Price & Volume (8w)

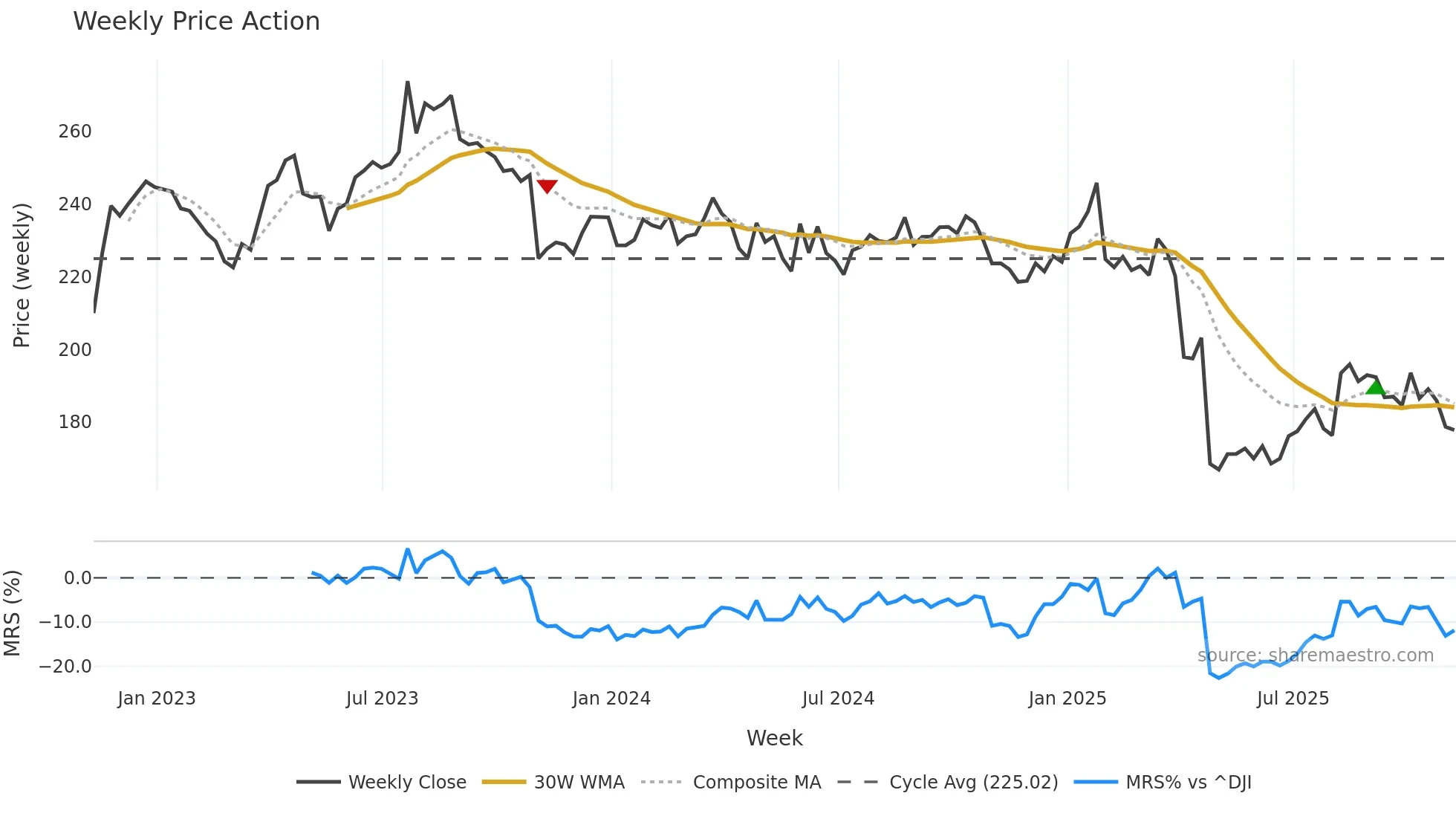

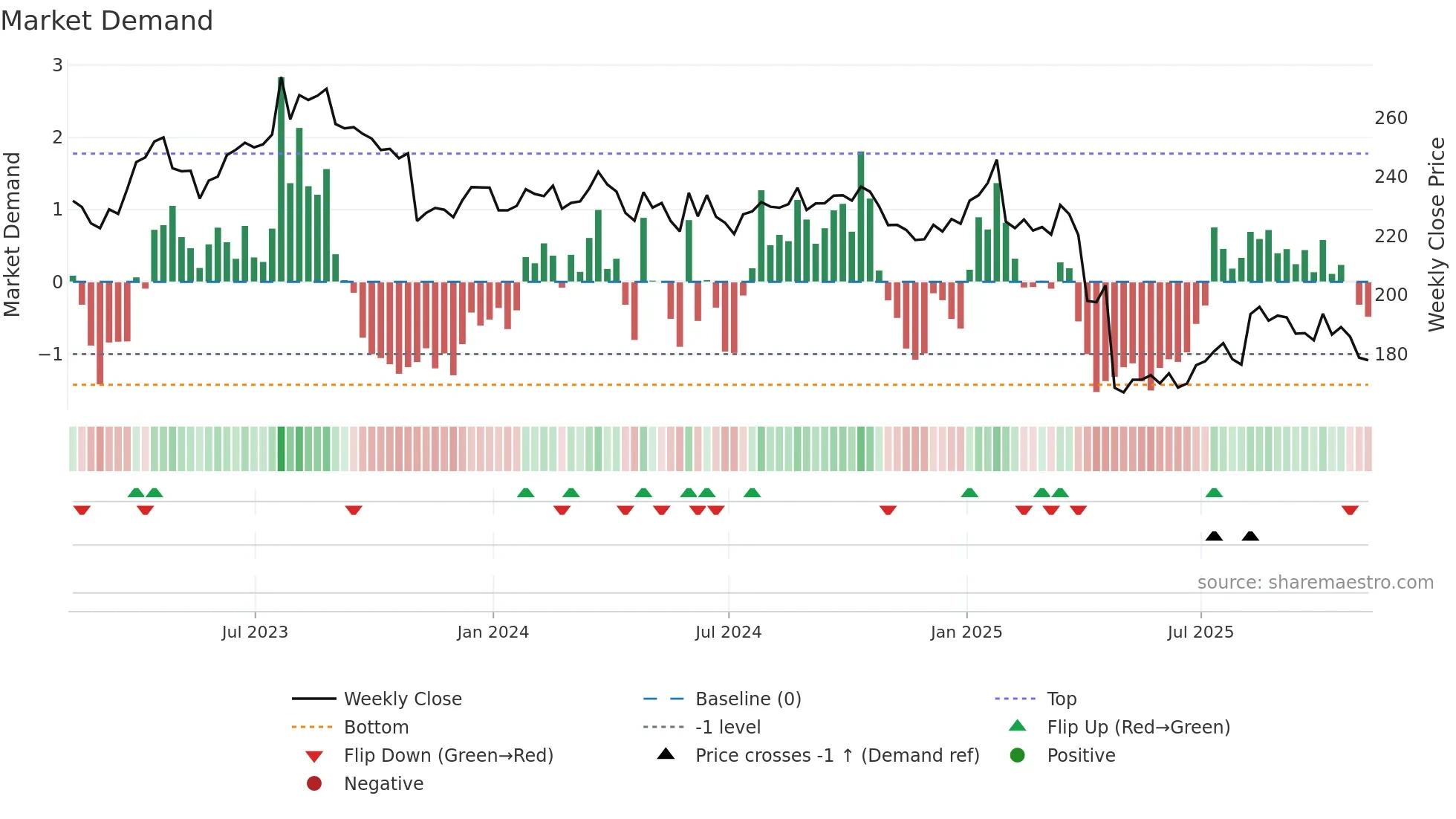

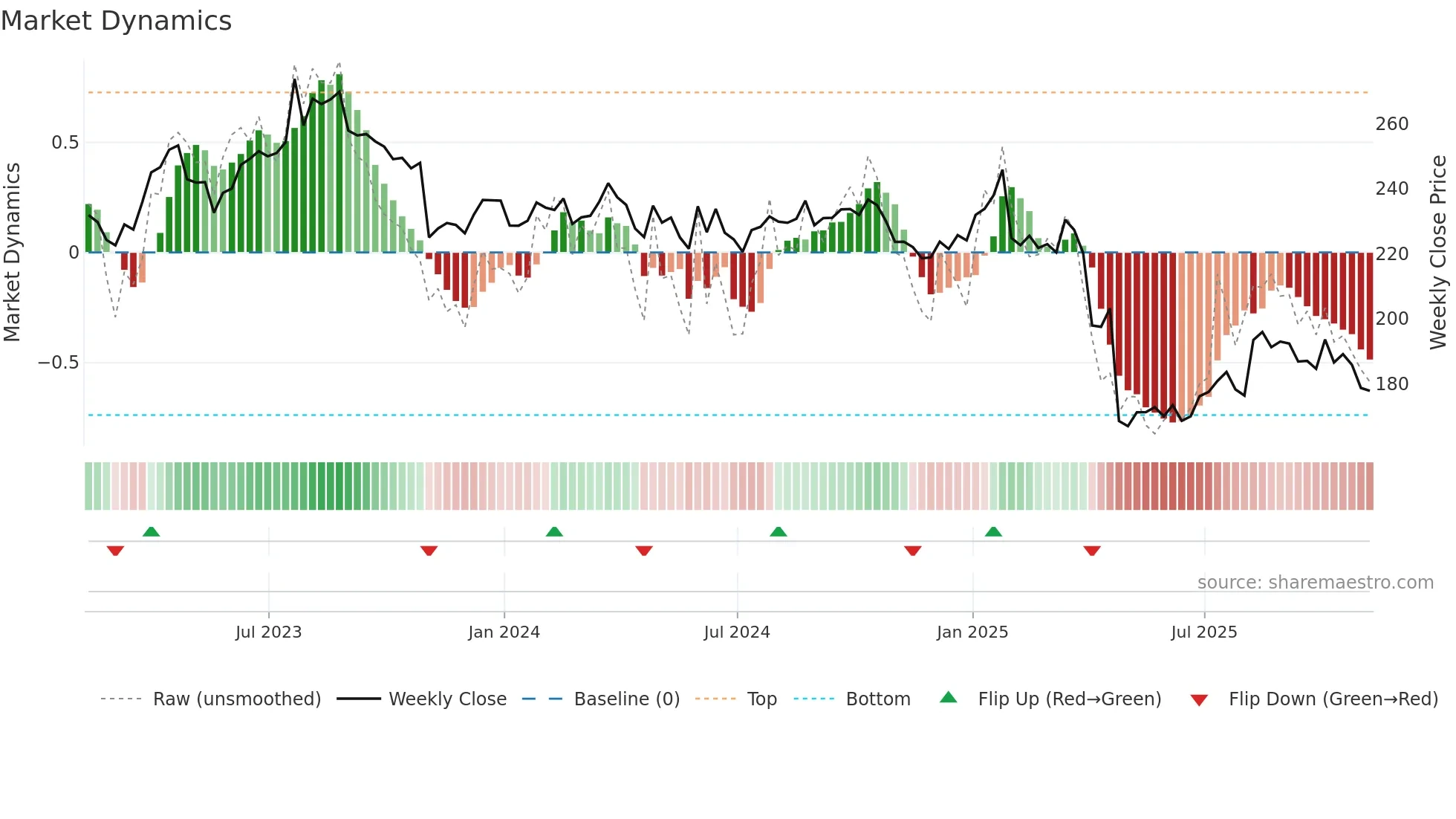

