Kuo Yang Construction Co., Ltd.

2505 TPE

Weekly Report

Kuo Yang Construction Co., Ltd. closed at 19.2500 (-1.03% WoW) . Data window ends Mon, 15 Sep 2025.

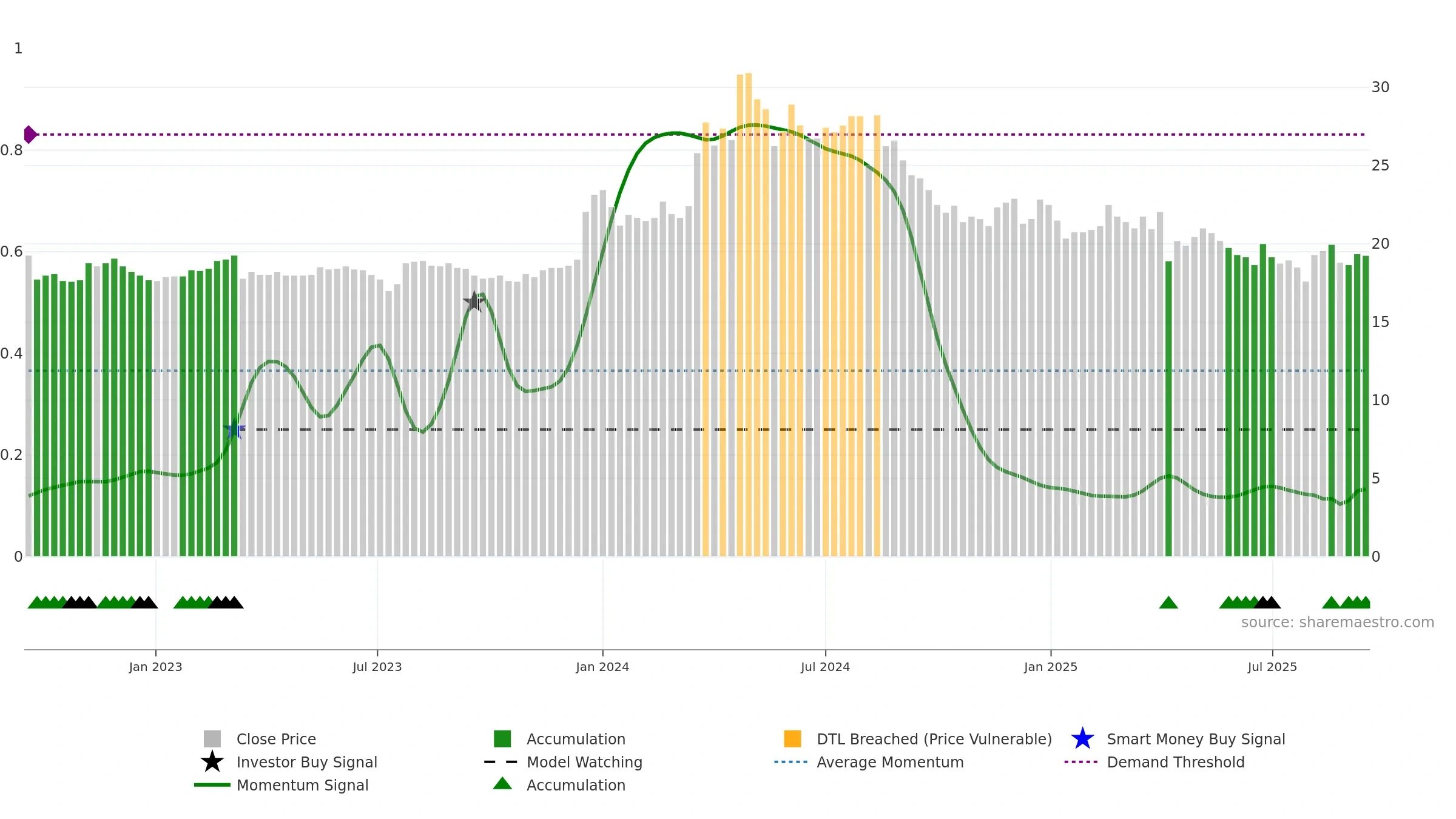

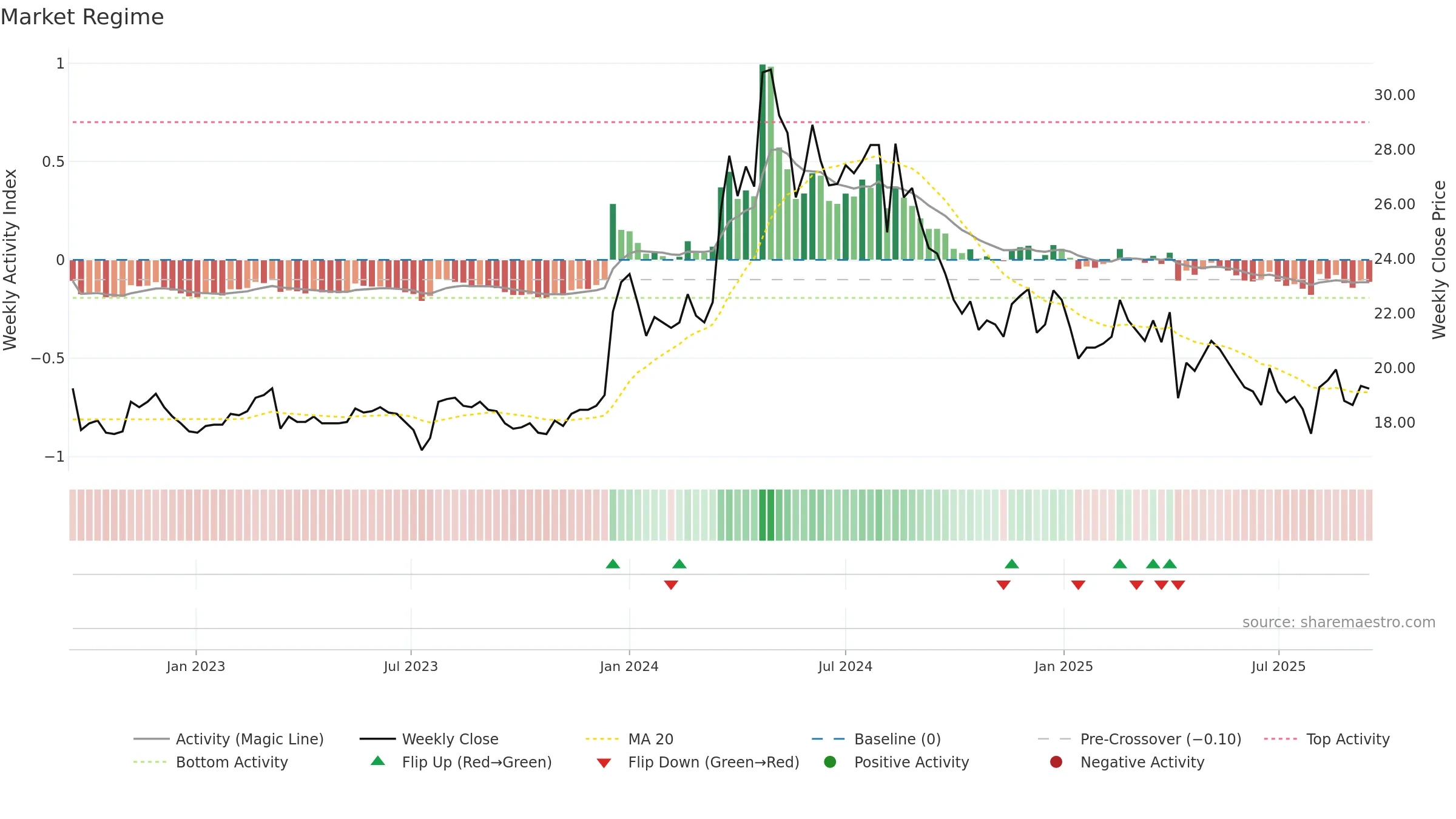

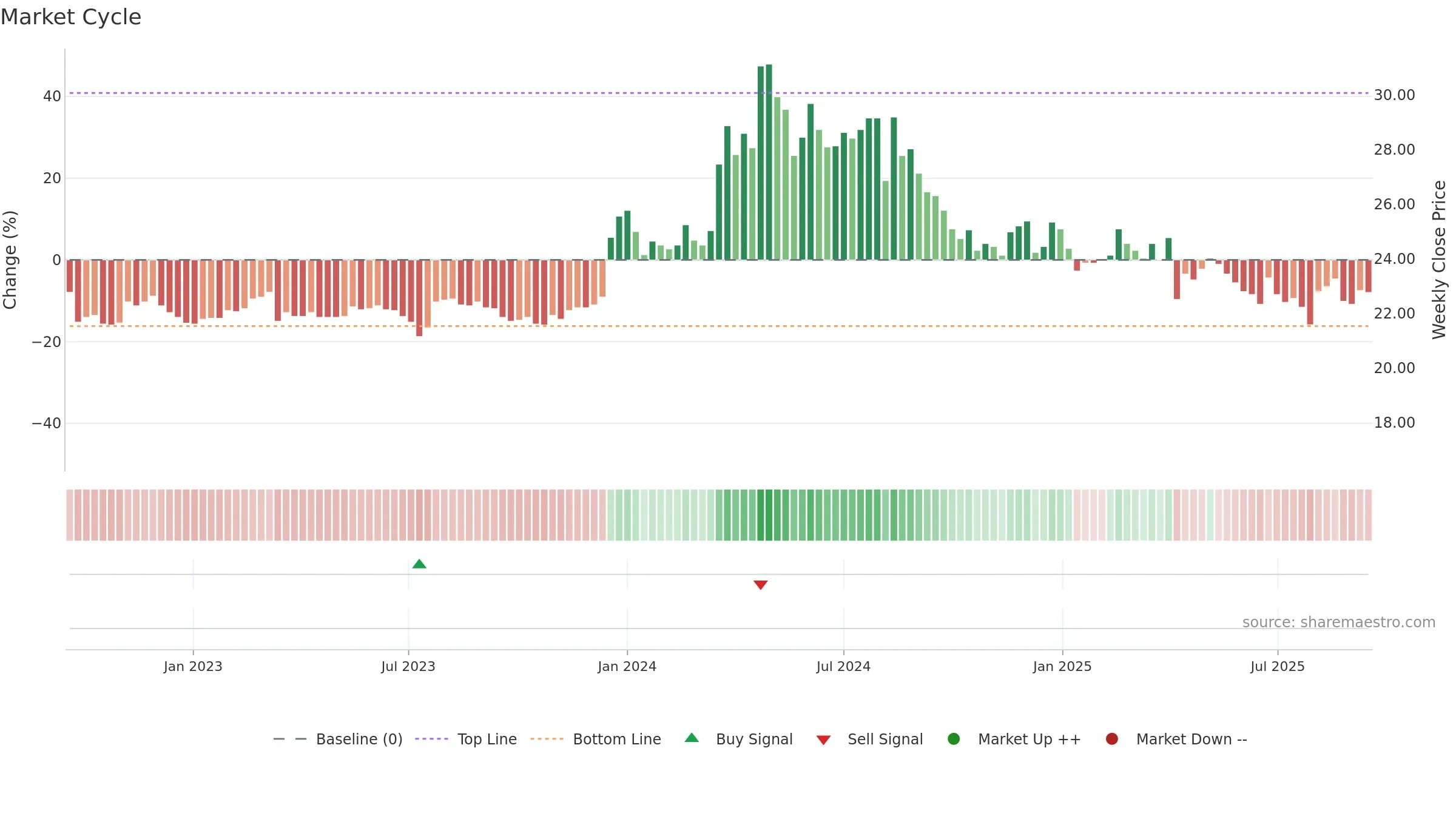

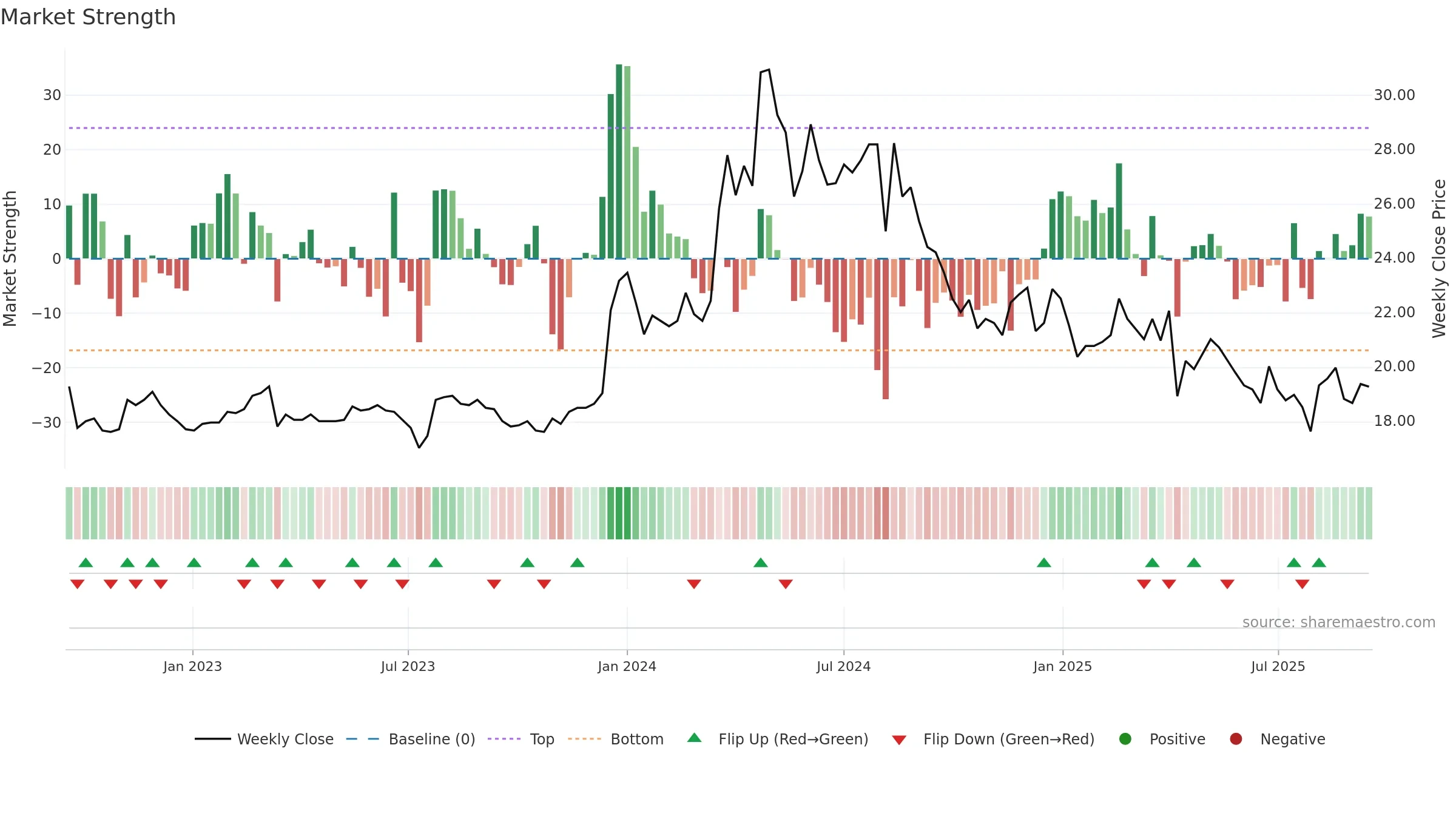

How to read this — Price slope is upward, indicating persistent buying over the window. Low weekly volatility favours steadier follow-through. Volume trend diverges from price — watch for fatigue or rotation. Weak MA stack argues for caution; rallies can fail near the 8–13 week region. Fresh short-term downside crossover weakens near-term tone.

