Pearson plc

PSON LSE

Weekly Report

Pearson plc closed at 1039.0000 (-0.24% WoW) . Data window ends Fri, 19 Sep 2025.

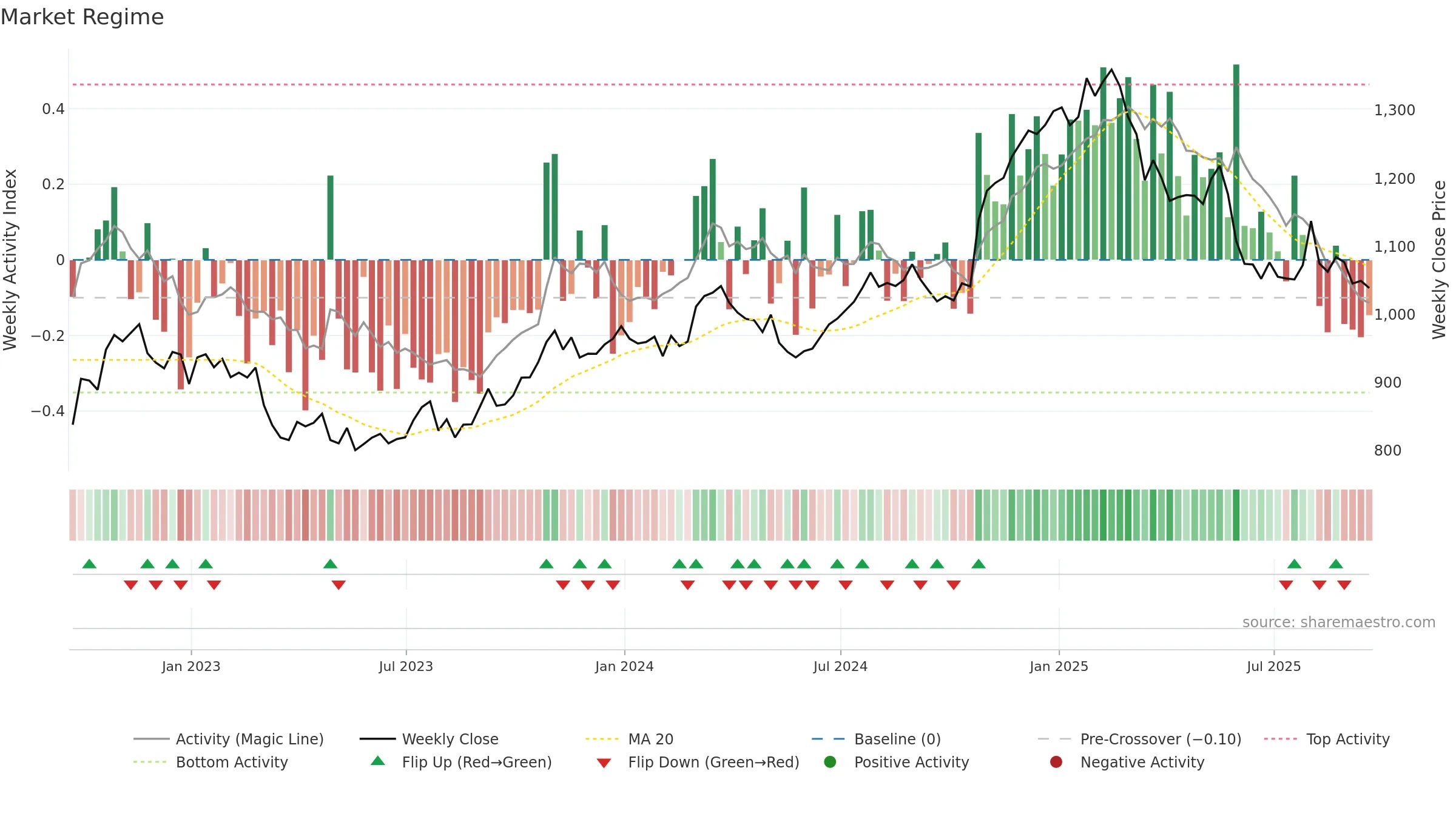

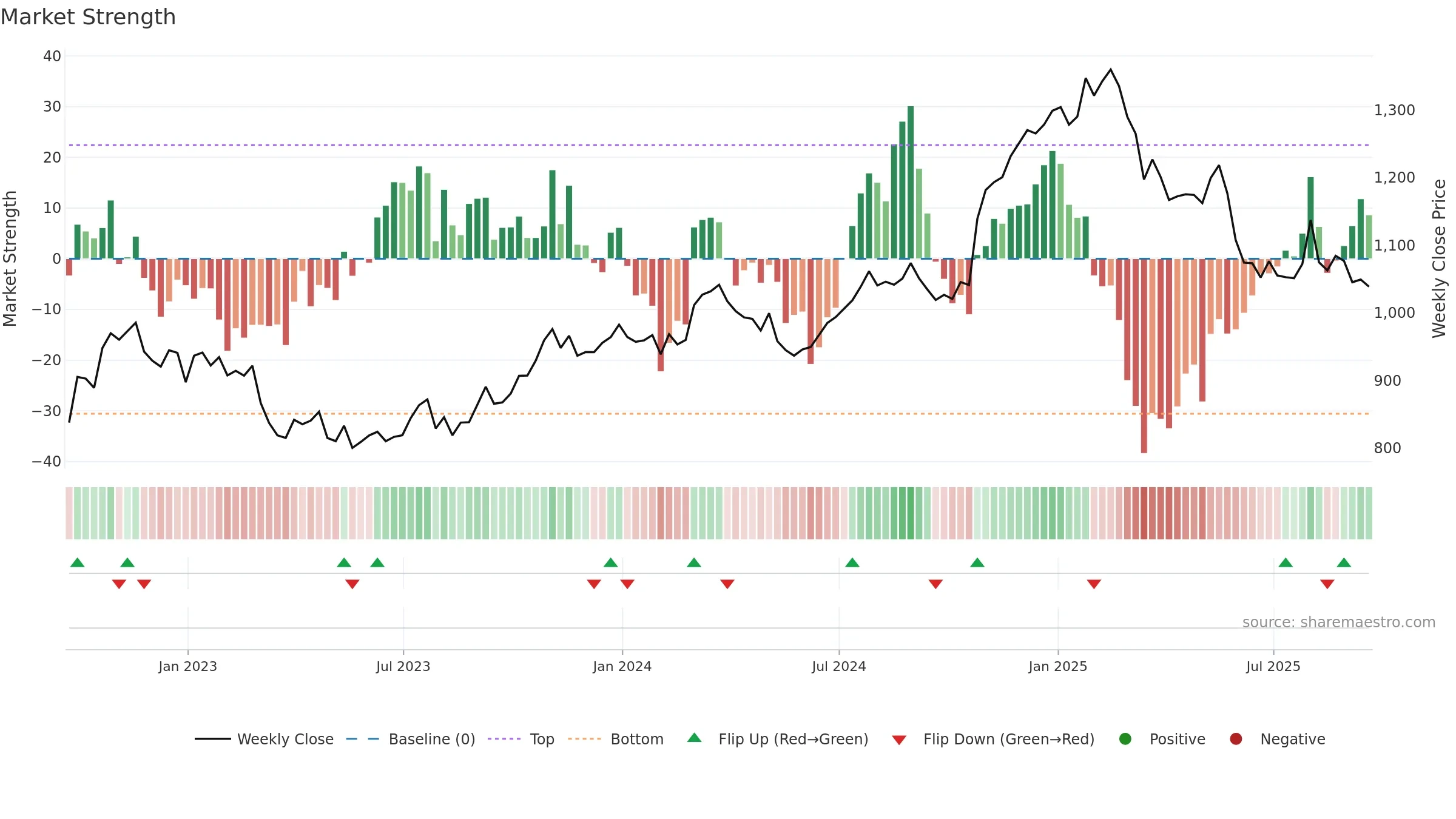

