CorVel Corporation

CRVL NASDAQ

Weekly Summary

CorVel Corporation closed at 79.4500 (-4.40% WoW) . Data window ends Fri, 19 Sep 2025.

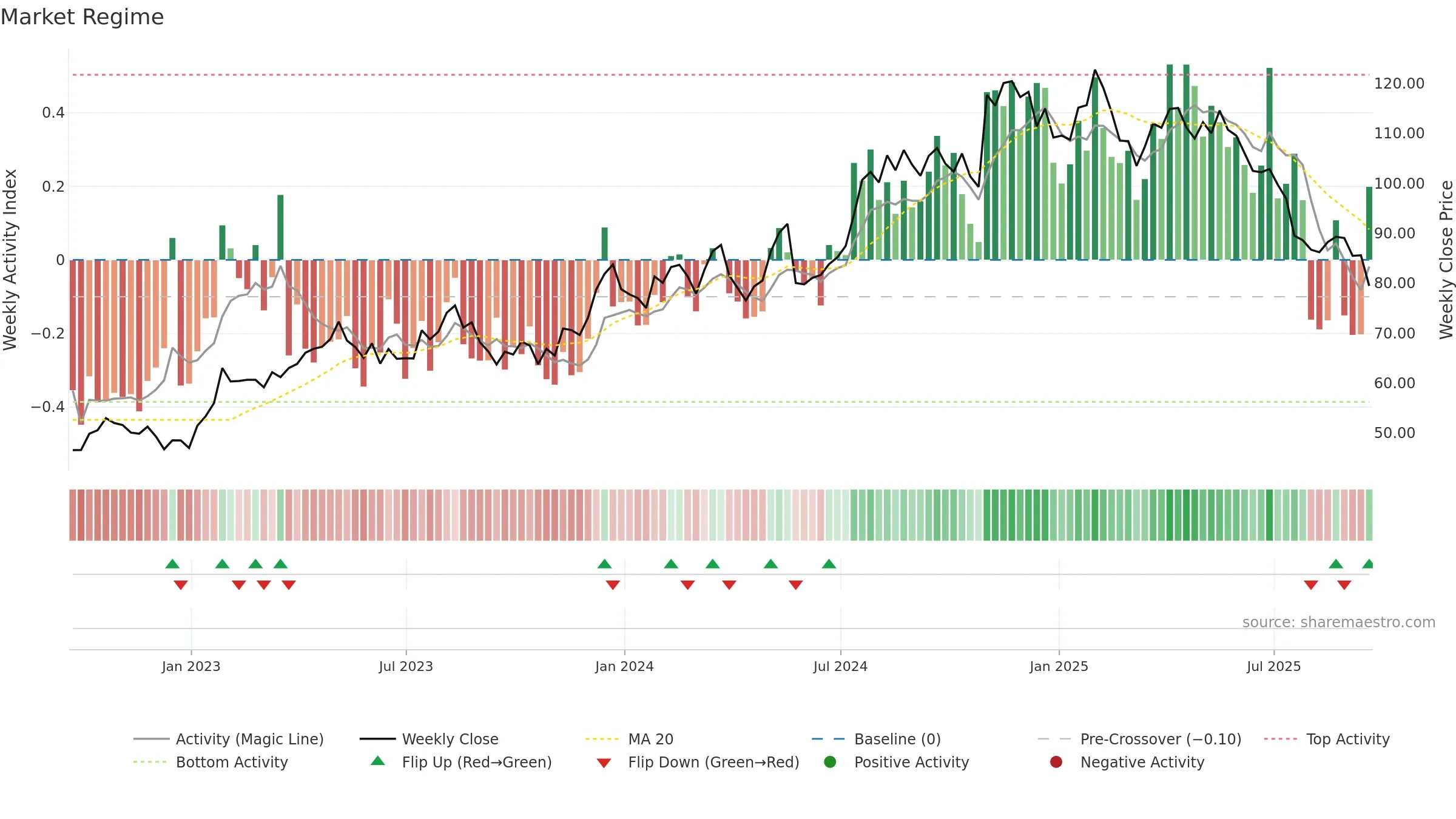

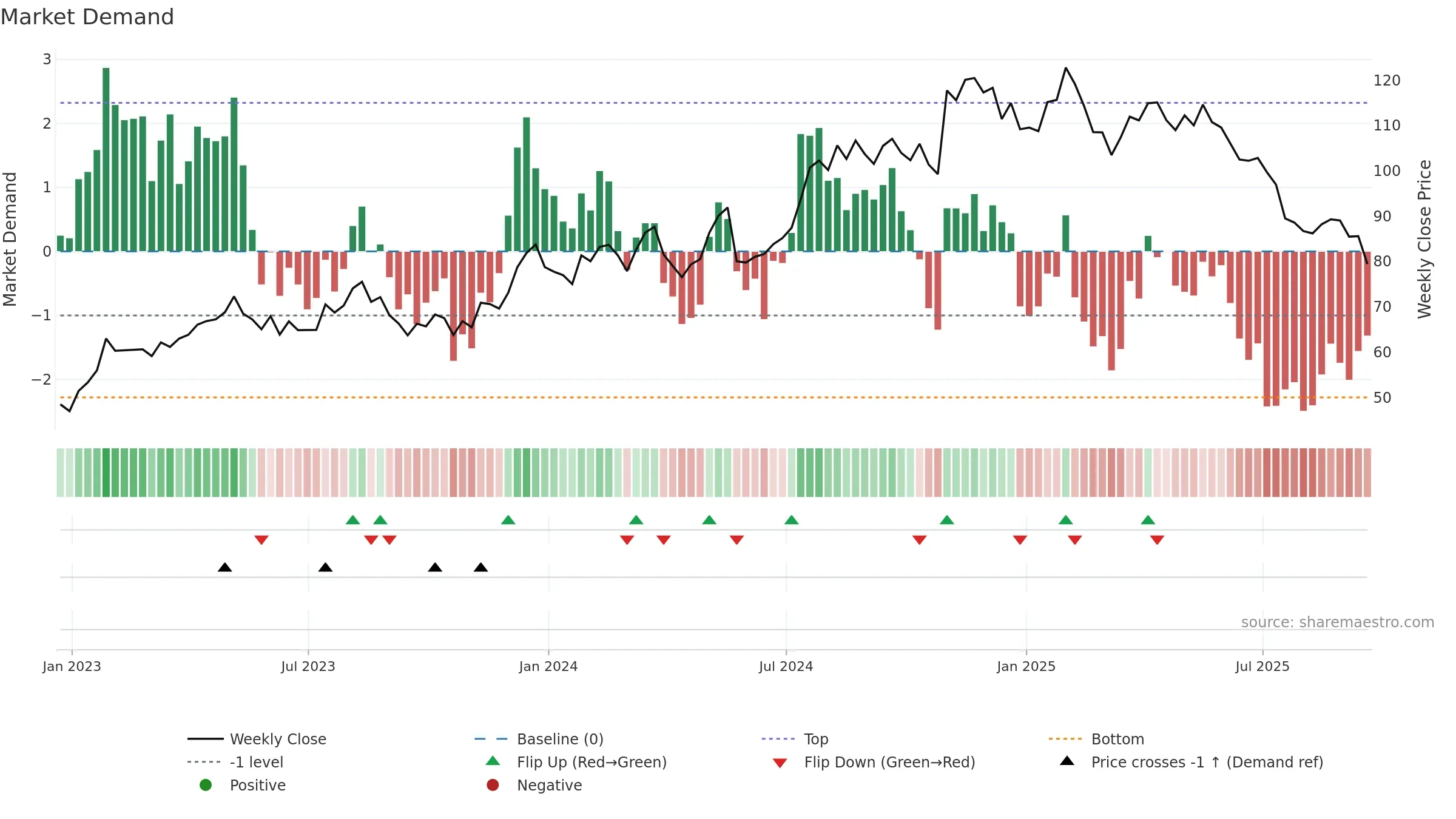

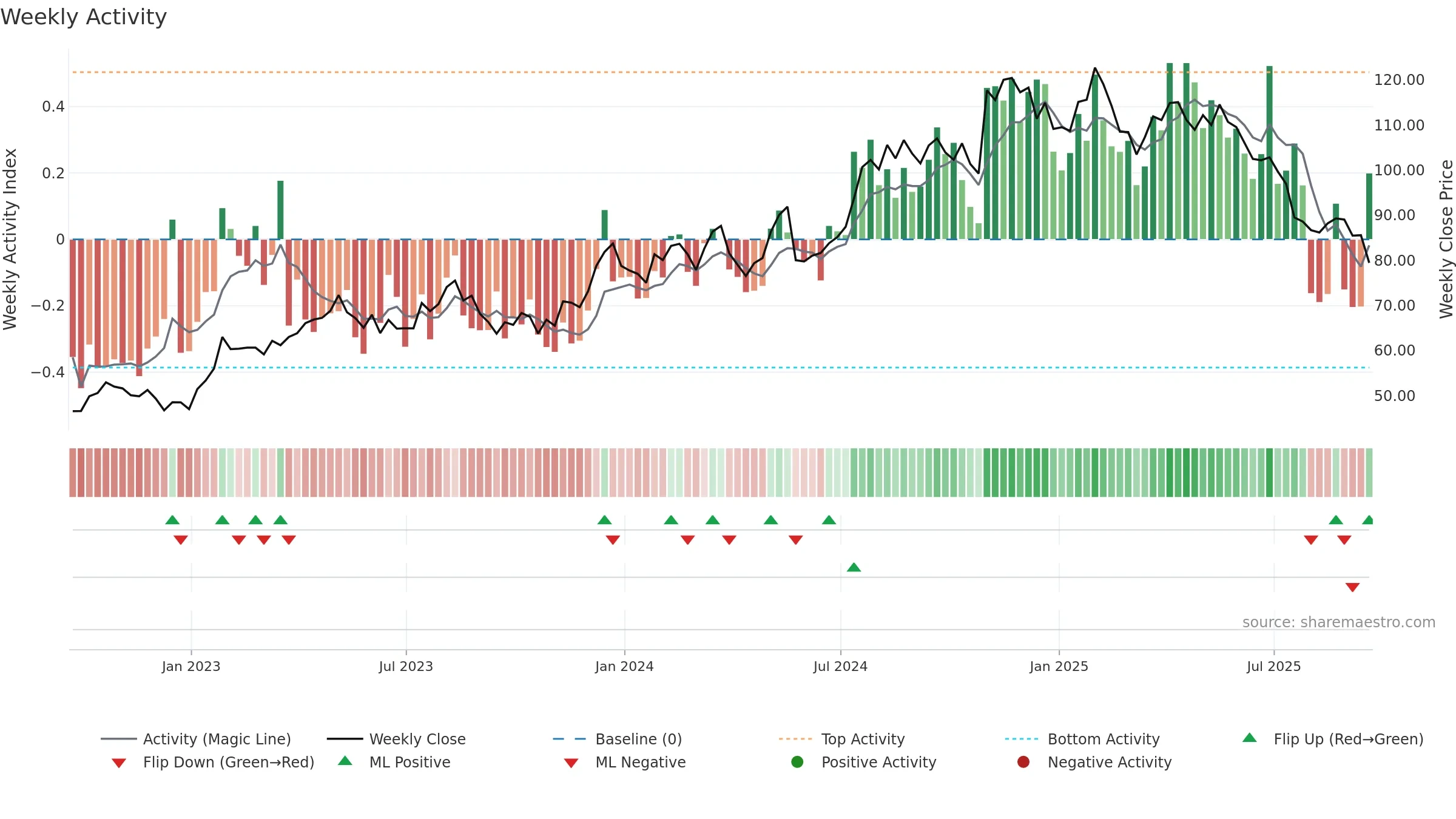

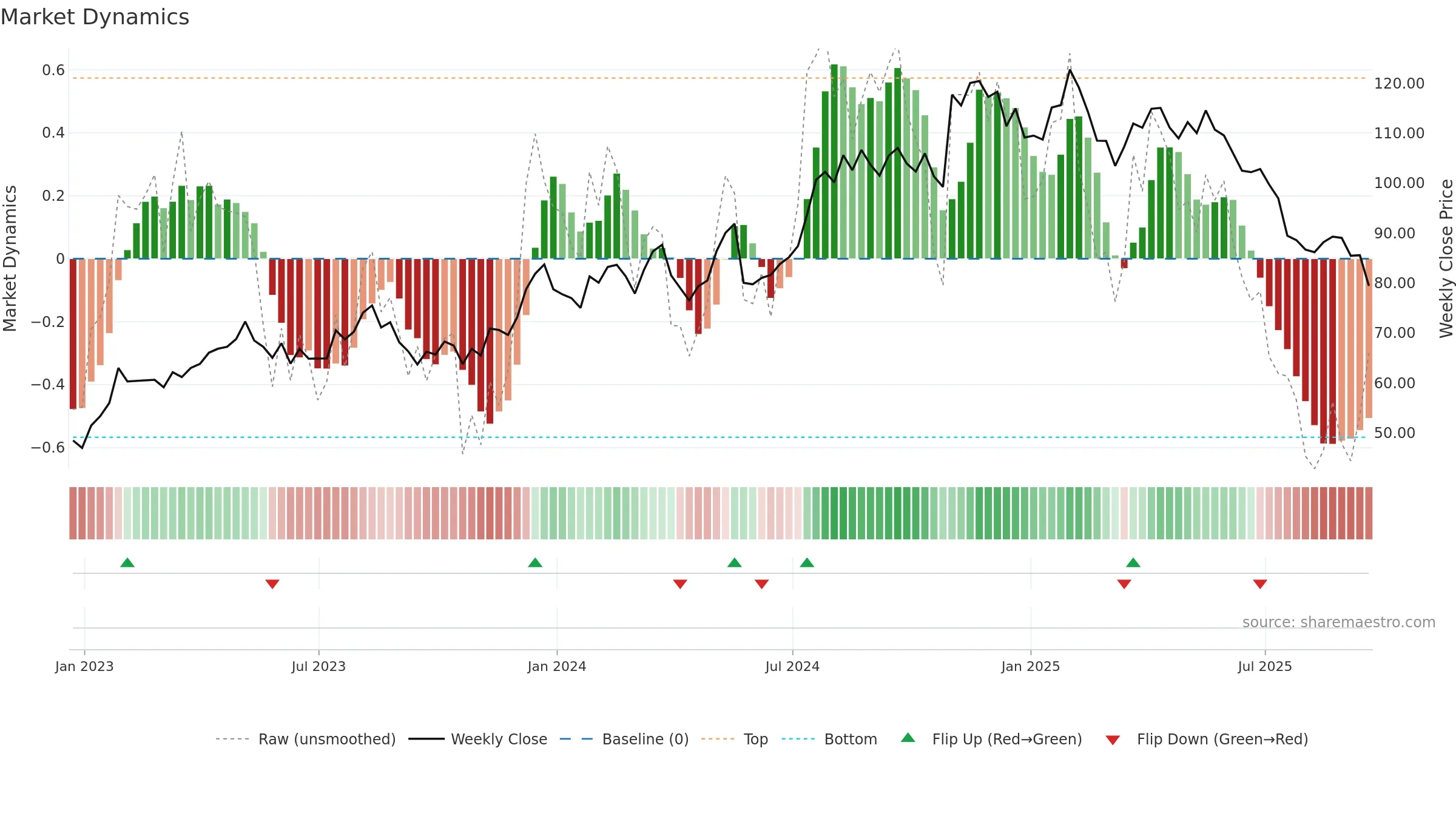

How to read this — Price slope is downward, indicating persistent supply pressure. Low weekly volatility favours steadier follow-through. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity. Price is extended below its baseline; rebounds can be sharp if demand improves. Distance to baseline is narrowing — reverting closer to its fair-value track. Weak MA stack argues for caution; rallies can fail near the 8–13 week region. Price sits below key averages, keeping pressure on the tape.

Down-slope argues for patience; rallies can fade sooner unless participation improves. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

