Godawari Power & Ispat Limited

GPIL NSE

Weekly Report

Godawari Power & Ispat Limited closed at 270.1300 (10.17% WoW) . Data window ends Mon, 15 Sep 2025.

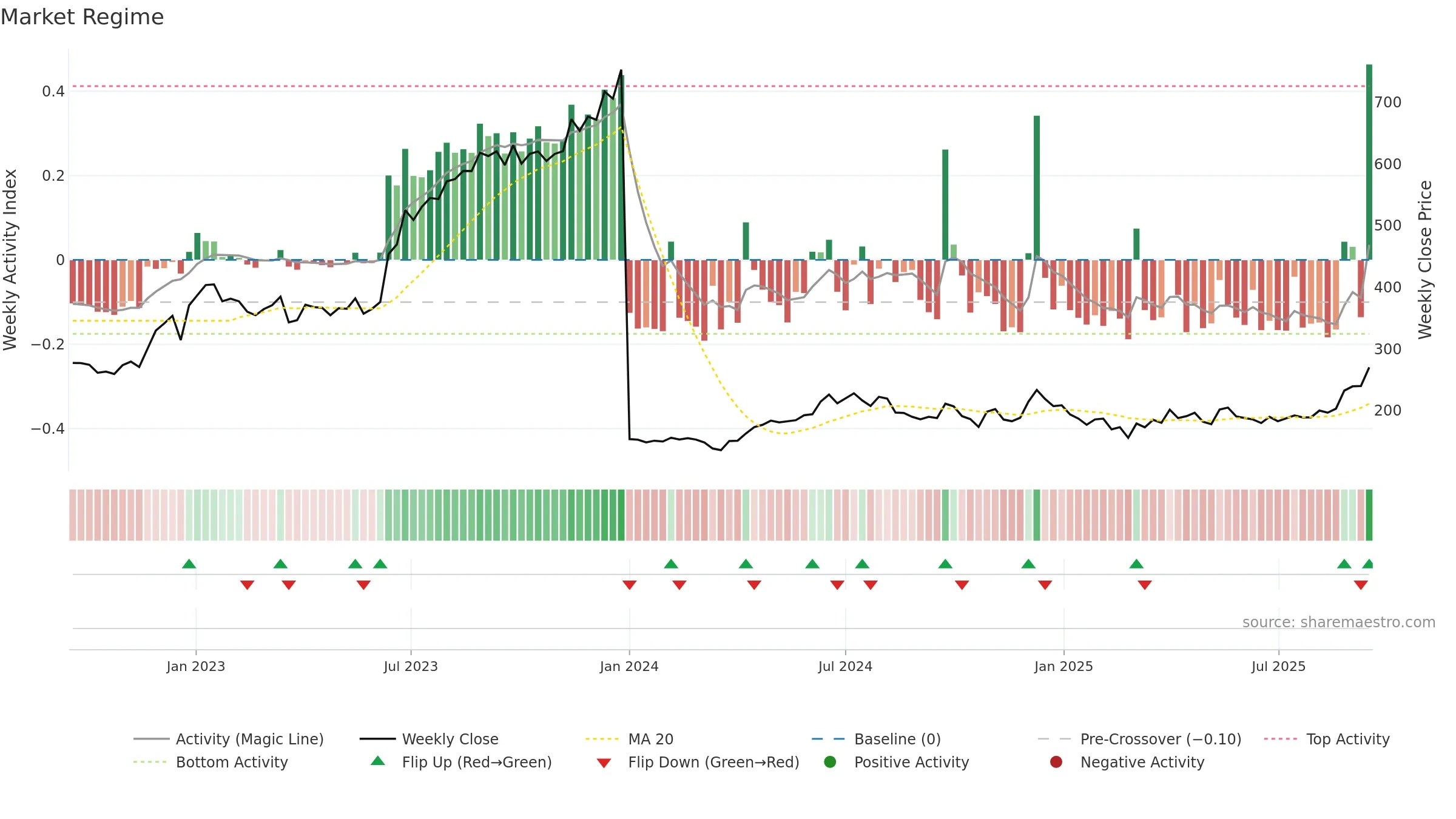

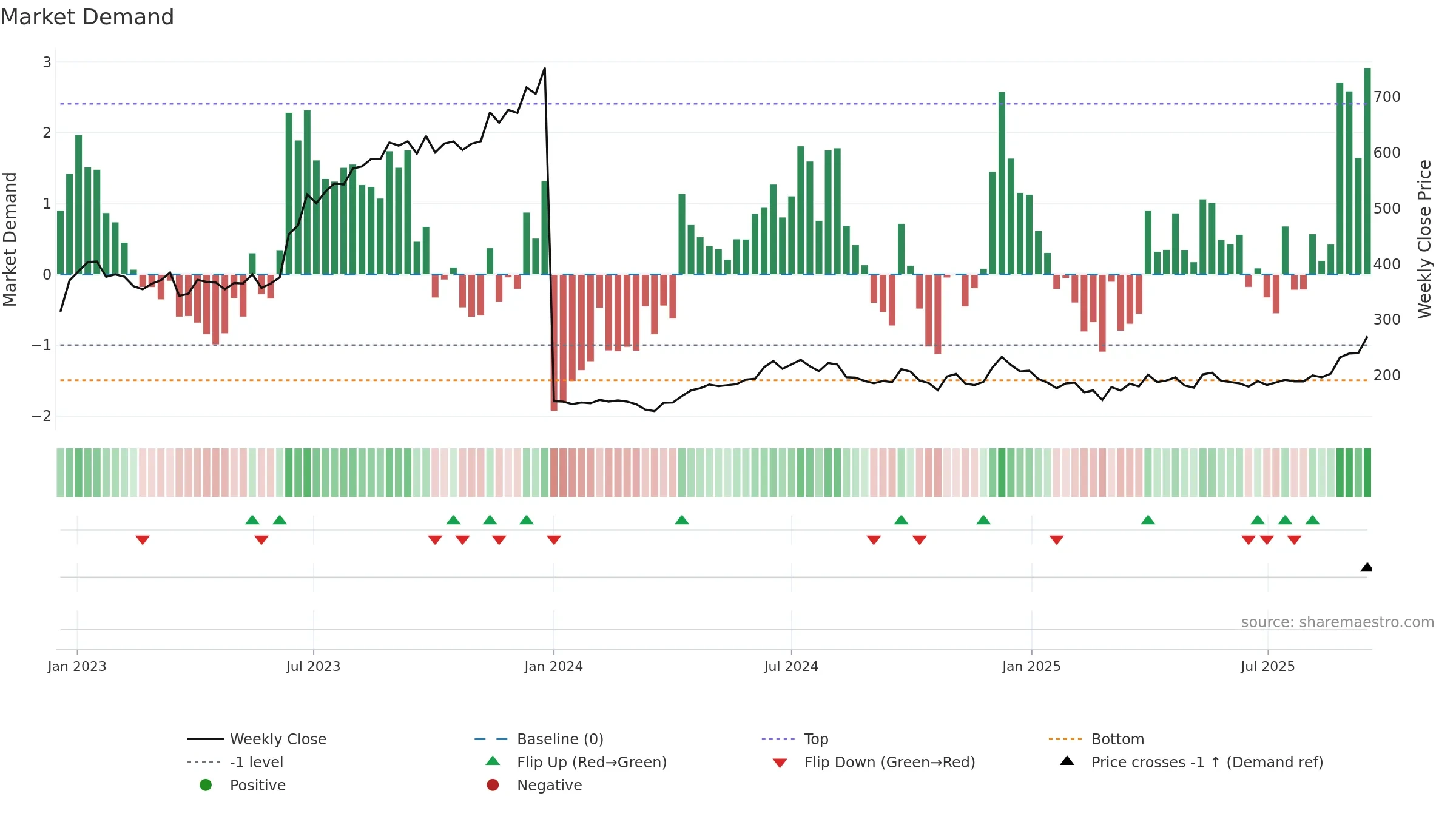

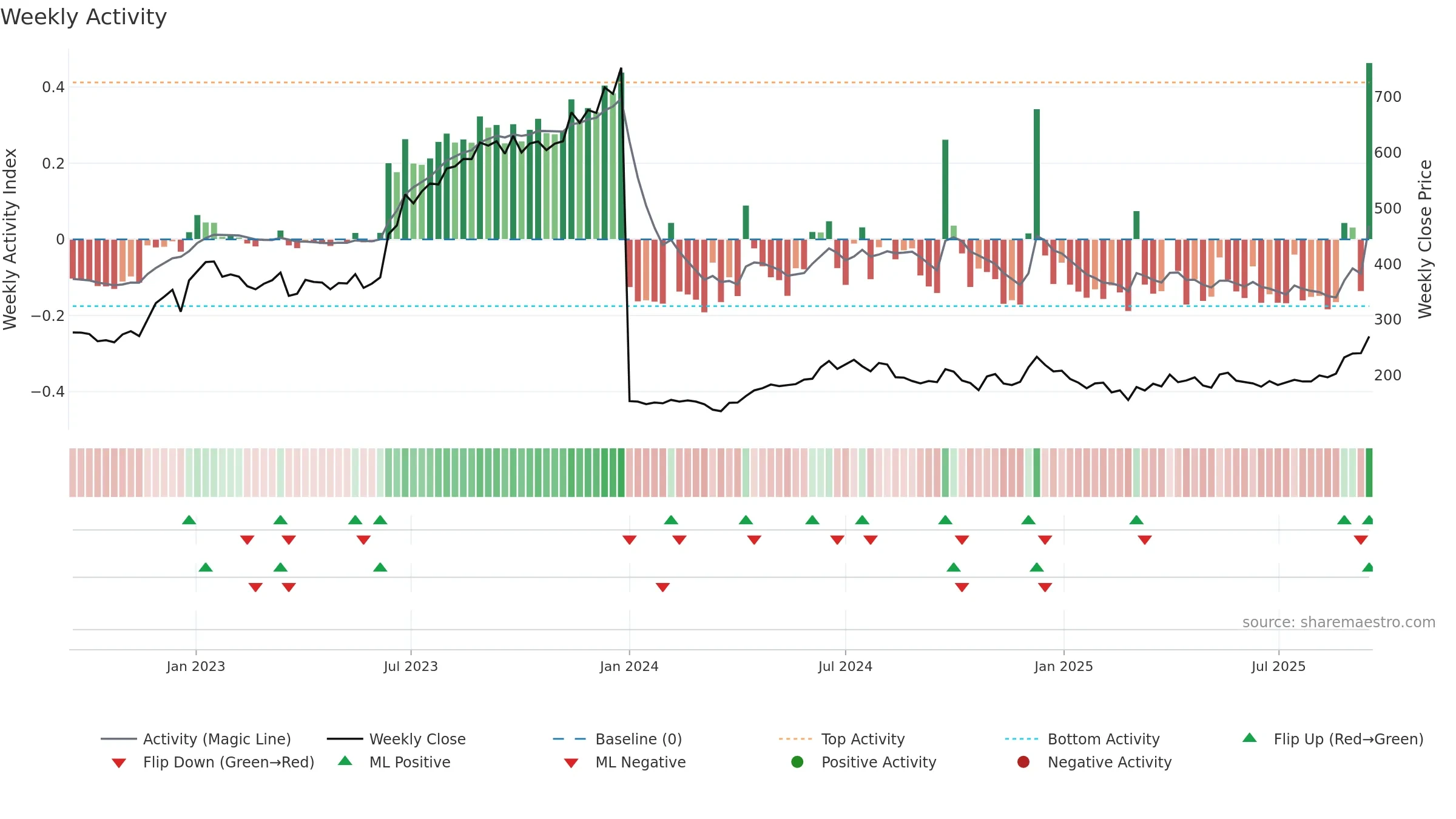