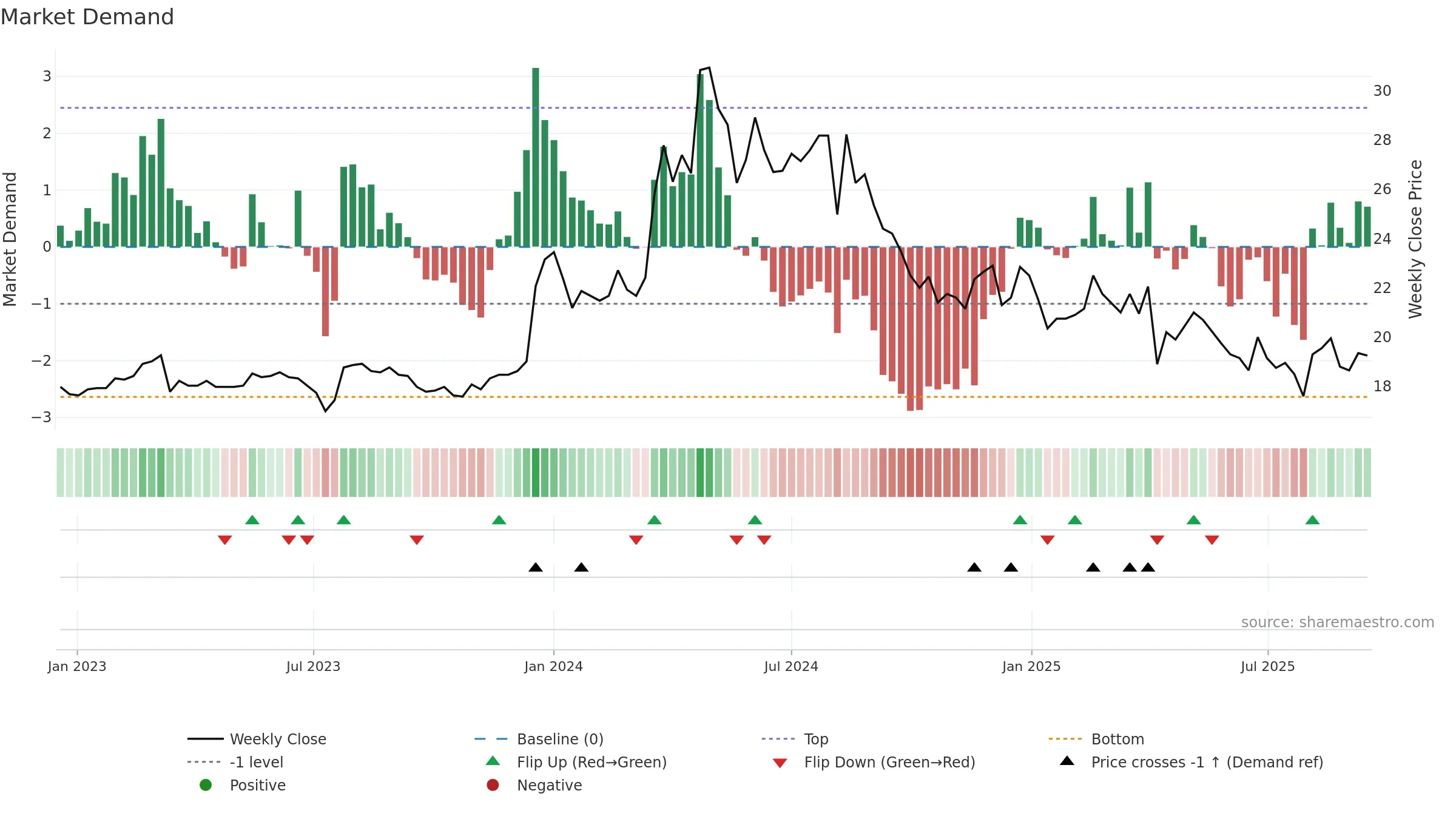

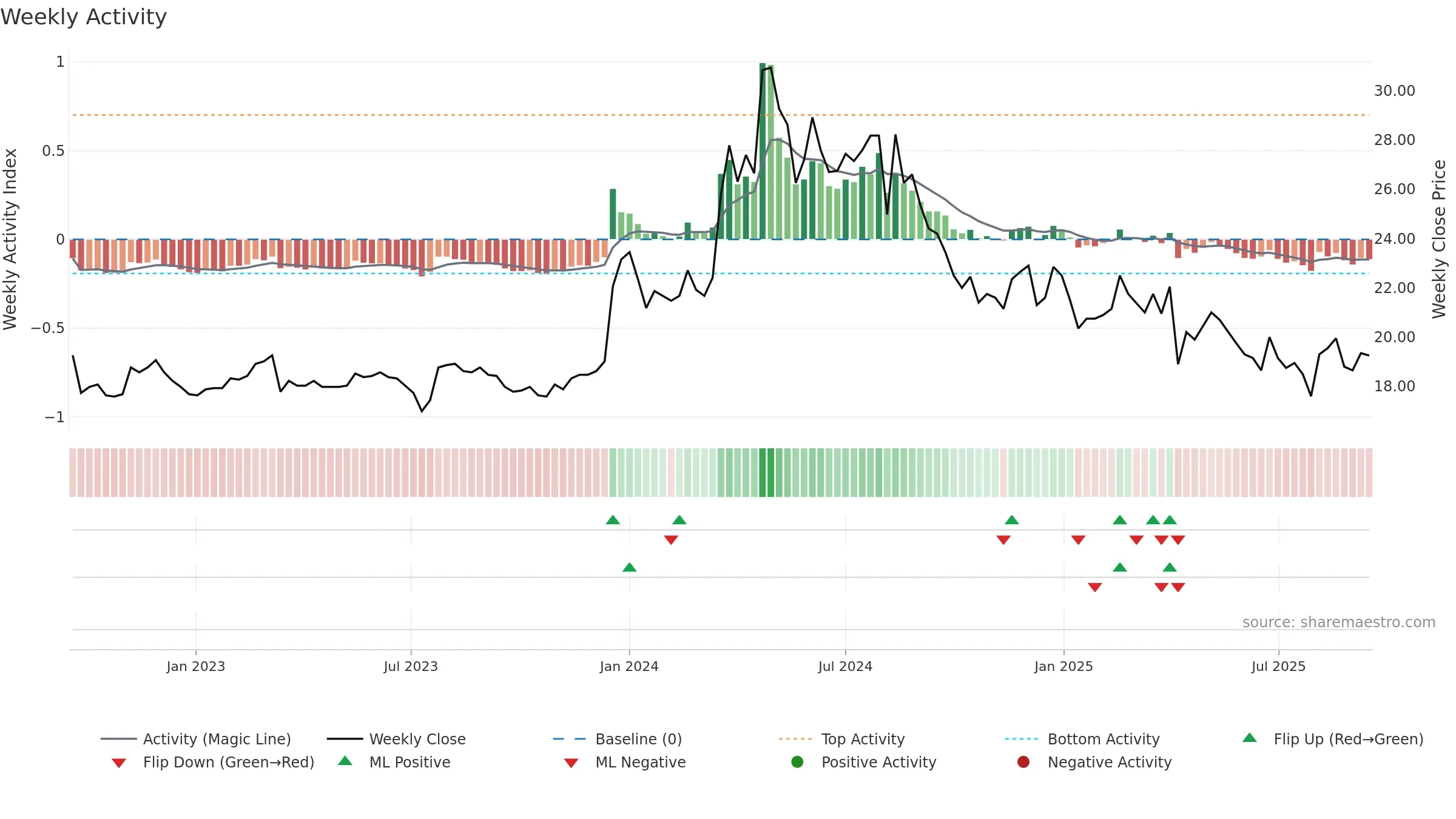

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

Gauge maps the trend signal to a 0–100 scale.

