RenaissanceRe Holdings Ltd.

RNR NYSE

Weekly Report

RenaissanceRe Holdings Ltd. closed at 243.0200 (-0.14% WoW) . Data window ends Fri, 19 Sep 2025.

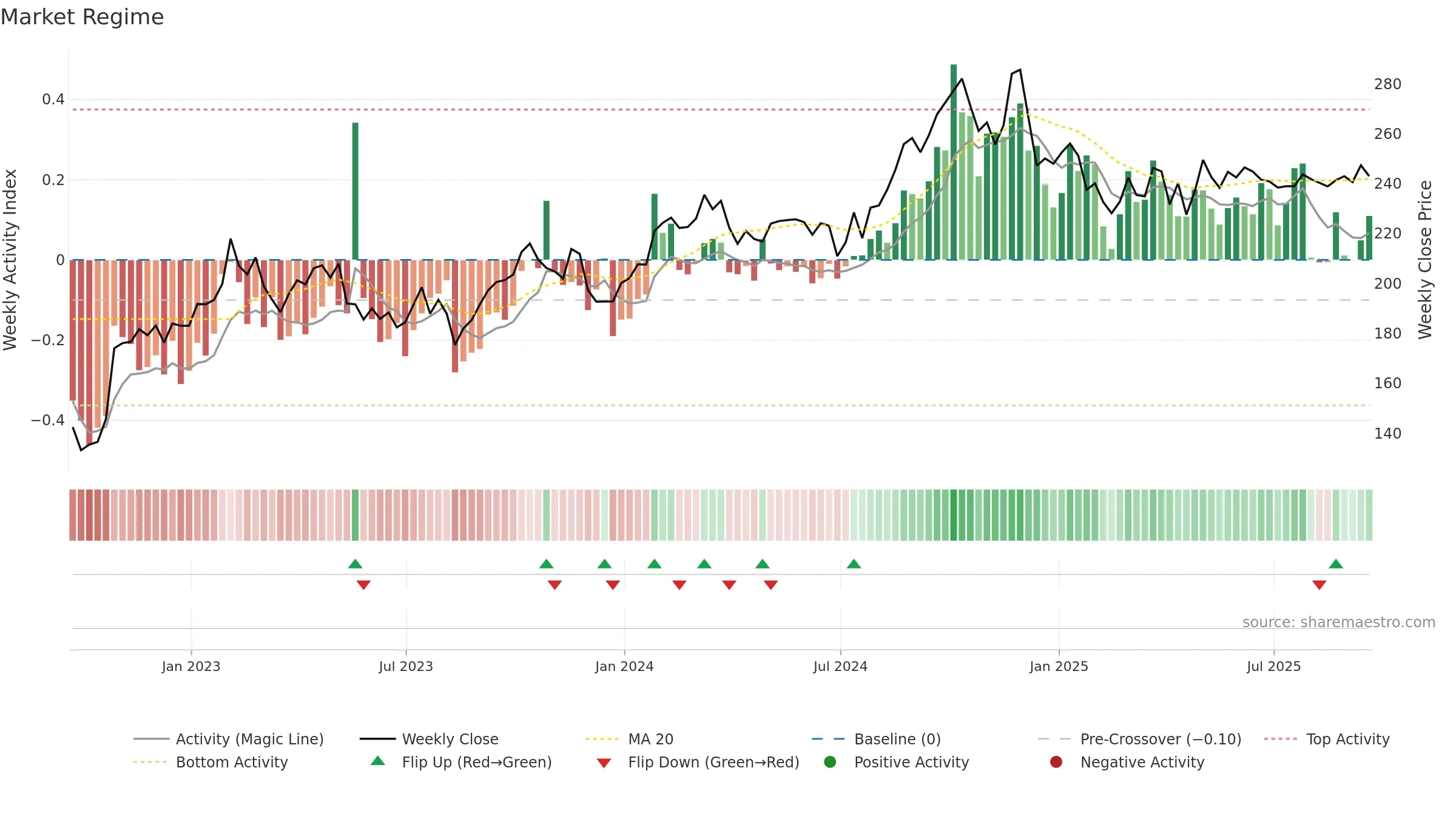

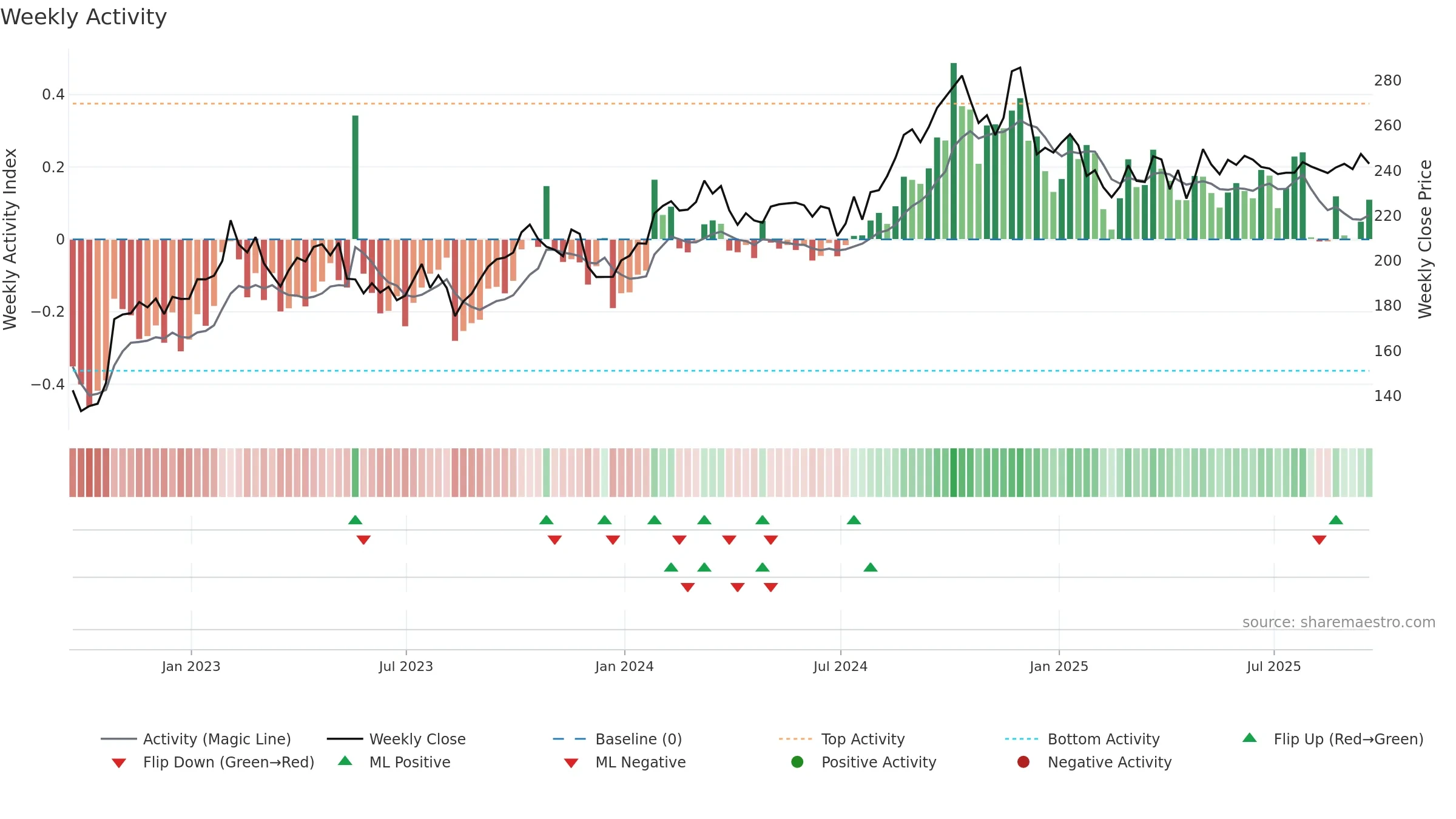

How to read this — Price slope is upward, indicating persistent buying over the window. Low weekly volatility favours steadier follow-through. Volume and price are moving in the same direction — a constructive confirmation. Returns are negatively correlated with volume — strength may come on lighter activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm.

