Ambipar Participações e Empreendimentos S.A.

AMBP3 BVMF

Weekly Summary

Ambipar Participações e Empreendimentos S.A. closed at 8.8500 (33.89% WoW) . Data window ends Fri, 26 Sep 2025.

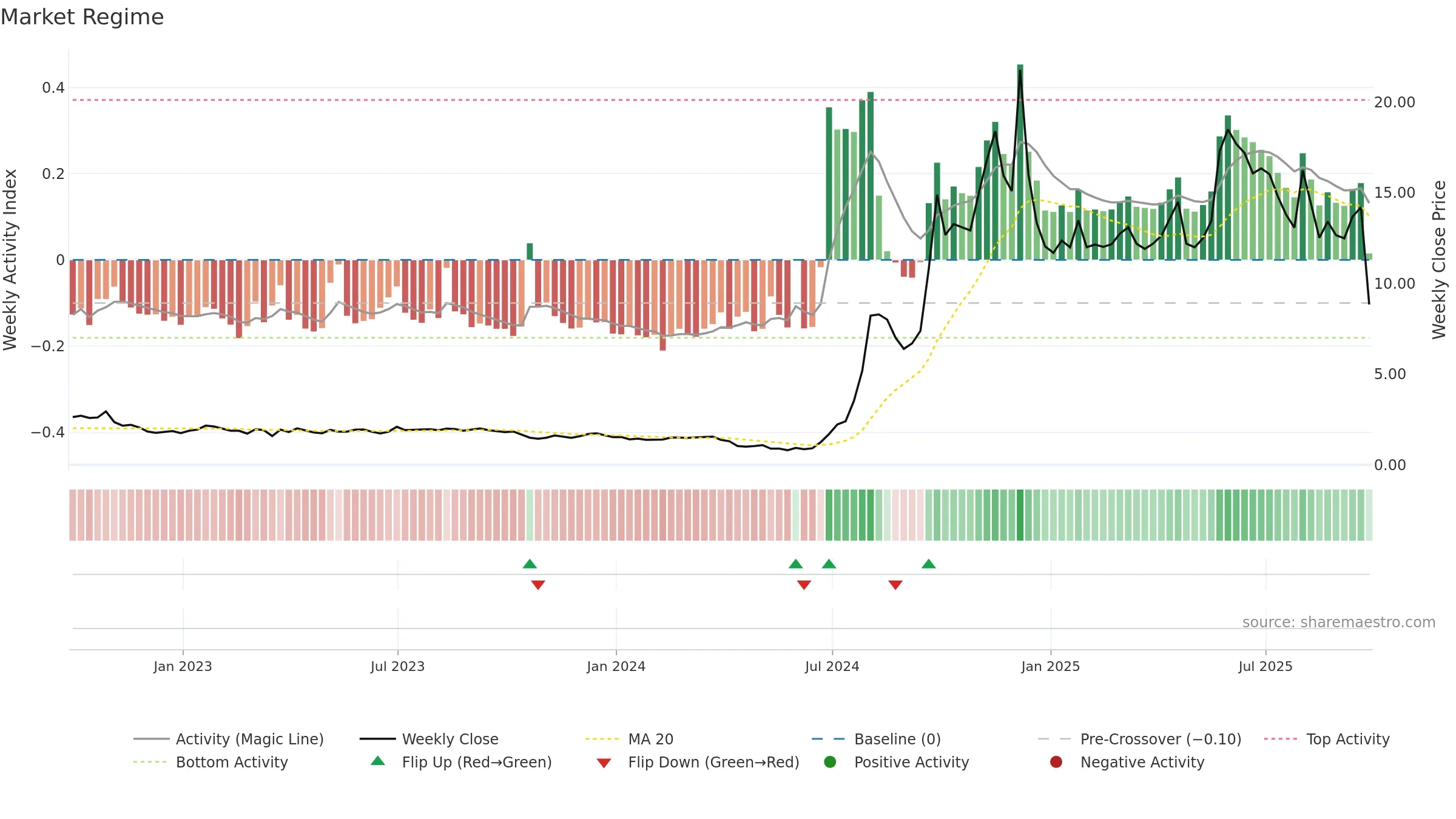

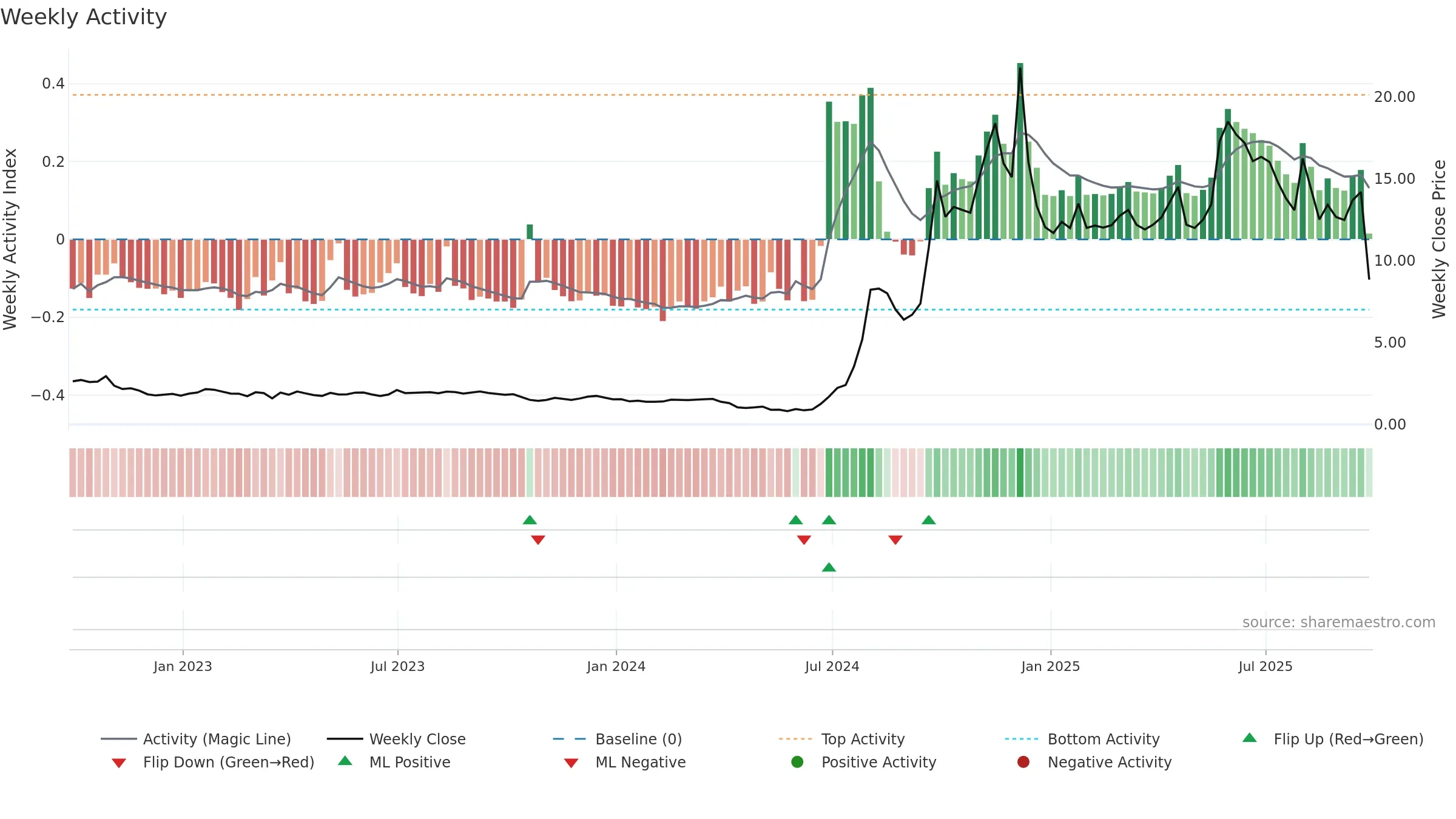