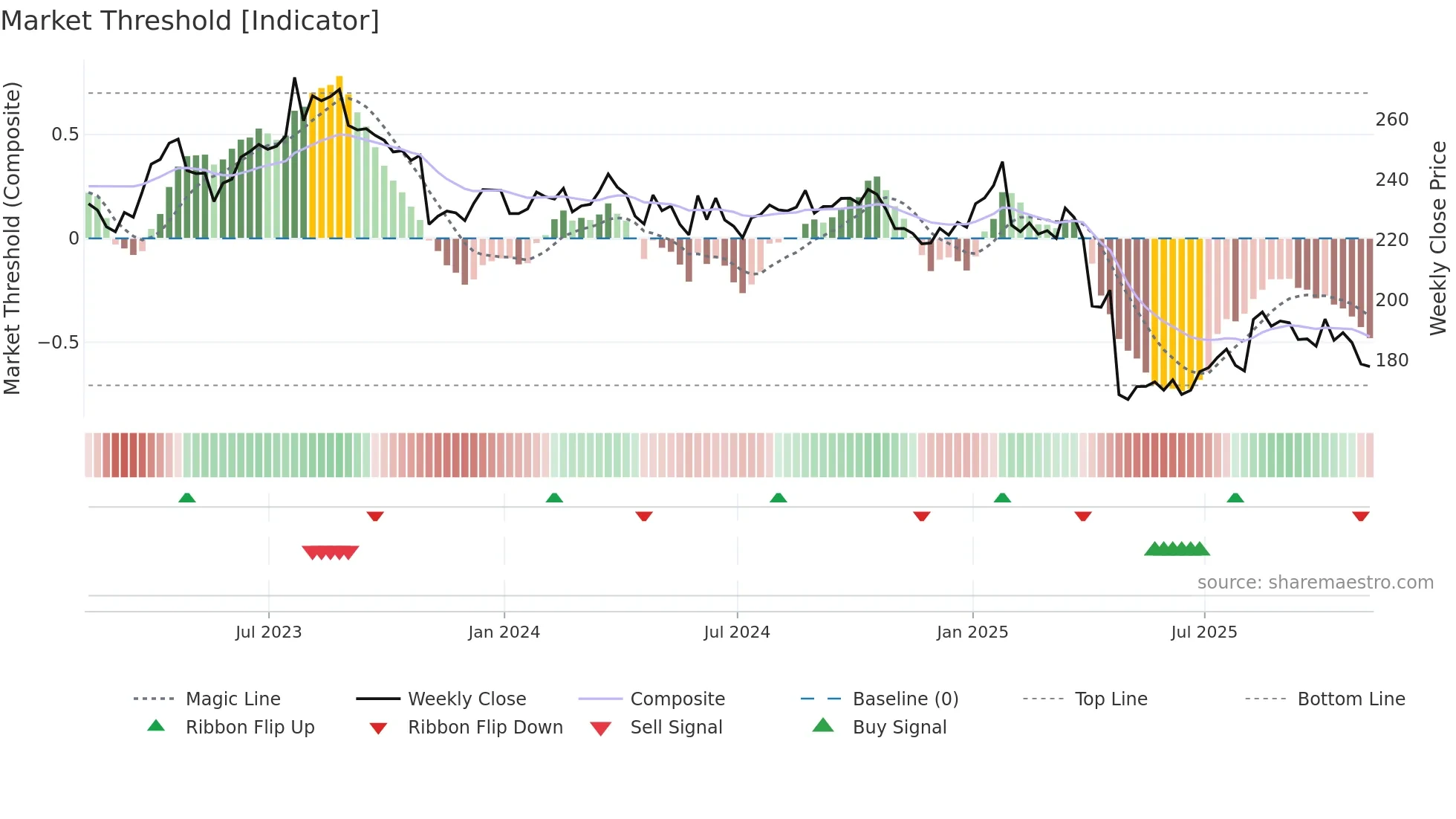

Last week closed up (0.50%), and over the last 8 weeks price is down (-4.92%) with a falling slope (-0.736%/w). Ranges are expanding (current 1.13× mean; 88th pct; realised vol ≈ 2.81%). Price spends time in the lower band (falling), participation is below typical with a buying-tilt bias (z -2.57), money flow is falling, and posture is below 30w & 50w (drawdown -8.15%). Pressure favours further decline unless momentum repairs.

