Stora Enso Oyj

STE-R STO

Weekly Report

Stora Enso Oyj closed at 105.0000 (1.16% WoW) . Data window ends Mon, 15 Sep 2025.

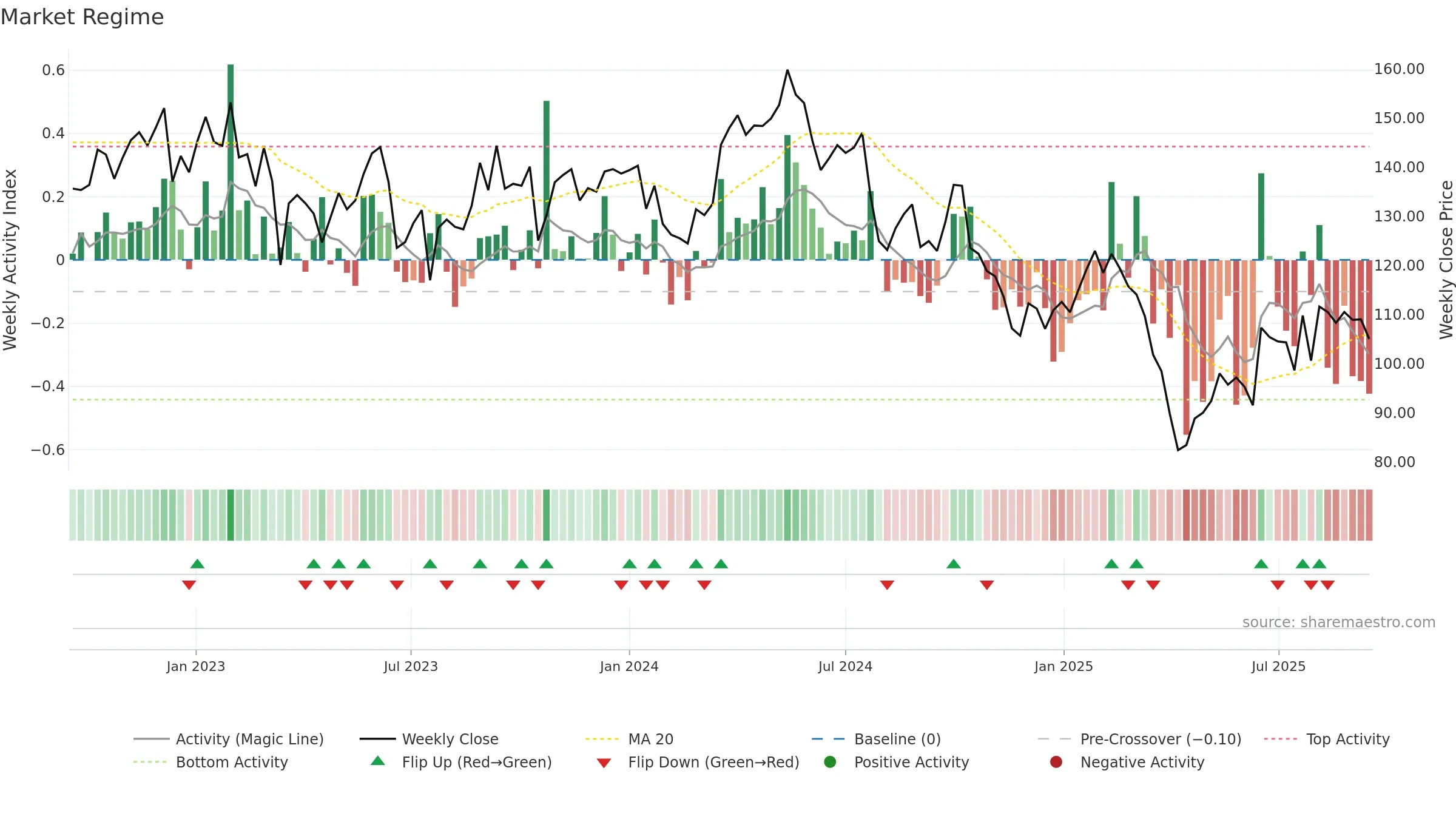

