Igarashi Motors India Limited

IGARASHI NSE

Weekly Summary

Igarashi Motors India Limited closed at 529.9000 (-3.30% WoW) . Data window ends Mon, 22 Sep 2025.

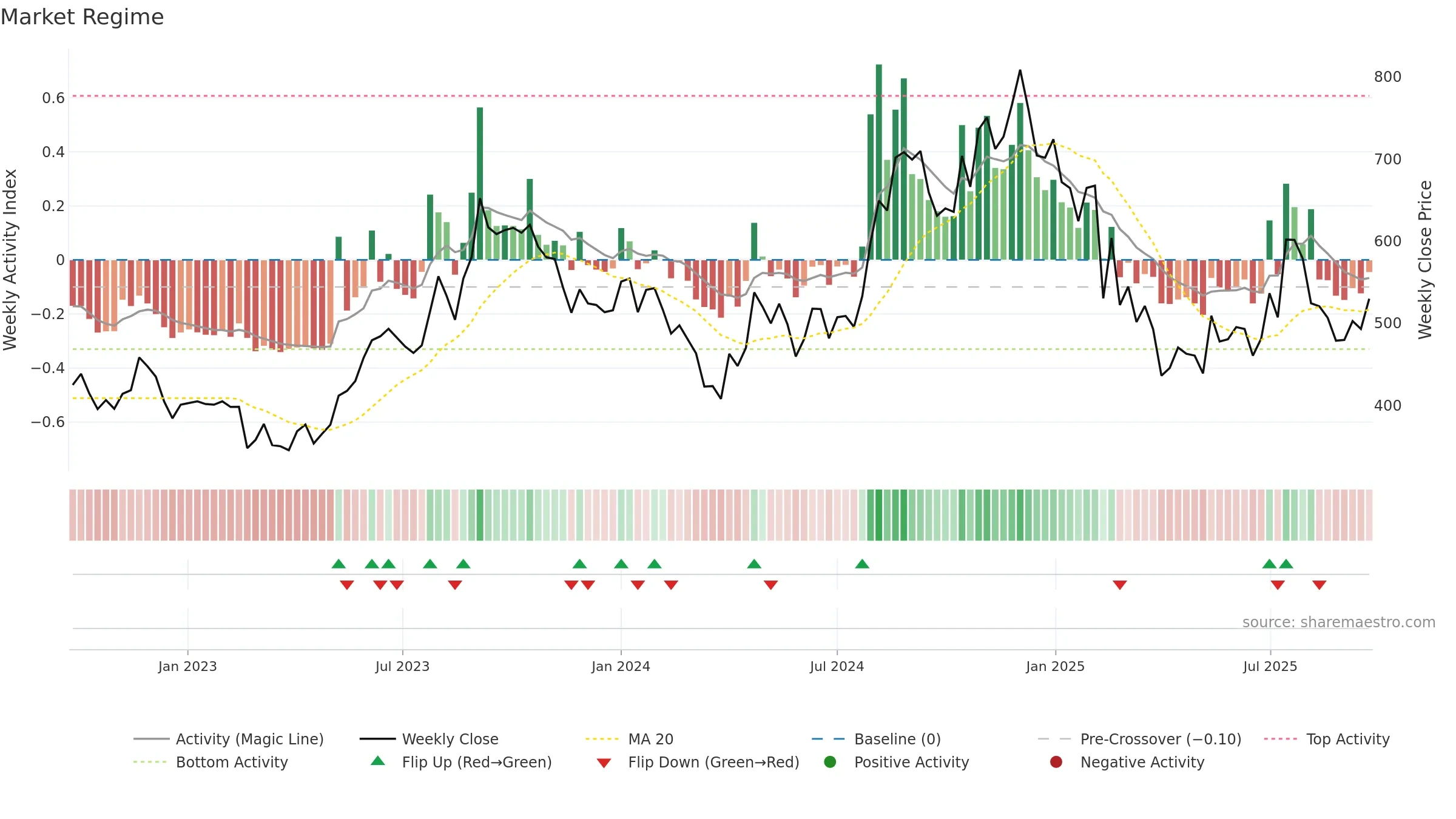

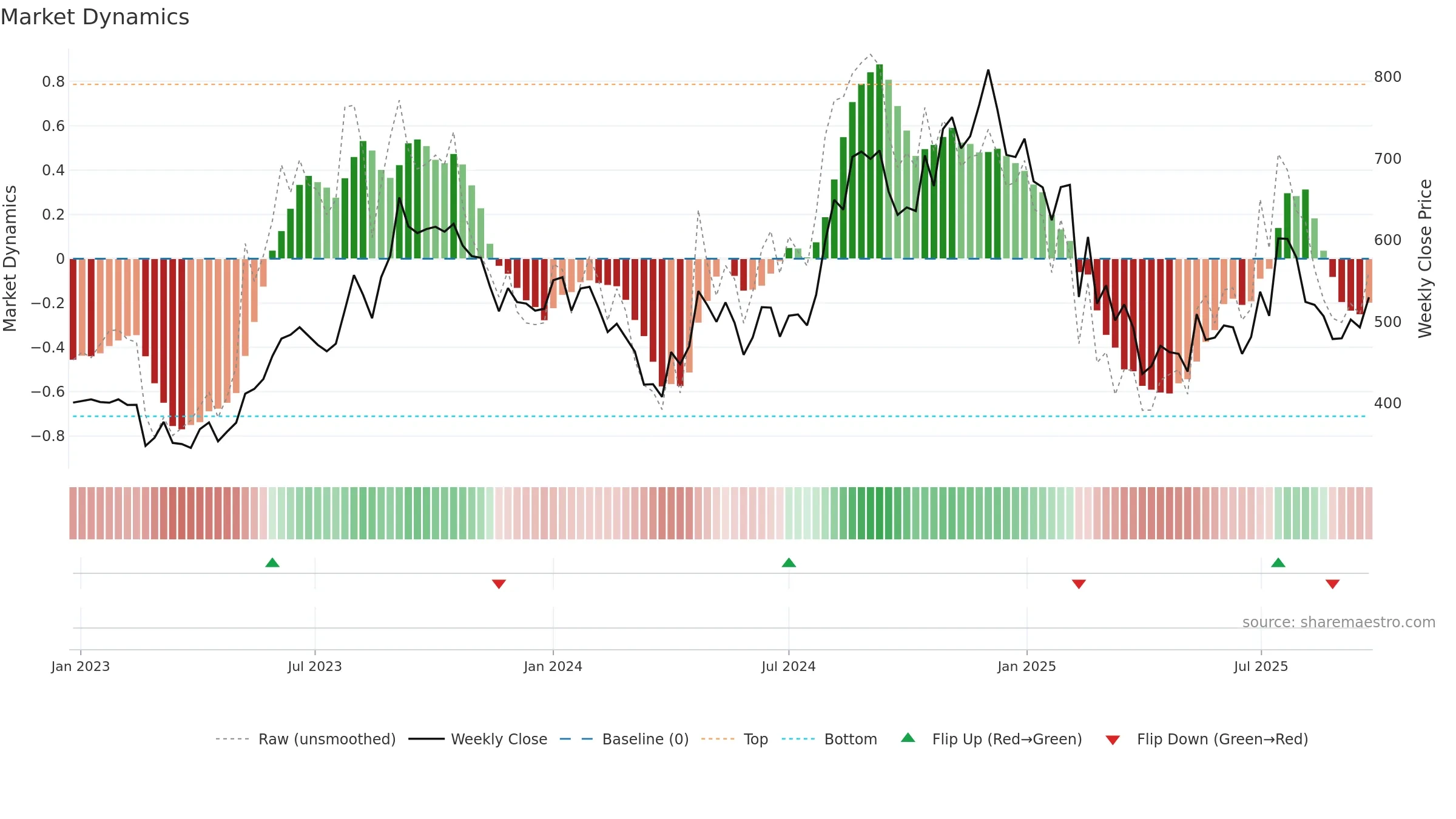

How to read this — Price slope is downward, indicating persistent supply pressure. Volume and price are moving in the same direction — a constructive confirmation. Returns are negatively correlated with volume — strength may come on lighter activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Price holds above key averages, indicating constructive participation.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

