Diamond Hill Investment Group, Inc.

DHIL NASDAQ

Weekly Summary

Diamond Hill Investment Group, Inc. closed at 140.3000 (-1.68% WoW) . Data window ends Fri, 19 Sep 2025.

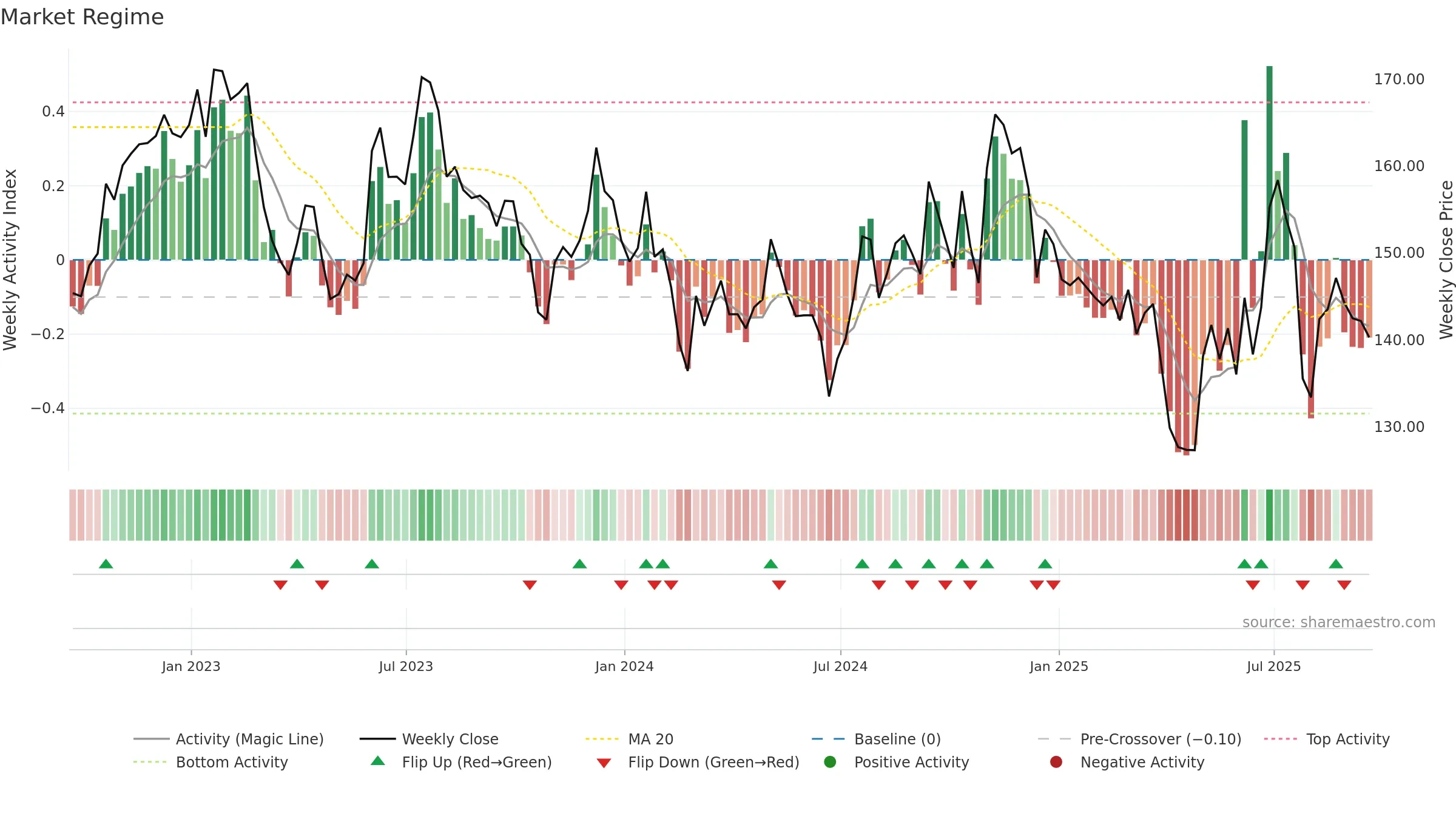

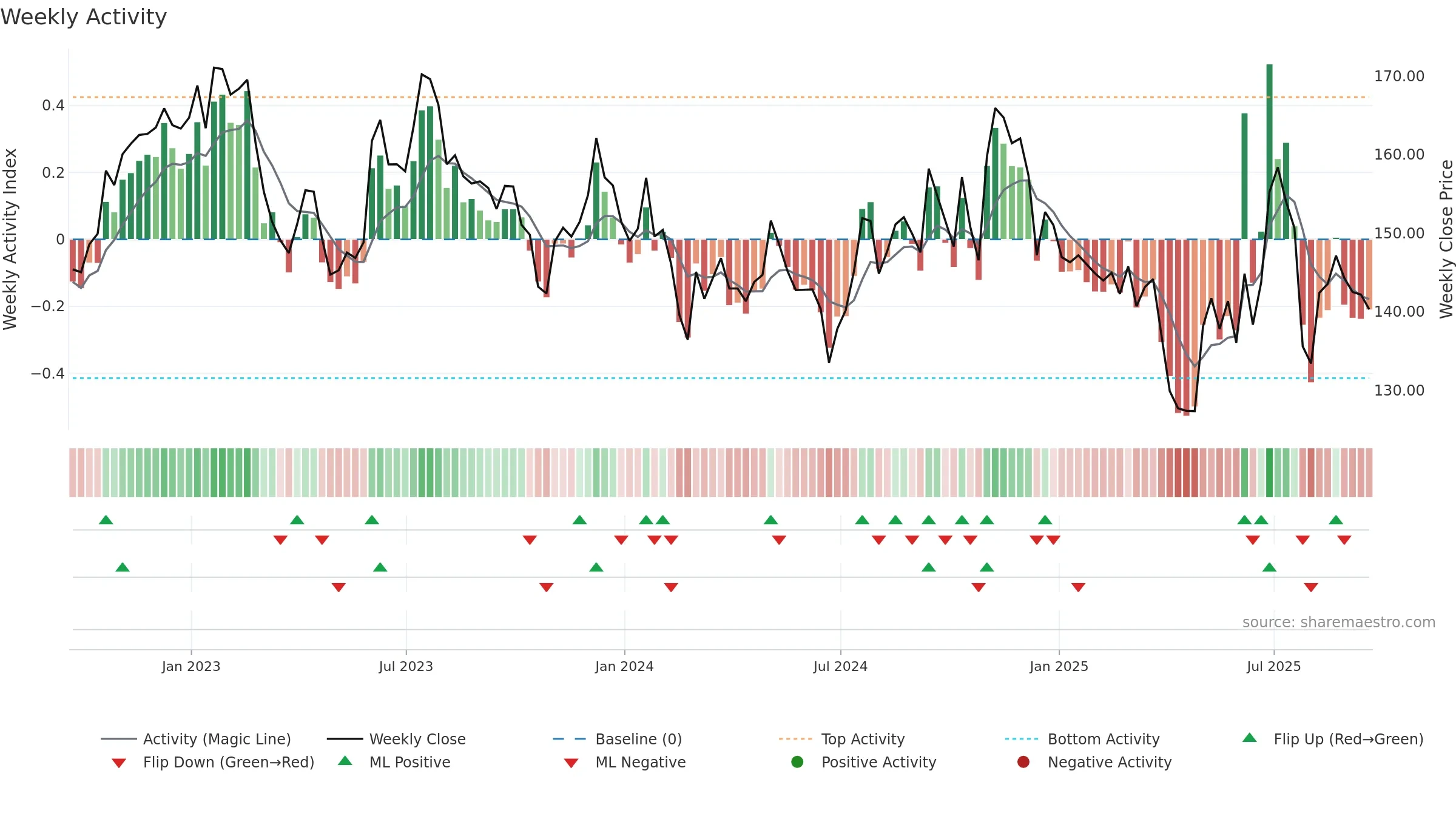

How to read this — Price slope is upward, indicating persistent buying over the window. Low weekly volatility favours steadier follow-through. Volume and price are moving in the same direction — a constructive confirmation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Price sits below key averages, keeping pressure on the tape.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm.

