Akebia Therapeutics, Inc.

AKBA NASDAQ

Weekly Report

Akebia Therapeutics, Inc. closed at 2.8200 (-4.73% WoW) . Data window ends Fri, 19 Sep 2025.

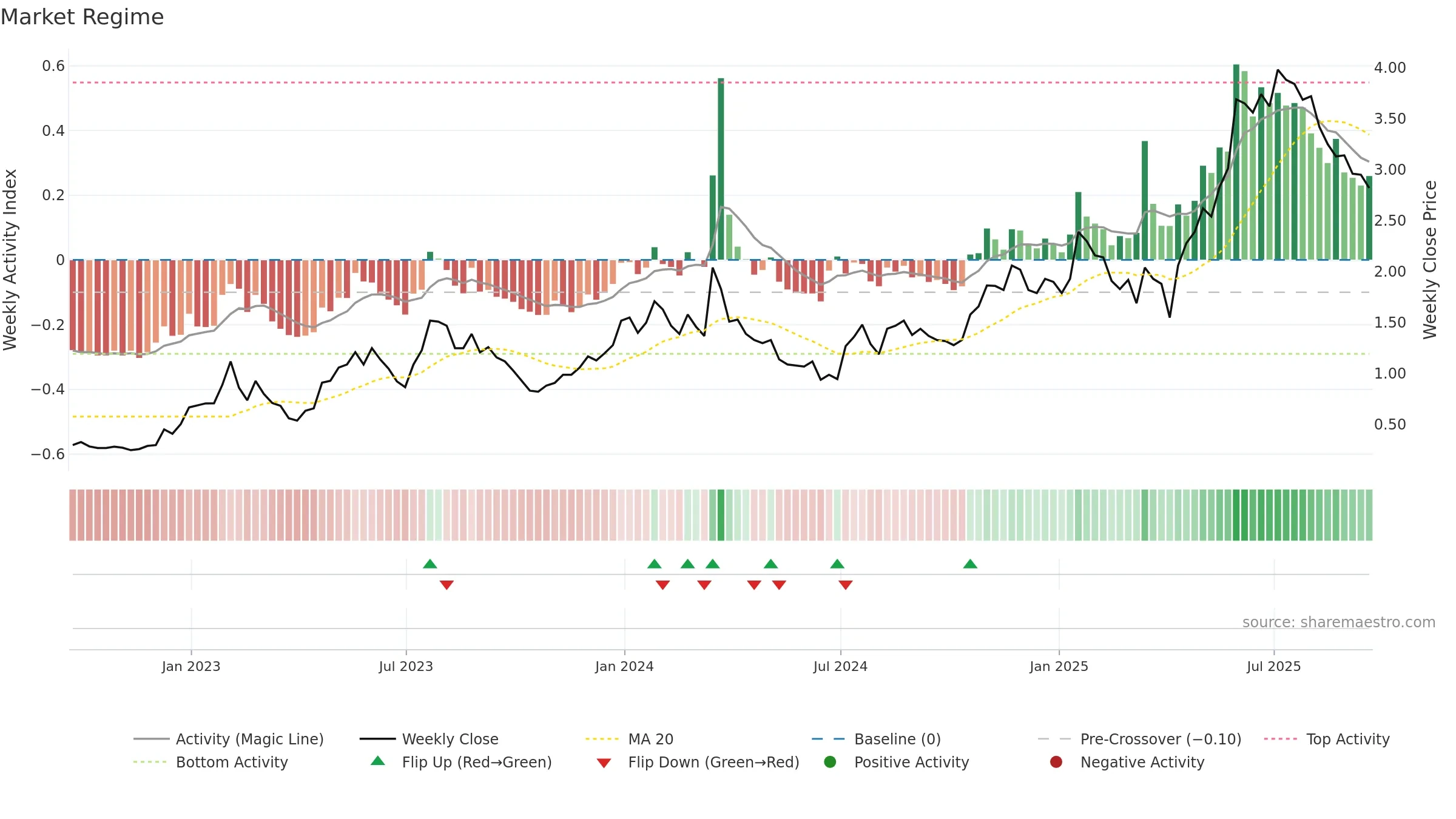

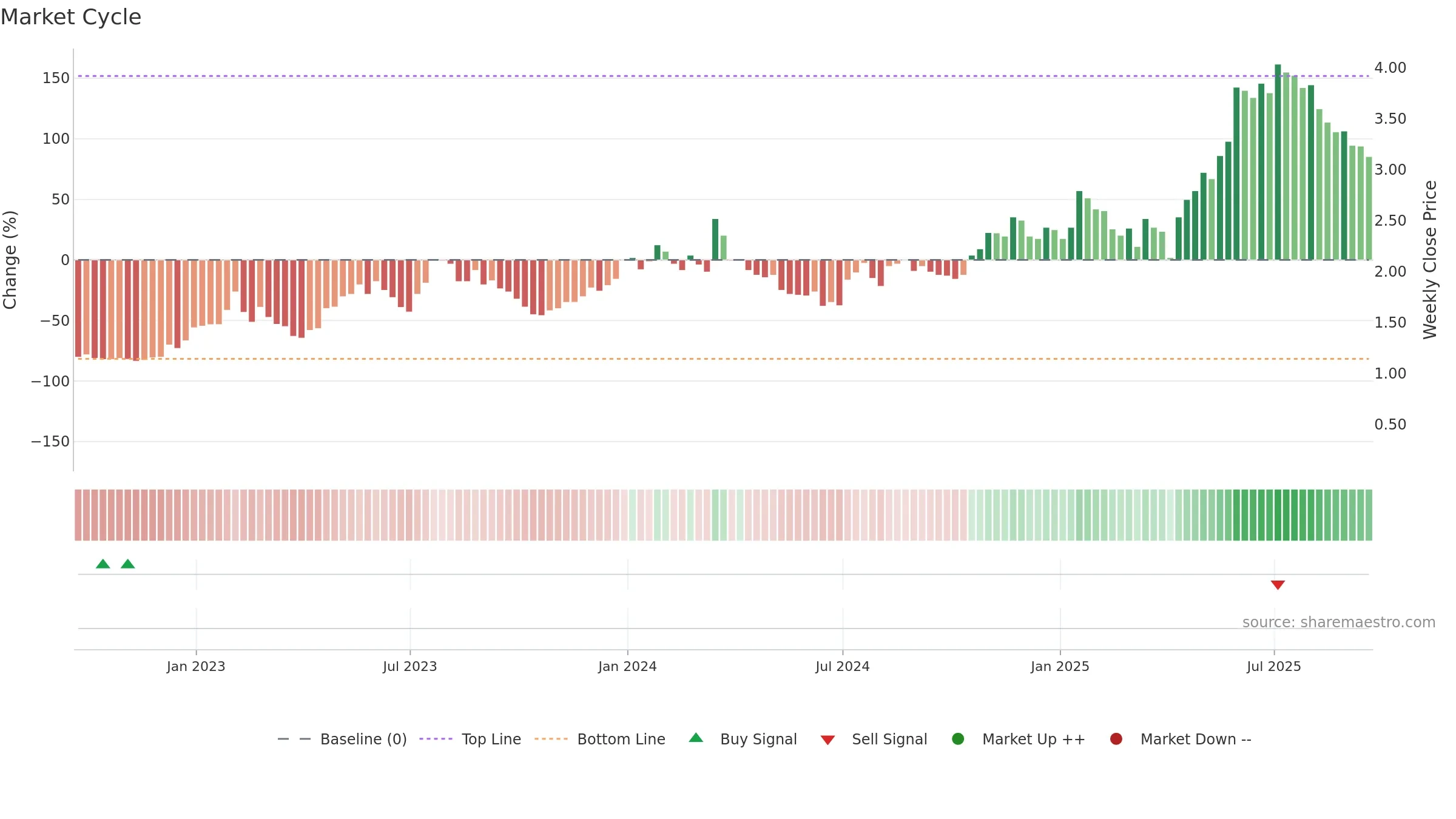

