Orora Limited

ORA ASX

Weekly Report

Orora Limited closed at 2.1200 (0.95% WoW) . Data window ends Mon, 15 Sep 2025.

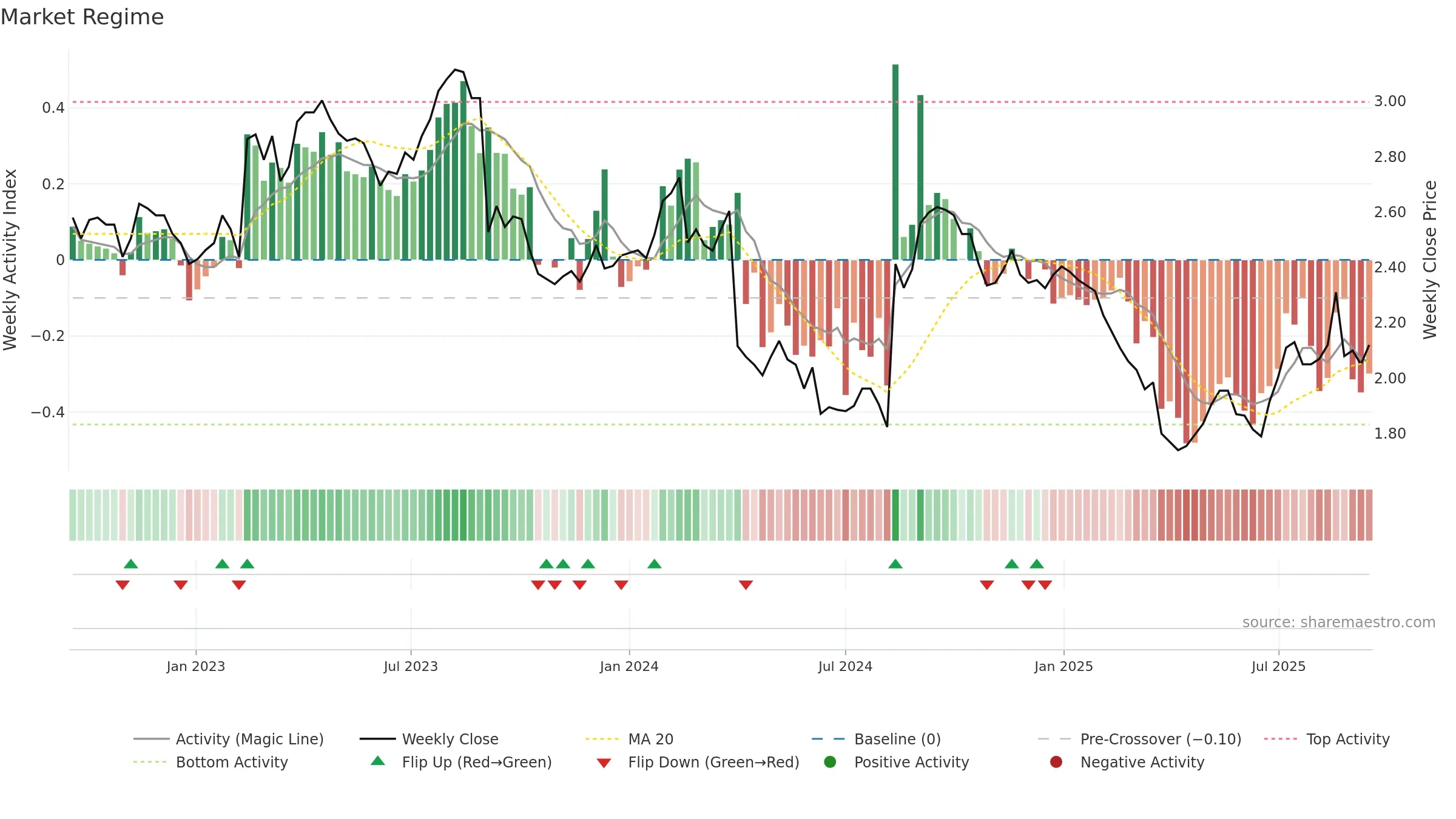

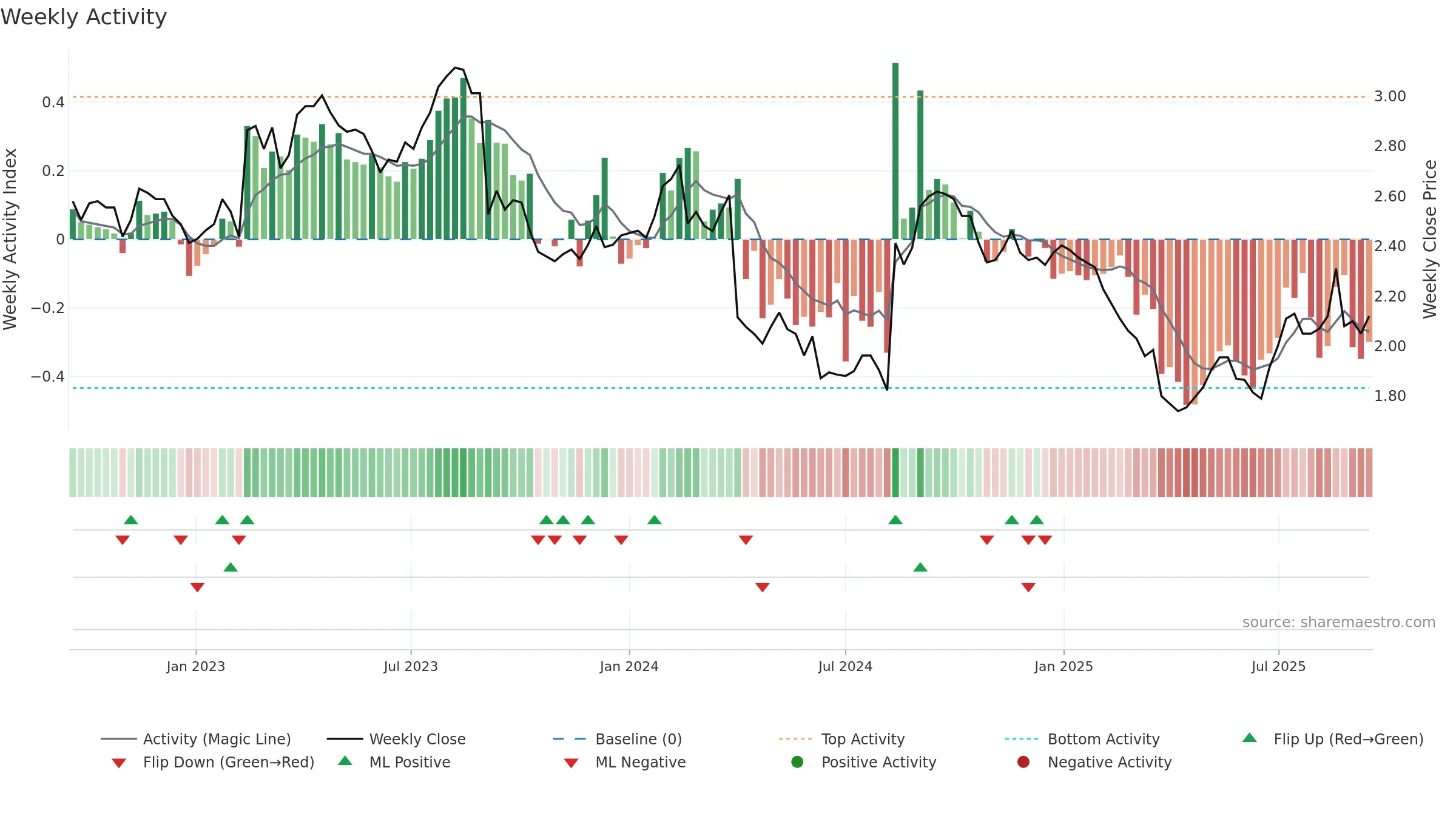

