Cellectar Biosciences, Inc.

CLRB NASDAQ

Weekly Report

Cellectar Biosciences, Inc. closed at 5.2000 (-7.96% WoW) . Data window ends Fri, 19 Sep 2025.

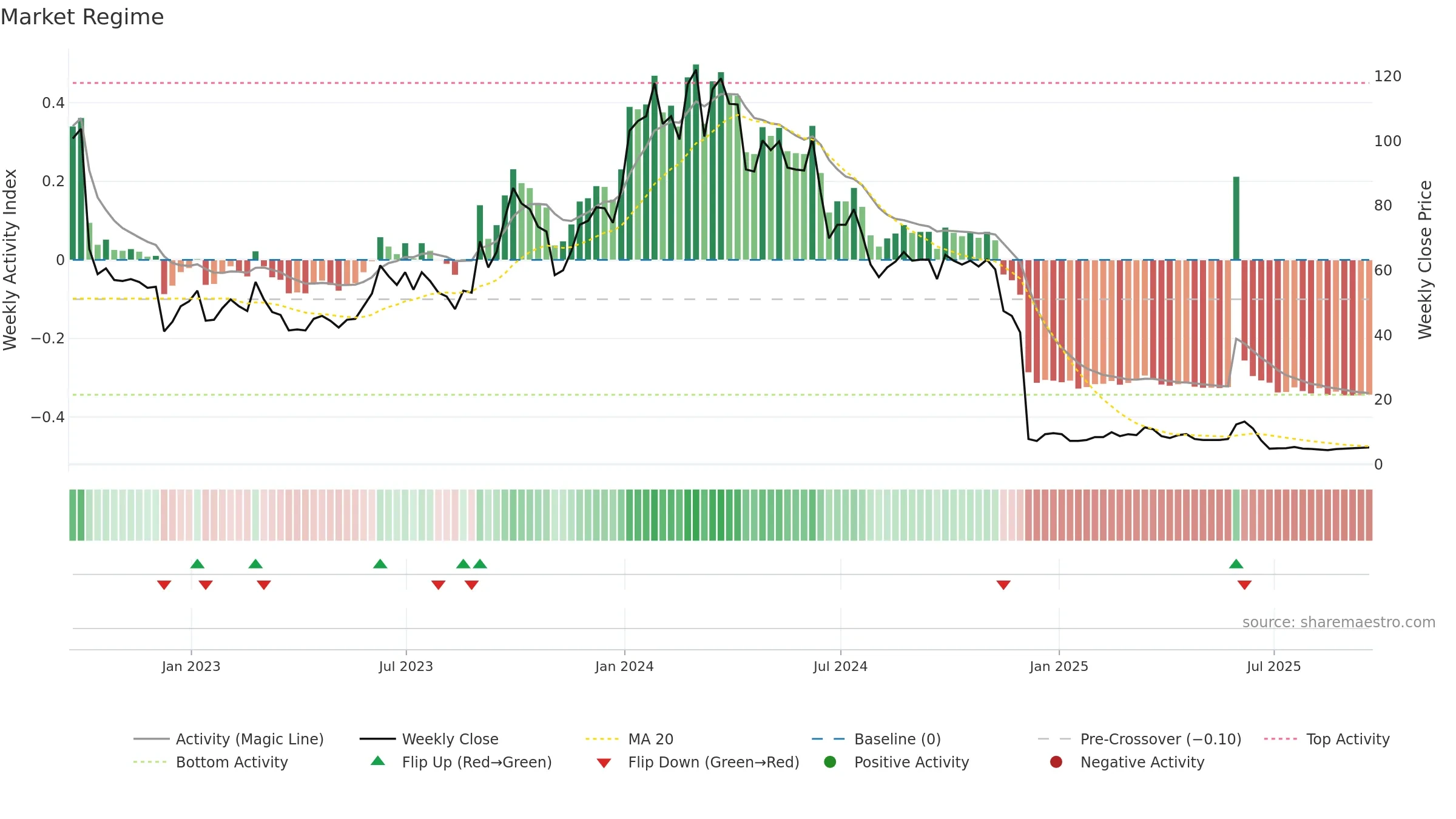

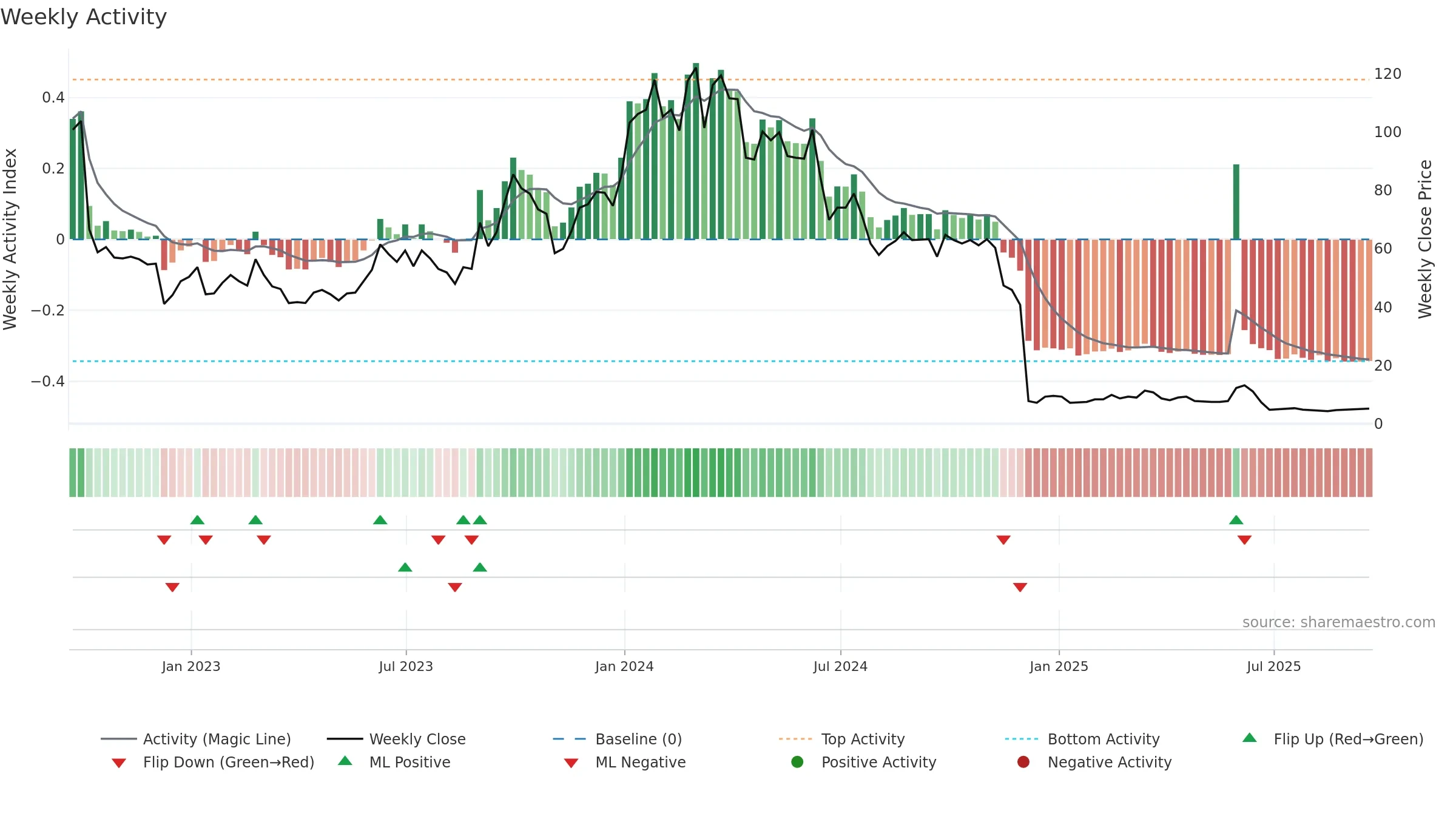

How to read this — Price slope is upward, indicating persistent buying over the window. Volume trend diverges from price — watch for fatigue or rotation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

