Weekly Report

Vanguard Short-Term Corporate Bond Index Fund ETF Shares closed at 79.9900 (0.05% WoW) . Data window ends Fri, 19 Sep 2025.

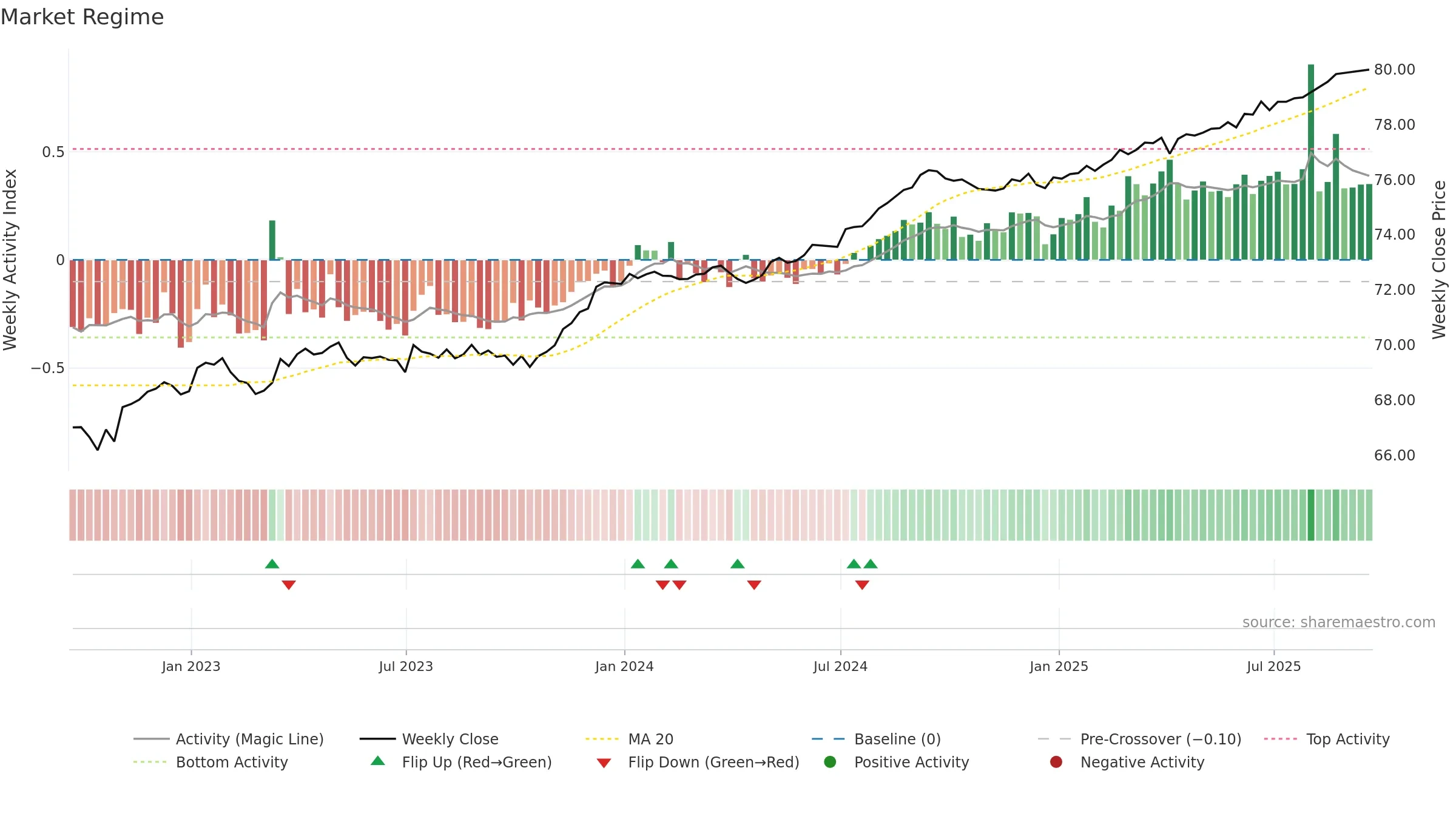