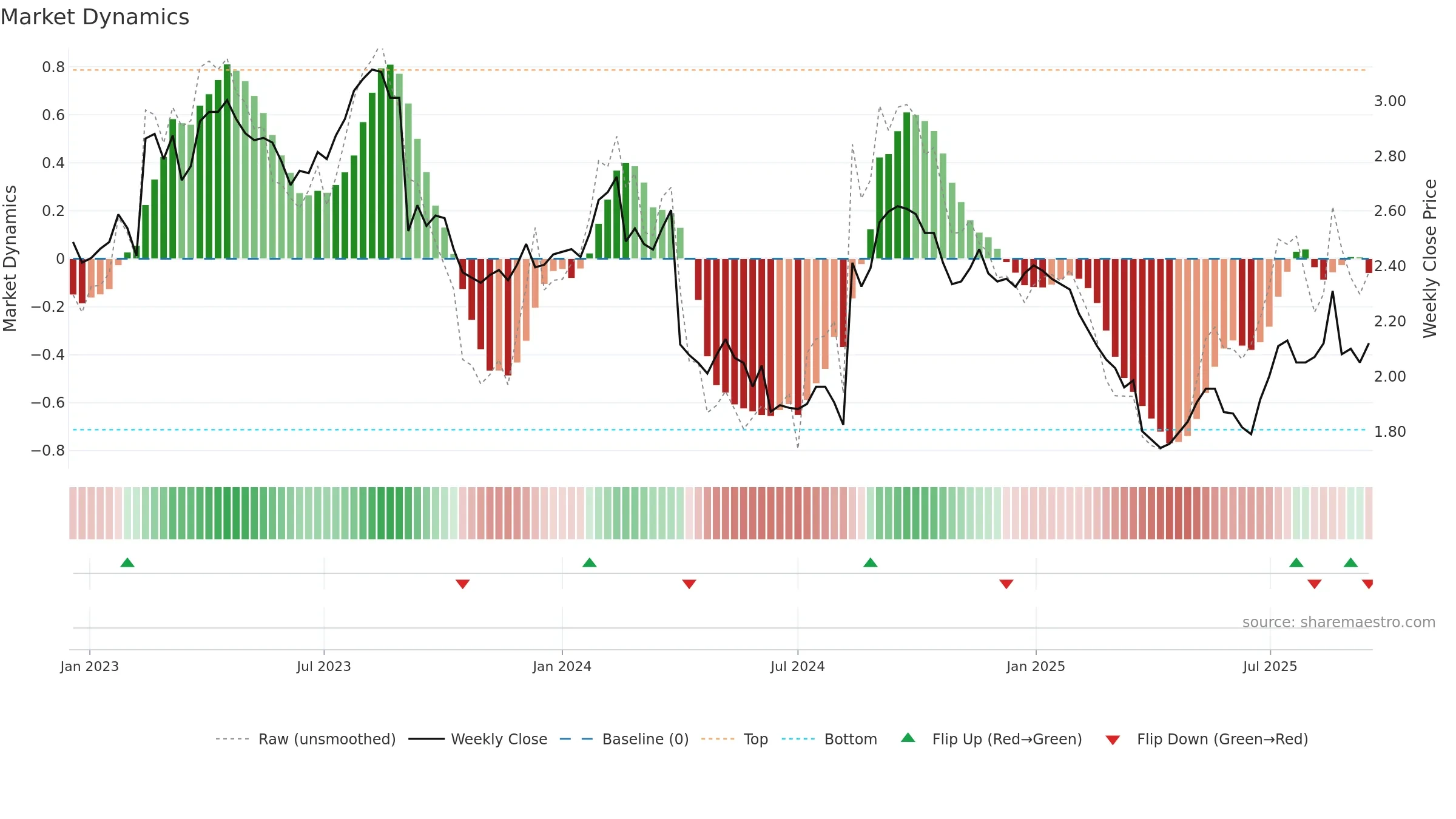

How to read this — Price slope is upward, indicating persistent buying over the window. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity. Fresh short-term downside crossover weakens near-term tone. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

Gauge maps the trend signal to a 0–100 scale.