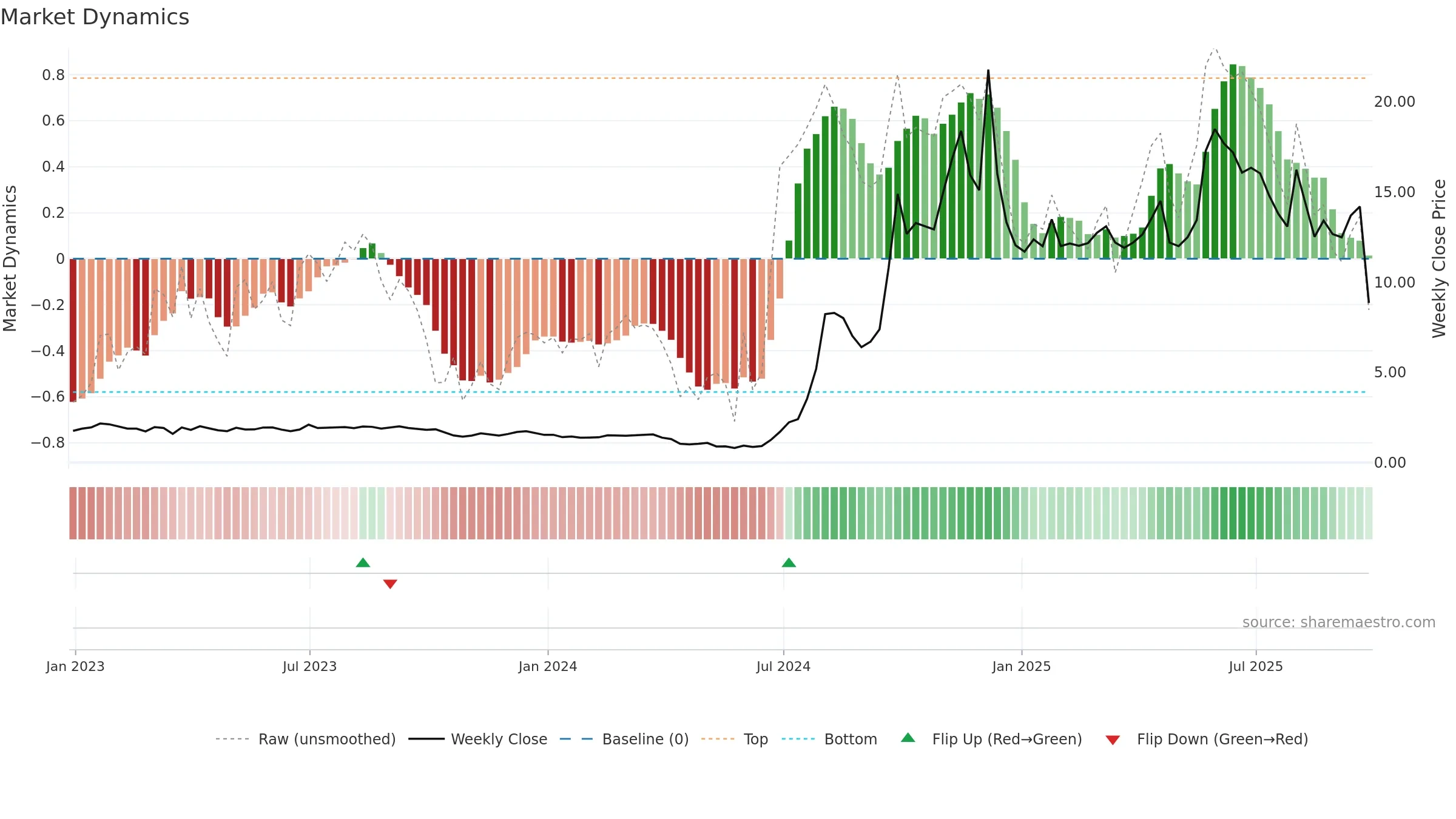

How to read this — Price slope is downward, indicating persistent supply pressure. Elevated weekly volatility increases whipsaw risk. Volume trend diverges from price — watch for fatigue or rotation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Weak MA stack argues for caution; rallies can fail near the 8–13 week region. Price sits below key averages, keeping pressure on the tape.

Down-slope argues for patience; rallies can fade sooner unless participation improves. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

