Equifax Inc.

EFX NYSE

Weekly Report

Equifax Inc. closed at 257.5800 (-1.59% WoW) . Data window ends Fri, 19 Sep 2025.

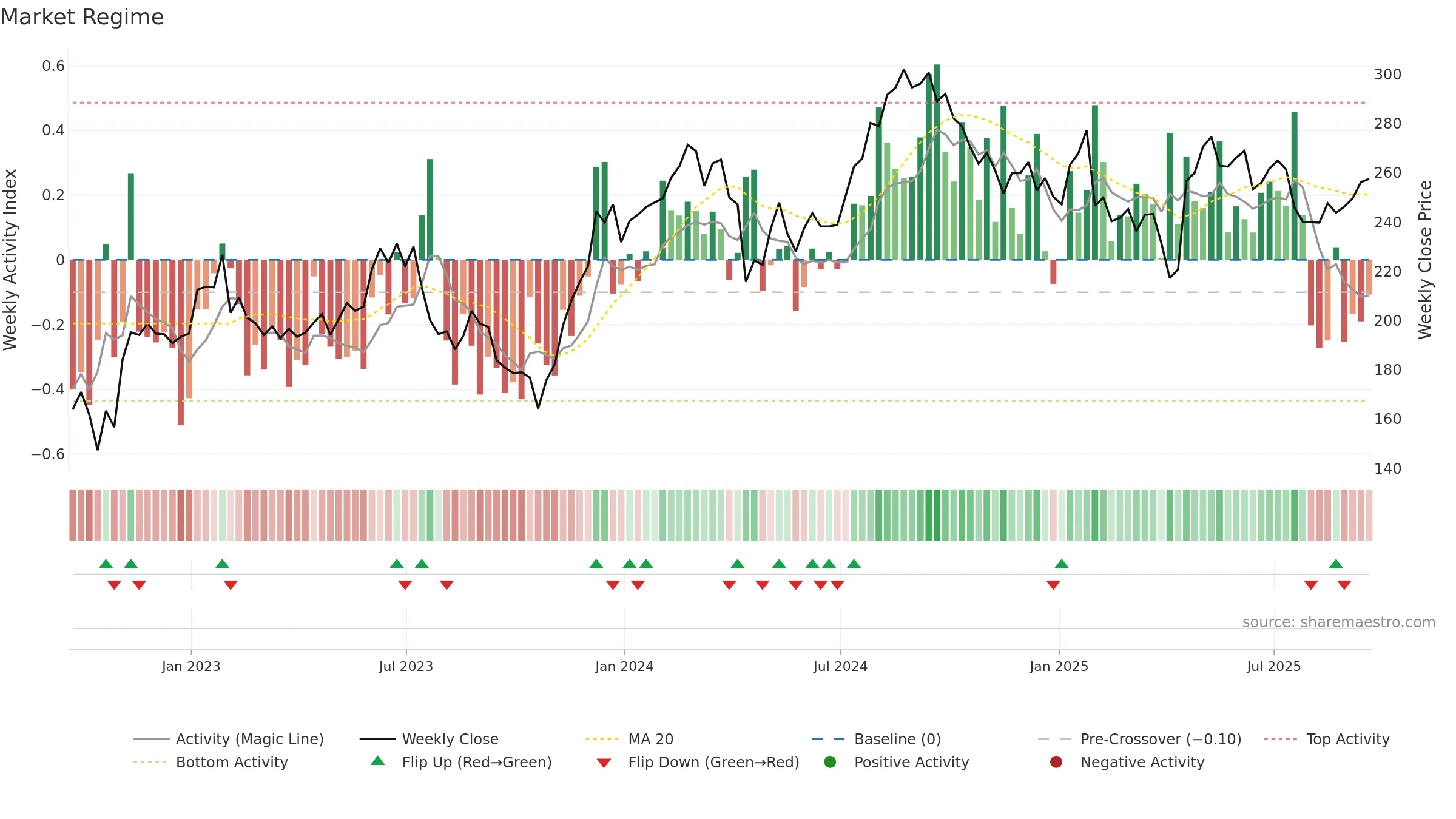

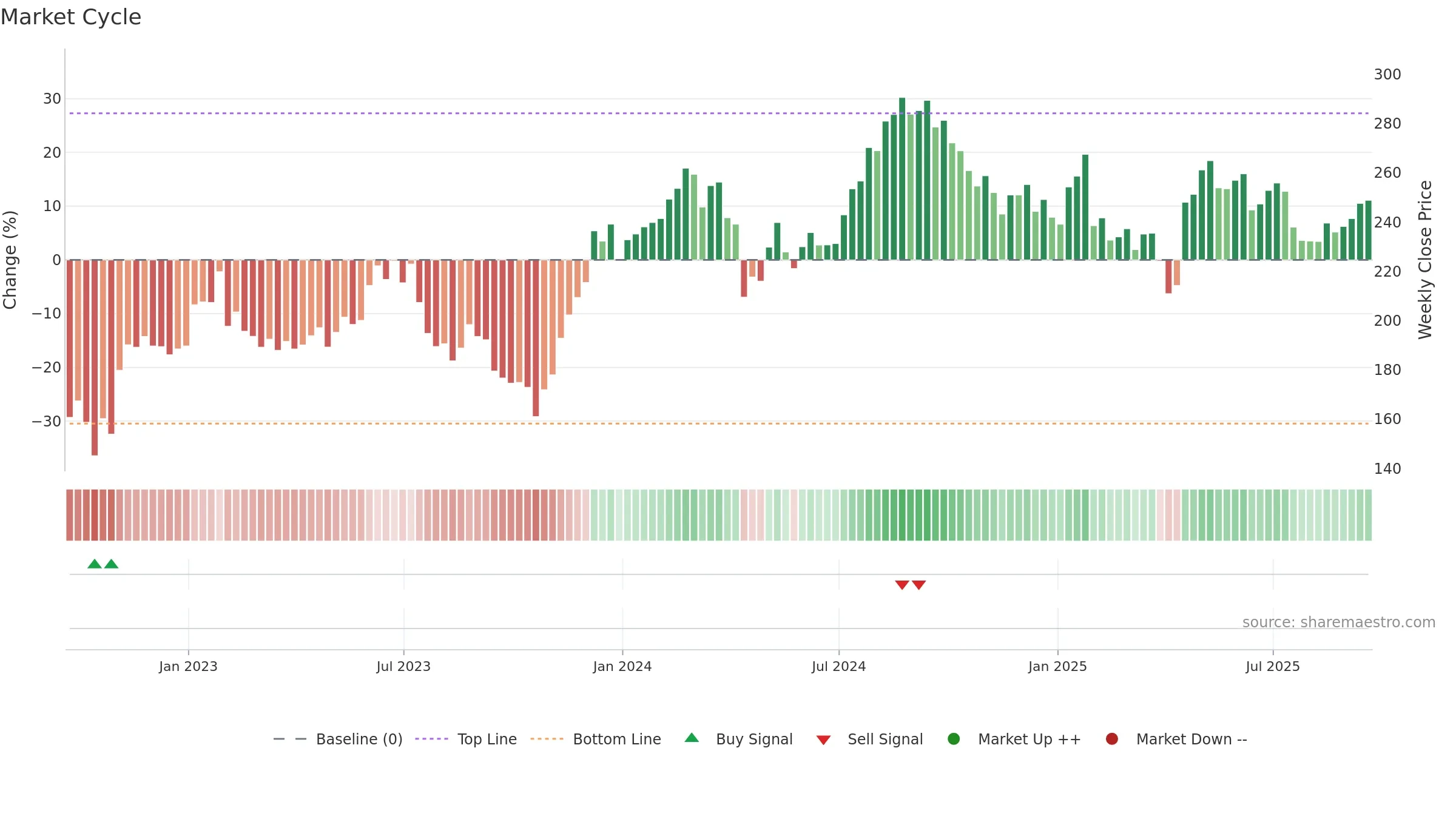

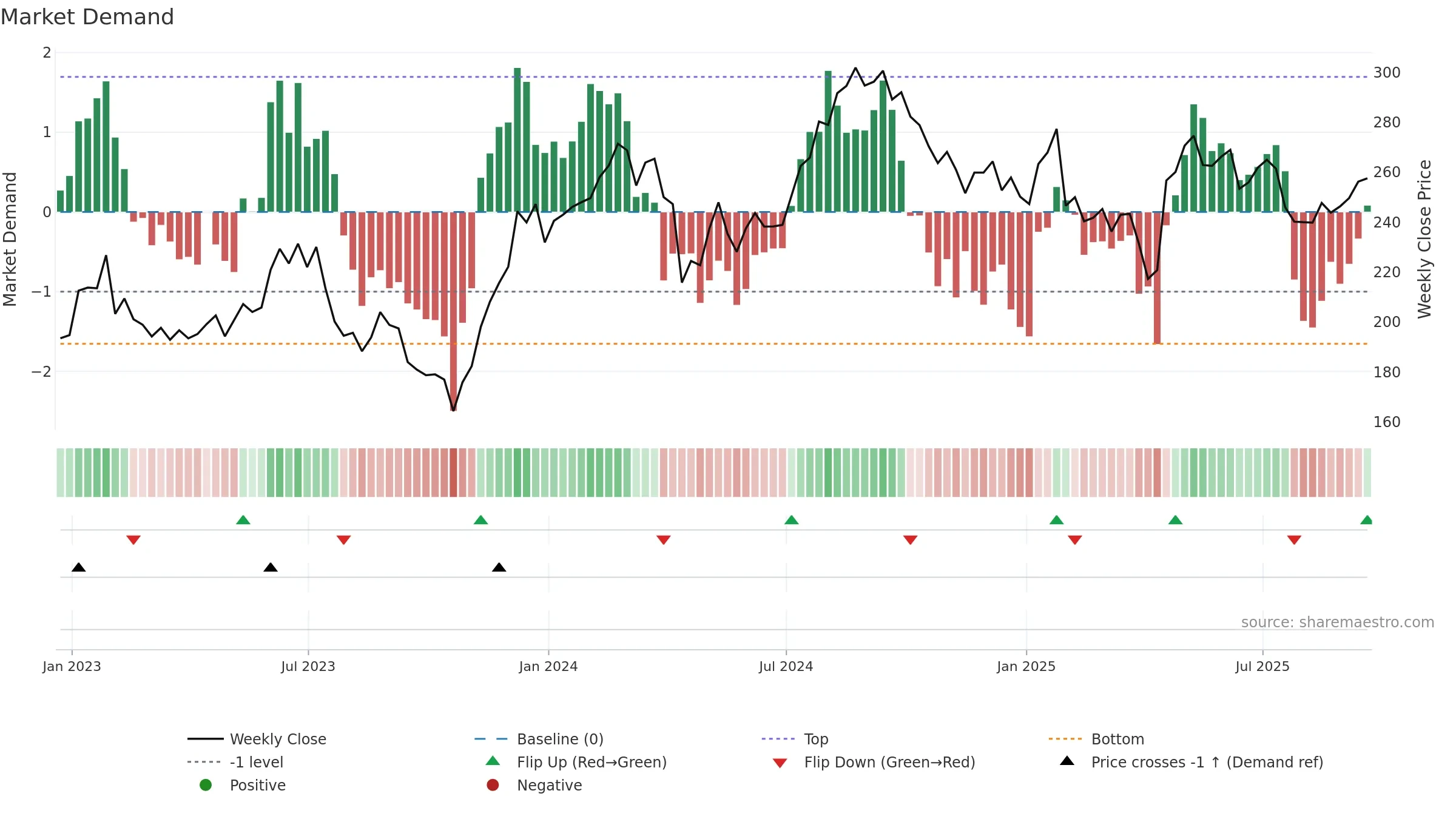

