AZZ Inc.

AZZ NYSE

Weekly Summary

AZZ Inc. closed at 113.9200 (-2.52% WoW) . Data window ends Fri, 19 Sep 2025.

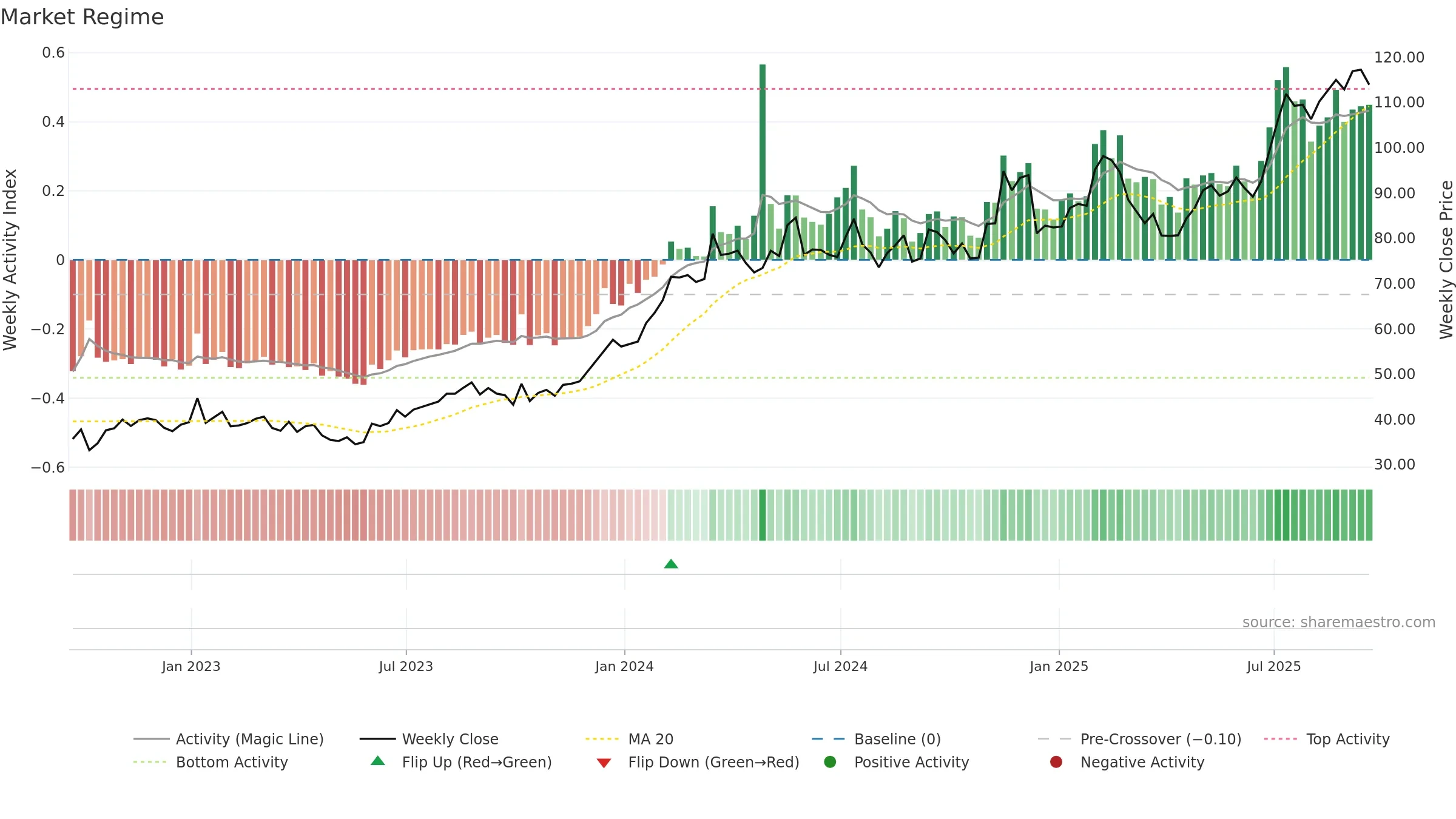

