Arko Corp.

ARKO NASDAQ

Weekly Report

Arko Corp. closed at 4.8300 (-3.78% WoW) . Data window ends Fri, 19 Sep 2025.

How to read this — Price slope is upward, indicating persistent buying over the window. Volume and price are moving in the same direction — a constructive confirmation. Returns are negatively correlated with volume — strength may come on lighter activity. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm.

Gauge maps the trend signal to a 0–100 scale.

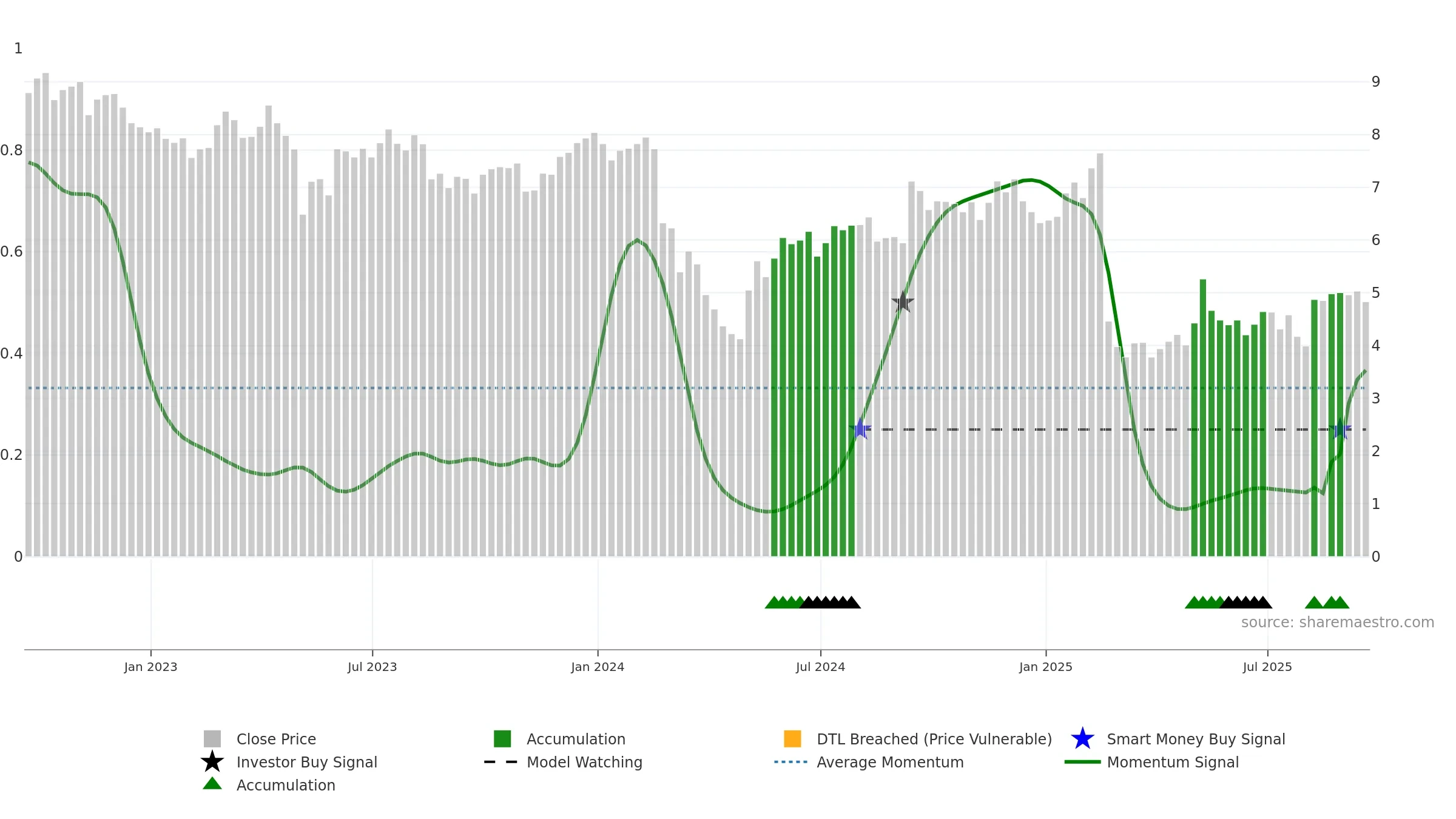

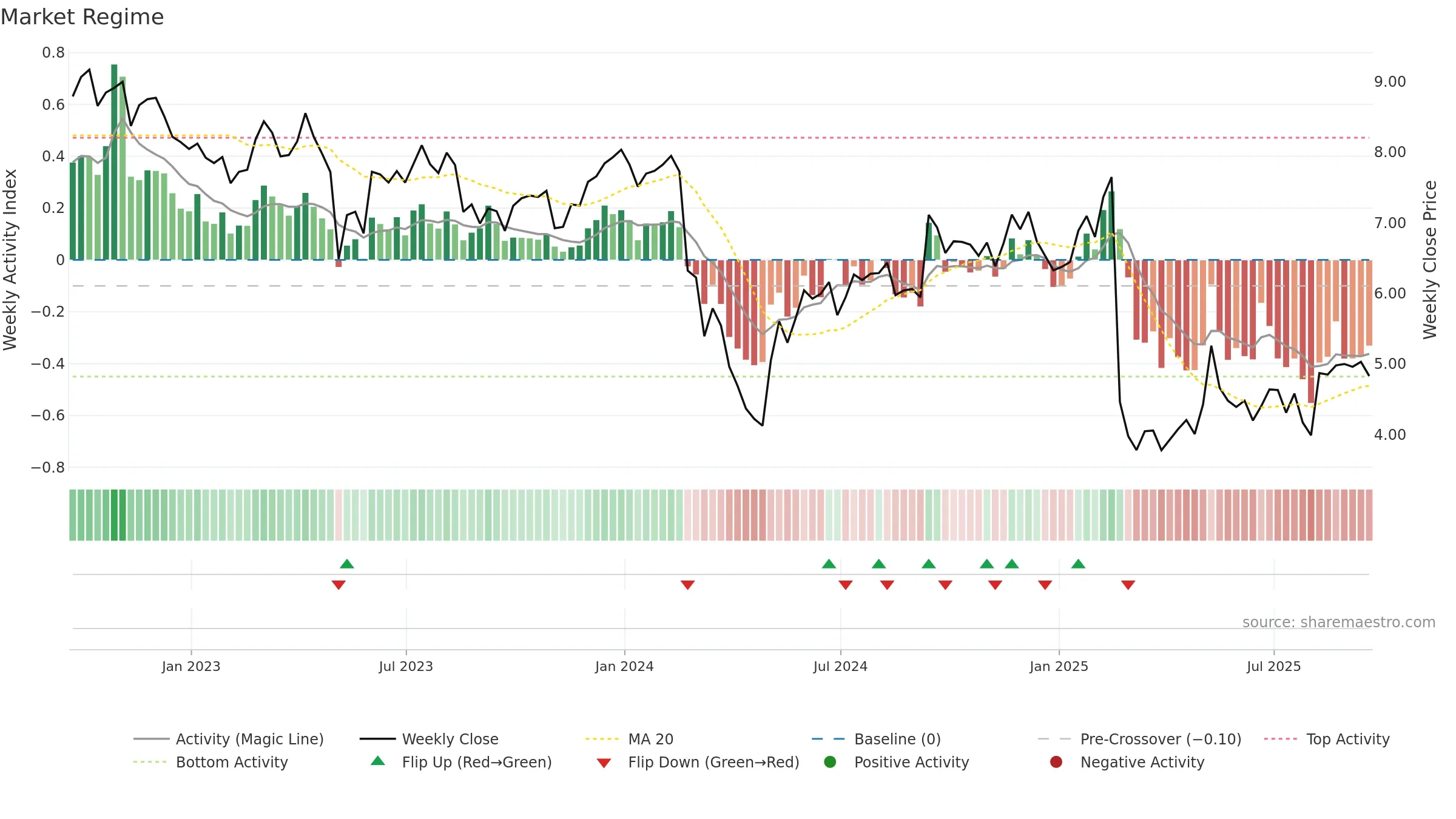