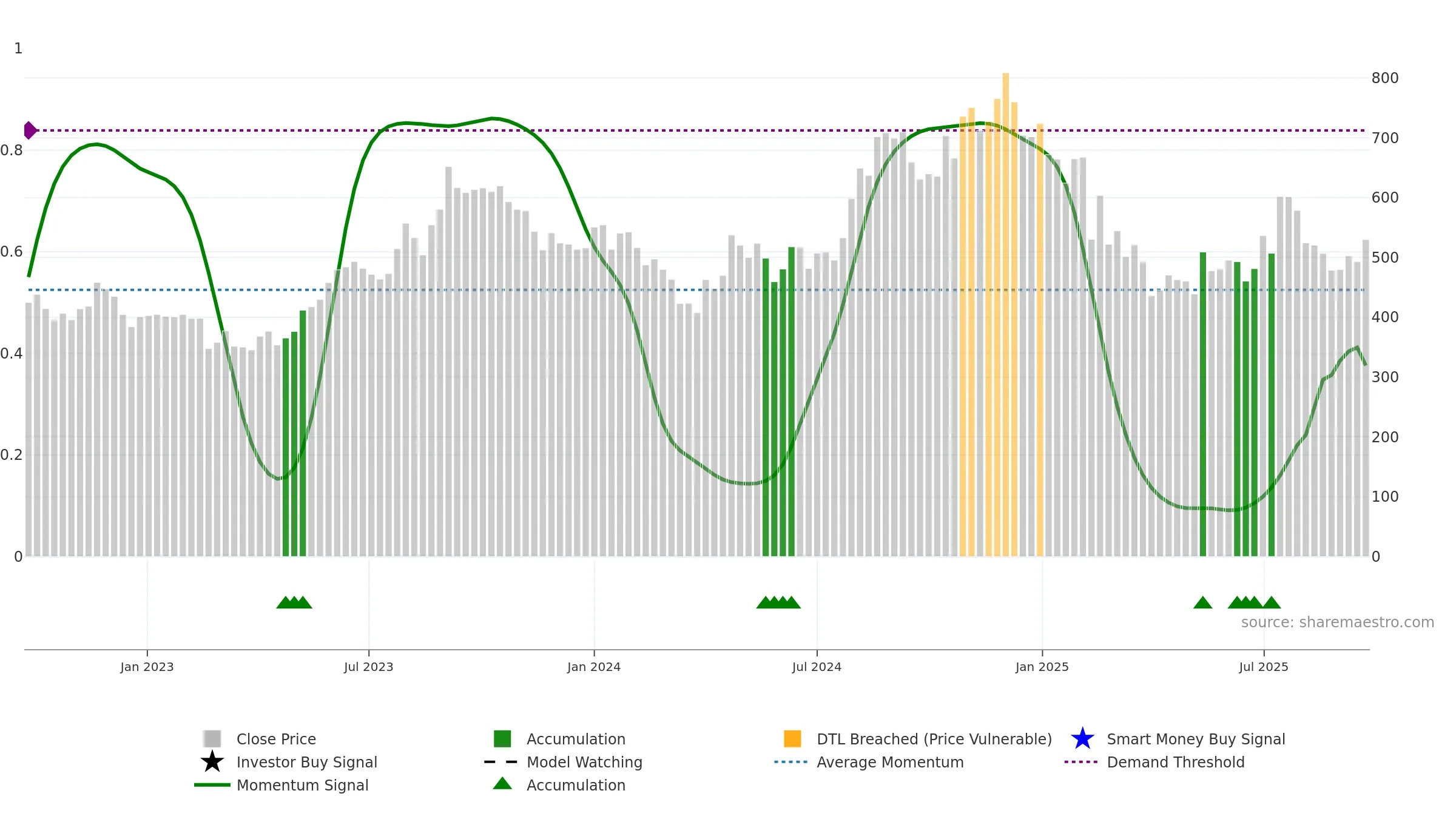

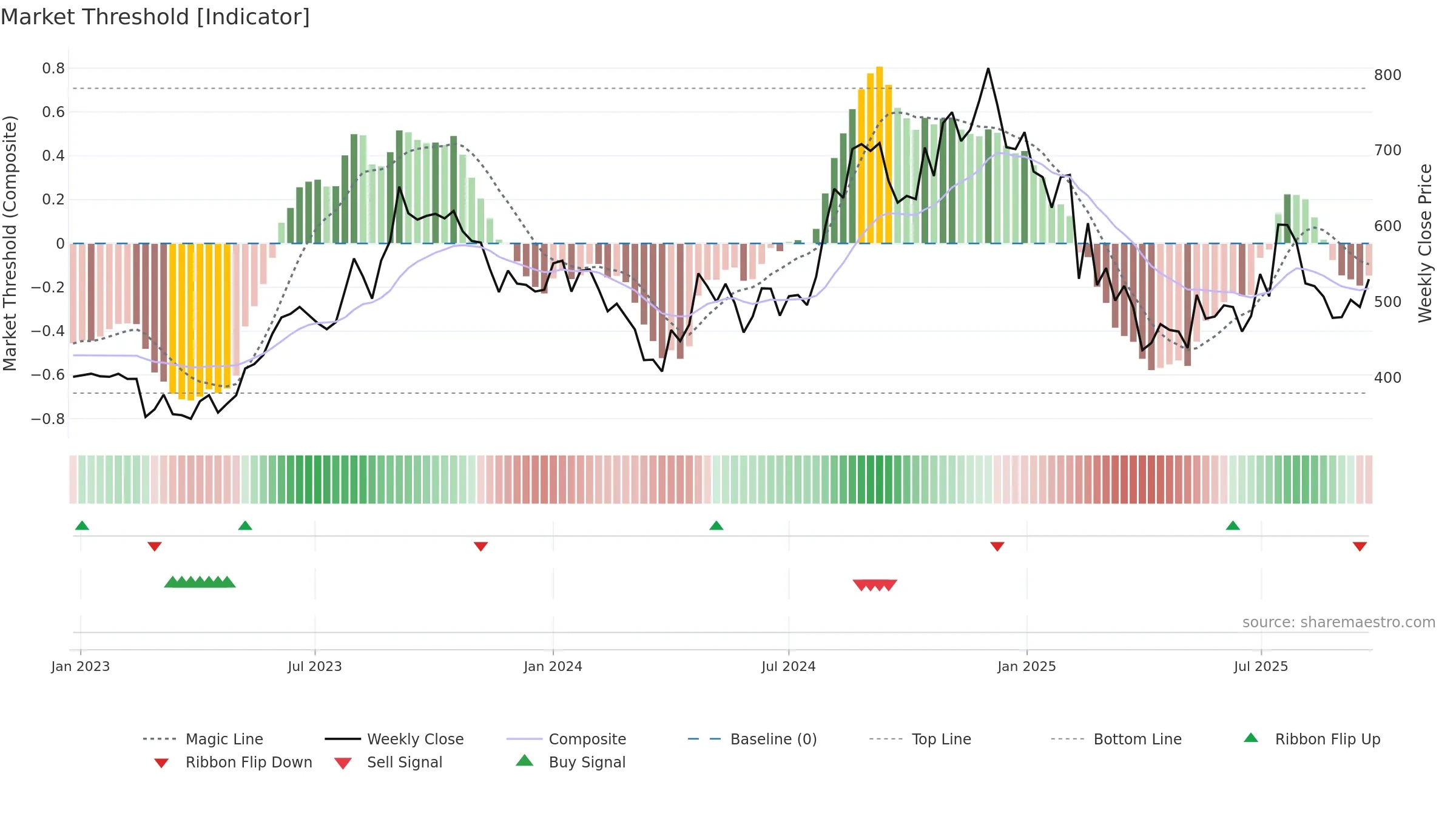

Gauge maps the trend signal to a 0–100 scale.