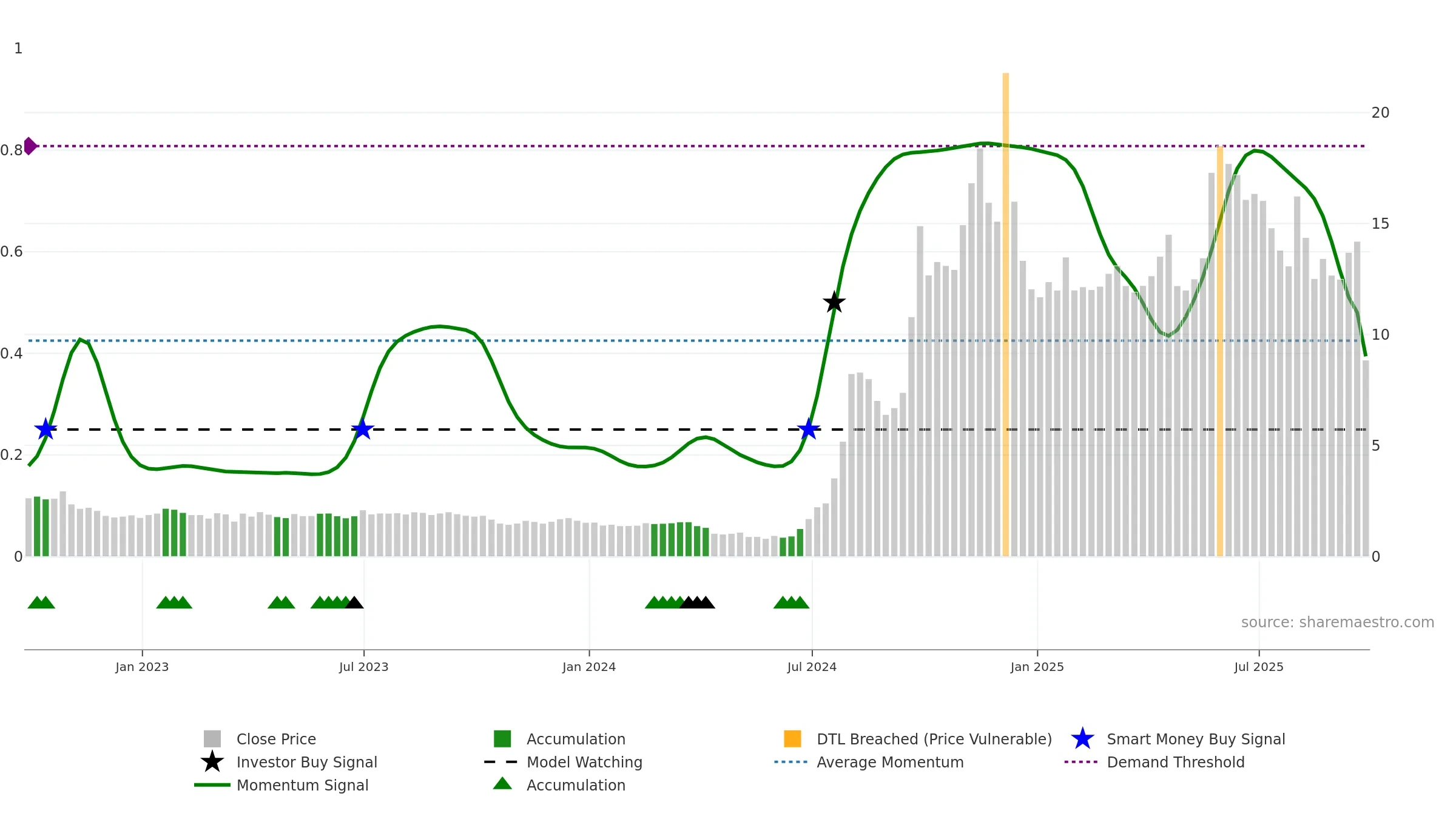

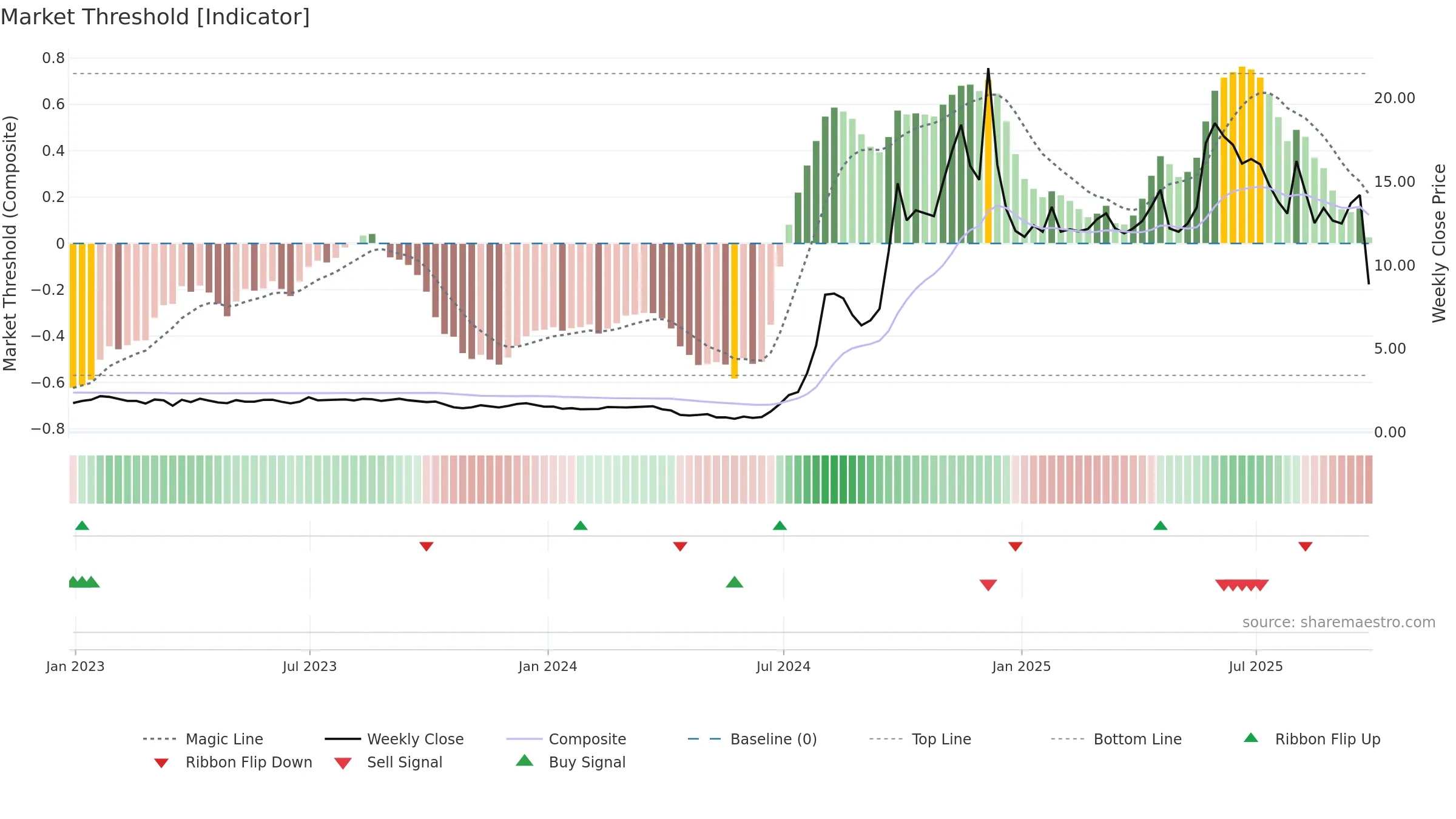

Gauge maps the trend signal to a 0–100 scale.

How to read this — Bearish zone with falling momentum — sellers in control. Loss of the ~0.50 midline after strength suggests regime shift. Sub-0.40 print confirms downside control.

Bias remains lower; rallies are suspect unless gauge reclaims 0.50/0.60.