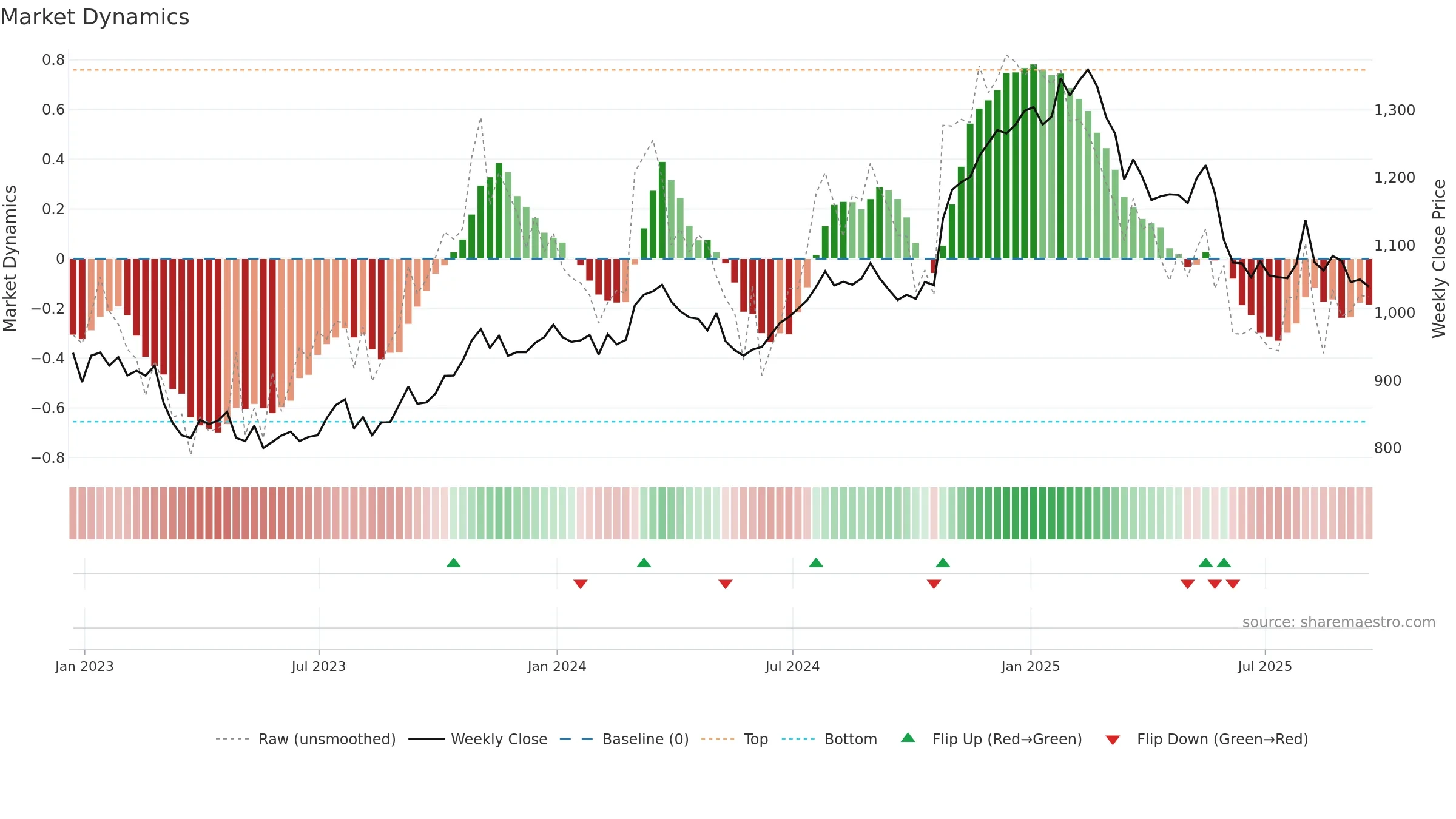

How to read this — Price slope is downward, indicating persistent supply pressure. Low weekly volatility favours steadier follow-through. Volume and price are moving in the same direction — a constructive confirmation. Distance to baseline is narrowing — reverting closer to its fair-value track. Price sits below key averages, keeping pressure on the tape.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

