Weekly Report

Vanguard S&P Small-Cap 600 Growth Index Fund ETF Shares closed at 122.4700 (-1.42% WoW) . Data window ends Fri, 19 Sep 2025.

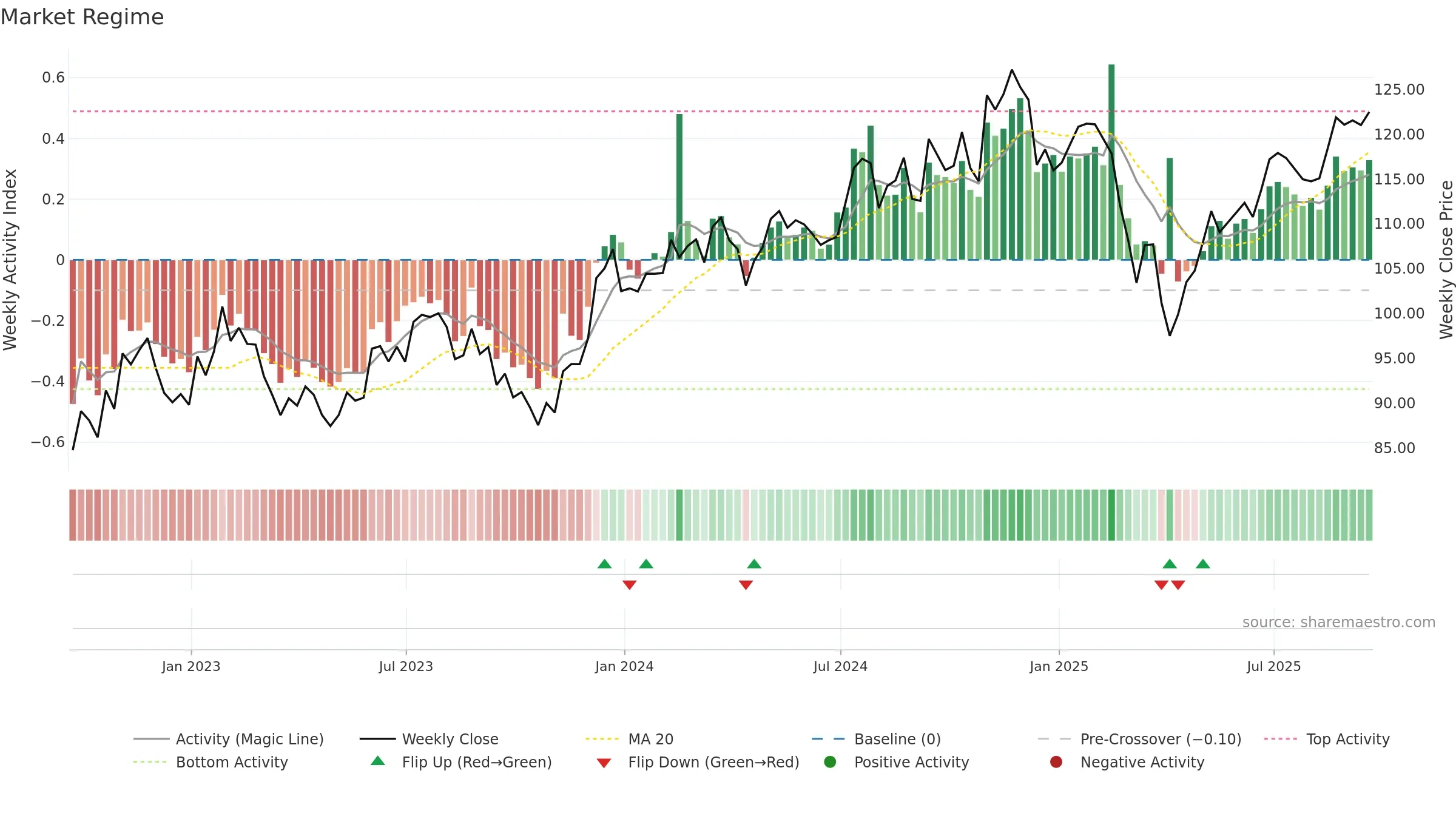

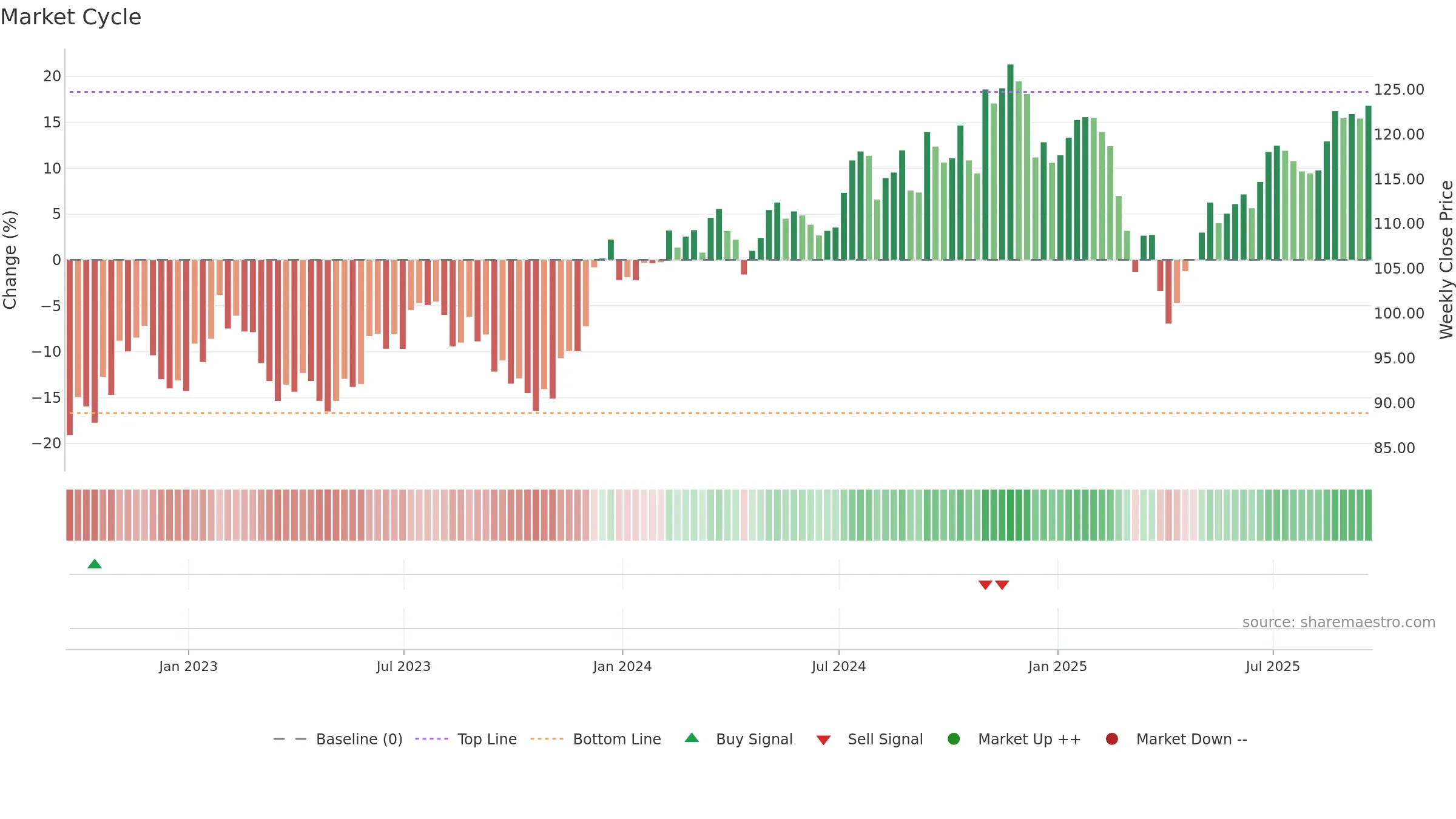

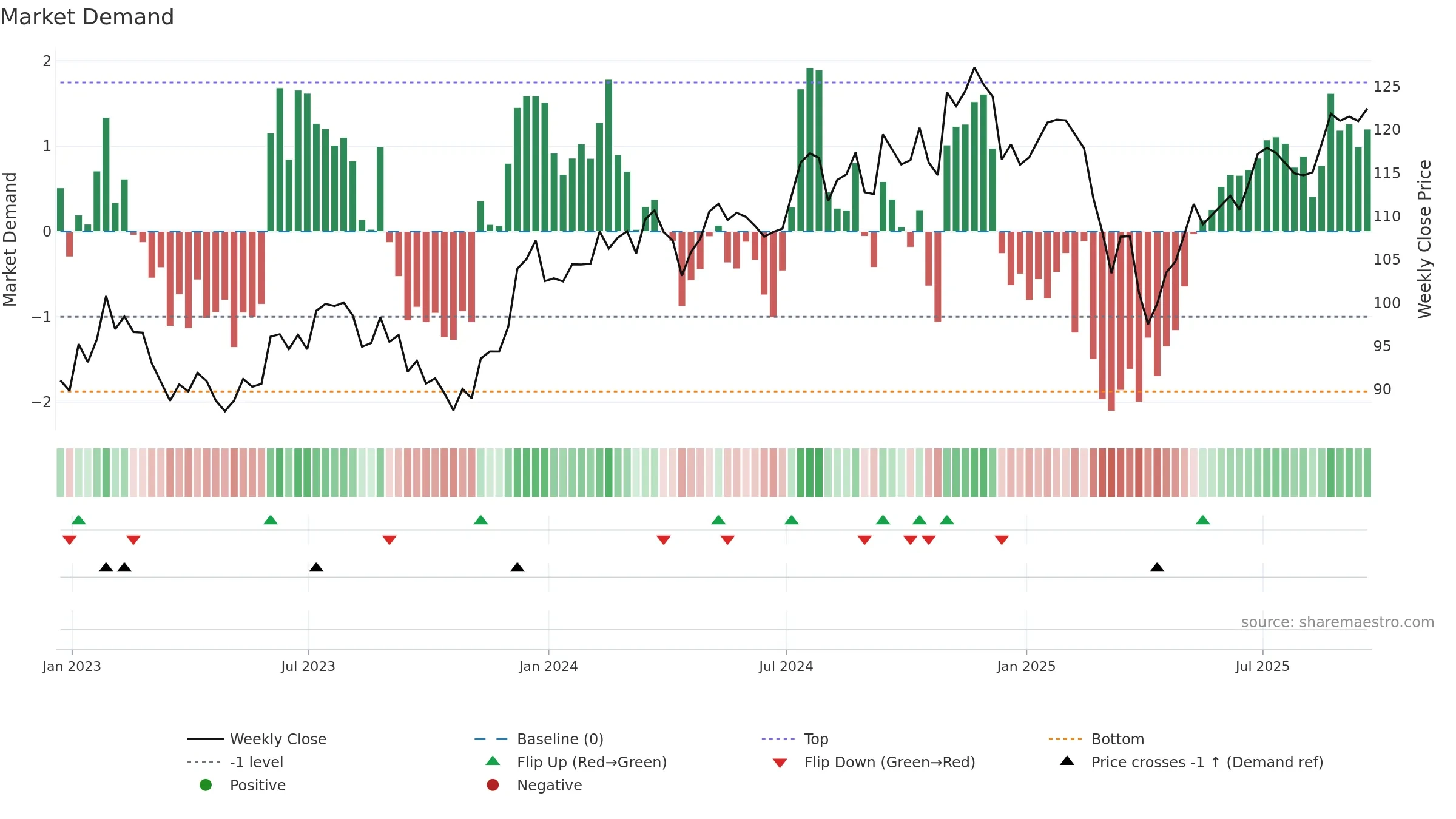

