Indo Count Industries Limited

ICIL NSE

Weekly Report

Indo Count Industries Limited closed at 280.4200 (-1.43% WoW) . Data window ends Mon, 15 Sep 2025.

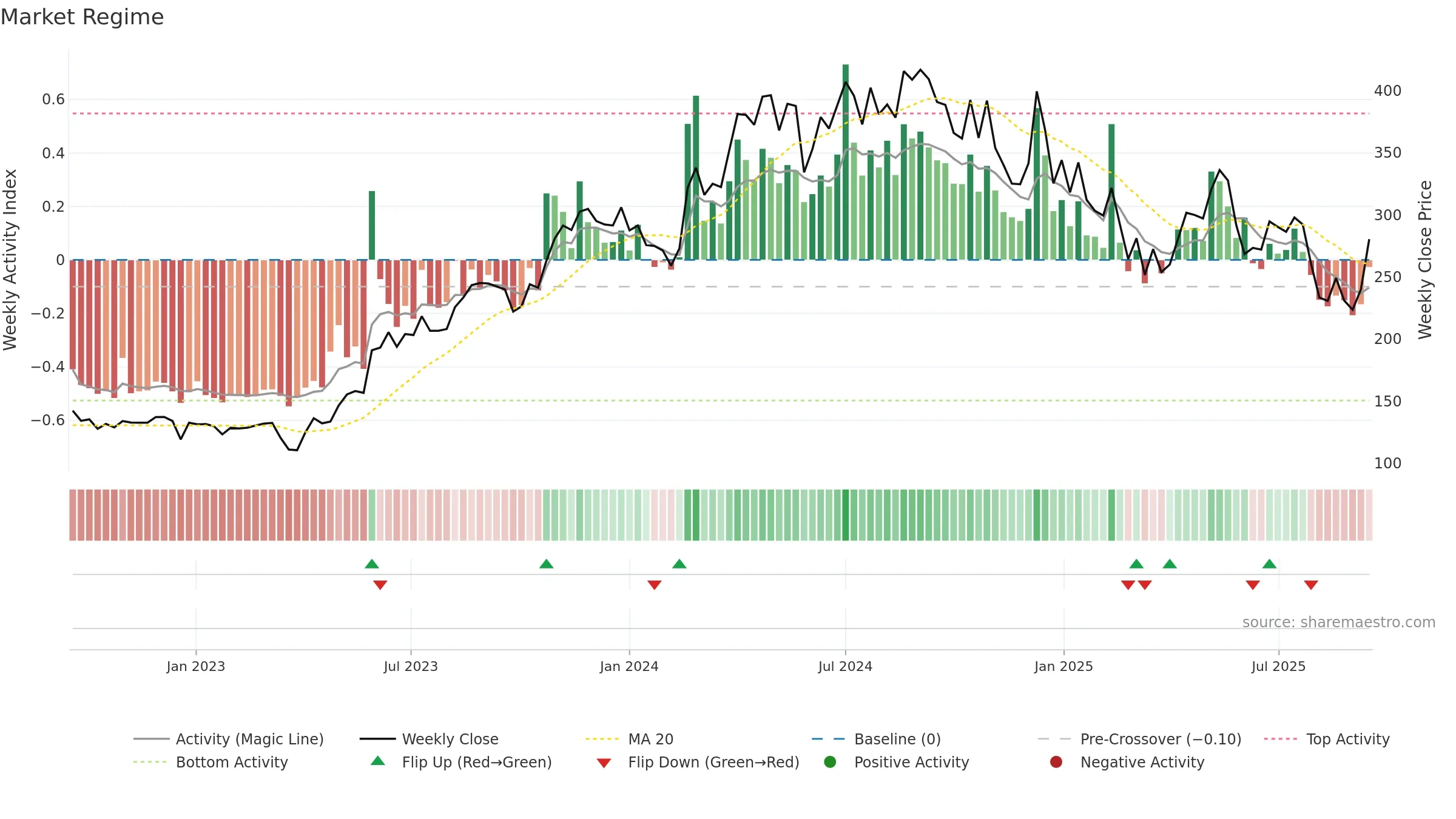