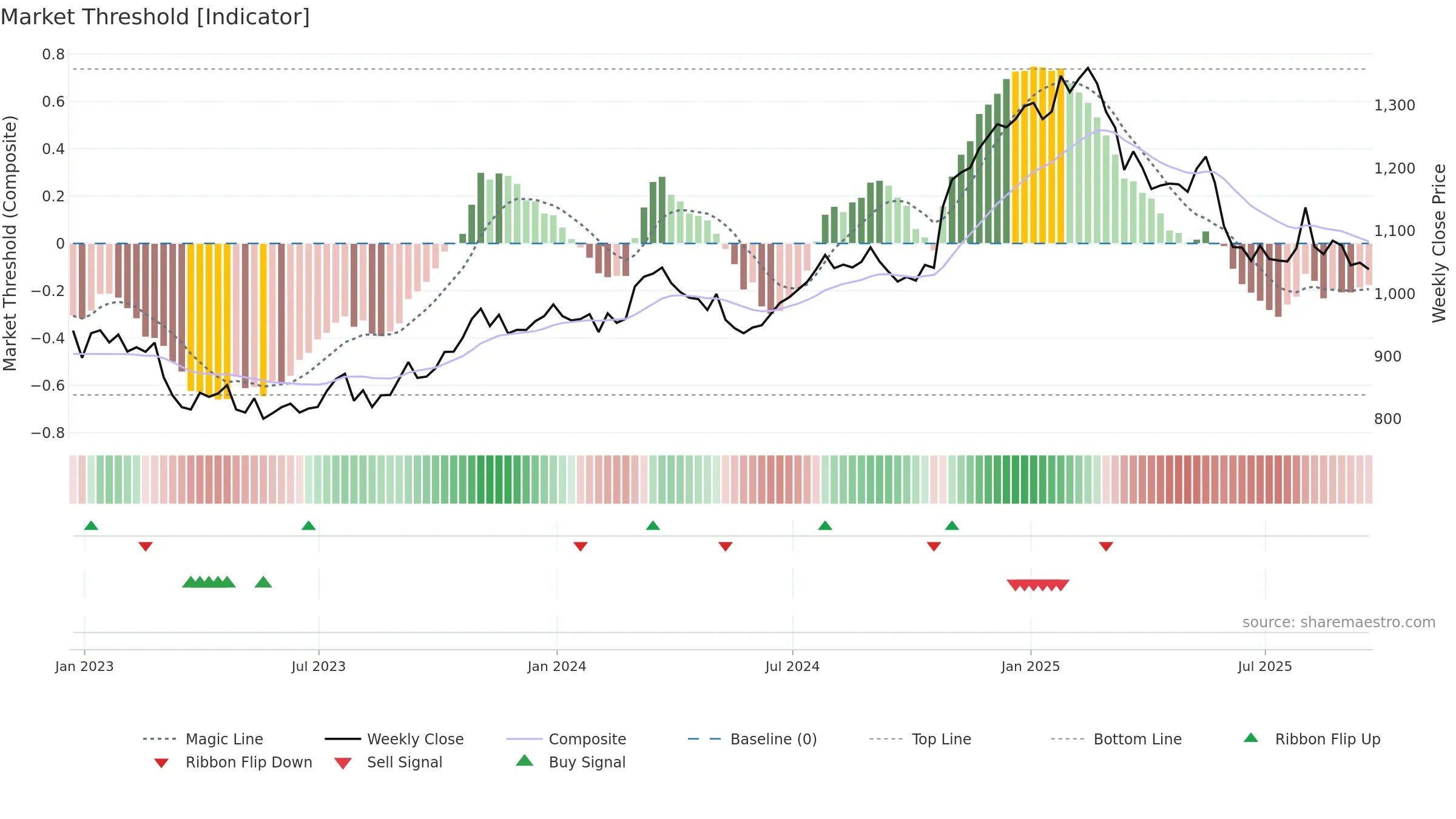

Gauge maps the trend signal to a 0–100 scale.