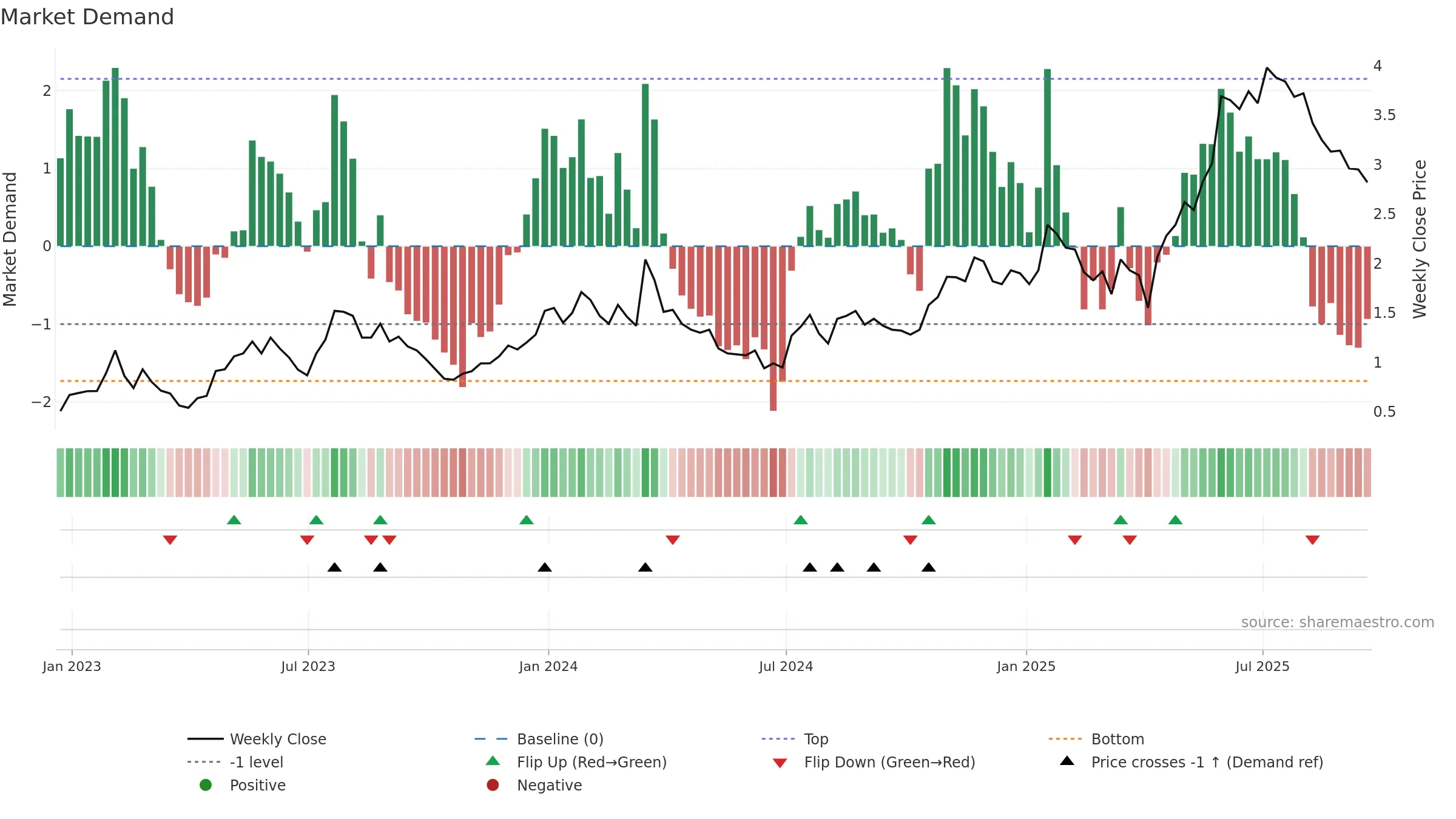

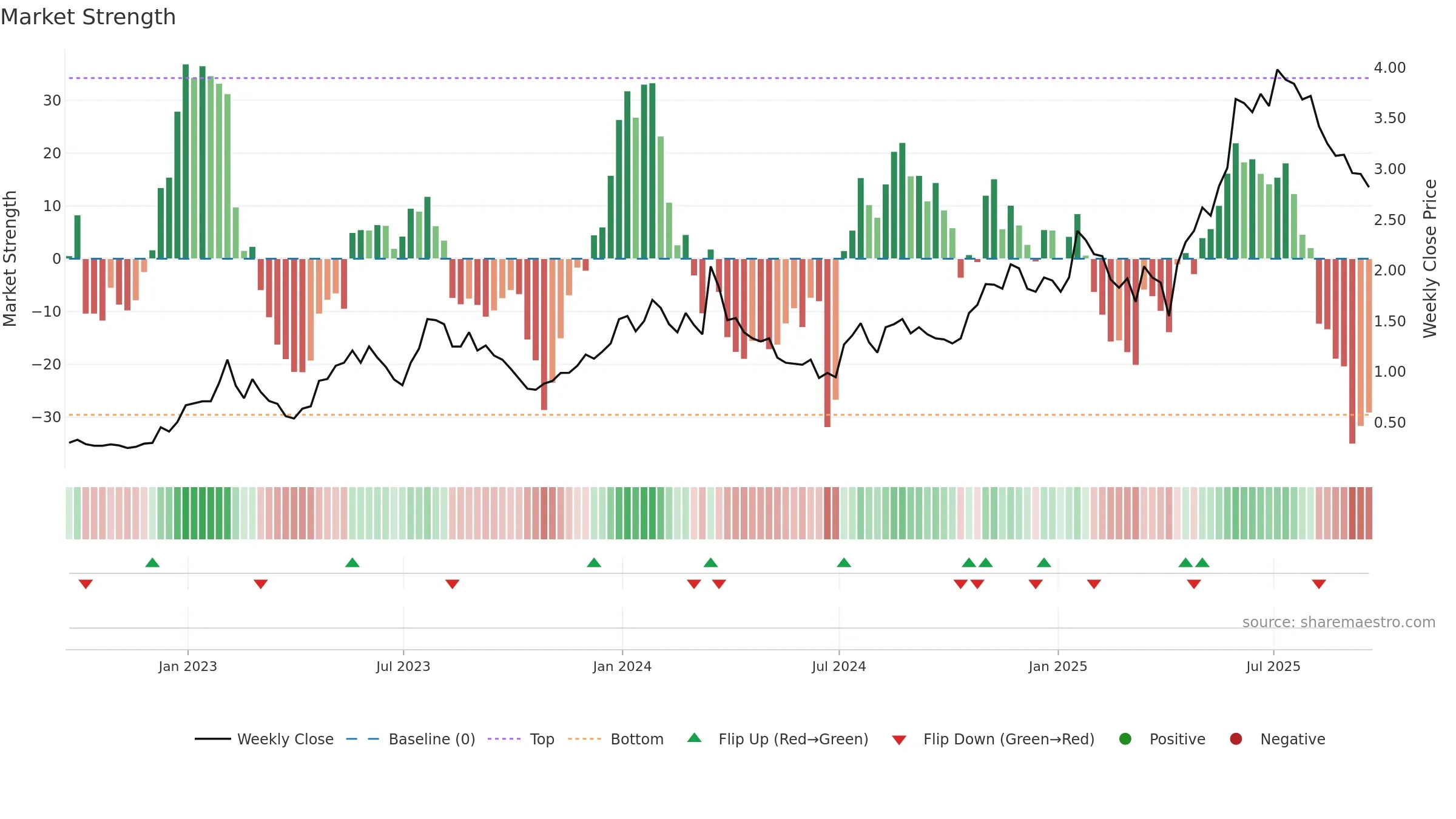

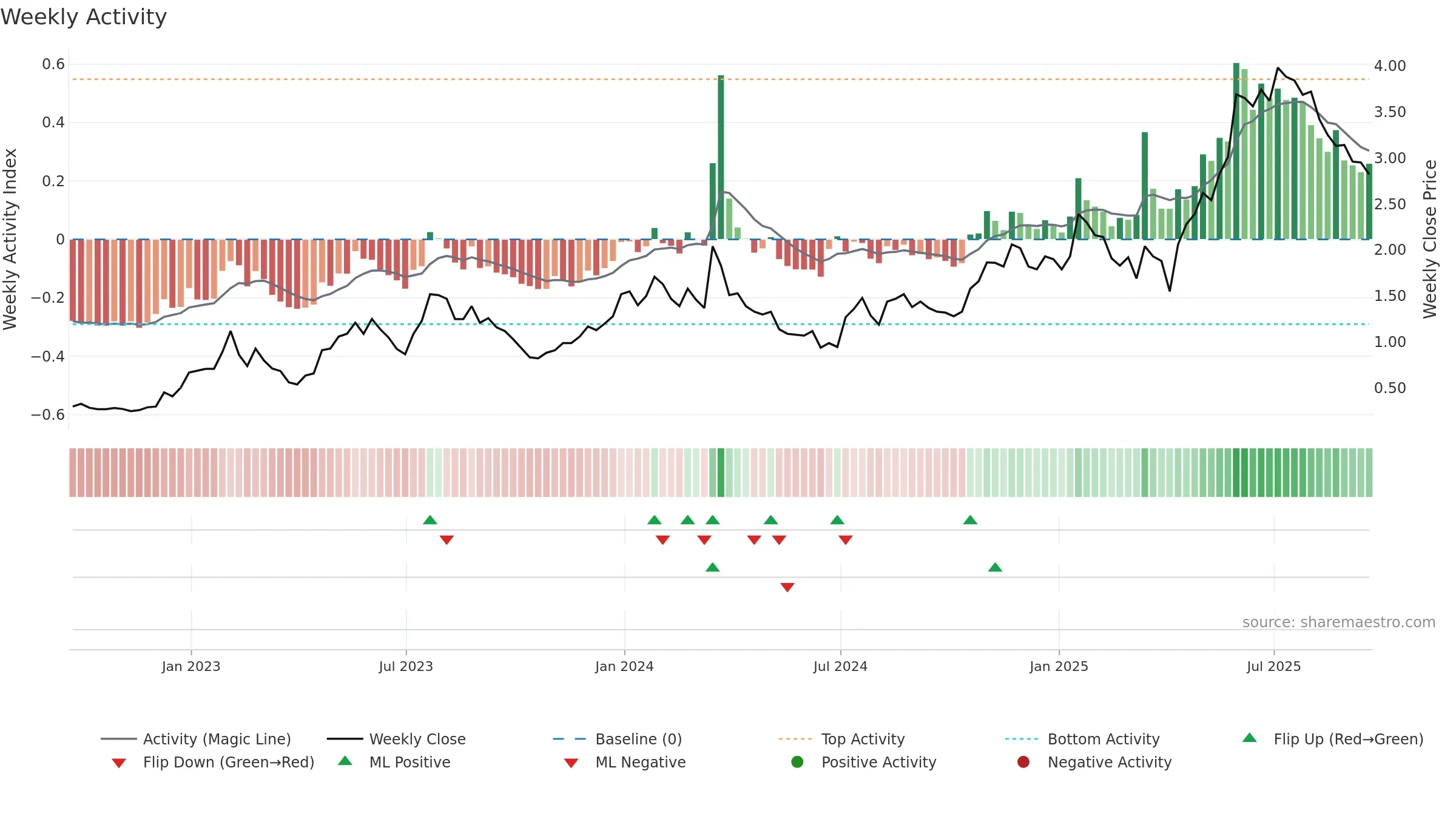

