SMS Pharmaceuticals Limited

SMSPHARMA NSE

Weekly Report

SMS Pharmaceuticals Limited closed at 291.9600 (-0.35% WoW) . Data window ends Mon, 15 Sep 2025.

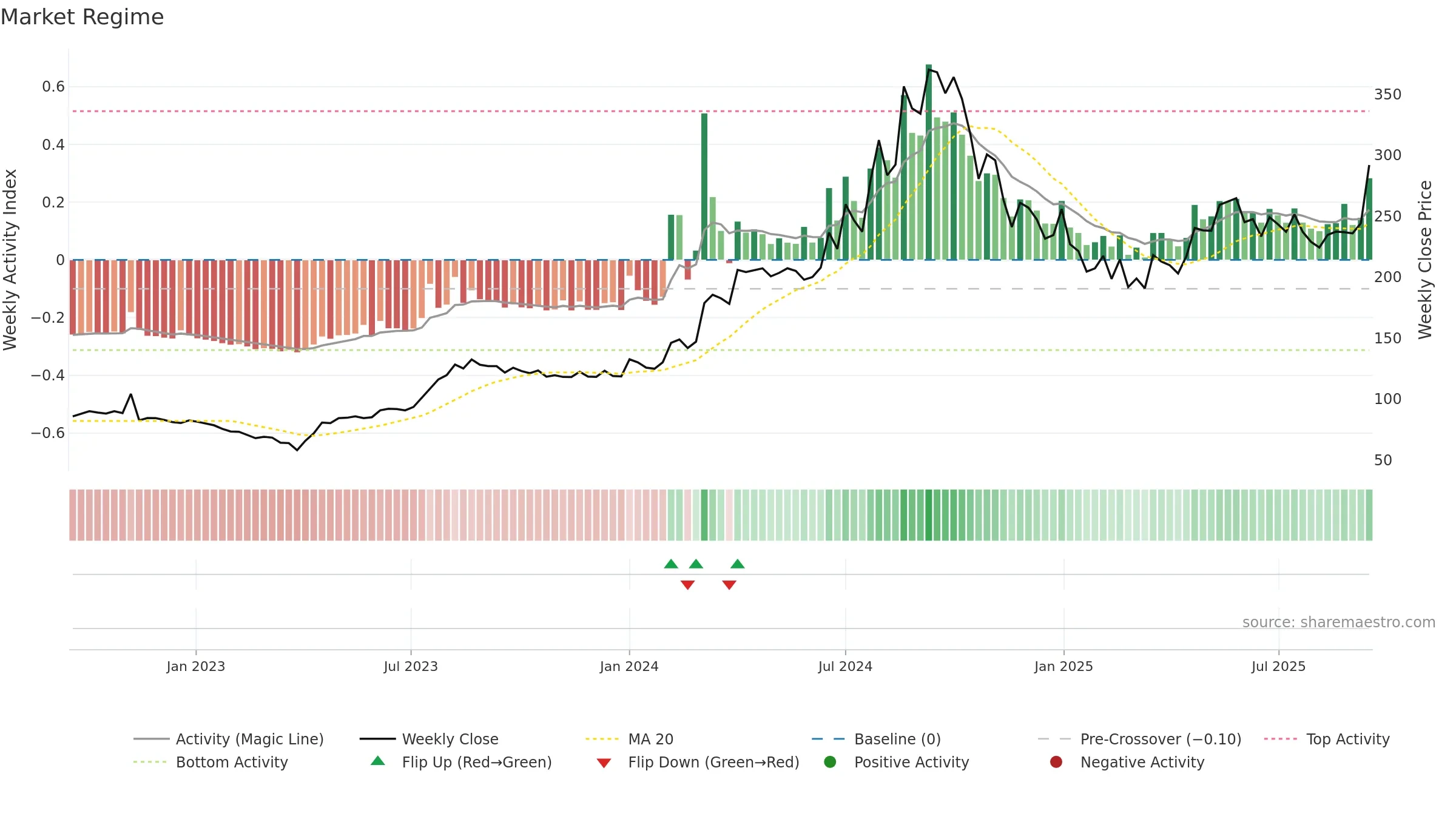

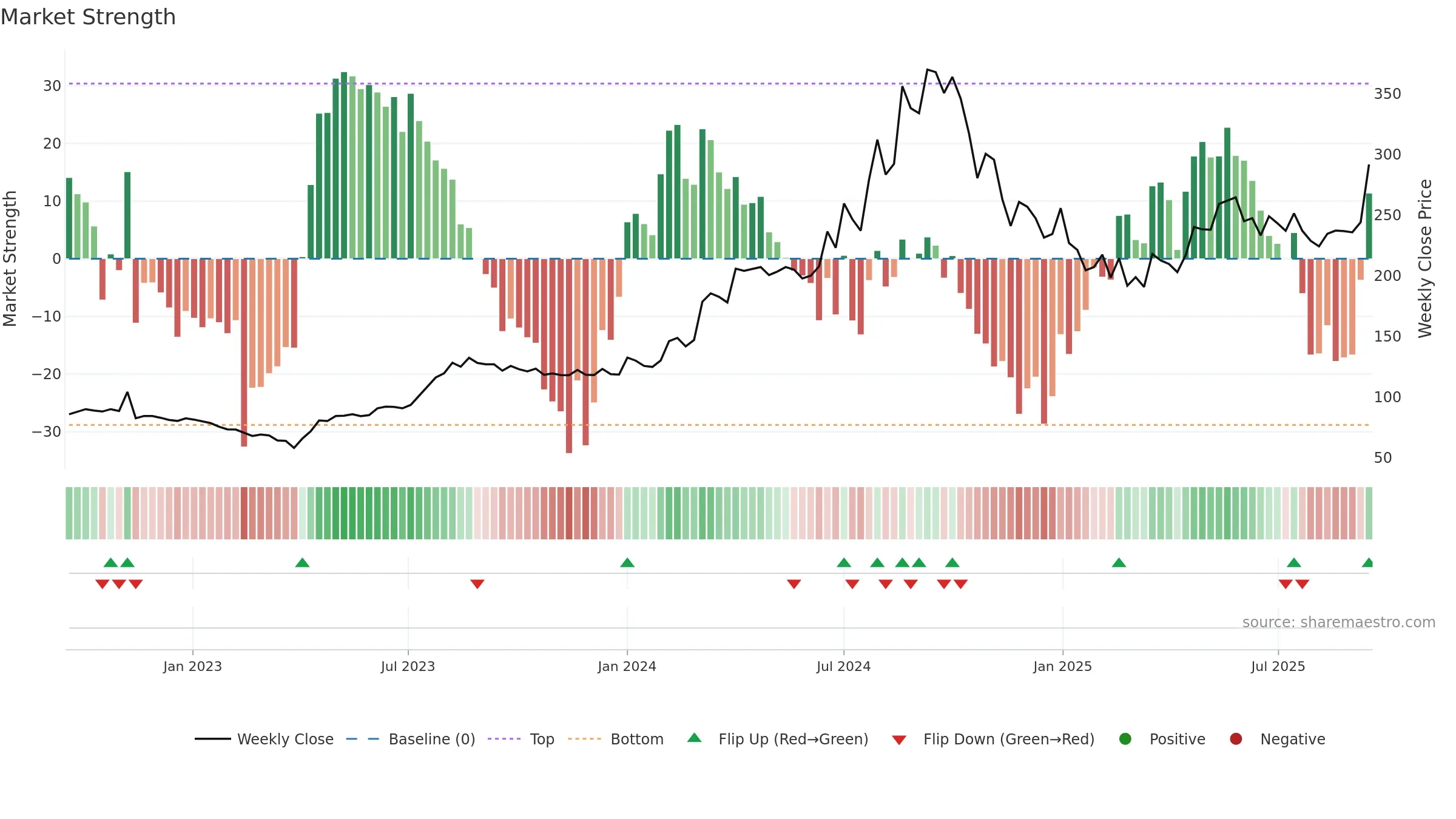

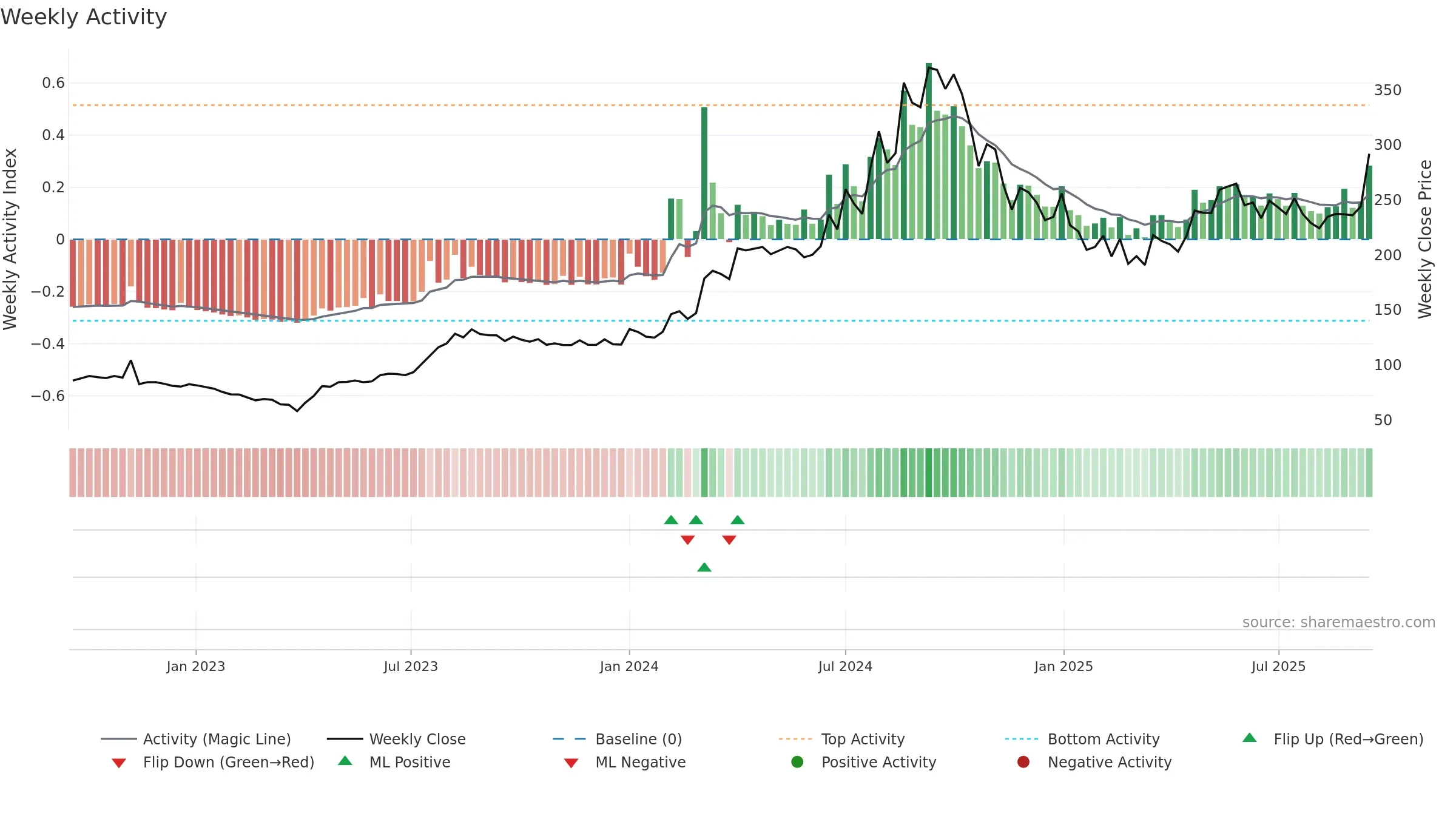

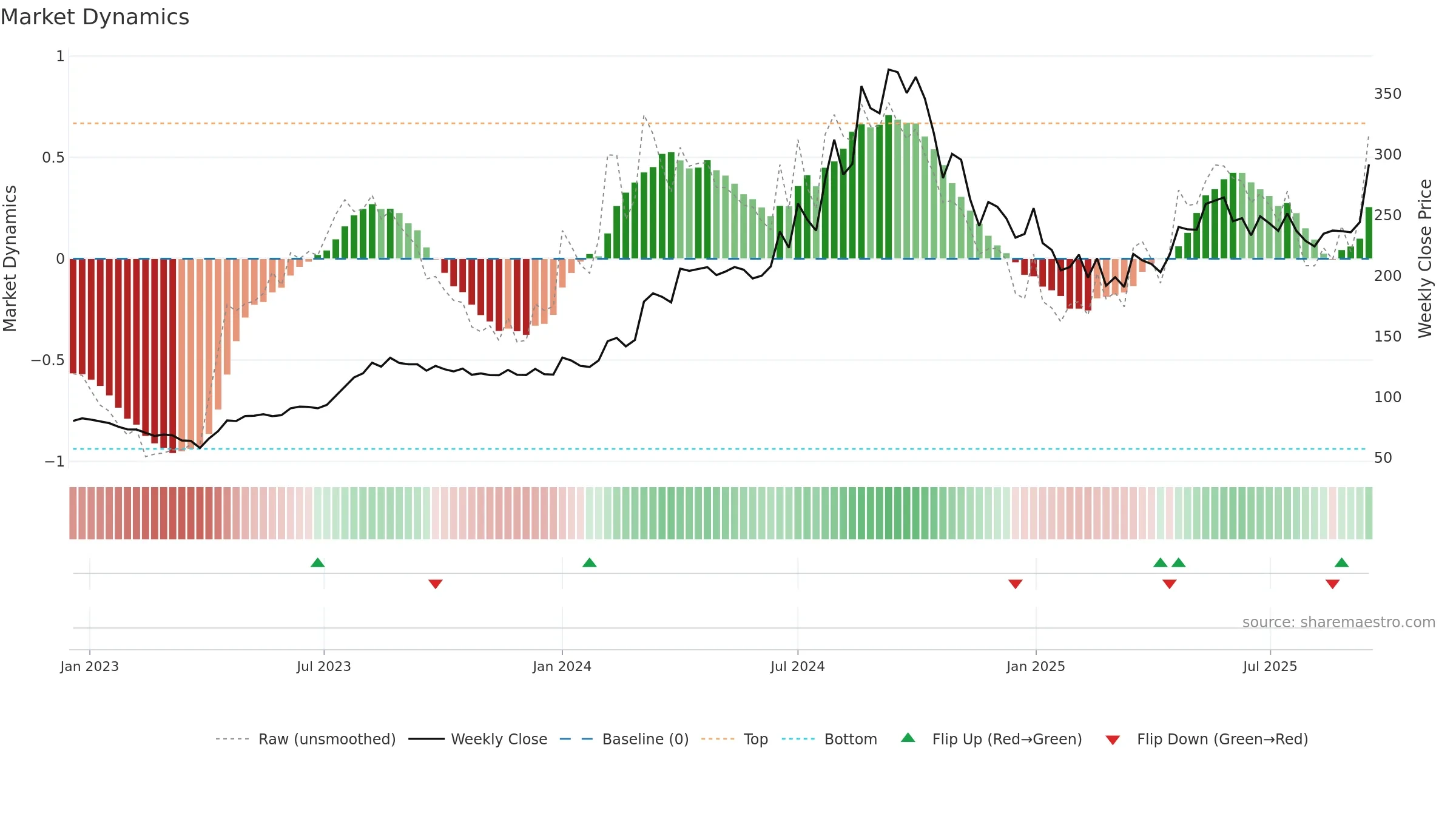

How to read this — Price slope is upward, indicating persistent buying over the window. Volume and price are moving in the same direction — a constructive confirmation. Price is stretched above its baseline; consolidation risk rises if activity fades. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm.

