Tripadvisor, Inc.

TRIP NASDAQ

Weekly Summary

Tripadvisor, Inc. closed at 18.8300 (-3.53% WoW) . Data window ends Fri, 19 Sep 2025.

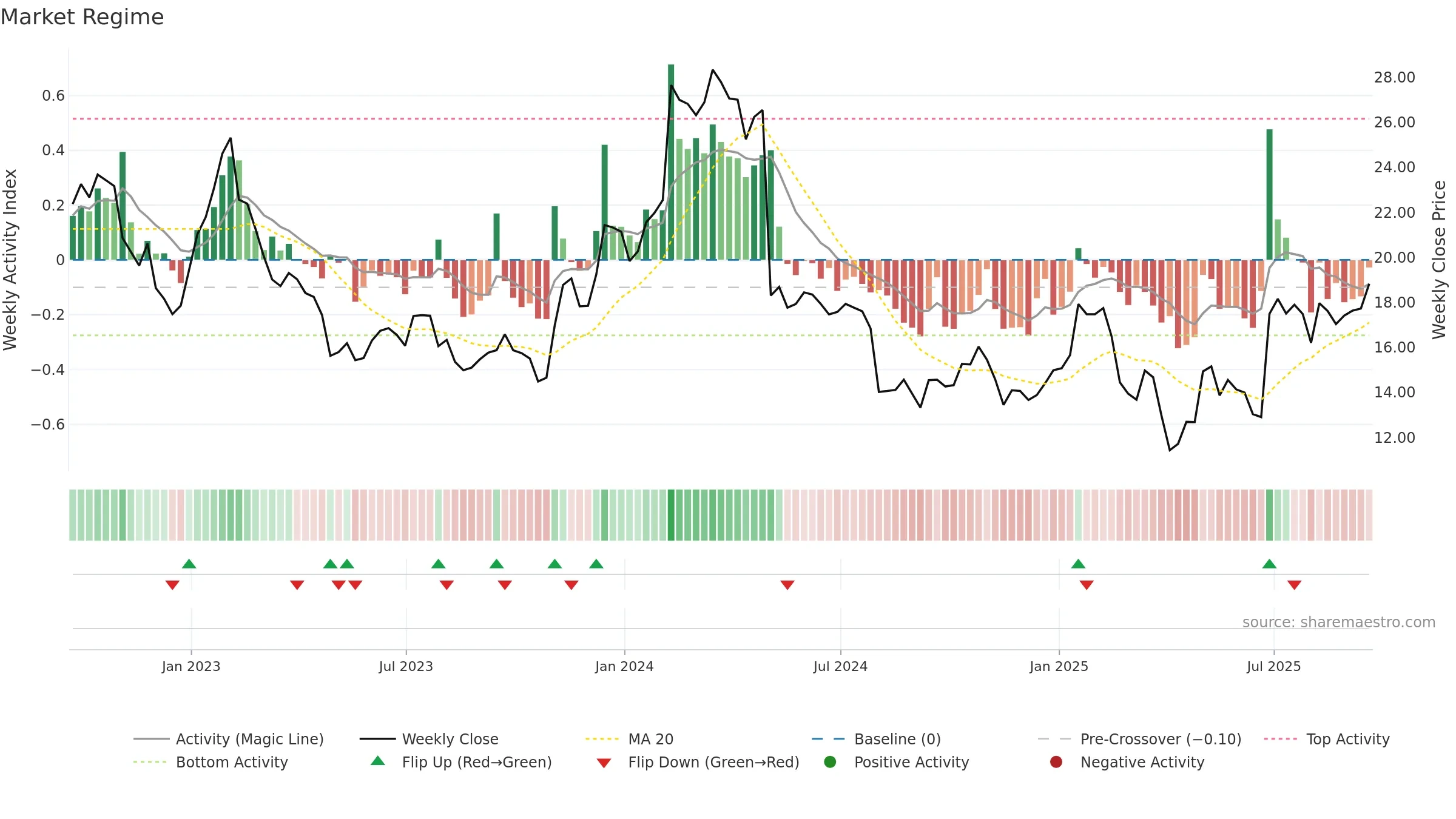

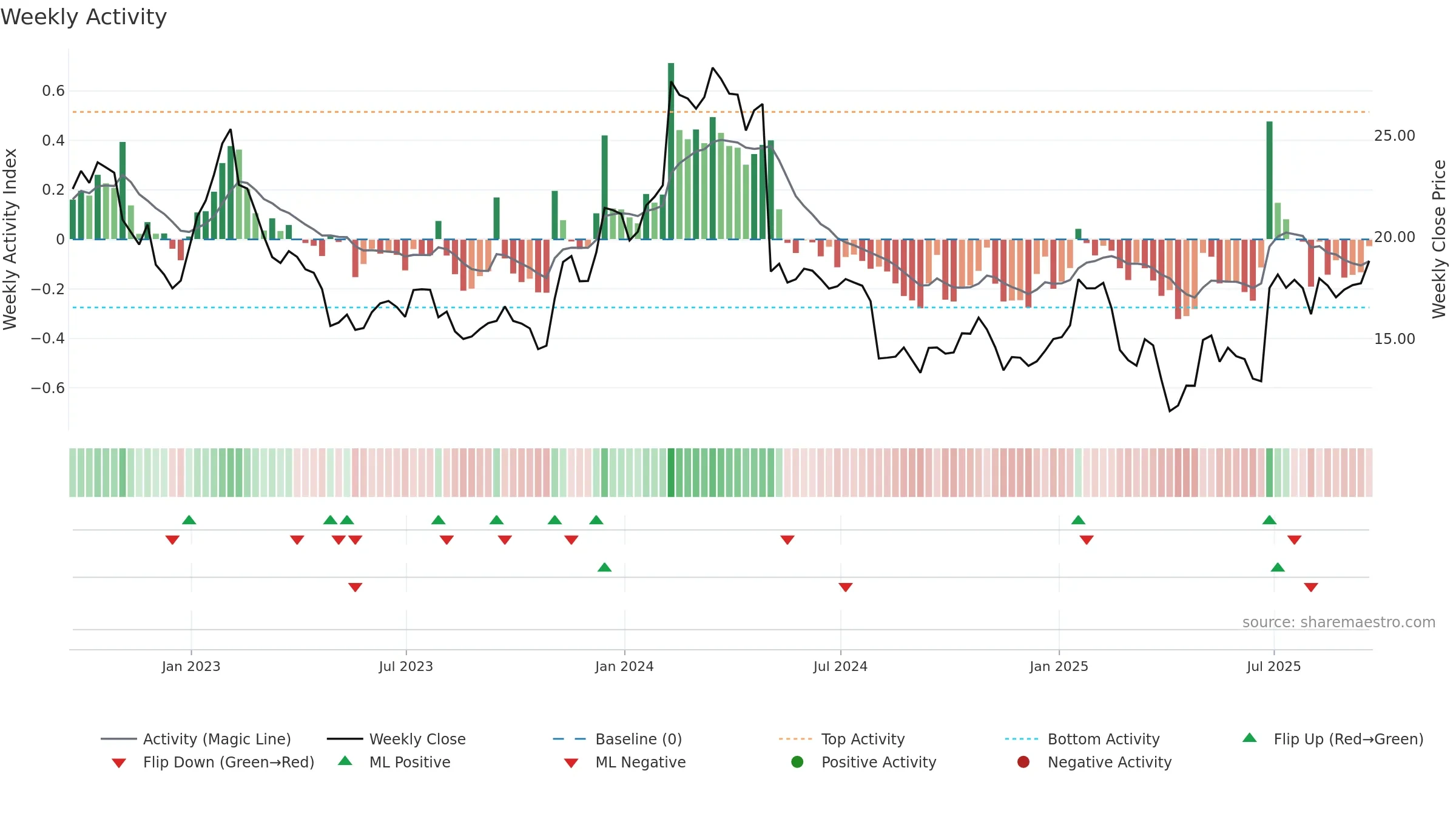

How to read this — Price slope is upward, indicating persistent buying over the window. Volume trend diverges from price — watch for fatigue or rotation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

