The Kroger Co.

KR NYSE

Weekly Summary

The Kroger Co. closed at 65.5800 (-0.27% WoW) . Data window ends Fri, 19 Sep 2025.

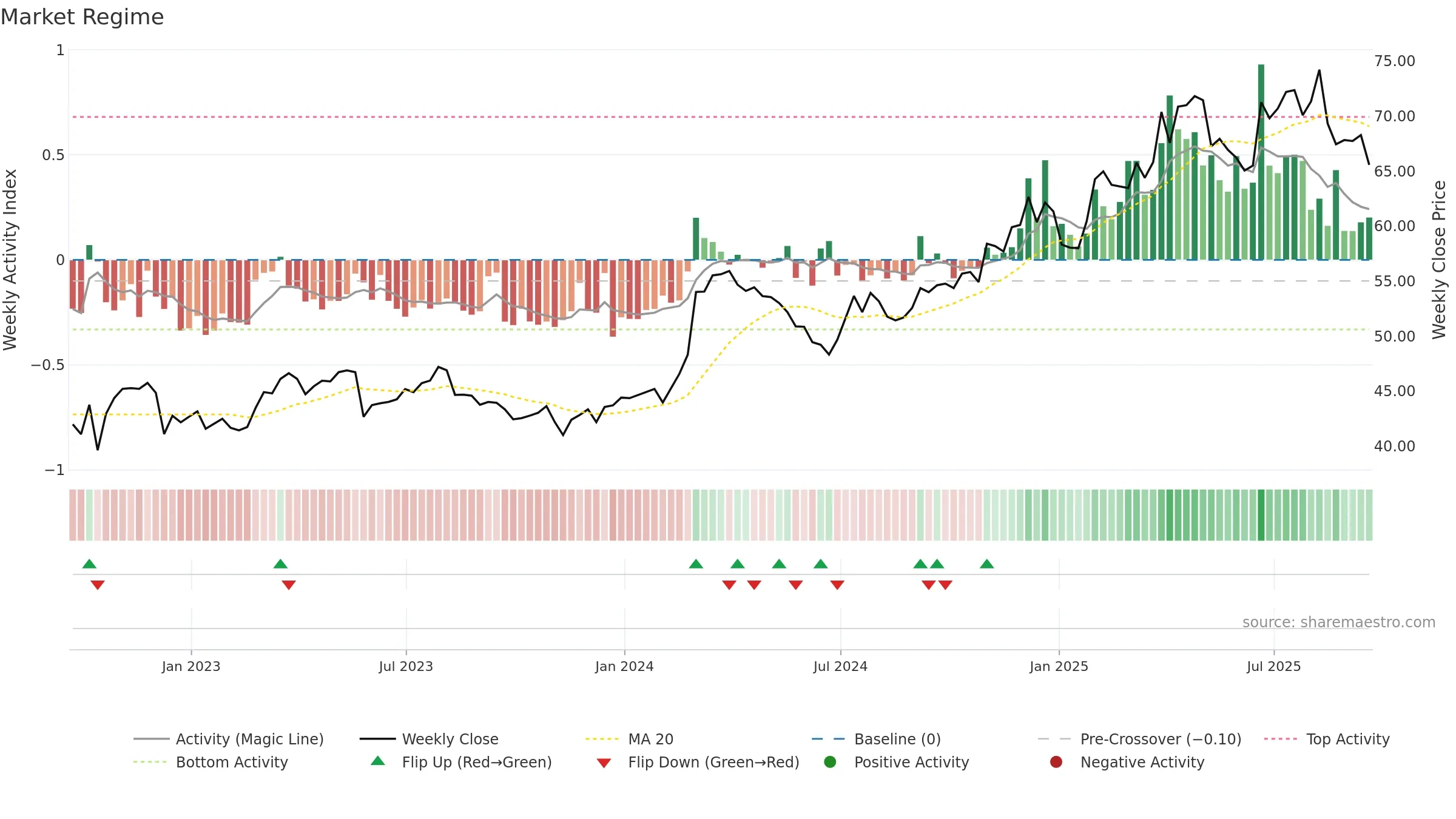