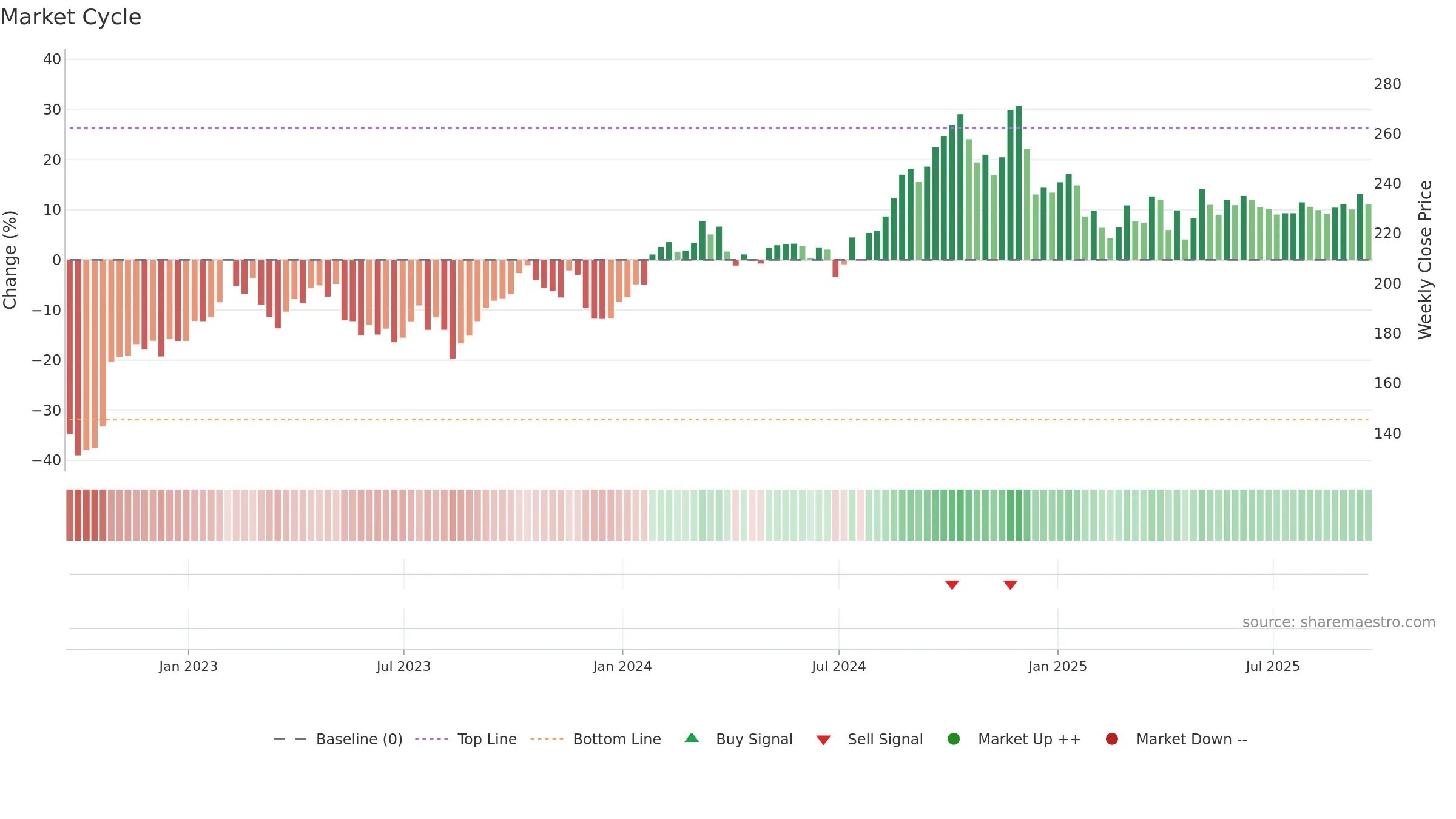

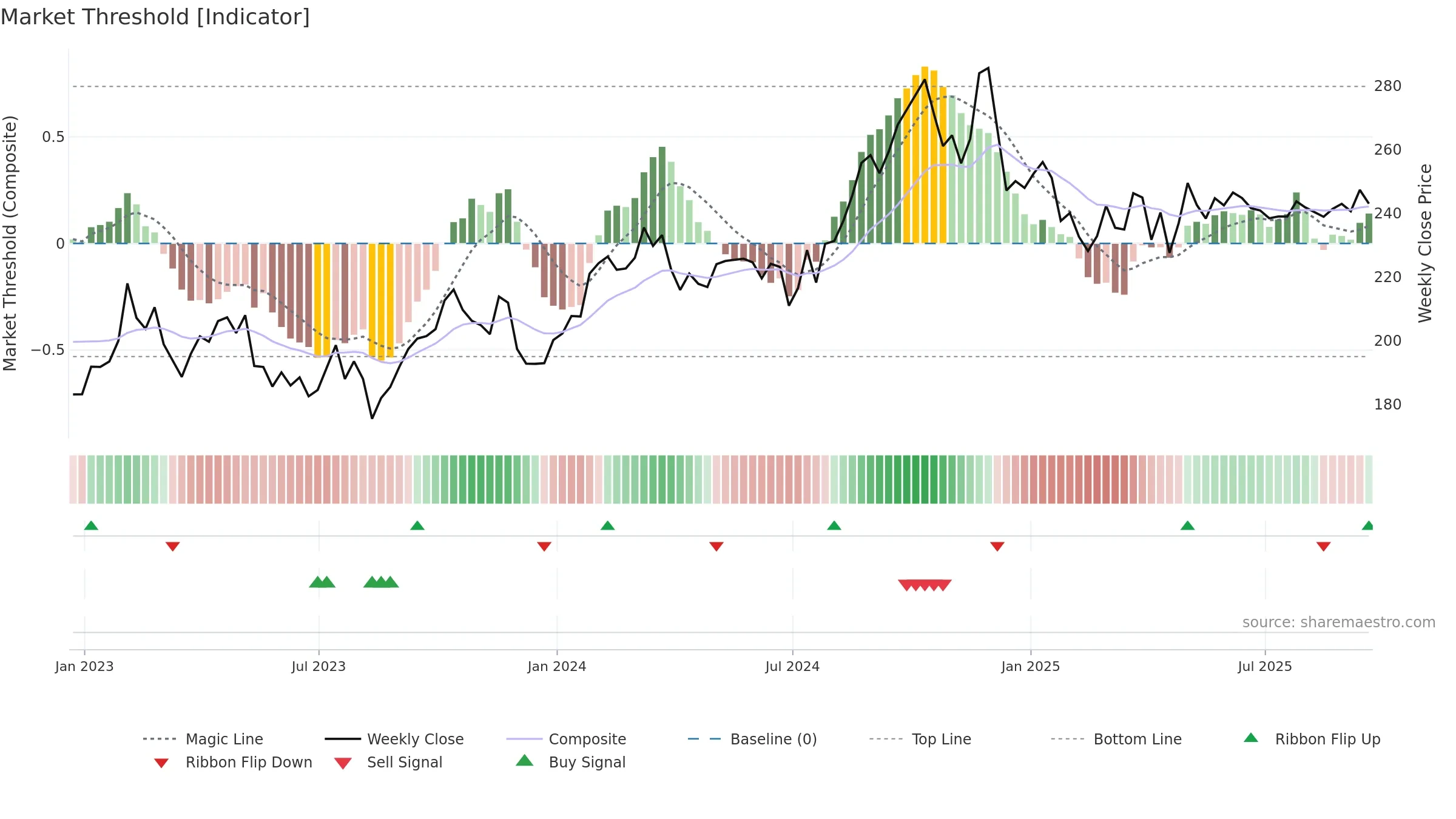

Gauge maps the trend signal to a 0–100 scale.