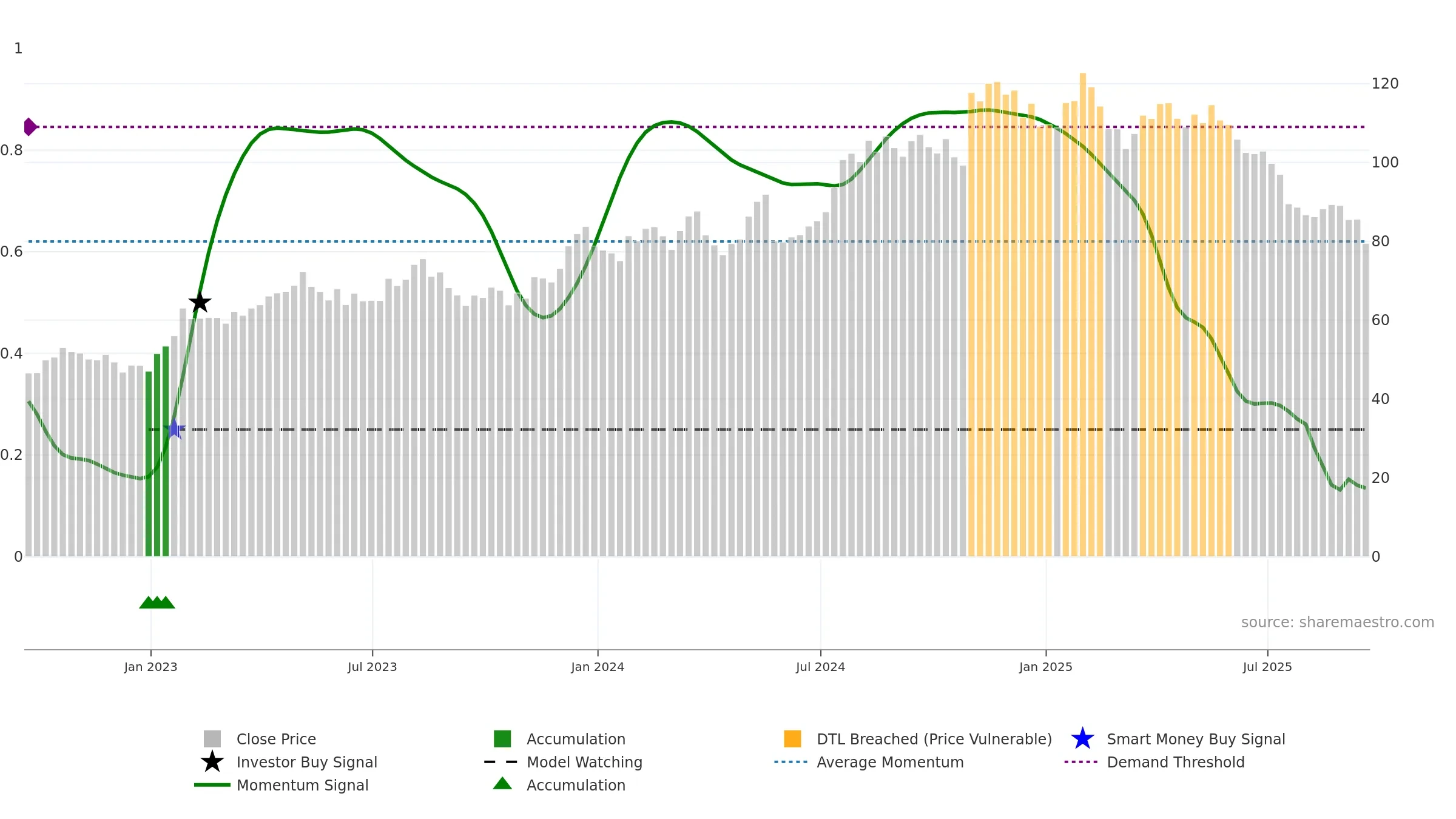

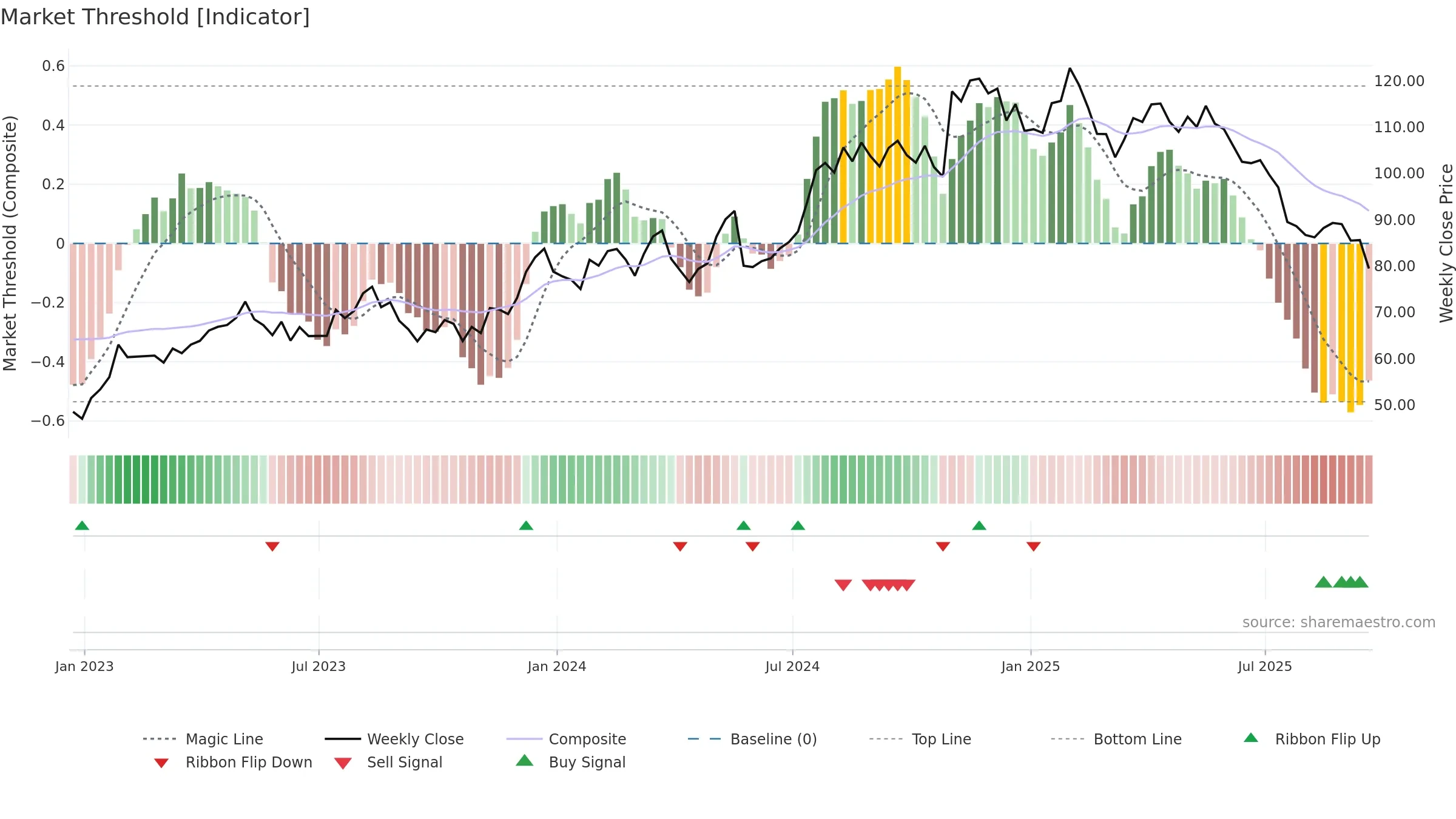

Gauge maps the trend signal to a 0–100 scale.

How to read this — Bearish zone with falling momentum — sellers in control.

Bias remains lower; rallies are suspect unless gauge reclaims 0.50/0.60.