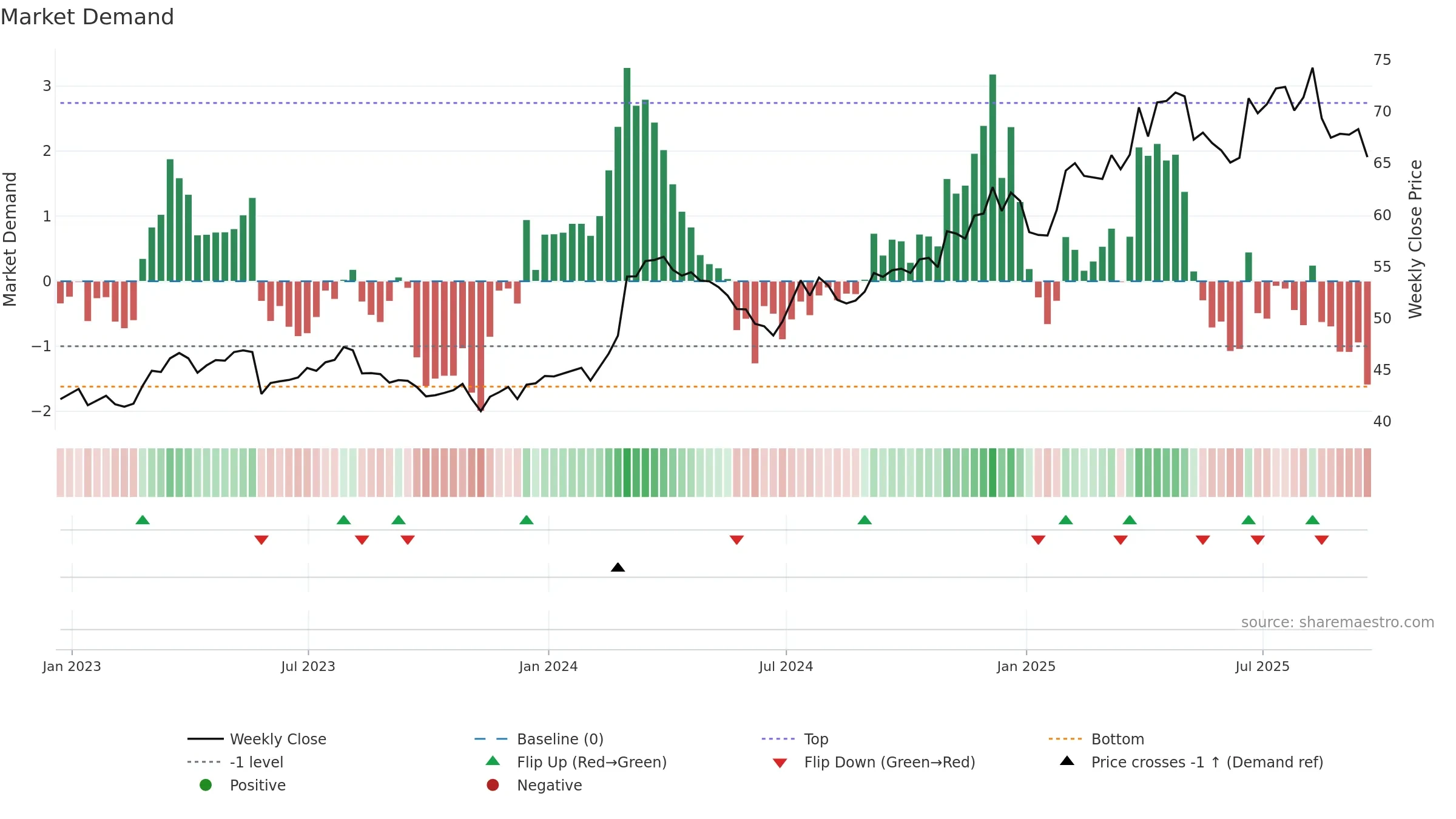

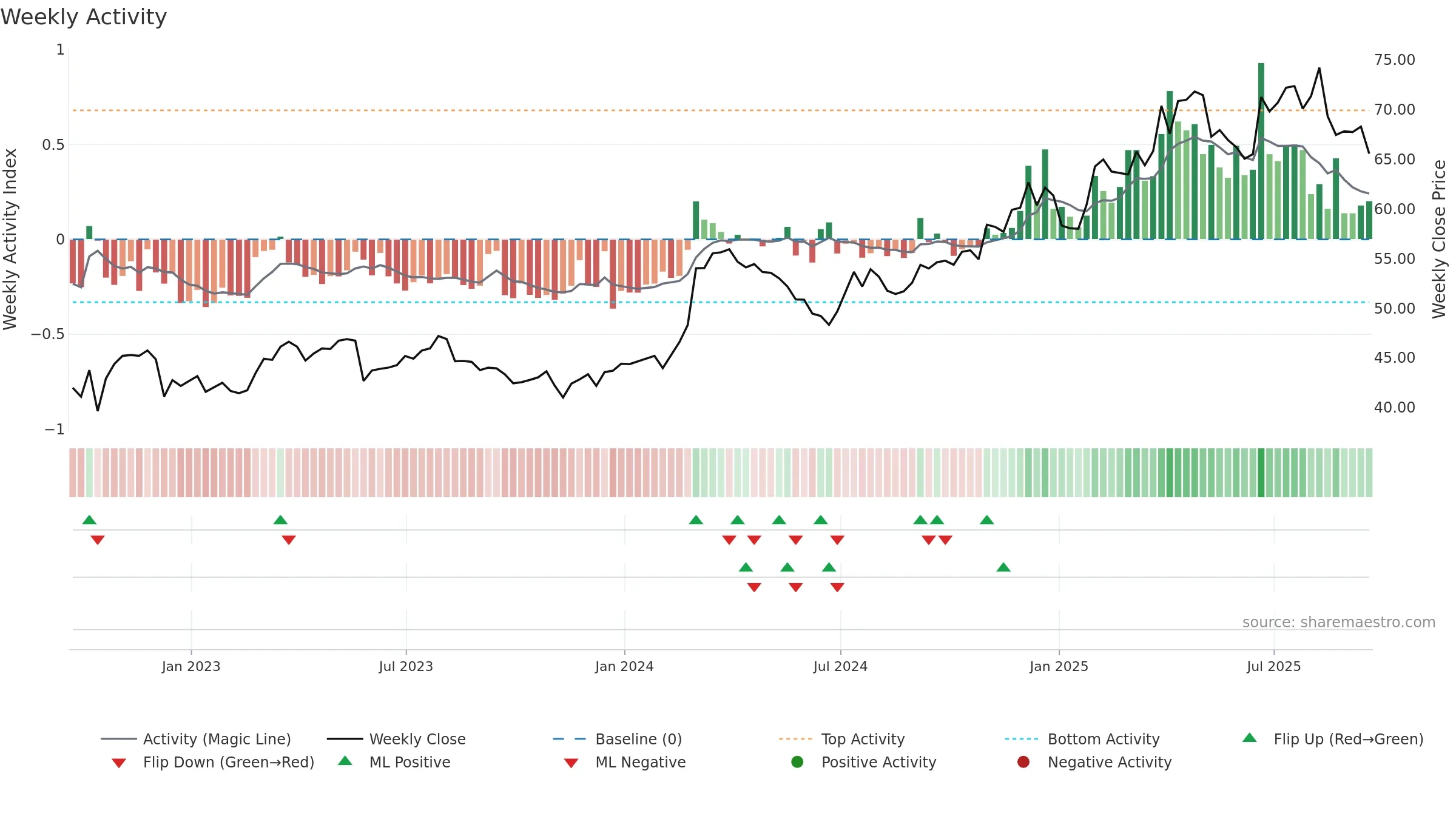

How to read this — Price slope is downward, indicating persistent supply pressure. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Price sits below key averages, keeping pressure on the tape.