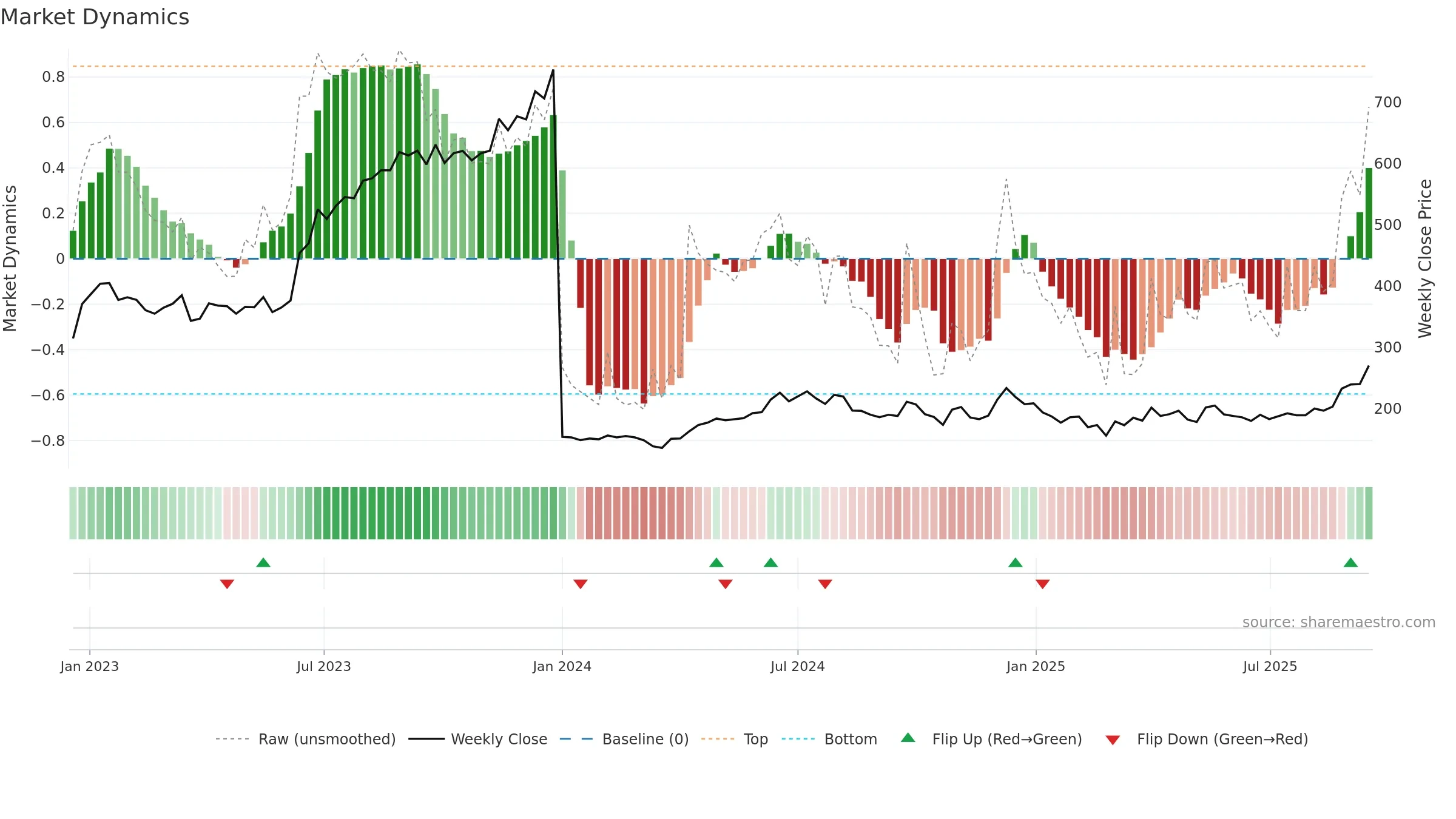

How to read this — Price slope is upward, indicating persistent buying over the window. Elevated weekly volatility increases whipsaw risk. Volume and price are moving in the same direction — a constructive confirmation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm.

