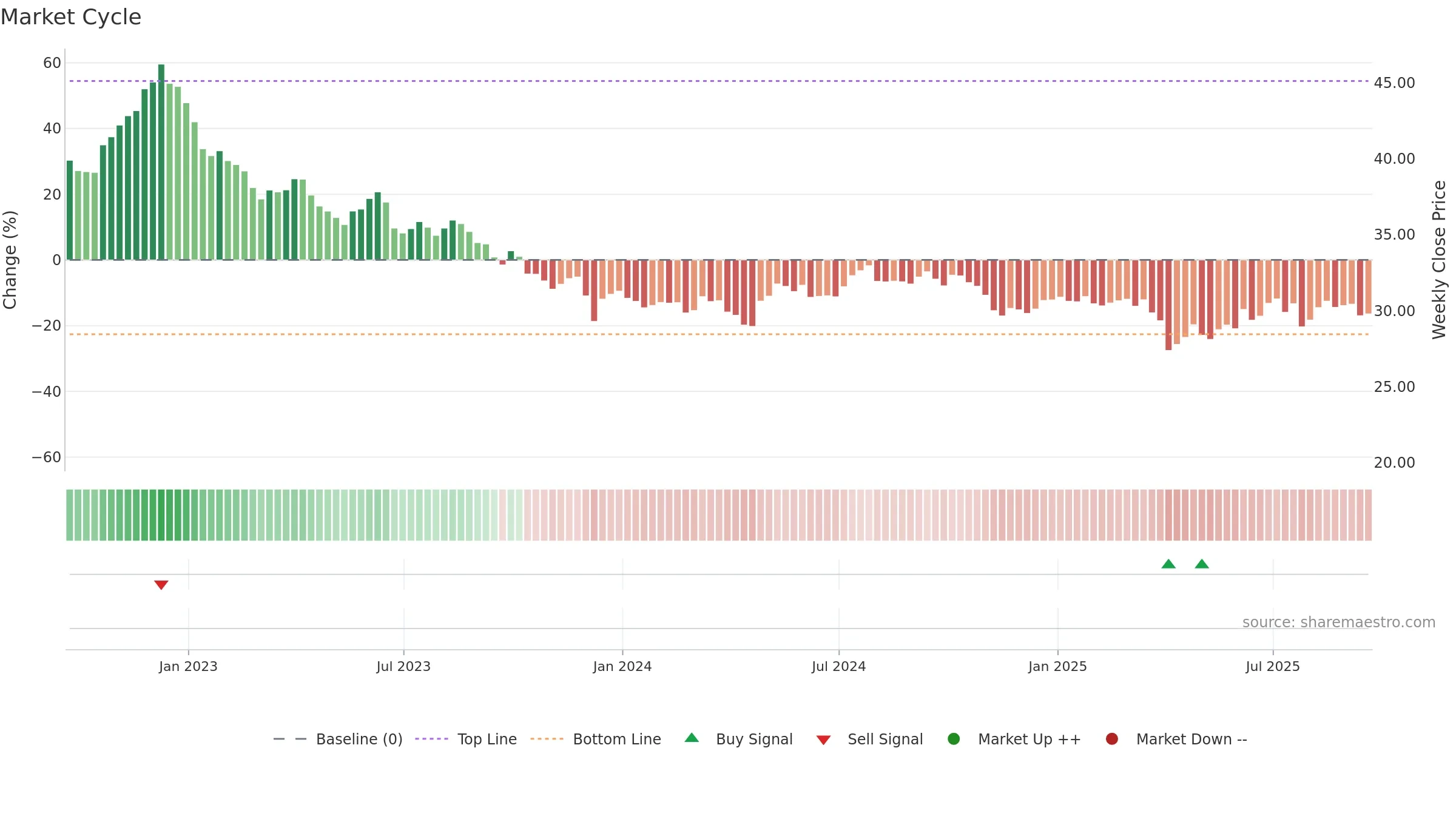

Neutral setup. ★★★☆☆ confidence. Price window: 2. Trend: Range / Neutral; gauge 56. In combination, liquidity diverges from price.

- Price is not above key averages

- Liquidity diverges from price

Why: Price window 2.30% over 8w. Close is -4.42% below the prior-window high. Return volatility 2.21%. Volume trend rising. Liquidity divergence with price. Trend state range / neutral. 4–8w crossover bearish. Momentum neutral and rising.

Tip: Most metrics include a hover tooltip where they appear in the report.