Daedong Corporation

000490 KRX

Weekly Report

Daedong Corporation closed at 10020.0000 (0.30% WoW) . Data window ends Mon, 15 Sep 2025.

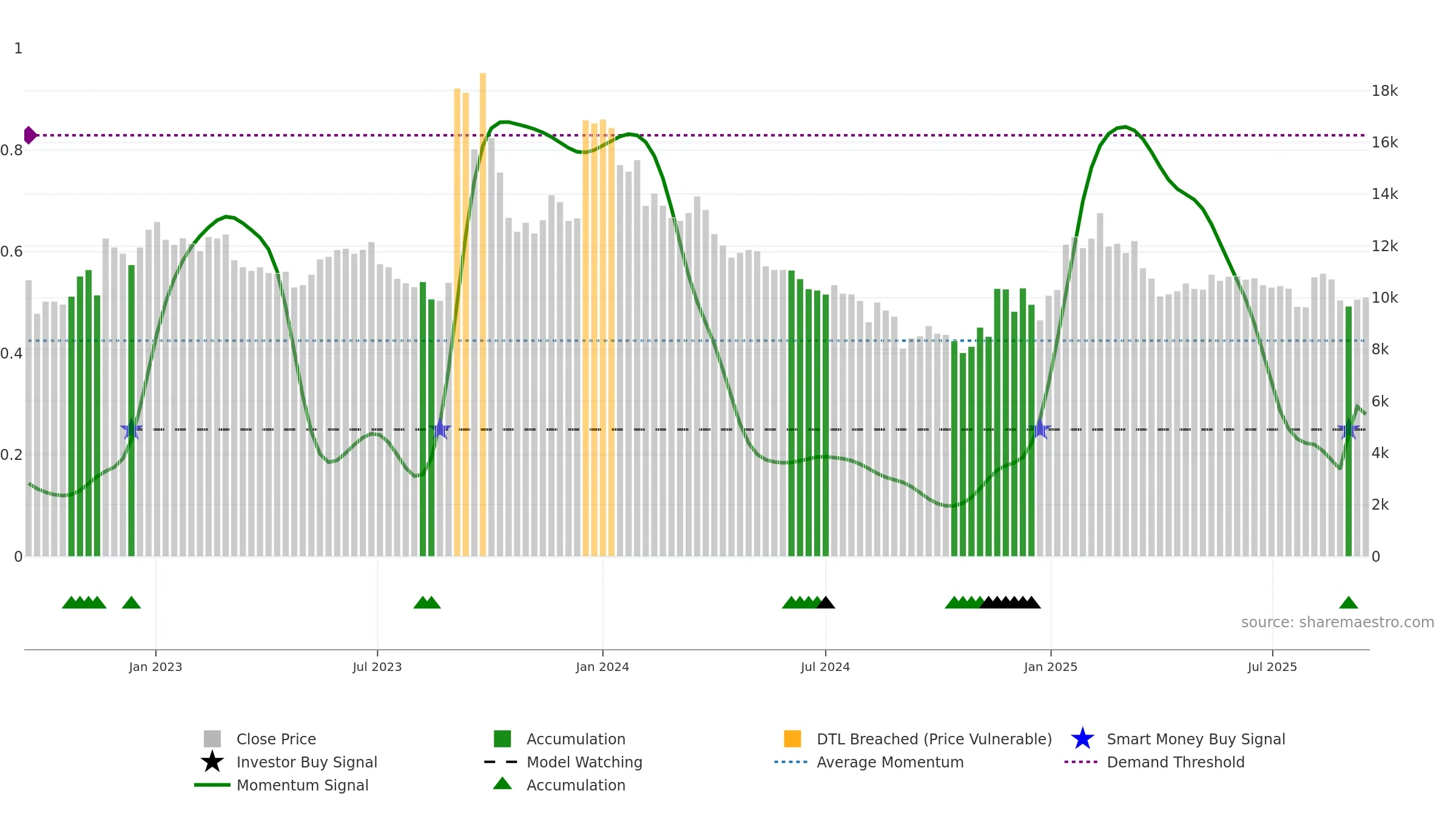