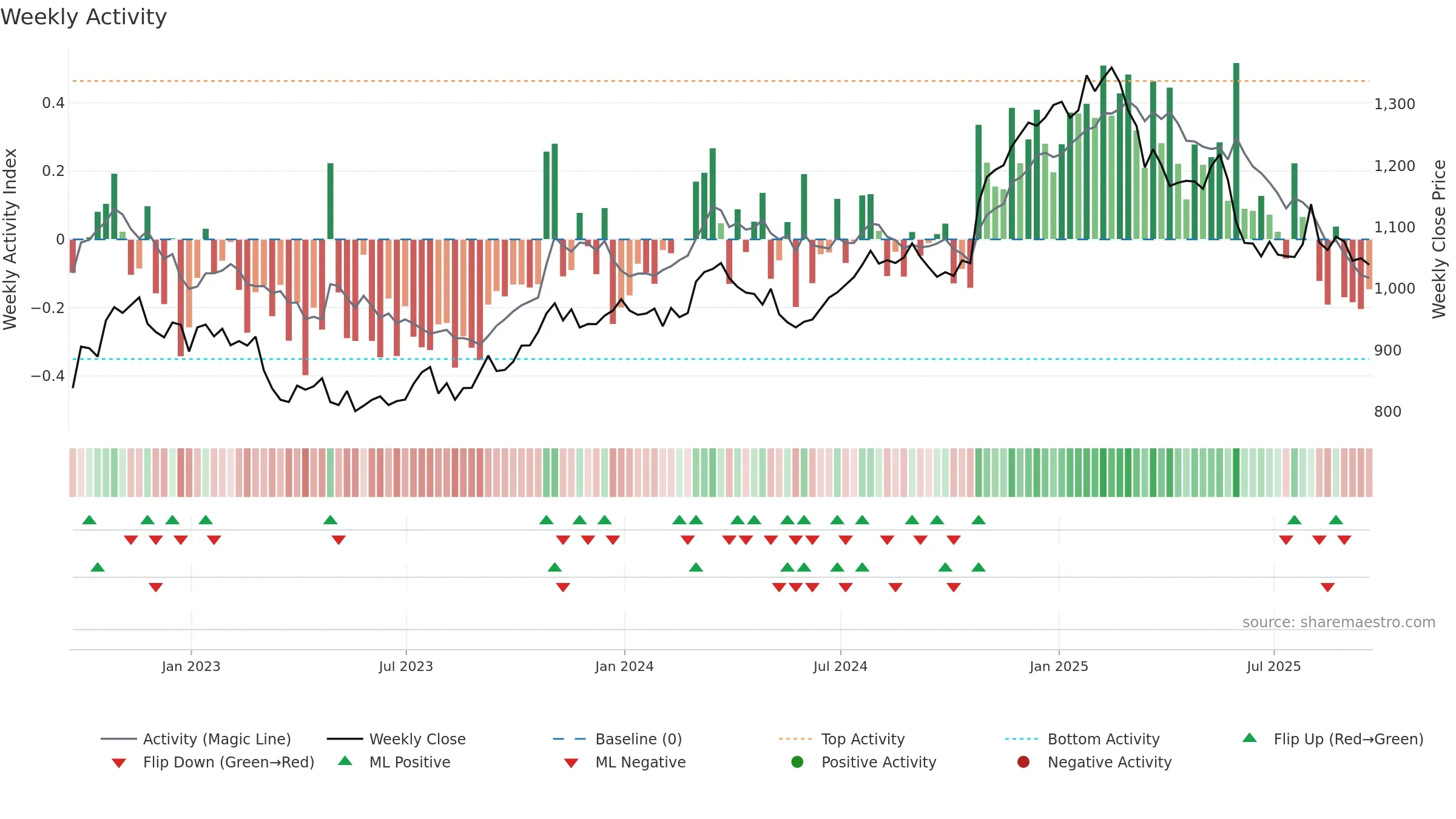

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