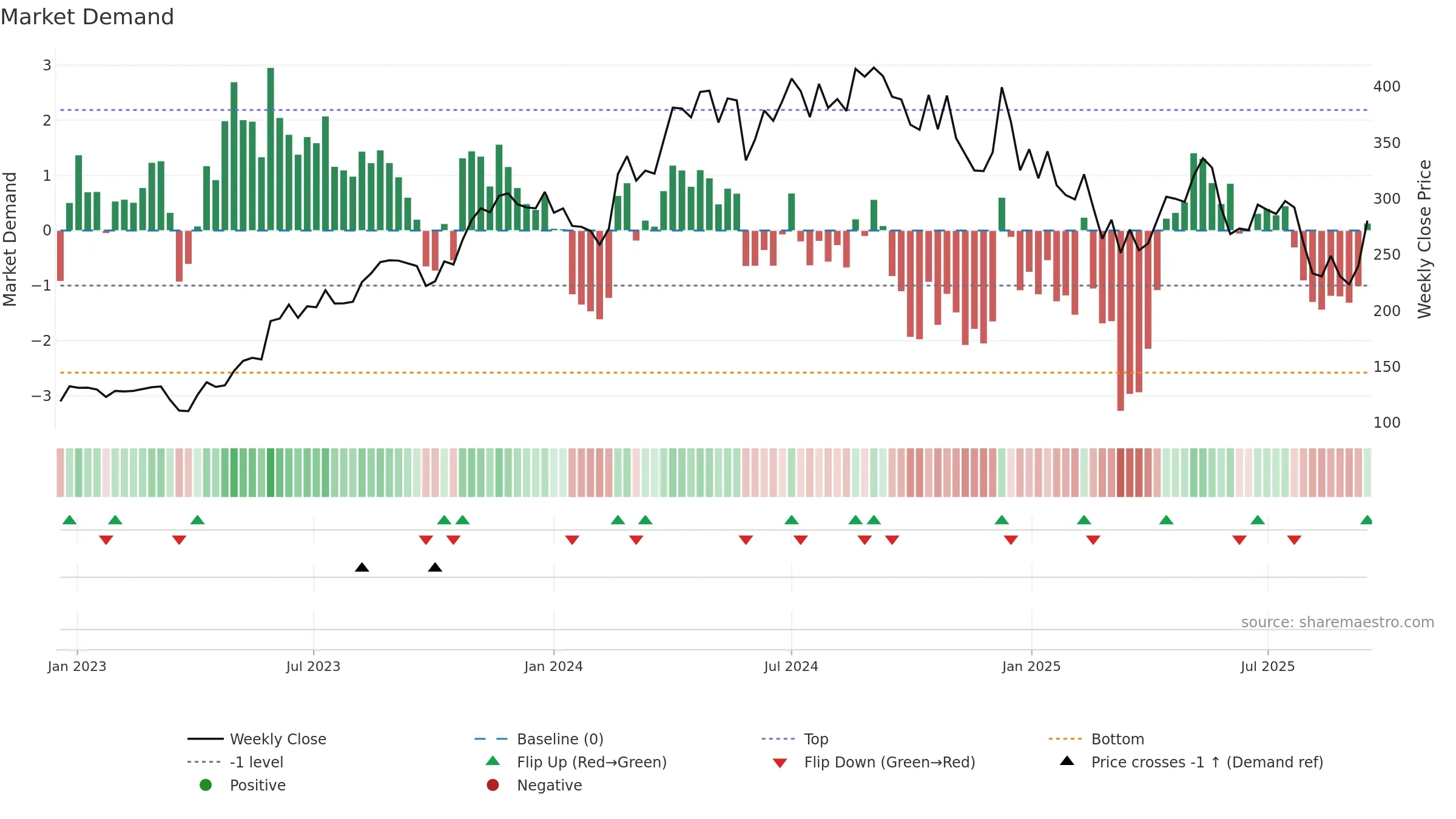

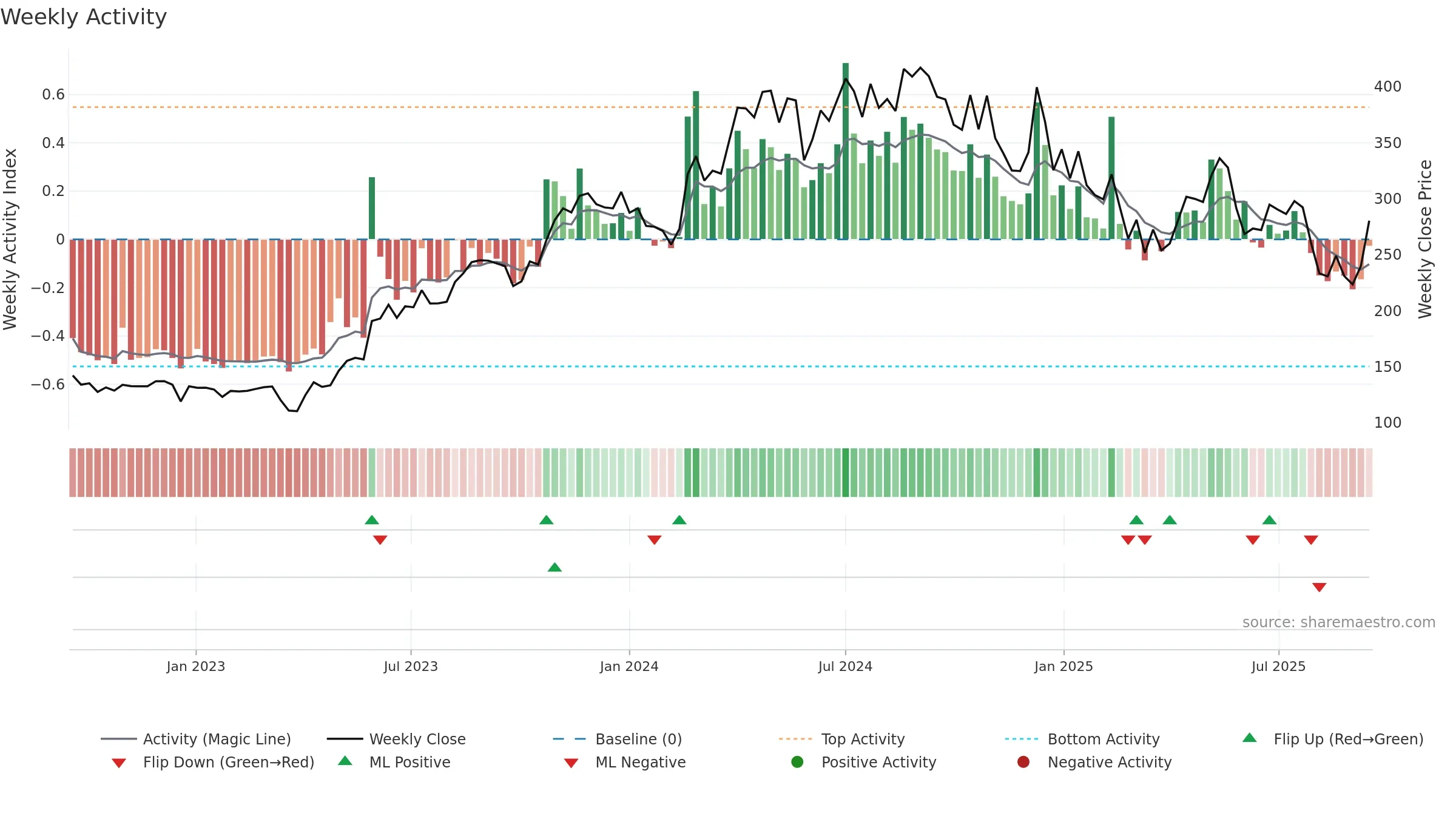

How to read this — Price slope is upward, indicating persistent buying over the window. Elevated weekly volatility increases whipsaw risk. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Fresh short-term crossover improves near-term tone. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

Gauge maps the trend signal to a 0–100 scale.