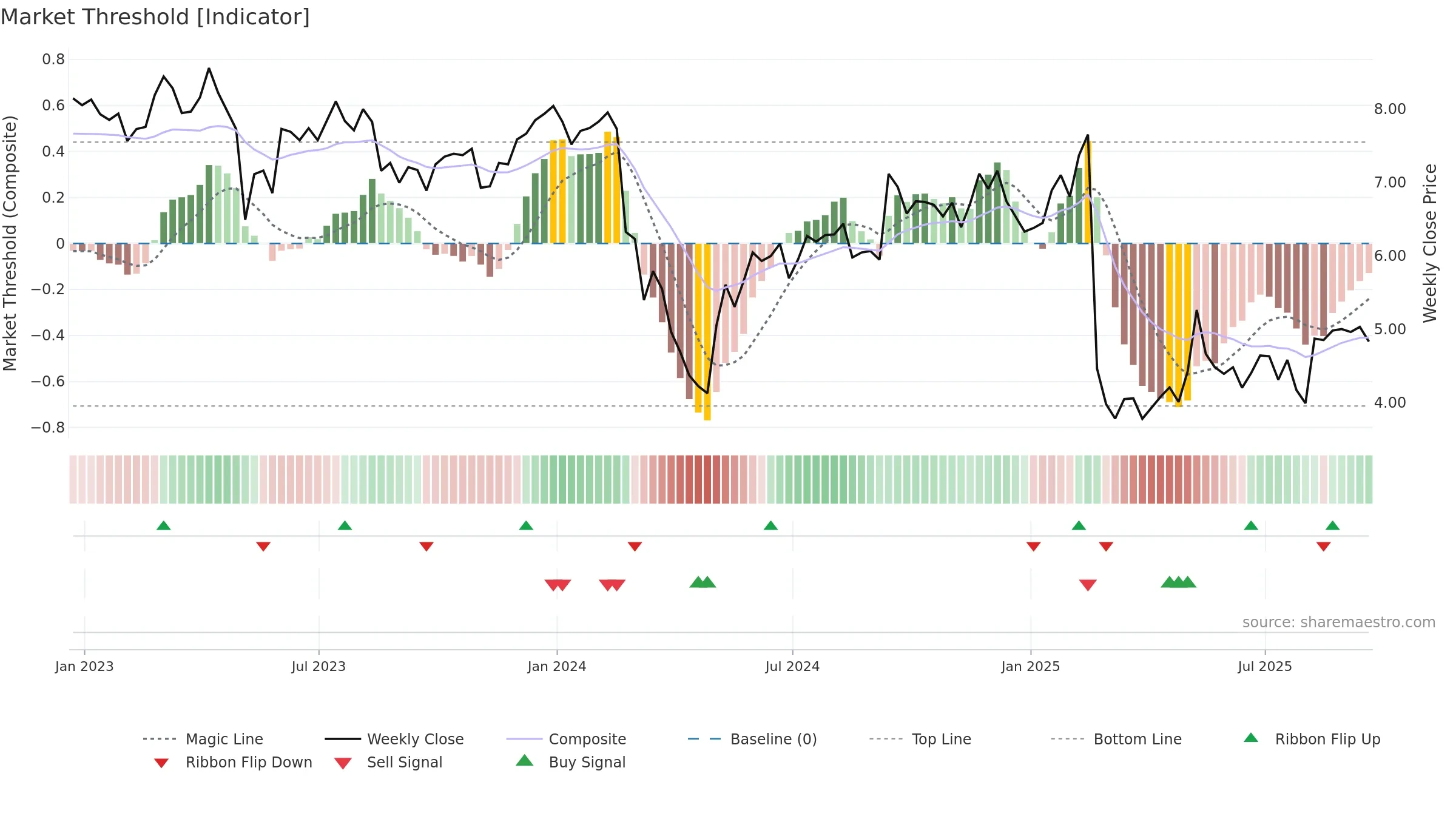

How to read this — Bearish backdrop but short-term momentum is improving; confirmation still needed.

Early improvement — look for a reclaim of 0.50→0.60 to validate.

Price is above fair value; upside may be capped without catalysts.

