Shanghai M&G Stationery Inc.

603899 SHA

Weekly Report

Shanghai M&G Stationery Inc. closed at 29.8000 (-1.06% WoW) . Data window ends Mon, 15 Sep 2025.

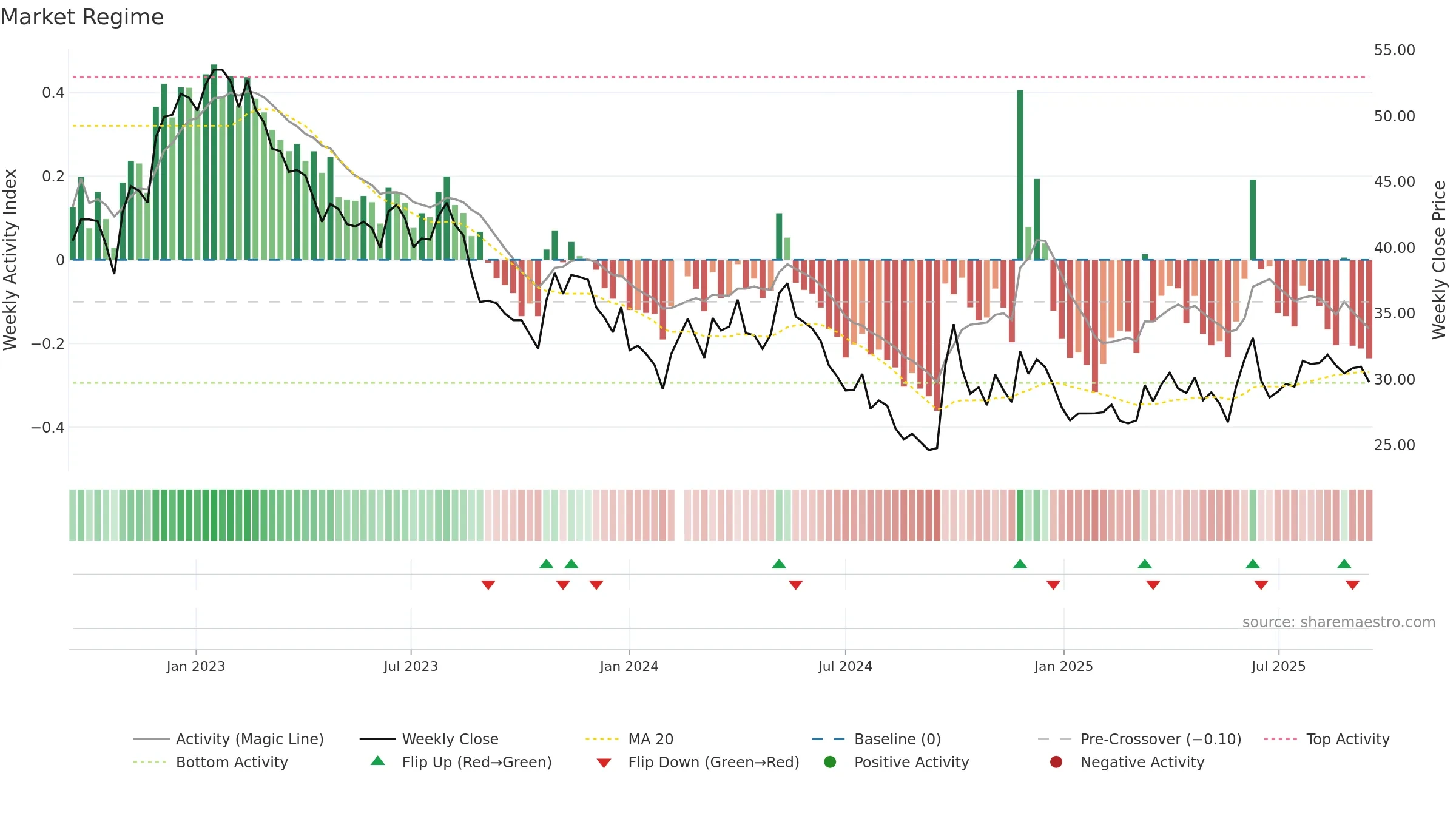