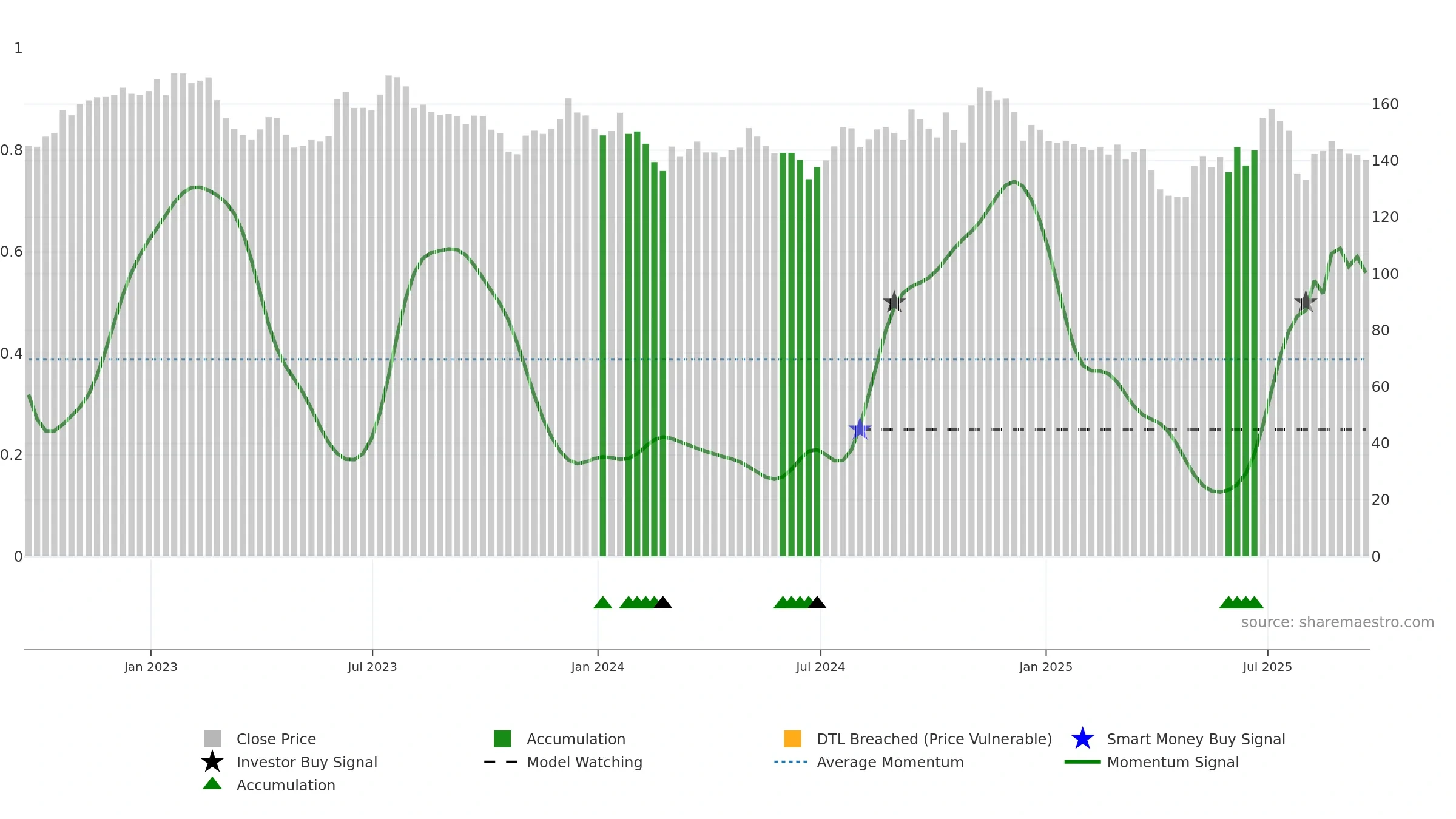

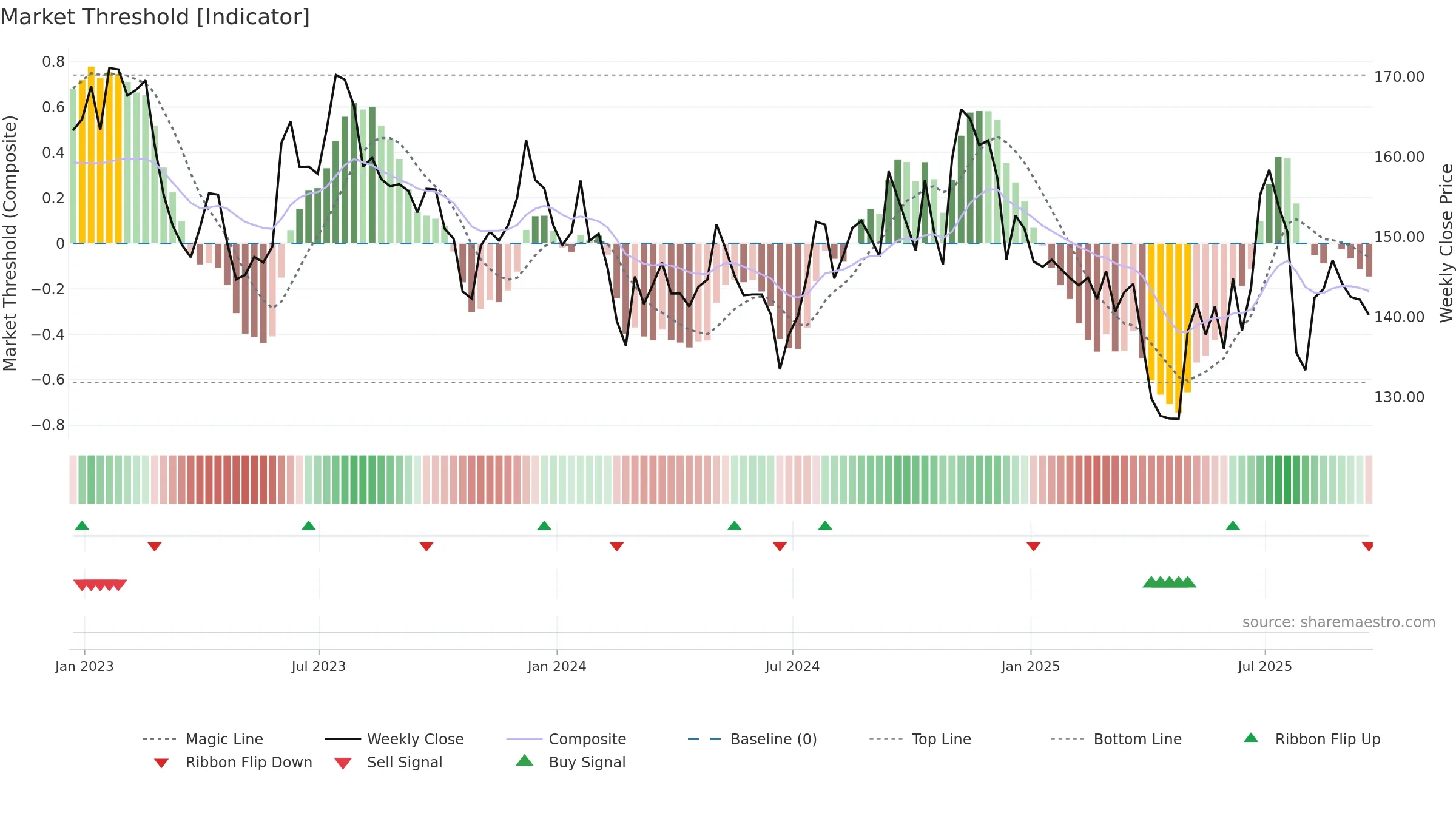

Gauge maps the trend signal to a 0–100 scale.