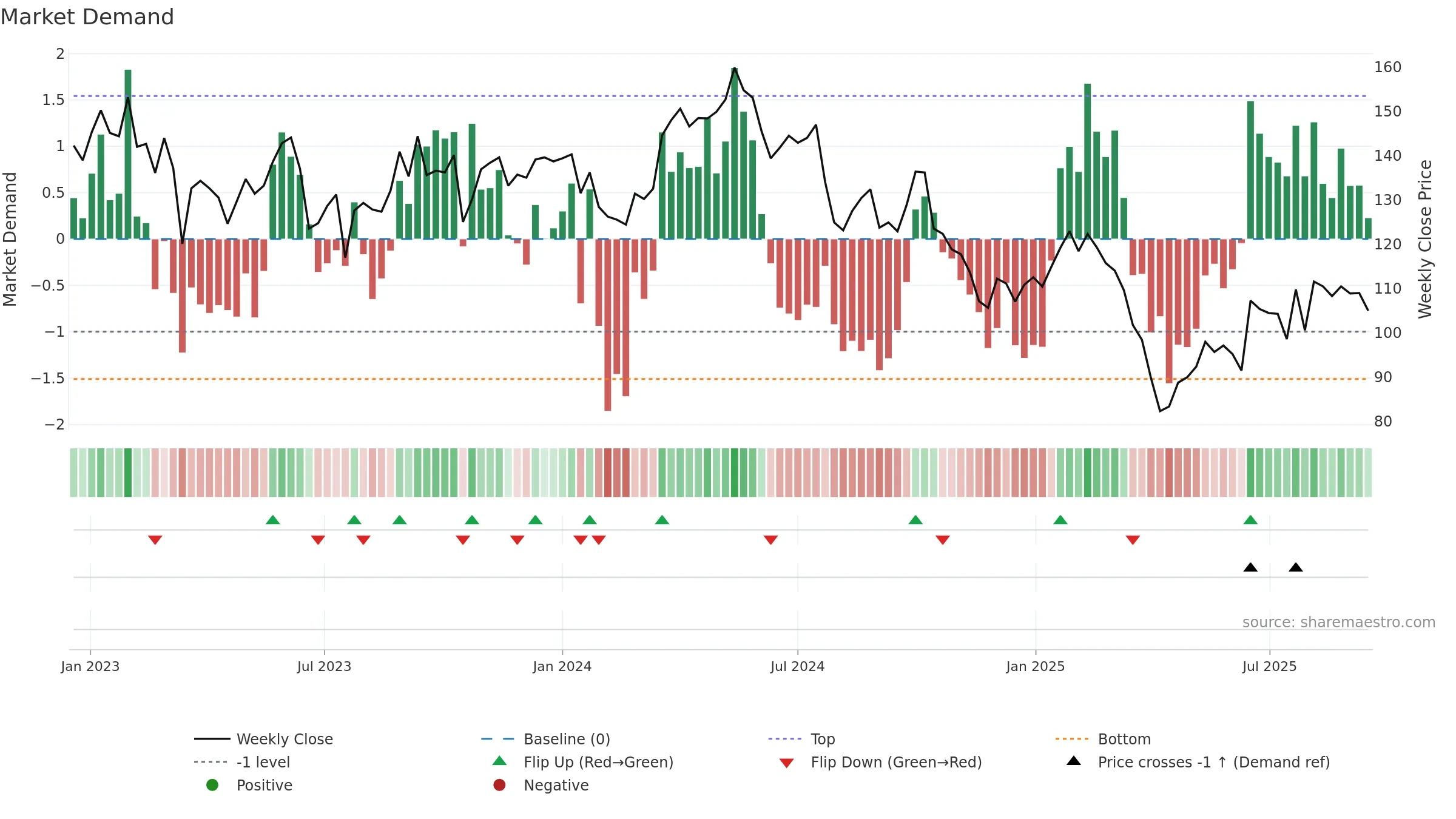

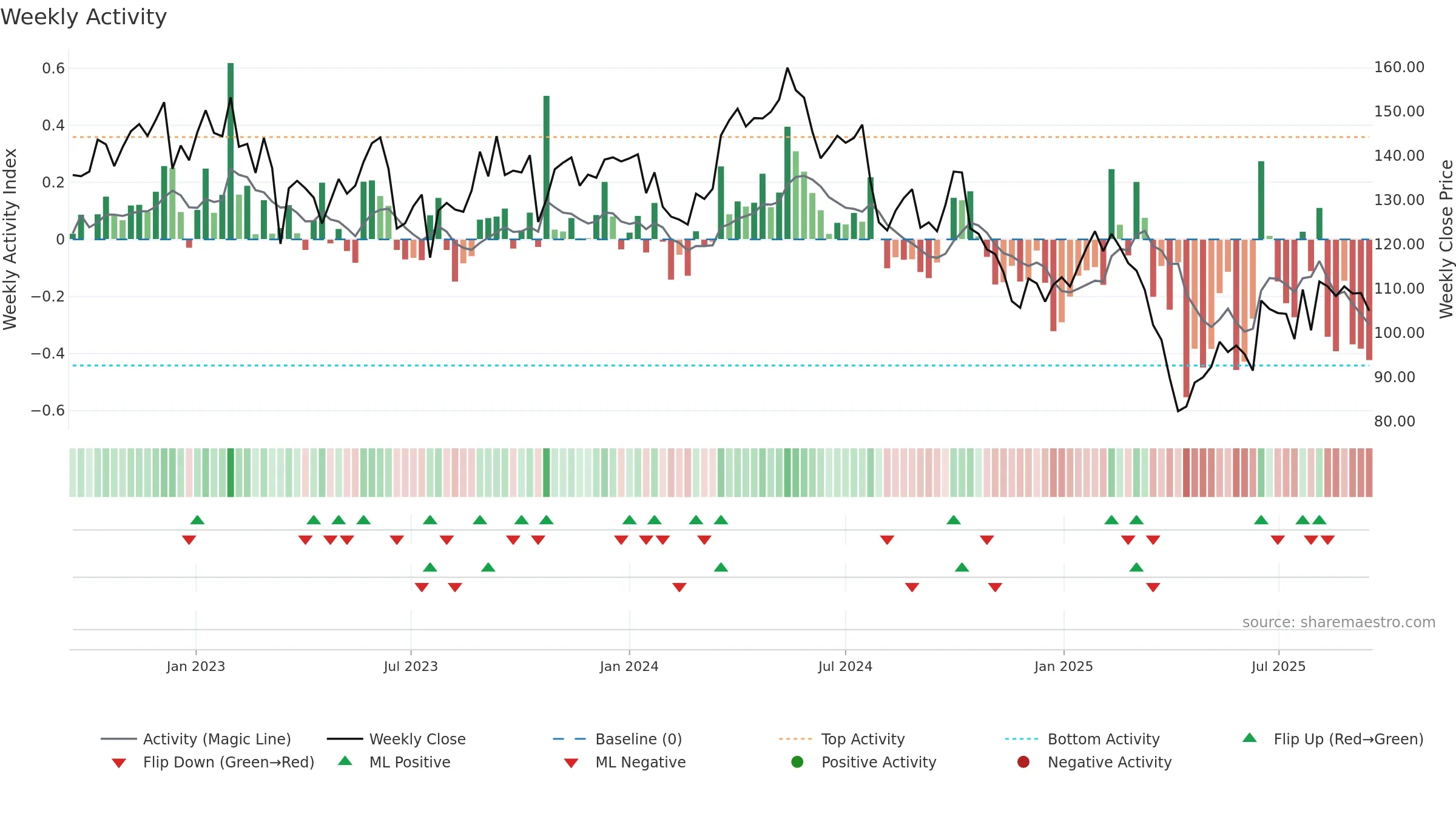

How to read this — Price slope is upward, indicating persistent buying over the window. Elevated weekly volatility increases whipsaw risk. Volume trend diverges from price — watch for fatigue or rotation. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