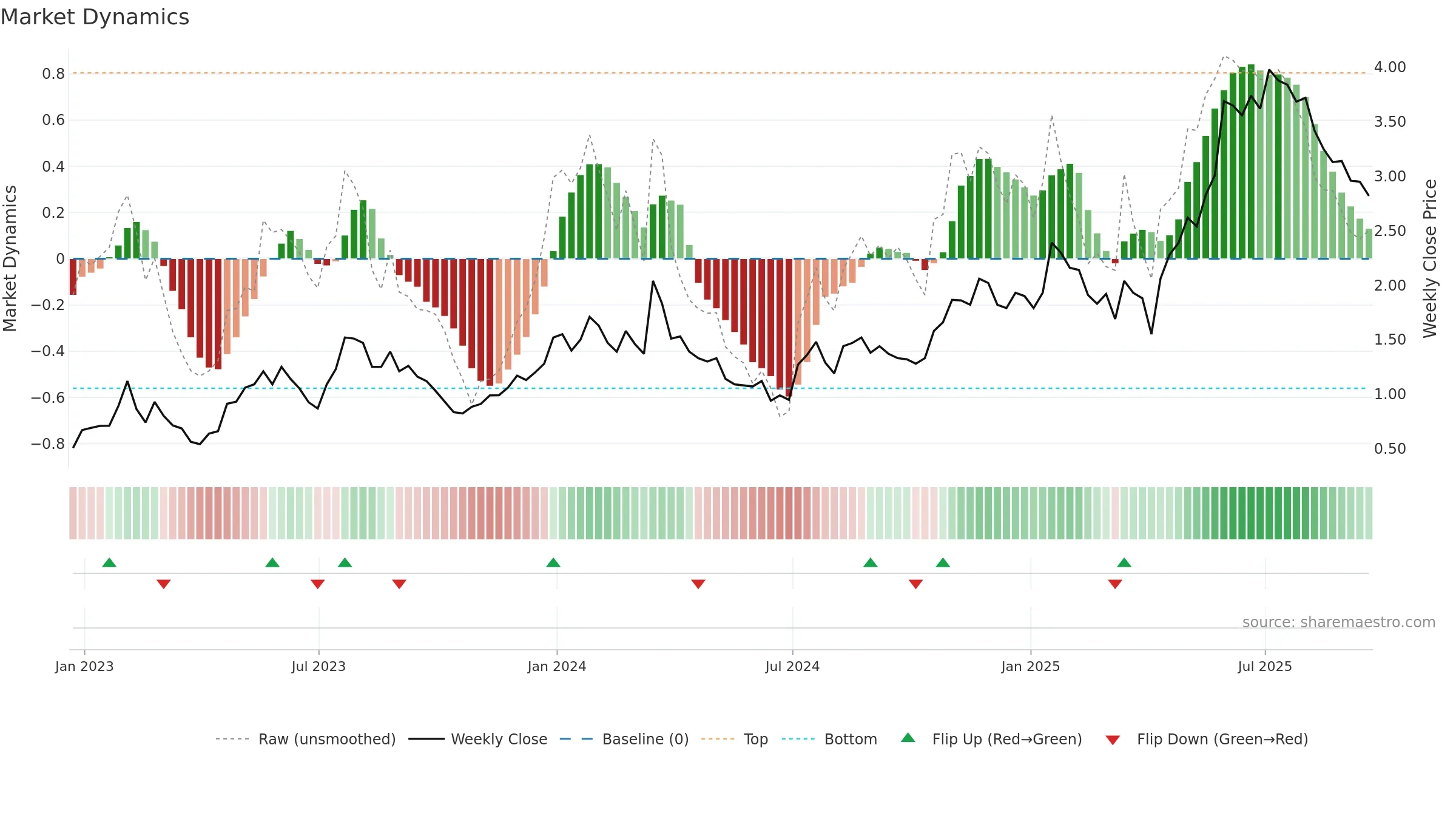

How to read this — Price slope is downward, indicating persistent supply pressure. Elevated weekly volatility increases whipsaw risk. Volume trend diverges from price — watch for fatigue or rotation. Distance to baseline is narrowing — reverting closer to its fair-value track. Price sits below key averages, keeping pressure on the tape.