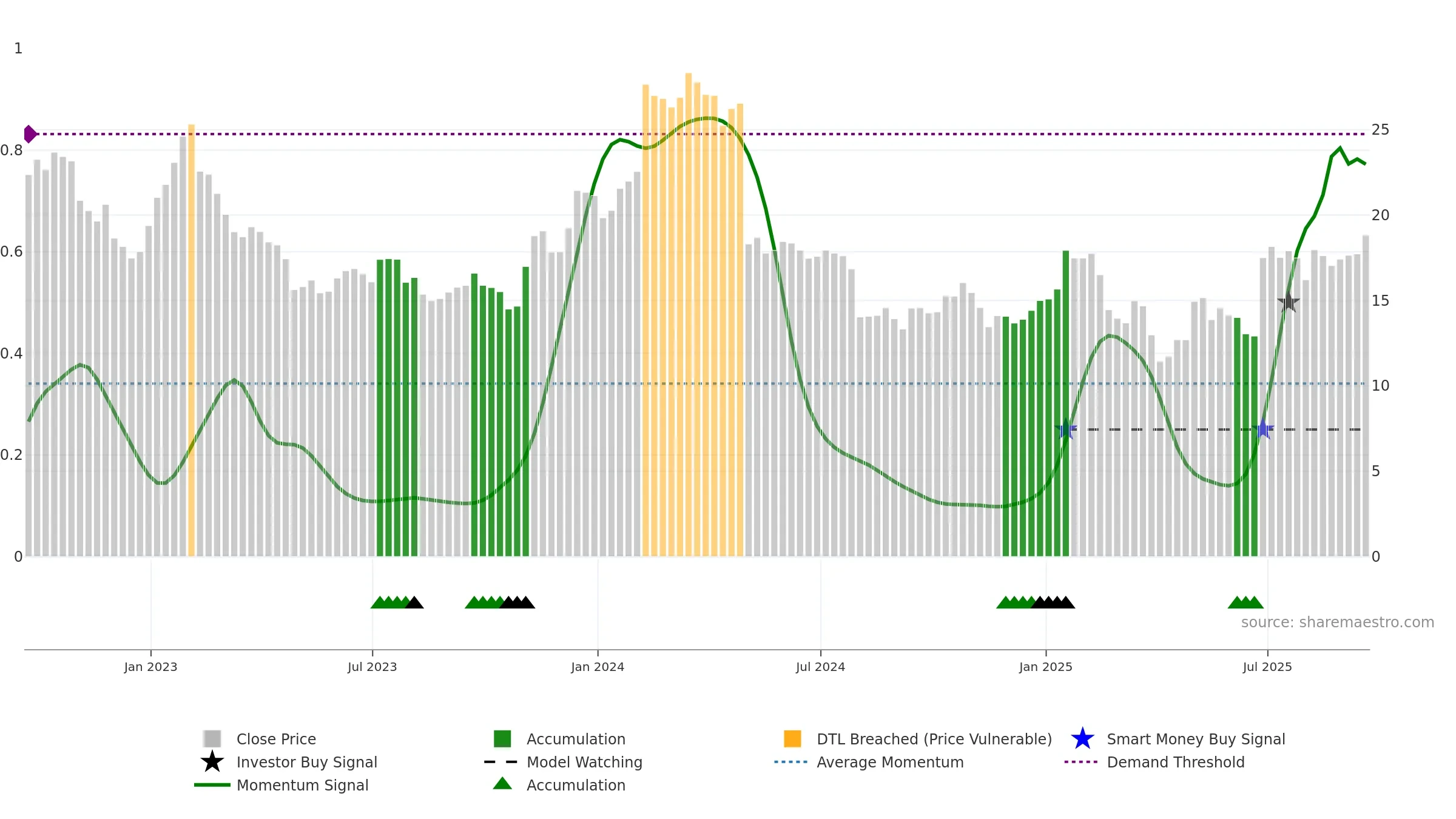

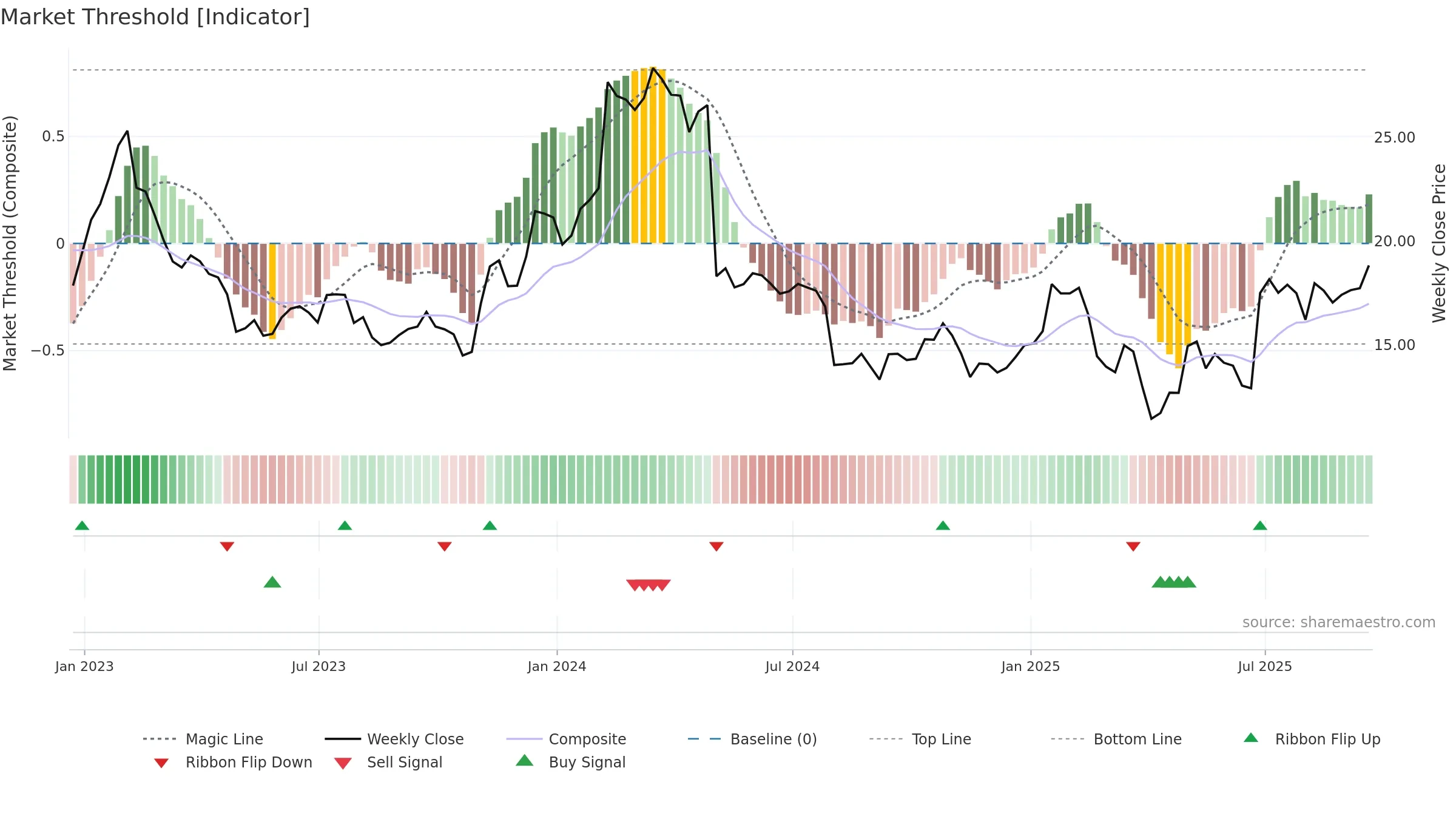

Gauge maps the trend signal to a 0–100 scale.

How to read this — Gauge is elevated but momentum is rolling over; topping risk is rising. Notable breakdown from ≥0.80 weakens trend quality.

Stay alert: protect gains or seek confirmation before adding risk.