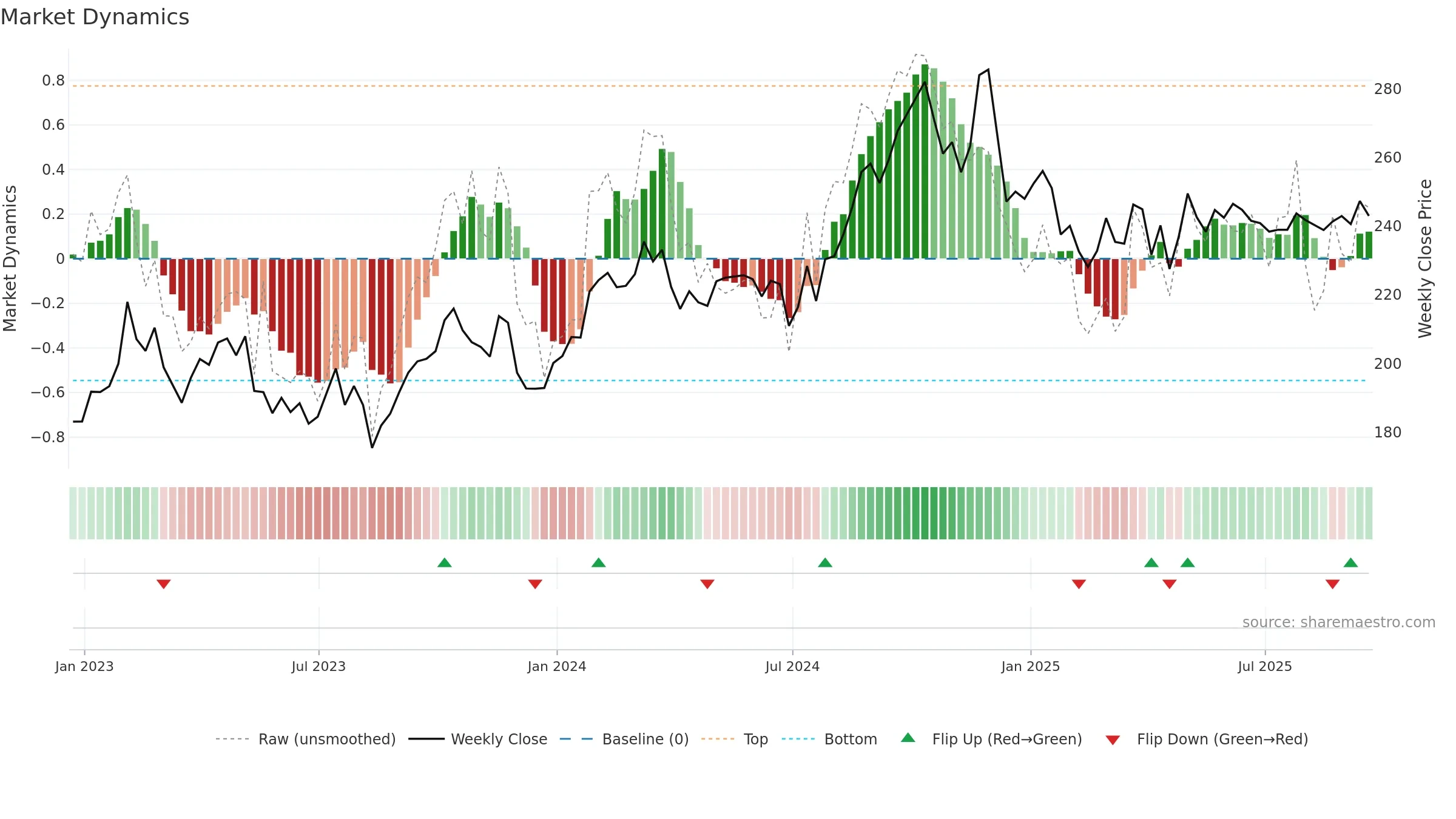

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