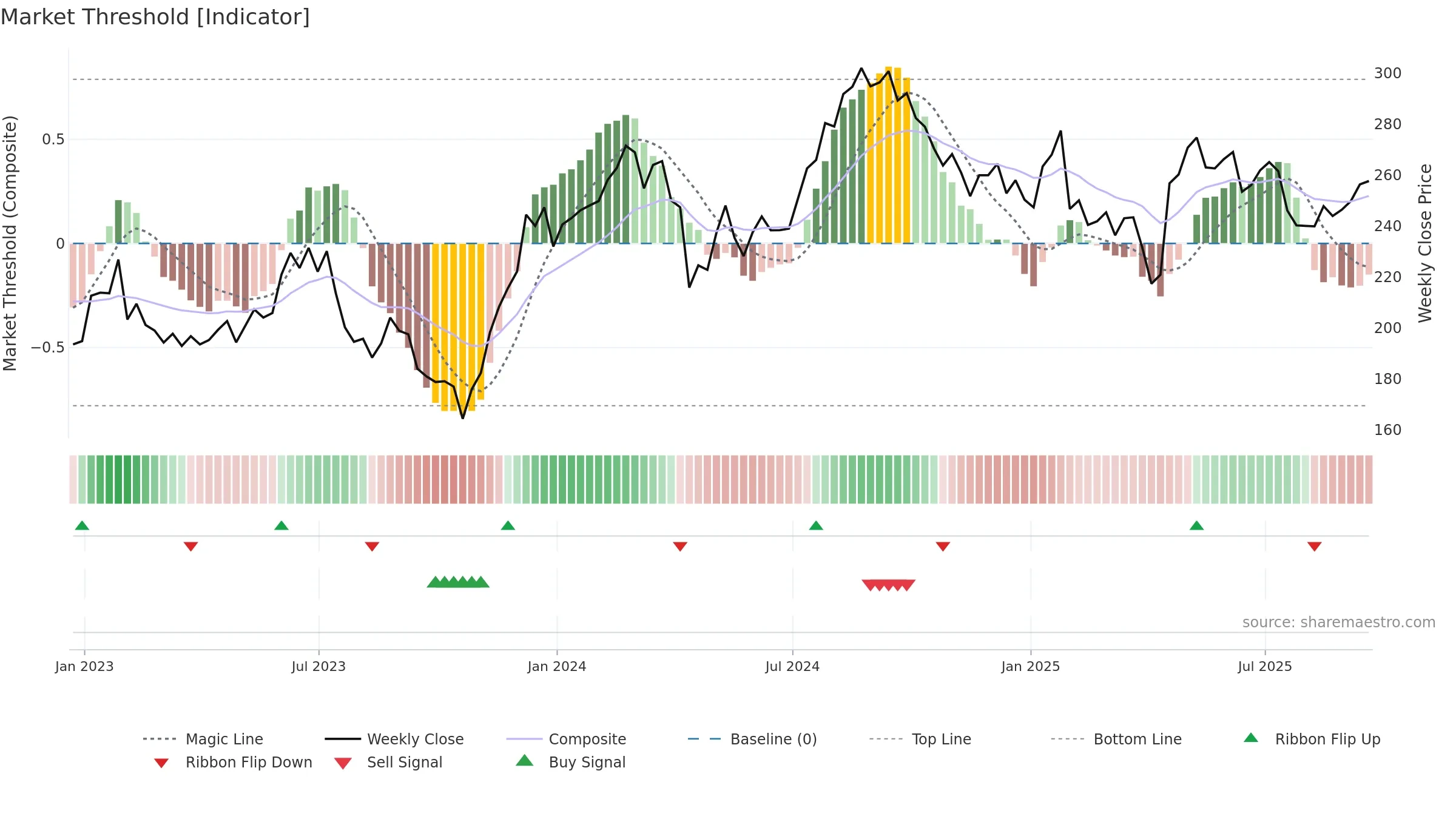

How to read this — Price slope is upward, indicating persistent buying over the window. Low weekly volatility favours steadier follow-through. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