Weekly Report (8w)

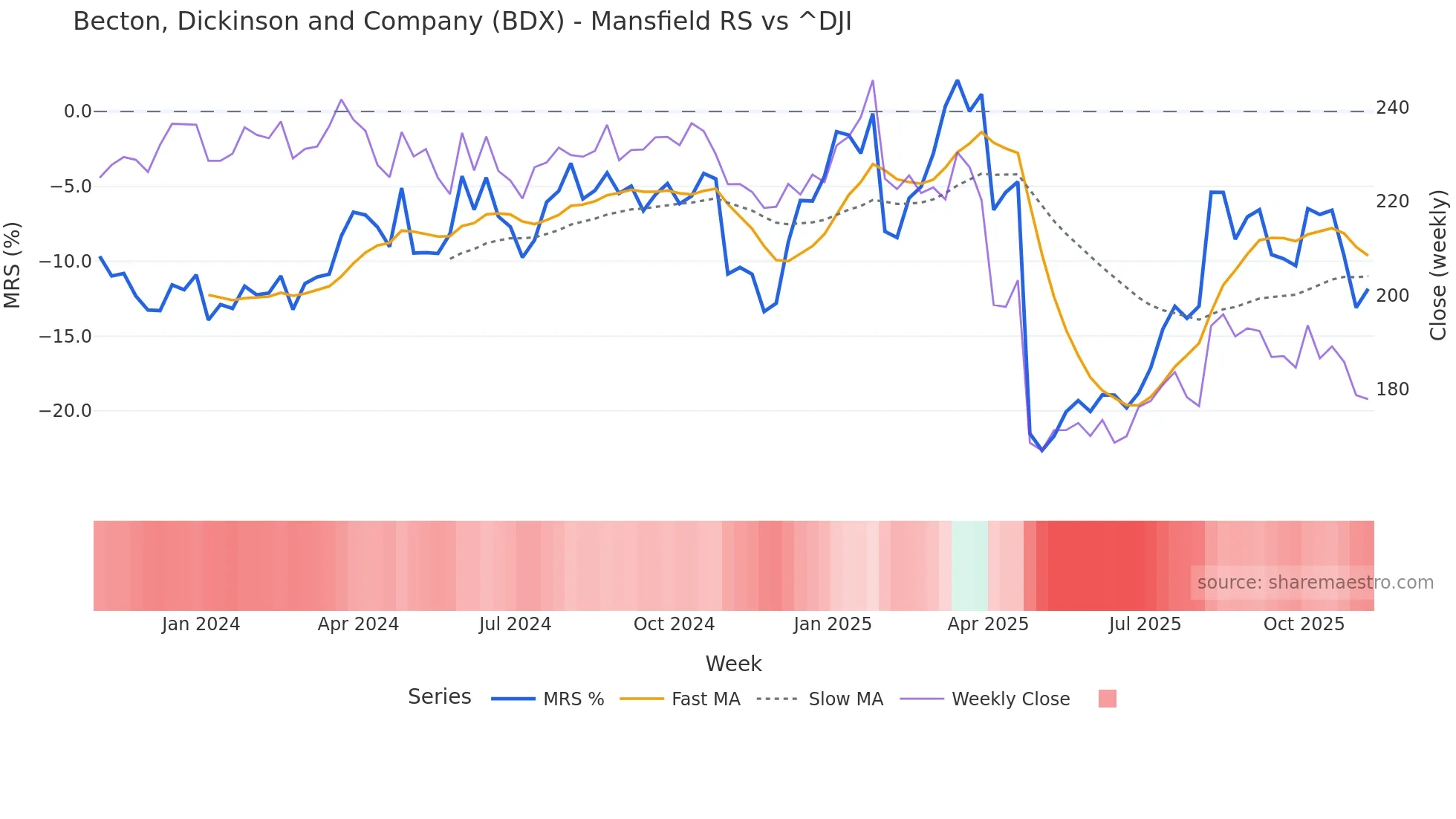

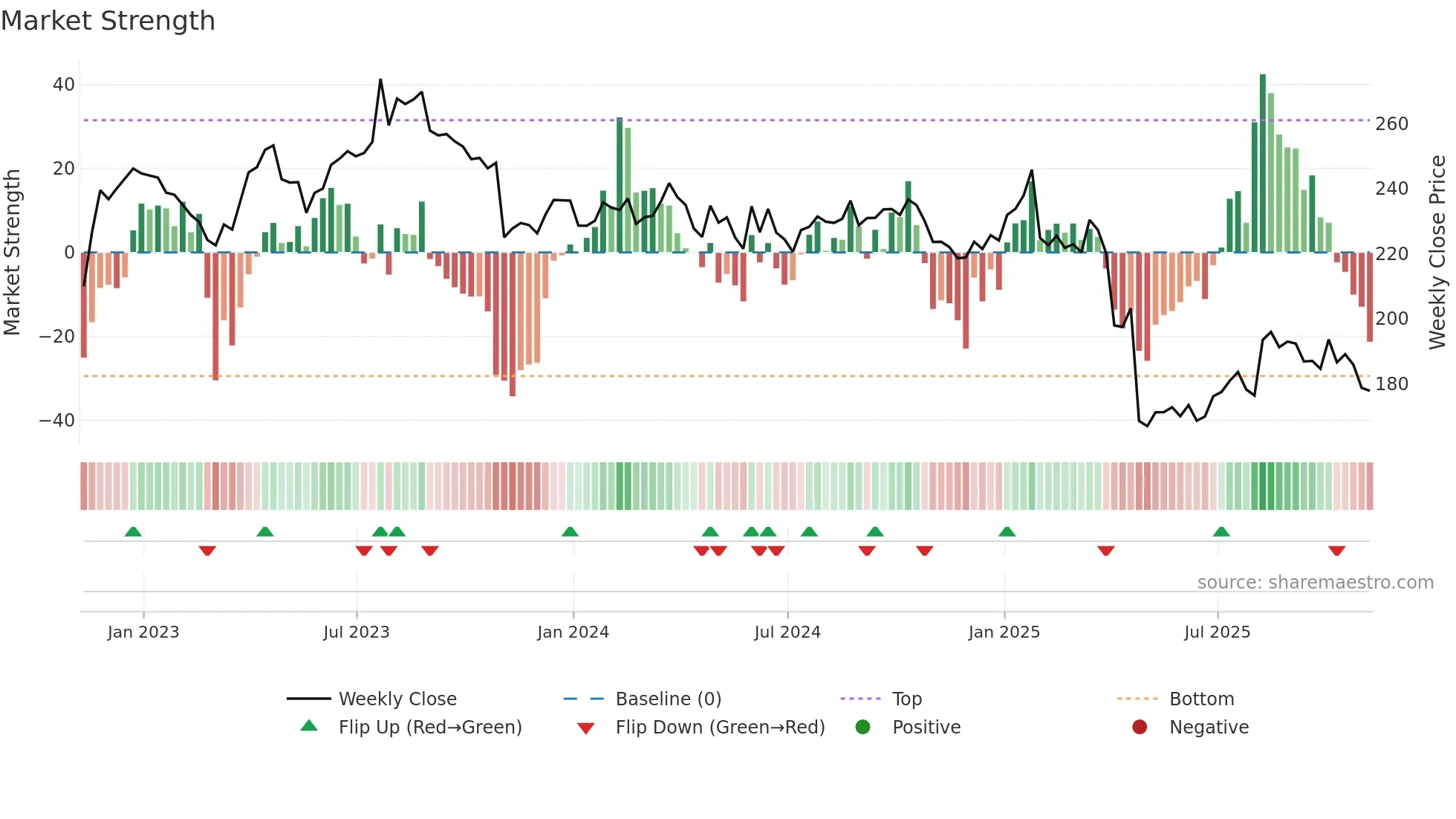

This week: relative strength is fading. In practical terms: backdrop leans corrective; rallies face a higher bar for sustainability; bearish divergence lowers the quality of upside attempts.

- Watch breadth (Up/Down mix) and %B slope to indicate directional follow-through.

