Epiroc AB (publ)

EPI-A STO

Weekly Report

Epiroc AB (publ) closed at 203.9000 (-0.49% WoW) . Data window ends Mon, 15 Sep 2025.

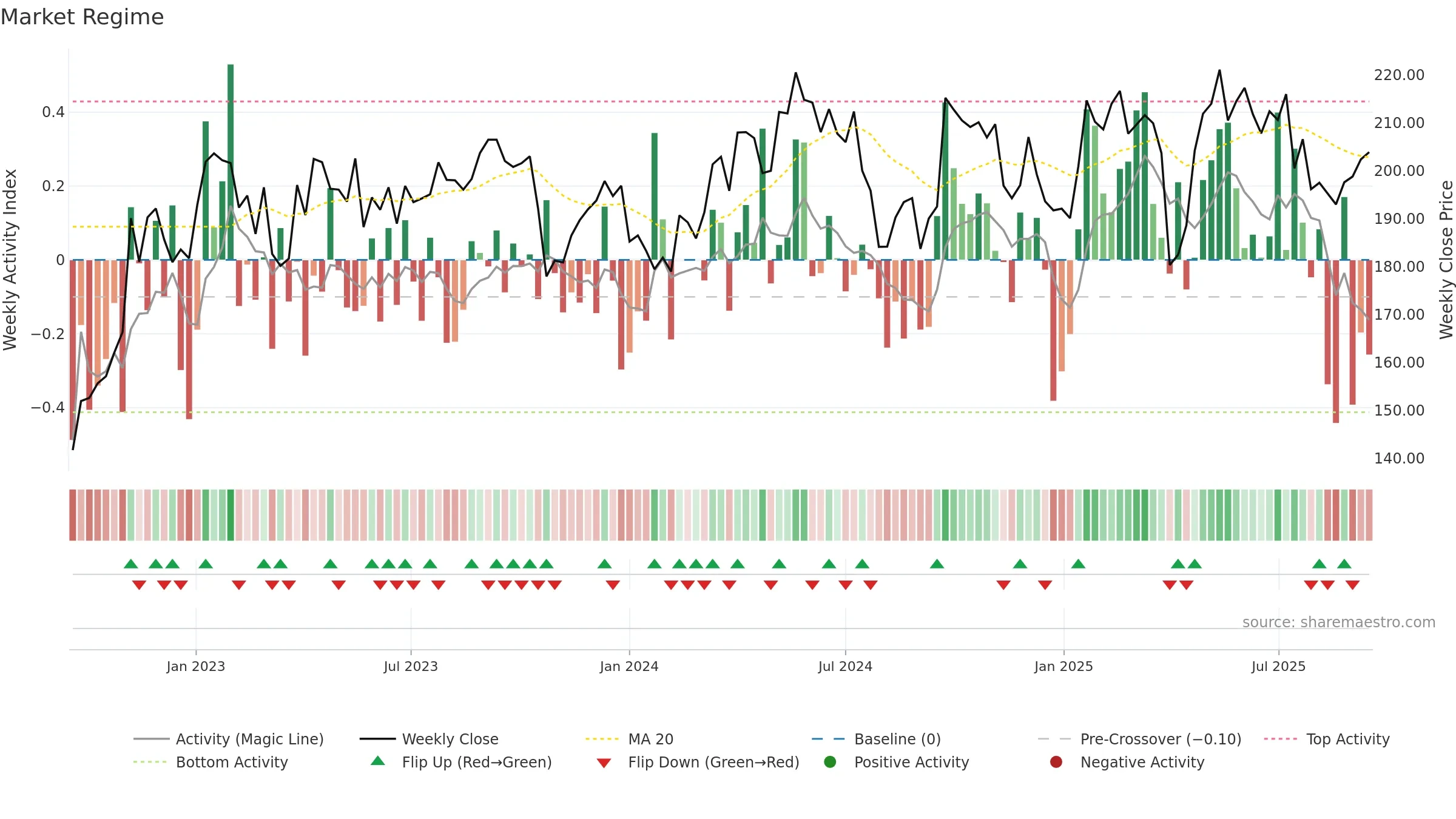