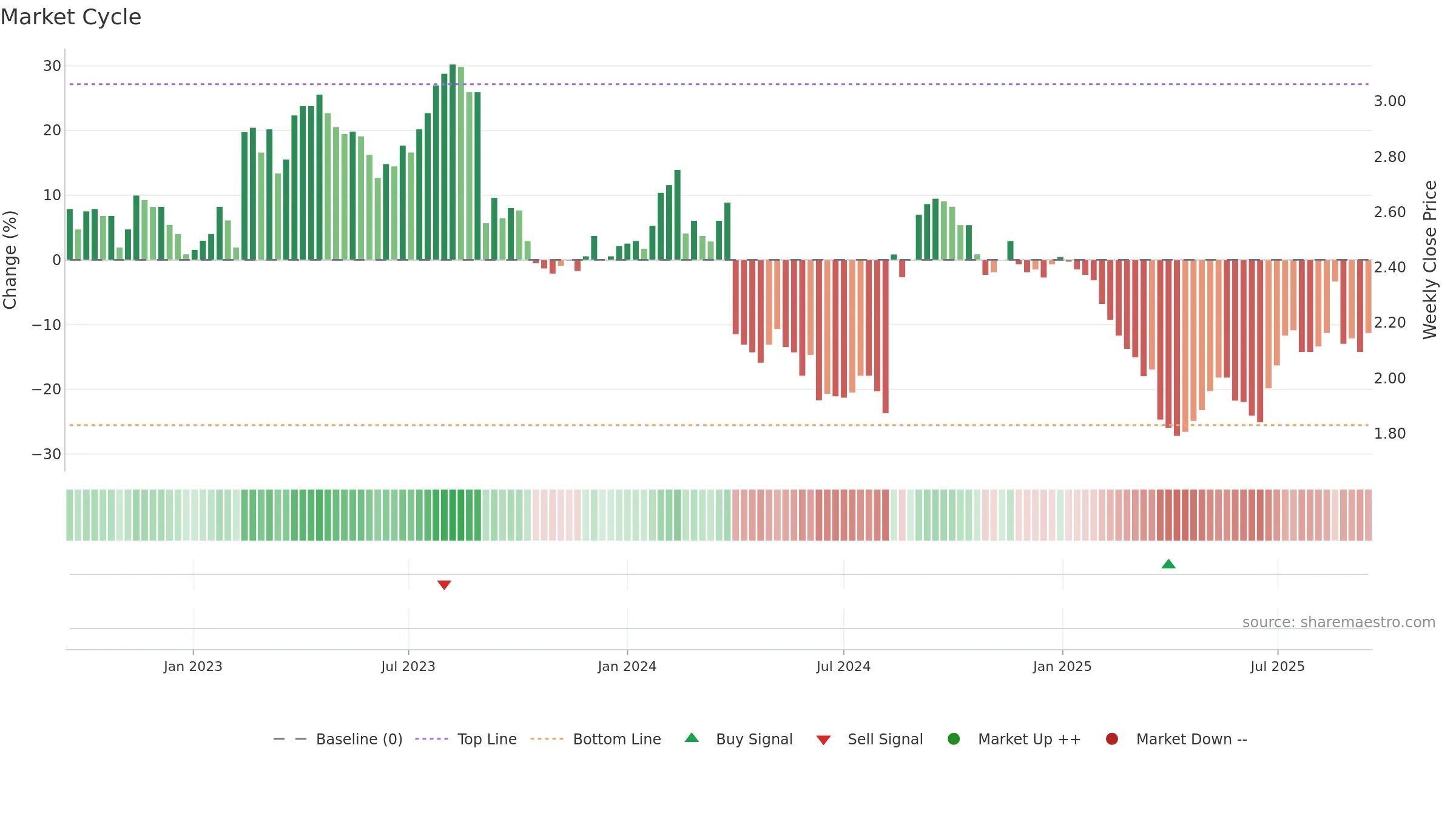

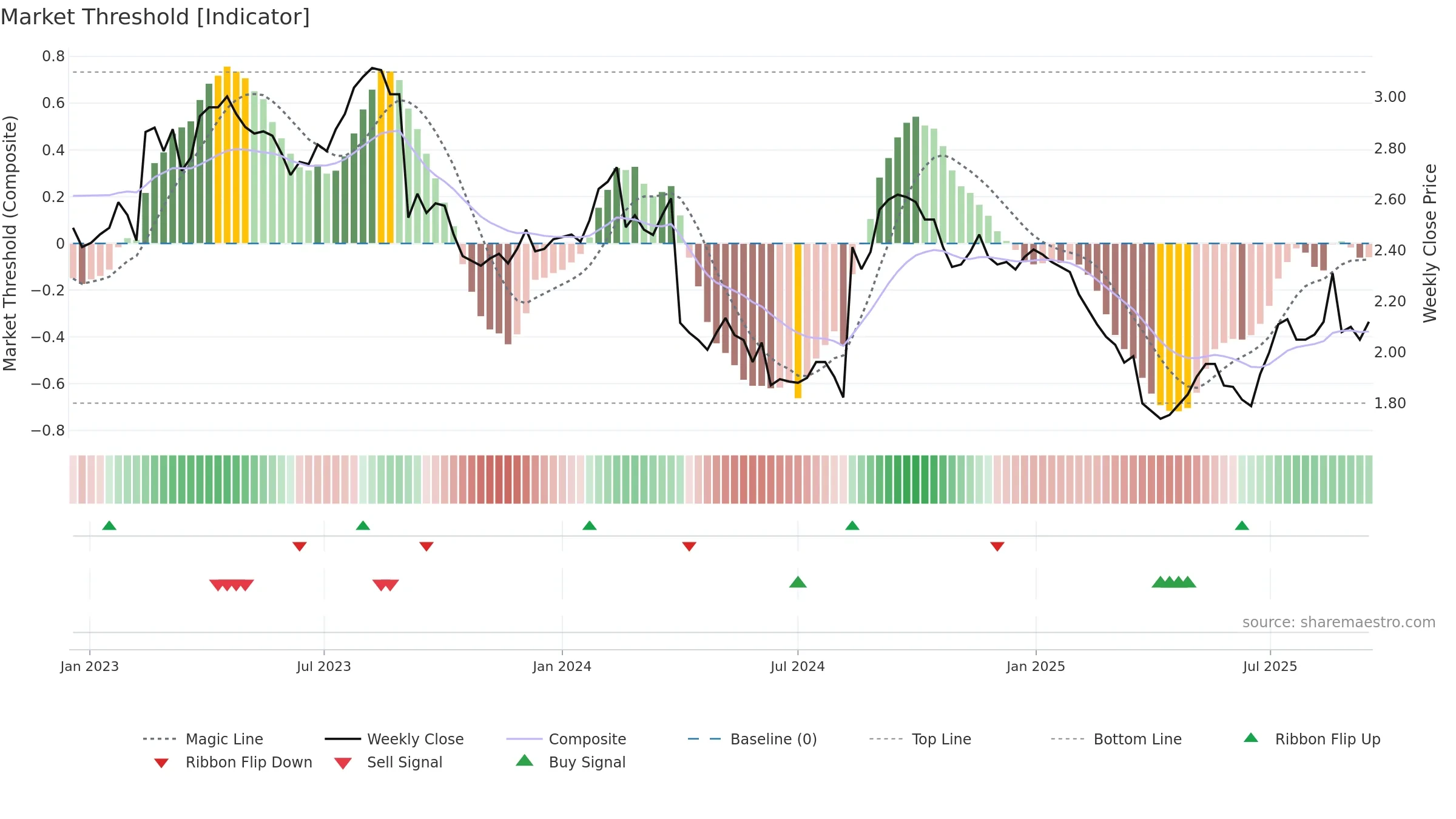