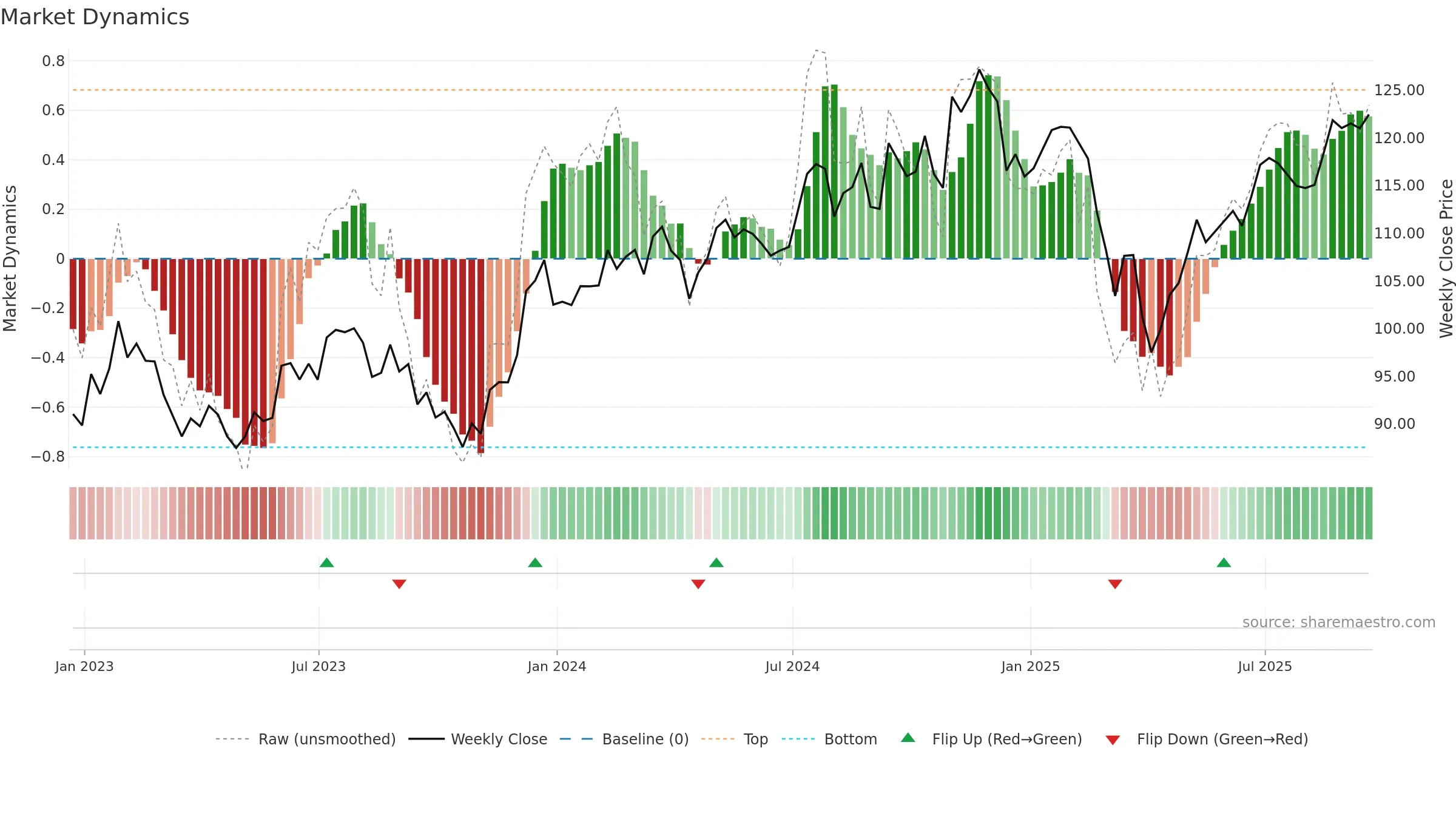

How to read this — Price slope is upward, indicating persistent buying over the window. Low weekly volatility favours steadier follow-through. Volume trend diverges from price — watch for fatigue or rotation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

