Chongqing Sulian Plastic Co.,Ltd.

301397 SHE

Weekly Report

Chongqing Sulian Plastic Co.,Ltd. closed at 45.1700 (4.97% WoW) . Data window ends Mon, 22 Sep 2025.

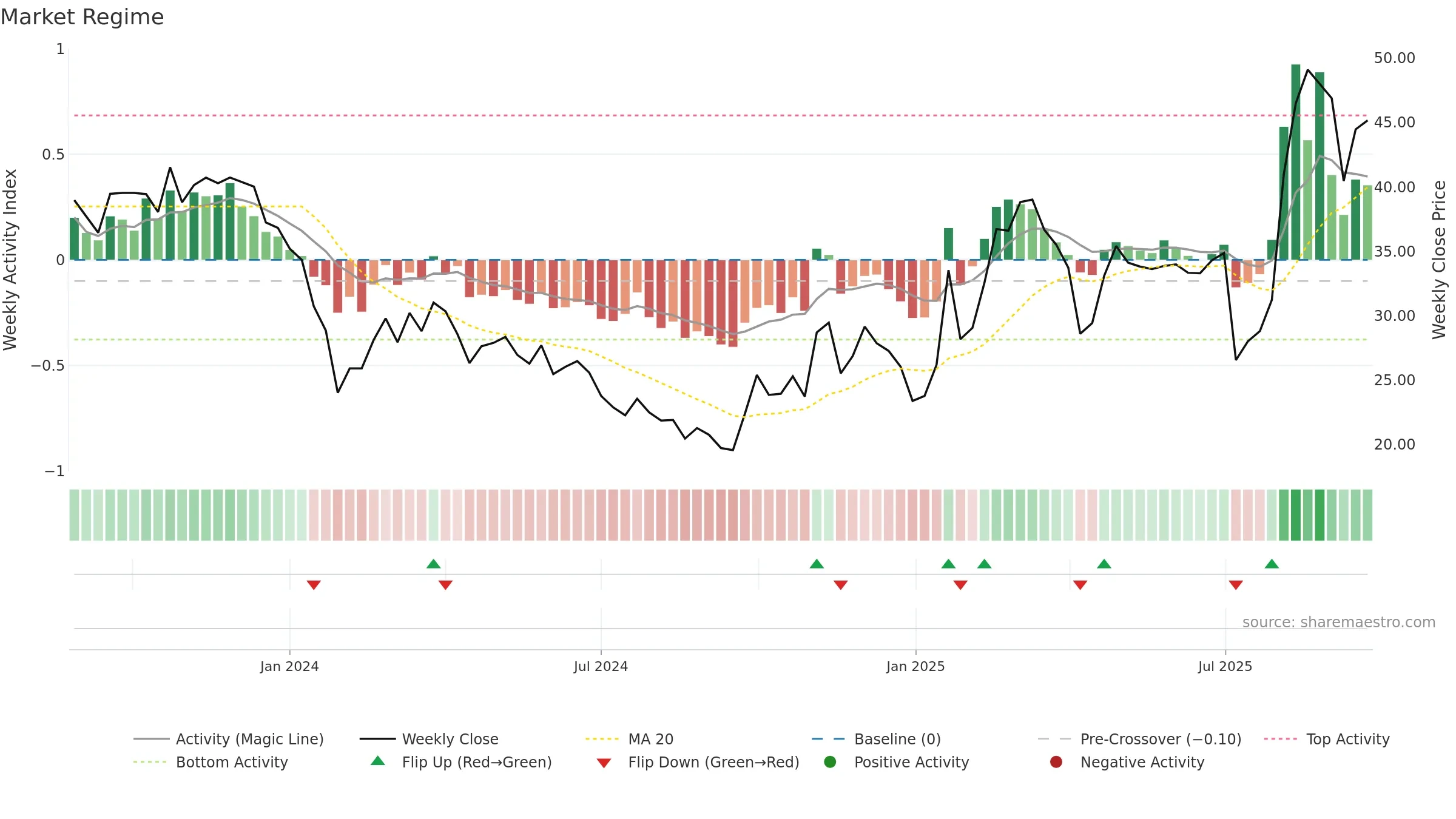

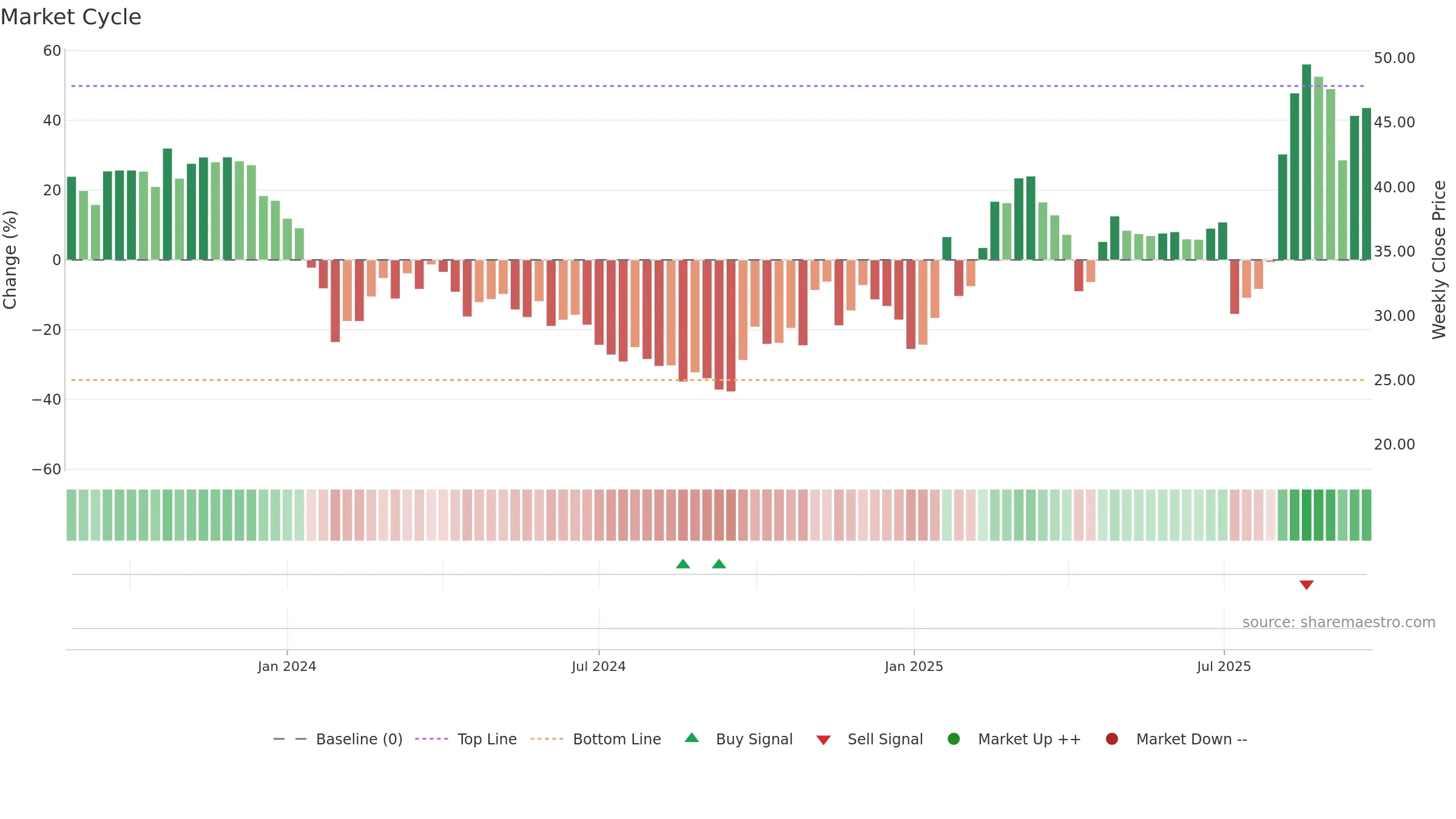

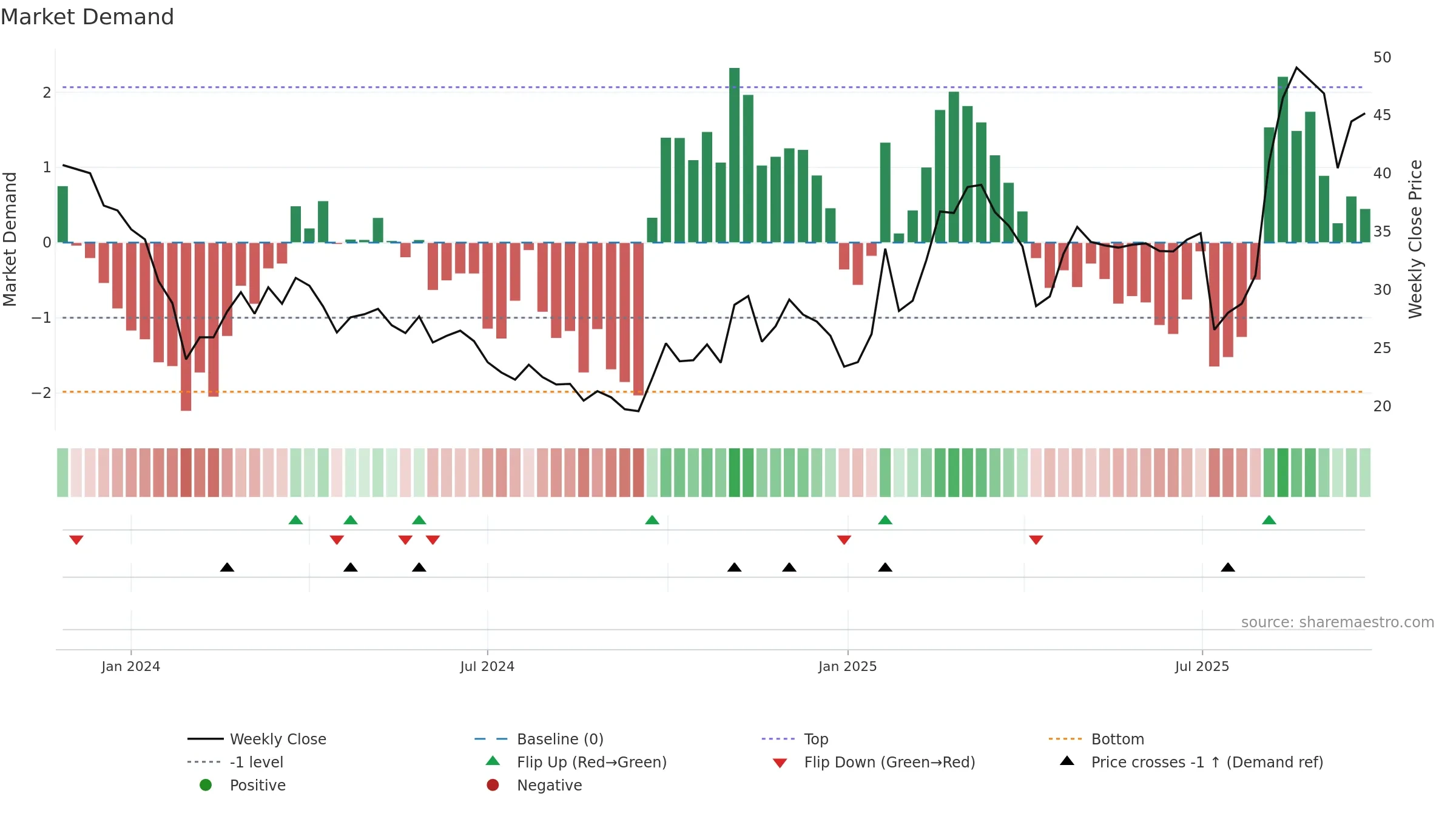

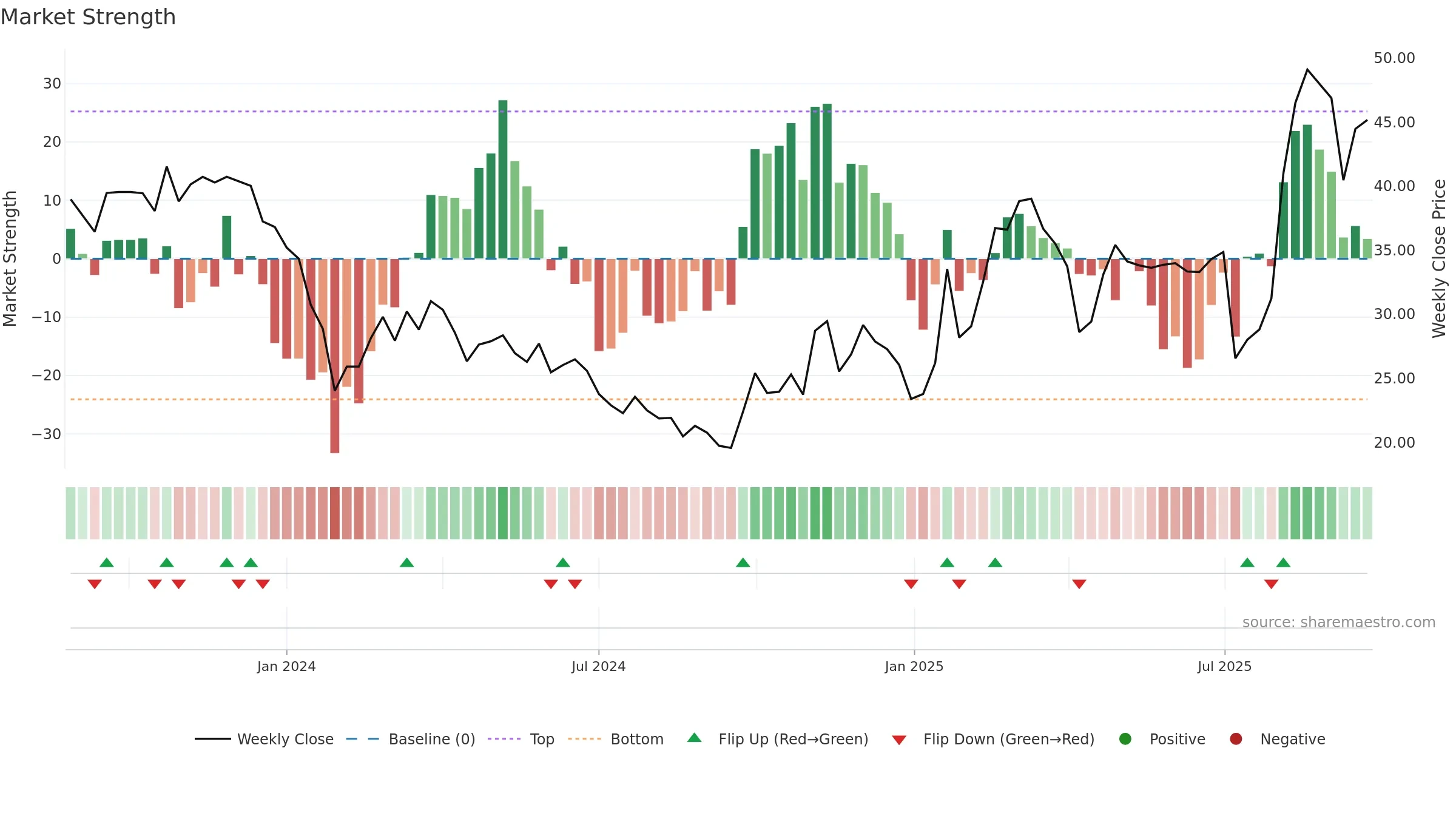

How to read this — Price slope is downward, indicating persistent supply pressure. Elevated weekly volatility increases whipsaw risk. Volume and price are moving in the same direction — a constructive confirmation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Fresh short-term downside crossover weakens near-term tone.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