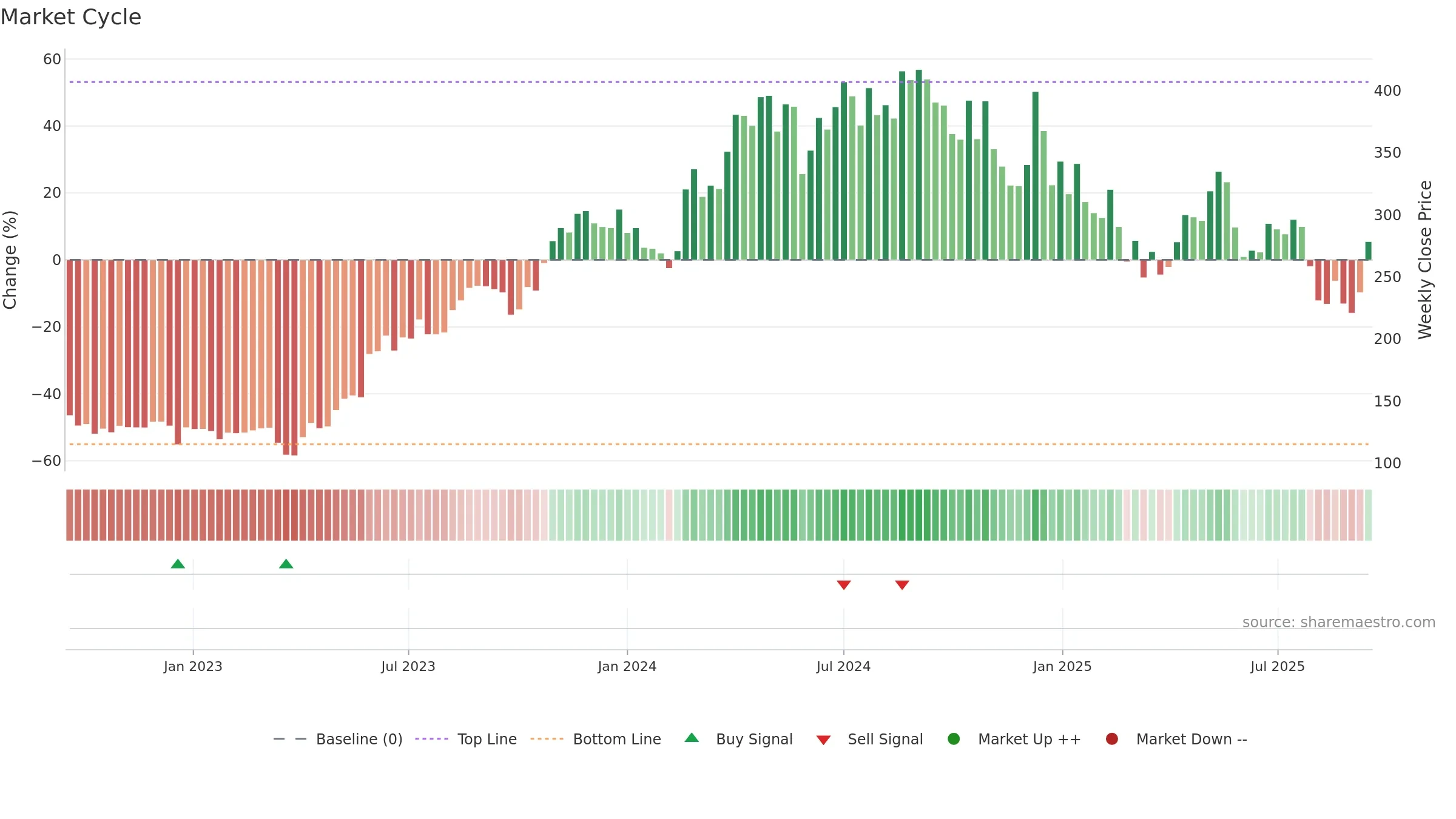

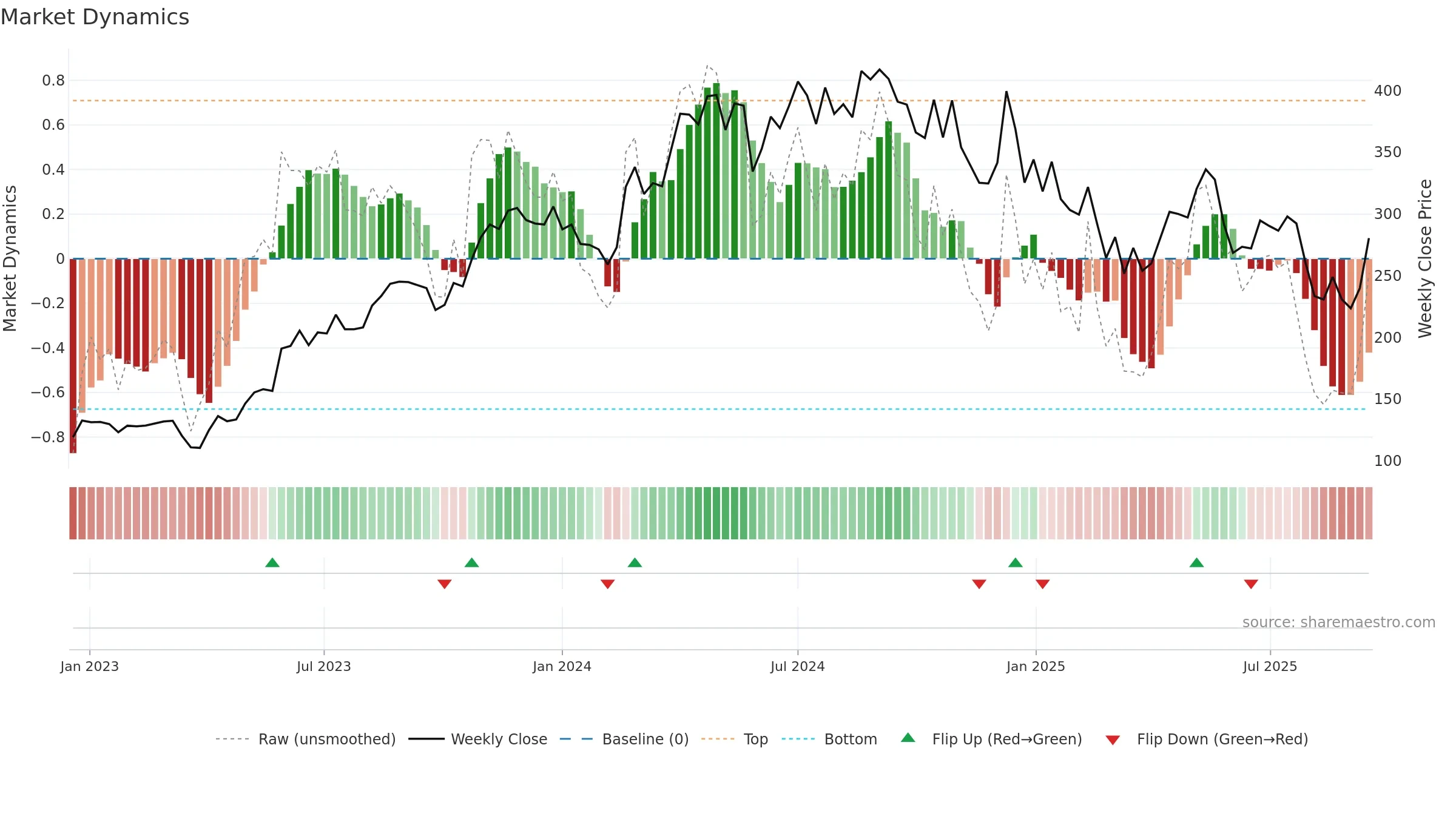