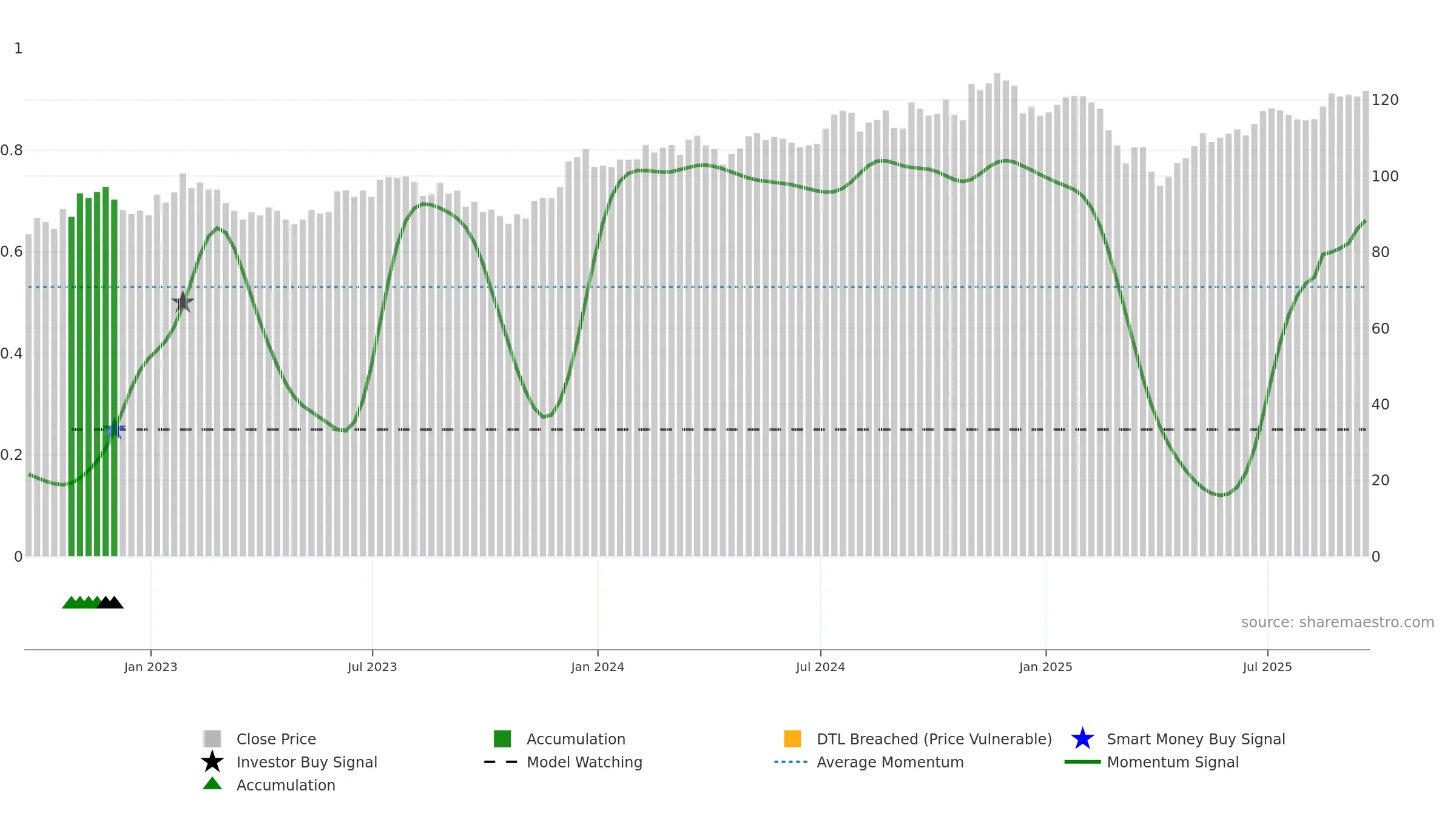

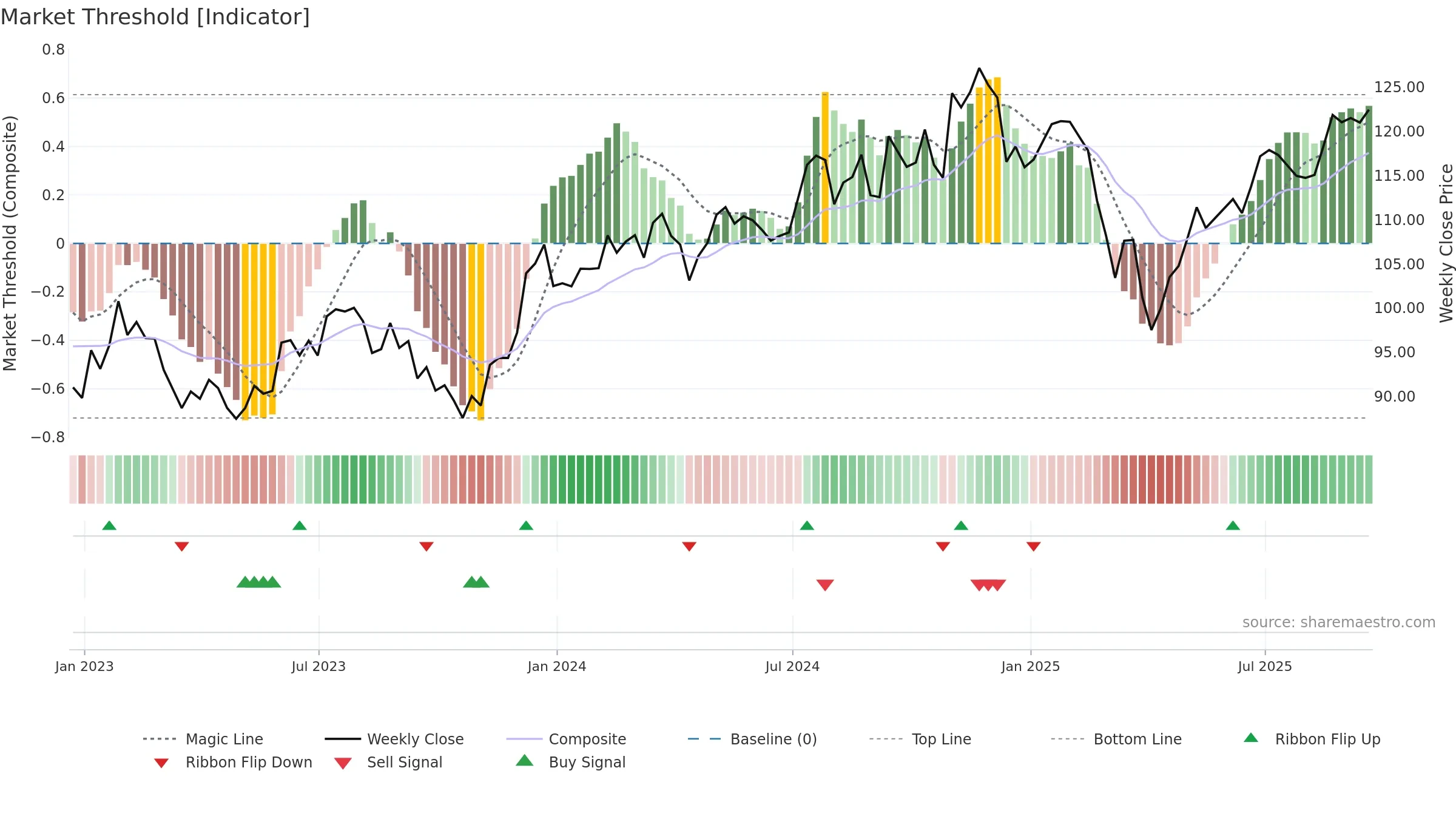

Gauge maps the trend signal to a 0–100 scale.

How to read this — Bullish gauge levels imply persistent upside pressure.

Conclusion

Positive setup. ★★★★☆ confidence. Price window: 6. Trend: Bullish @ 66. In combination, liquidity diverges from price.