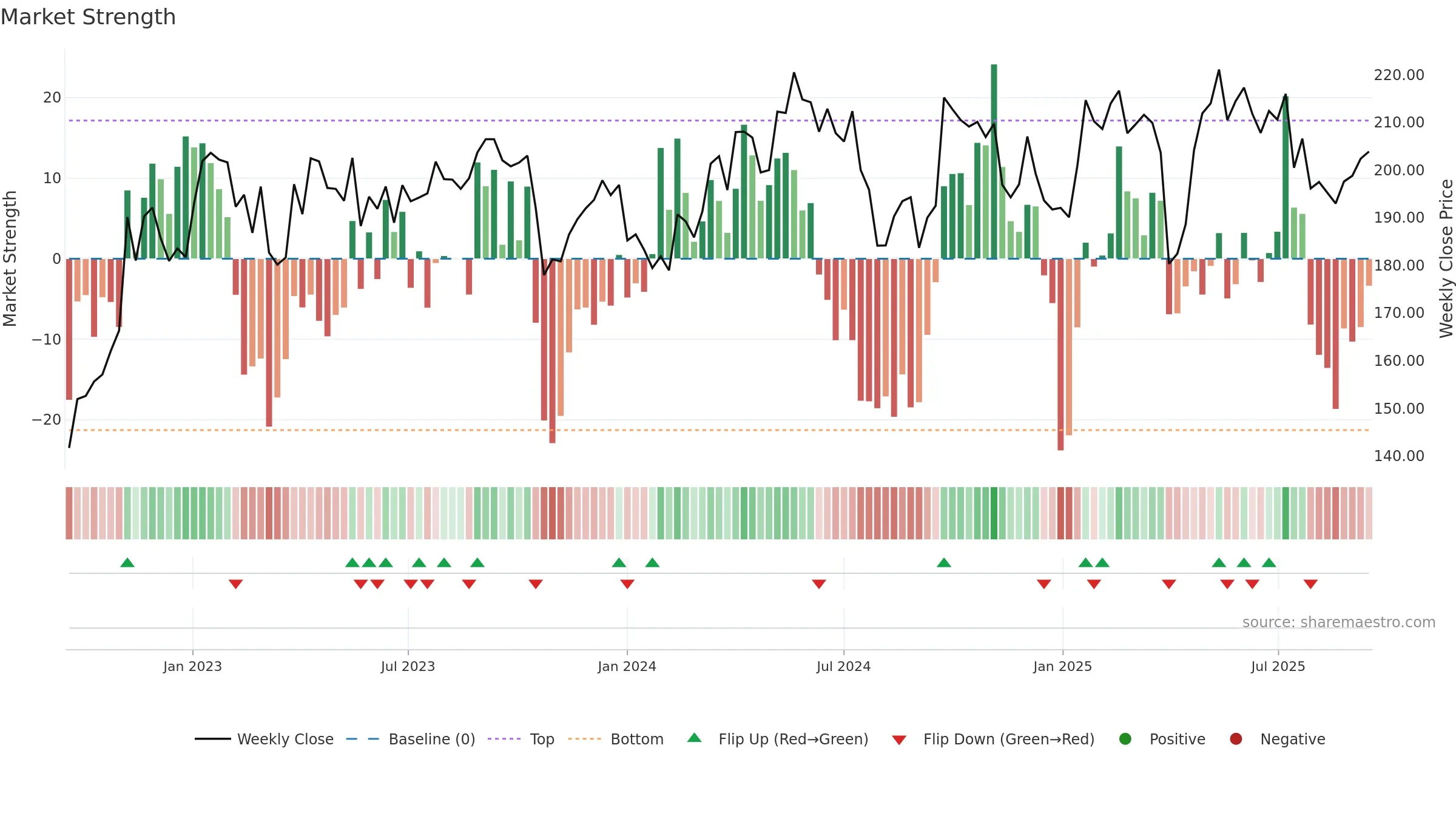

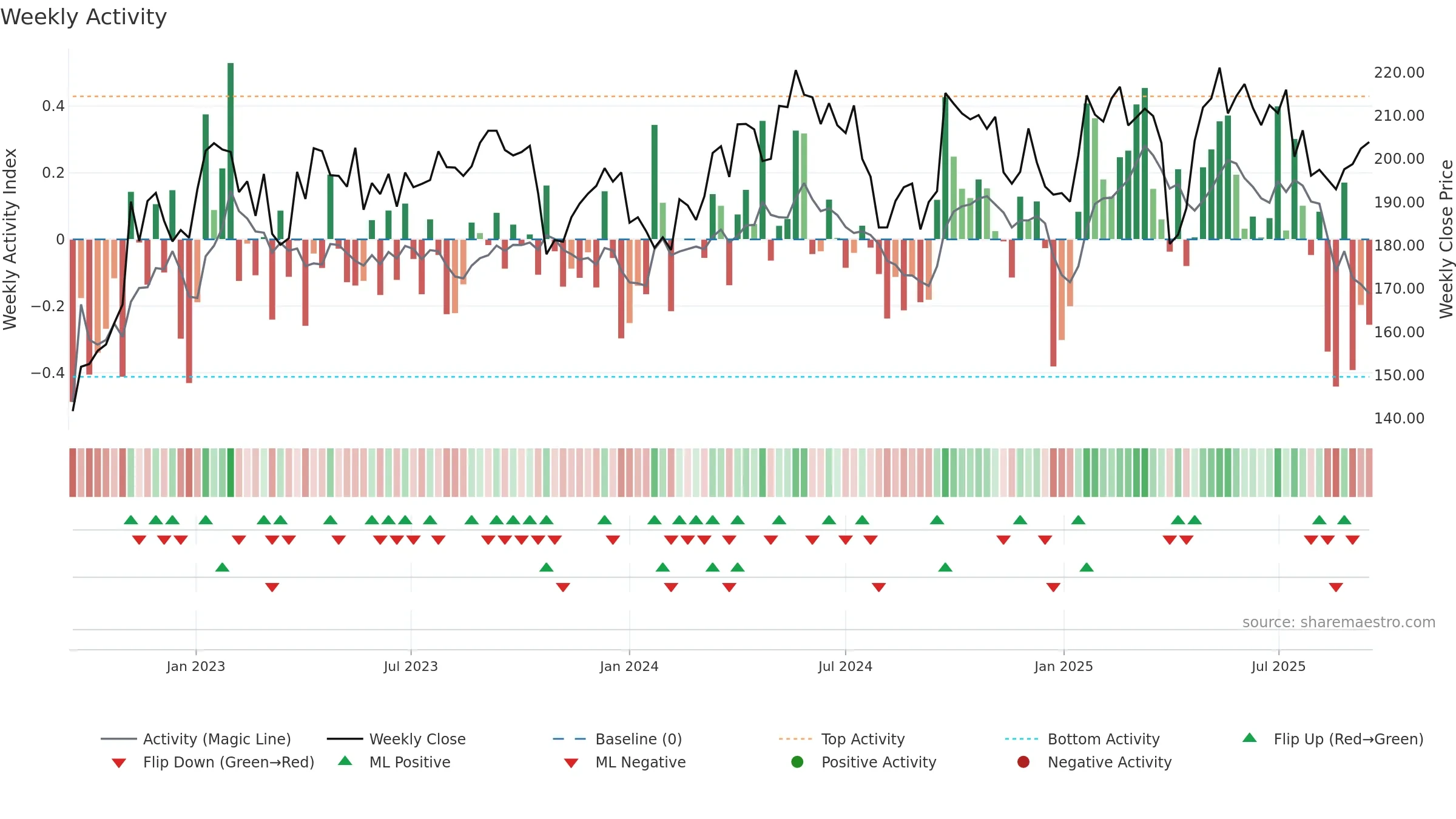

How to read this — Price slope is upward, indicating persistent buying over the window. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Fresh short-term crossover improves near-term tone. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

