FRP Advisory Group plc

FRP LSE

Weekly Report

FRP Advisory Group plc closed at 144.0000 (2.13% WoW) . Data window ends Fri, 19 Sep 2025.

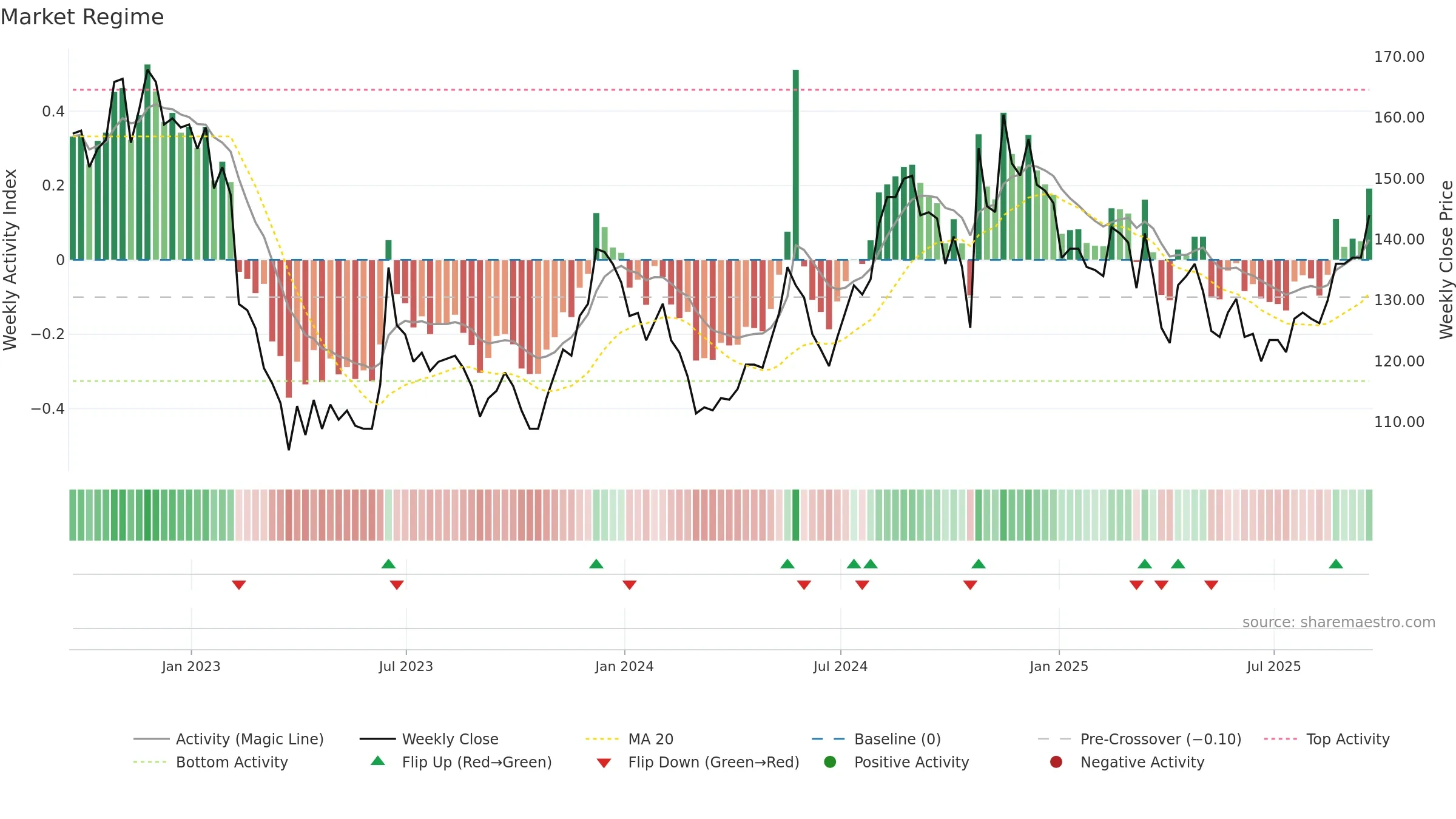

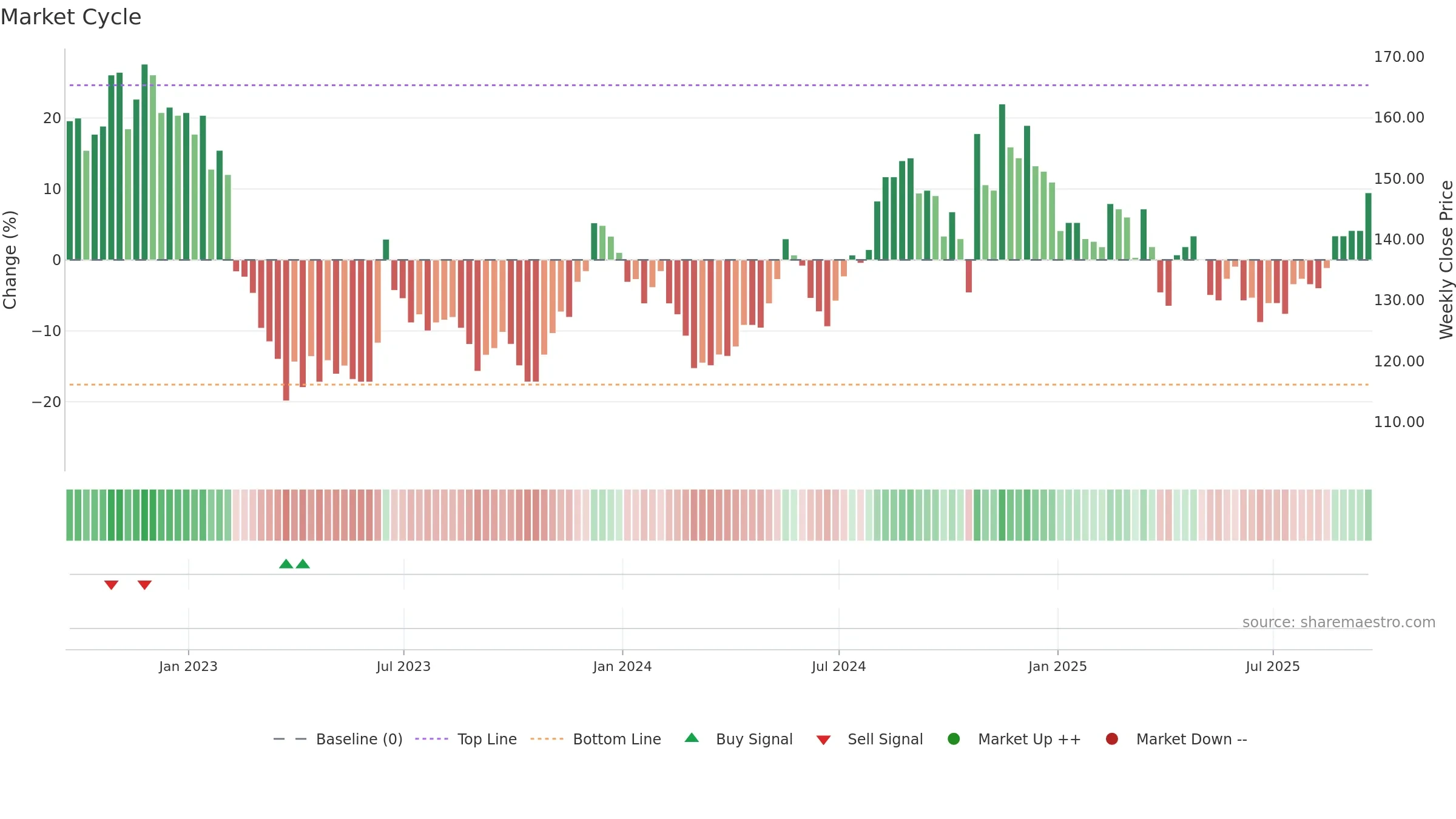

How to read this — Price slope is upward, indicating persistent buying over the window. Low weekly volatility favours steadier follow-through. Volume trend diverges from price — watch for fatigue or rotation. Price is stretched above its baseline; consolidation risk rises if activity fades. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region. Price holds above key averages, indicating constructive participation.