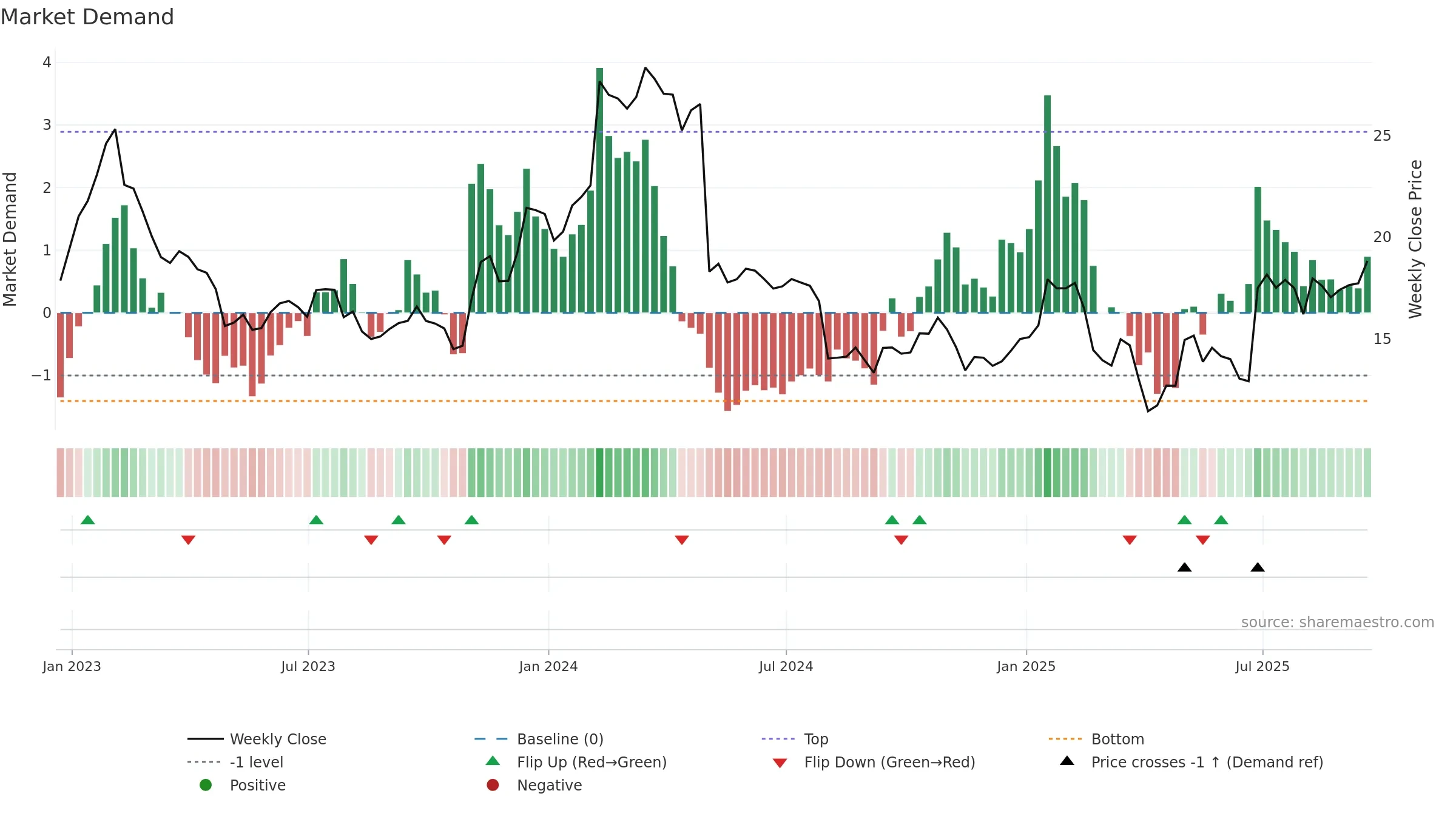

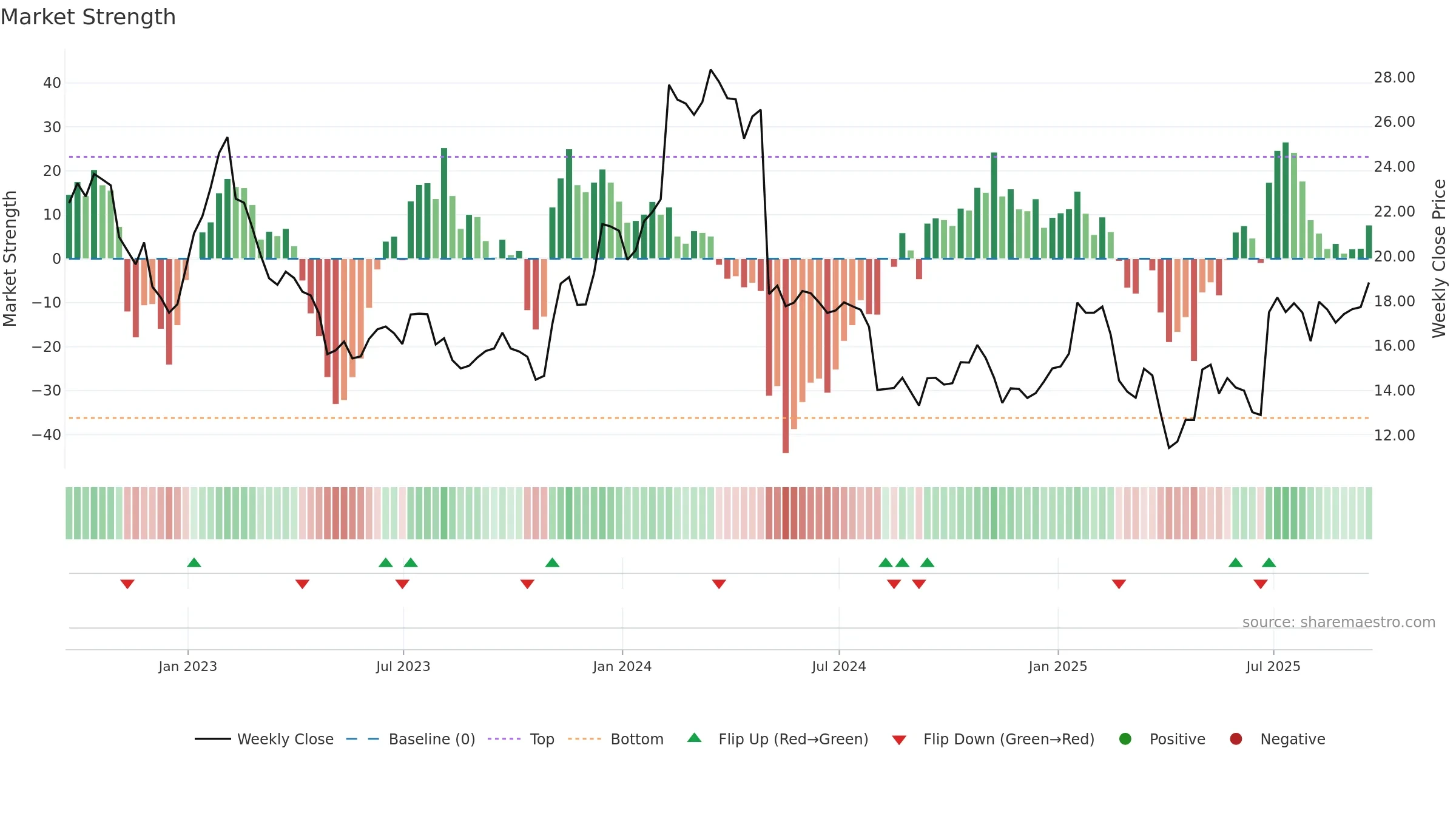

Relative strength is Positive

(> 0%, outperforming).

Latest MRS: 5.30% (week ending Fri, 19 Sep 2025).

Slope: Rising over 8w.

Notes:

- Holding above the zero line indicates relative bid.

- MRS slope rising over ~8 weeks.

Price is below fair value; potential upside if momentum constructive.