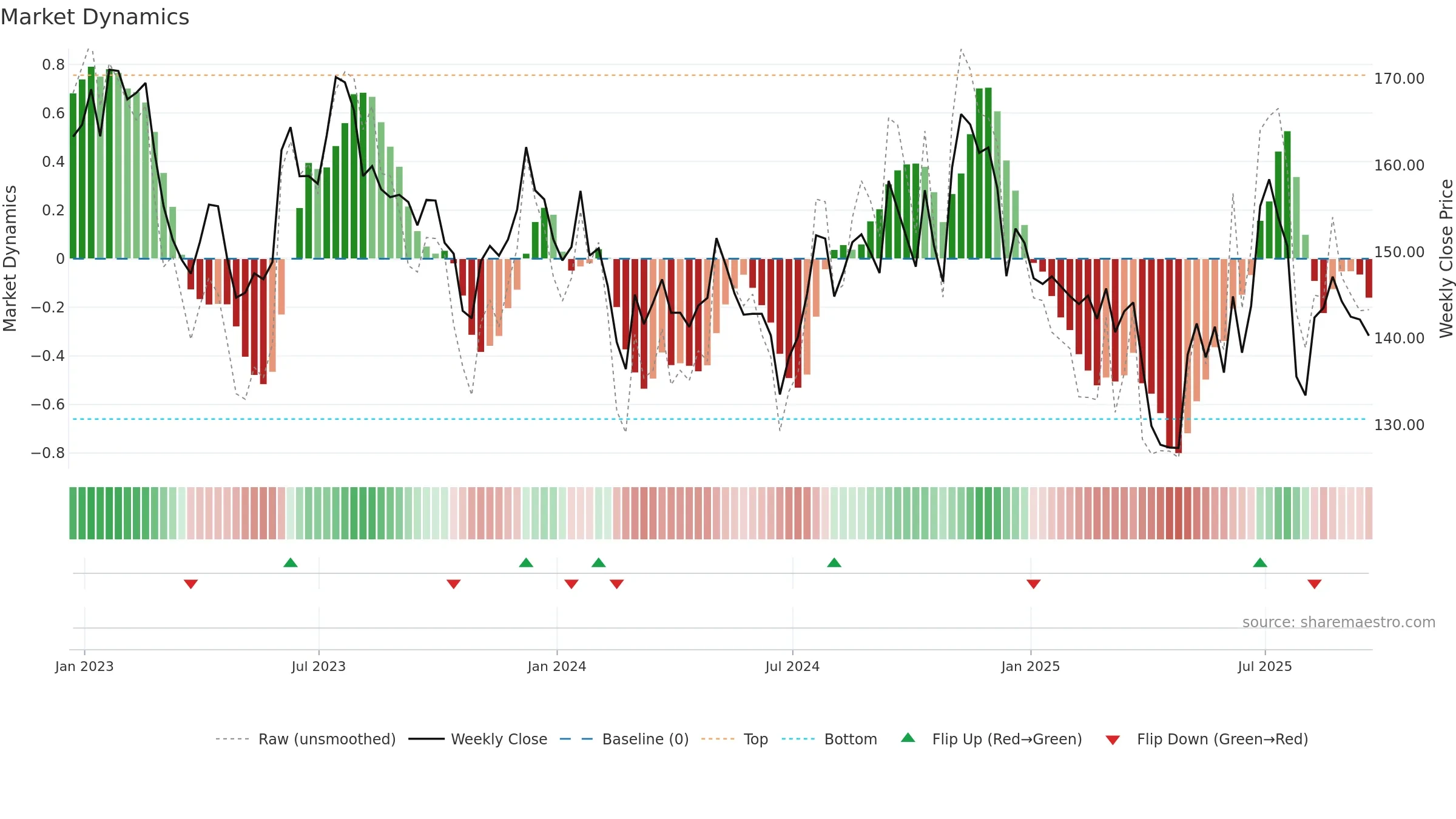

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

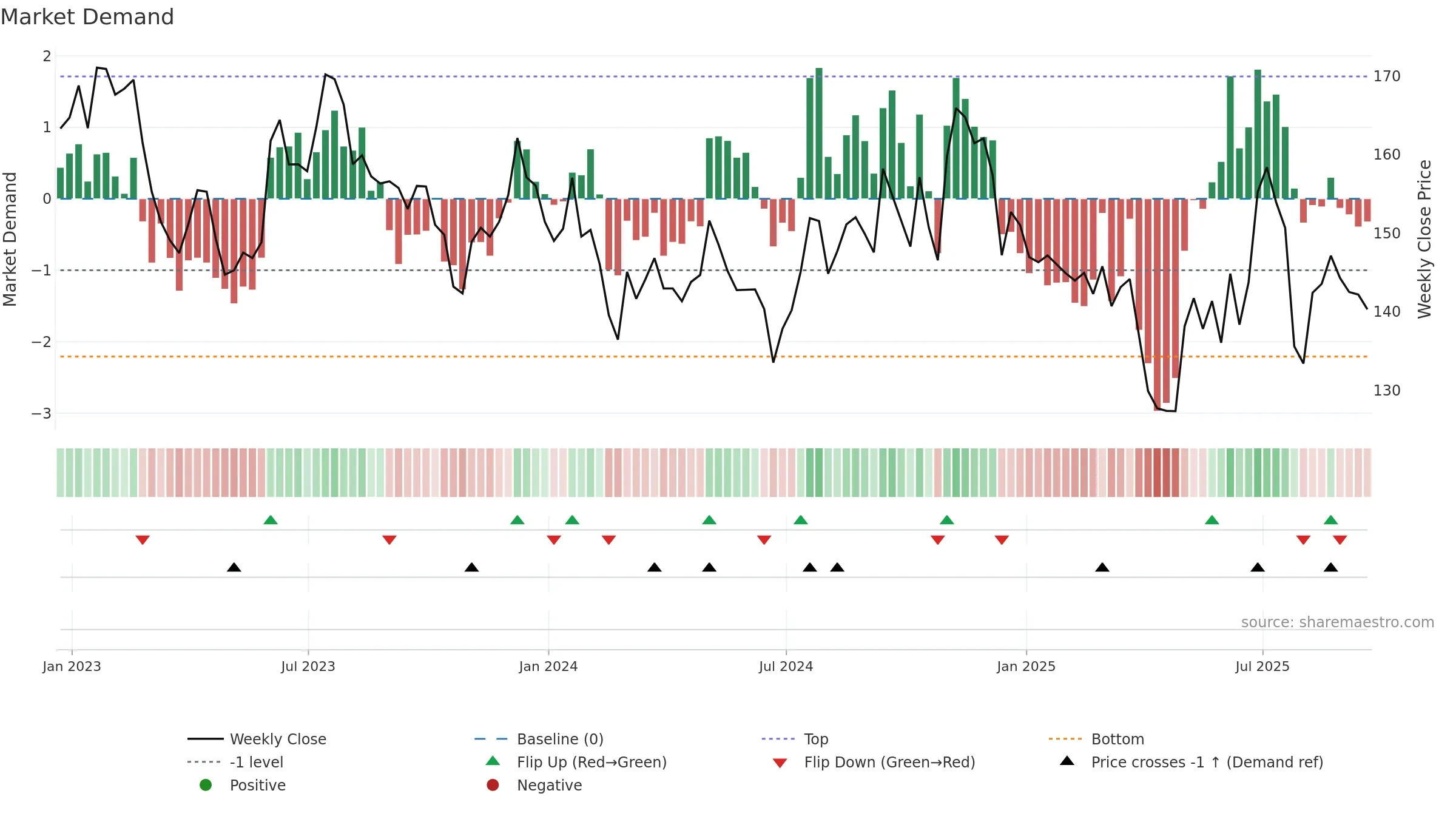