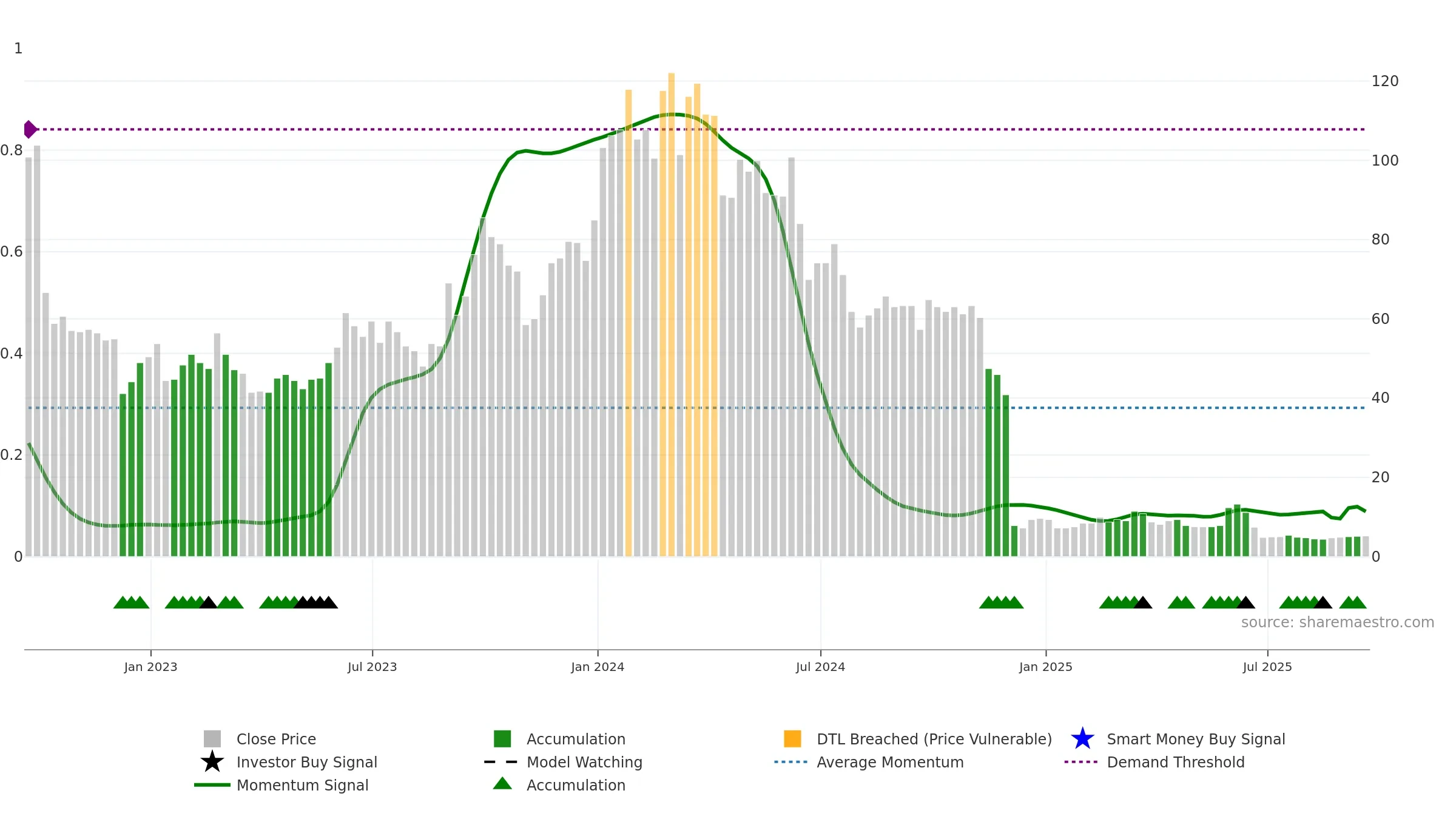

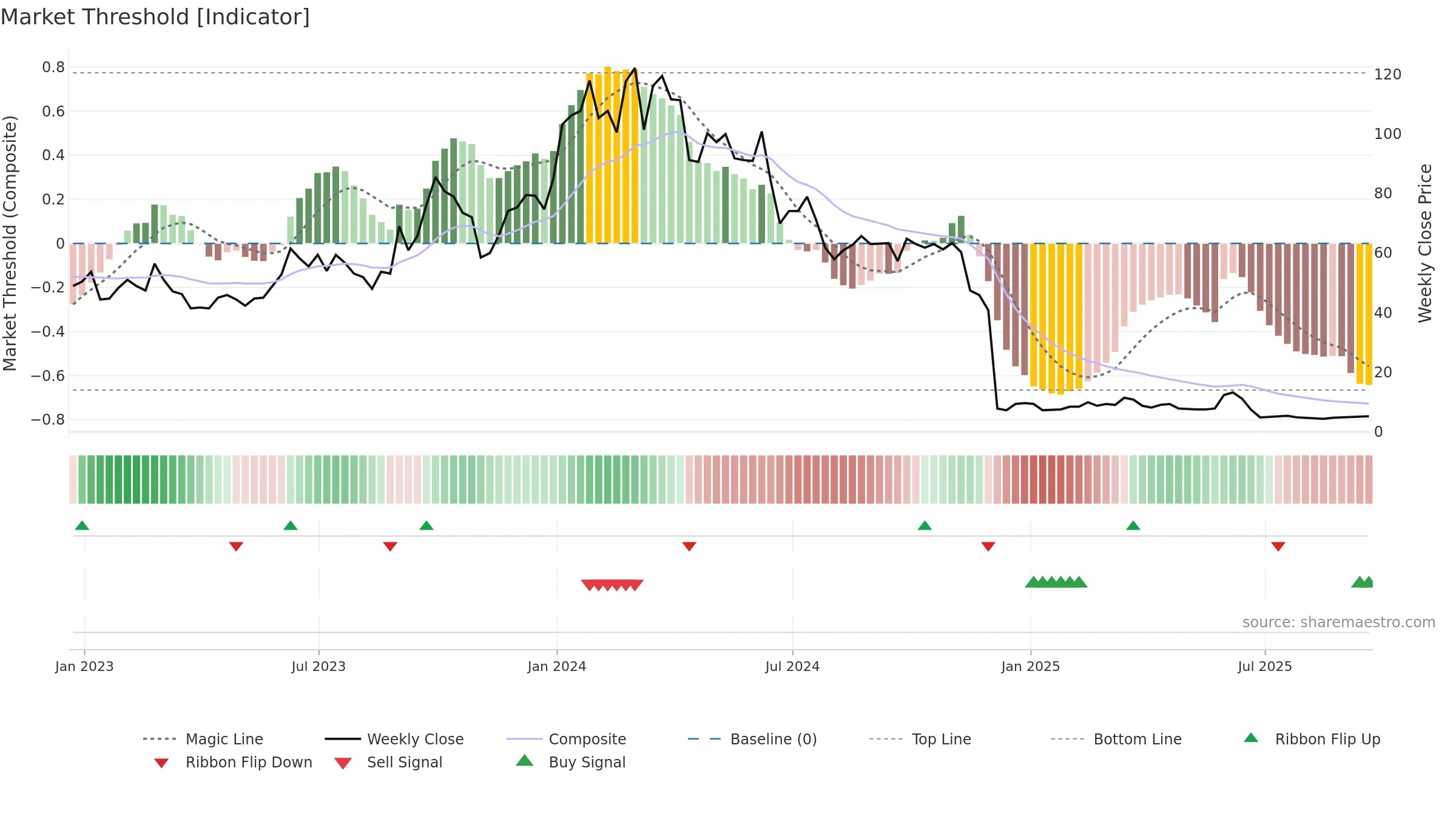

Gauge maps the trend signal to a 0–100 scale.