Down-slope argues for patience; rallies can fade sooner unless participation improves. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

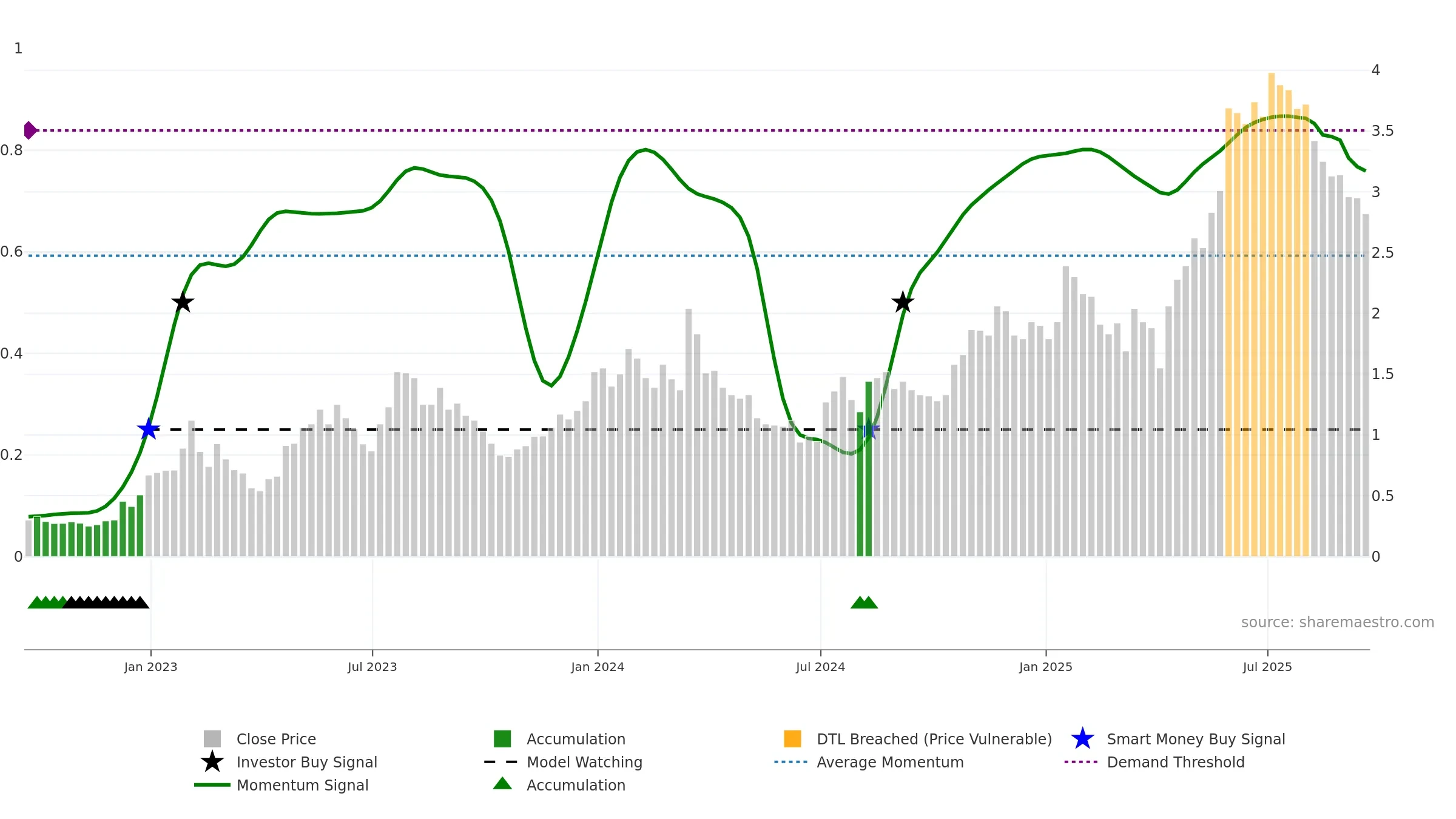

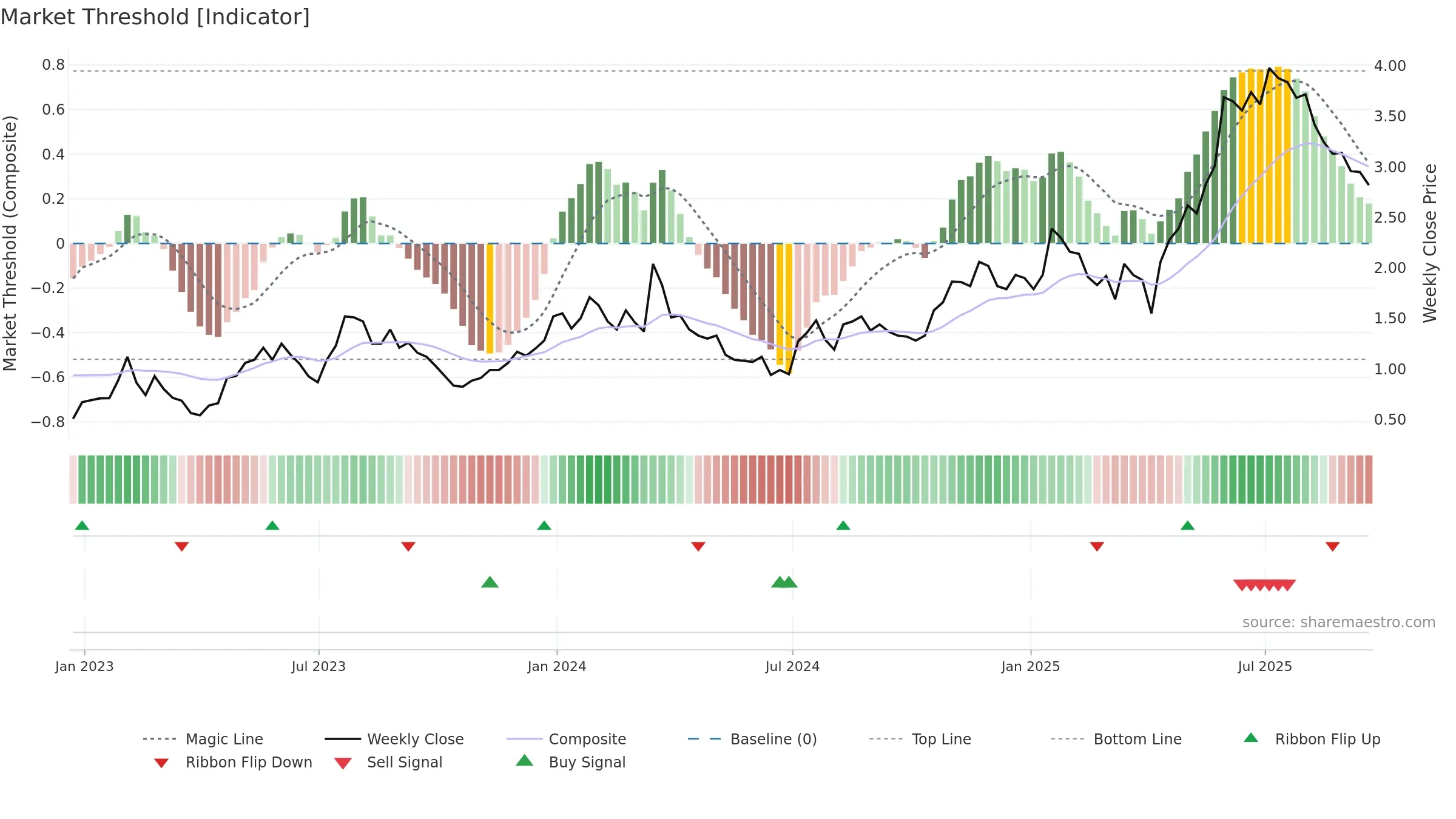

Gauge maps the trend signal to a 0–100 scale.

How to read this — Gauge is elevated but momentum is rolling over; topping risk is rising. Notable breakdown from ≥0.80 weakens trend quality.

Stay alert: protect gains or seek confirmation before adding risk.

Conclusion

Negative setup. ★☆☆☆☆ confidence. Price window: -24. Trend: Uptrend at Risk; gauge 75. In combination, liquidity diverges from price.

- High-level but rolling over (topping risk)

- Momentum is weak/falling

- Price is not above key averages

- Liquidity diverges from price

Why: Price window -24.19% over 8w. Close is -24.19% below the prior-window high. Return volatility 4.69%. Volume trend rising. Liquidity divergence with price. Trend state uptrend at risk. High-regime (0.80–1.00) downticks 5/5 (100.0%) • Distributing. Momentum neutral and falling.

Tip: Most metrics include a hover tooltip where they appear in the report.