Down-slope argues for patience; rallies can fade sooner unless participation improves. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

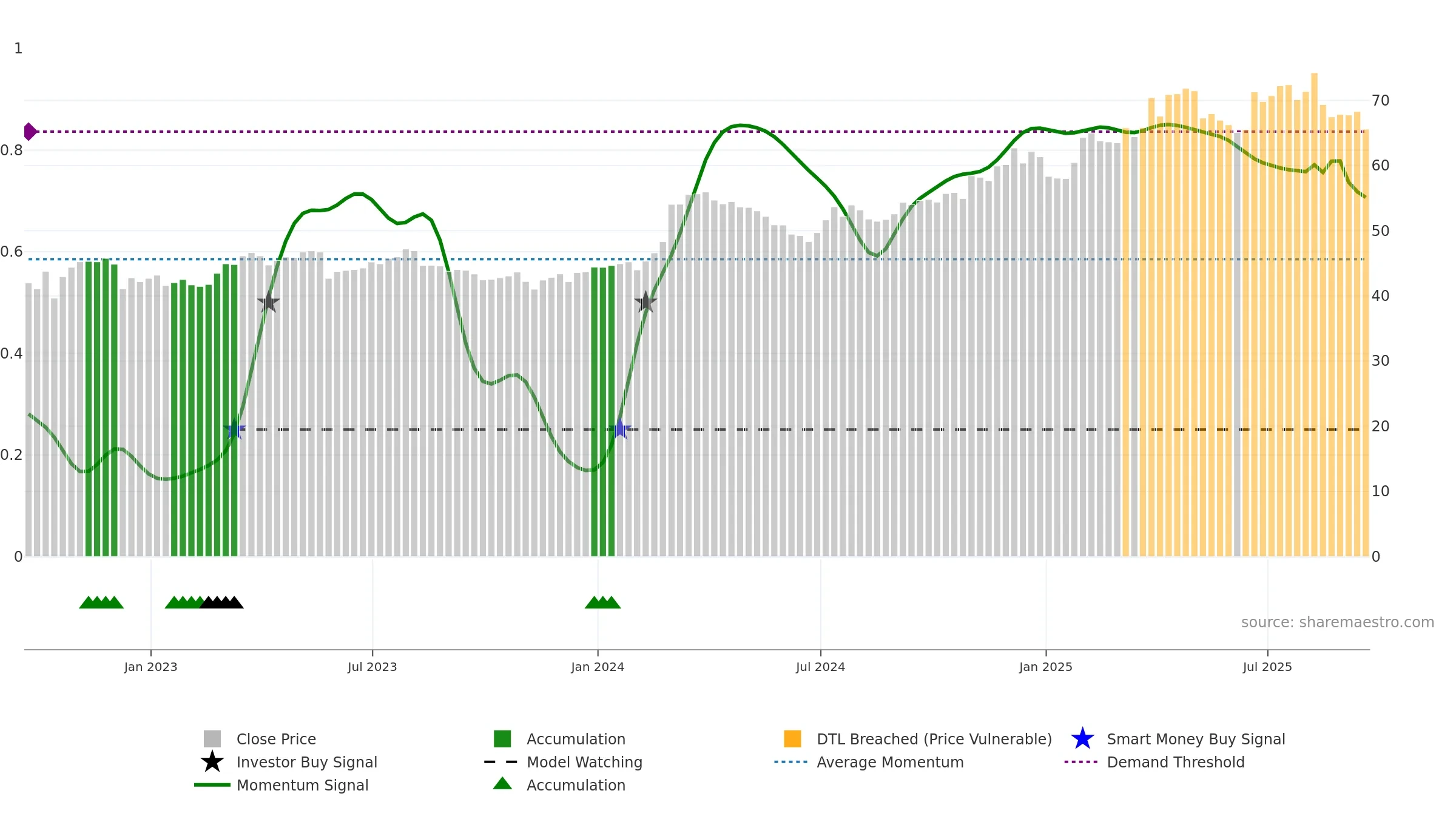

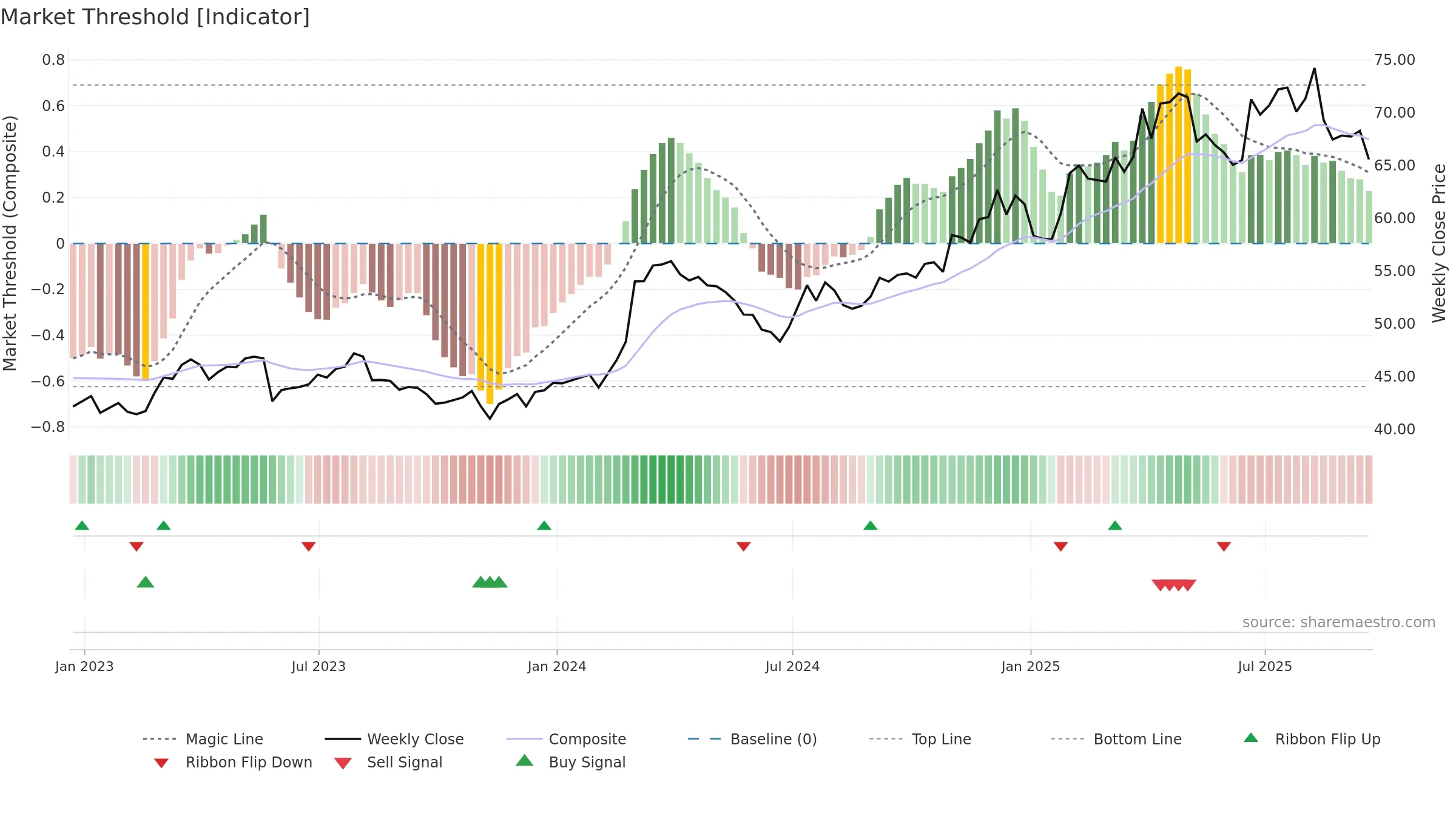

Gauge maps the trend signal to a 0–100 scale.

How to read this — Gauge is elevated but momentum is rolling over; topping risk is rising.

Stay alert: protect gains or seek confirmation before adding risk.