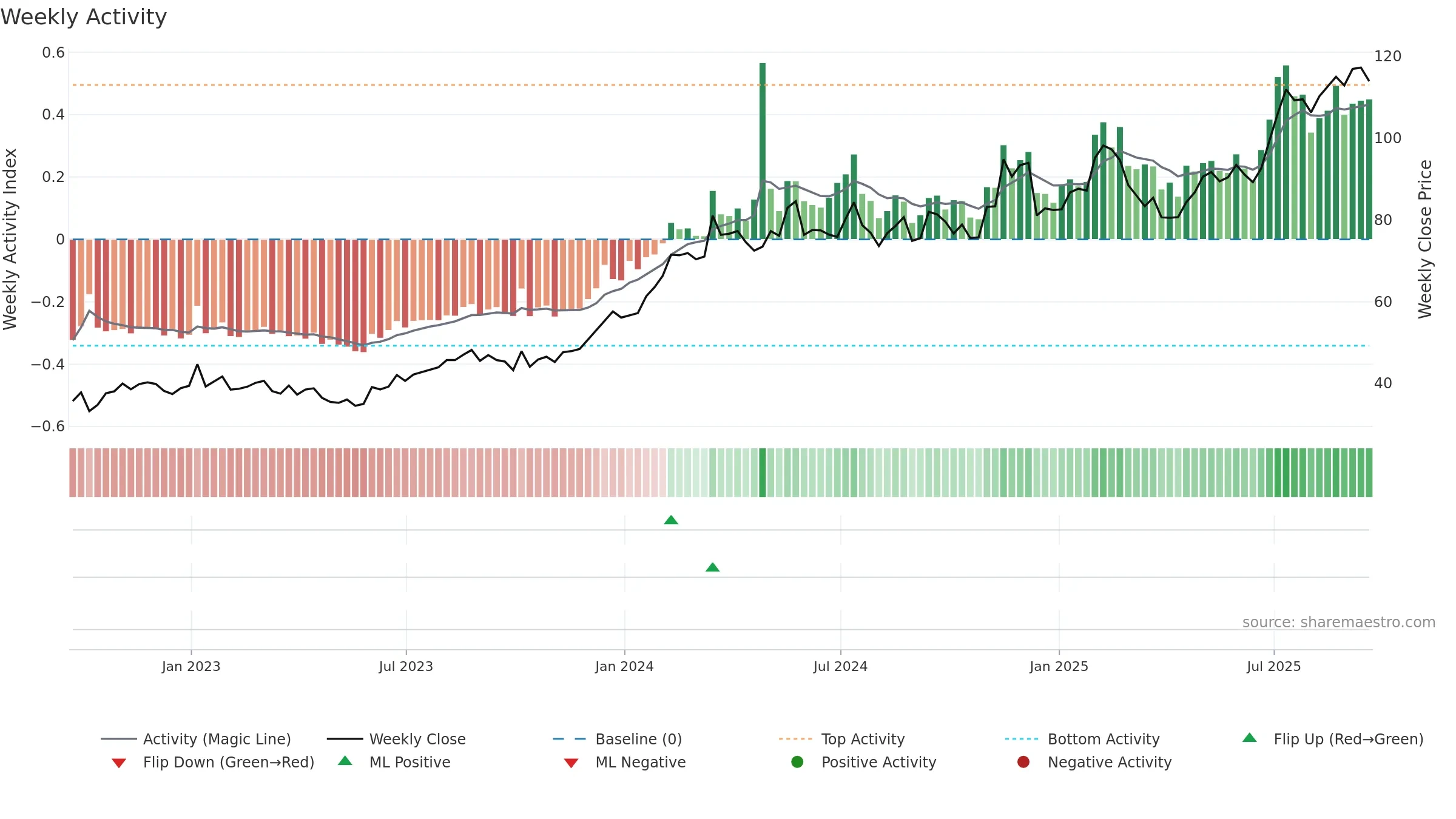

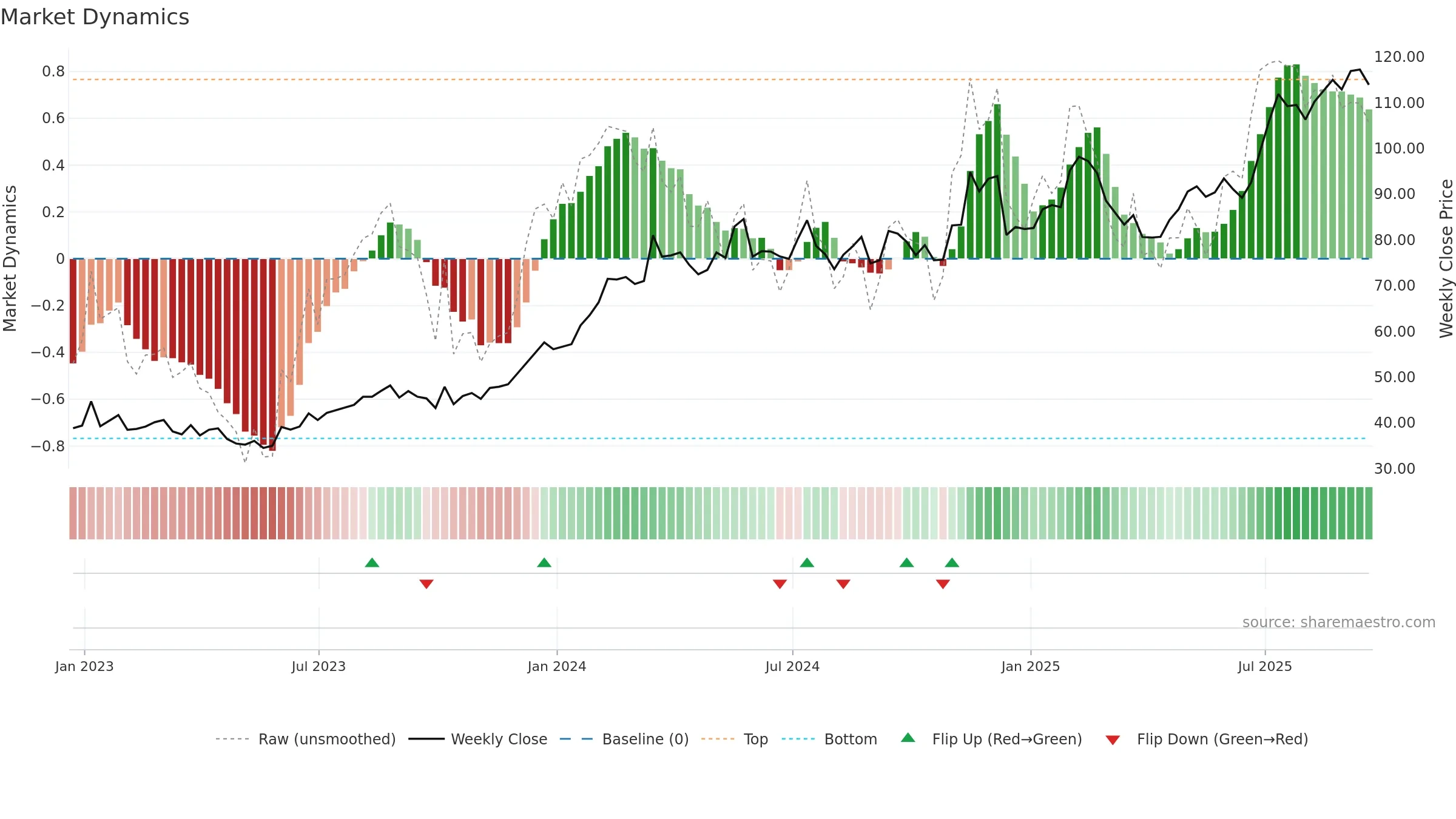

How to read this — Price slope is upward, indicating persistent buying over the window. Low weekly volatility favours steadier follow-through. Volume and price are moving in the same direction — a constructive confirmation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm.