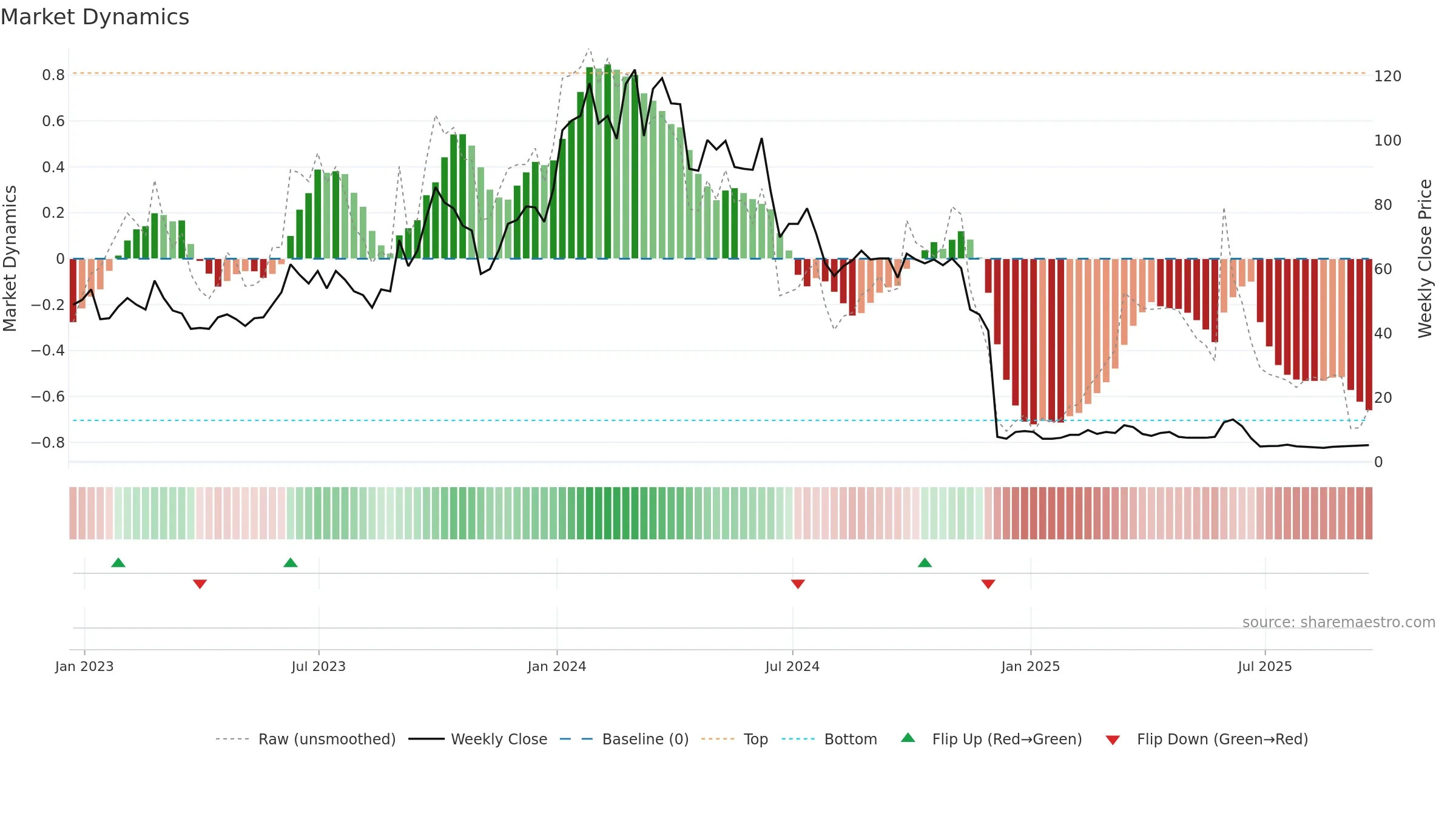

How to read this — Bearish backdrop but short-term momentum is improving; confirmation still needed.

Early improvement — look for a reclaim of 0.50→0.60 to validate.

