Danske Bank A/S

DANSKE CPH

Weekly Report

Danske Bank A/S closed at 268.1000 (1.09% WoW) . Data window ends Mon, 15 Sep 2025.

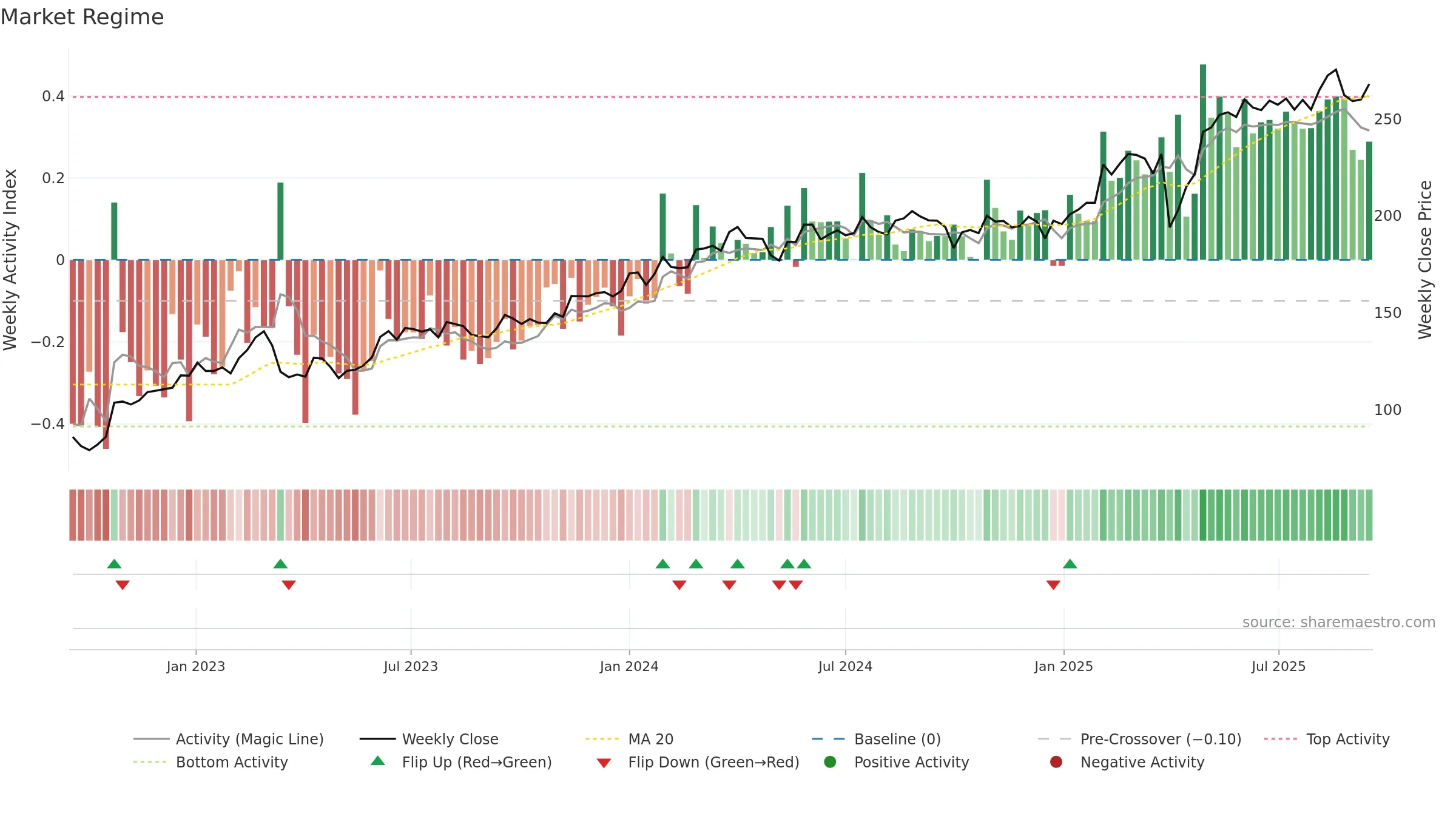

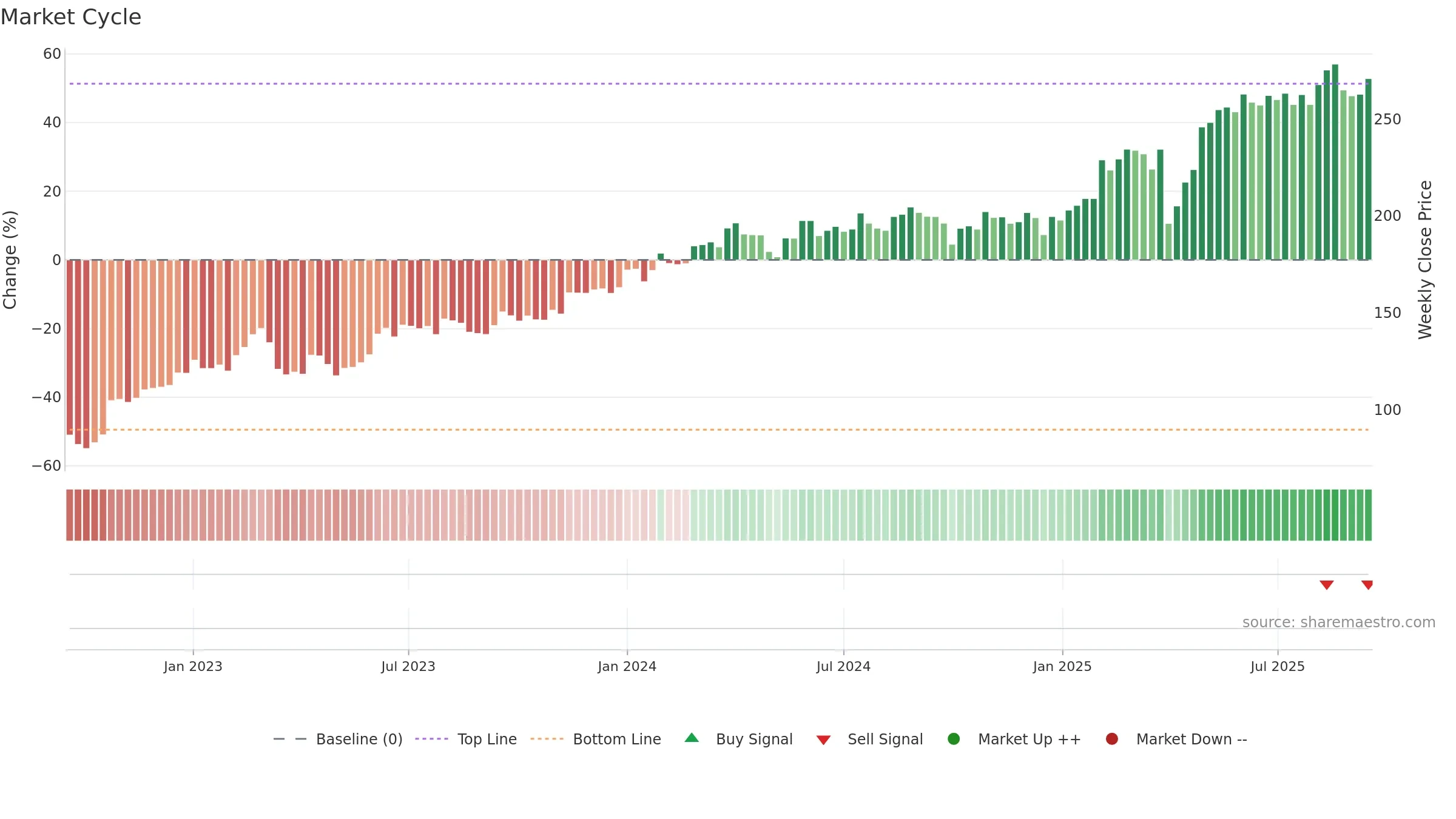