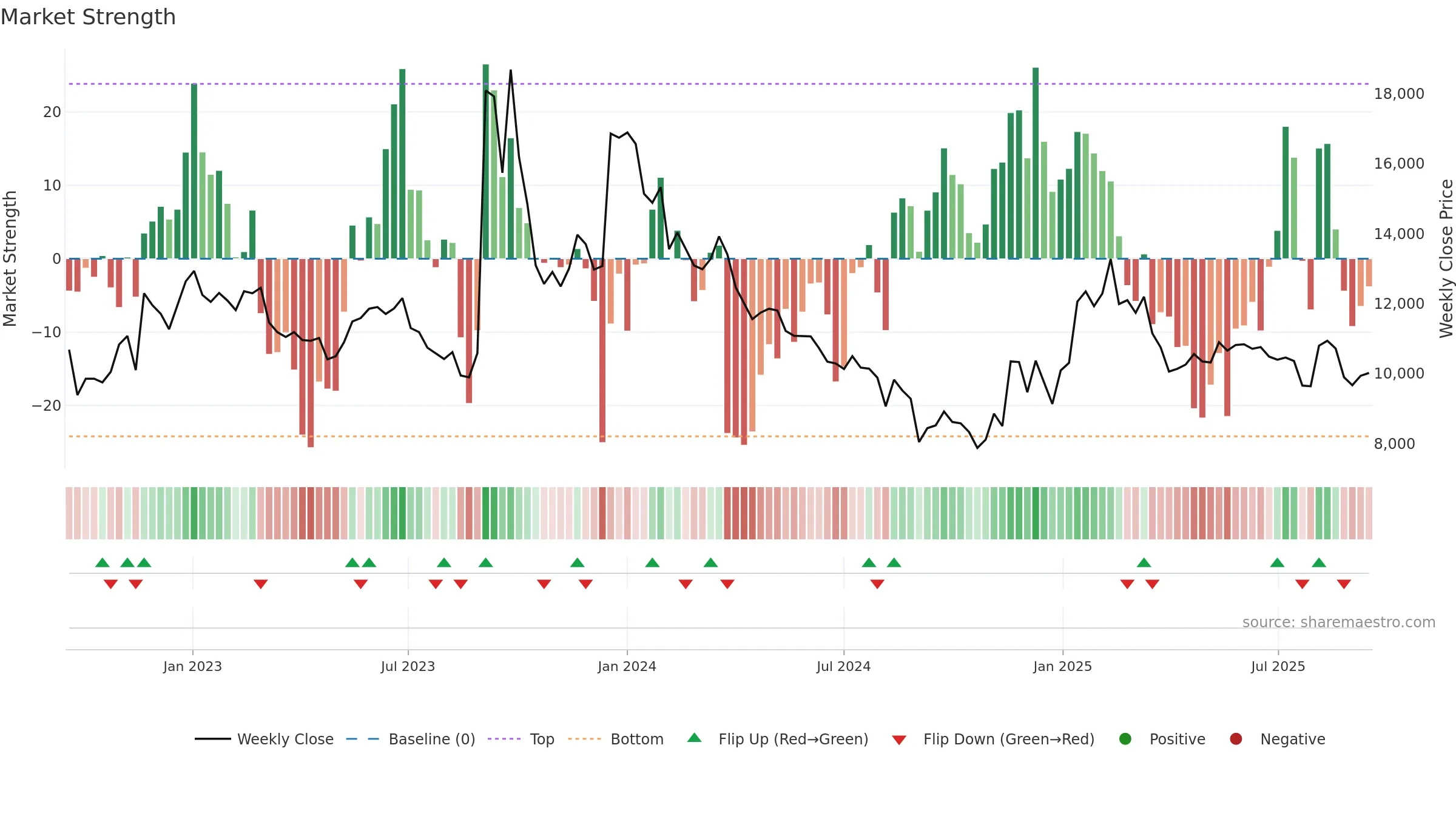

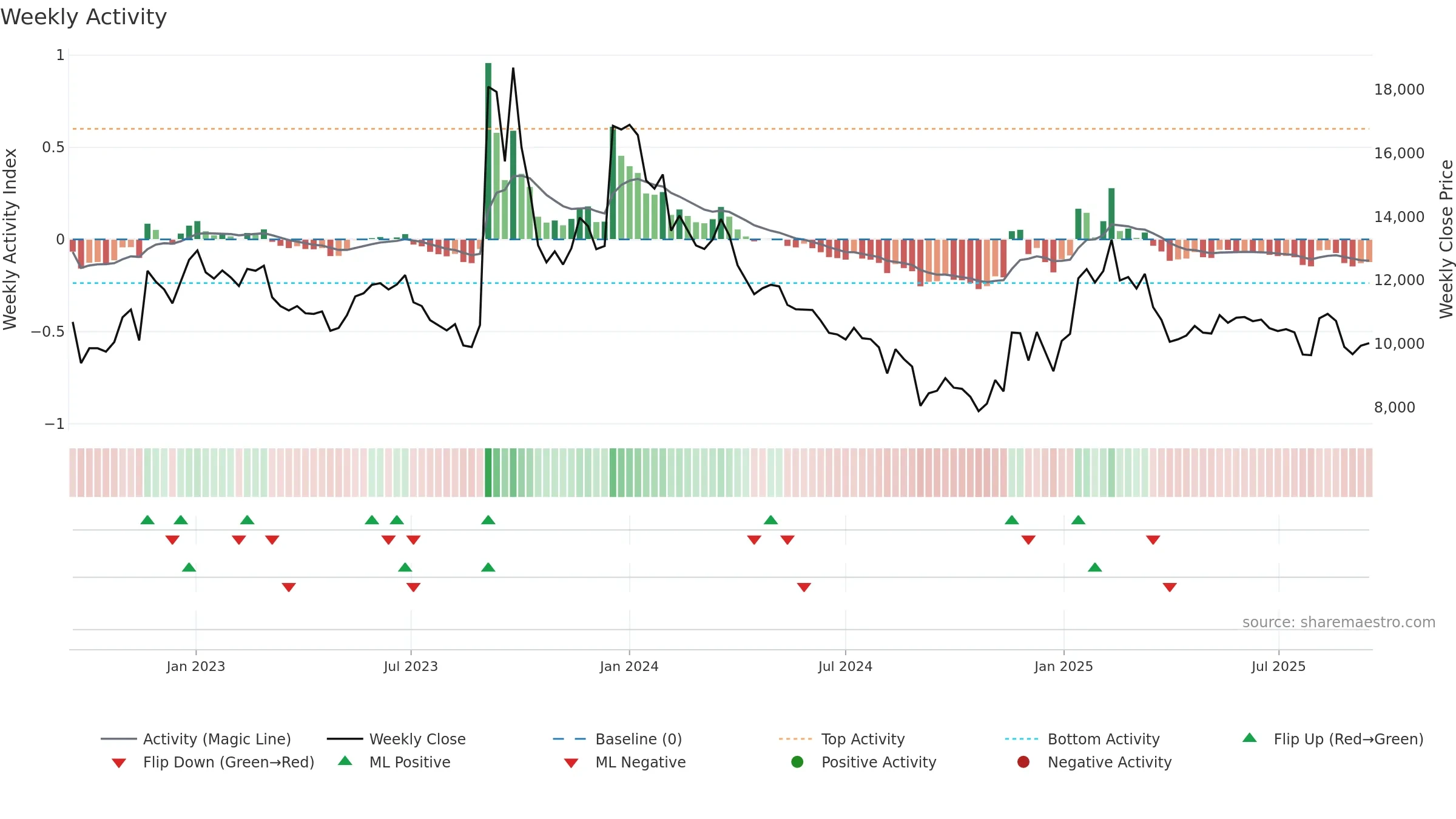

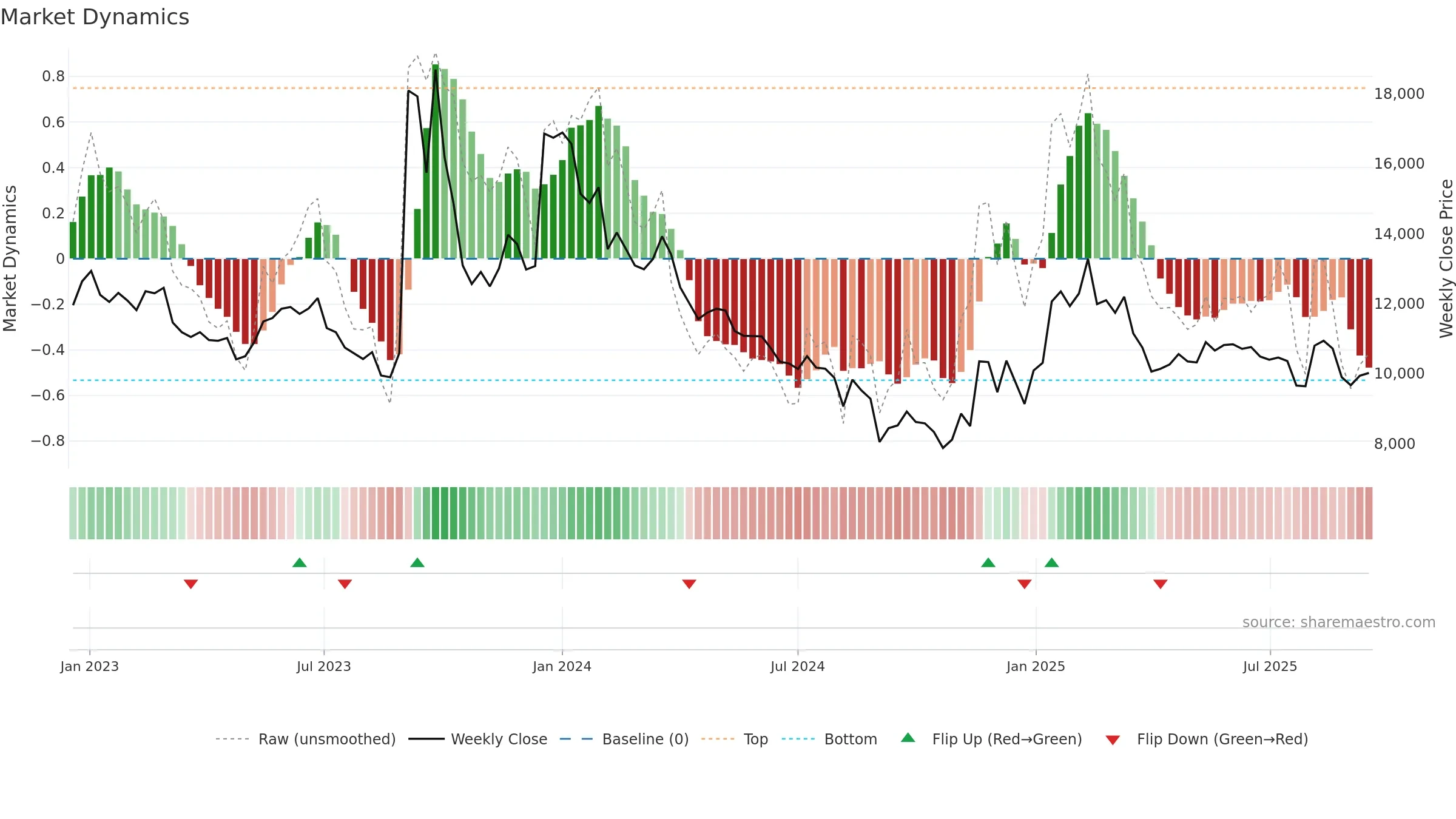

How to read this — Price slope is downward, indicating persistent supply pressure. Elevated weekly volatility increases whipsaw risk. Volume and price are moving in the same direction — a constructive confirmation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Weak MA stack argues for caution; rallies can fail near the 8–13 week region. Price sits below key averages, keeping pressure on the tape.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