Conclusion

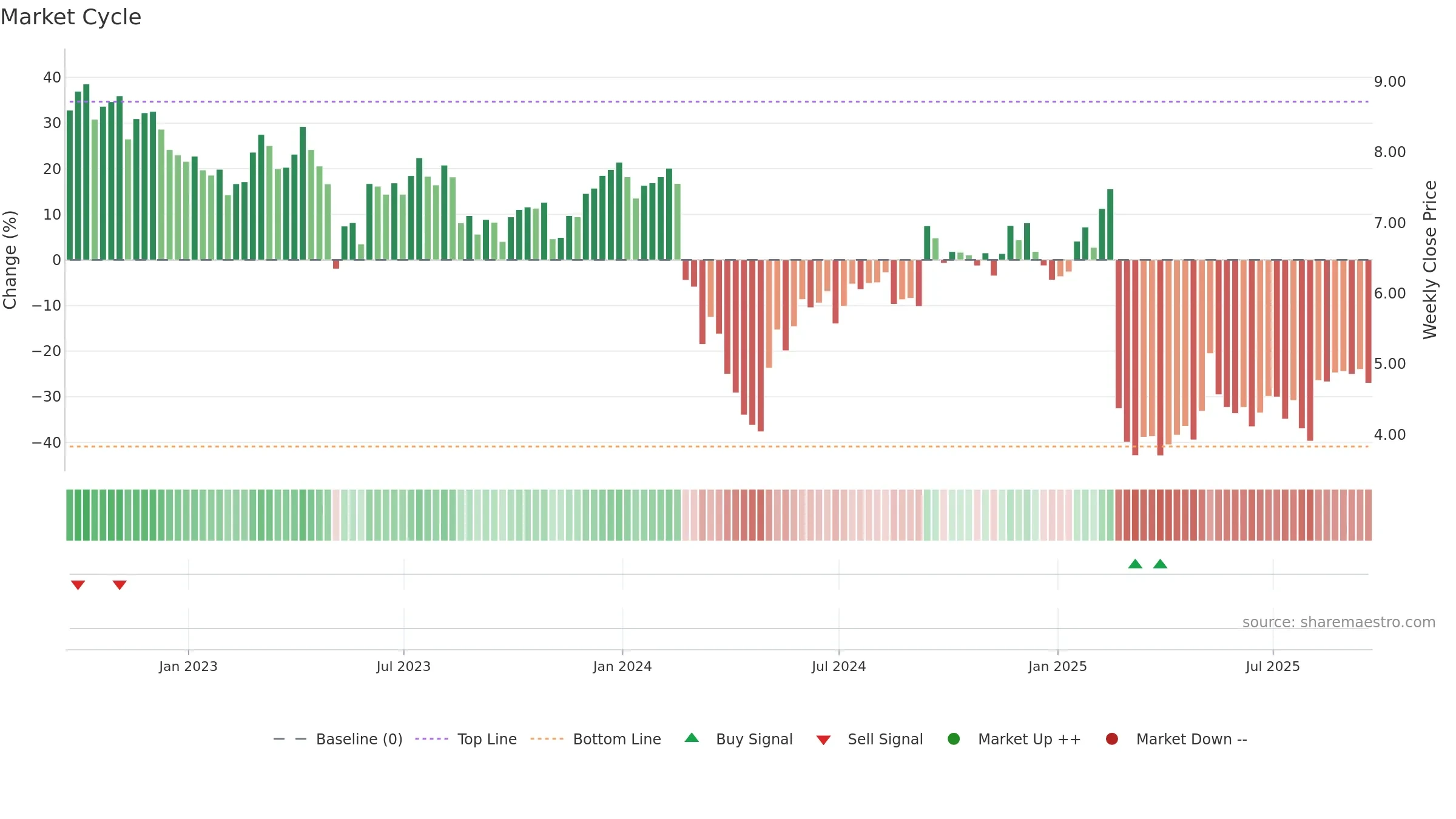

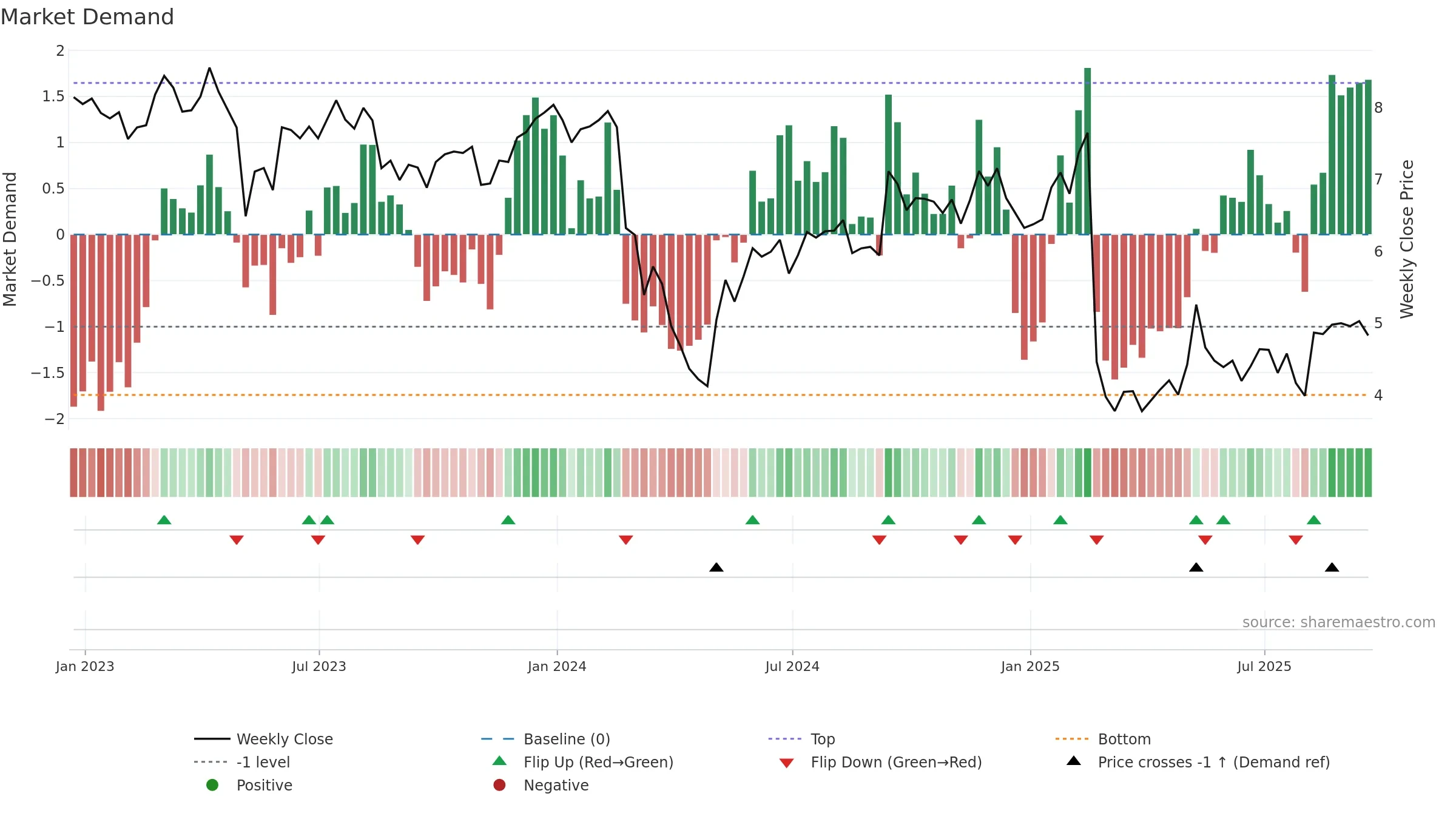

Positive setup. ★★★★★ confidence. Price window: 21. Trend: Bottoming Attempt; gauge 36. In combination, liquidity confirms the move.

- Early improvement from bearish zone (bottoming attempt)

- Price holds above 8w & 26w averages

- Constructive moving-average stack

- Liquidity confirms the price trend

Why: Price window 21.05% over 8w. Close is -3.98% below the prior-window high. Return volatility 2.36%. Volume trend rising. Liquidity convergence with price. Trend state bottoming attempt. Low-regime (≤0.25) upticks 4/5 (80.0%) • Accumulating. MA stack constructive. Momentum neutral and rising. Valuation limited upside without catalysts.

Tip: Most metrics include a hover tooltip where they appear in the report.