Uniphar plc

UPR LSE

Weekly Report

Uniphar plc closed at 341.0000 (-0.58% WoW) . Data window ends Fri, 19 Sep 2025.

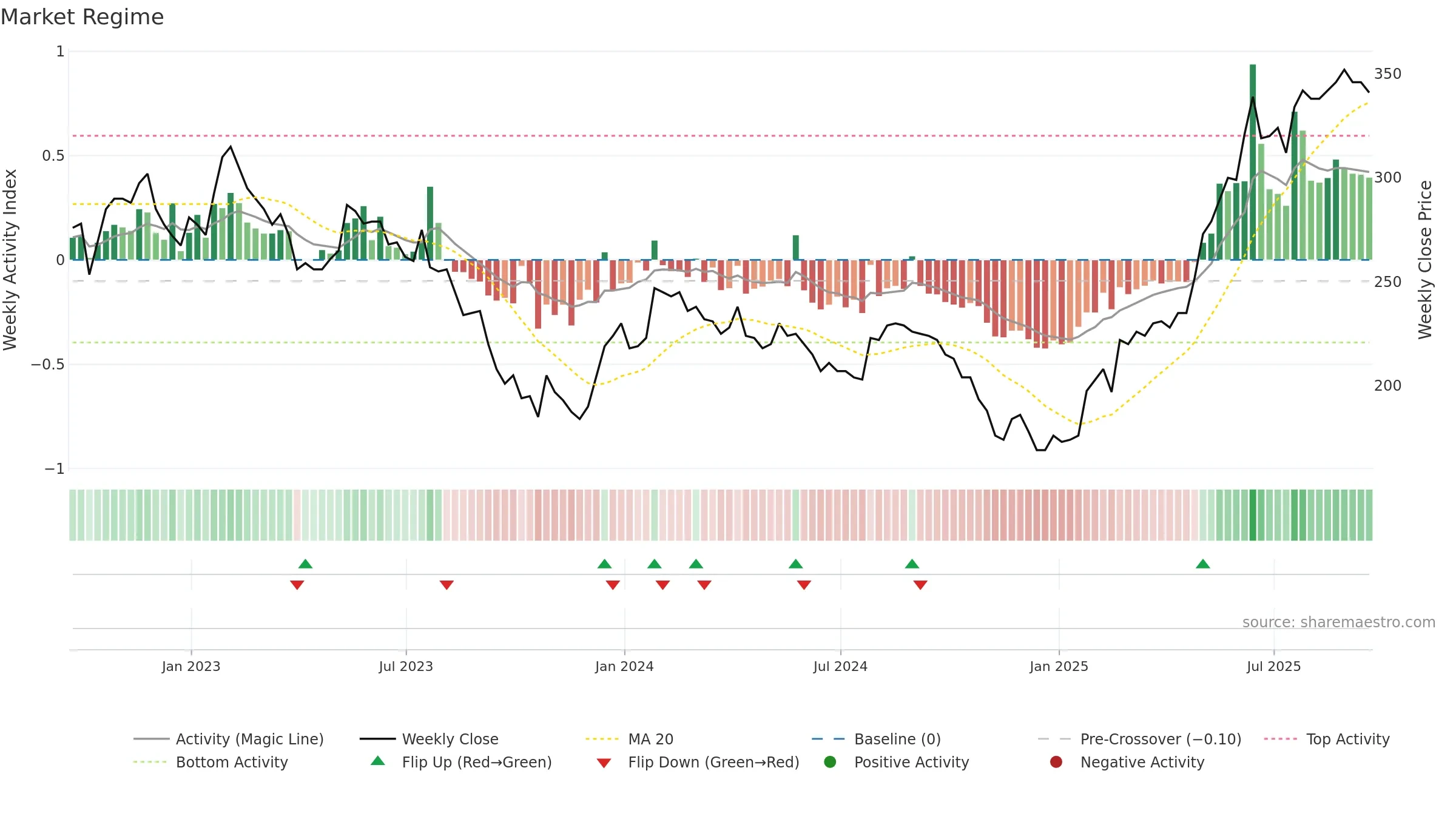

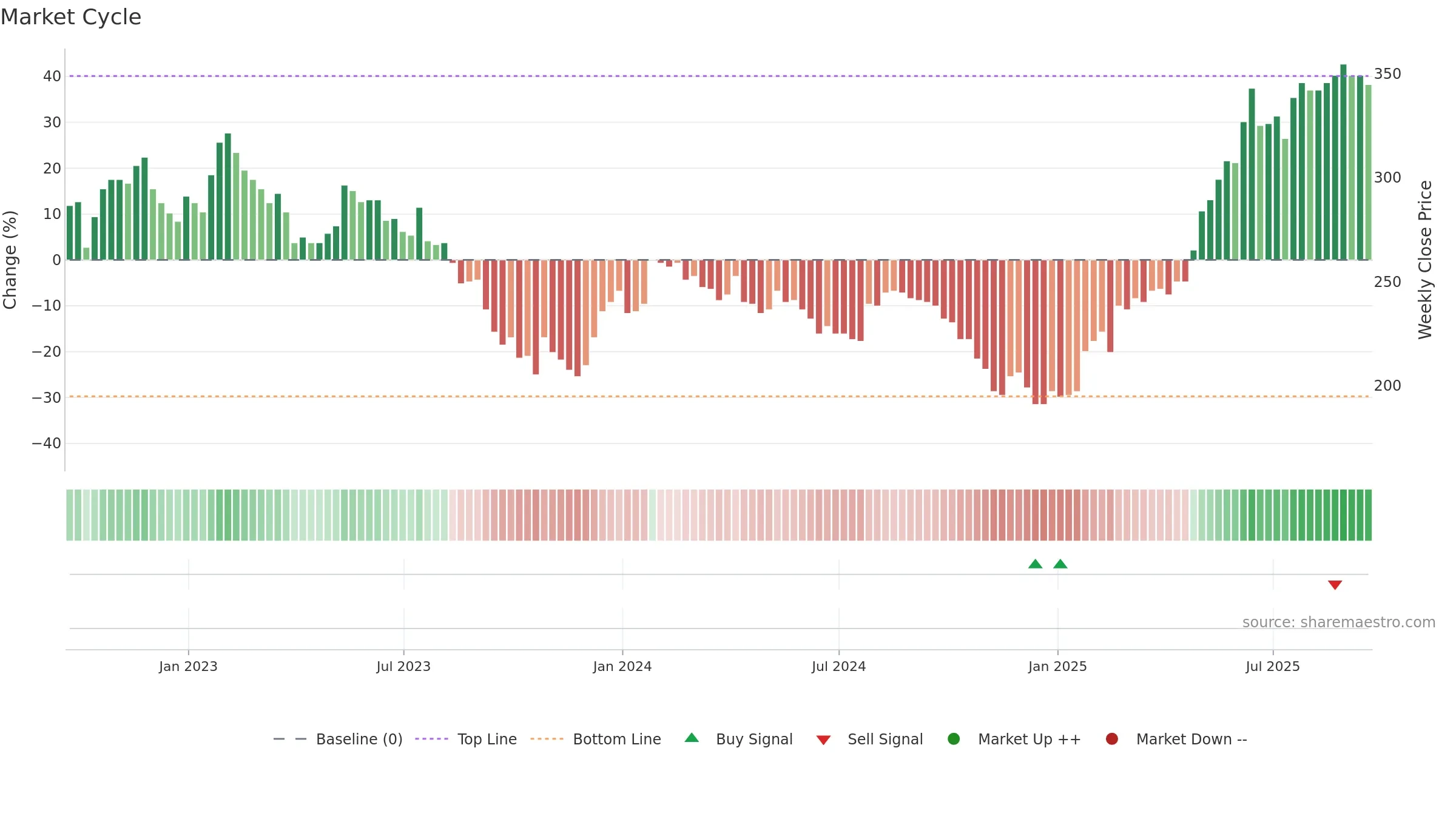

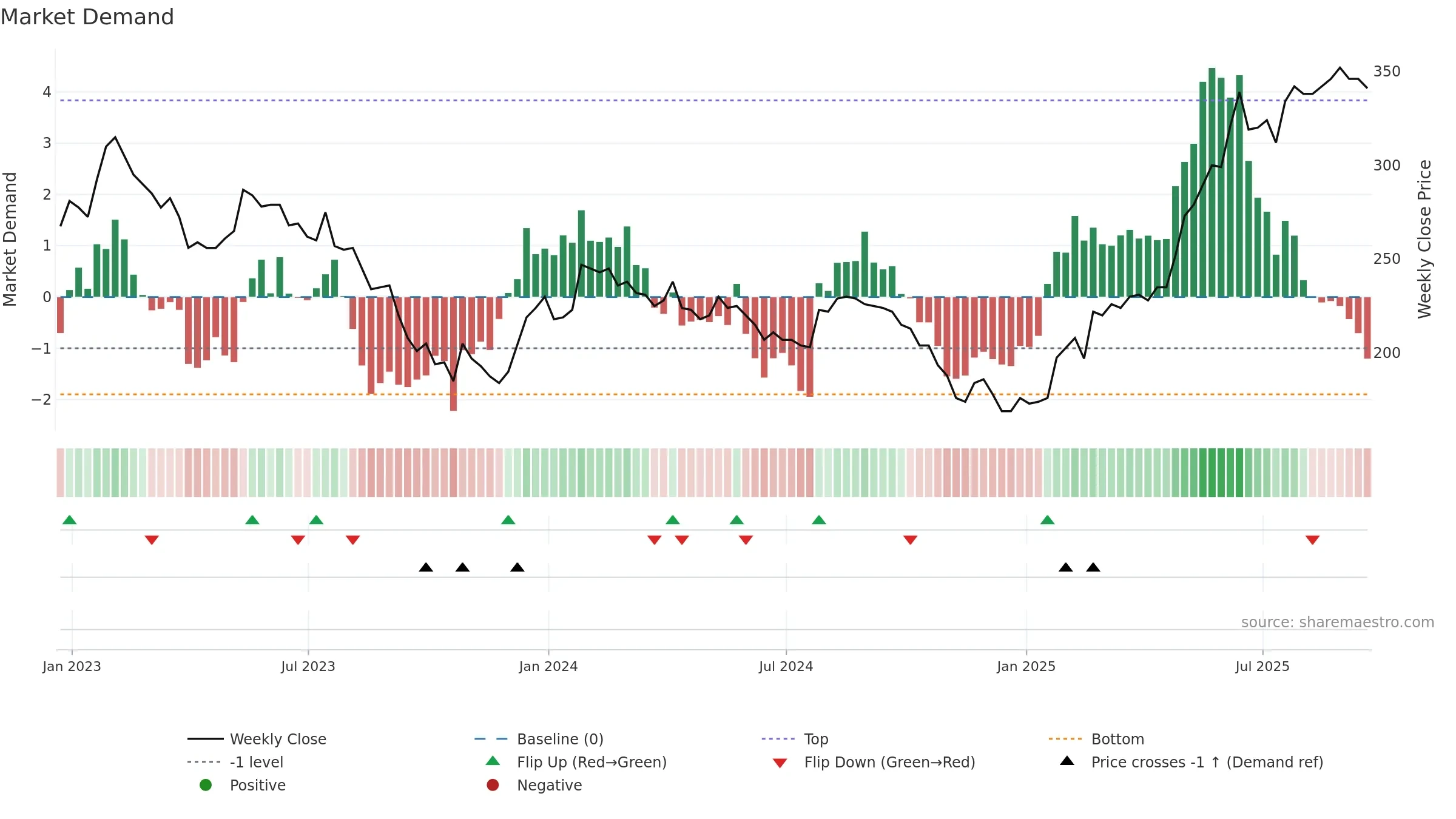