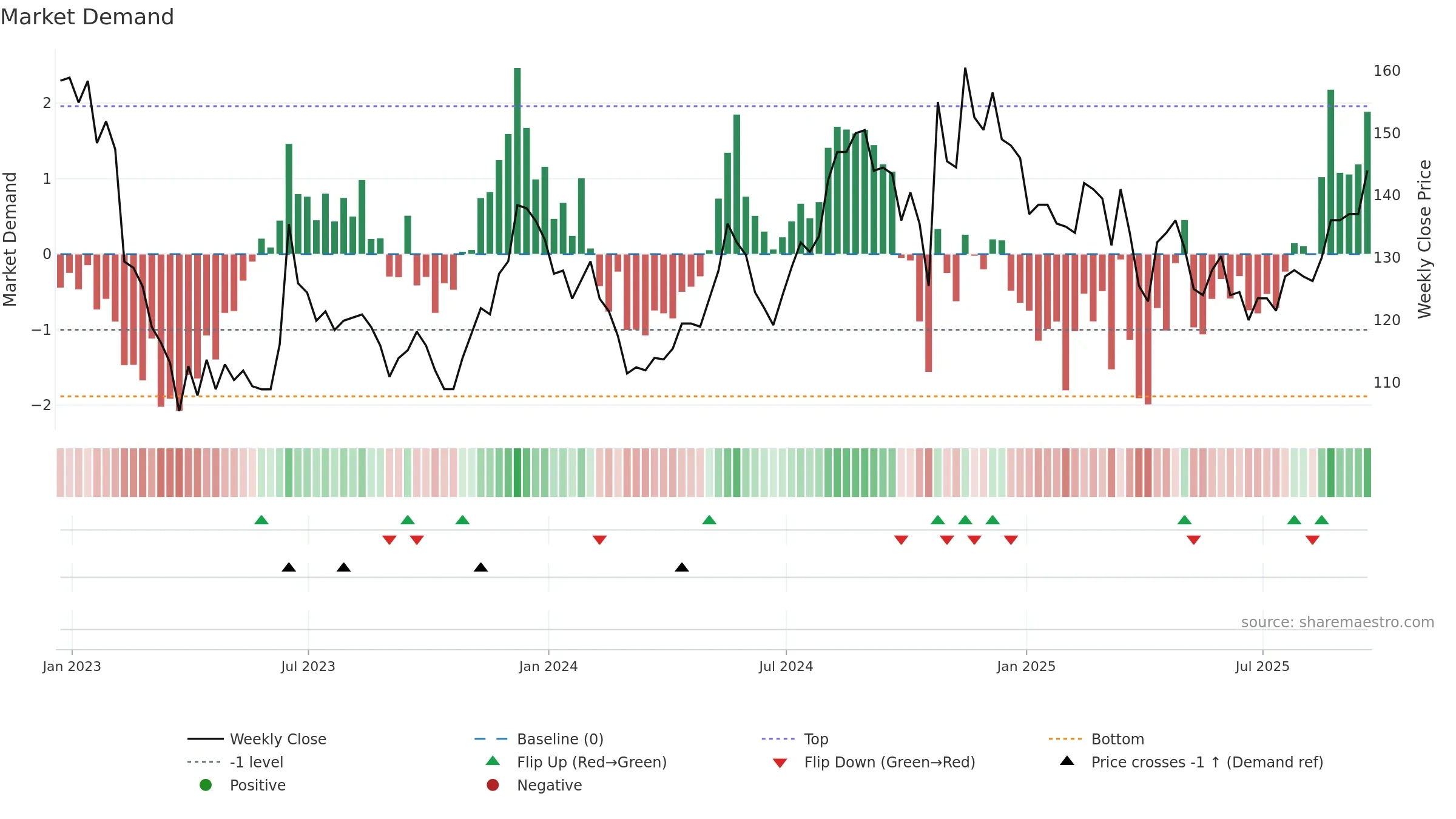

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