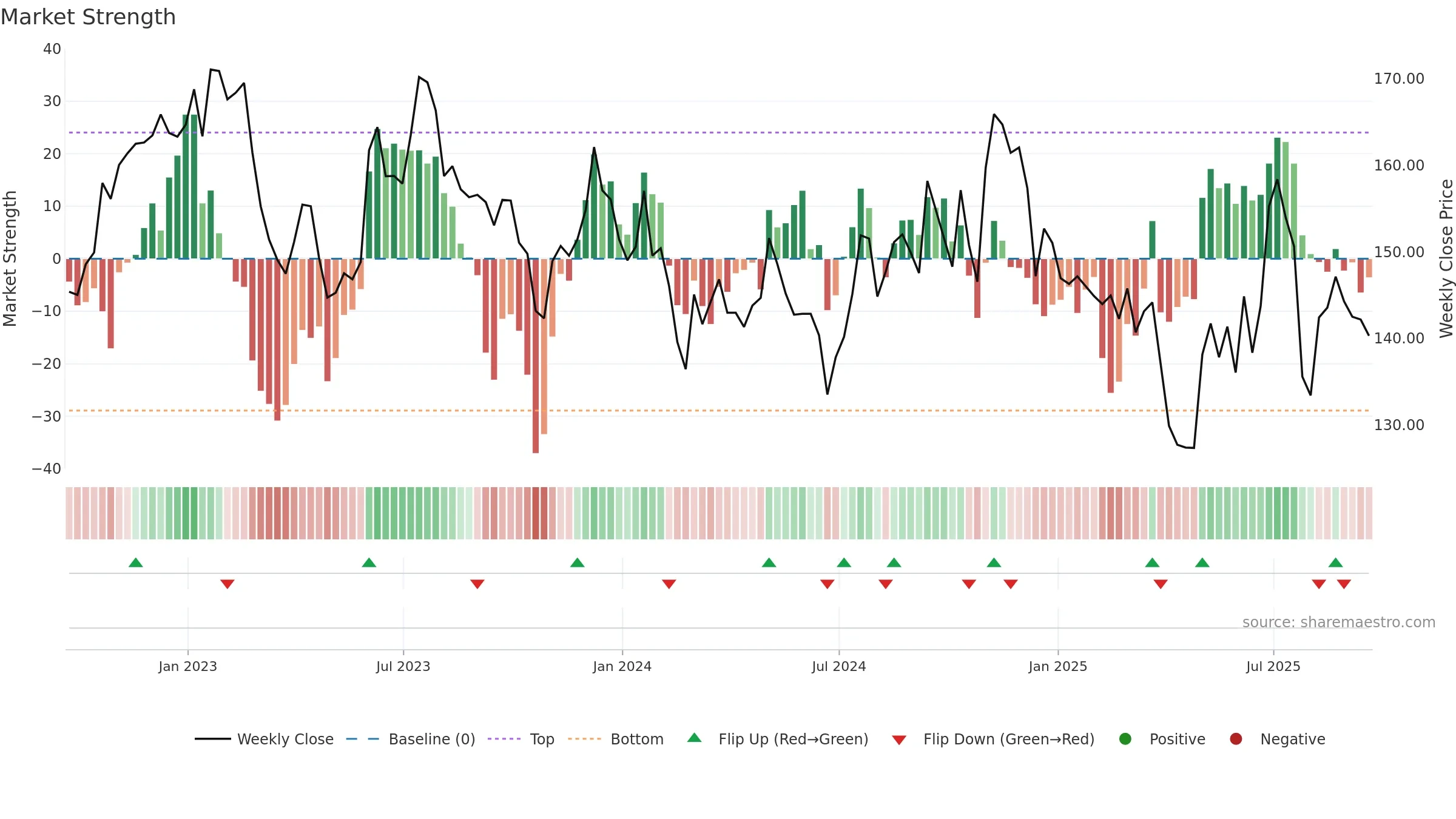

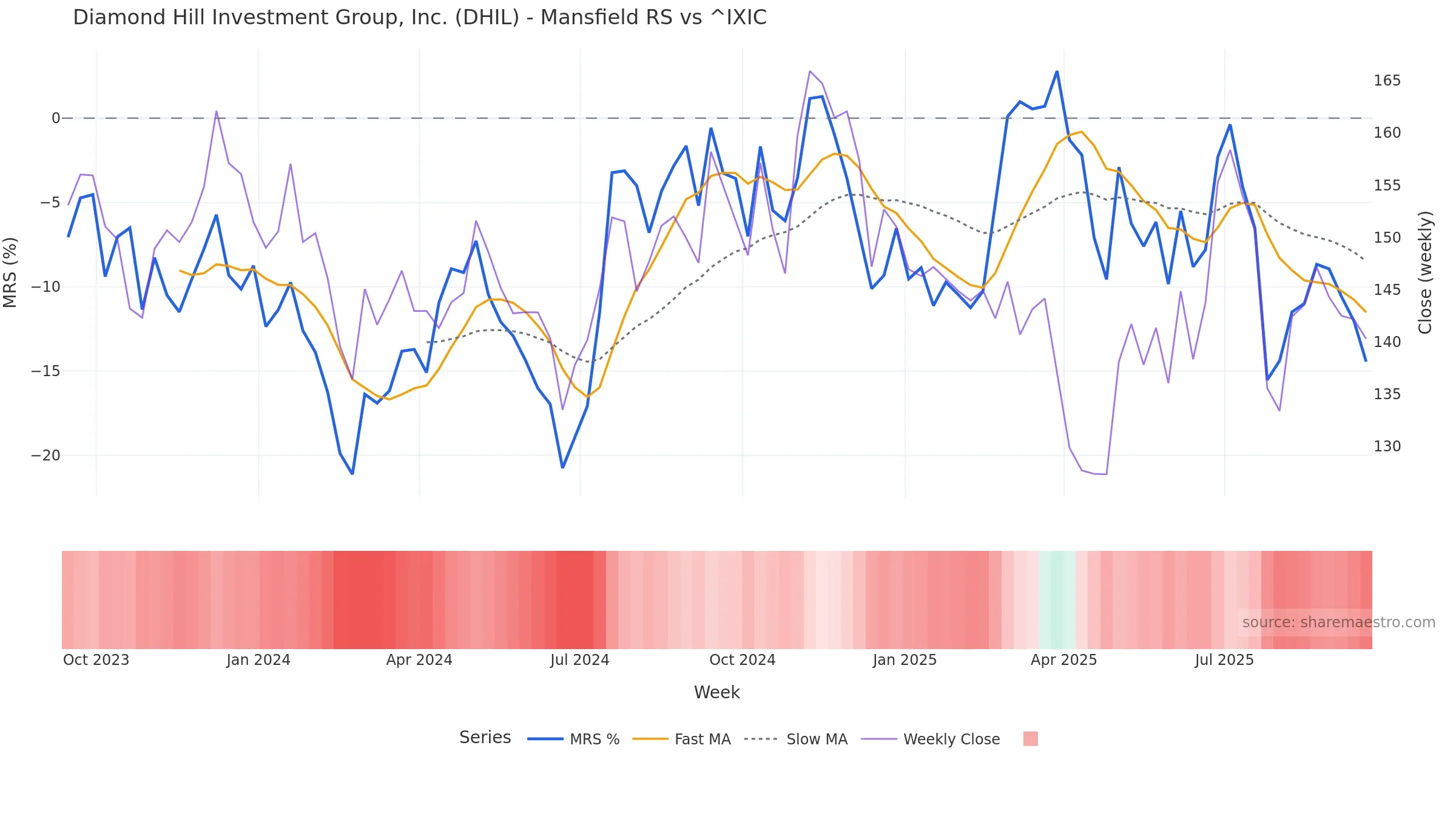

Relative strength is Negative

(< 0%, underperforming).

Latest MRS: -14.44% (week ending Fri, 19 Sep 2025).

Slope: Falling over 8w.

Notes:

- Below zero line indicates relative weakness vs benchmark.