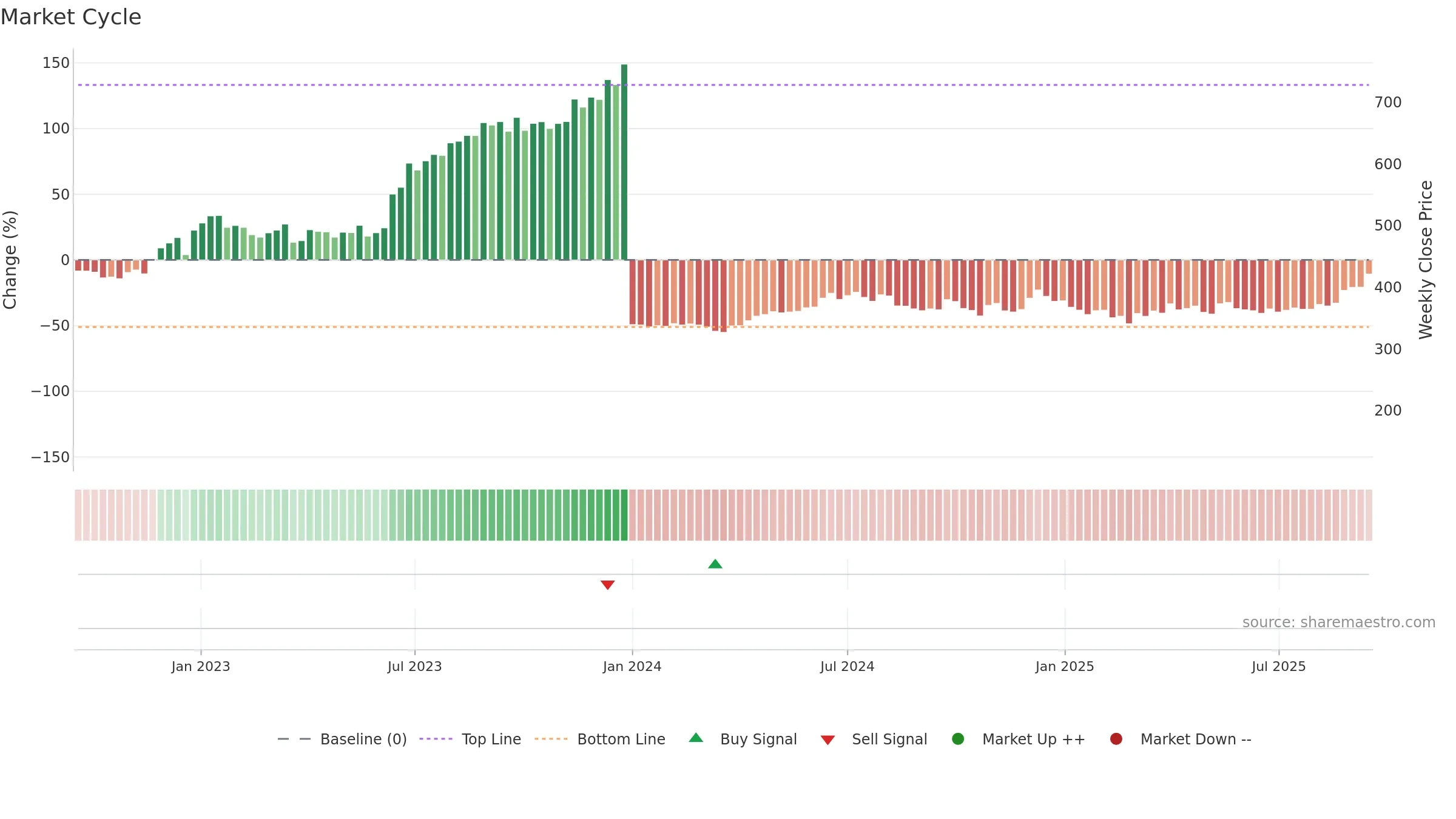

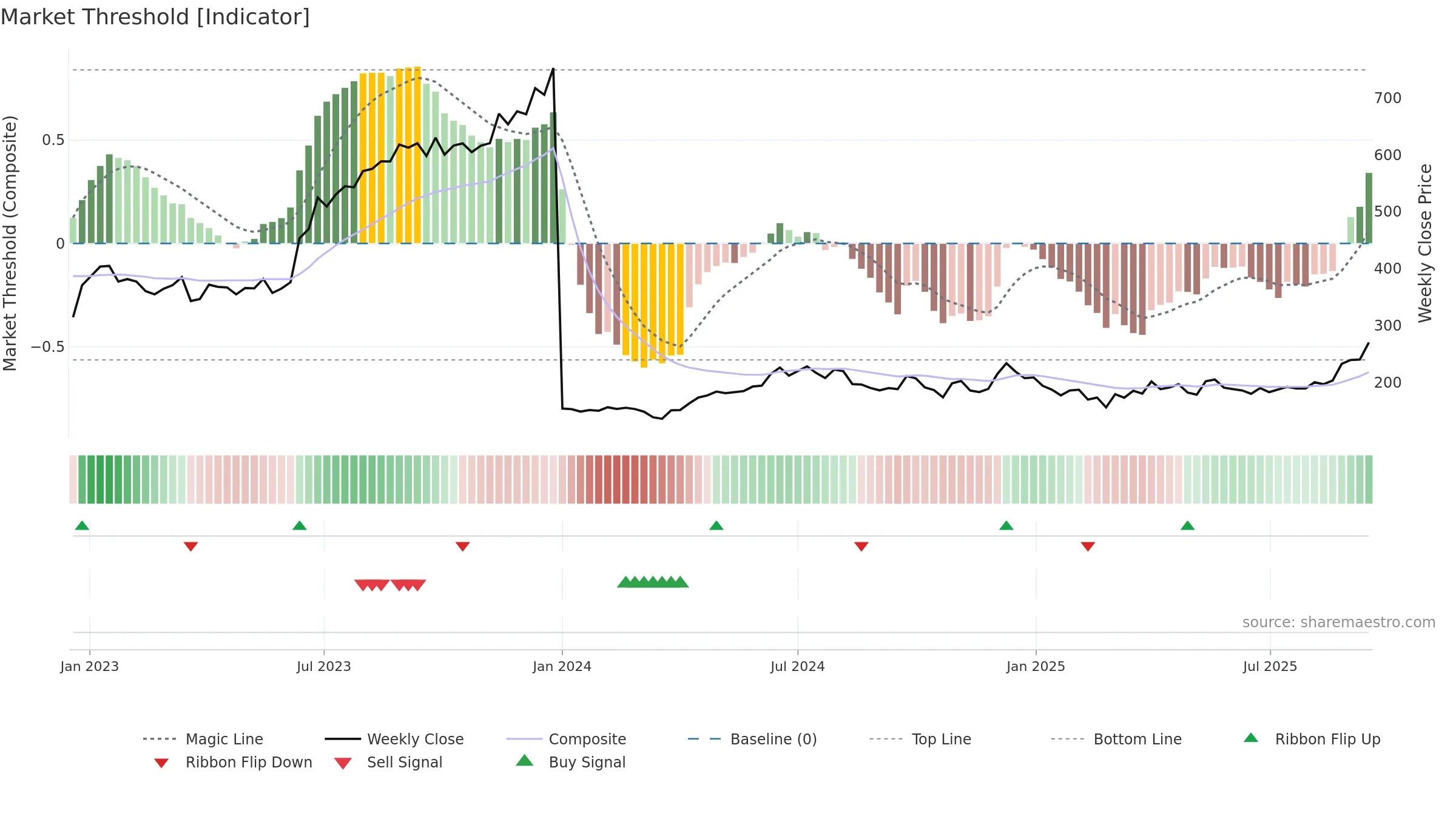

Gauge maps the trend signal to a 0–100 scale.

How to read this — High gauge and rising momentum — buyers in control.

Bias remains higher; pullbacks could be buyable if participation holds.

The flag is positive: favourable upside skew with supportive conditions.