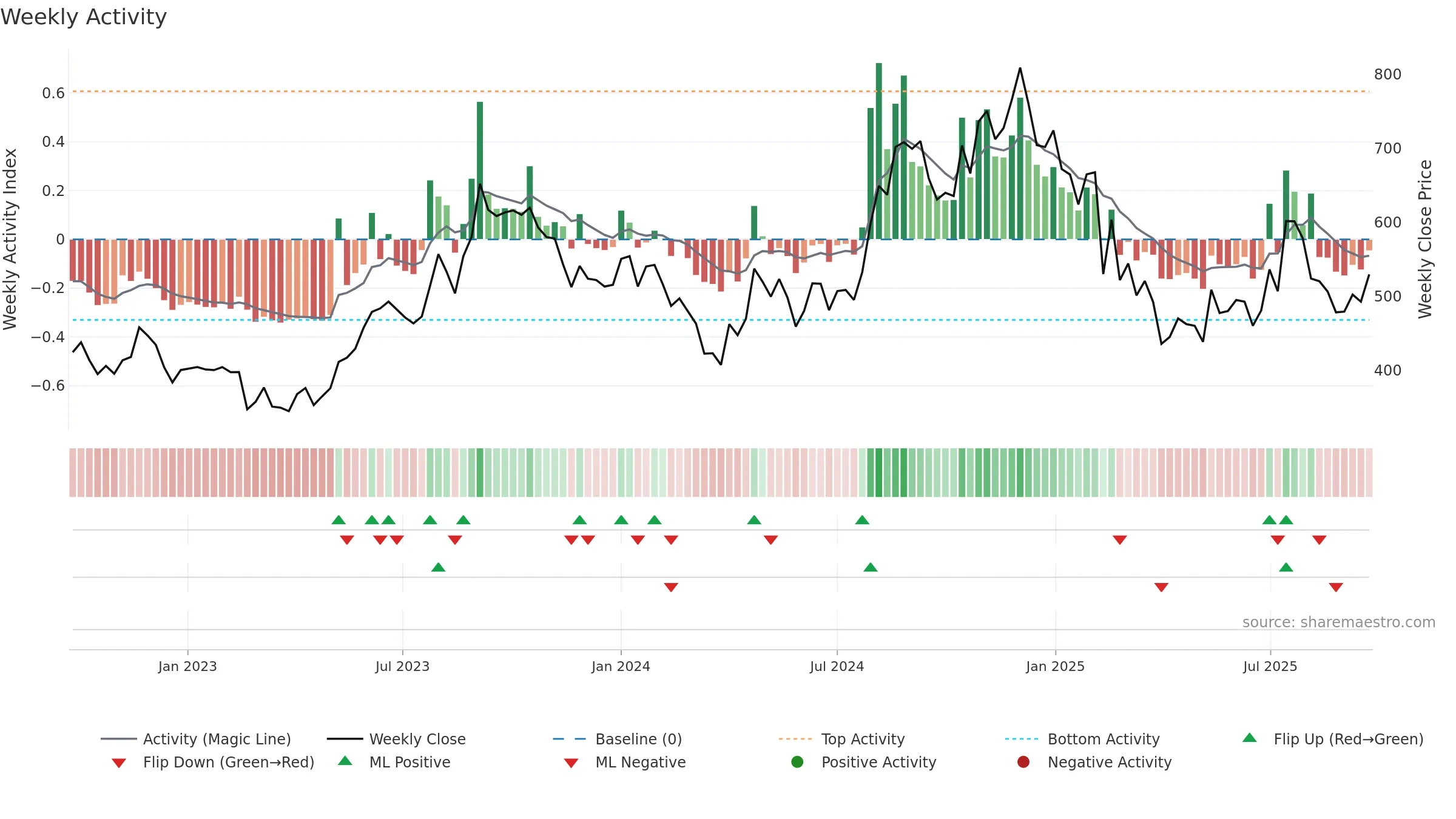

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges. Sub-0.40 print confirms downside control.

Wait for a directional break or improving acceleration.