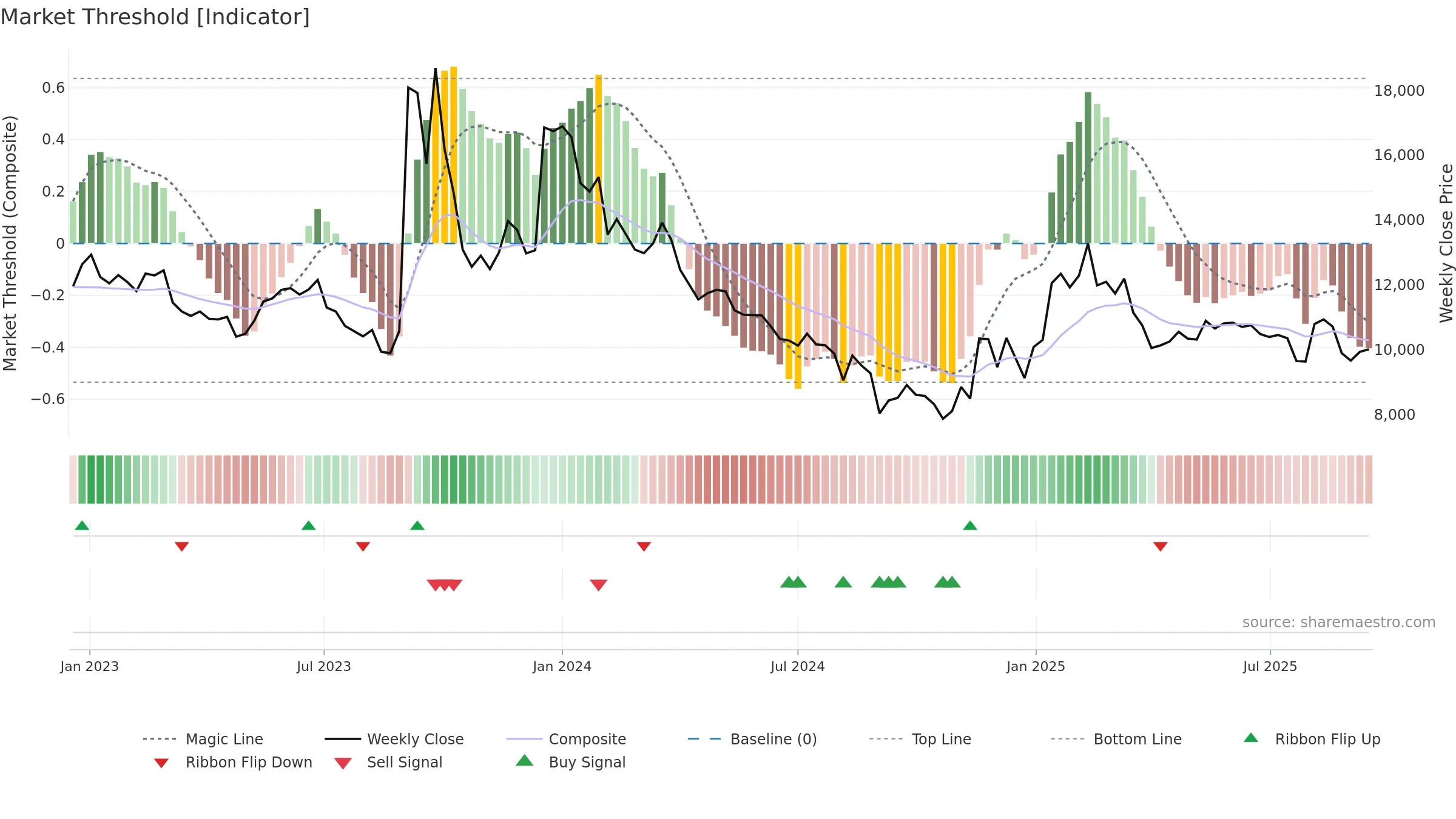

Gauge maps the trend signal to a 0–100 scale.