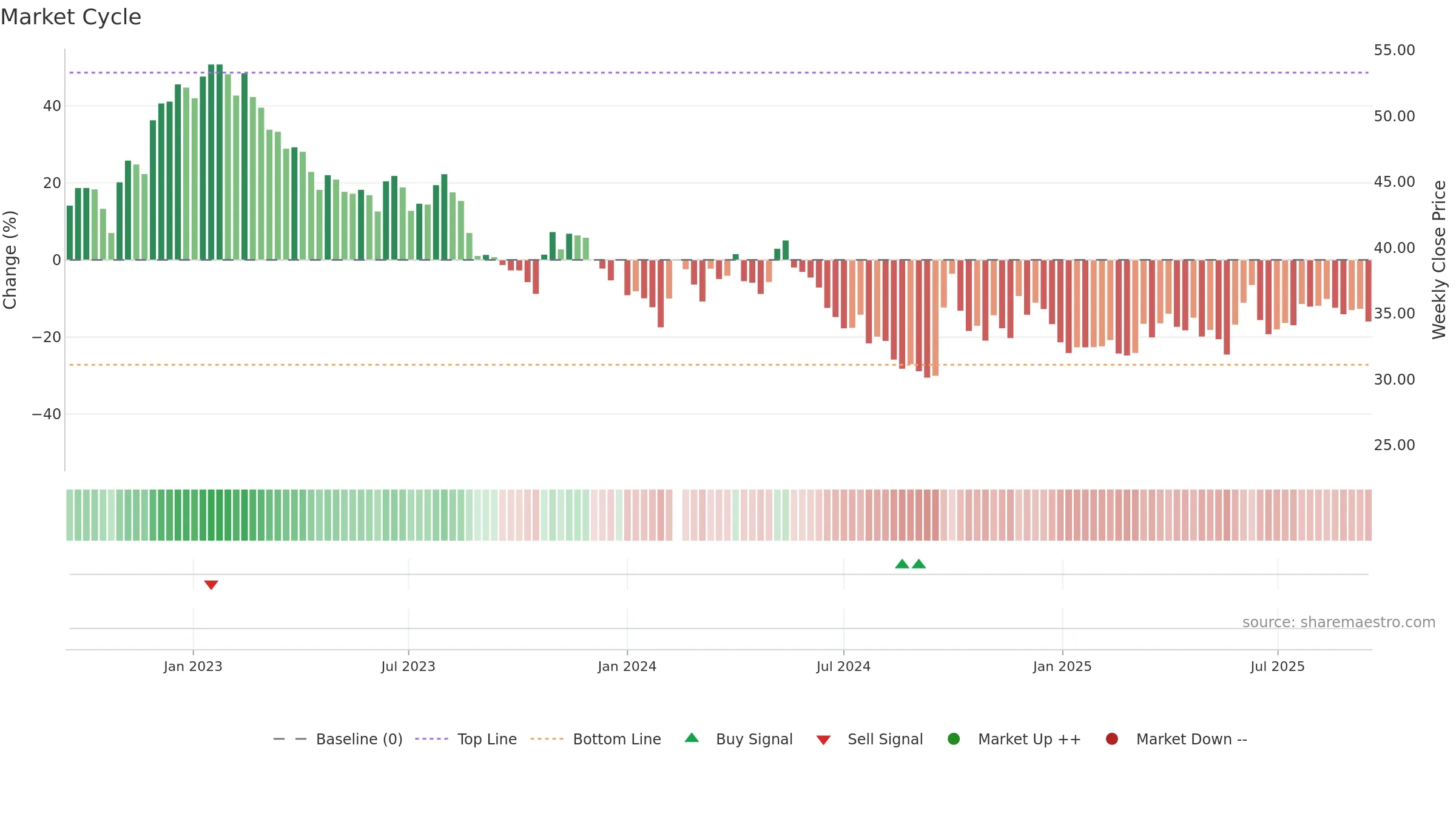

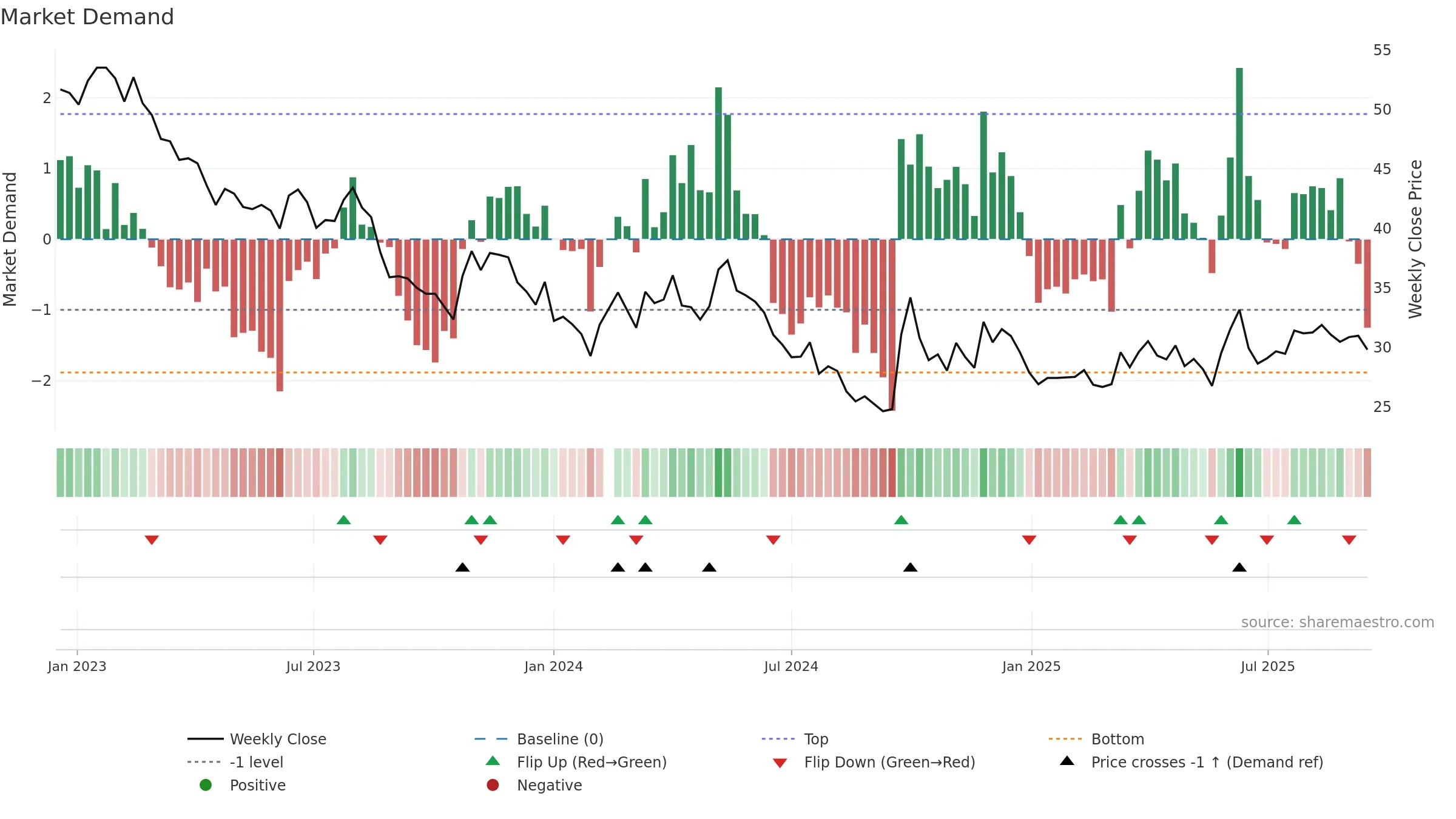

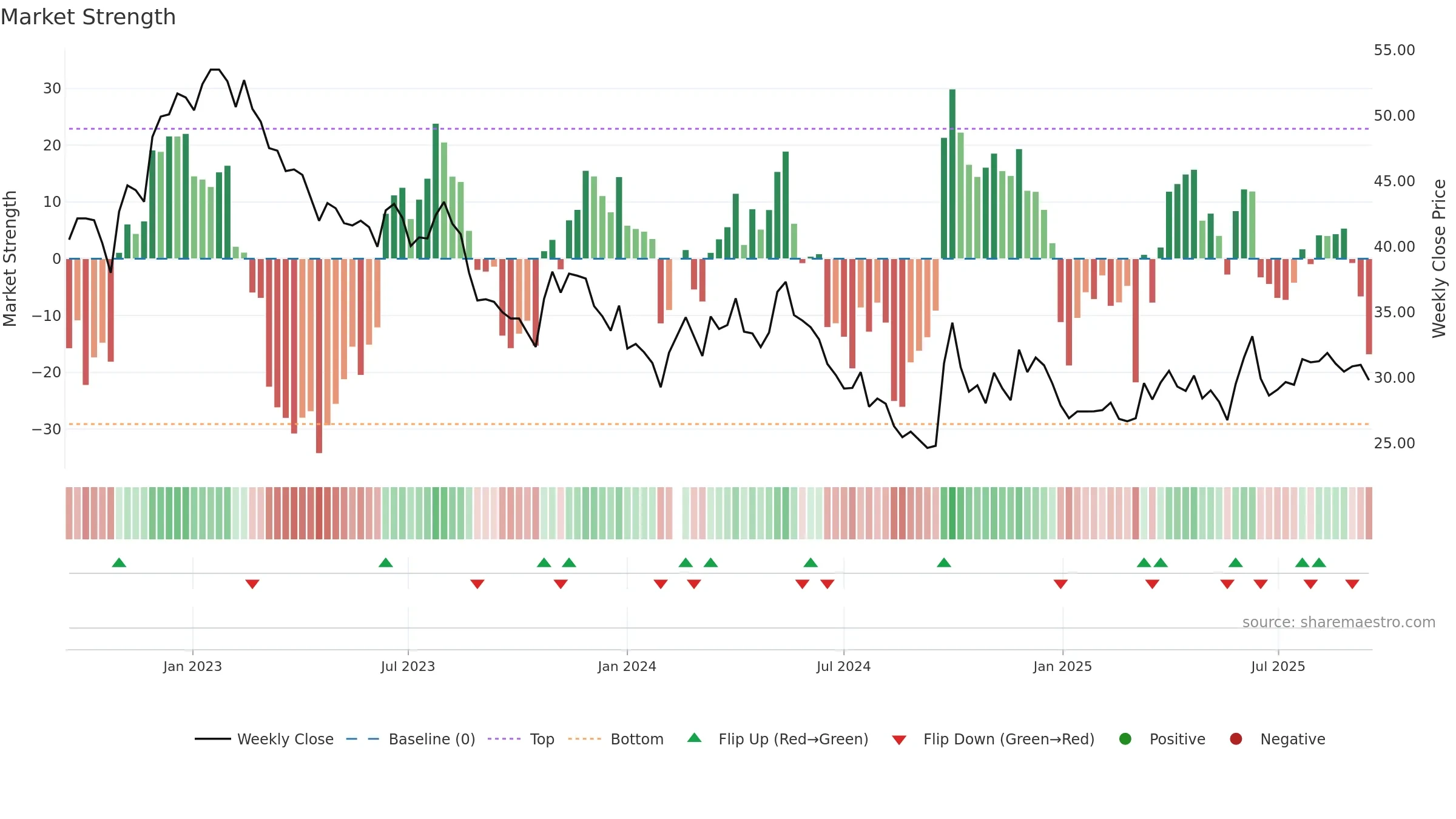

How to read this — Price slope is downward, indicating persistent supply pressure. Low weekly volatility favours steadier follow-through. Volume and price are moving in the same direction — a constructive confirmation. Returns are negatively correlated with volume — strength may come on lighter activity. Price sits below key averages, keeping pressure on the tape.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