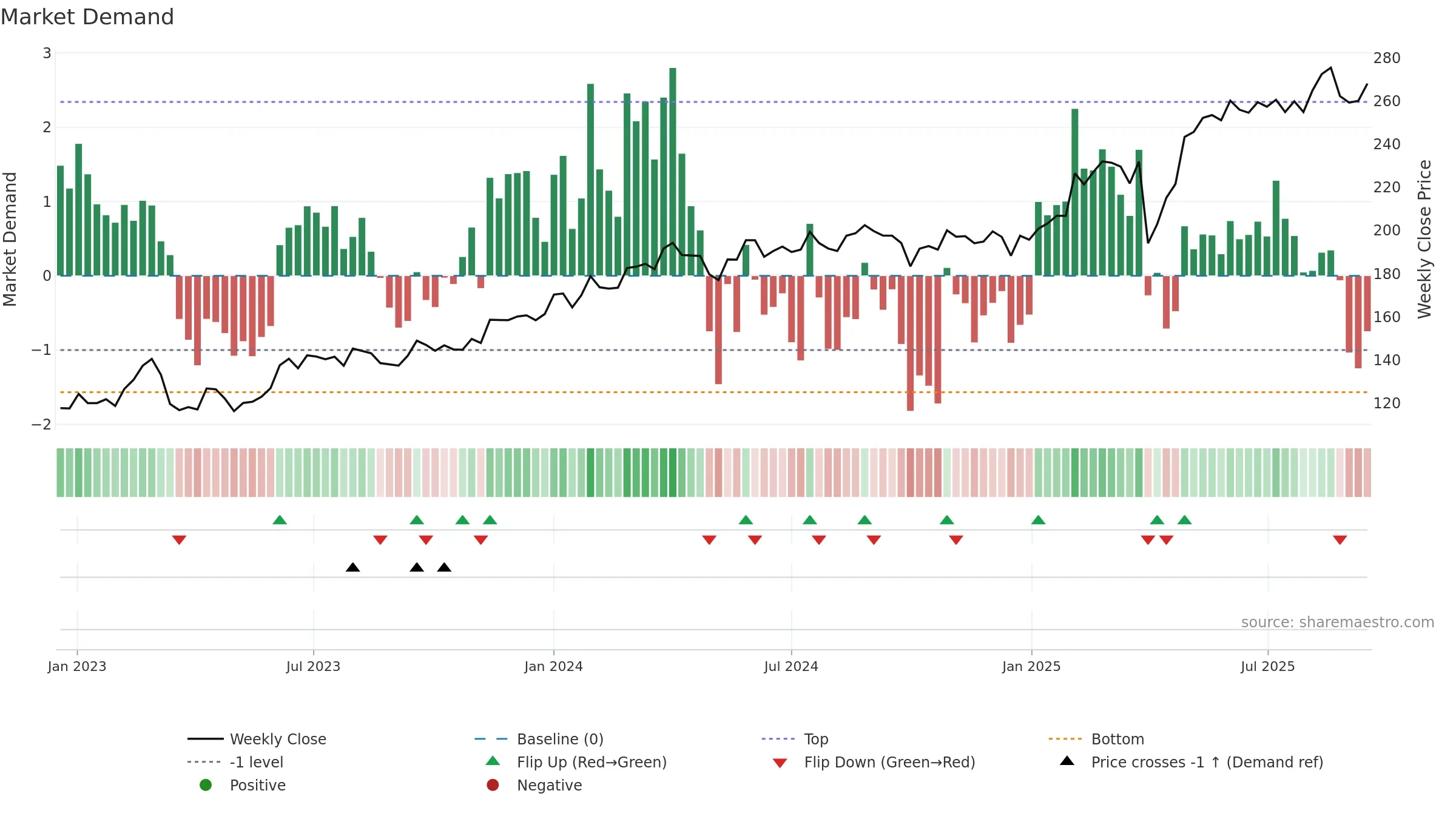

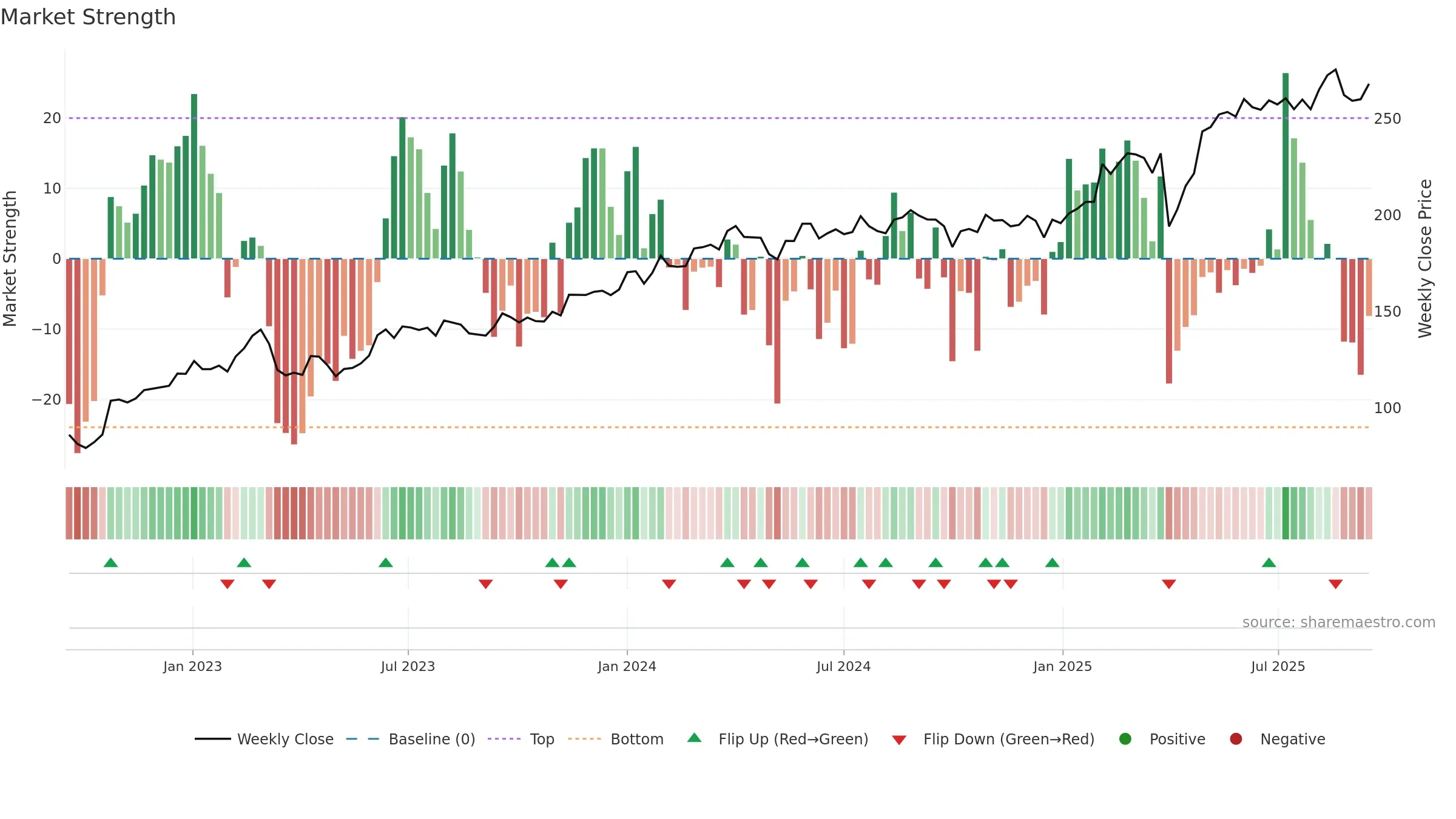

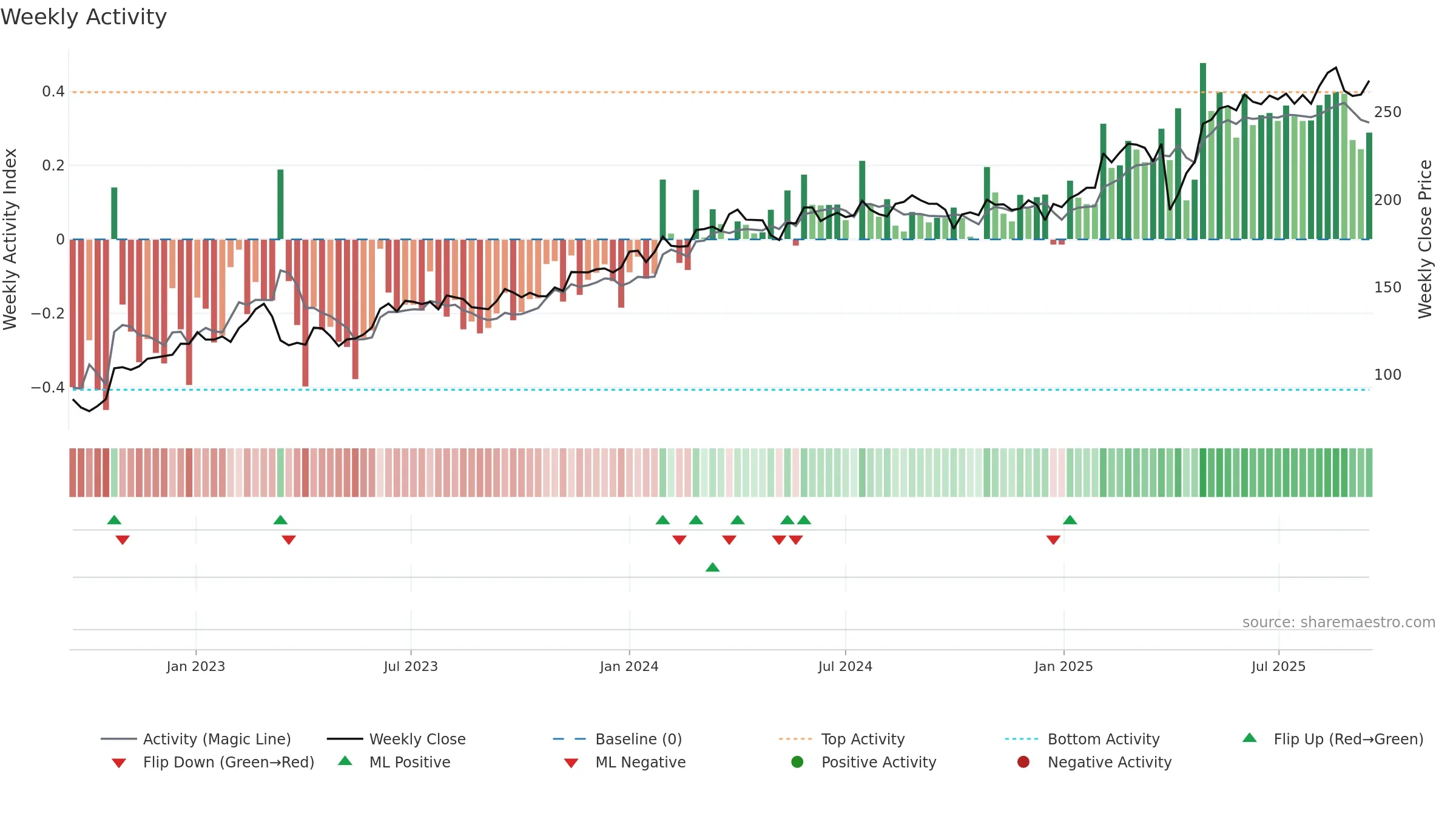