Conclusion

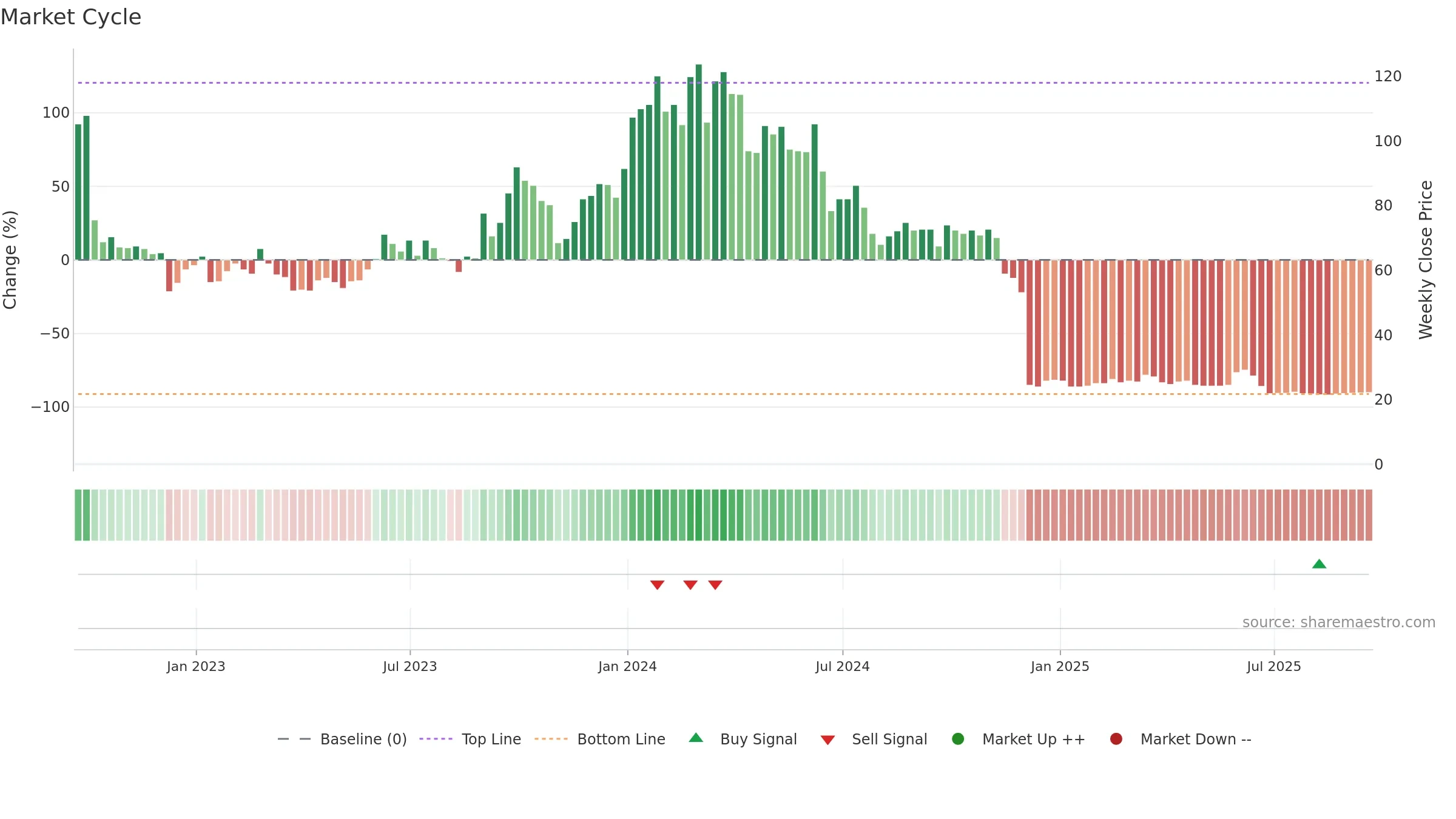

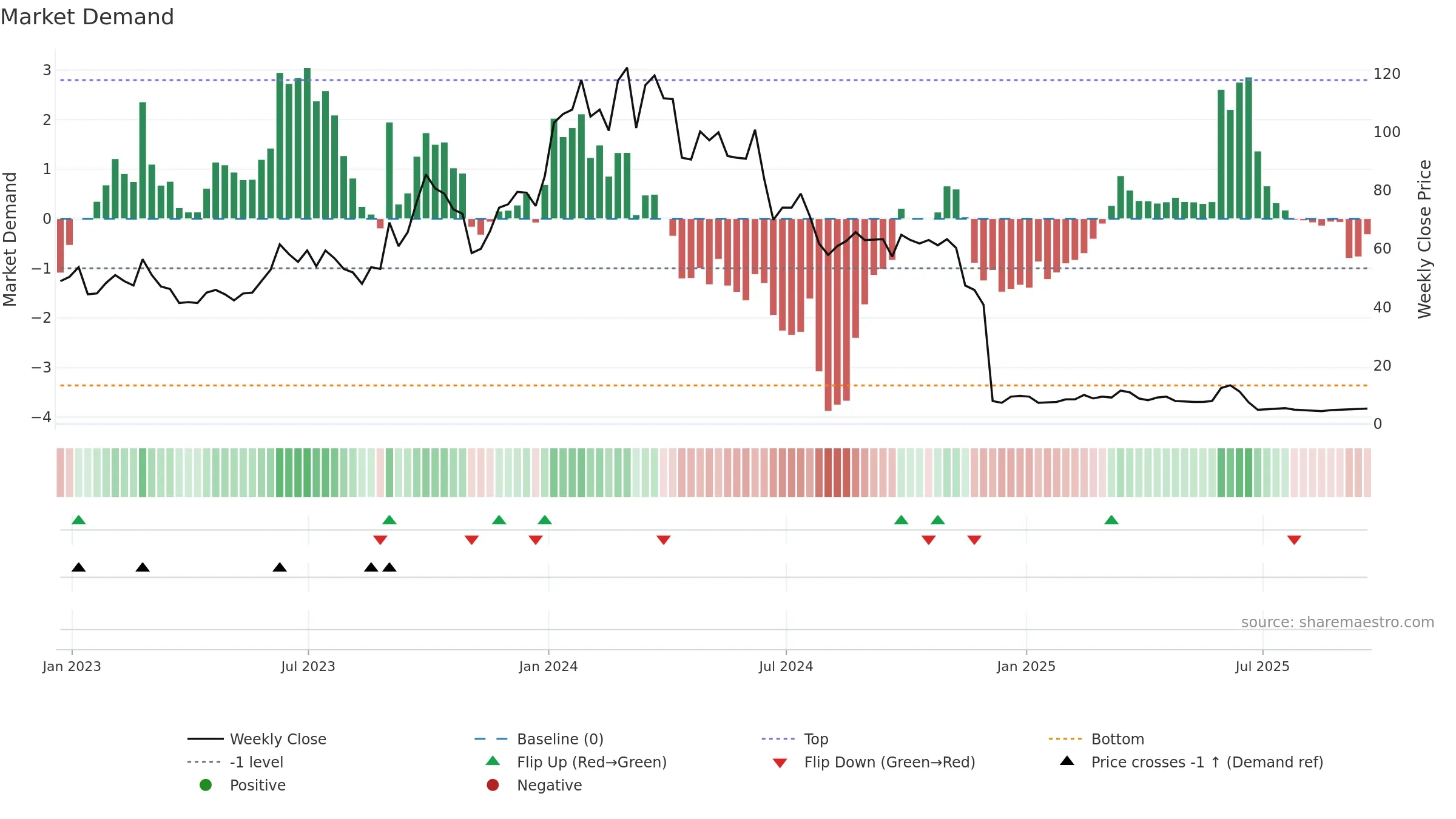

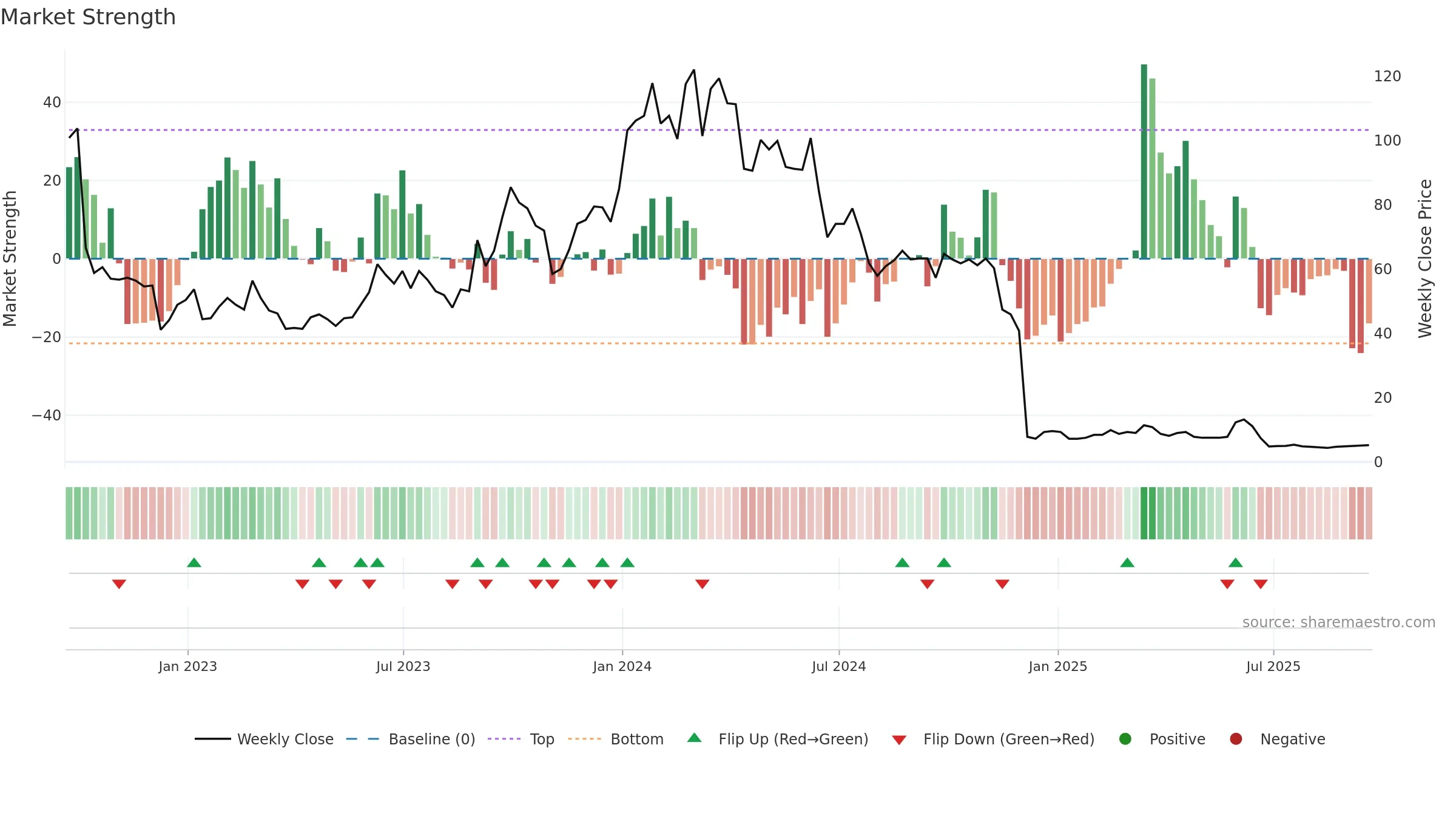

Negative setup. ★★☆☆☆ confidence. Price window: 10. Trend: Bottoming Attempt; gauge 8. In combination, liquidity diverges from price.

- Early improvement from bearish zone (bottoming attempt)

- Solid multi-week performance

- Momentum is weak/falling

- Price is not above key averages

- Liquidity diverges from price

Why: Price window 10.40% over 8w. Close is 2.36% above the prior-window high. Volume trend falling. Liquidity divergence with price. Trend state bottoming attempt. Low-regime (≤0.25) upticks 4/7 (57.0%) • Accumulating. Momentum bearish and rising.

Tip: Most metrics include a hover tooltip where they appear in the report.