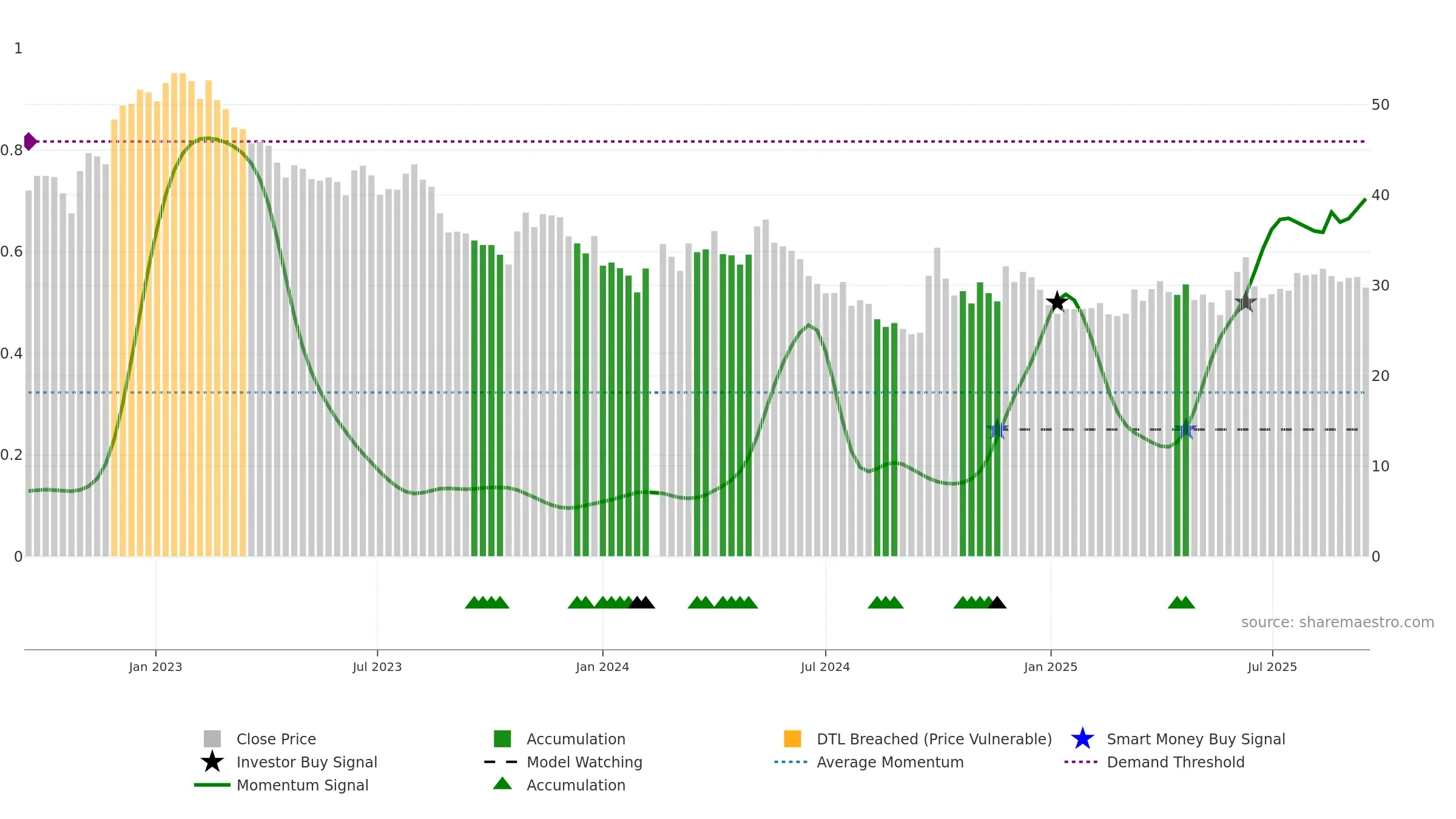

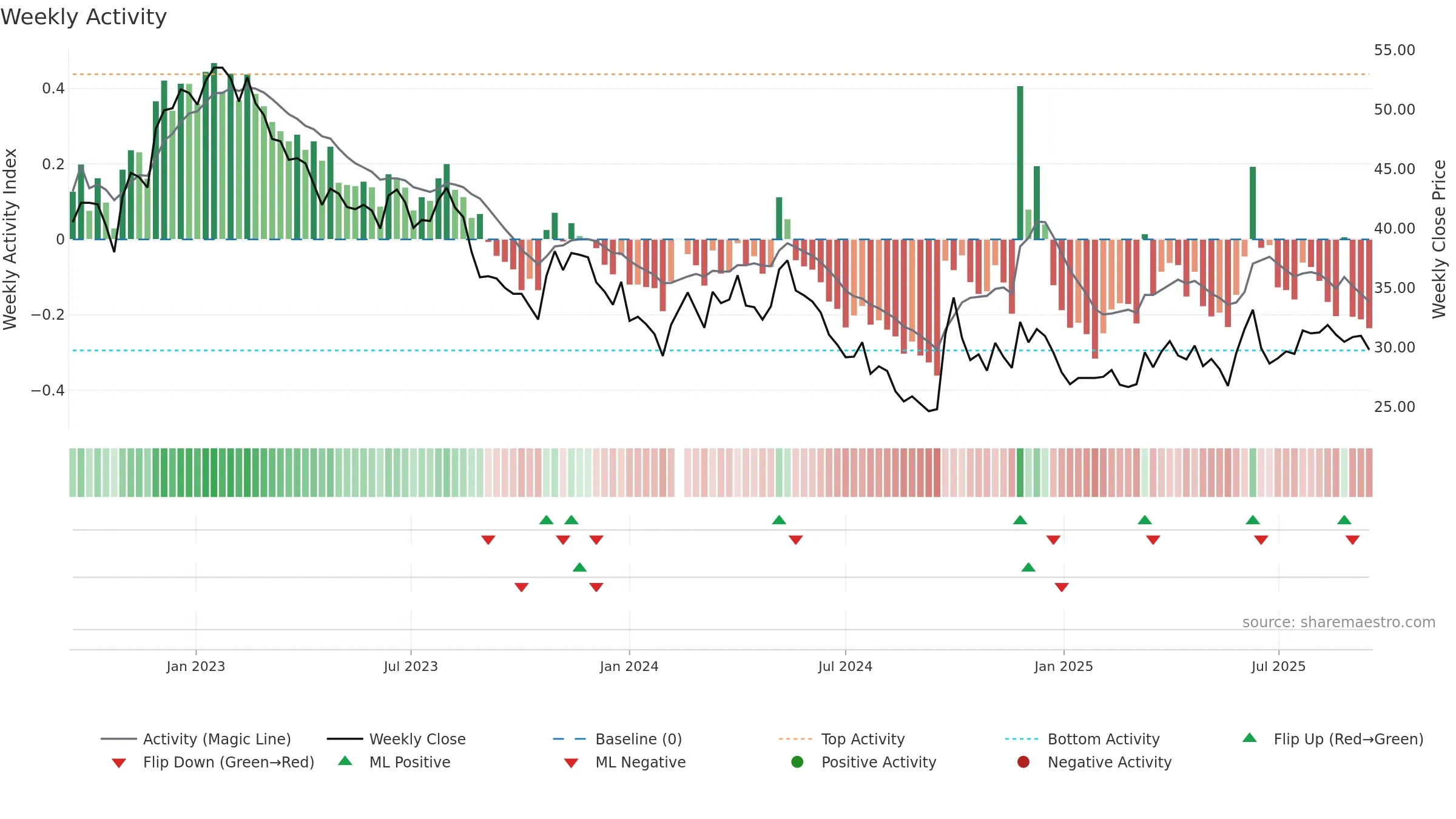

Gauge maps the trend signal to a 0–100 scale.

How to read this — High gauge and rising momentum — buyers in control.

Bias remains higher; pullbacks could be buyable if participation holds.

Price is below fair value; potential upside if momentum constructive.