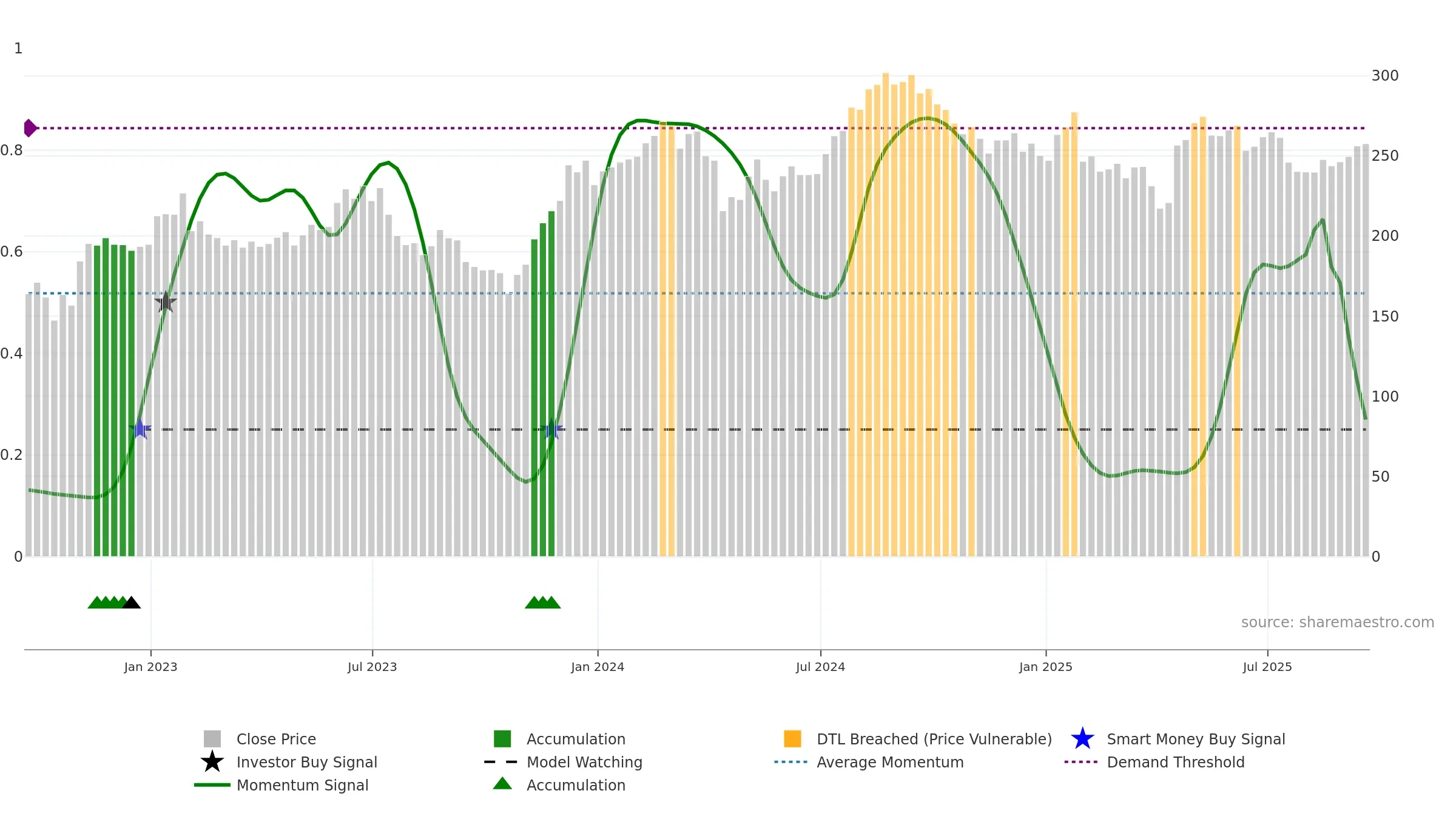

Gauge maps the trend signal to a 0–100 scale.

How to read this — Bearish zone with falling momentum — sellers in control. Loss of the ~0.50 midline after strength suggests regime shift. Sub-0.40 print confirms downside control.

Bias remains lower; rallies are suspect unless gauge reclaims 0.50/0.60.

Conclusion

Negative setup. ★★☆☆☆ confidence. Price window: 7. Trend: Downtrend Confirmed; gauge 27. In combination, liquidity diverges from price.

- Price holds above 8w & 26w averages

- Low return volatility supports durability

- Bearish control with falling momentum

- Momentum is weak/falling

- Liquidity diverges from price

- Midline (~0.50) failure after strength

Why: Price window 7.33% over 8w. Close is 0.52% above the prior-window high. Return volatility 1.25%. Volume trend falling. Liquidity divergence with price. Trend state downtrend confirmed. Momentum bearish and falling.

Tip: Most metrics include a hover tooltip where they appear in the report.