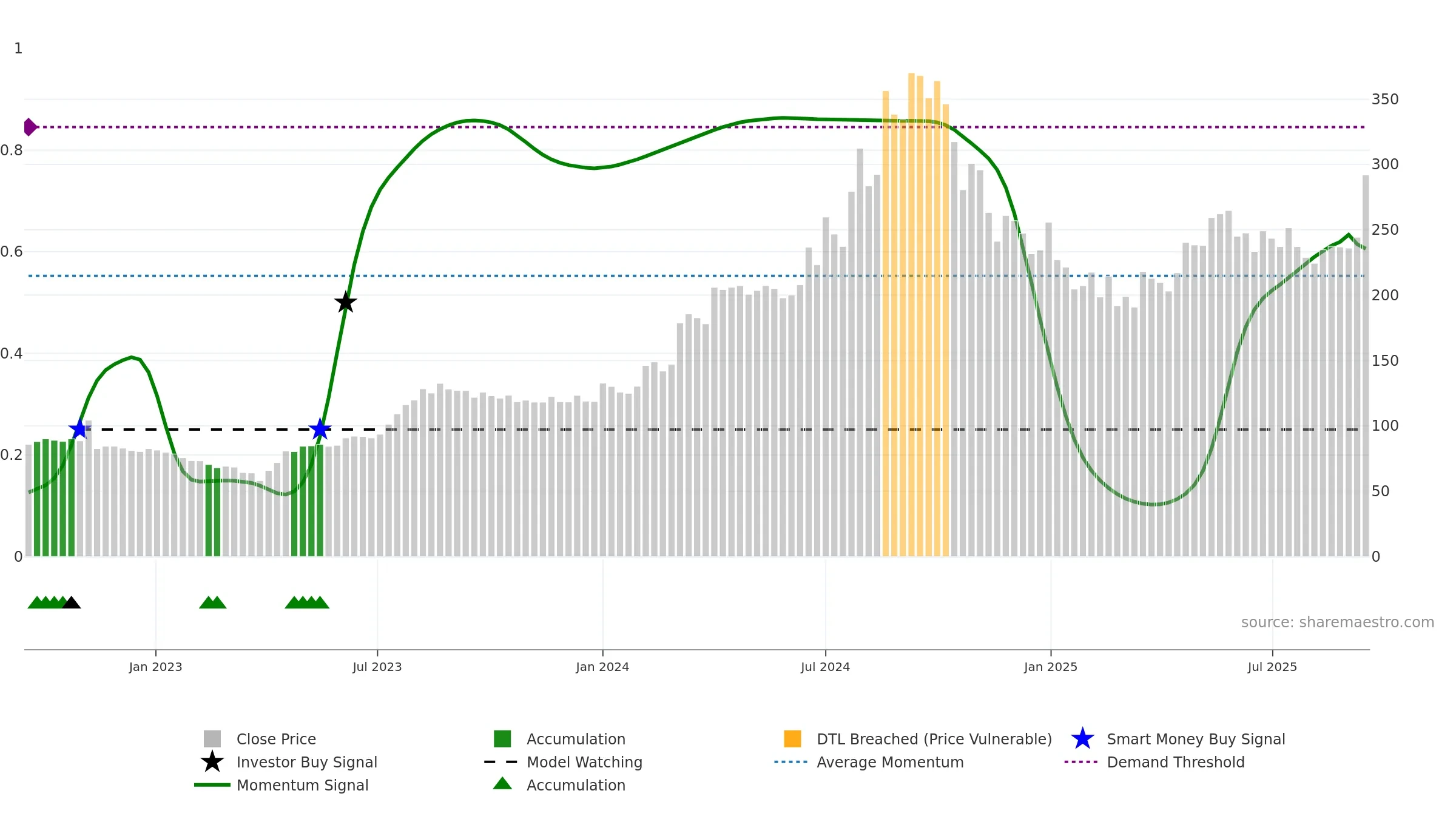

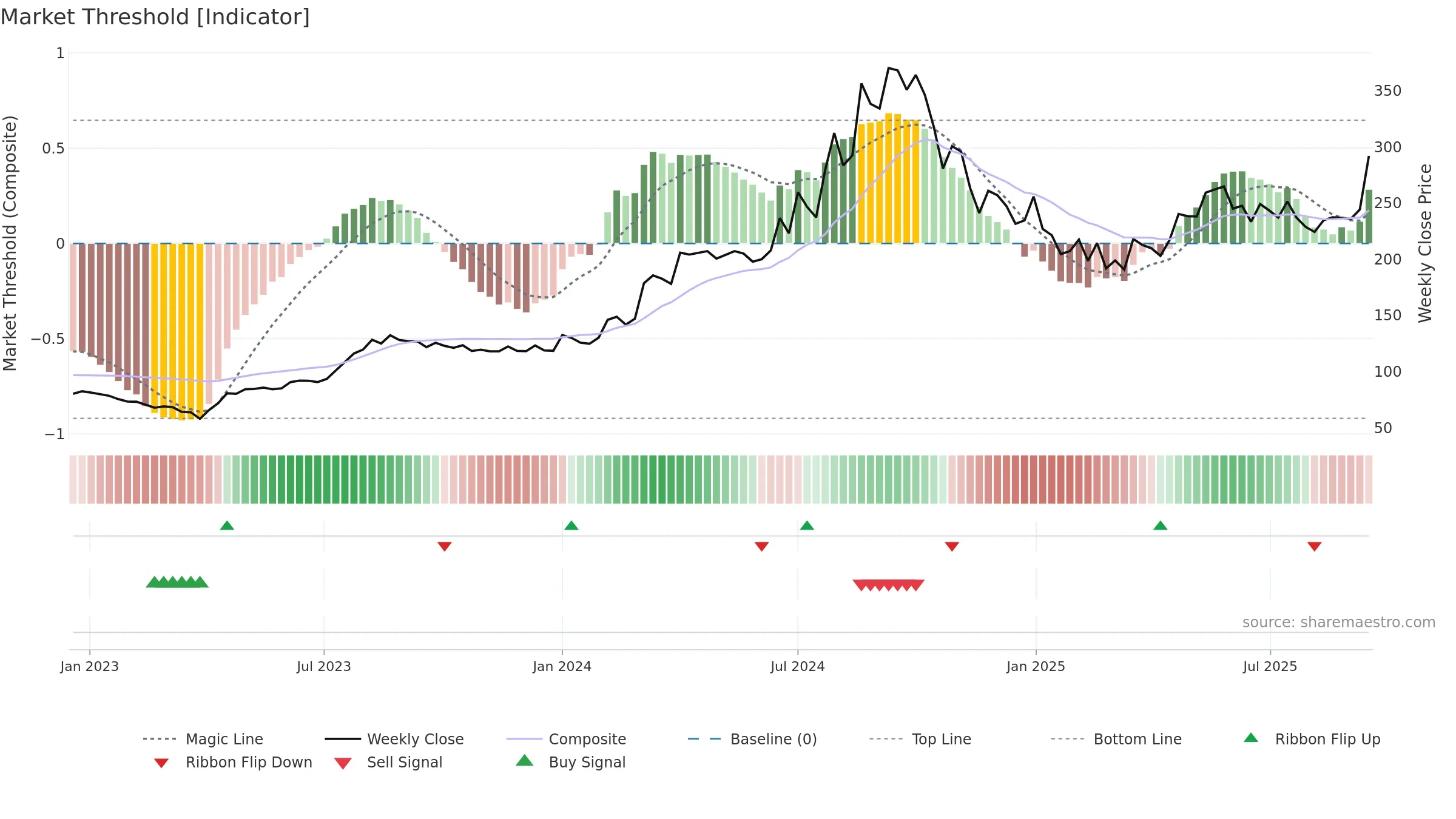

Gauge maps the trend signal to a 0–100 scale.

How to read this — Gauge is elevated but momentum is rolling over; topping risk is rising.

Stay alert: protect gains or seek confirmation before adding risk.

Price is below fair value; potential upside if momentum constructive.