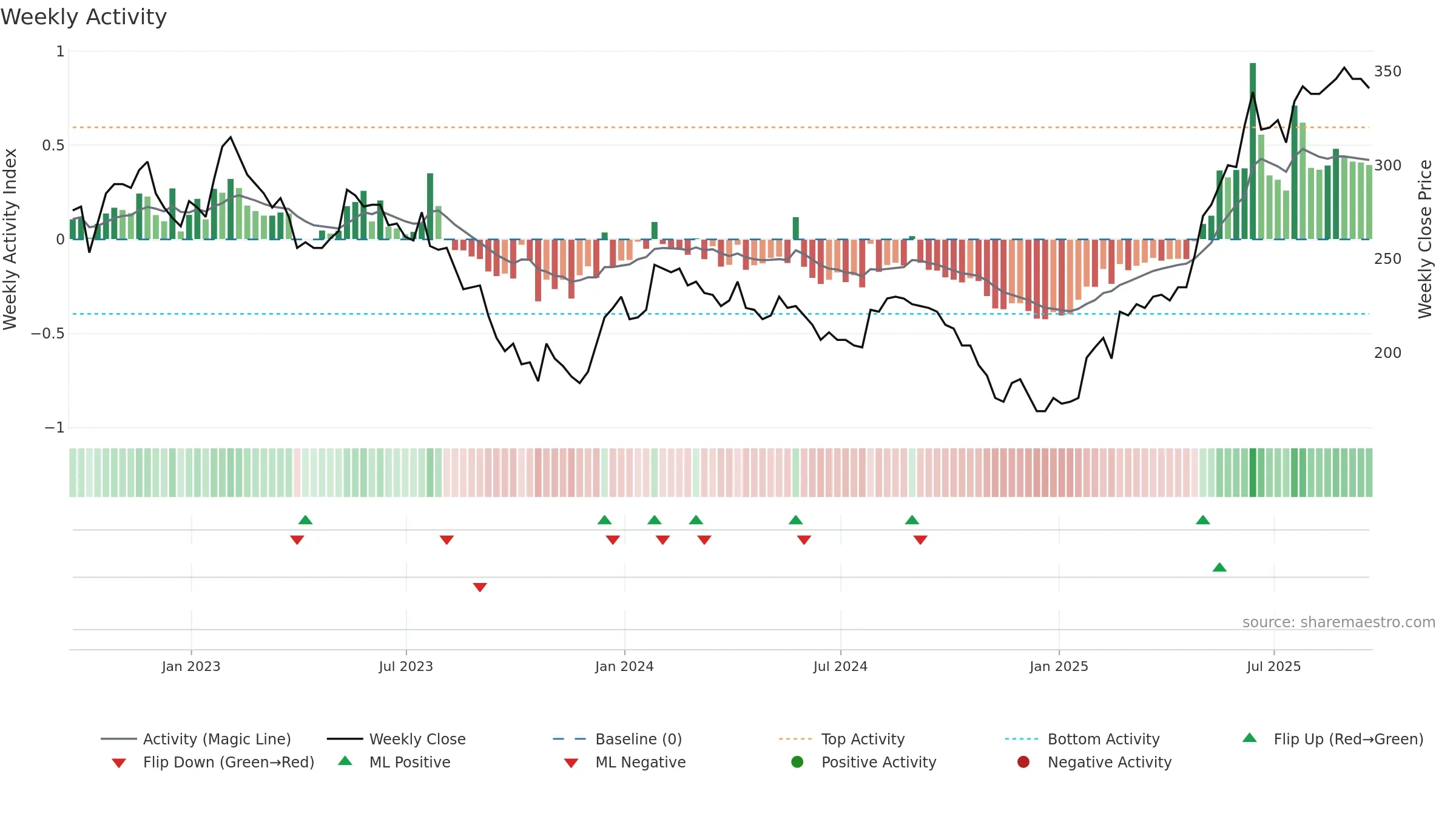

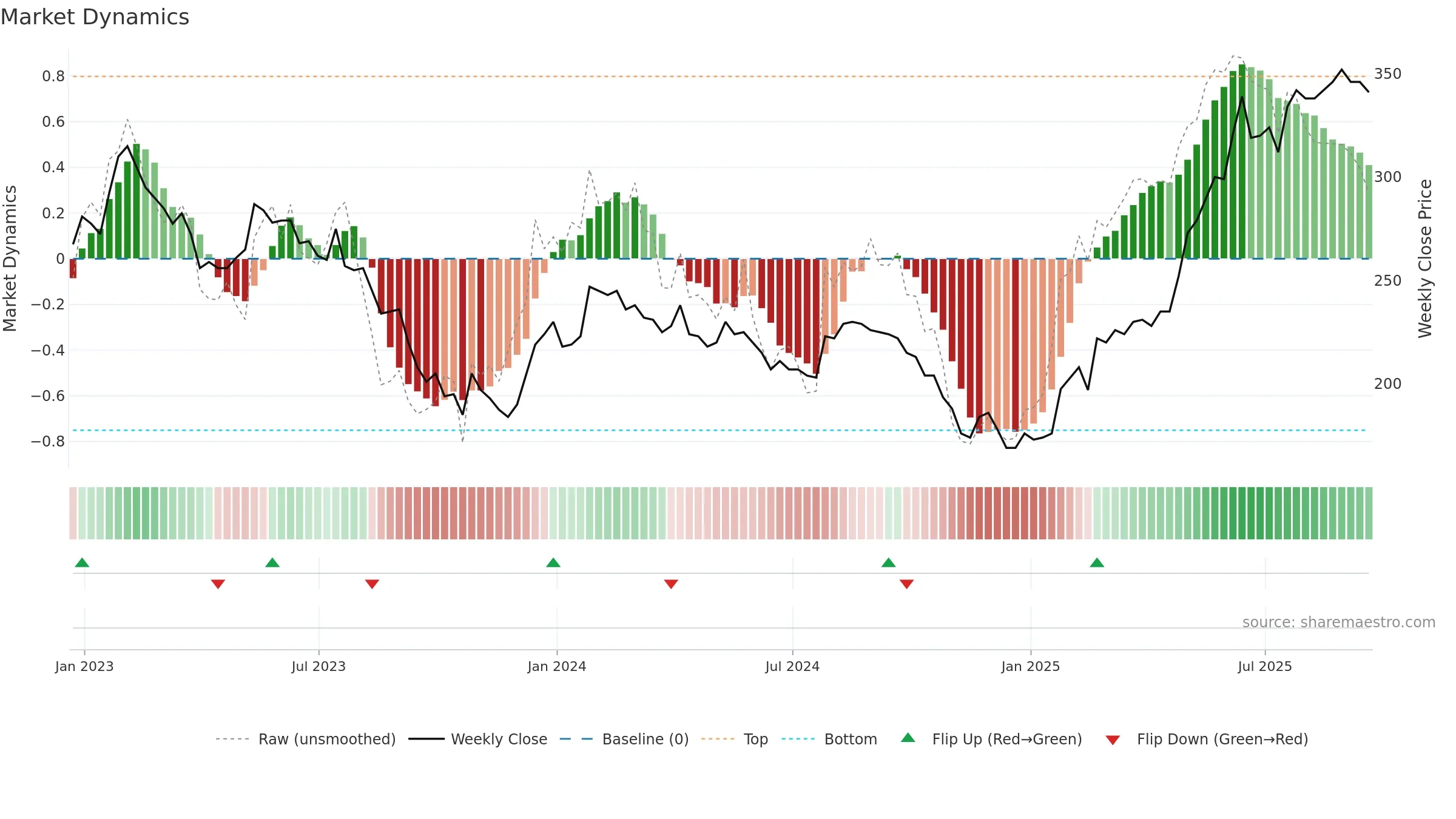

How to read this — Price slope is upward, indicating persistent buying over the window. Low weekly volatility favours steadier follow-through. Volume trend diverges from price — watch for fatigue or rotation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