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

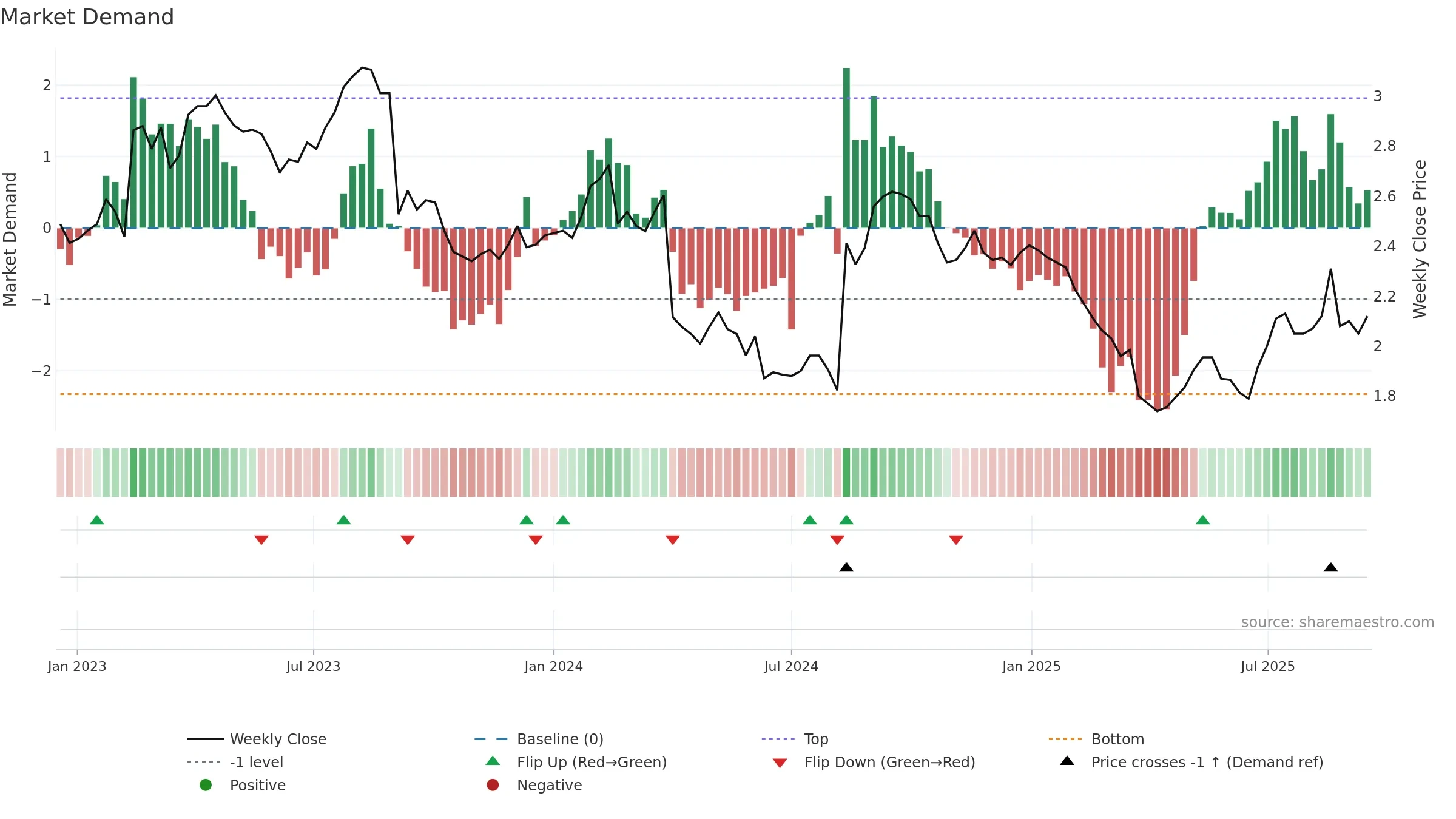

The flag is positive: favourable upside skew with supportive conditions.