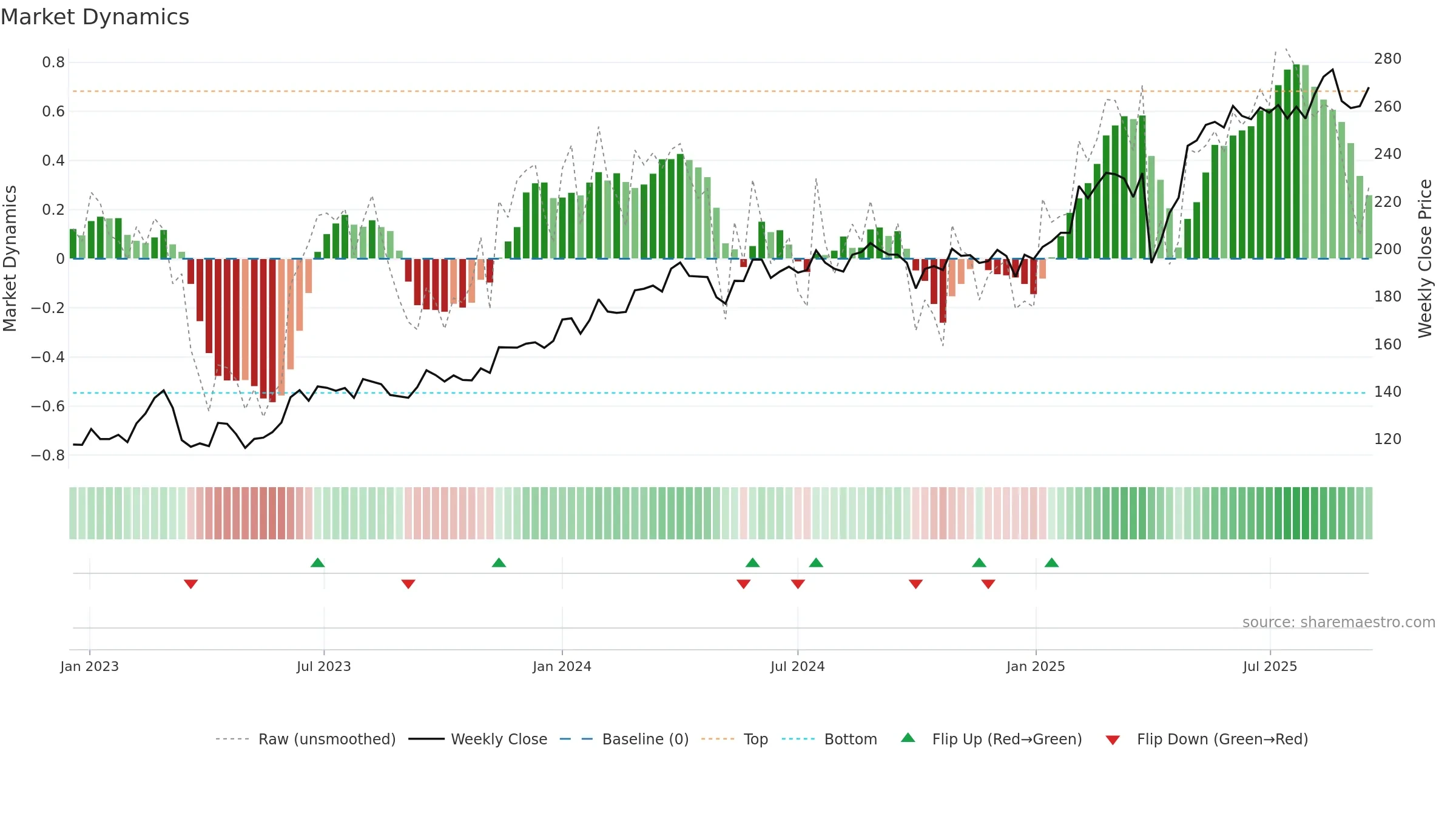

How to read this — Price slope is upward, indicating persistent buying over the window. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Fresh short-term downside crossover weakens near-term tone. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