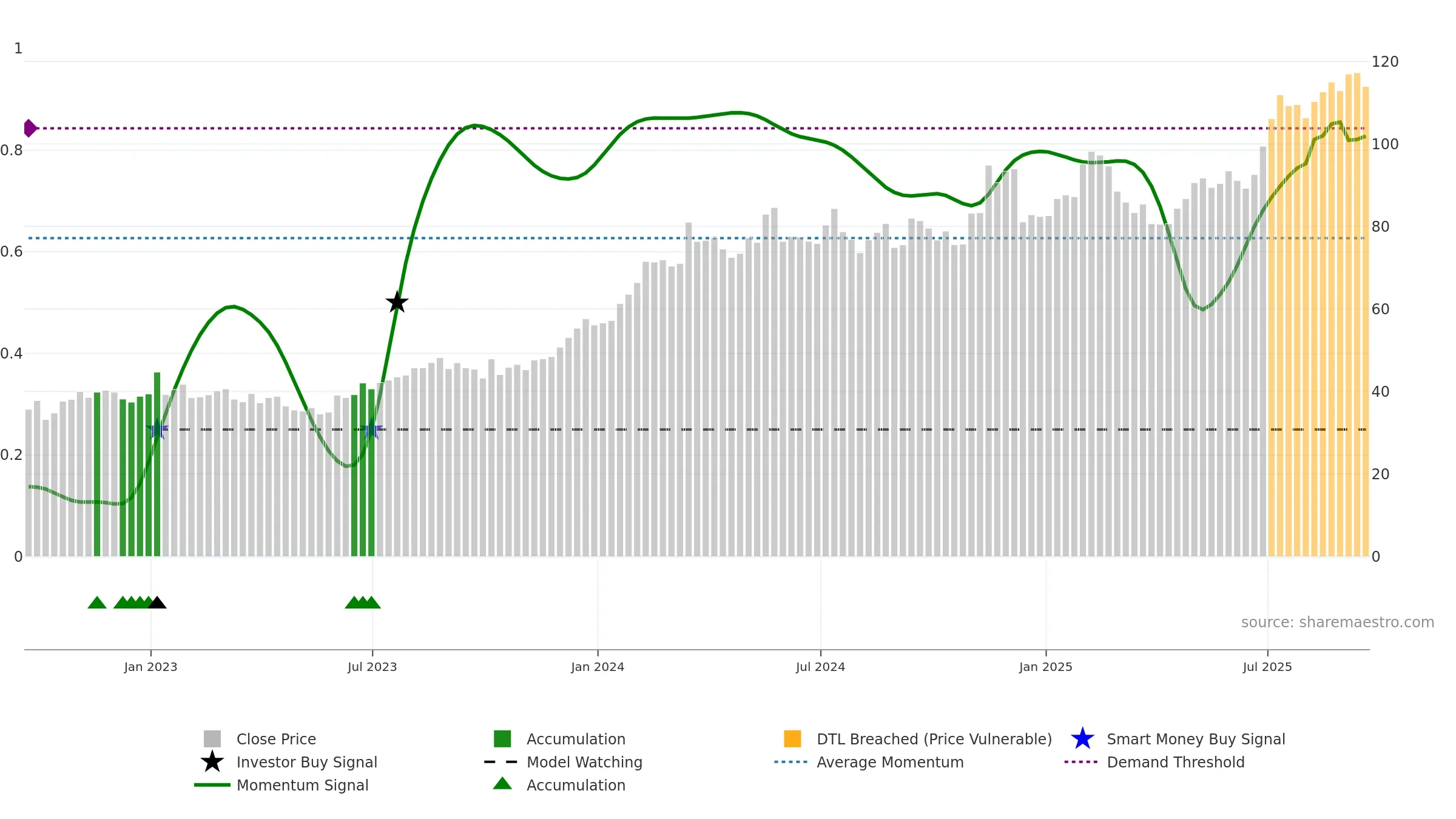

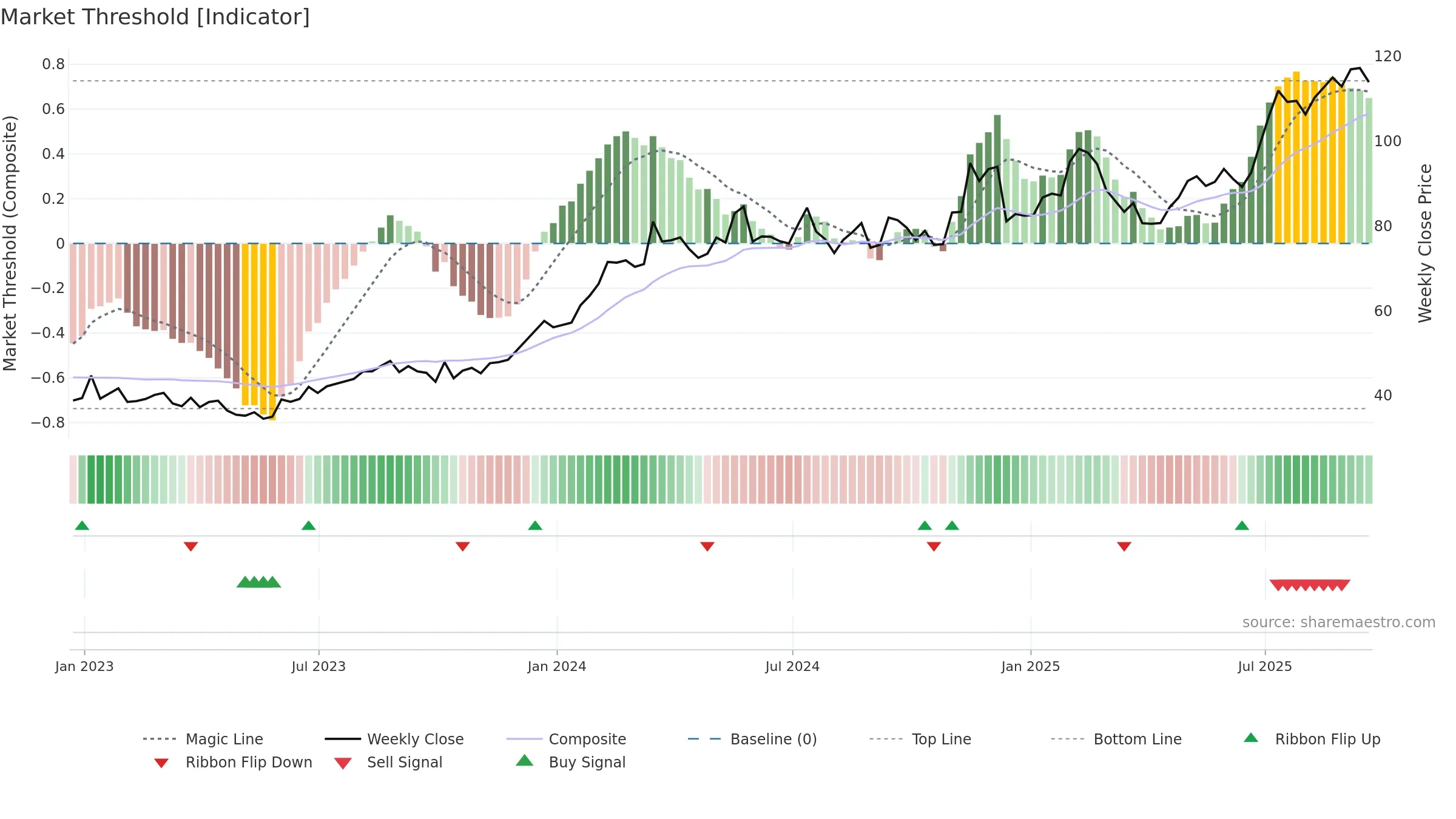

Gauge maps the trend signal to a 0–100 scale.

How to read this — Gauge is elevated but momentum is rolling over; topping risk is rising.

Stay alert: protect gains or seek confirmation before adding risk.