Conclusion

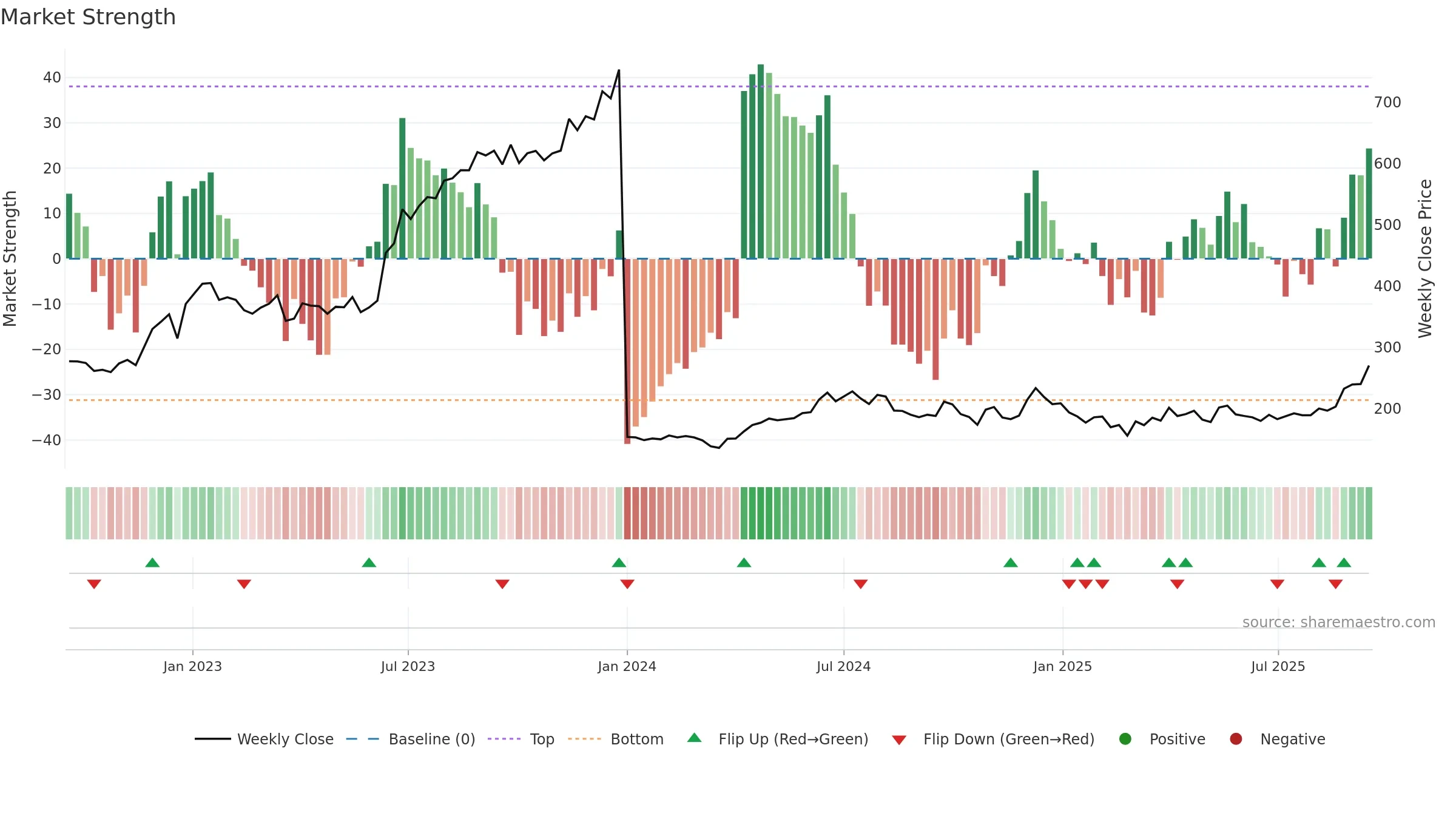

Positive setup. ★★★★☆ confidence. Price window: 42. Trend: Strong Uptrend; gauge 68. In combination, liquidity confirms the move.