Conclusion

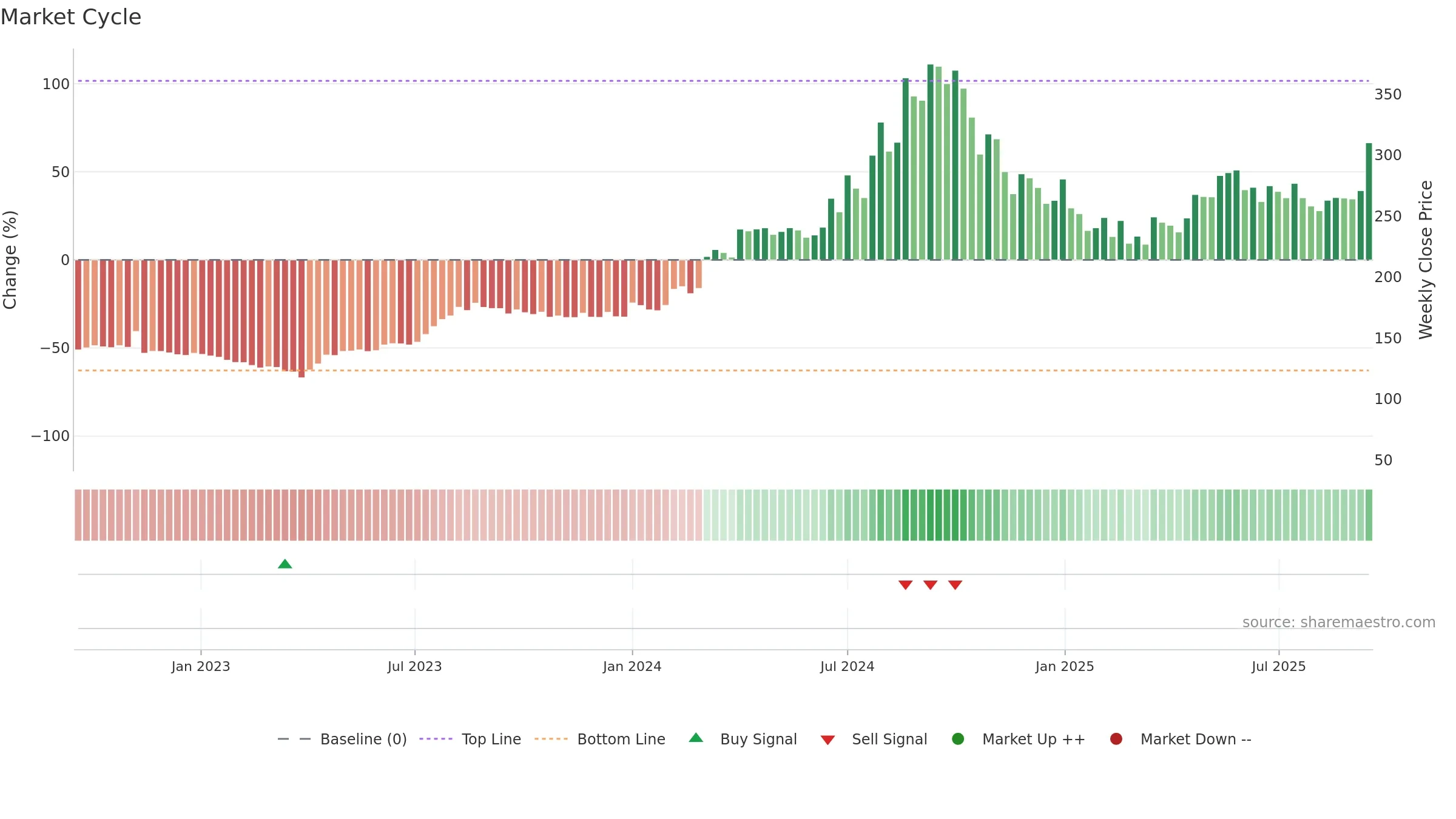

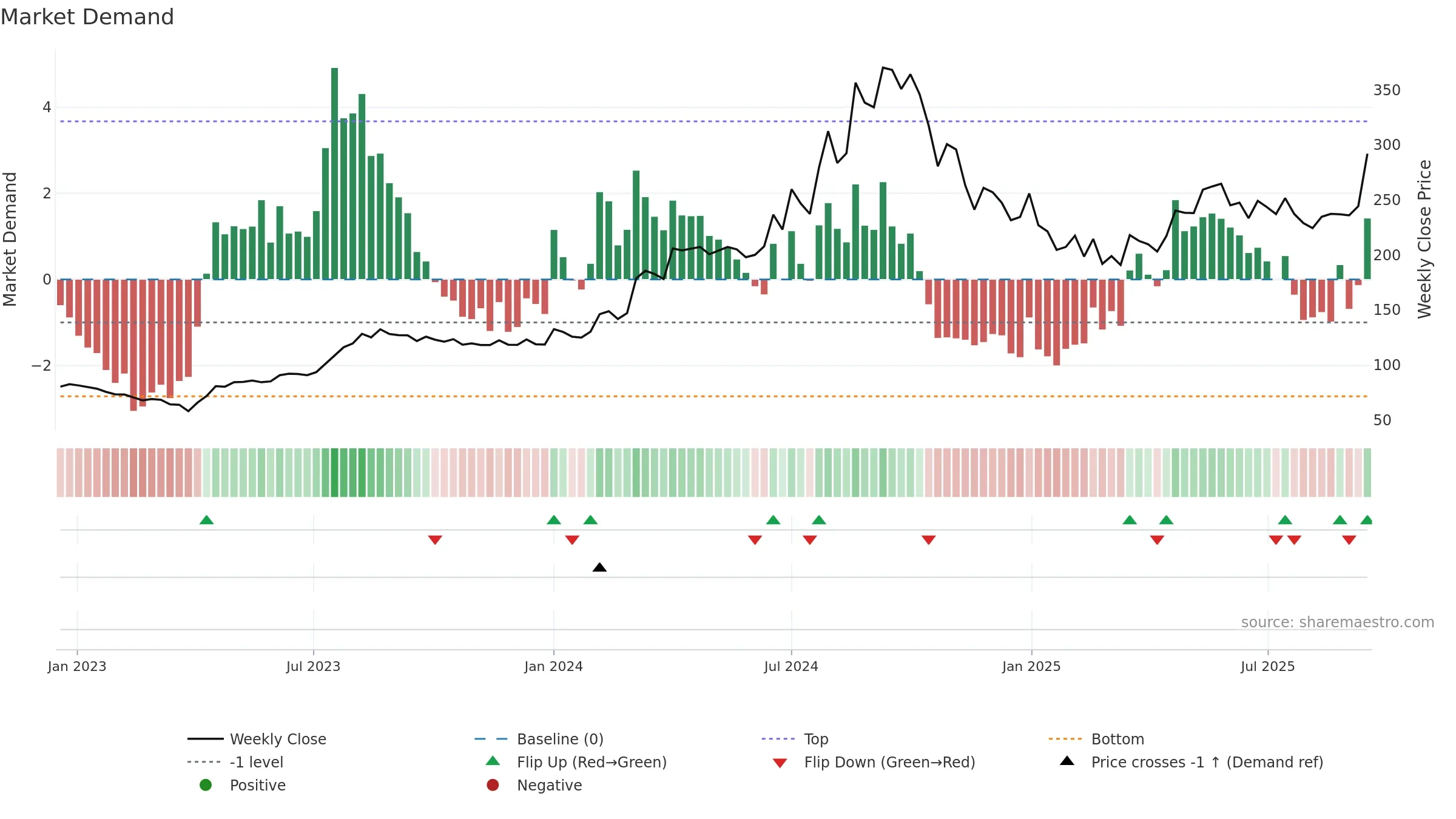

Positive setup. ★★★★☆ confidence. Price window: 27. Trend: Uptrend at Risk; gauge 60. In combination, liquidity confirms the move.

- Momentum is bullish and rising

- Price holds above 8w & 26w averages

- Liquidity confirms the price trend

- Solid multi-week performance

- High-level but rolling over (topping risk)

Why: Price window 27.54% over 8w. Close is 19.52% above the prior-window high. Return volatility 2.03%. Volume trend rising. Liquidity convergence with price. Trend state uptrend at risk. Momentum bullish and rising. Valuation supportive skew.

Tip: Most metrics include a hover tooltip where they appear in the report.