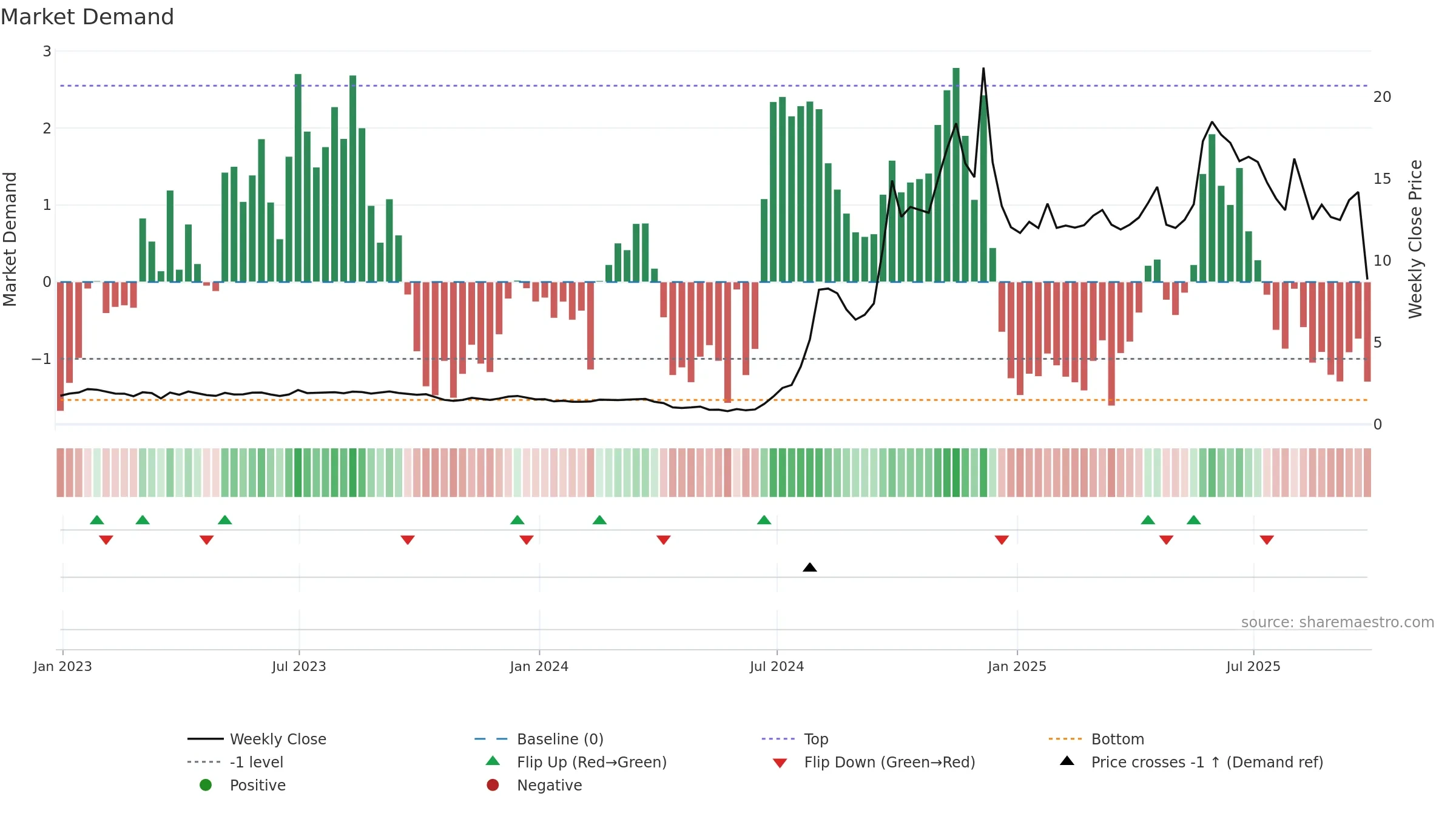

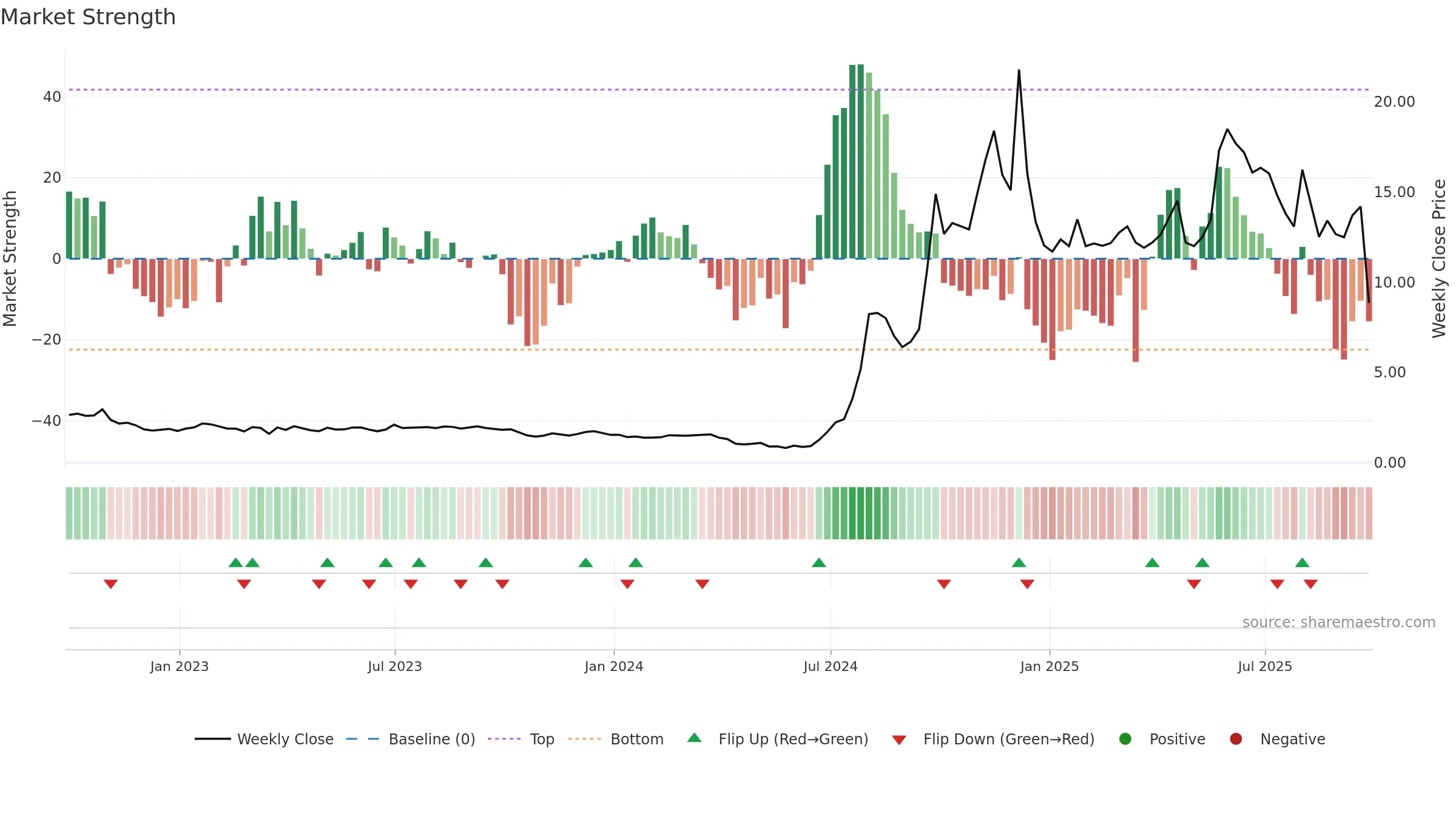

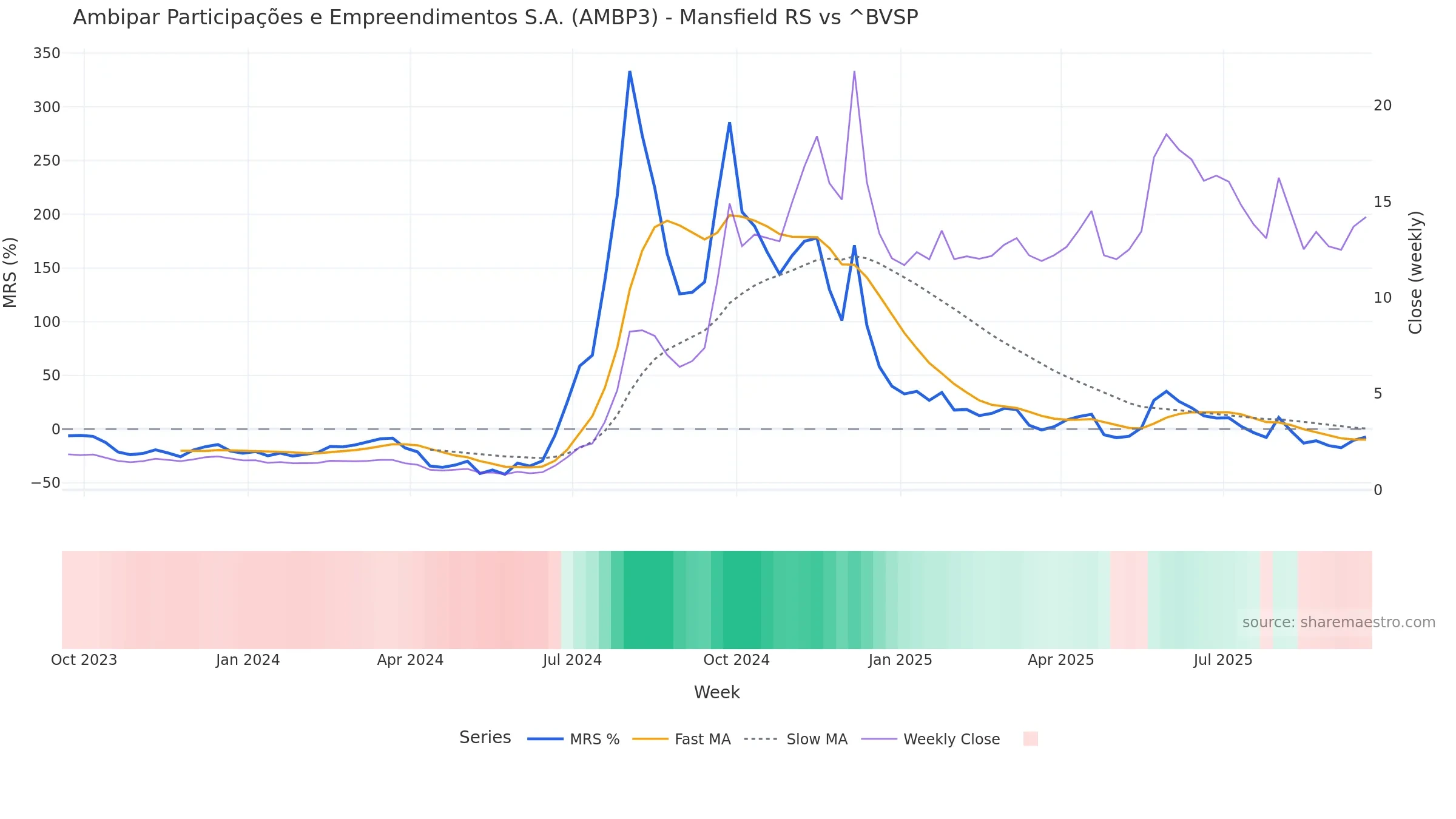

Relative strength is Negative

(< 0%, underperforming).

Latest MRS: -7.42% (week ending Fri, 19 Sep 2025).

Slope: Falling over 8w.