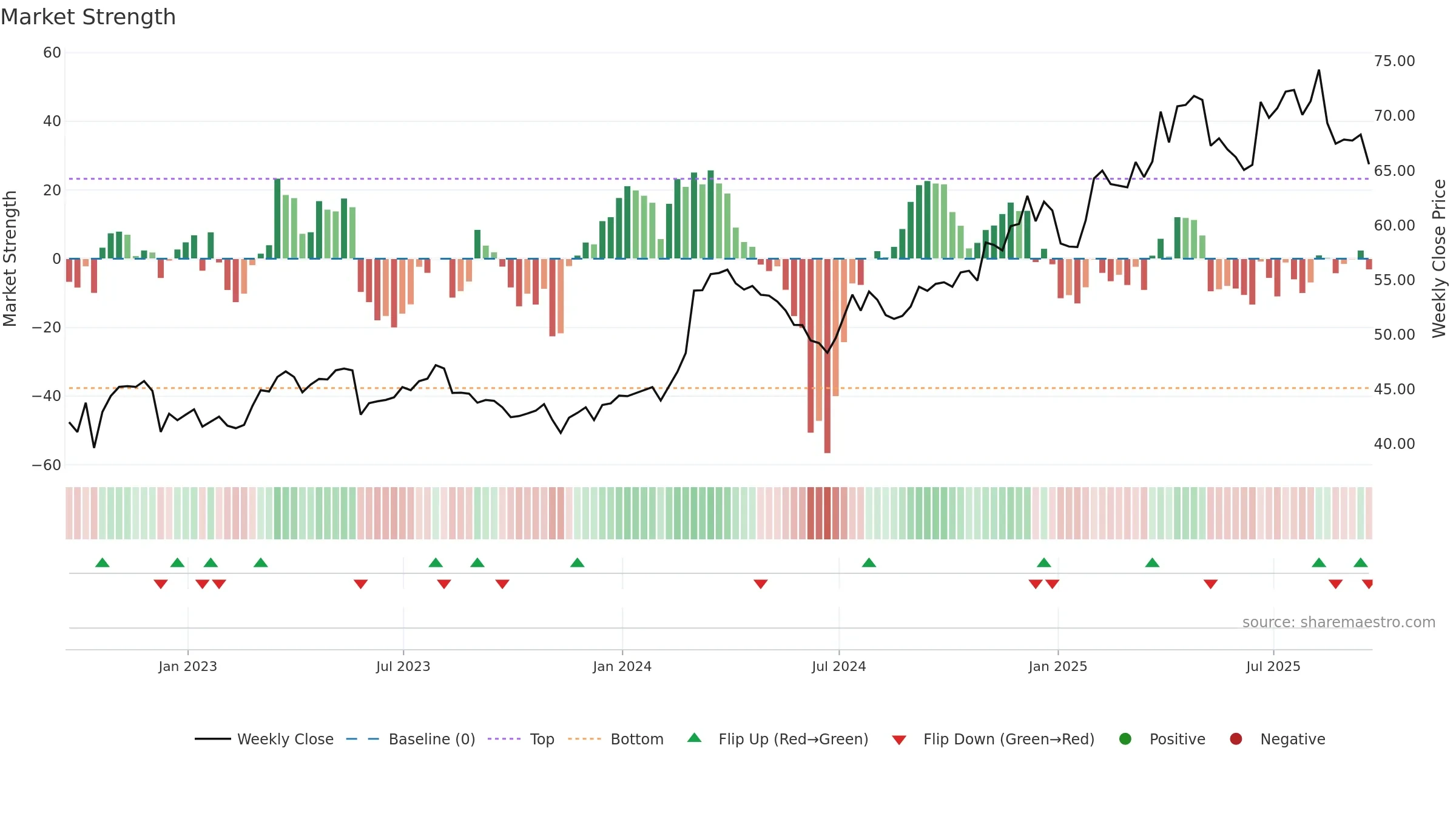

Relative strength is Negative

(< 0%, underperforming).

Latest MRS: -8.80% (week ending Fri, 19 Sep 2025).

Slope: Falling over 8w.

Notes:

- Below zero line indicates relative weakness vs benchmark.

- MRS slope falling over ~8 weeks.