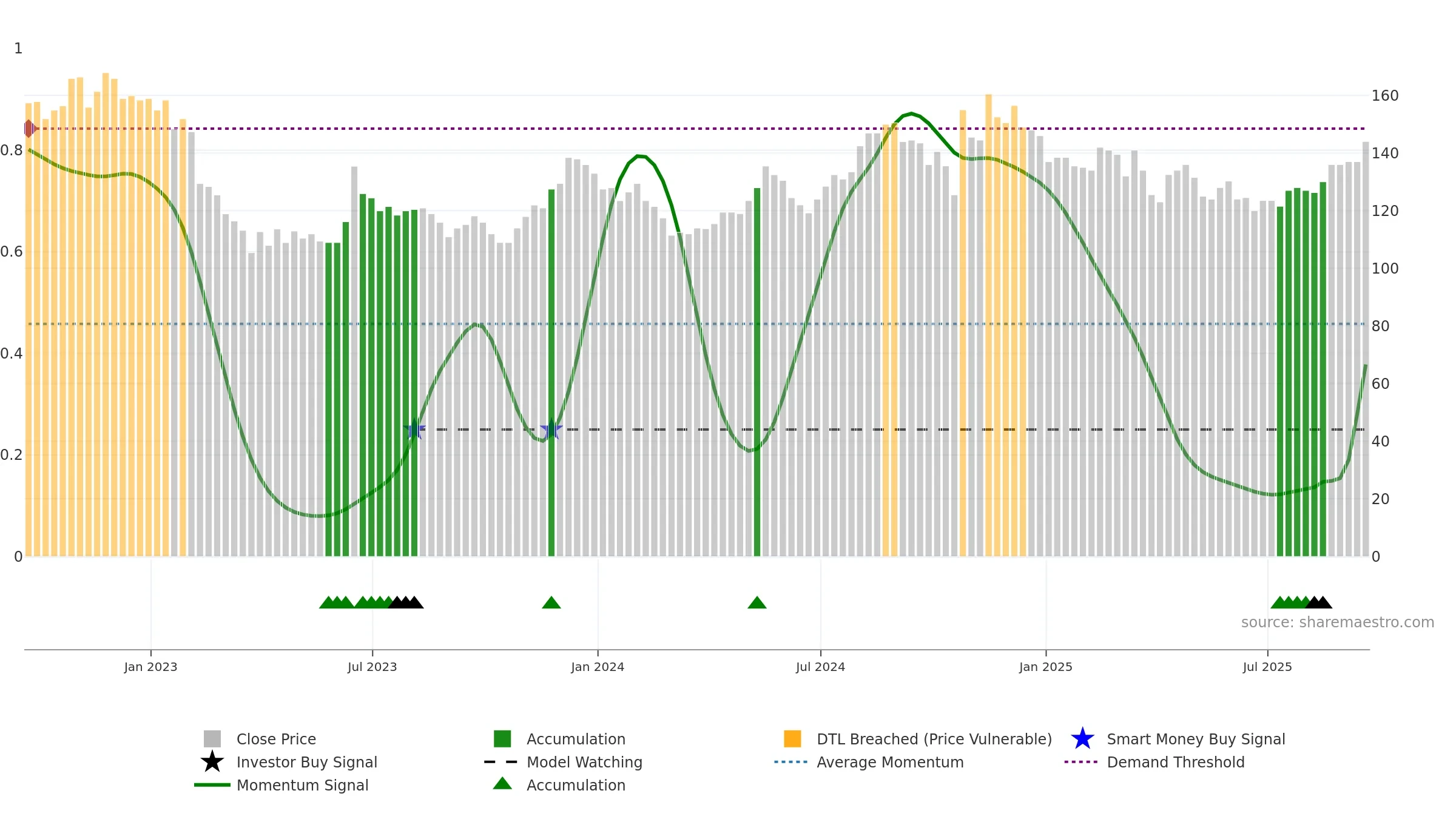

Gauge maps the trend signal to a 0–100 scale.