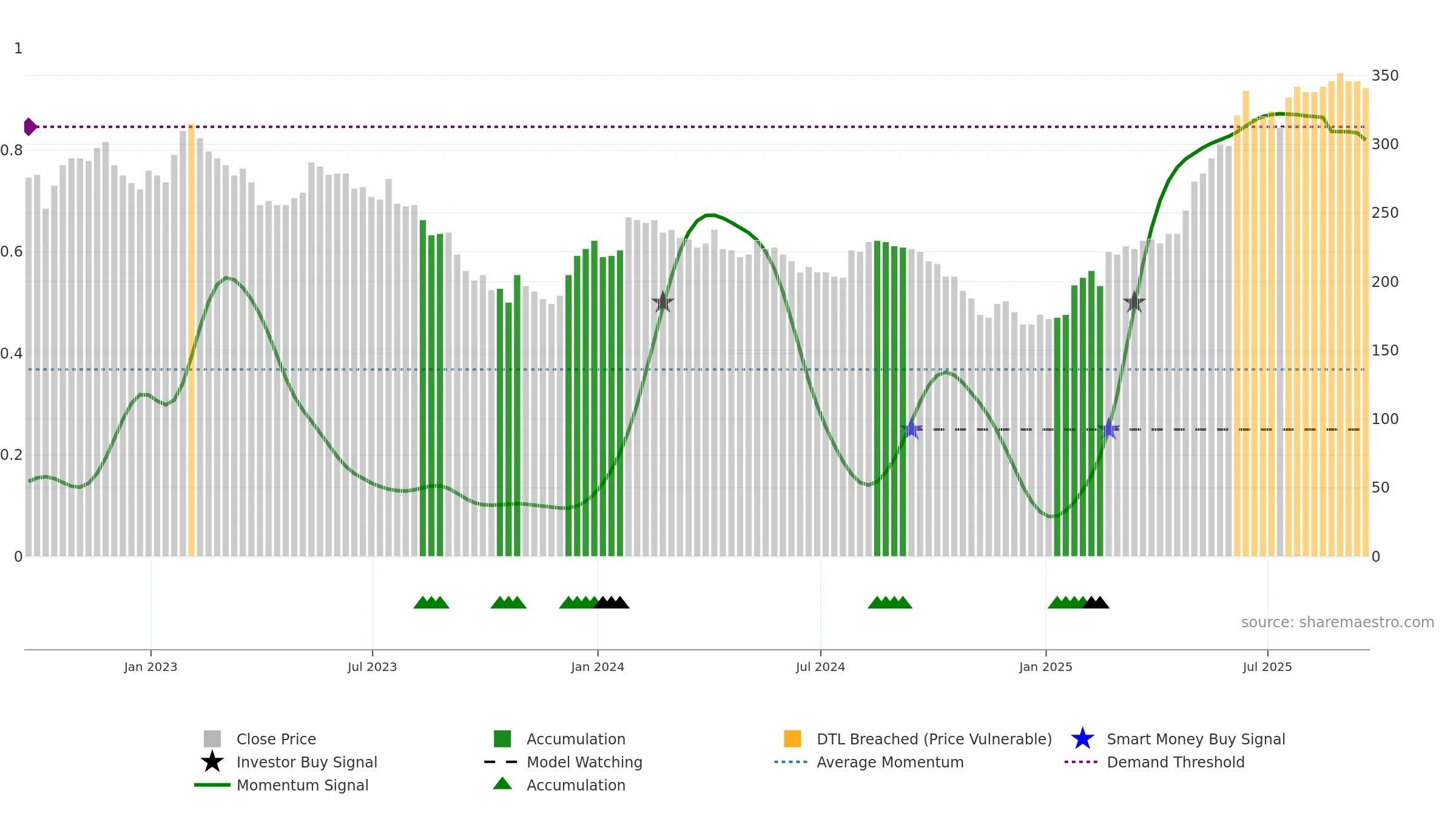

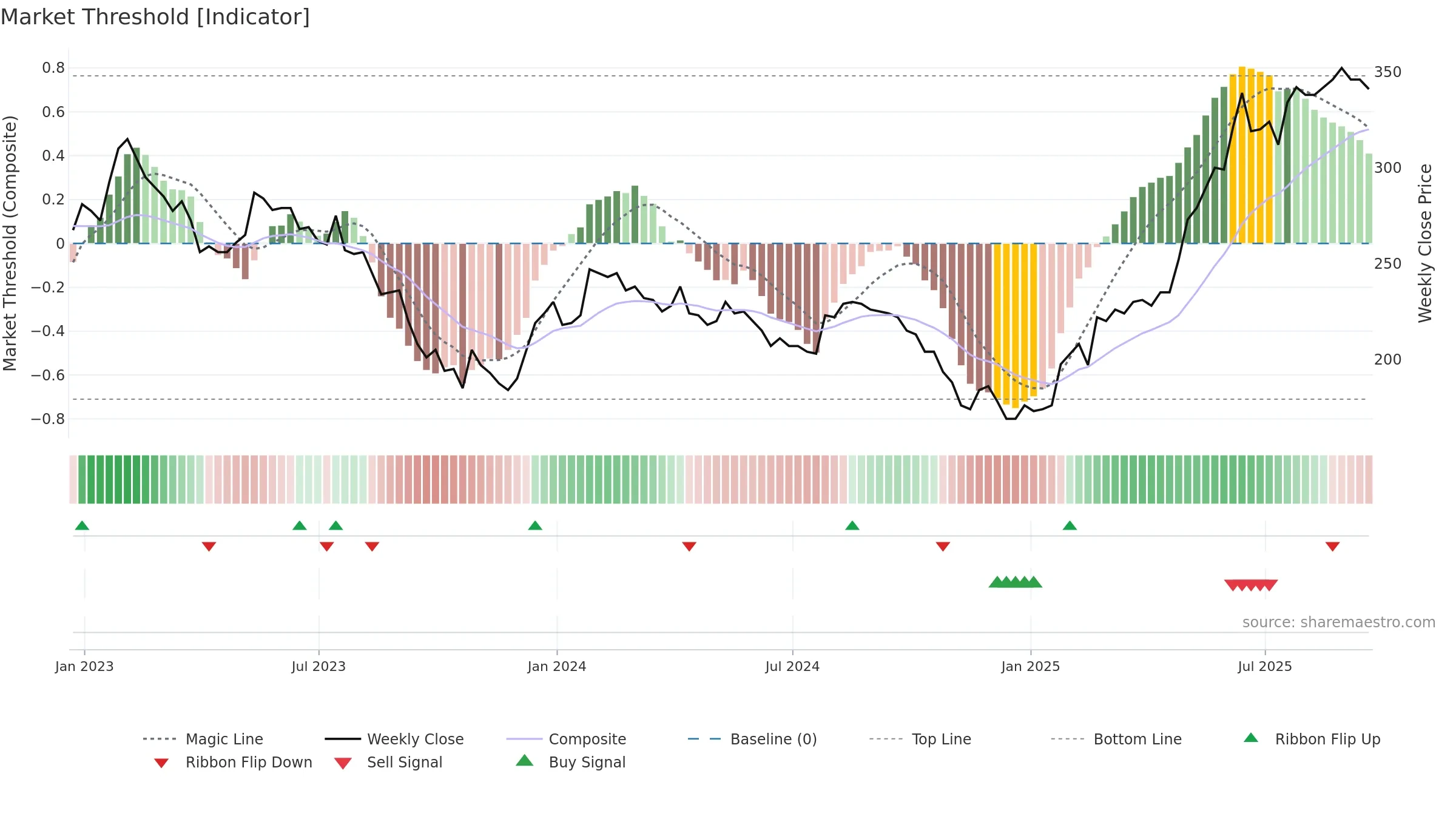

Gauge maps the trend signal to a 0–100 scale.

How to read this — Gauge is elevated but momentum is rolling over; topping risk is rising.

Stay alert: protect gains or seek confirmation before adding risk.

The flag is positive: favourable upside skew with supportive conditions.