Conclusion

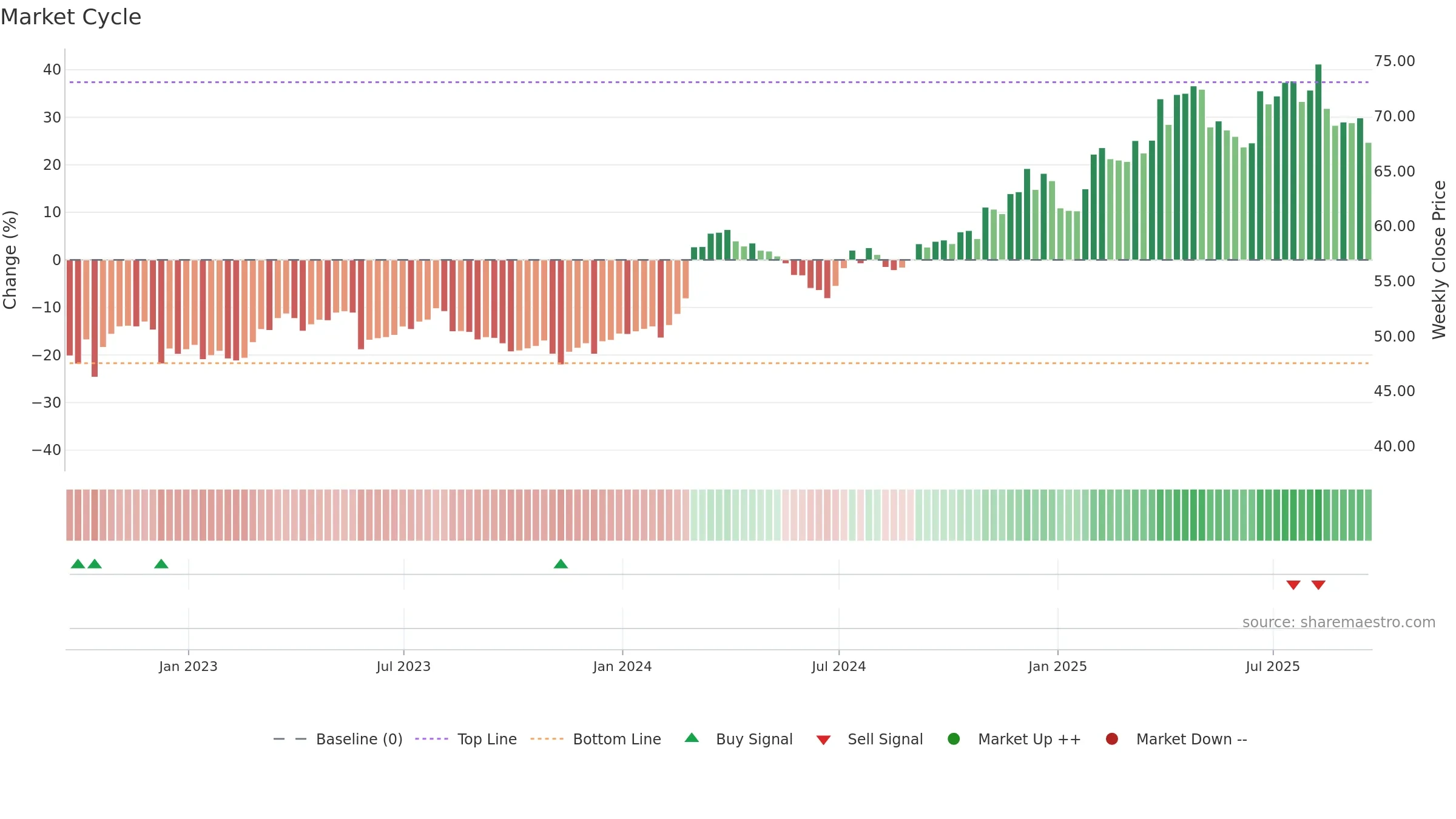

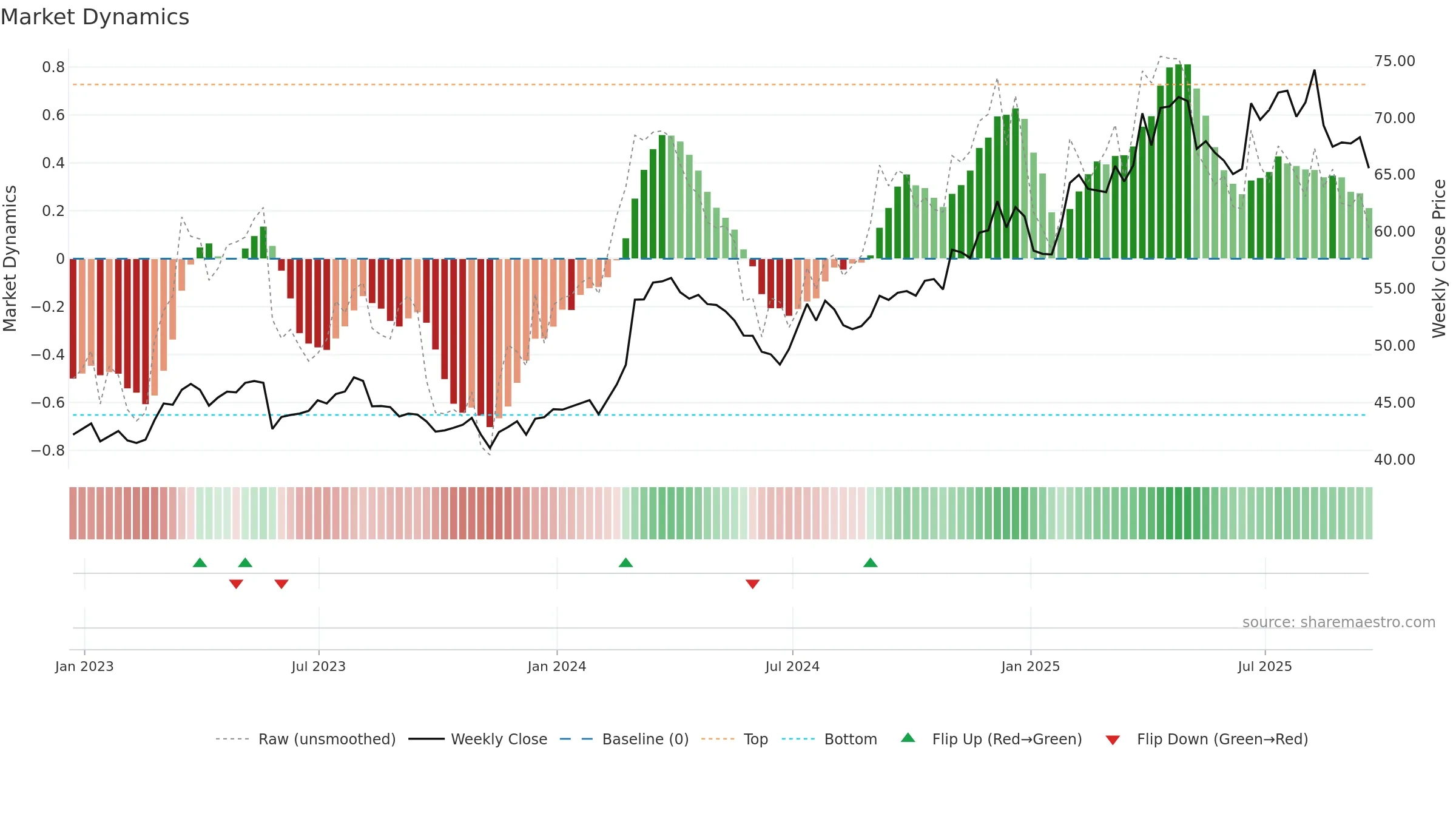

Negative setup. ★⯪☆☆☆ confidence. Trend: Uptrend at Risk · -8.10% over window · vol 2.10% · liquidity divergence · posture below · RS weak

- High level but momentum rolling over (topping risk)

- Momentum is weak/falling

- Price is not above key averages

- Liquidity diverges from price

Why: Price window -8.10% over w. Close is -11.66% below the prior-window high. Return volatility 2.10%. Volume trend rising. Liquidity divergence with price. Trend state uptrend at risk. Momentum neutral and falling.

Tip: Most metrics include a hover tooltip where they appear in the report.