Conclusion

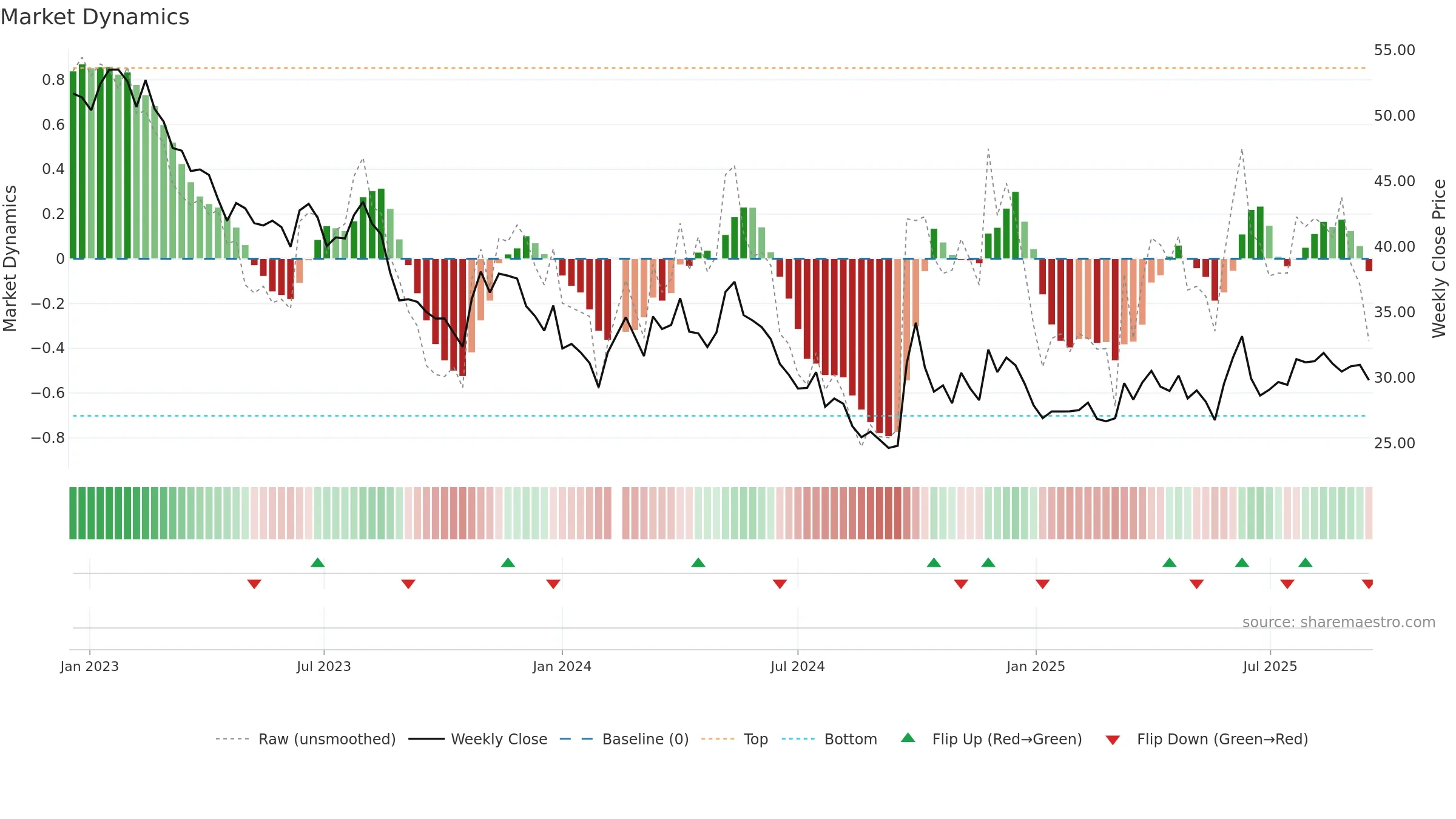

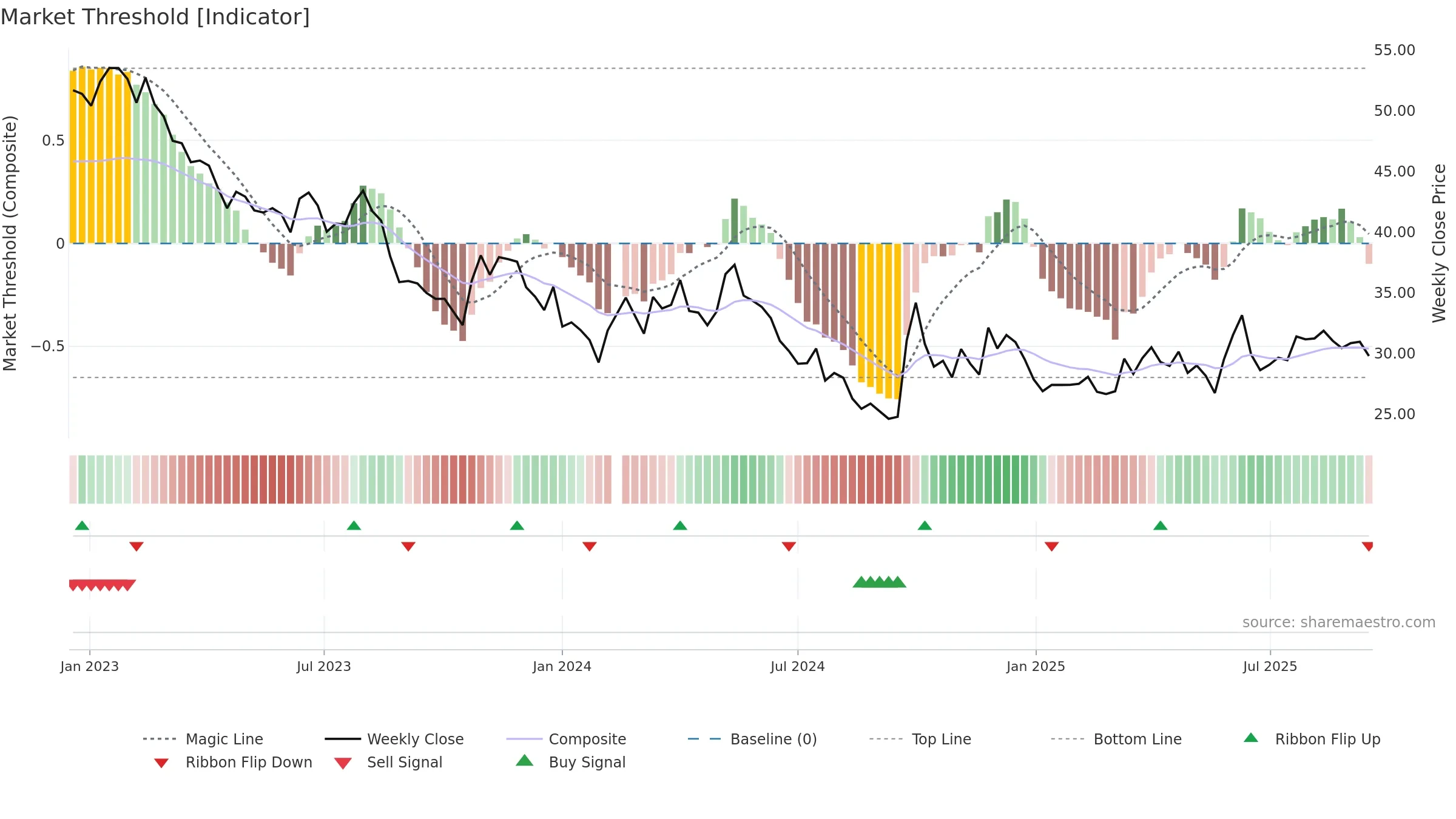

Positive setup. ★★★★☆ confidence. Price window: -4. Trend: Strong Uptrend; gauge 70. In combination, liquidity confirms the move.

- High gauge with rising momentum (strong uptrend)

- Momentum is bullish and rising

- Liquidity confirms the price trend

- Low return volatility supports durability

- Price is not above key averages

- Negative multi-week performance

Why: Price window -4.40% over 8w. Close is -6.52% below the prior-window high. Return volatility 1.93%. Volume trend falling. Liquidity convergence with price. Trend state strong uptrend. Momentum bullish and rising. Valuation supportive skew.

Tip: Most metrics include a hover tooltip where they appear in the report.