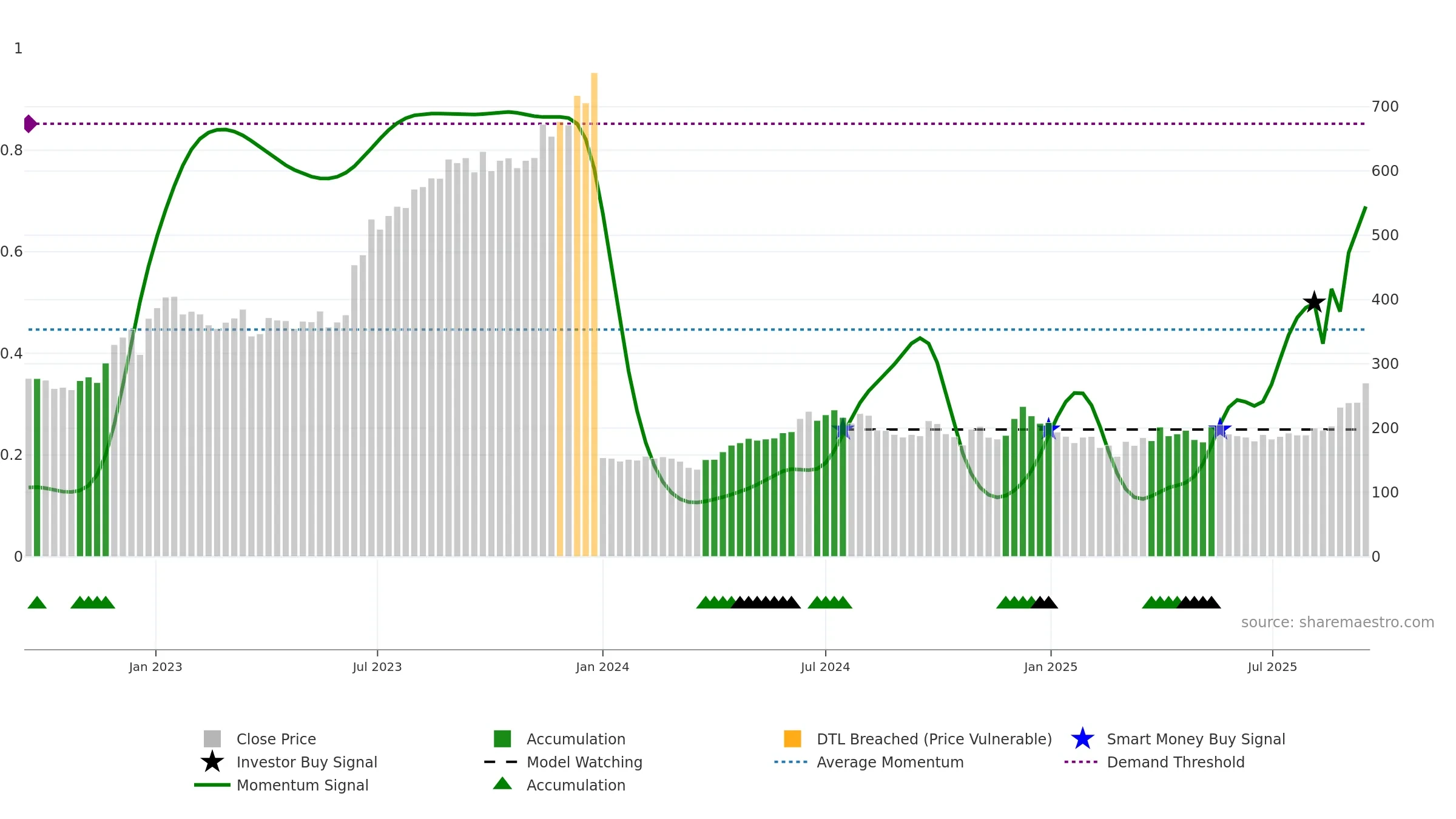

- High gauge with rising momentum (strong uptrend)

- Momentum is bullish and rising

- Price holds above 8w & 26w averages

- Constructive moving-average stack

- High return volatility raises whipsaw risk

Why: Price window 42.89% over 8w. Close is 12.61% above the prior-window high. Return volatility 4.08%. Volume trend rising. Liquidity convergence with price. Trend state strong uptrend. MA stack constructive. Momentum bullish and rising. Valuation stance positive.

Tip: Most metrics include a hover tooltip where they appear in the report.