Notes:

- Below zero line indicates relative weakness vs benchmark.

- MRS slope falling over ~8 weeks.

Conclusion

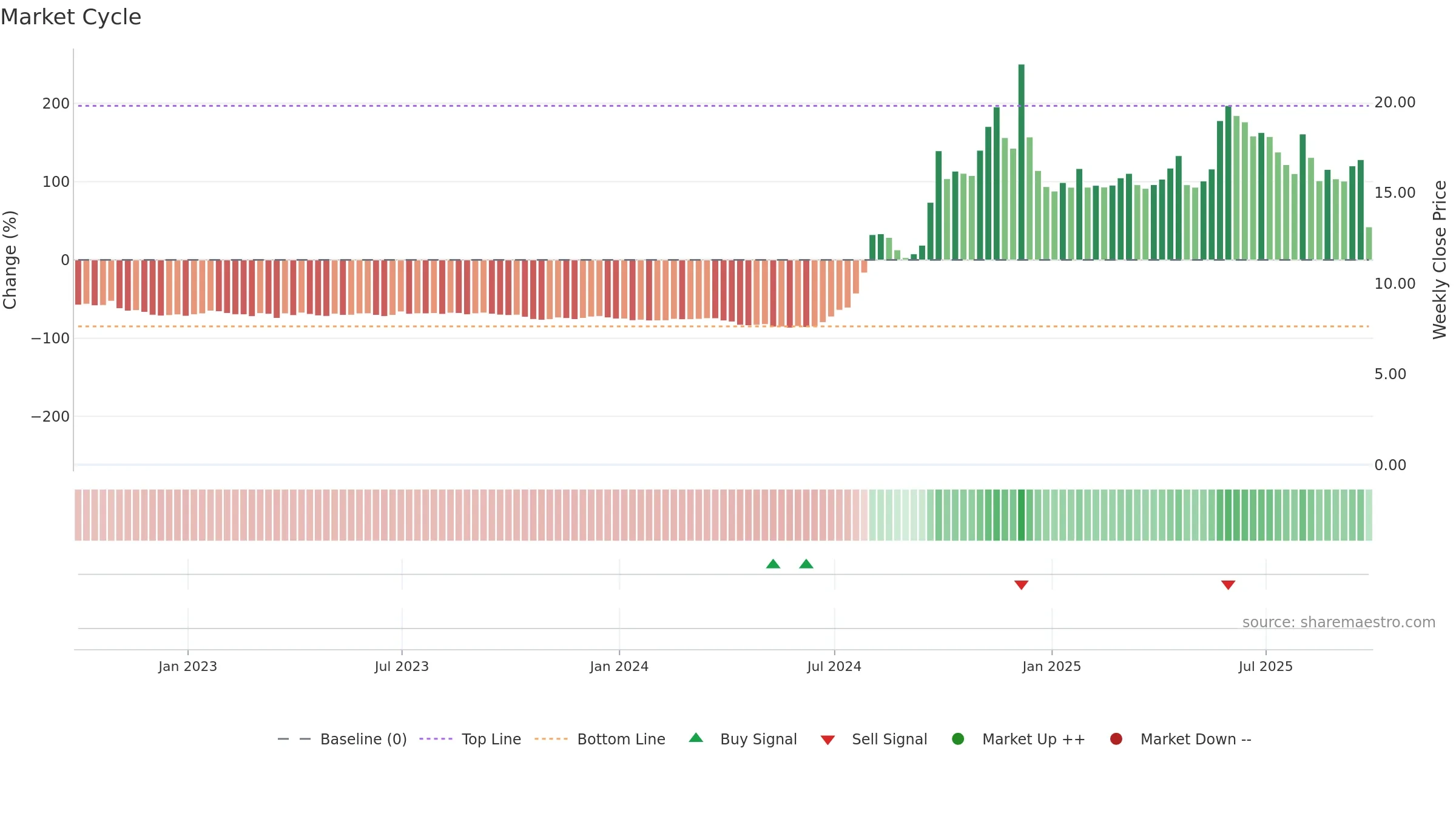

Negative setup. ⯪☆☆☆☆ confidence. Trend: Downtrend Confirmed · -38.41% over window · vol 13.83% · liquidity divergence · posture below · RS weak

- Bearish control with falling momentum

- Momentum is weak/falling

- Price is not above key averages

- Weak moving-average stack

Why: Price window -38.41% over w. Close is -38.41% below the prior-window high. Return volatility 13.83%. Volume trend rising. Liquidity divergence with price. Trend state downtrend confirmed. MA stack weak. Momentum bearish and falling.

Tip: Most metrics include a hover tooltip where they appear in the report.