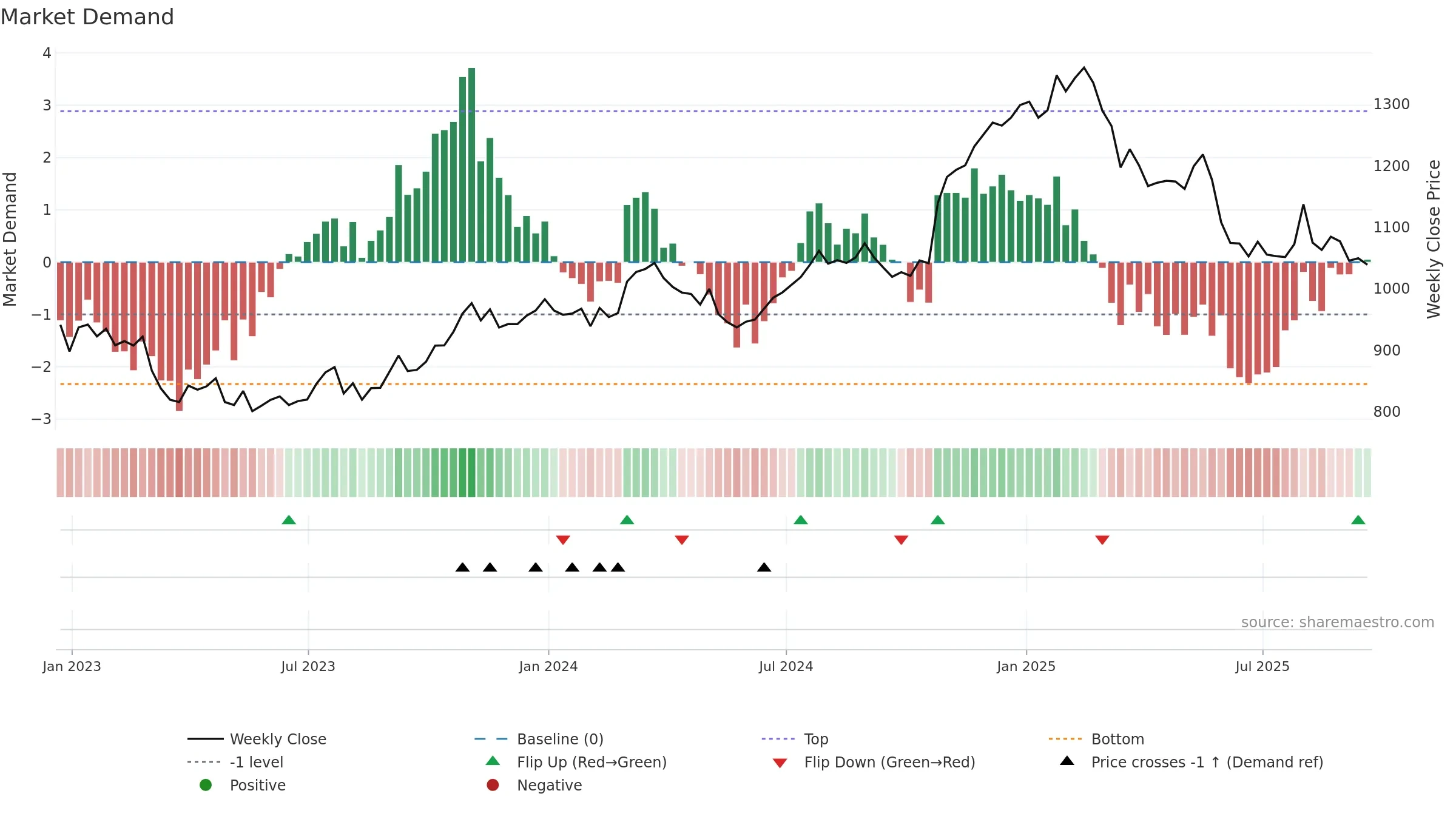

Price is below fair value; potential upside if momentum constructive.