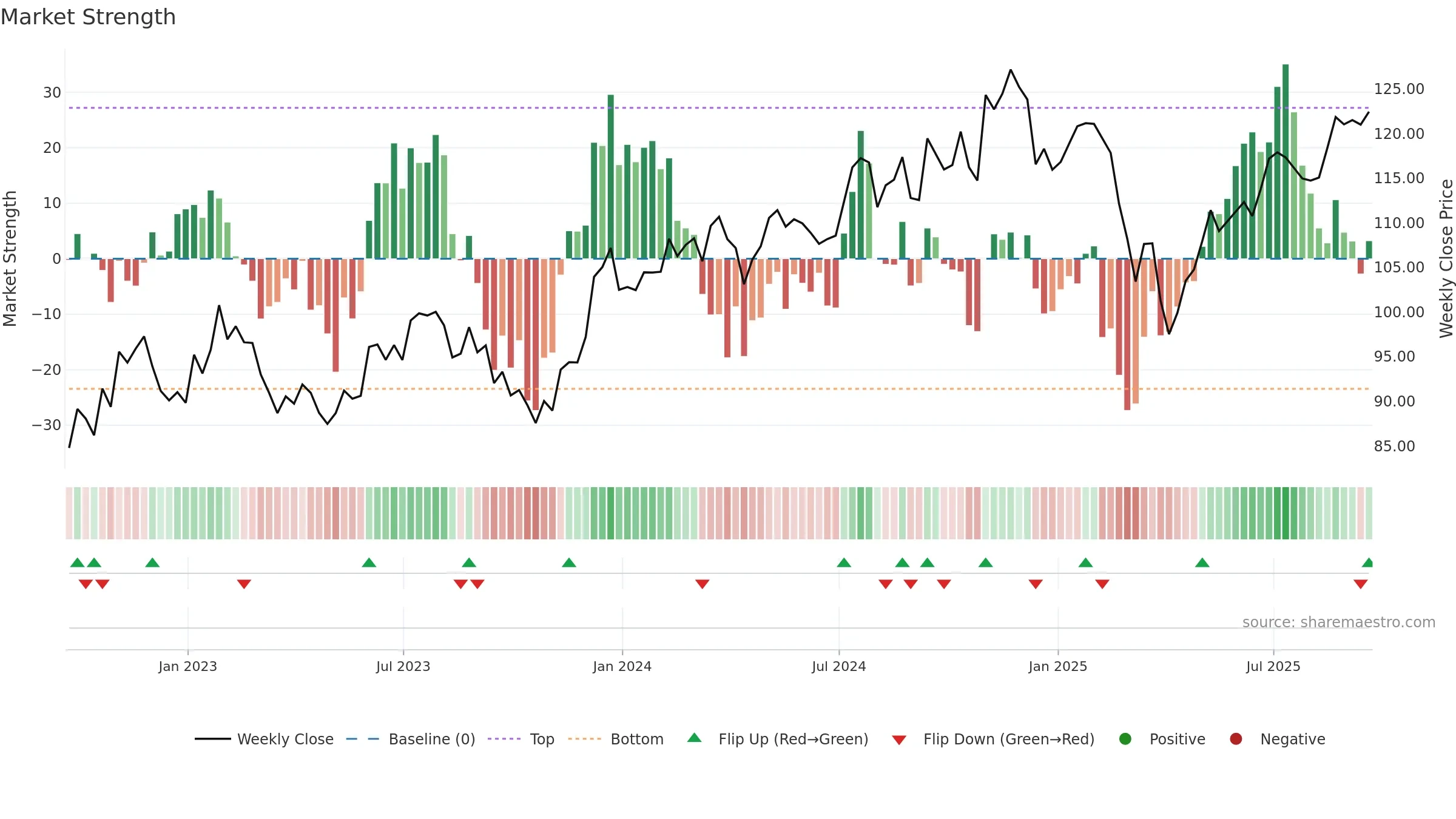

- Momentum is bullish and rising

- Price holds above 8w & 26w averages

- Constructive moving-average stack

- Low return volatility supports durability

- Liquidity diverges from price

Why: Price window 6.73% over 8w. Return volatility 1.30%. Volume trend falling. Liquidity divergence with price. MA stack constructive. Momentum bullish and rising .

Tip: Most metrics also include a hover tooltip where they appear in the report.