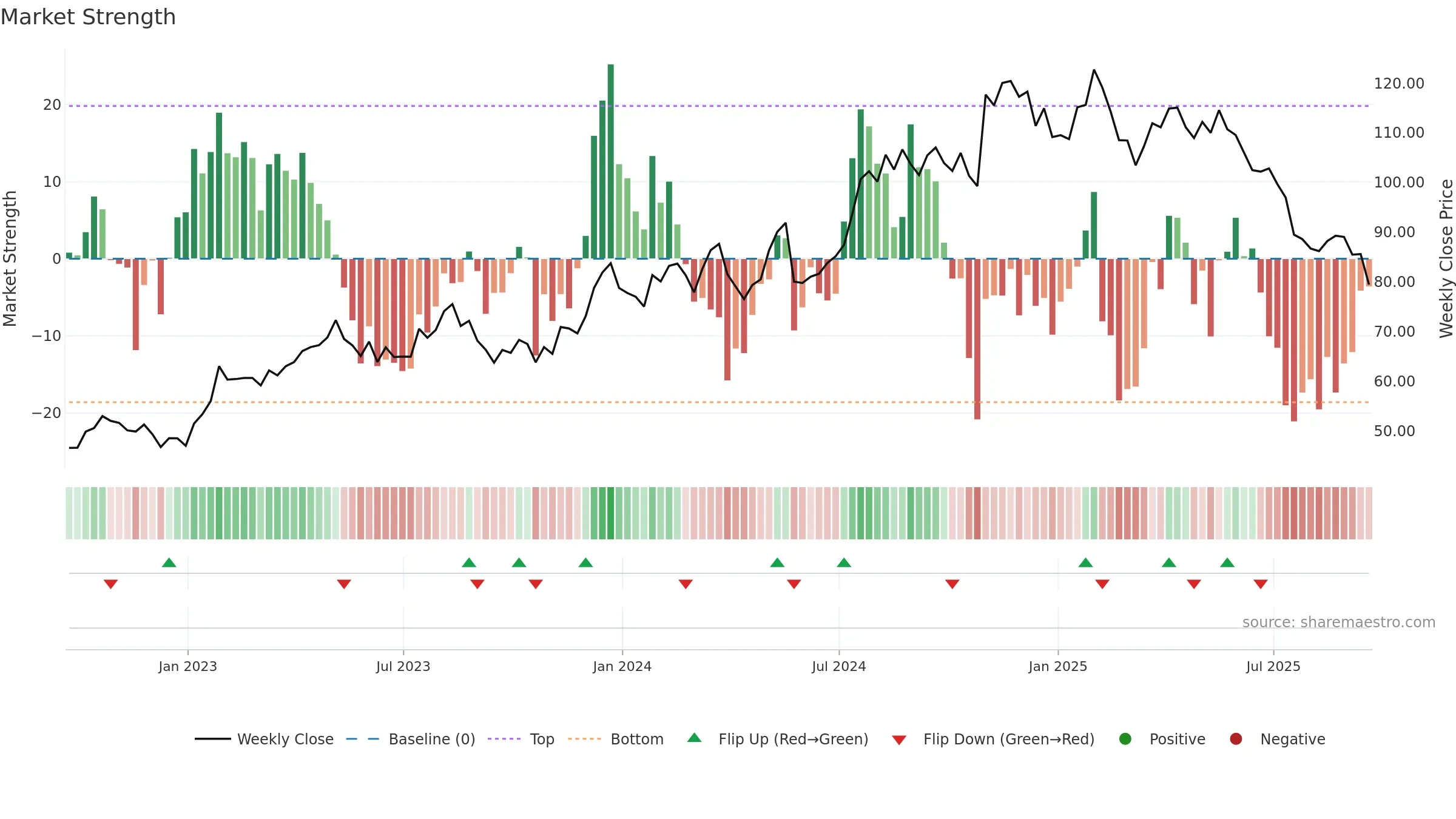

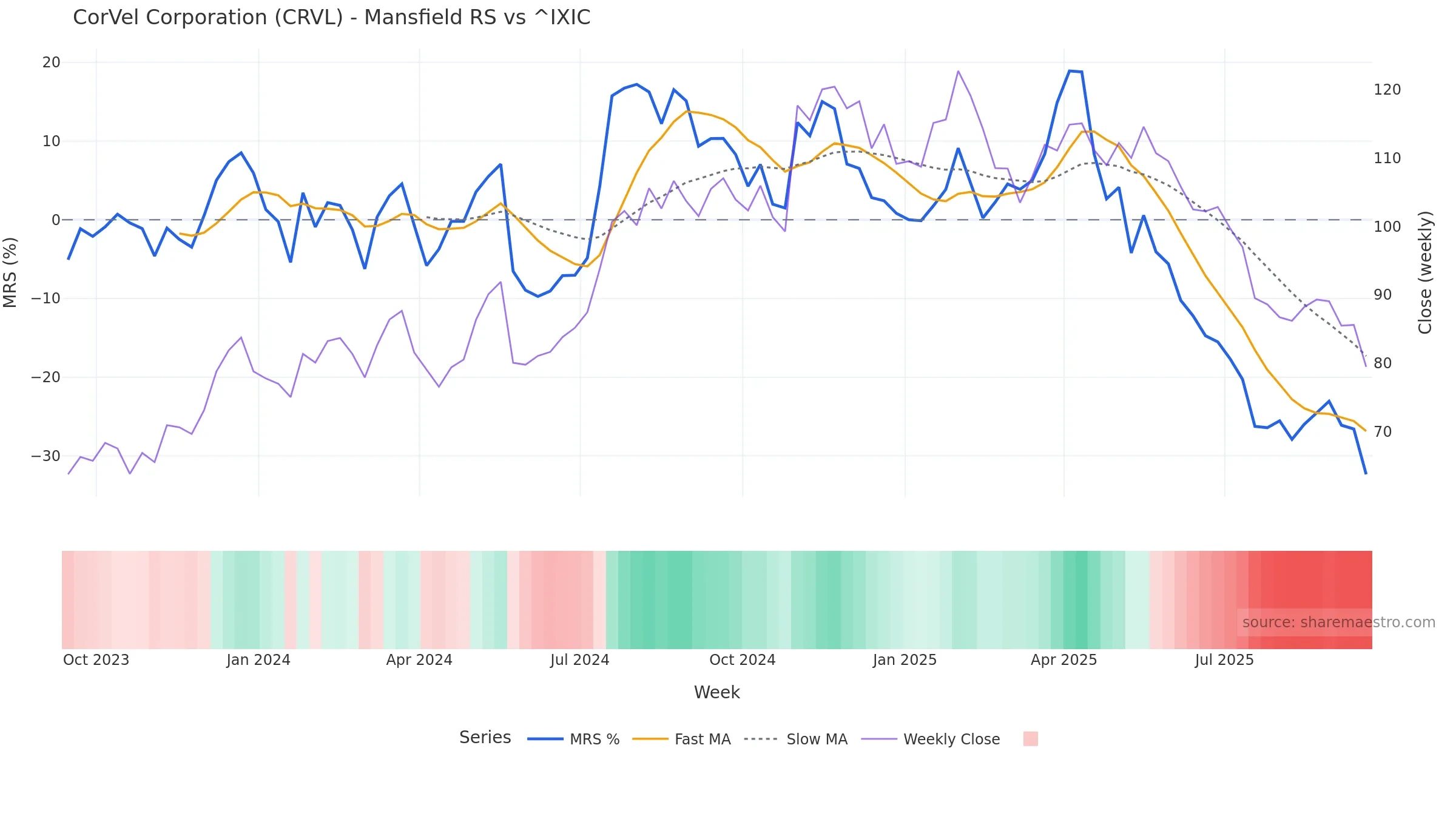

Relative strength is Negative

(< 0%, underperforming).

Latest MRS: -32.33% (week ending Fri, 19 Sep 2025).

Slope: Falling over 8w.

Notes:

- Below zero line indicates relative weakness vs benchmark.

- MRS slope falling over ~8 weeks.