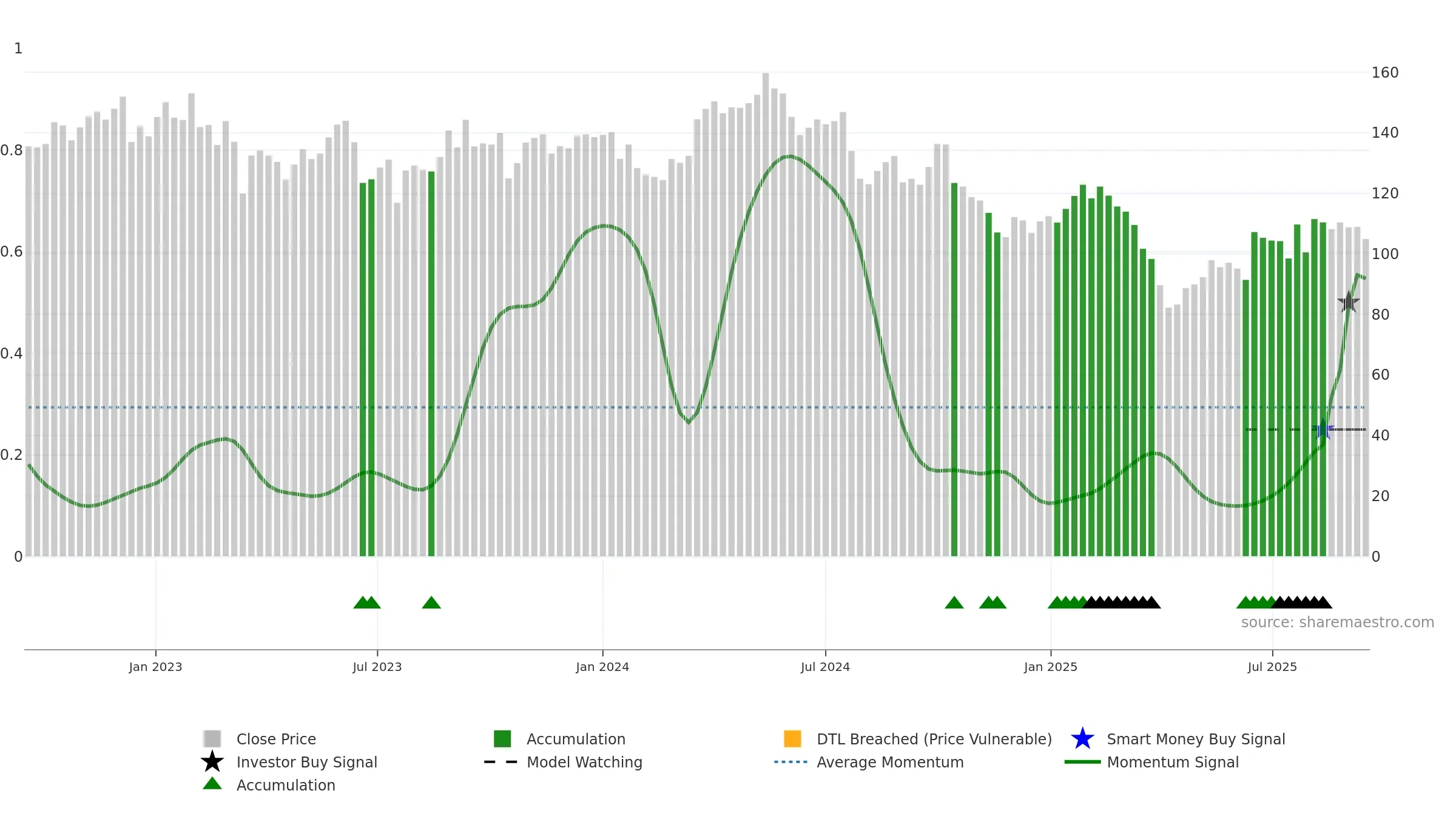

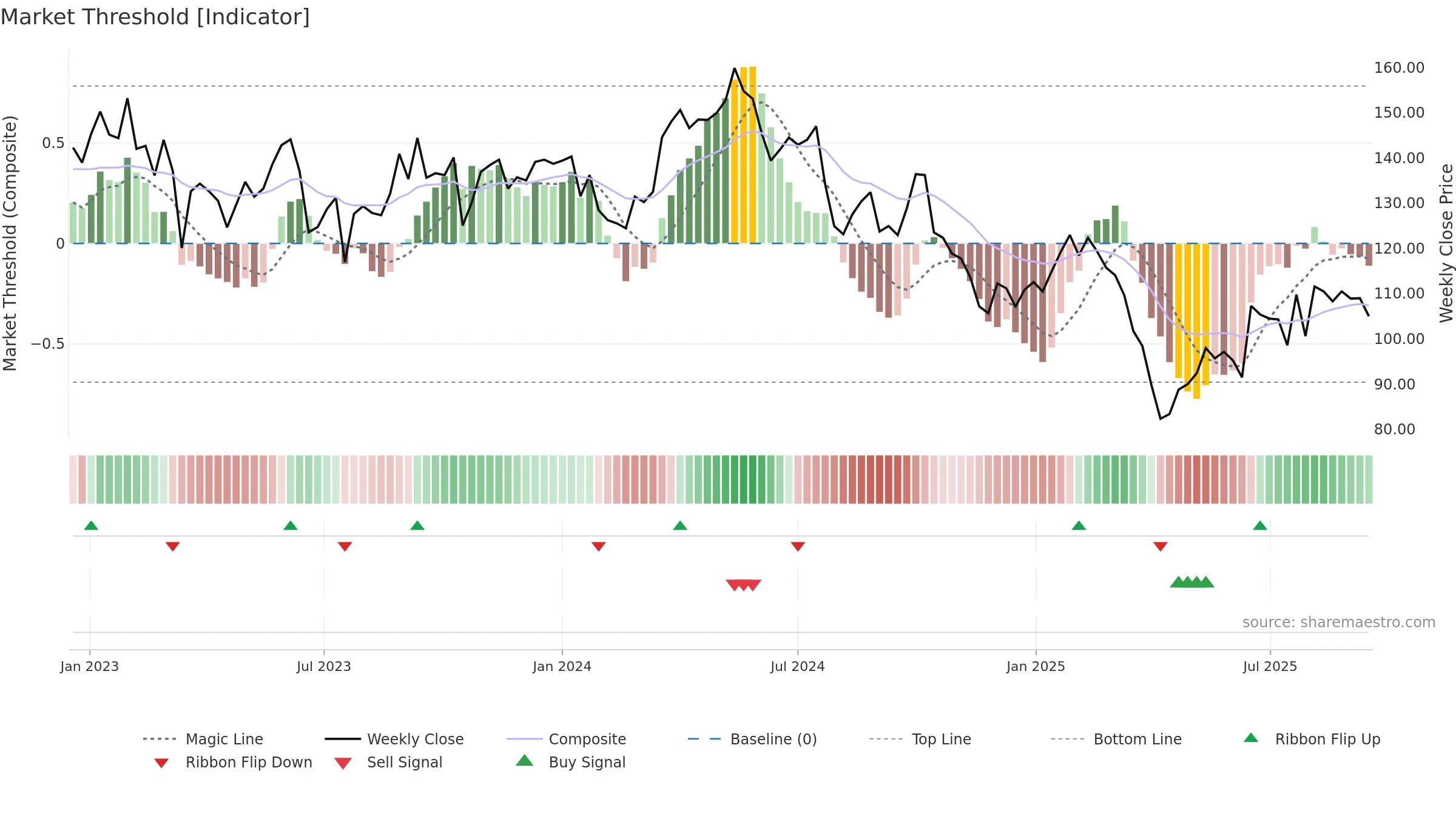

Gauge maps the trend signal to a 0–100 scale.