Conclusion

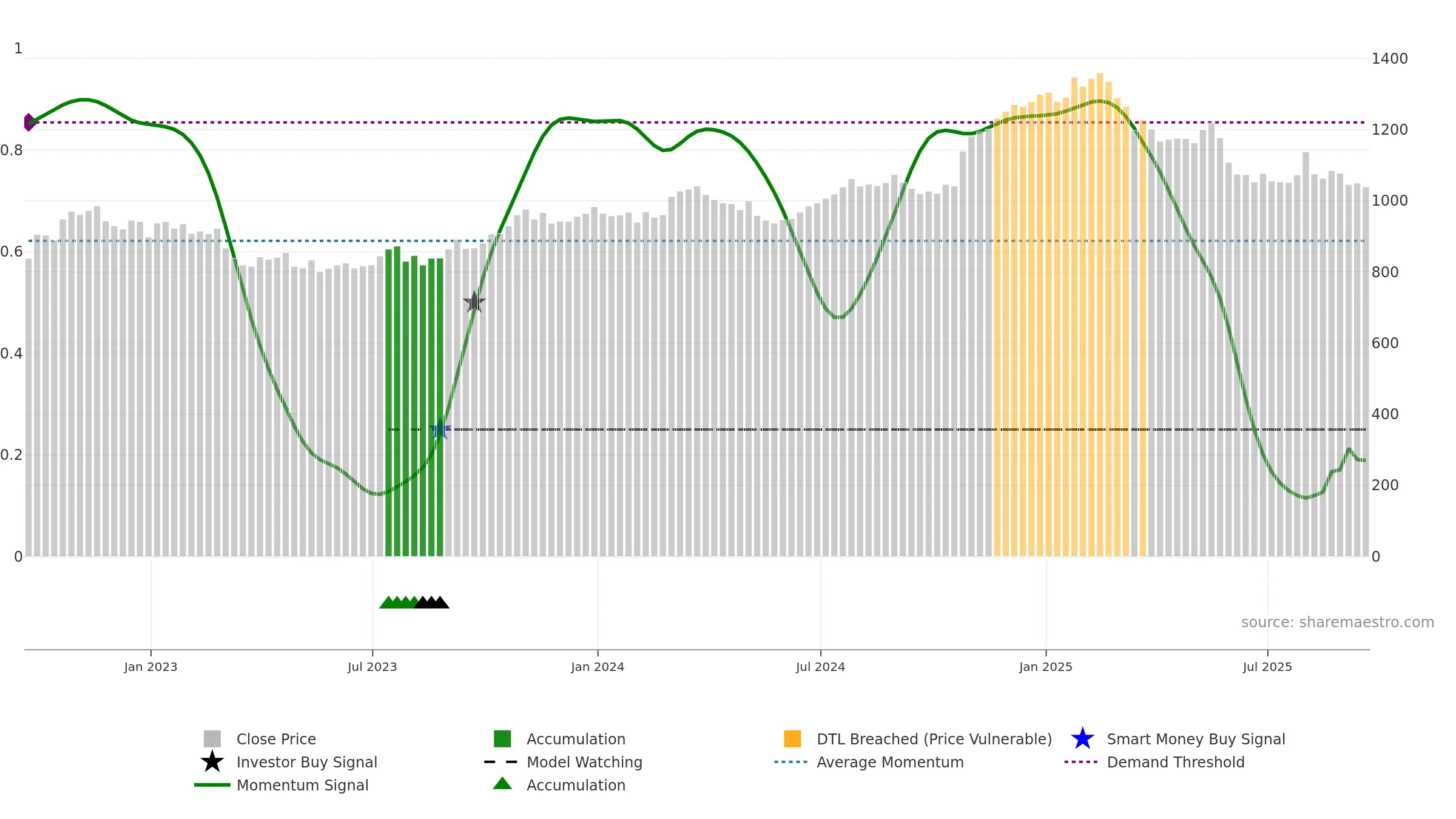

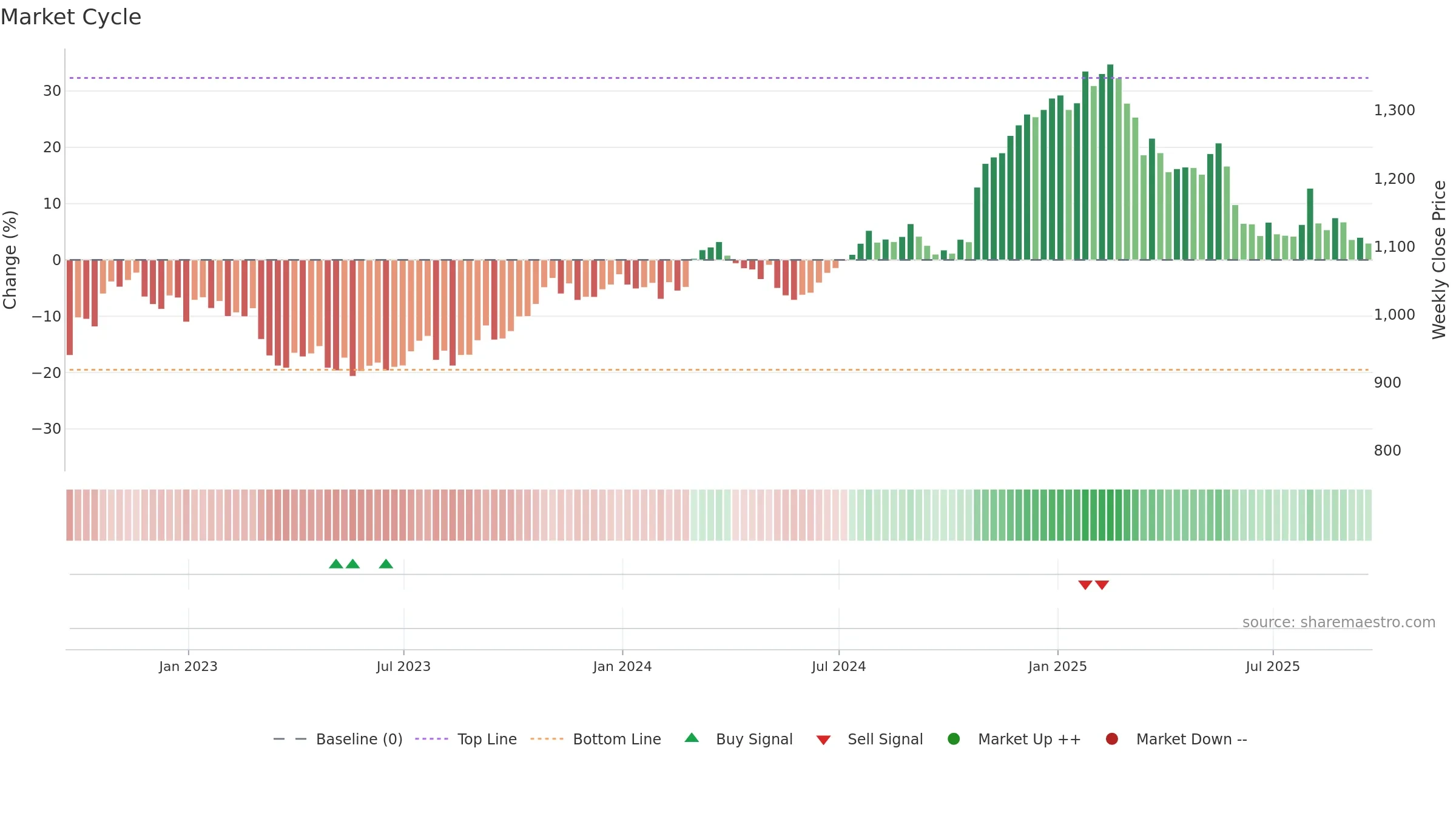

Neutral setup. ★★★☆☆ confidence. Price window: -8. Trend: Range / Neutral; gauge 18. In combination, liquidity confirms the move.

- Liquidity confirms the price trend

- Low return volatility supports durability

- Buyers step in at depressed levels (accumulation)

- Momentum is weak/falling

- Price is not above key averages

- Negative multi-week performance

Why: Price window -8.66% over 8w. Close is -8.66% below the prior-window high. Return volatility 0.63%. Volume trend falling. Liquidity convergence with price. Trend state range / neutral. Low-regime (≤0.25) upticks 5/7 (71.0%) • Accumulating. Momentum bearish and rising. Valuation supportive skew.

Tip: Most metrics include a hover tooltip where they appear in the report.