The flag is positive: favourable upside skew with supportive conditions.

Conclusion

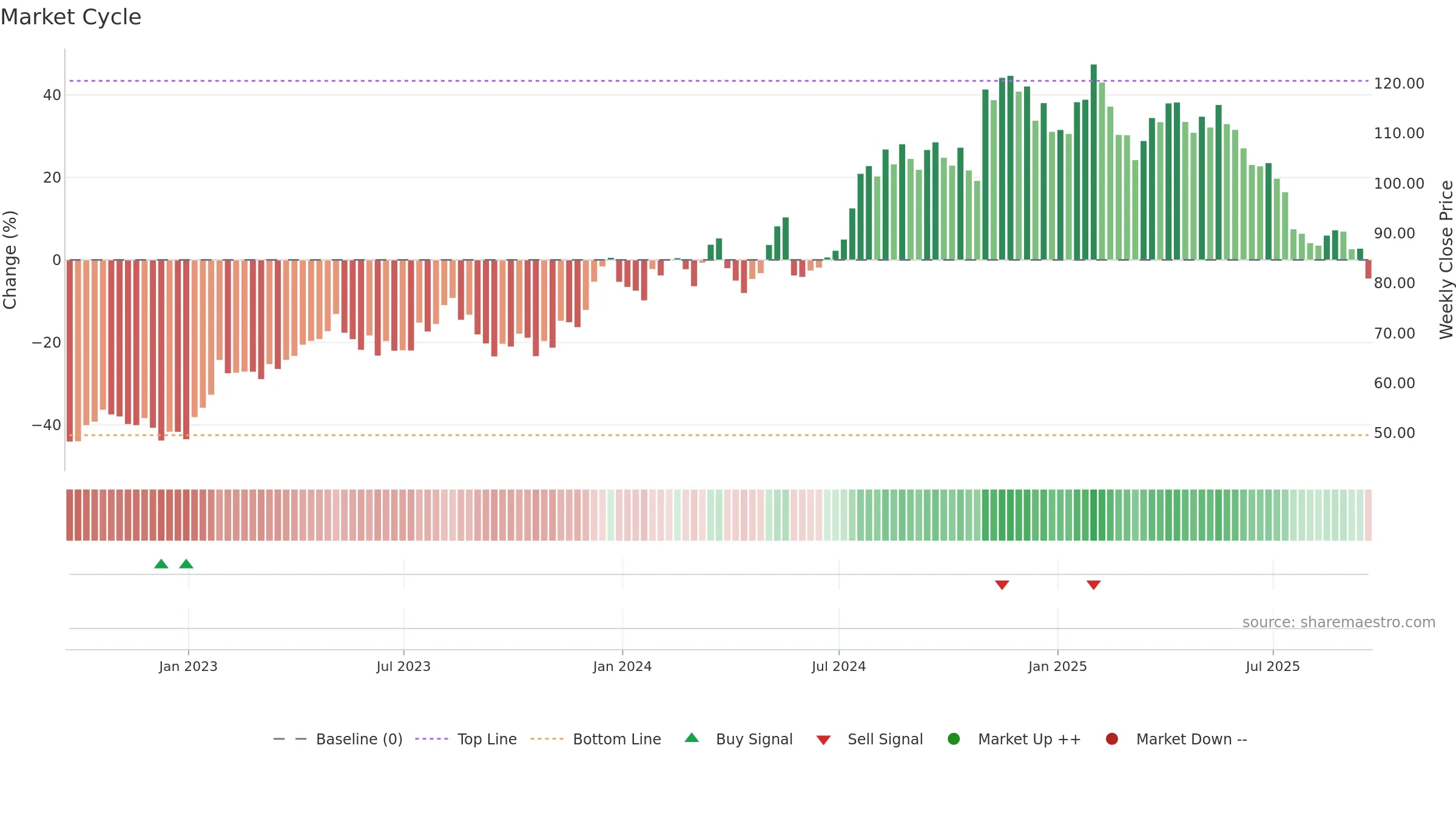

Negative setup. ⯪☆☆☆☆ confidence. Trend: Downtrend Confirmed · -8.37% over window · vol 1.35% · liquidity divergence · posture below · RS weak

- Low return volatility supports durability

- Bearish control with falling momentum

- Momentum is weak/falling

- Price is not above key averages

- Weak moving-average stack

Why: Price window -8.37% over w. Close is -11.03% below the prior-window high. Return volatility 1.35%. Volume trend rising. Liquidity divergence with price. Trend state downtrend confirmed. MA stack weak. Momentum bearish and falling. Valuation stance positive.

Tip: Most metrics include a hover tooltip where they appear in the report.