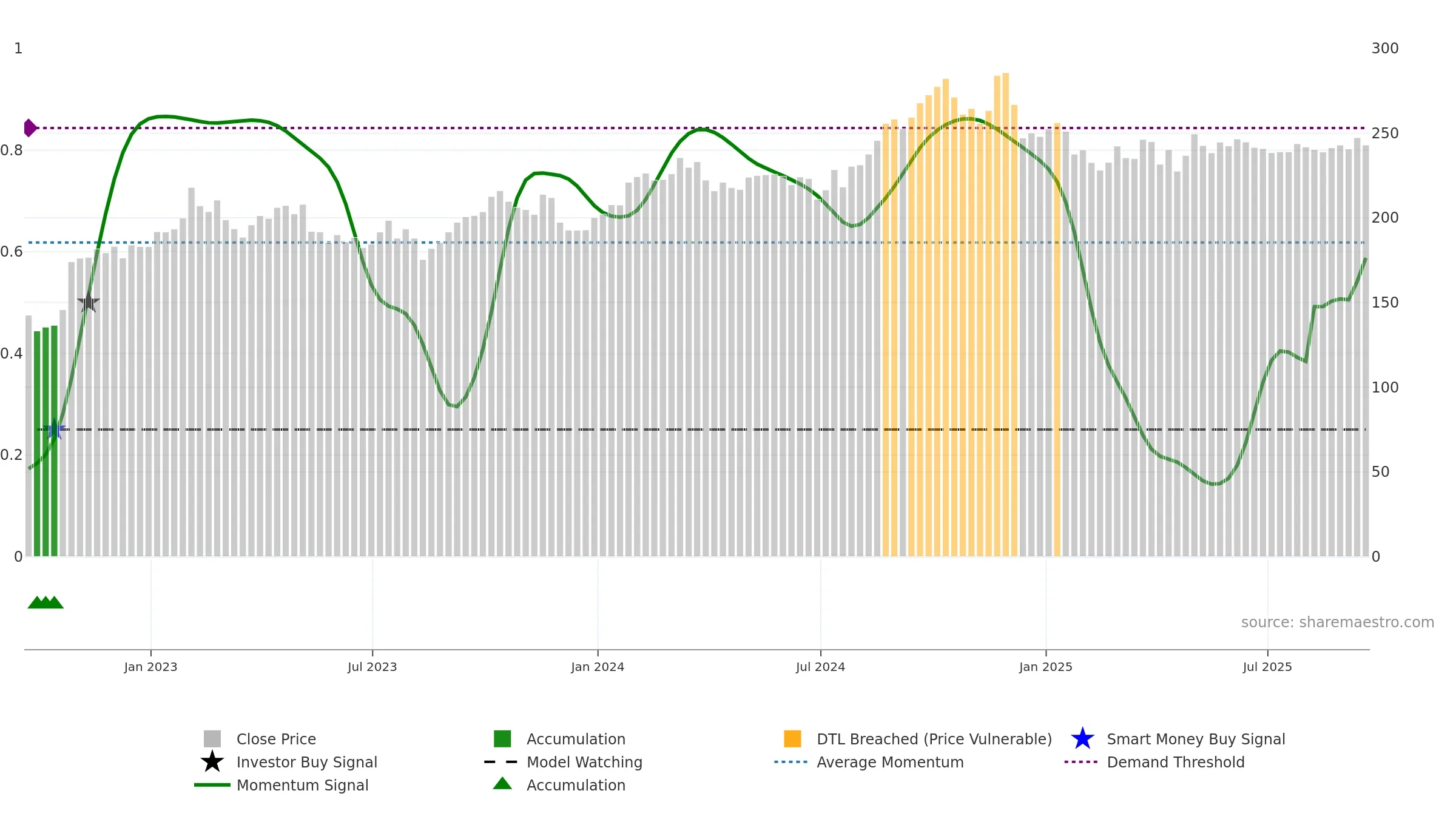

Price is below fair value; potential upside if momentum constructive.