Conclusion

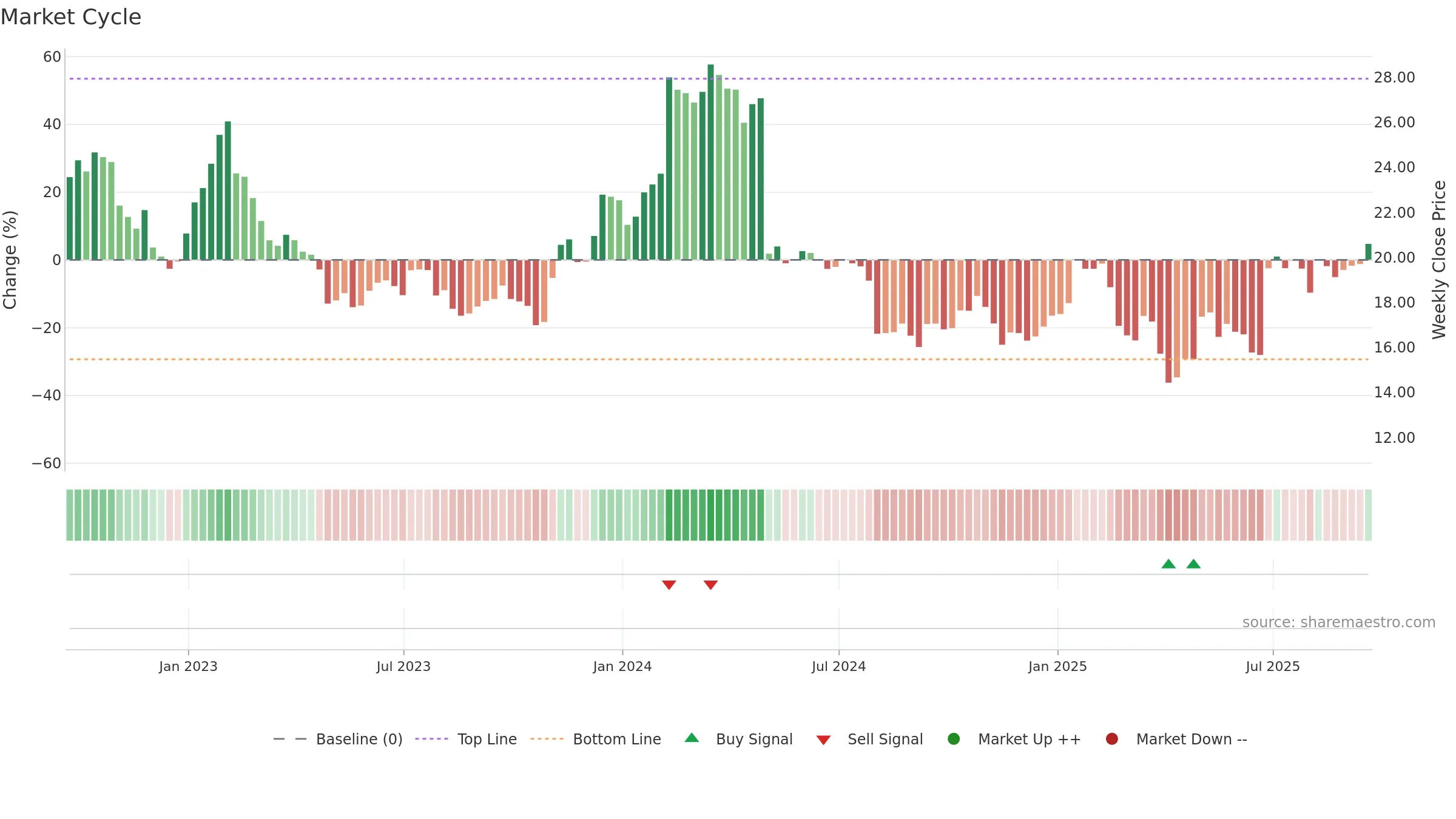

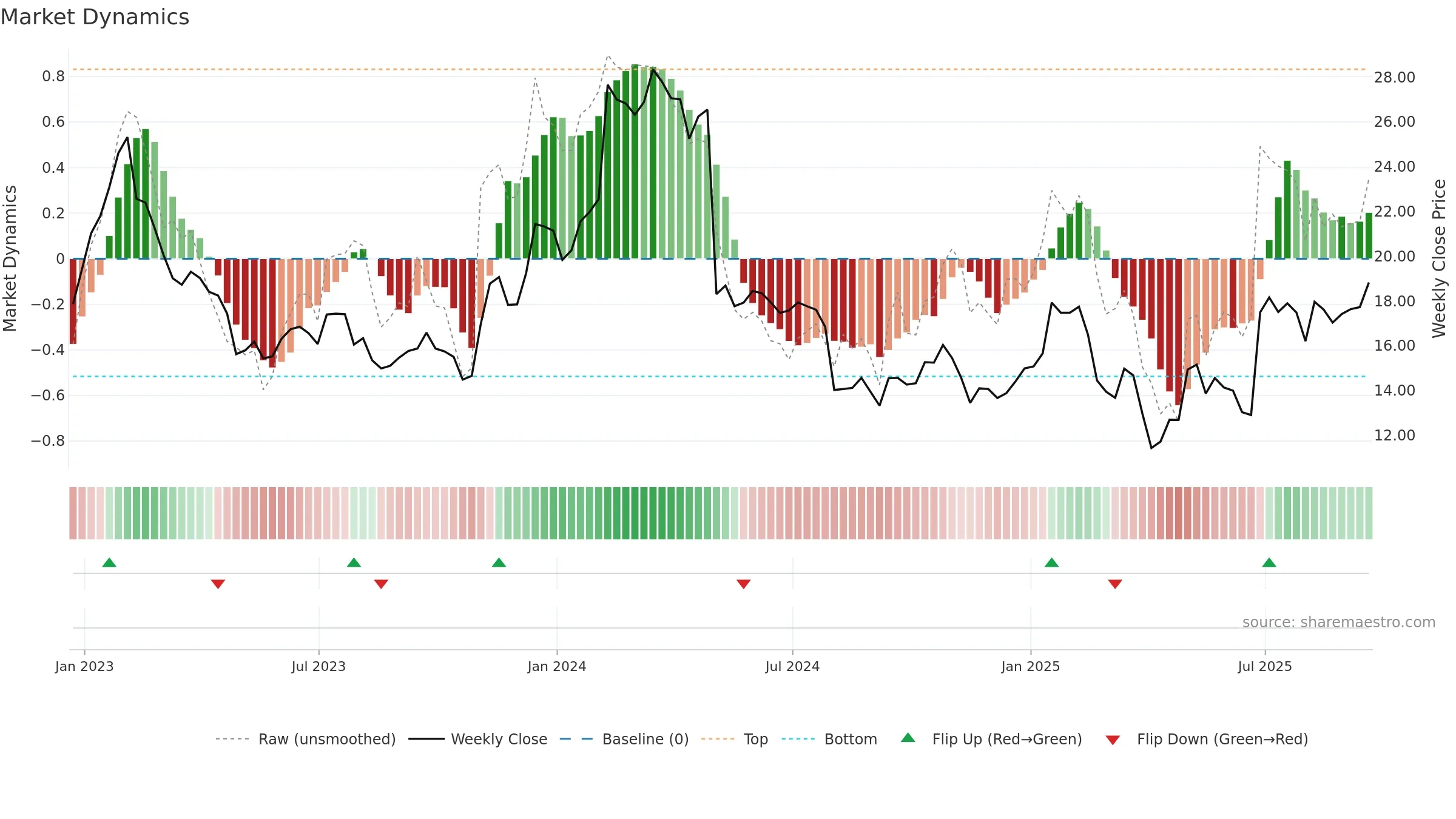

Neutral setup. ★★★⯪☆ confidence. Trend: Uptrend at Risk · 16.16% over window · vol 2.89% · liquidity divergence · posture above · RS outperforming · leaning positive

- Momentum is bullish and rising

- Price holds above 8–26 week averages

- Solid multi-week performance

- Mansfield RS: outperforming & rising

- High level but momentum rolling over (topping risk)

- Liquidity diverges from price

- Recent breakdown from ≥0.80 weakens trend quality

Why: Price window 16.16% over w. Close is 4.79% above the prior-window high. Volume trend falling. Liquidity divergence with price. Trend state uptrend at risk. Momentum bullish and rising. Valuation supportive skew.

Tip: Most metrics include a hover tooltip where they appear in the report.