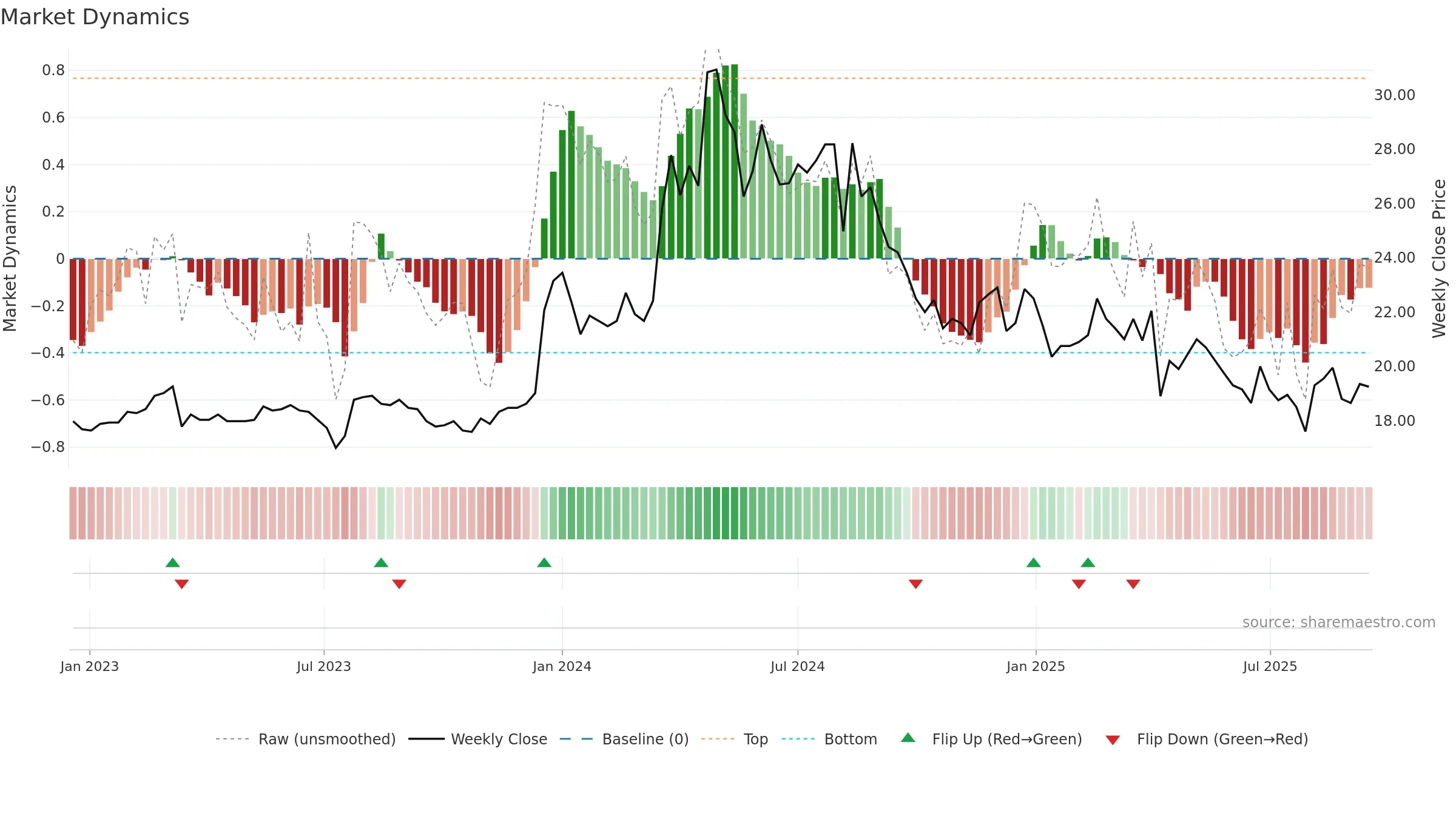

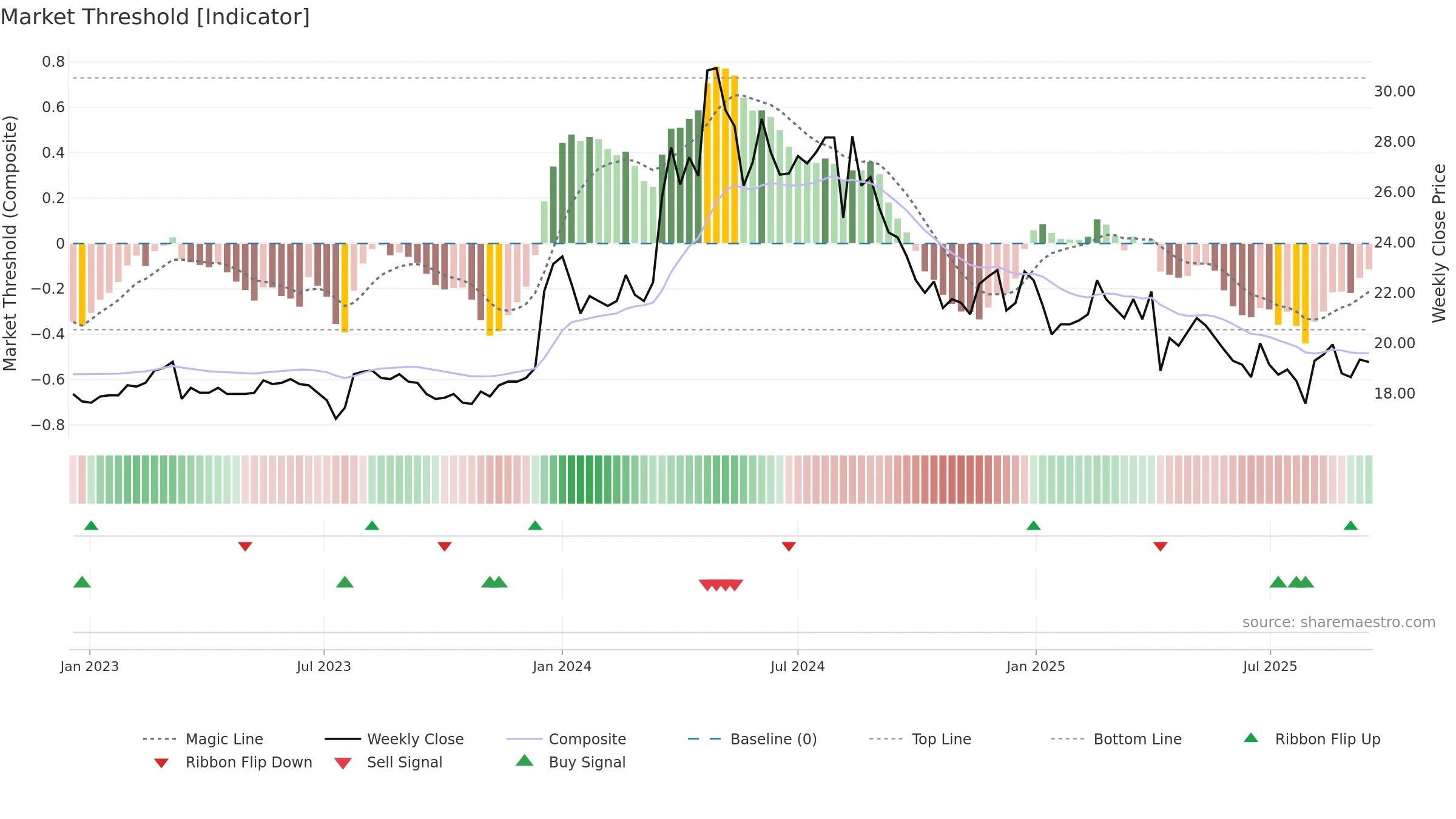

How to read this — Bearish backdrop but short-term momentum is improving; confirmation still needed.

Early improvement — look for a reclaim of 0.50→0.60 to validate.

Price is above fair value; upside may be capped without catalysts.

Conclusion

Neutral setup. ★★★☆☆ confidence. Price window: 9. Trend: Bottoming Attempt; gauge 13. In combination, liquidity diverges from price.

- Early improvement from bearish zone (bottoming attempt)

- Low return volatility supports durability

- Price is not above key averages

- Weak moving-average stack

- Liquidity diverges from price

Why: Price window 9.37% over 8w. Close is -3.51% below the prior-window high. Return volatility 1.92%. Volume trend falling. Liquidity divergence with price. Trend state bottoming attempt. Low-regime (≤0.25) upticks 4/7 (57.0%) • Accumulating. MA stack weak. 4–8w crossover bearish. Momentum neutral and rising. Valuation limited upside without catalysts.

Tip: Most metrics include a hover tooltip where they appear in the report.