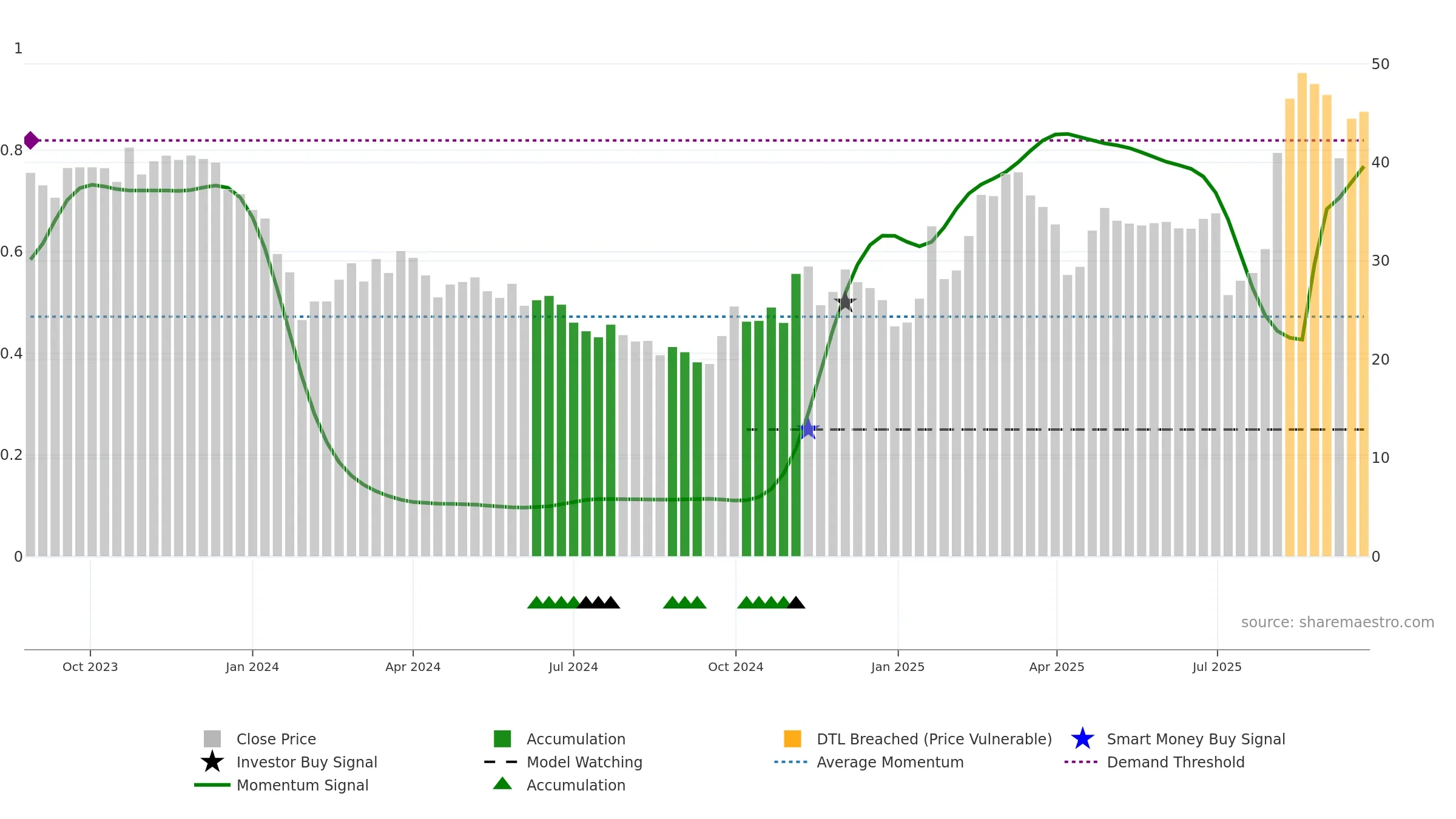

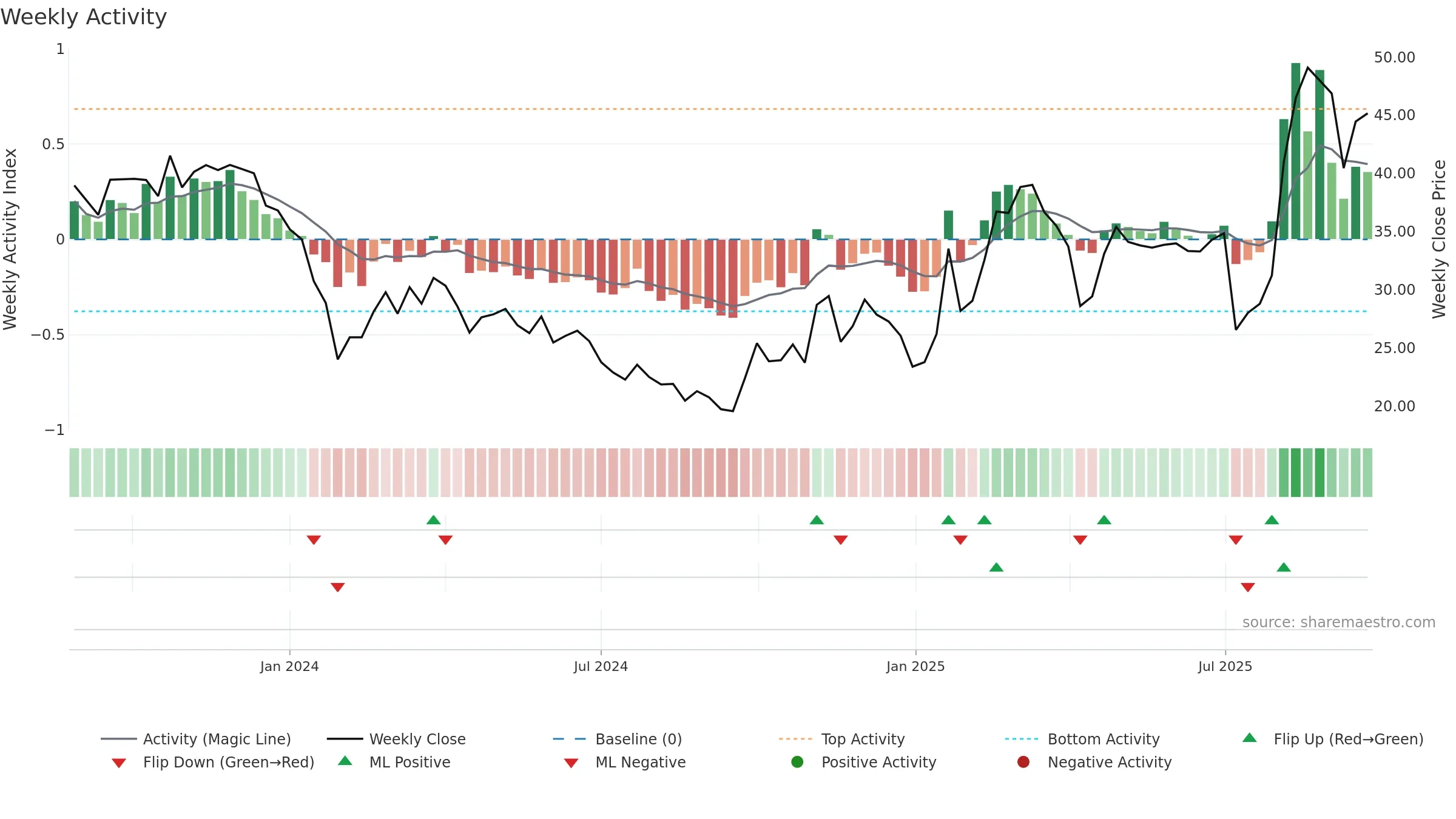

Gauge maps the trend signal to a 0–100 scale.

How to read this — High gauge and rising momentum — buyers in control.

Bias remains higher; pullbacks could be buyable if participation holds.

Price is above fair value; upside may be capped without catalysts.