- MRS slope falling over ~8 weeks.

Valuation neutral pending further data.

Conclusion

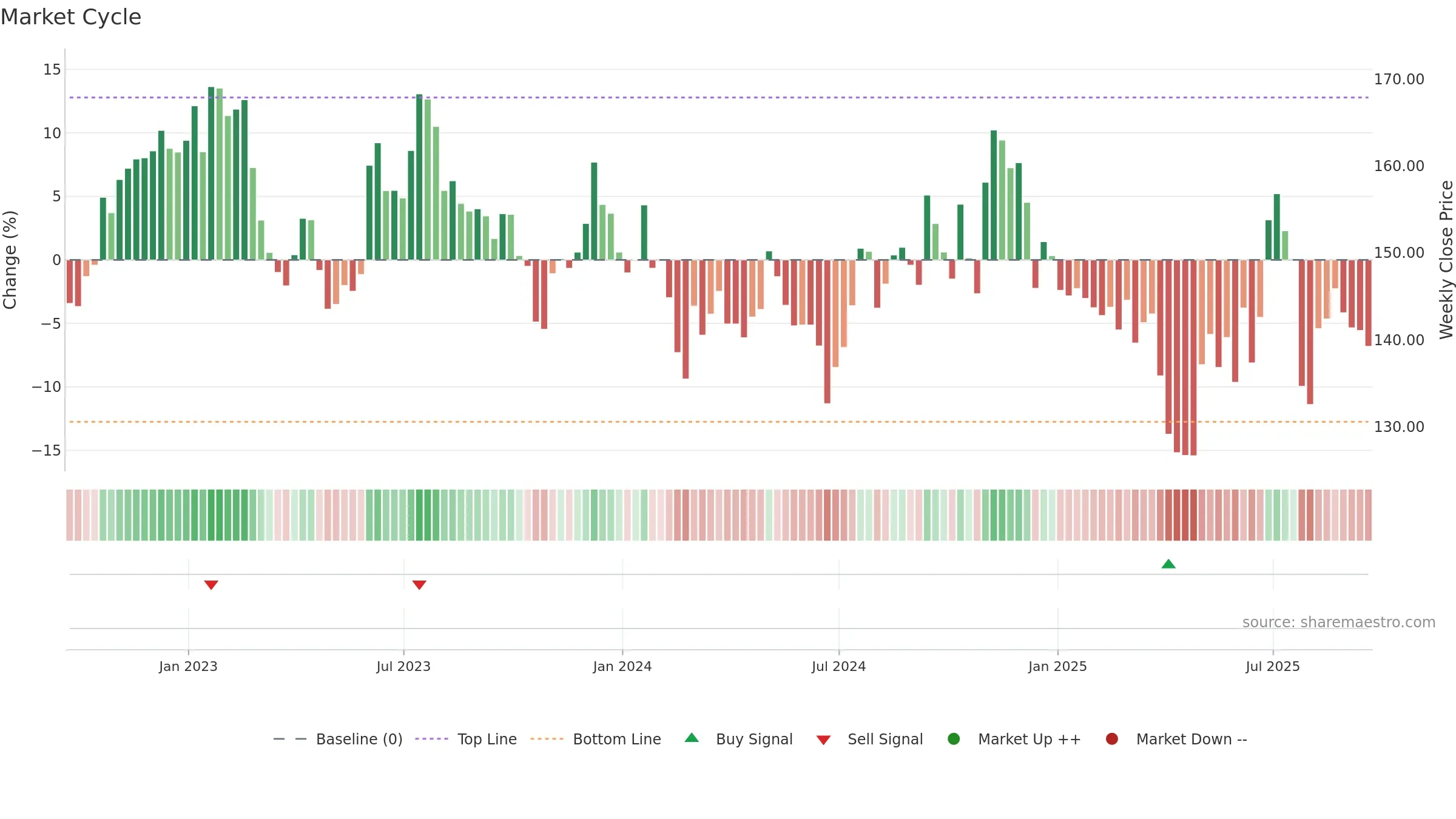

Positive setup. ★★★★☆ confidence. Trend: Range / Neutral · 5.17% over window · vol 1.40% · liquidity convergence · posture below · RS weak

- Liquidity confirms the price trend

- Low return volatility supports durability

- Price is not above key averages

- Mansfield RS: weak & falling

Why: Price window 5.17% over w. Close is -4.64% below the prior-window high. Return volatility 1.40%. Volume trend rising. Liquidity convergence with price. Trend state range / neutral. Momentum neutral and rising. Valuation neutral.

Tip: Most metrics include a hover tooltip where they appear in the report.