Weekly Report

Direxion Daily Semiconductor Bear 3X Shares closed at 5.5300 (1.28% WoW) . Data window ends Fri, 19 Sep 2025.

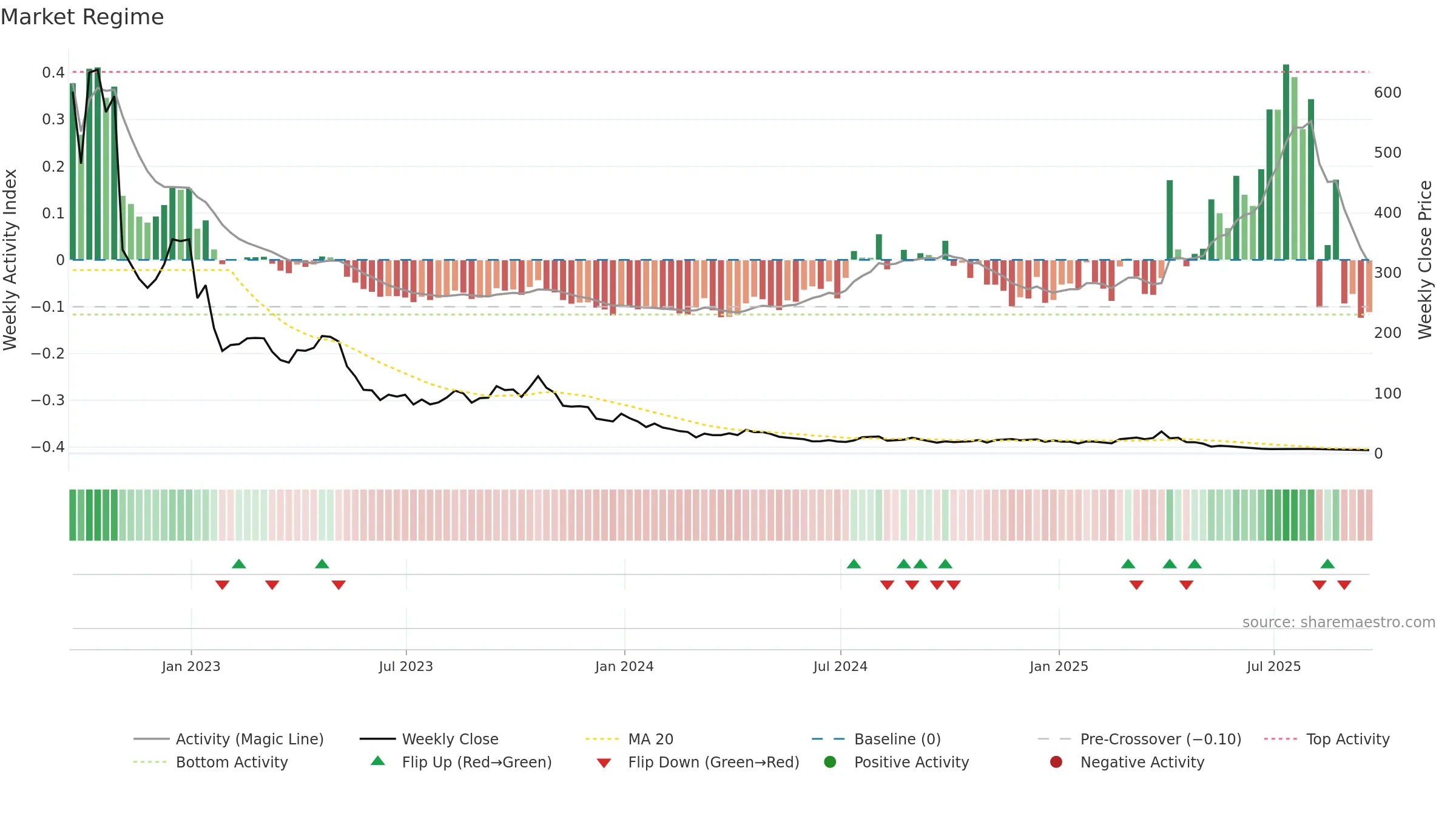

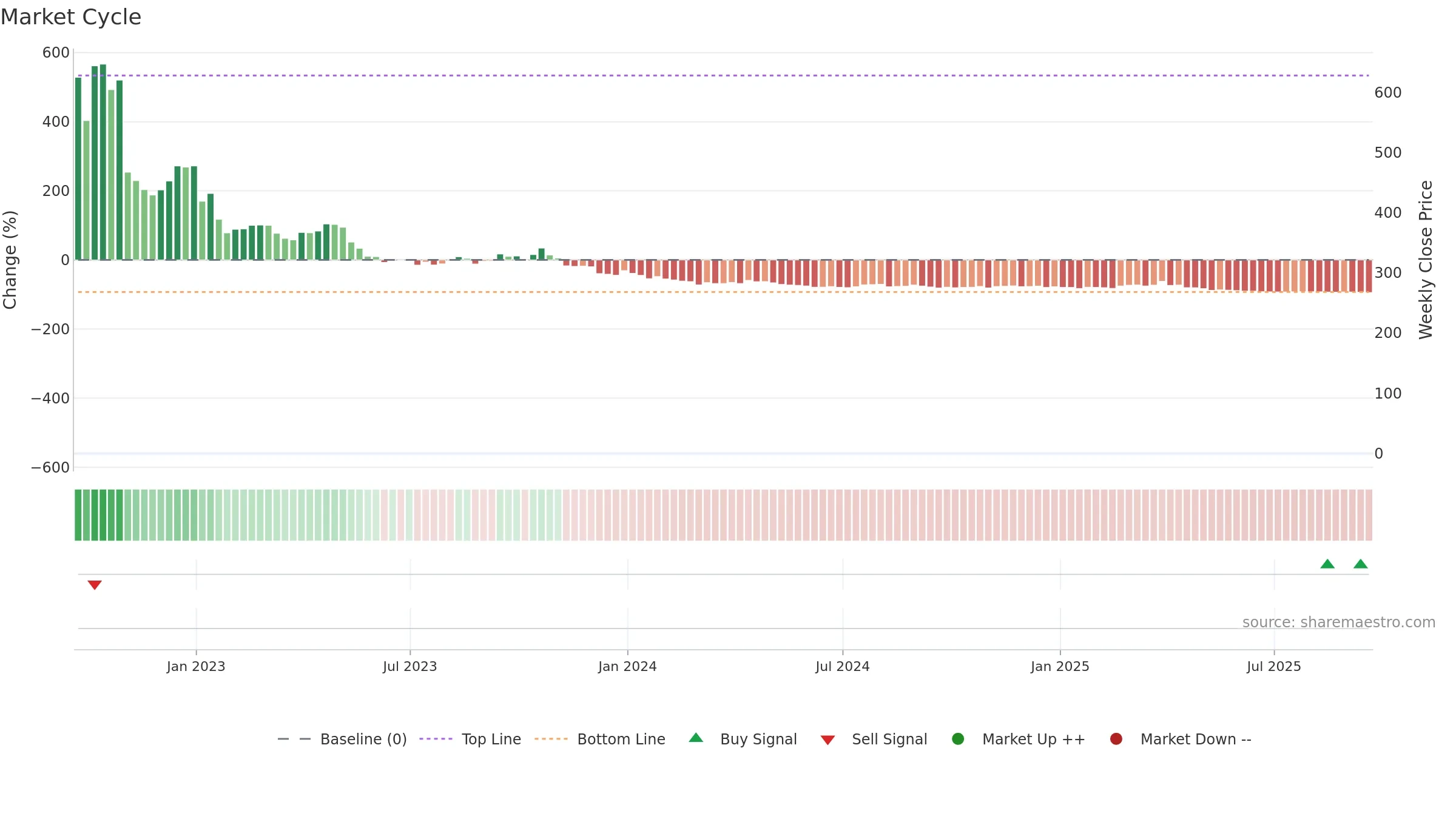