Conclusion

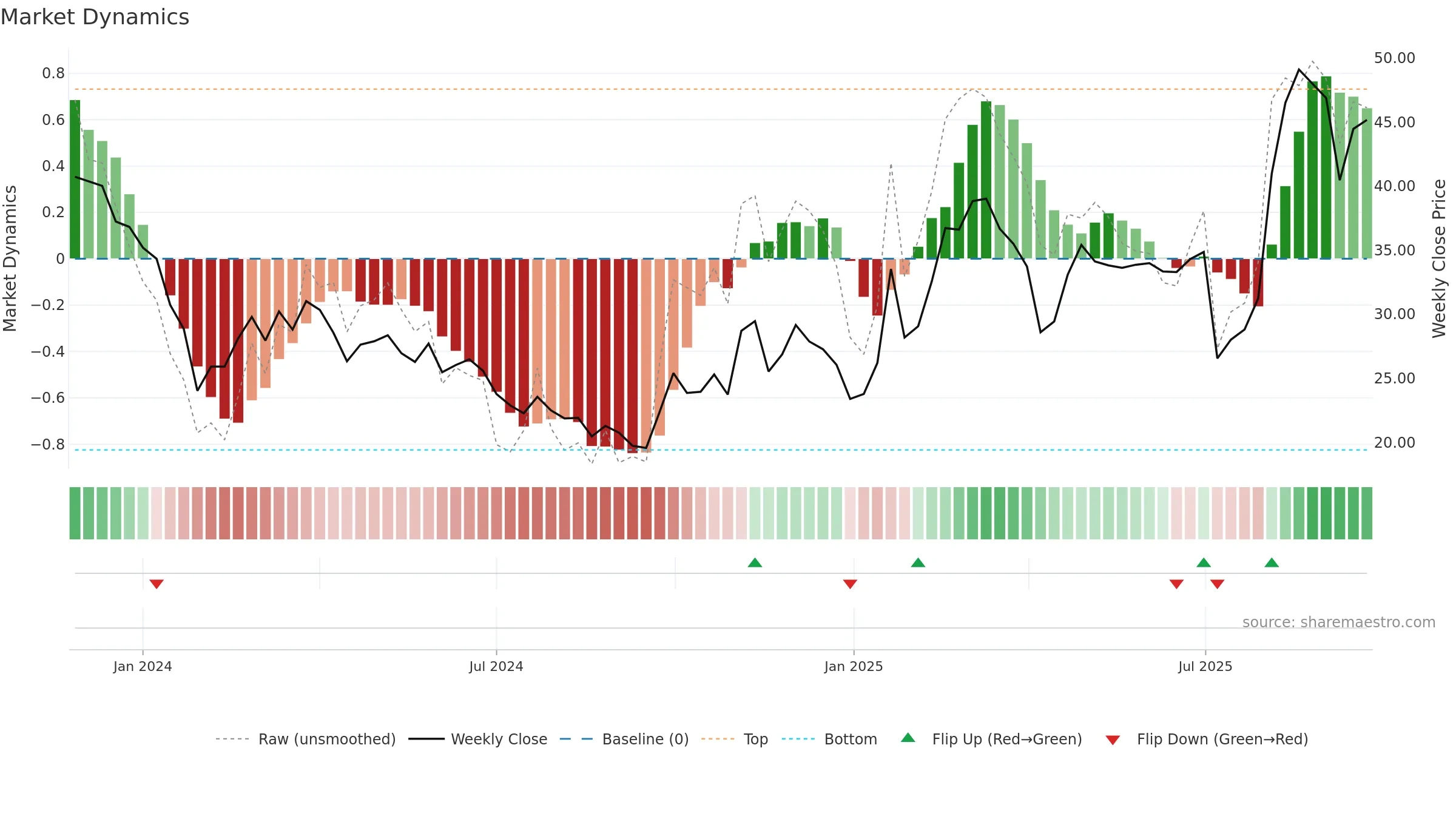

Neutral setup. ★★★☆☆ confidence. Price window: 10. Trend: Strong Uptrend; gauge 76. In combination, liquidity confirms the move.

- High gauge with rising momentum (strong uptrend)

- Momentum is bullish and rising

- Liquidity confirms the price trend

- Solid multi-week performance

- Price is not above key averages

- High return volatility raises whipsaw risk

Why: Price window 10.20% over 8w. Close is -8.00% below the prior-window high. Return volatility 11.57%. Volume trend falling. Liquidity convergence with price. Trend state strong uptrend. 4–8w crossover bearish. Momentum bullish and rising. Valuation limited upside without catalysts.

Tip: Most metrics include a hover tooltip where they appear in the report.