Conclusion

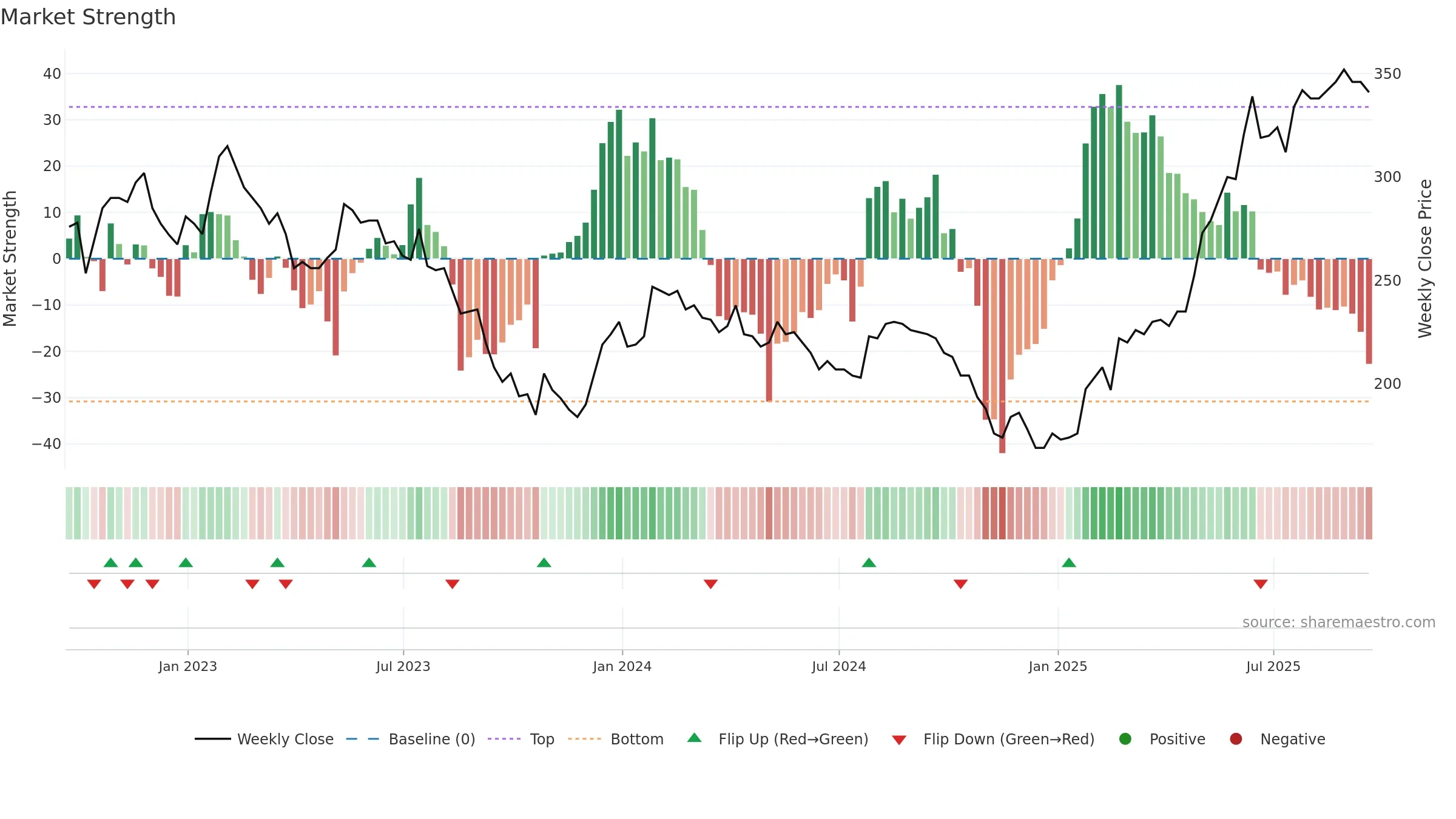

Negative setup. ★★☆☆☆ confidence. Price window: 0. Trend: Uptrend at Risk; gauge 82. In combination, liquidity diverges from price.

- Constructive moving-average stack

- Low return volatility supports durability

- High-level but rolling over (topping risk)

- Momentum is weak/falling

- Price is not above key averages

- Liquidity diverges from price

Why: Price window 0.89% over 8w. Close is -3.13% below the prior-window high. Return volatility 1.17%. Volume trend falling. Liquidity divergence with price. Trend state uptrend at risk. High-regime (0.80–1.00) downticks 7/7 (100.0%) • Distributing. MA stack constructive. Momentum neutral and falling. Valuation stance positive.

Tip: Most metrics include a hover tooltip where they appear in the report.