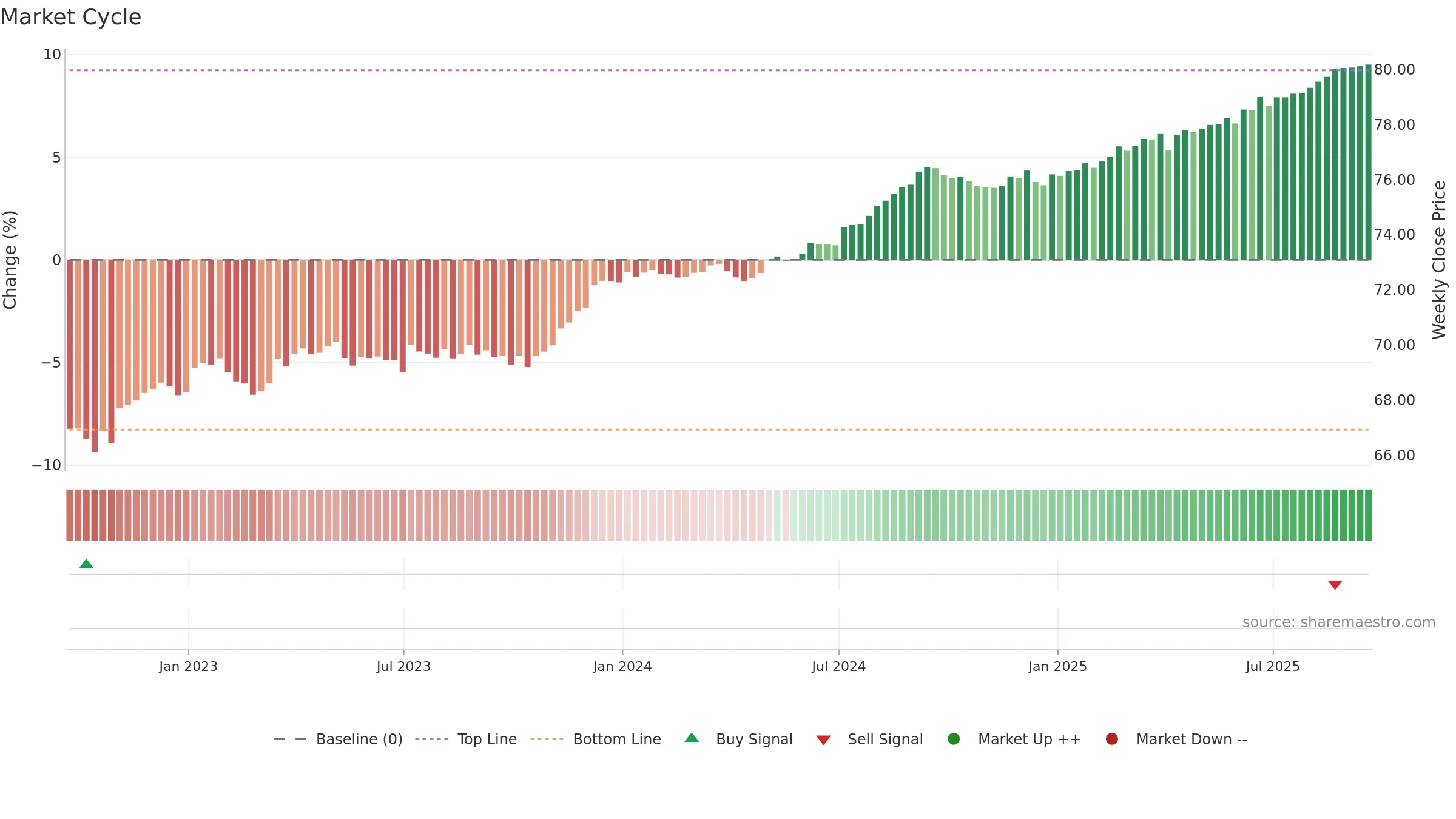

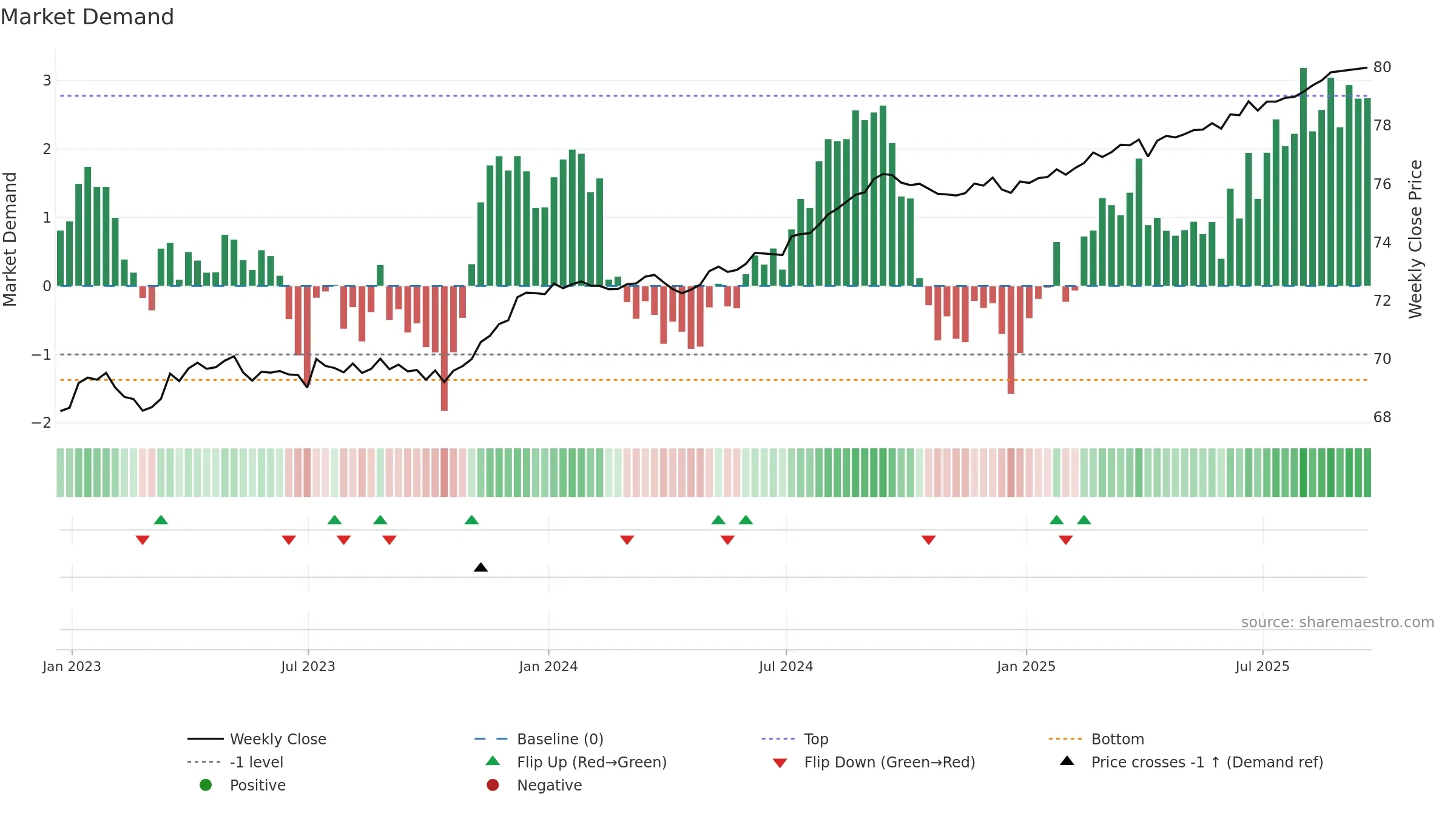

How to read this — Price slope is upward, indicating persistent buying over the window. Low weekly volatility favours steadier follow-through. Volume trend diverges from price — watch for fatigue or rotation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