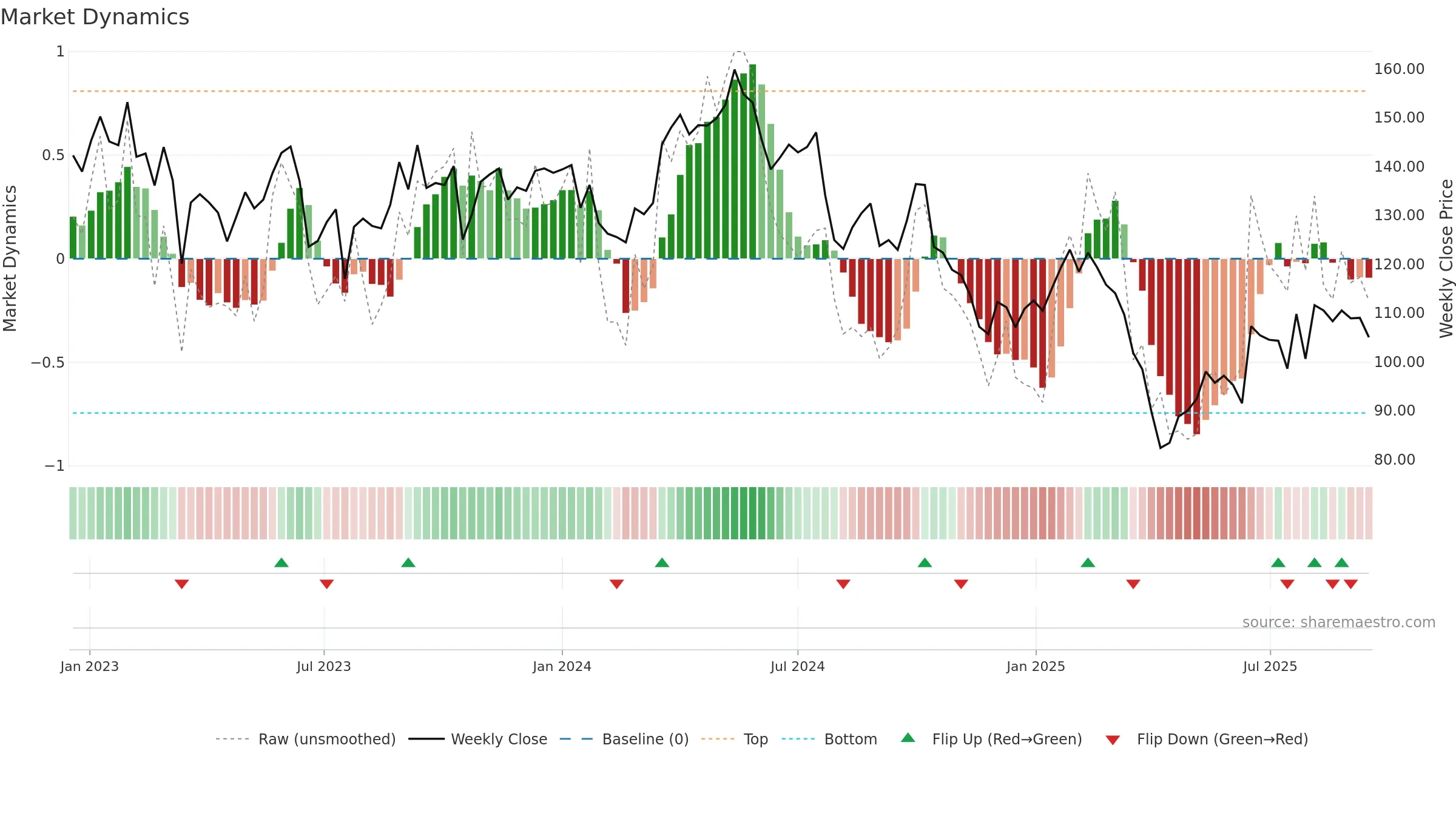

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

Conclusion

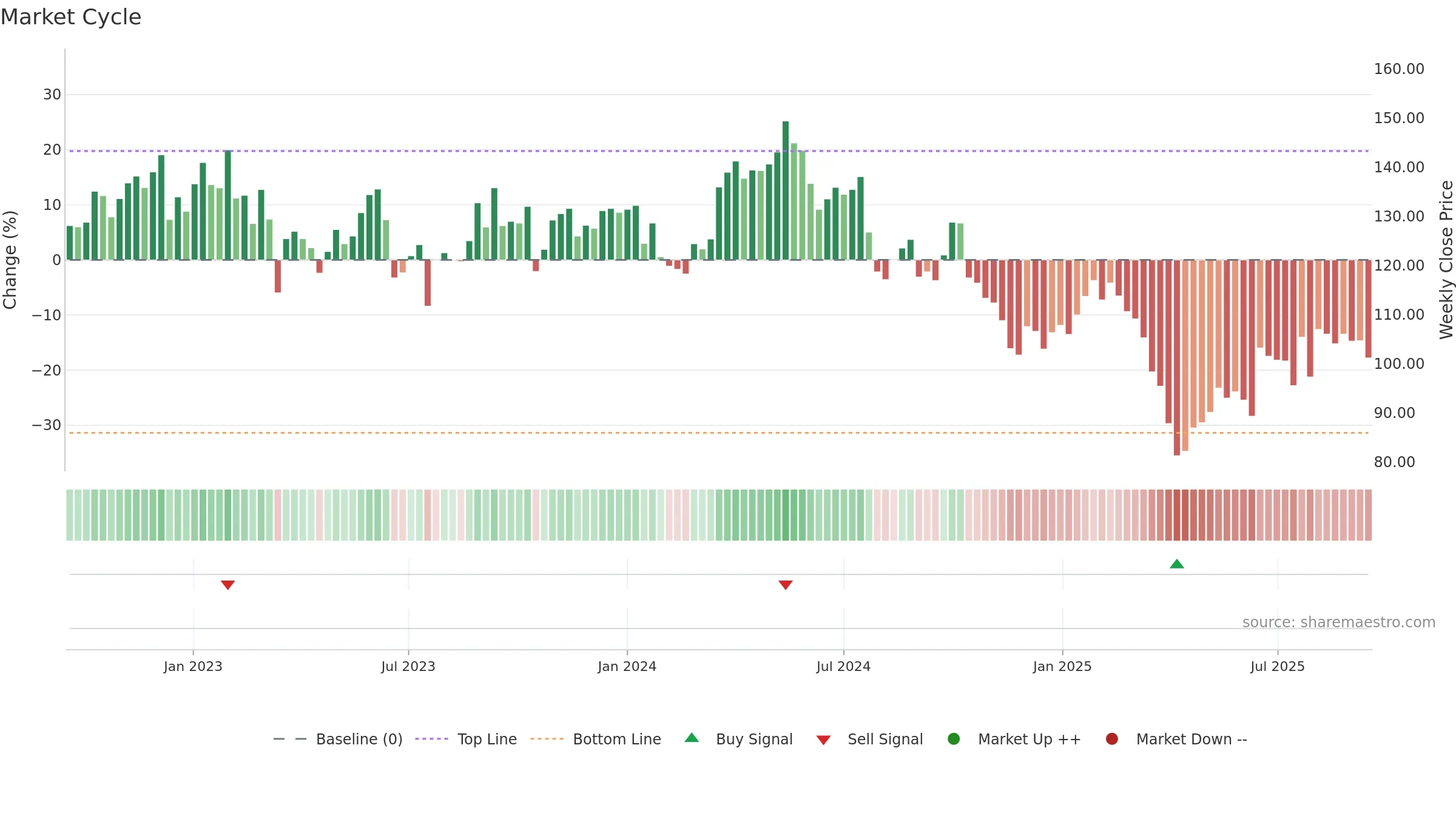

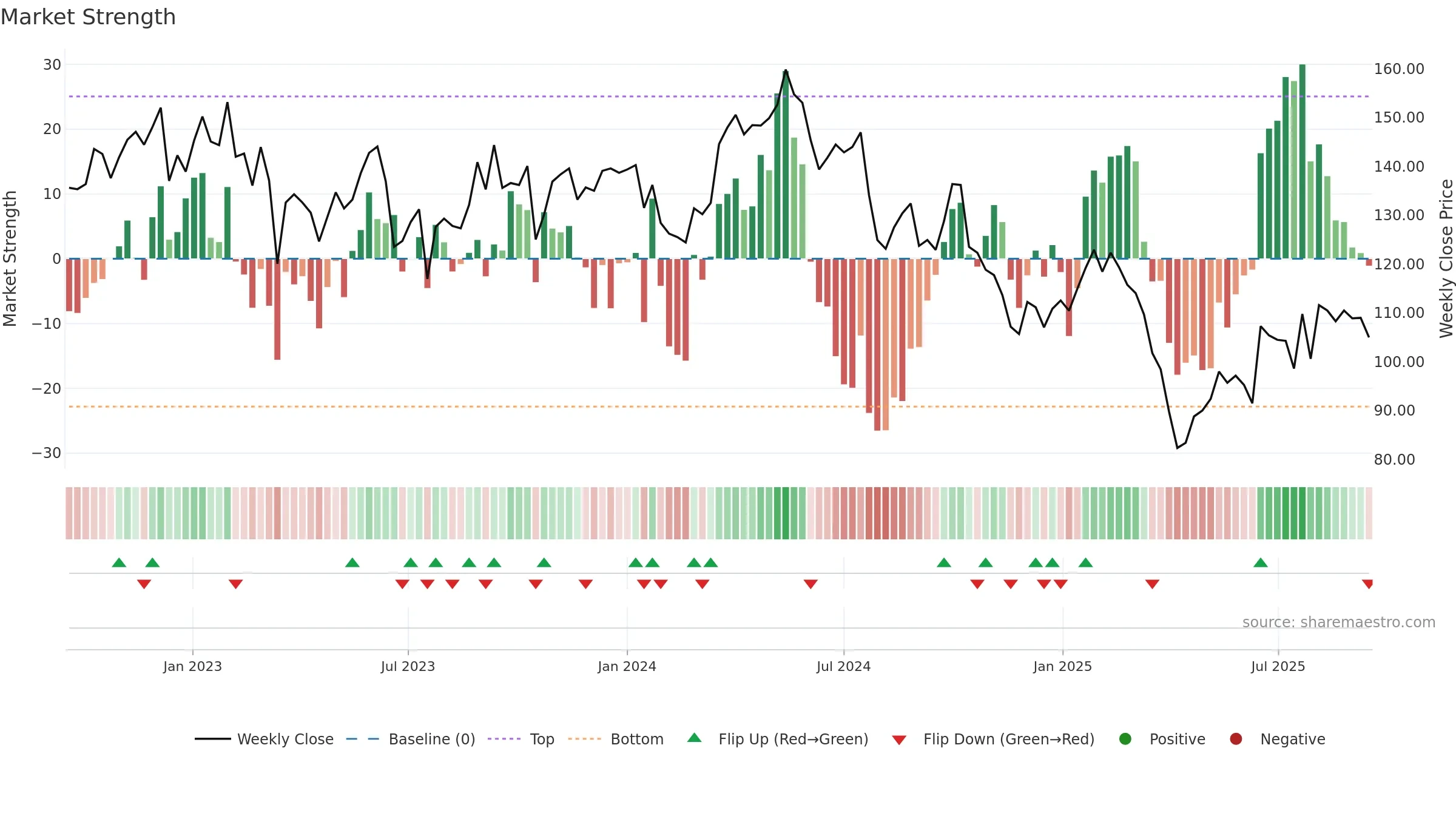

Negative setup. ★★☆☆☆ confidence. Price window: 4. Trend: Range / Neutral; gauge 54. In combination, liquidity diverges from price.

- Constructive moving-average stack

- Buyers step in at depressed levels (accumulation)

- Price is not above key averages

- Liquidity diverges from price

- High return volatility raises whipsaw risk

Why: Price window 4.37% over 8w. Close is -5.91% below the prior-window high. Return volatility 5.55%. Volume trend falling. Liquidity divergence with price. Trend state range / neutral. Low-regime (≤0.25) upticks 3/3 (100.0%) • Accumulating. MA stack constructive. Momentum neutral and rising.

Tip: Most metrics include a hover tooltip where they appear in the report.