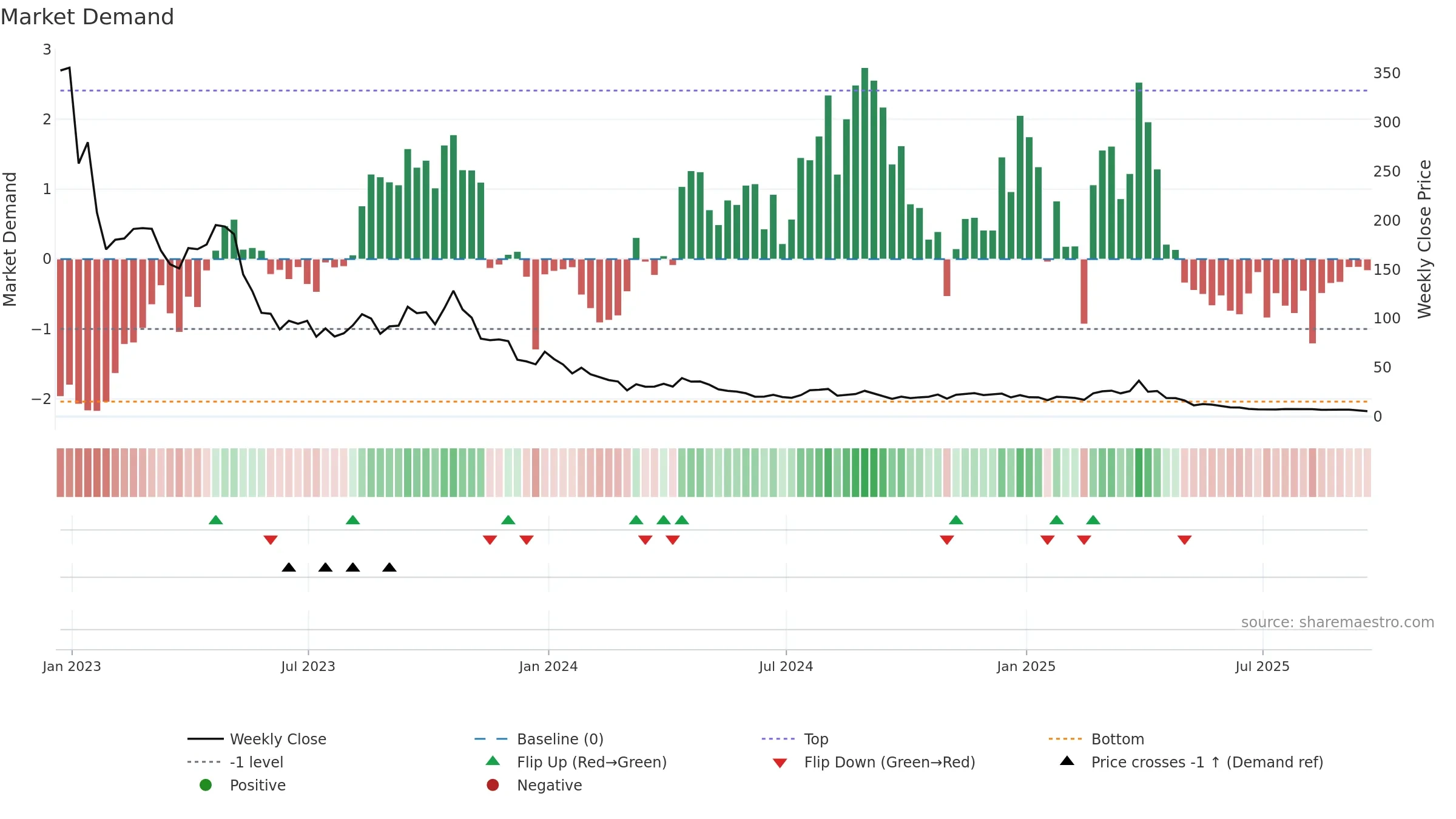

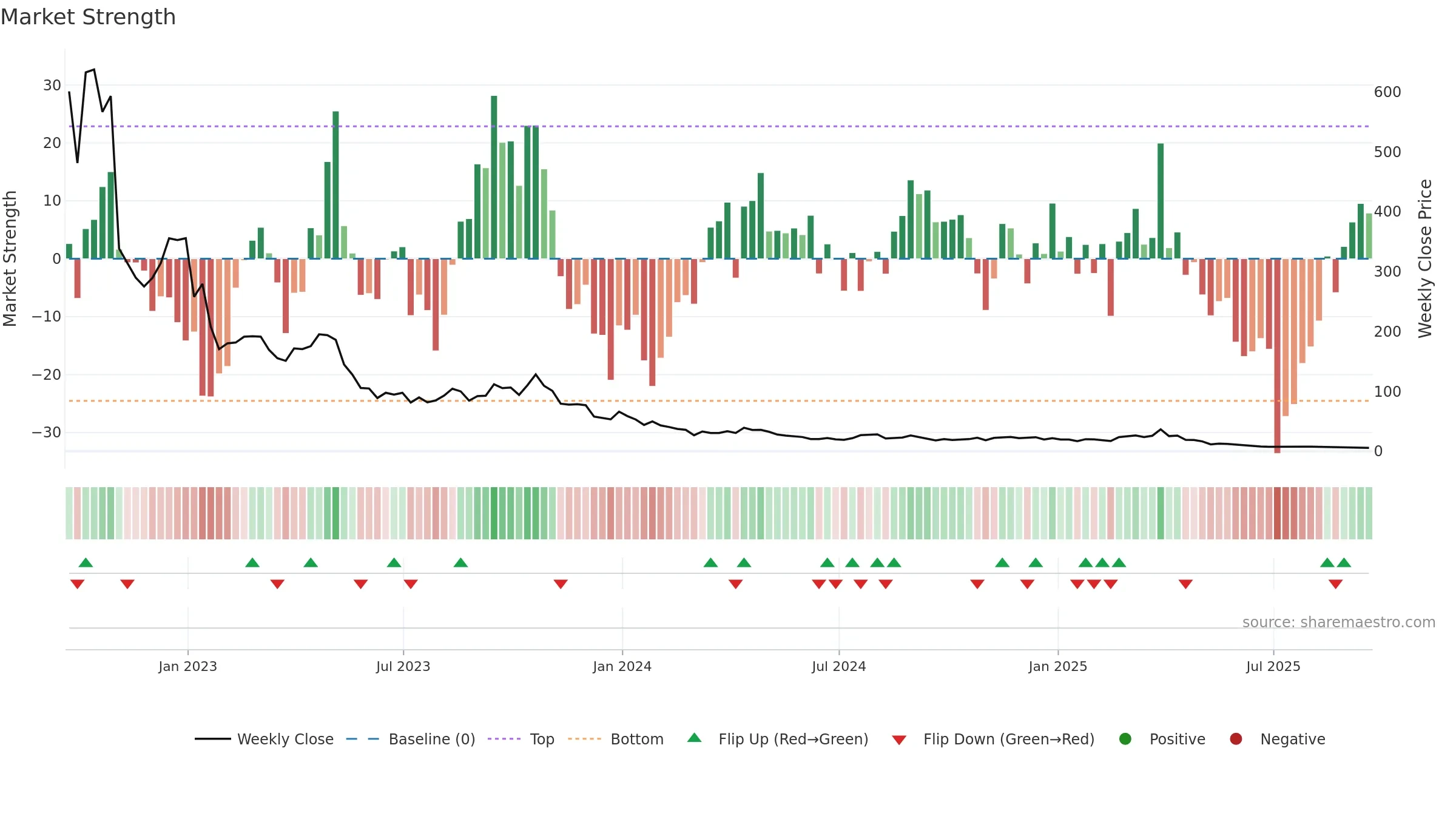

How to read this — Price slope is downward, indicating persistent supply pressure. Elevated weekly volatility increases whipsaw risk. Volume and price are moving in the same direction — a constructive confirmation. Returns are negatively correlated with volume — strength may come on lighter activity. Accumulation weeks: 3; distribution weeks: 1. Price-level slope and return-drift differ — moves have been uneven week to week. Weak MA stack argues for caution; rallies can fail near the 8–13 week region. Price sits below key averages, keeping pressure on the tape.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