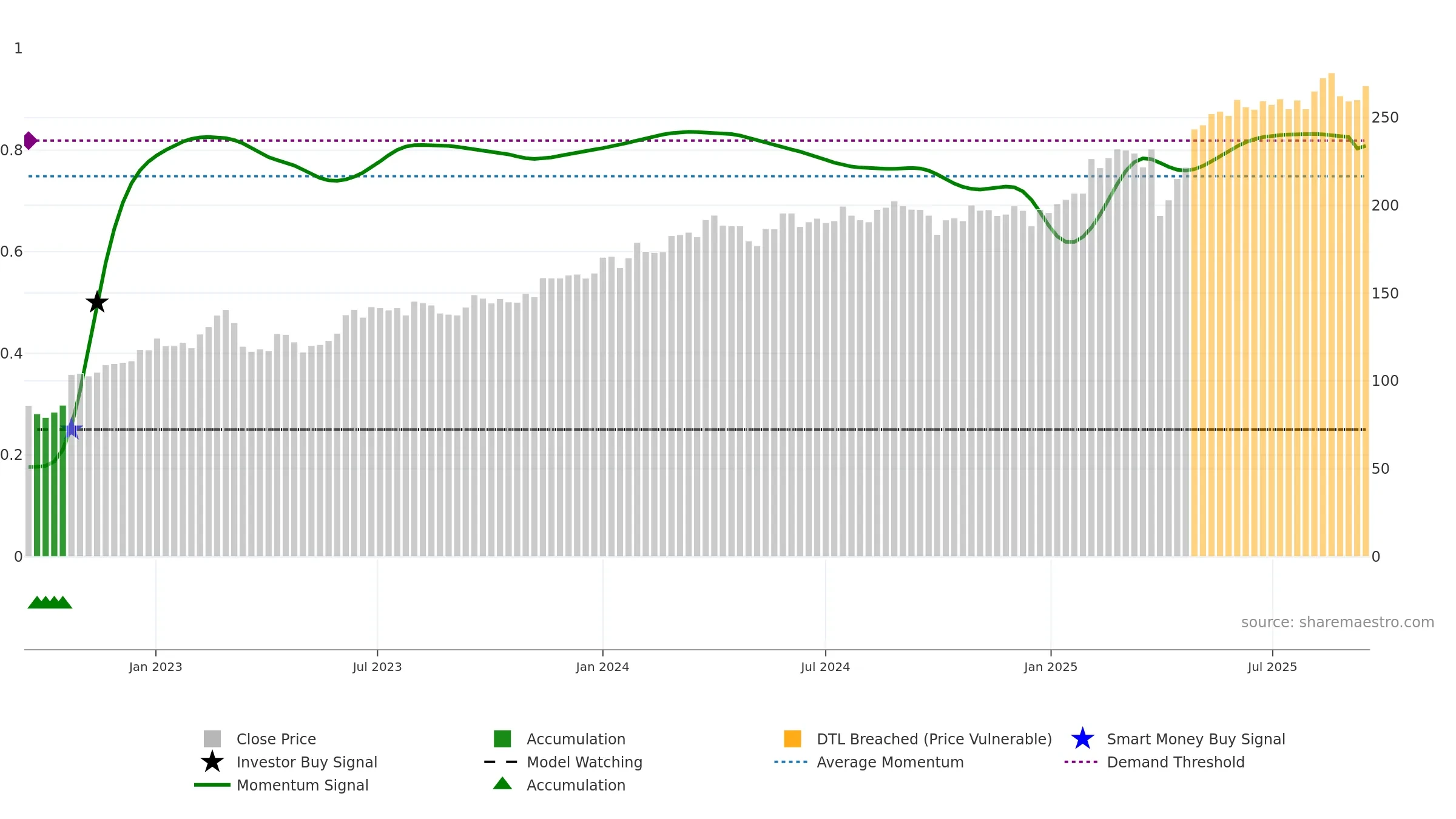

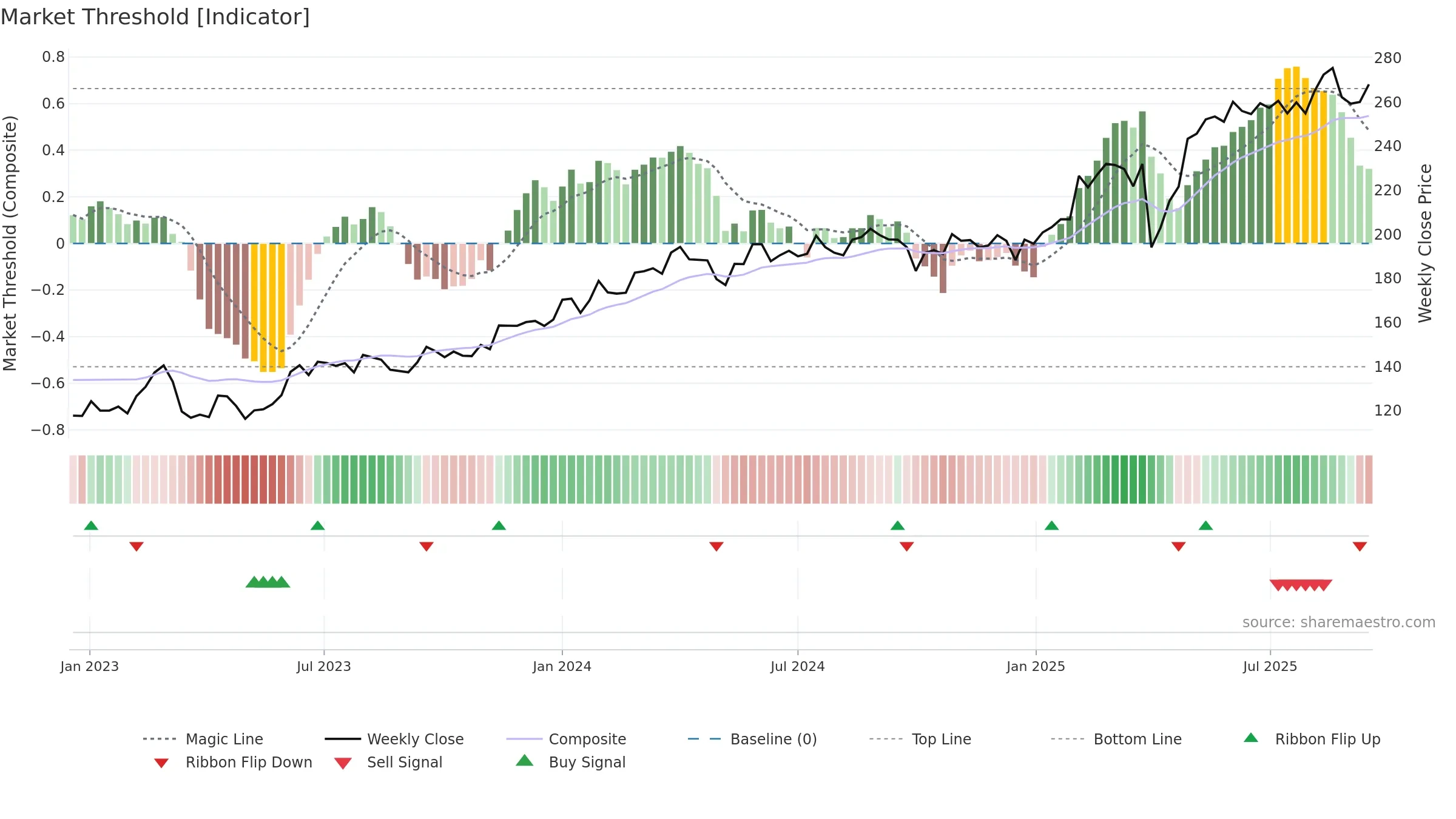

Gauge maps the trend signal to a 0–100 scale.

How to read this — Gauge is elevated but momentum is rolling over; topping risk is rising.

Stay alert: protect gains or seek confirmation before adding risk.

Price is below fair value; potential upside if momentum constructive.

Conclusion

Negative setup. ★★☆☆☆ confidence. Price window: 5. Trend: Uptrend at Risk; gauge 80. In combination, liquidity diverges from price.

- Price holds above 8w & 26w averages

- High-level but rolling over (topping risk)

- Momentum is weak/falling

- Liquidity diverges from price

- Sellers active at elevated levels (distribution)

Why: Price window 5.18% over 8w. Close is -2.69% below the prior-window high. Return volatility 2.33%. Volume trend falling. Liquidity divergence with price. Trend state uptrend at risk. High-regime (0.80–1.00) downticks 6/7 (86.0%) • Distributing. 4–8w crossover bearish. Momentum neutral and falling. Valuation supportive skew.

Tip: Most metrics include a hover tooltip where they appear in the report.