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

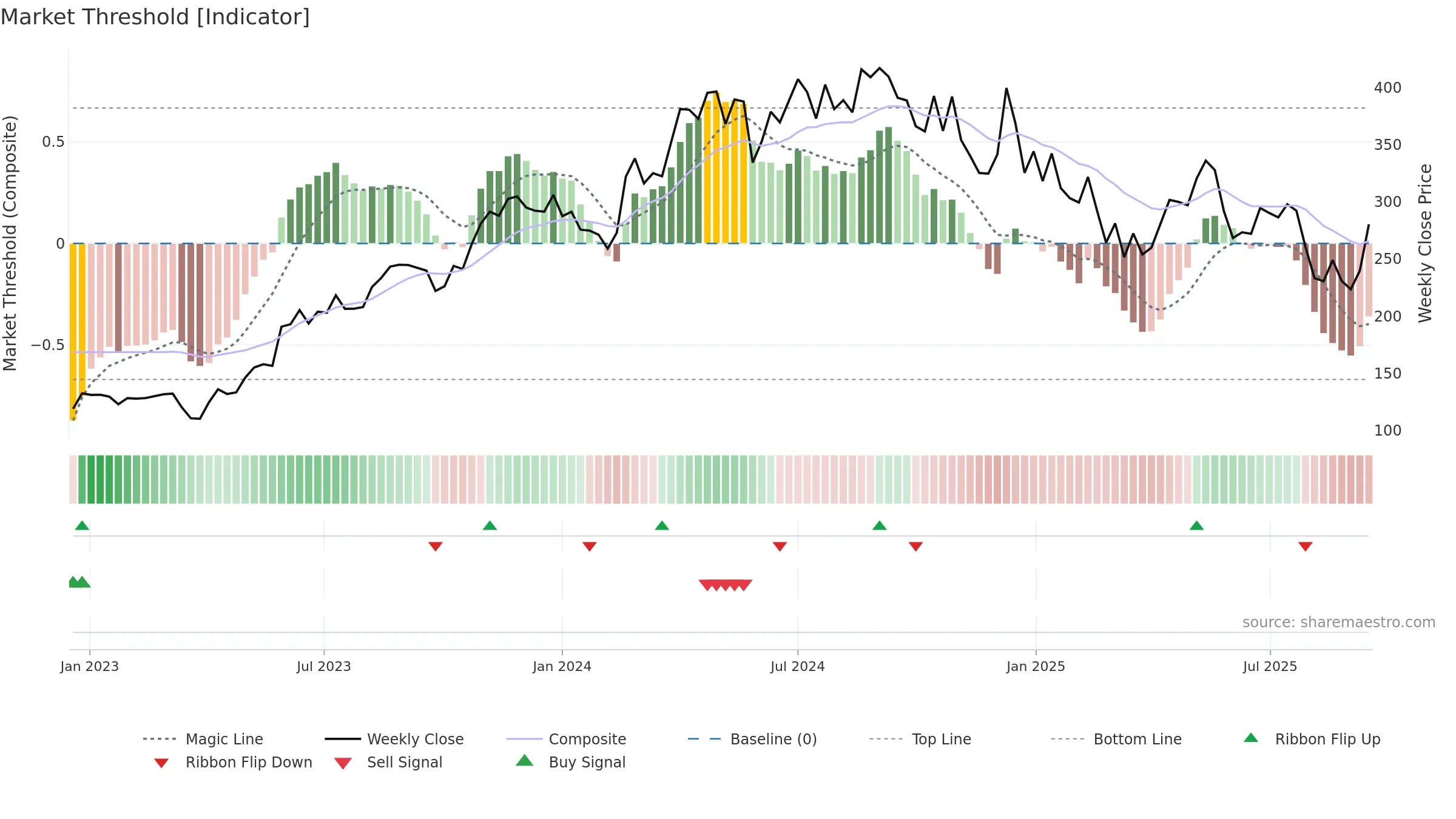

Price is above fair value; upside may be capped without catalysts.