Mansfield Relative Strength

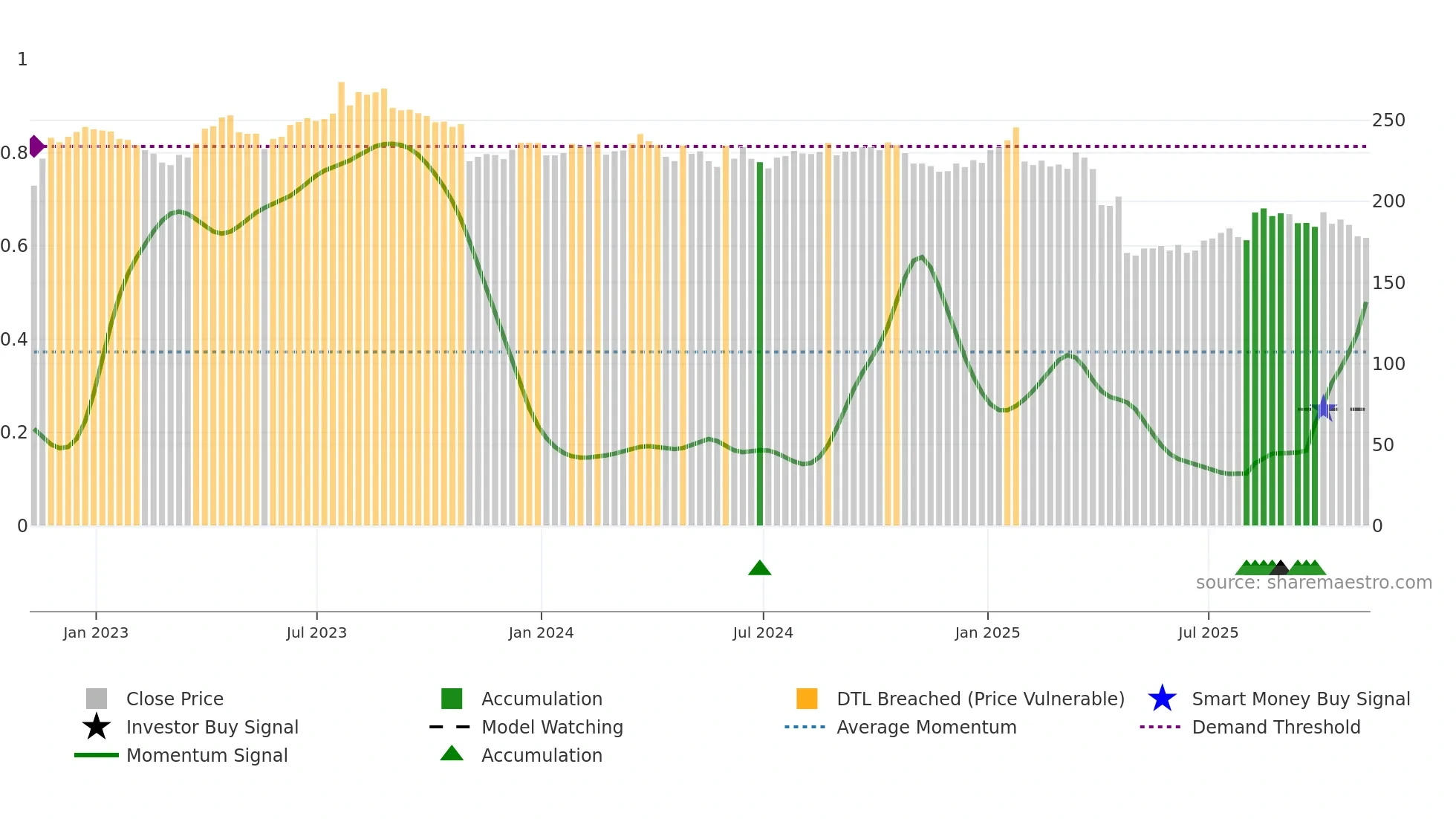

Market Regime (Activity)

Convergence / Divergence (SI vs Price)

(New − Old) / Old × 100.

Compression Ratio compares the latest range to the recent average (e.g., 0.72× means tighter than usual).

Range Percentile shows where the latest range sits within the recent distribution (e.g., 38th pct).

Realised Volatility is the standard deviation of week-to-week Close→Close % changes over the window (a volatility proxy).

0.0=lower band, 0.5=middle MA, 1.0=upper band.

Values >1 or <0 are outside the bands.

%B slope is the weekly drift of %B — rising means price is gravitating toward strength.

Band location (lower/middle/upper) and Band trend (rising/falling/flat)

summarise where price lives and whether that placement is improving.

Proprietary Analysis: All Sharemaestro charts, signals, and insights are unique to our platform. We do not follow conventional market models - this proprietary approach is what sets Sharemaestro apart.