Conclusion

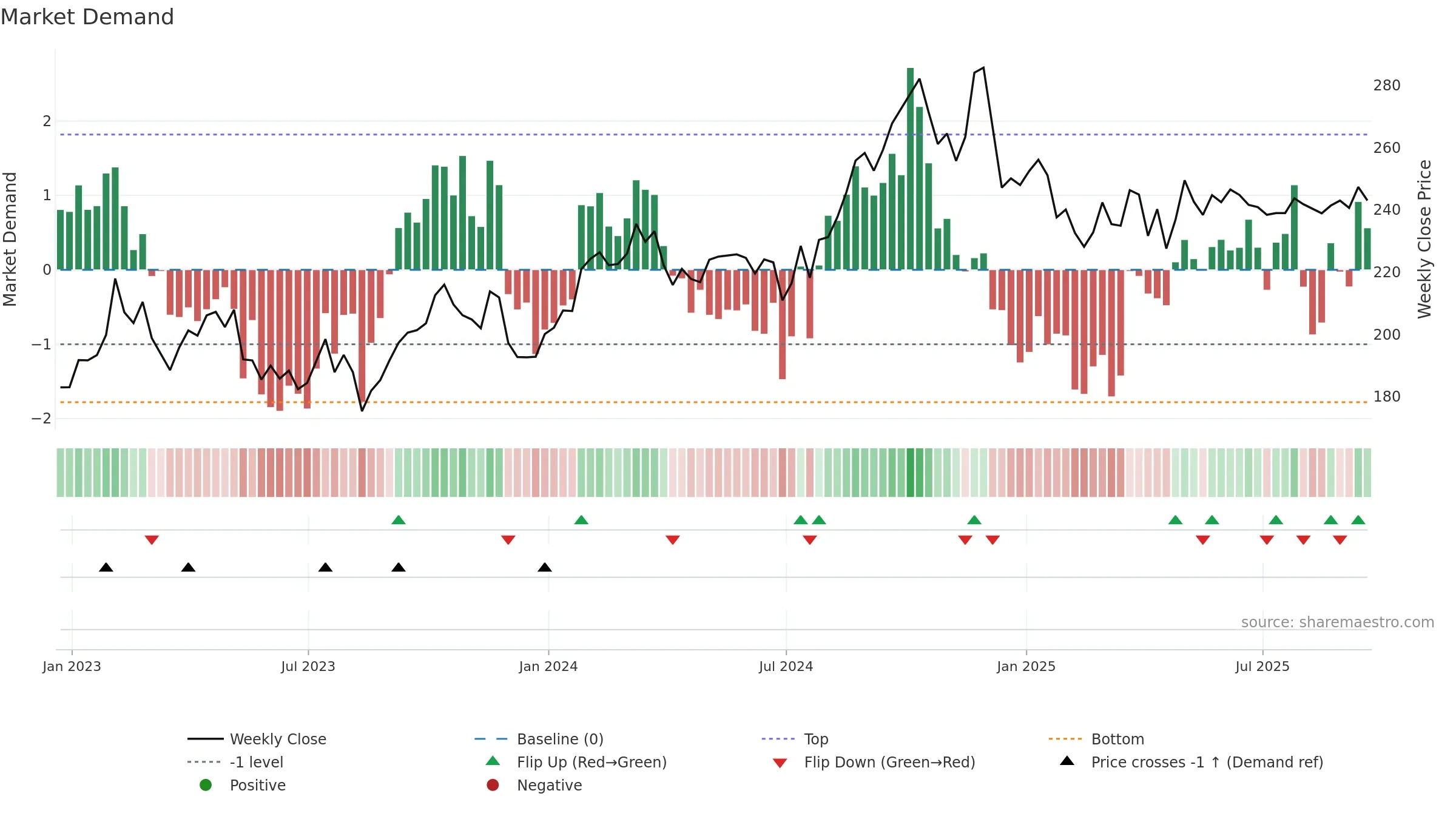

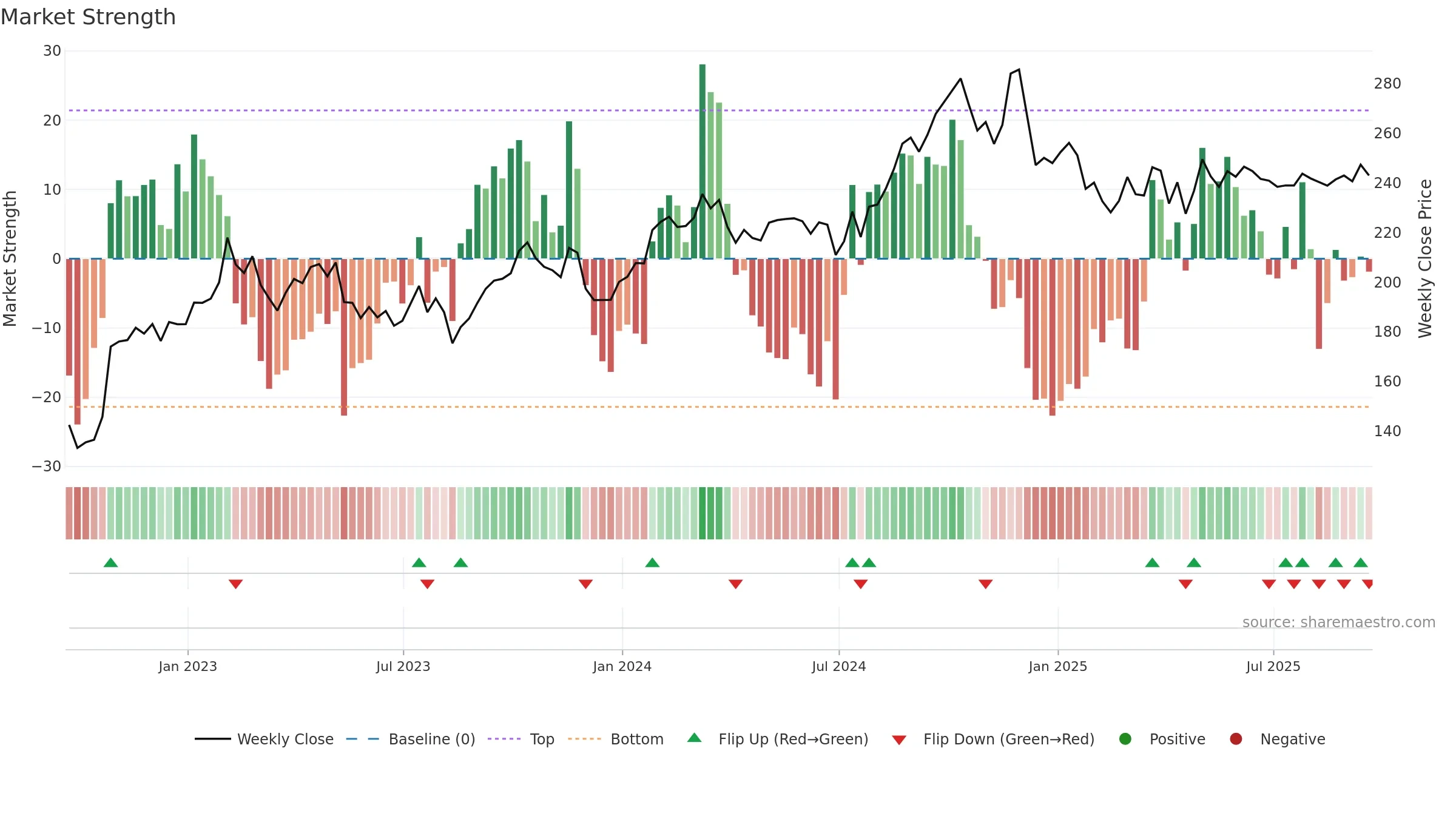

Positive setup. ★★★★★ confidence. Price window: 0. Trend: Range / Neutral; gauge 58. In combination, liquidity confirms the move.

- Price holds above 8w & 26w averages

- Constructive moving-average stack

- Liquidity confirms the price trend

- Low return volatility supports durability

Why: Price window 0.49% over 8w. Close is -1.75% below the prior-window high. Return volatility 1.58%. Volume trend rising. Liquidity convergence with price. Trend state range / neutral. MA stack constructive. Momentum neutral and rising. Valuation supportive skew.

Tip: Most metrics include a hover tooltip where they appear in the report.