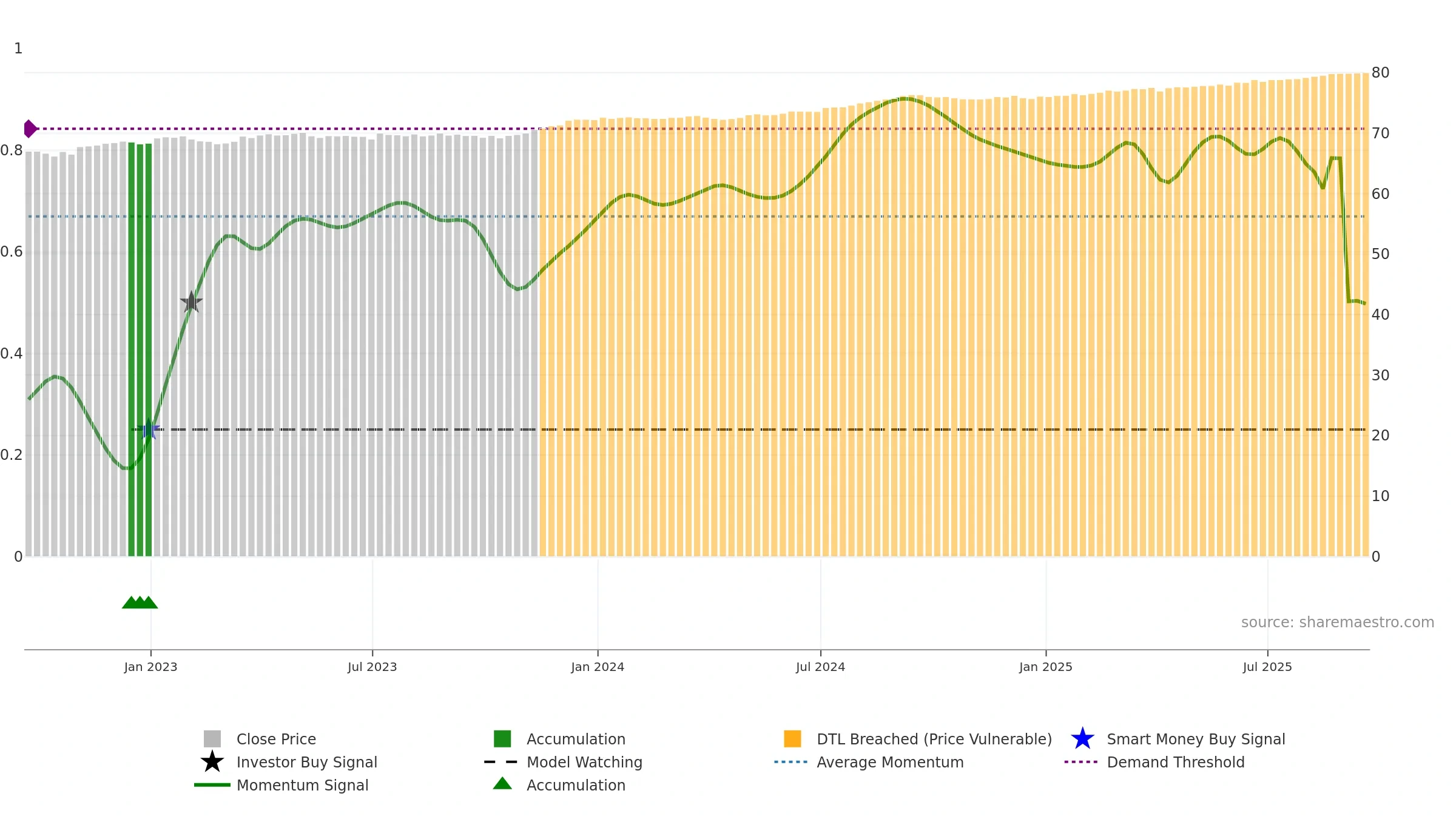

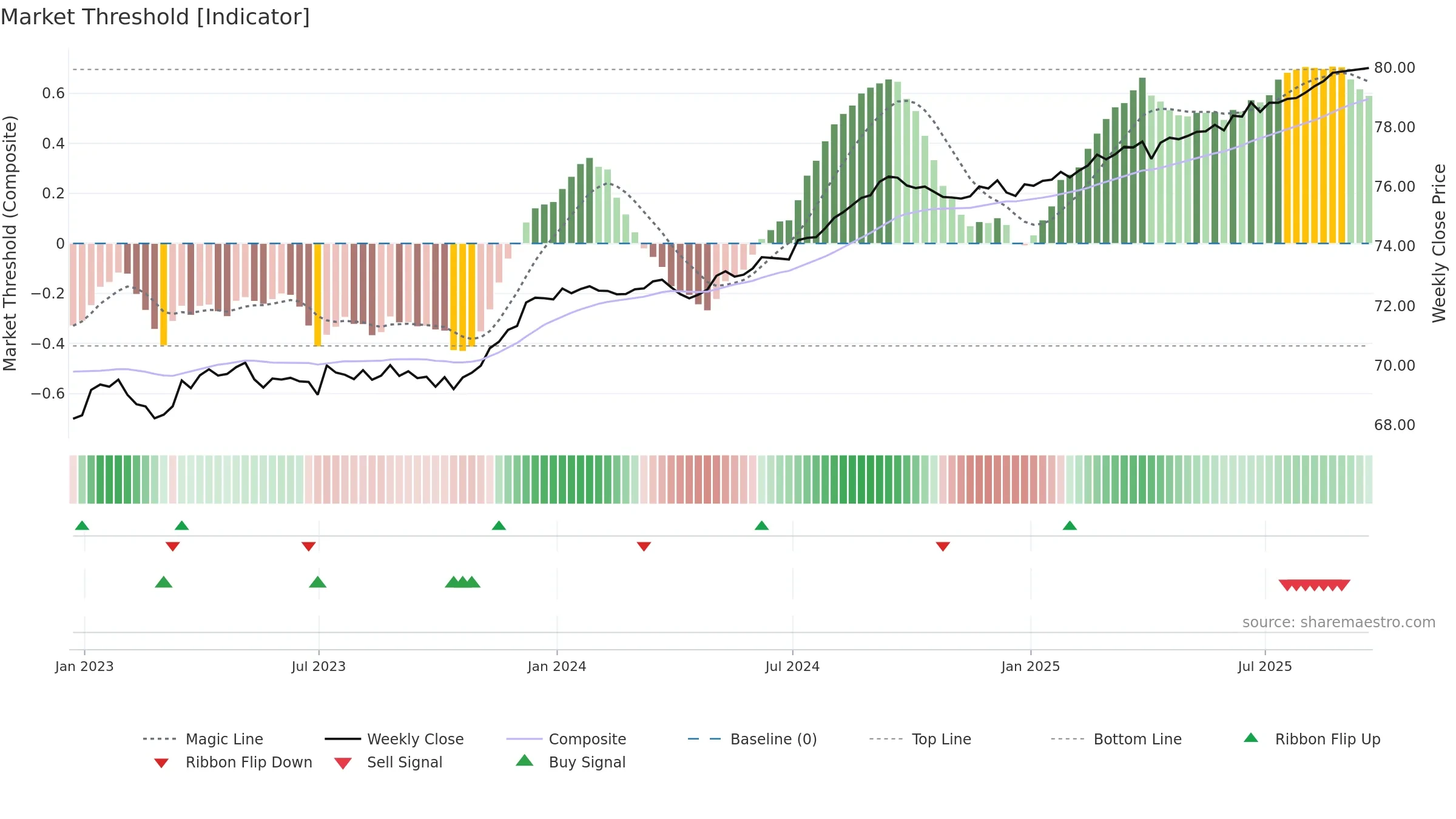

Gauge maps the trend signal to a 0–100 scale.

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges. Loss of the ~0.50 midline after strength suggests regime shift.

Wait for a directional break or improving acceleration.

Conclusion

Neutral setup. ★★★☆☆ confidence. Price window: 1. Trend: Range / Neutral; gauge 49. In combination, liquidity diverges from price.

- Price holds above 8w & 26w averages

- Constructive moving-average stack

- Low return volatility supports durability

- Momentum is weak/falling

- Liquidity diverges from price

- Midline (~0.50) failure after strength

Why: Price window 1.05% over 8w. Return volatility 0.15%. Volume trend falling. Liquidity divergence with price. Trend state range / neutral. MA stack constructive. Momentum neutral and falling .

Tip: Most metrics also include a hover tooltip where they appear in the report.