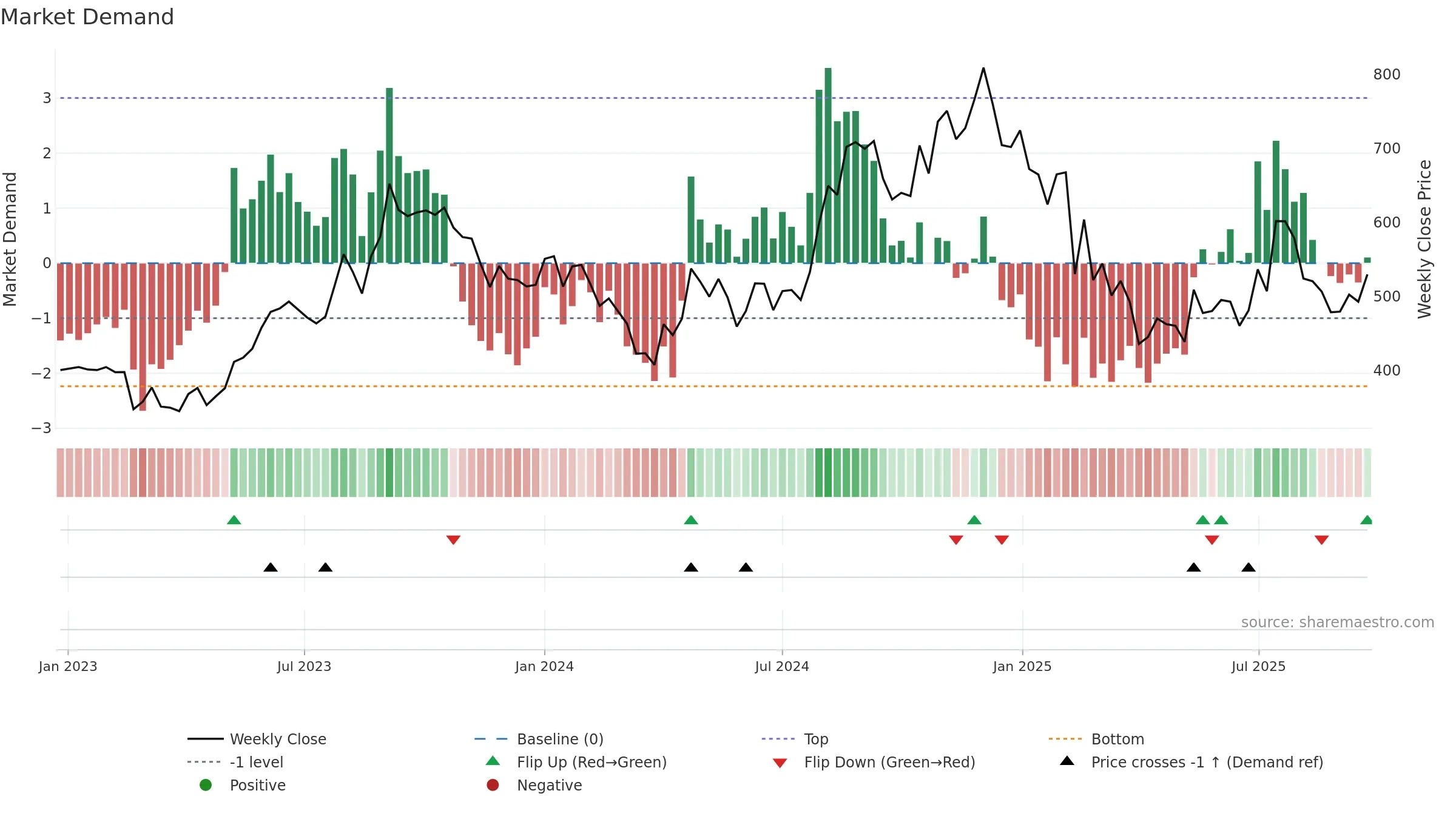

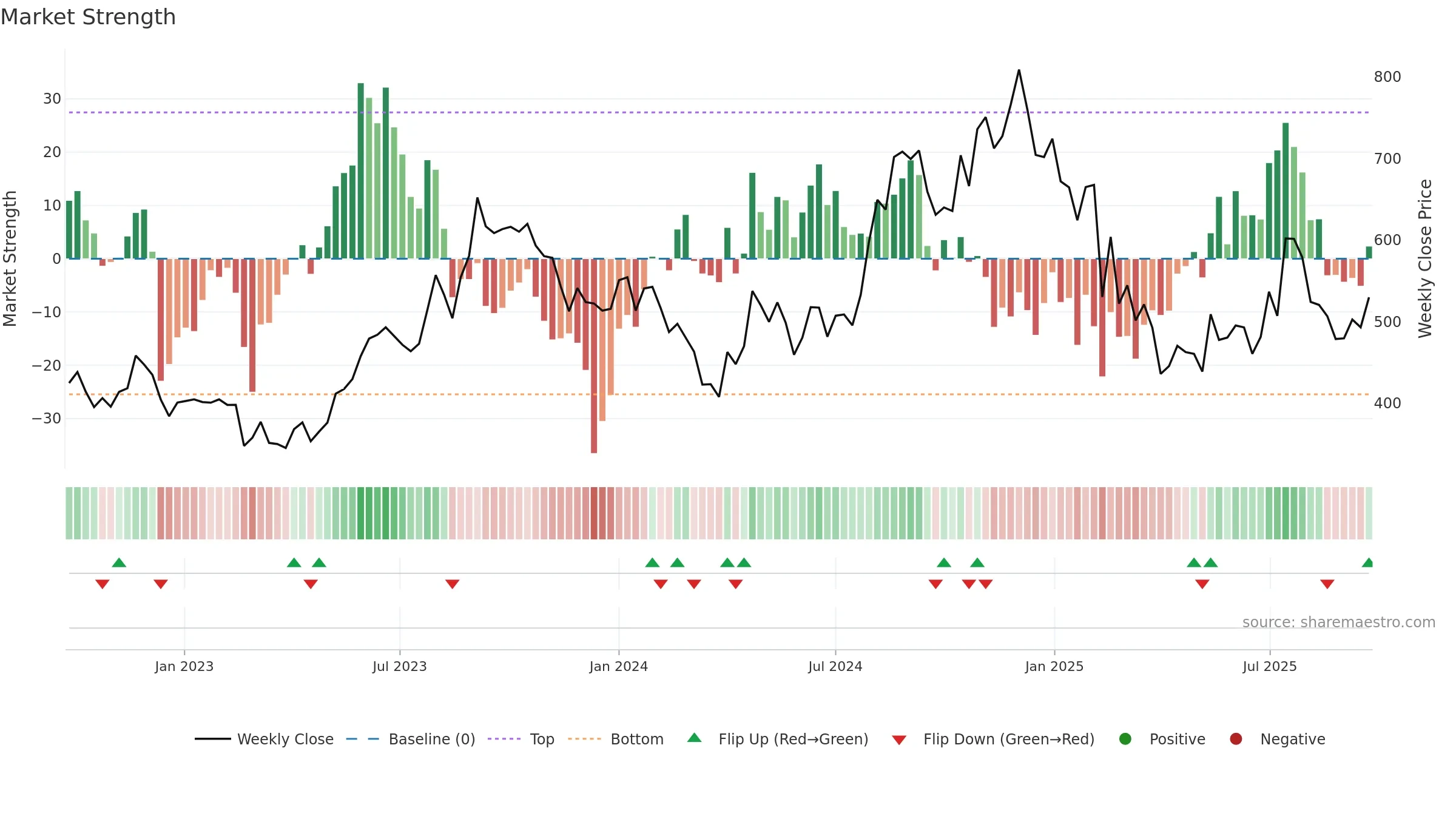

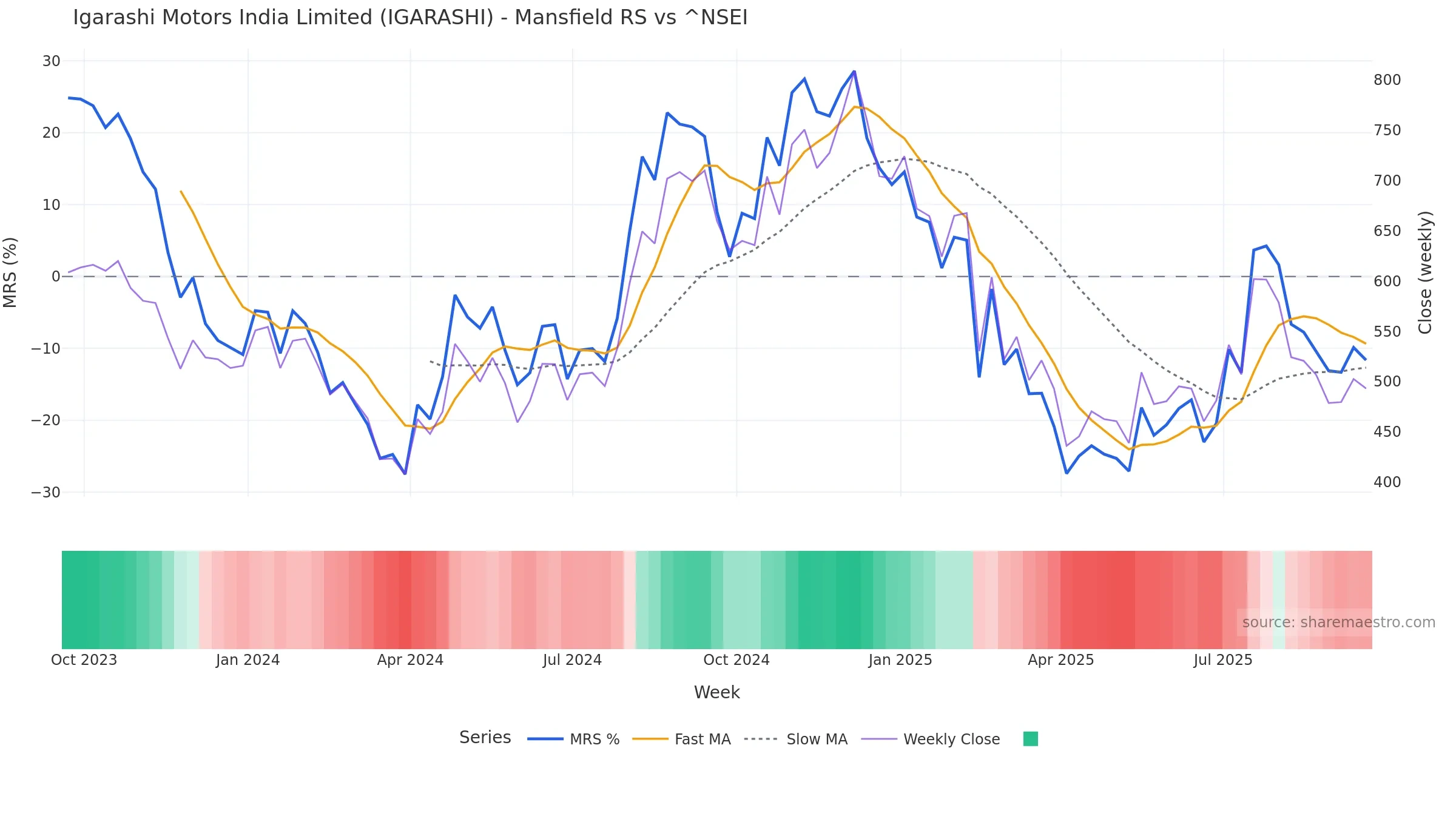

Relative strength is Negative

(< 0%, underperforming).

Latest MRS: -11.65% (week ending Fri, 19 Sep 2025).

Slope: Falling over 8w.

Notes:

- Below zero line indicates relative weakness vs benchmark.