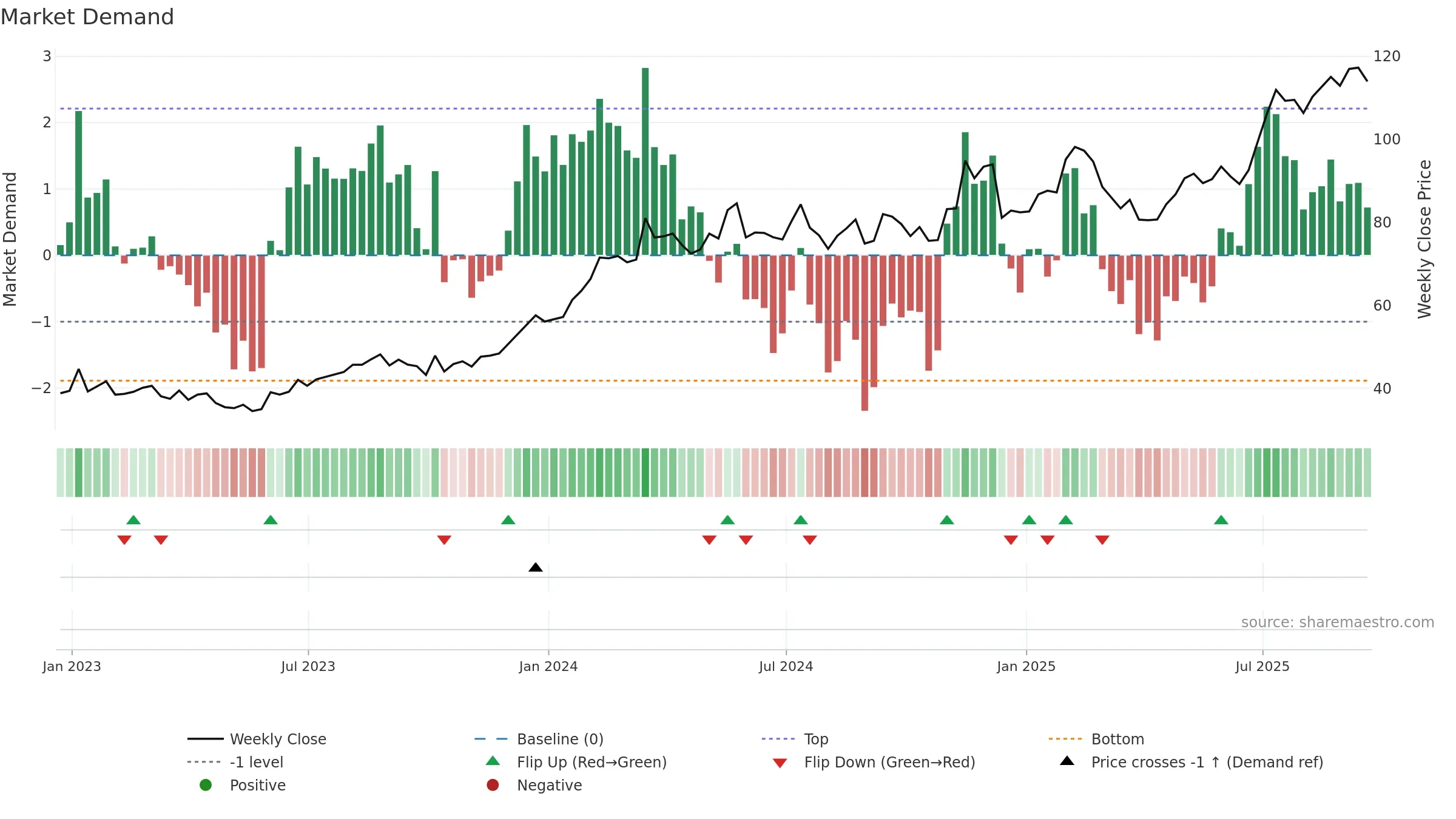

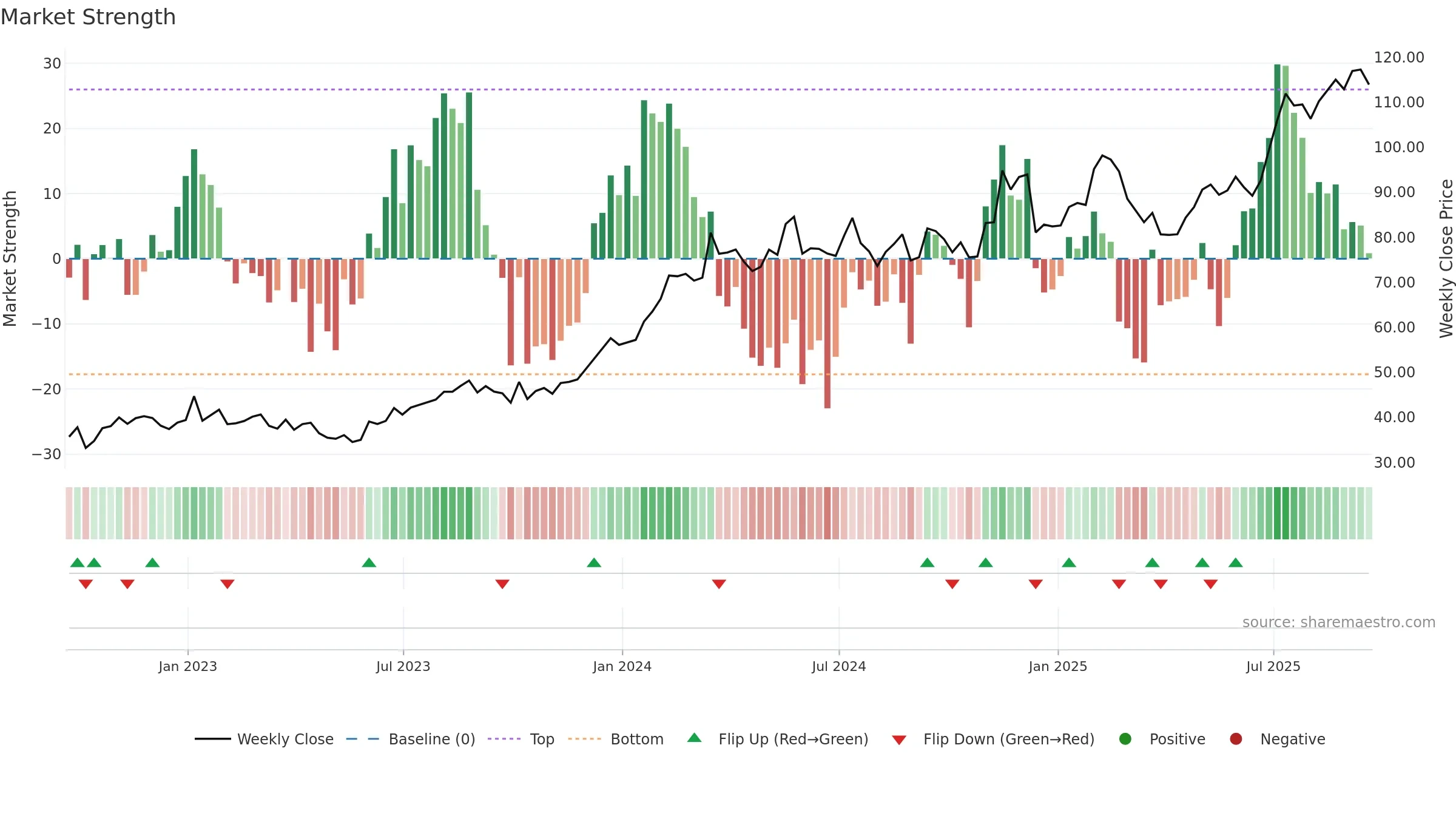

Relative strength is Positive

(> 0%, outperforming).

Latest MRS: 9.20% (week ending Fri, 19 Sep 2025).

Slope: Falling over 8w.

Notes:

- Holding above the zero line indicates relative bid.

- MRS slope falling over ~8 weeks.

Price is above fair value; upside may be capped without catalysts.