Conclusion

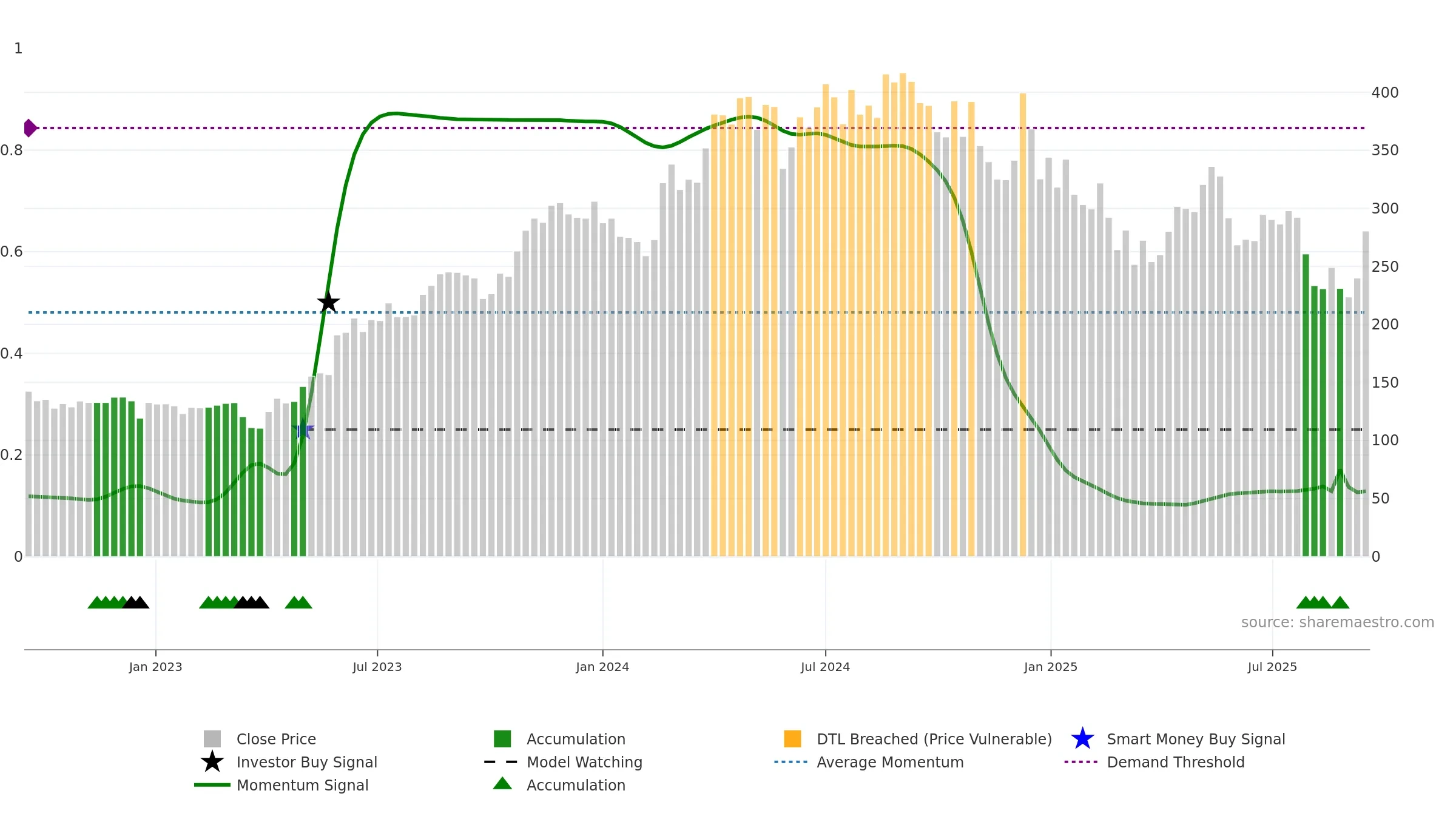

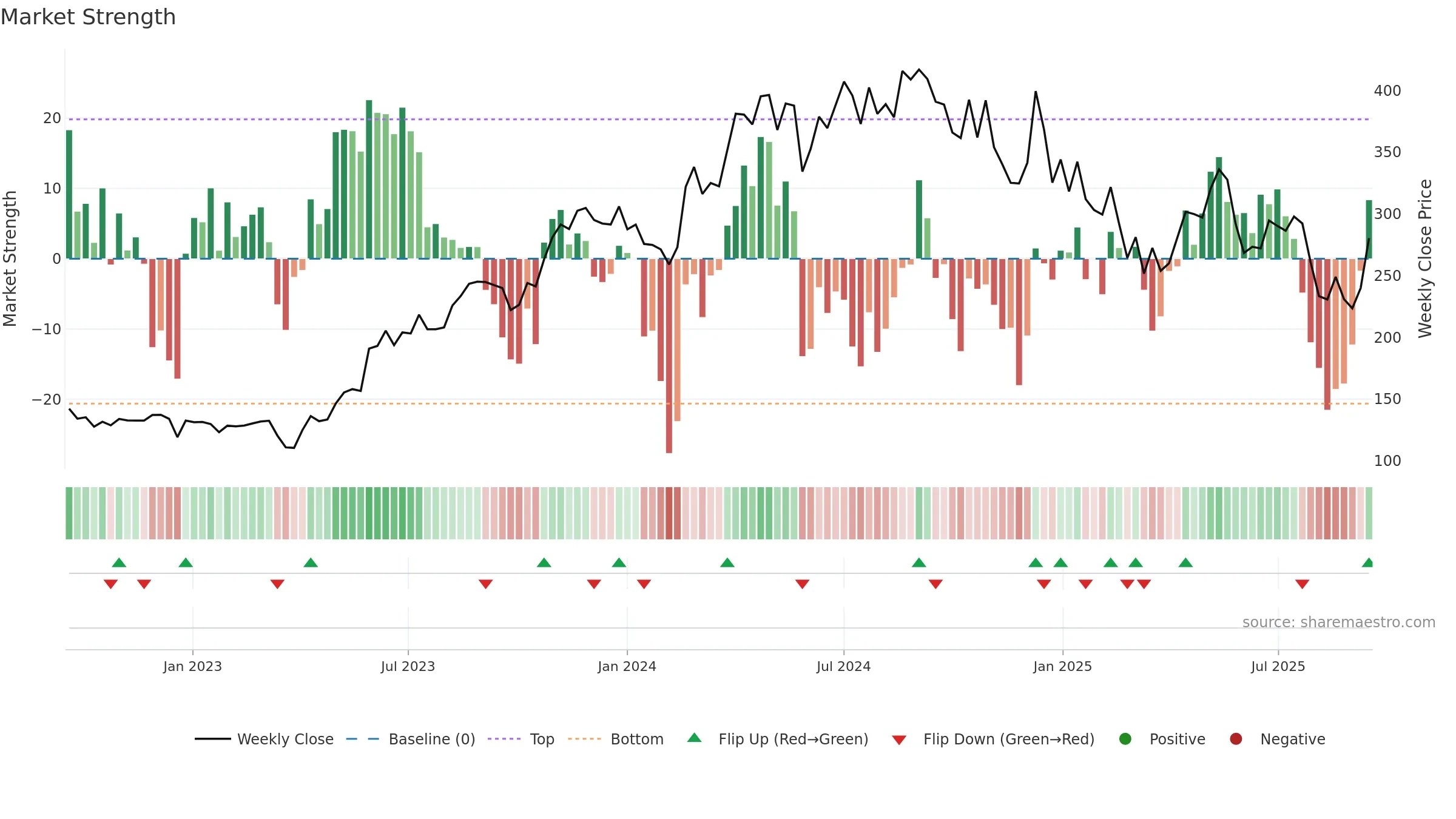

Negative setup. ★★☆☆☆ confidence. Price window: 7. Trend: Range / Neutral; gauge 12. In combination, liquidity diverges from price.

- Price holds above 8w & 26w averages

- Momentum is weak/falling

- Liquidity diverges from price

- High return volatility raises whipsaw risk

Why: Price window 7.58% over 8w. Close is 7.58% above the prior-window high. Return volatility 5.12%. Volume trend falling. Liquidity divergence with price. Trend state range / neutral. Low-regime (≤0.25) upticks 4/7 (57.0%) • Accumulating. 4–8w crossover bullish. Momentum bearish and falling. Valuation limited upside without catalysts.

Tip: Most metrics include a hover tooltip where they appear in the report.