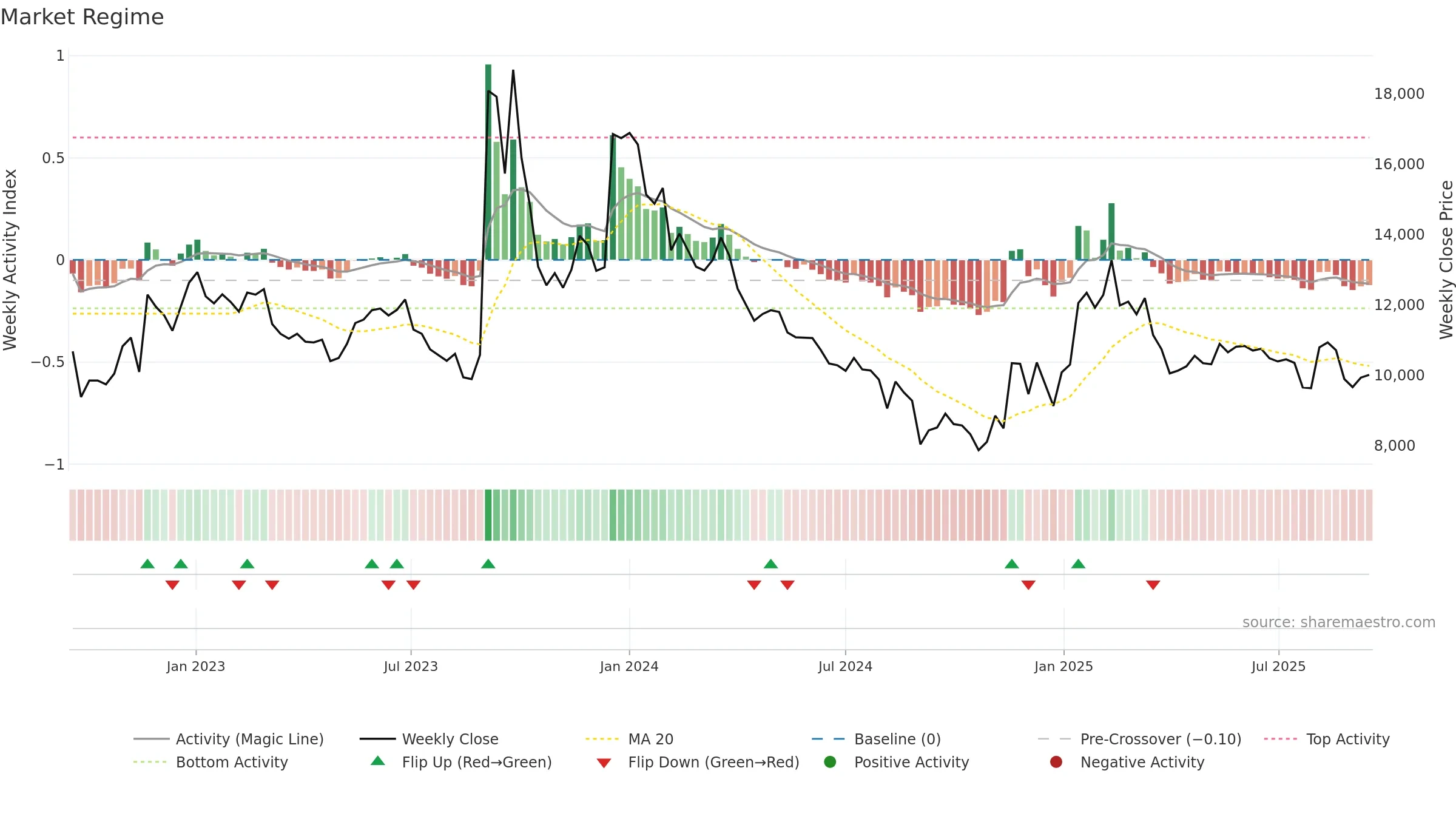

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

Conclusion

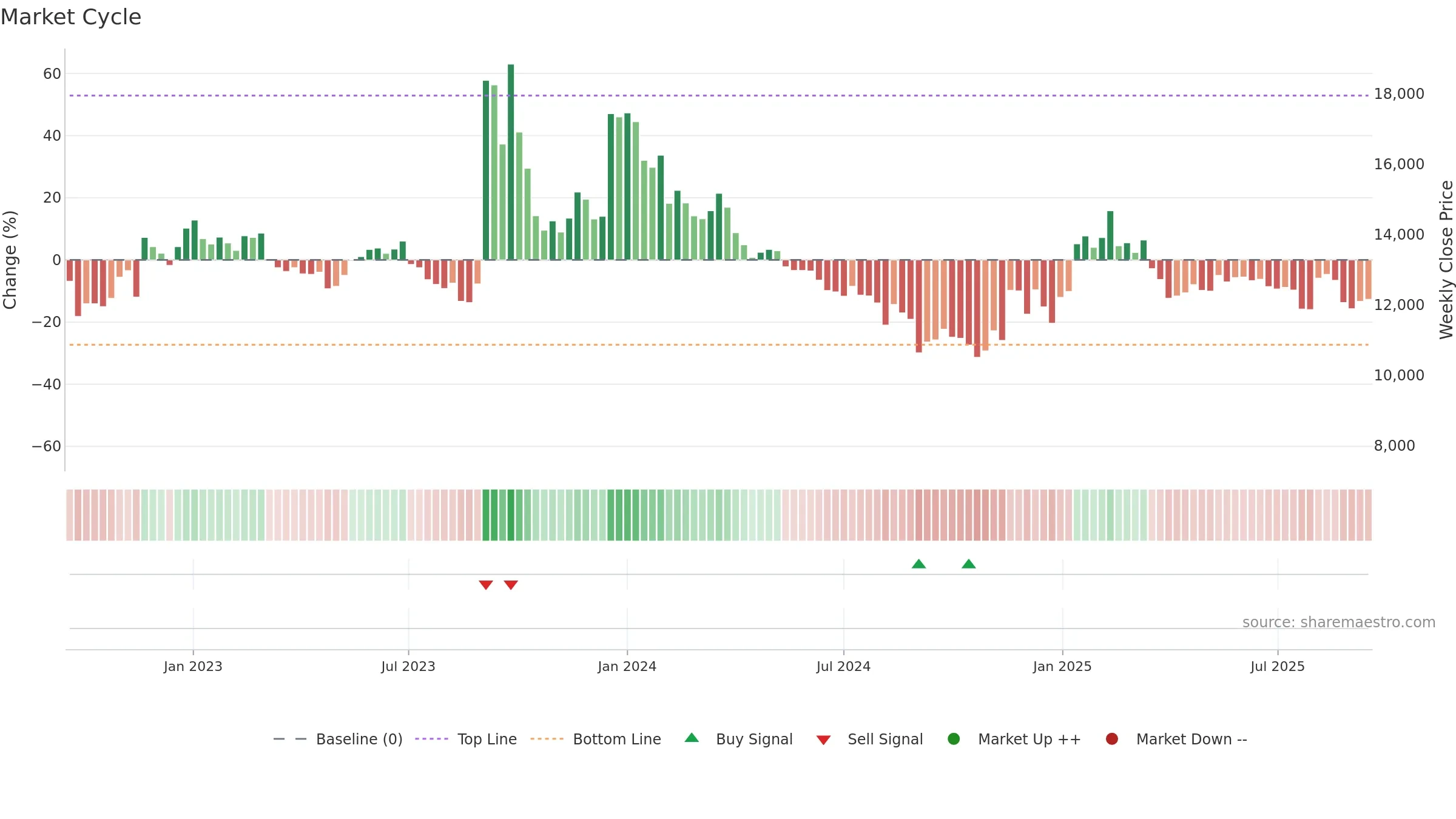

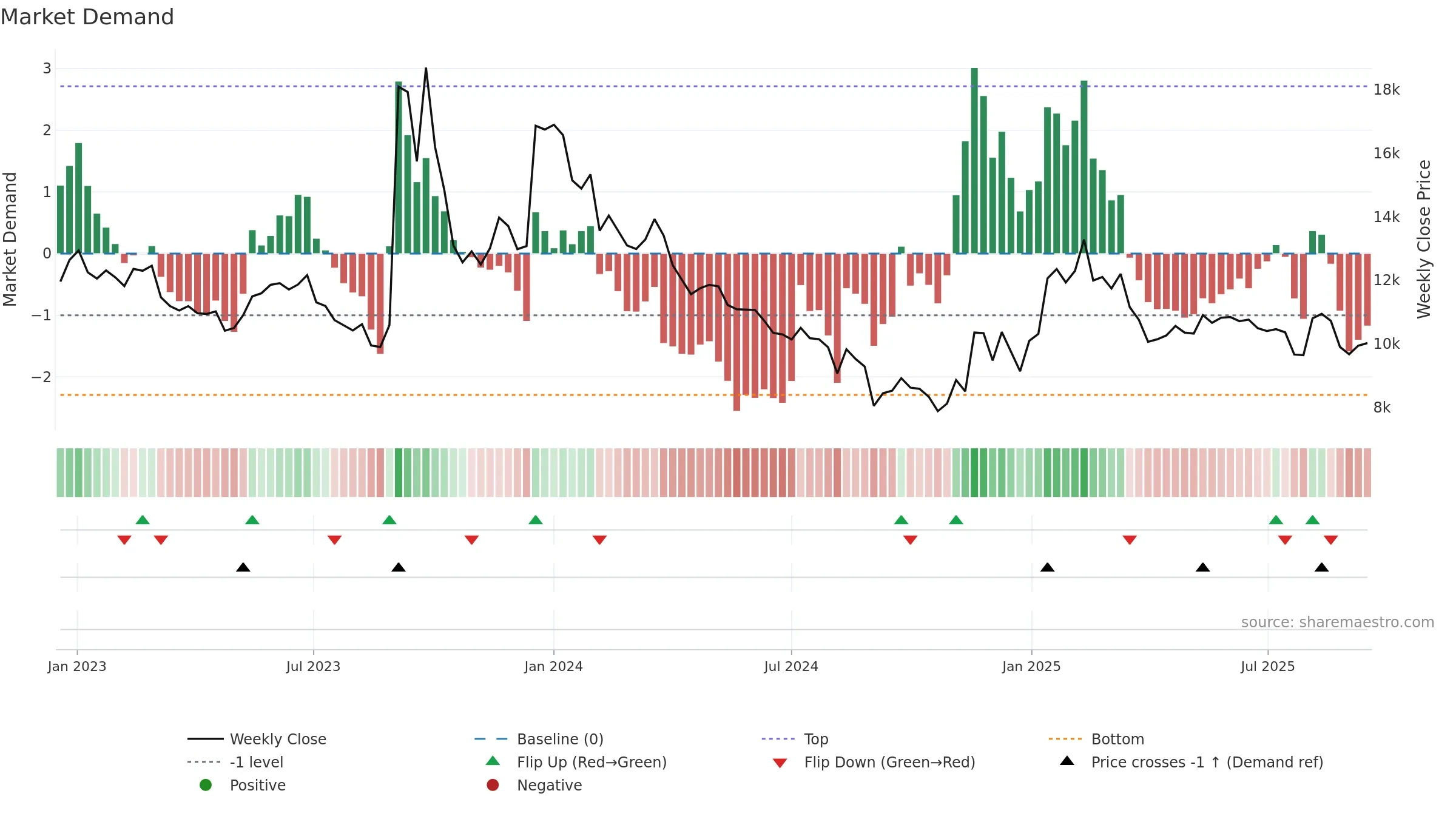

Neutral setup. ★★★☆☆ confidence. Price window: 3. Trend: Range / Neutral; gauge 28. In combination, liquidity confirms the move.

- Liquidity confirms the price trend

- Price is not above key averages

- Weak moving-average stack

- High return volatility raises whipsaw risk

Why: Price window 3.94% over 8w. Close is -8.41% below the prior-window high. Return volatility 4.32%. Volume trend falling. Liquidity convergence with price. Trend state range / neutral. Low-regime (≤0.25) upticks 2/6 (33.0%) • Distributing. MA stack weak. Momentum neutral and rising.

Tip: Most metrics include a hover tooltip where they appear in the report.