- MRS slope falling over ~8 weeks.

Price is above fair value; upside may be capped without catalysts.

Conclusion

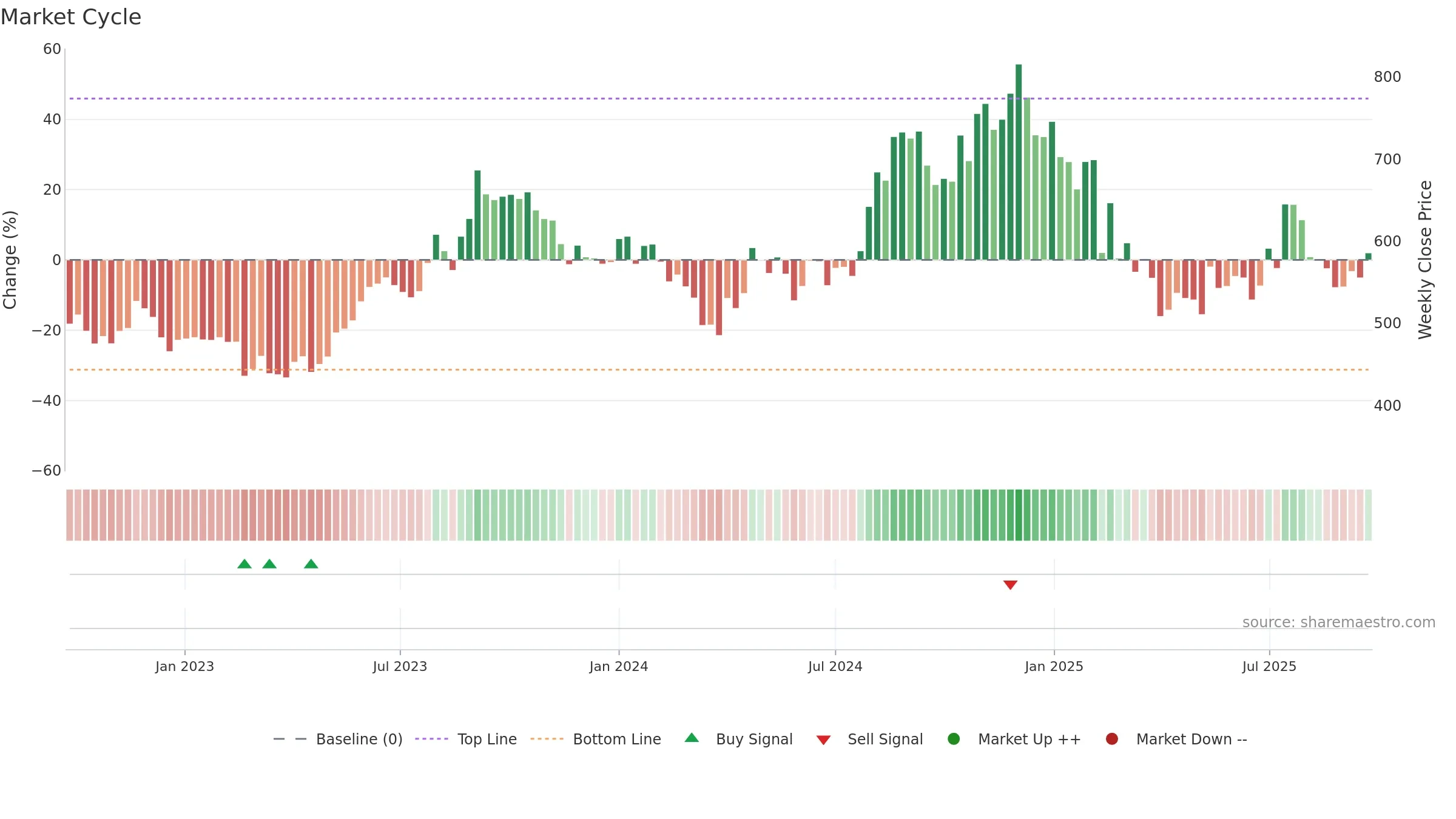

Neutral setup. ★★★☆☆ confidence. Price window: 1. Trend: Range / Neutral; gauge 37. In combination, liquidity confirms the move.

- Price holds above 8w & 26w averages

- Liquidity confirms the price trend

- Momentum is weak/falling

- Sub-0.40 print confirms bear control

Why: Price window 1.08% over 8w. Close is 1.08% above the prior-window high. Volume trend falling. Liquidity convergence with price. Trend state range / neutral. Momentum bearish and rising. Valuation limited upside without catalysts.

Tip: Most metrics include a hover tooltip where they appear in the report.