Conclusion

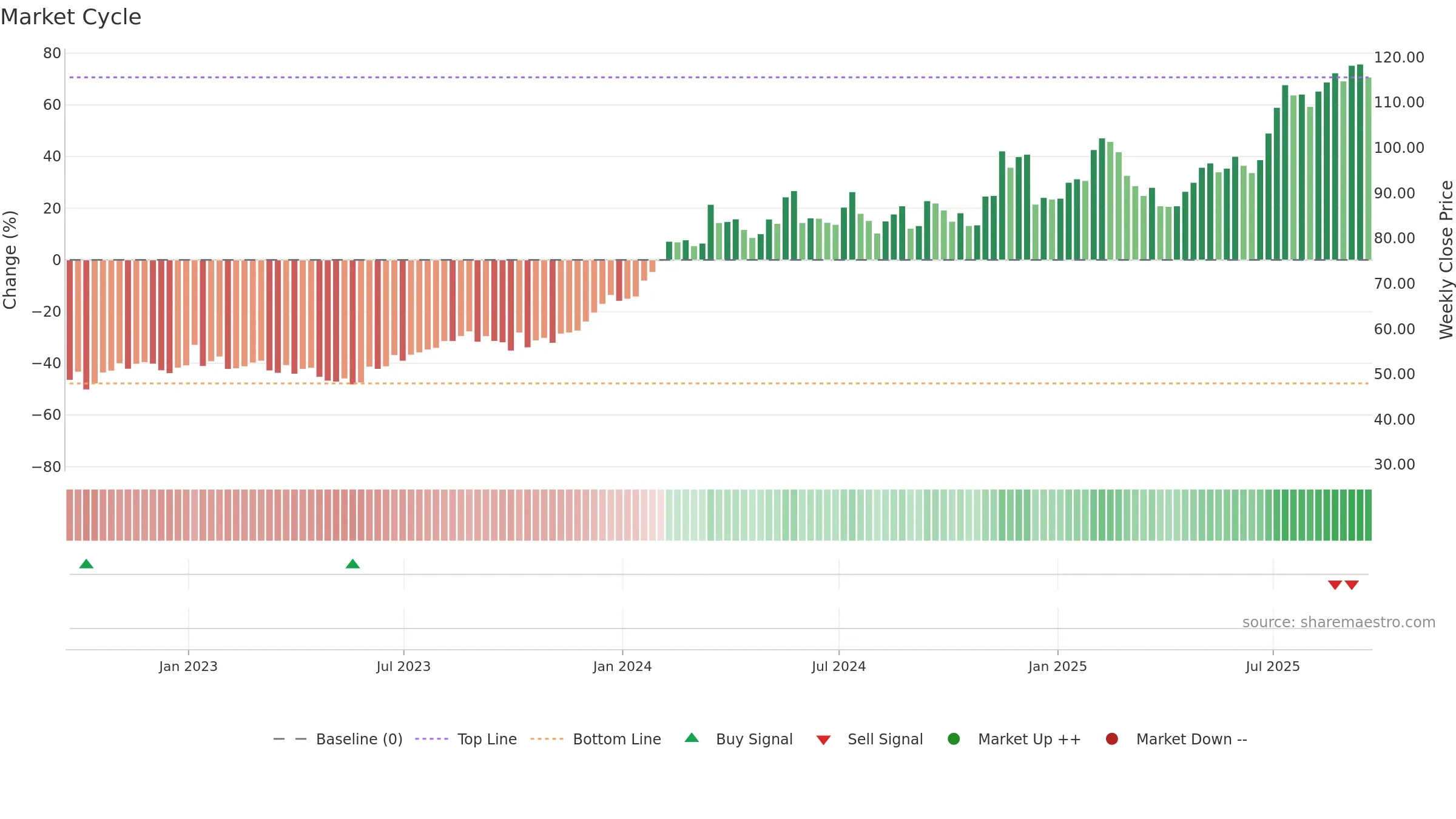

Positive setup. ★★★★⯪ confidence. Trend: Uptrend at Risk · 7.15% over window · vol 1.32% · liquidity convergence · posture above · RS outperforming

- Momentum is bullish and rising

- Price holds above 8–26 week averages

- Constructive moving-average stack

- Liquidity confirms the price trend

- High level but momentum rolling over (topping risk)

Why: Price window 7.15% over w. Close is -2.84% below the prior-window high. Return volatility 1.32%. Volume trend rising. Liquidity convergence with price. Trend state uptrend at risk. MA stack constructive. Momentum bullish and rising. Valuation limited upside without catalysts.

Tip: Most metrics include a hover tooltip where they appear in the report.