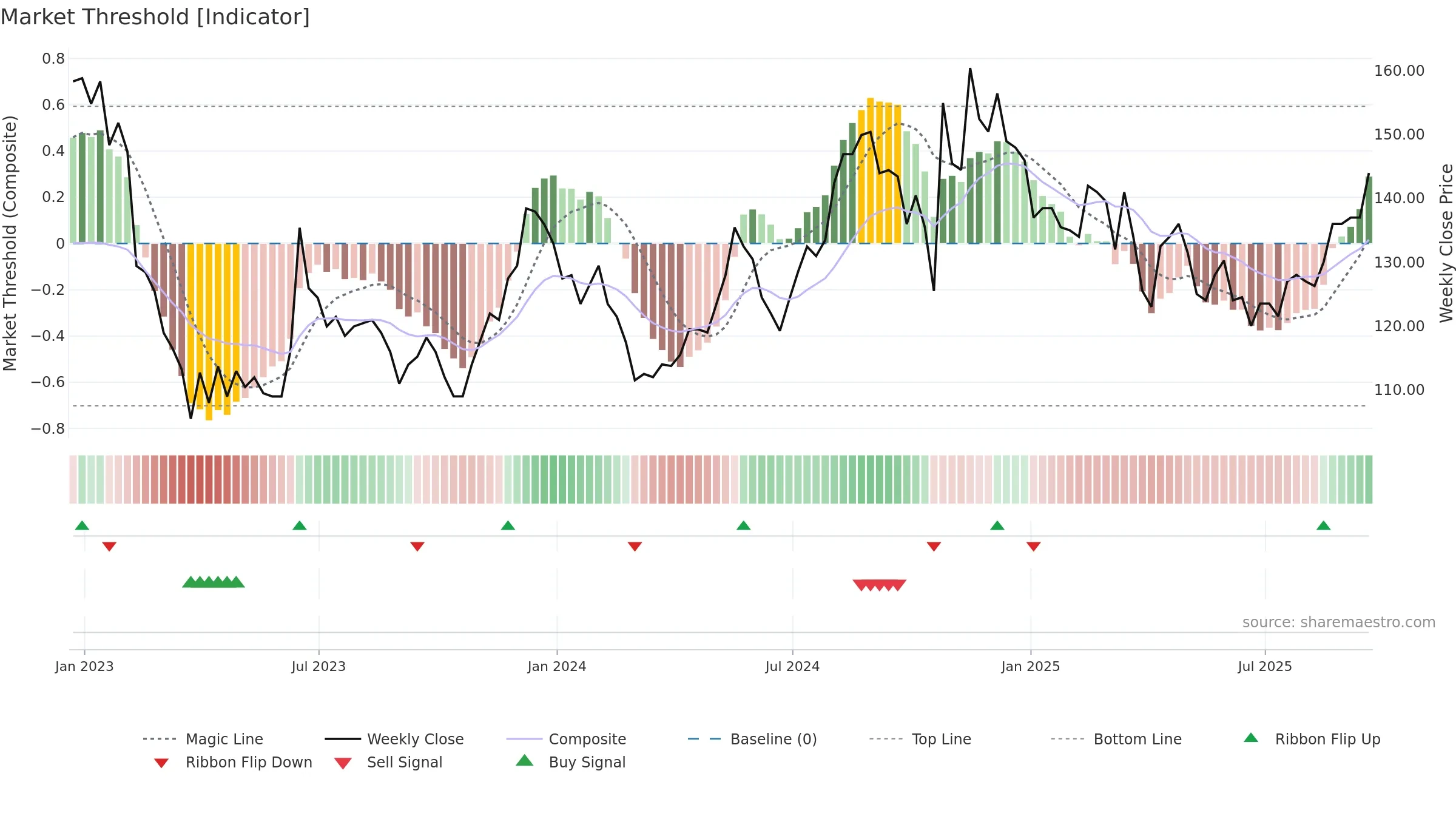

How to read this — Bearish backdrop but short-term momentum is improving; confirmation still needed.

Early improvement — look for a reclaim of 0.50→0.60 to validate.

Price is below fair value; potential upside if momentum constructive.

Conclusion

Positive setup. ★★★★☆ confidence. Price window: 13. Trend: Bottoming Attempt; gauge 37. In combination, liquidity diverges from price.

- Early improvement from bearish zone (bottoming attempt)

- Price holds above 8w & 26w averages

- Constructive moving-average stack

- Low return volatility supports durability

- Liquidity diverges from price

Why: Price window 13.39% over 8w. Close is 5.11% above the prior-window high. Return volatility 0.96%. Volume trend falling. Liquidity divergence with price. Trend state bottoming attempt. Low-regime (≤0.25) upticks 6/6 (100.0%) • Accumulating. MA stack constructive. Momentum neutral and rising. Valuation supportive skew.

Tip: Most metrics include a hover tooltip where they appear in the report.