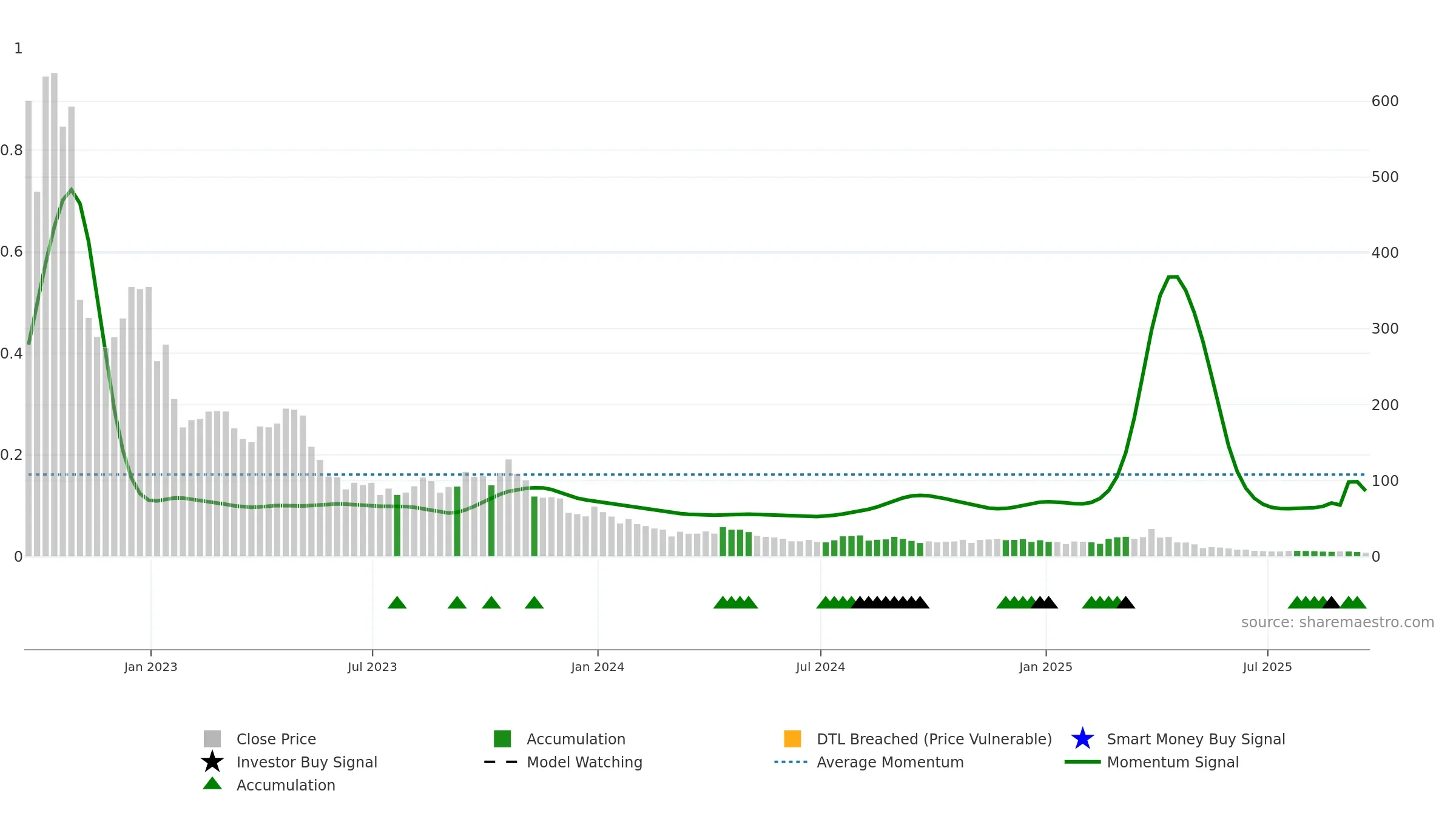

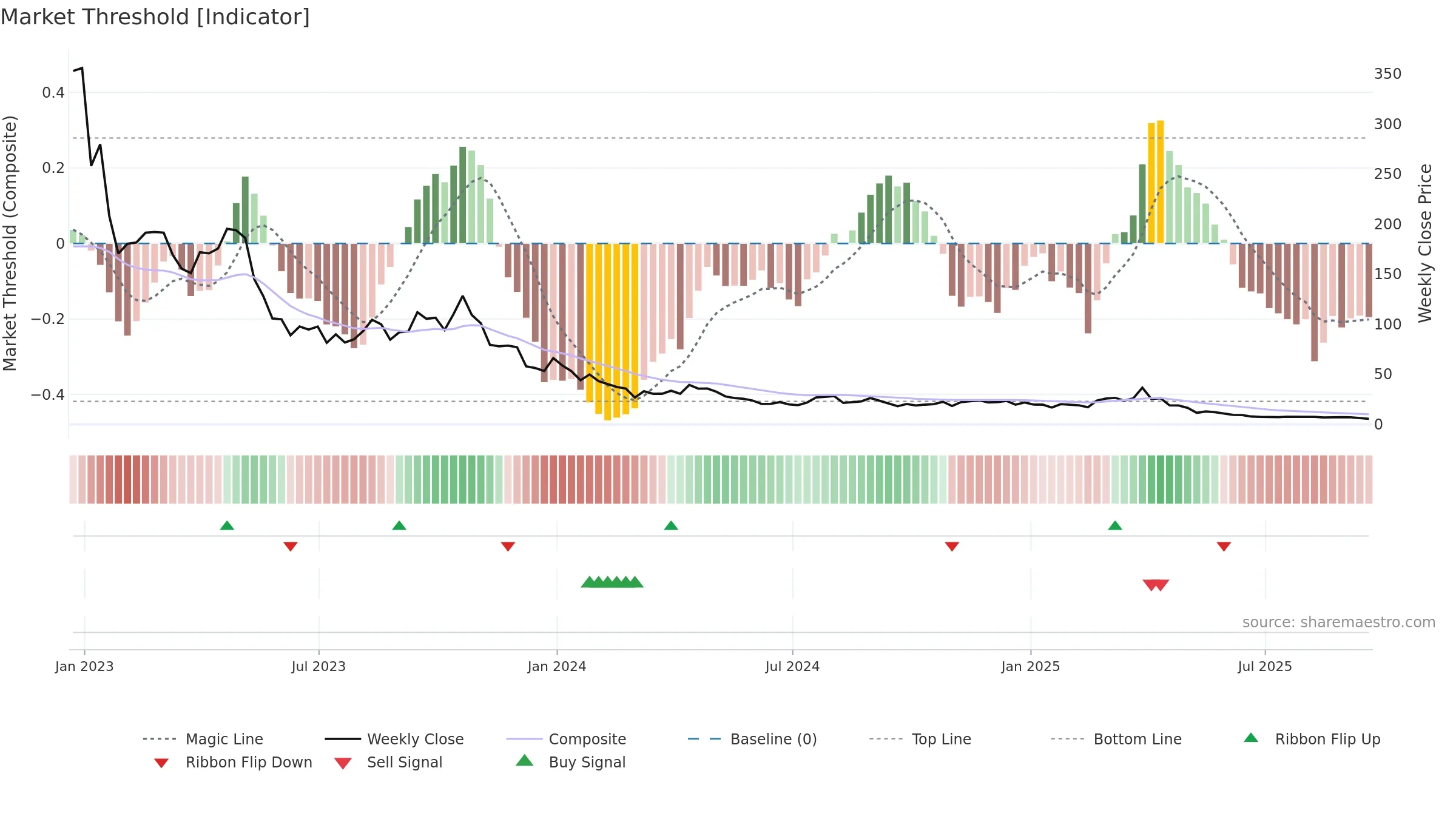

Gauge maps the trend signal to a 0–100 scale.