Conclusion

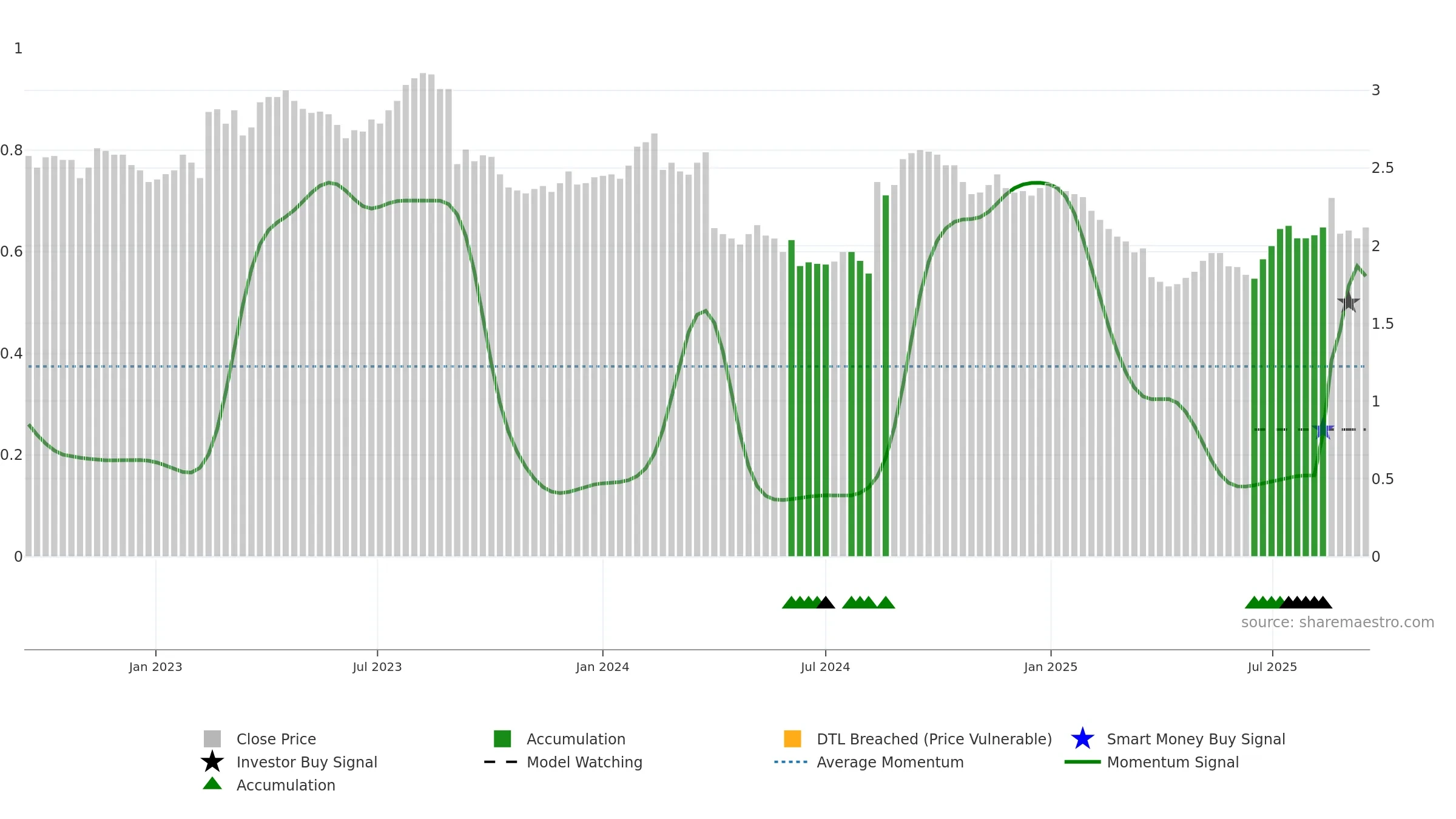

Positive setup. ★★★★☆ confidence. Price window: 3. Trend: Range / Neutral; gauge 55. In combination, liquidity diverges from price.

- Price holds above 8w & 26w averages

- Buyers step in at depressed levels (accumulation)

- Liquidity diverges from price

Why: Price window 3.41% over 8w. Close is -8.23% below the prior-window high. Volume trend falling. Liquidity divergence with price. Trend state range / neutral. Low-regime (≤0.25) upticks 3/3 (100.0%) • Accumulating. 4–8w crossover bearish. Momentum neutral and rising. Valuation stance positive.

Tip: Most metrics include a hover tooltip where they appear in the report.