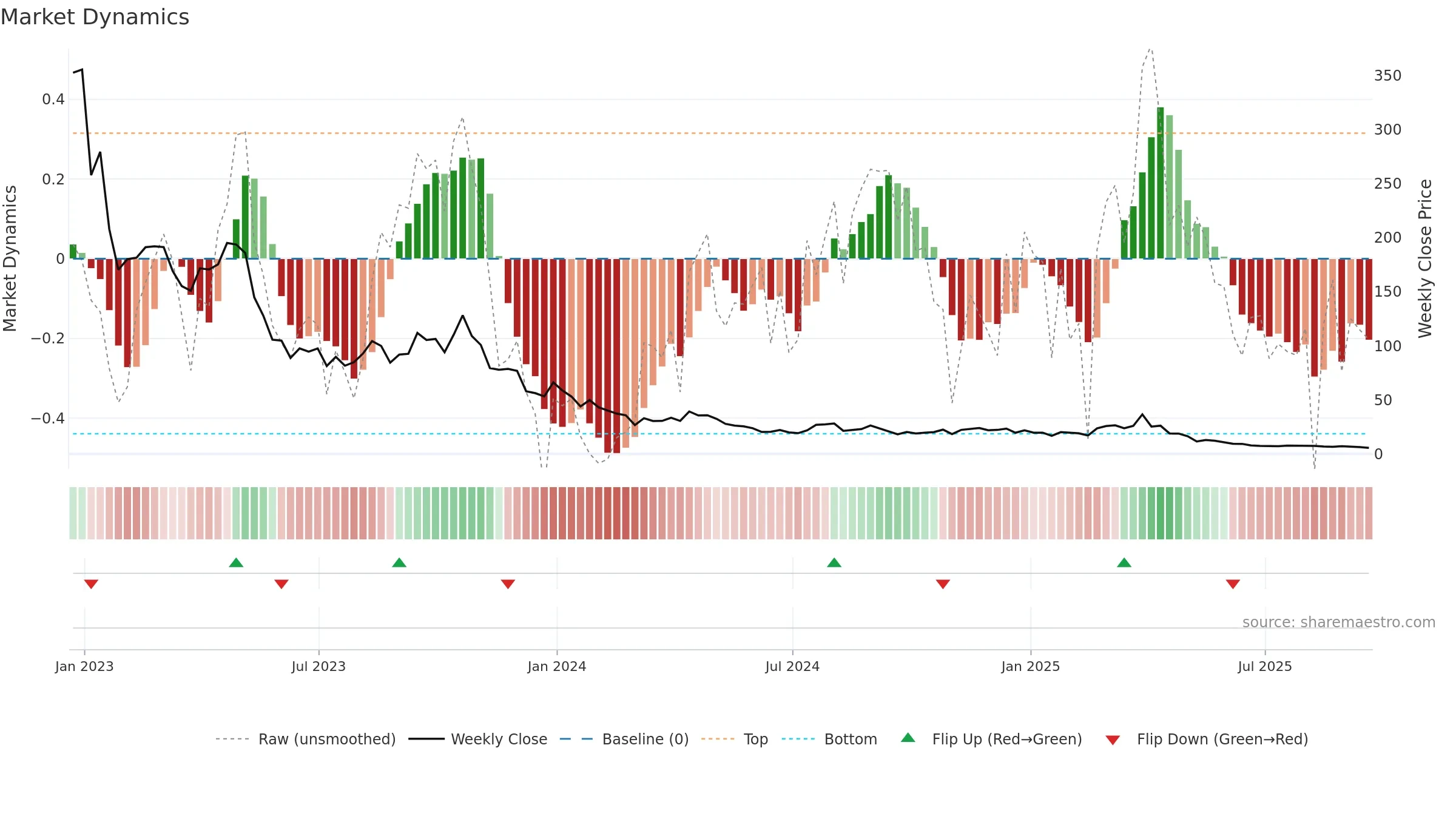

How to read this — Bullish gauge levels imply persistent upside pressure. A rising gauge shows momentum building rather than fading. Deceleration reduces the odds of persistence.

Constructive backdrop; dips are more likely to find support while the gauge stays high.

Conclusion

Neutral setup. ★★★☆☆ confidence. Price window: -27. Trend: Bullish @ 56. In combination, liquidity confirms the move.

Why: Price window -27.81% over 8w. Close is -27.81% below the window high. Return volatility 4.88%. Volume trend falling. Liquidity convergence with price. Accumulation 3; distribution 1. MA stack weak. Baseline deviation -0.94% (widening). Momentum bullish and rising. Acceleration decelerating. Gauge volatility low.

Tip: Most metrics also include a hover tooltip where they appear in the report.