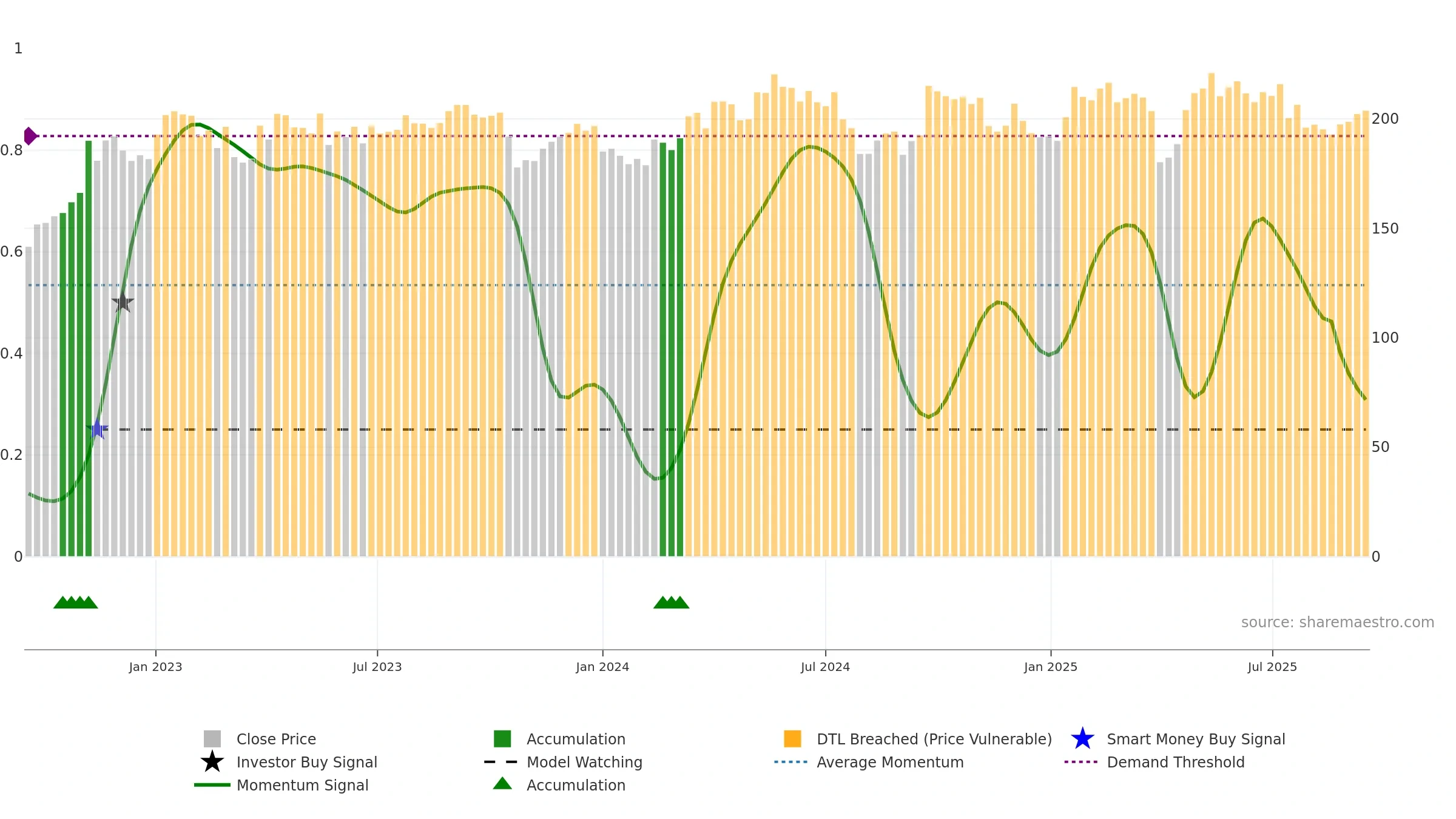

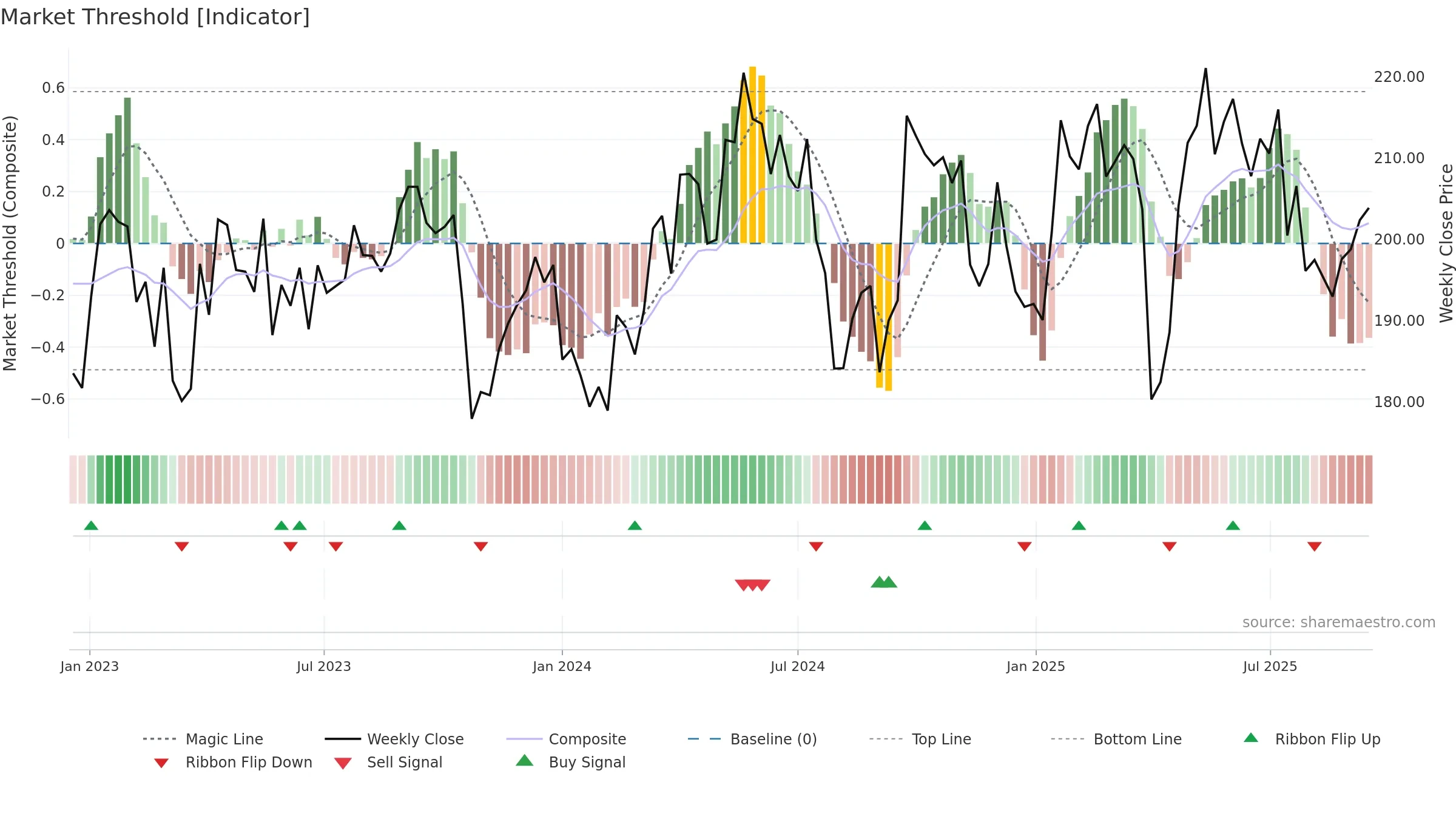

Gauge maps the trend signal to a 0–100 scale.

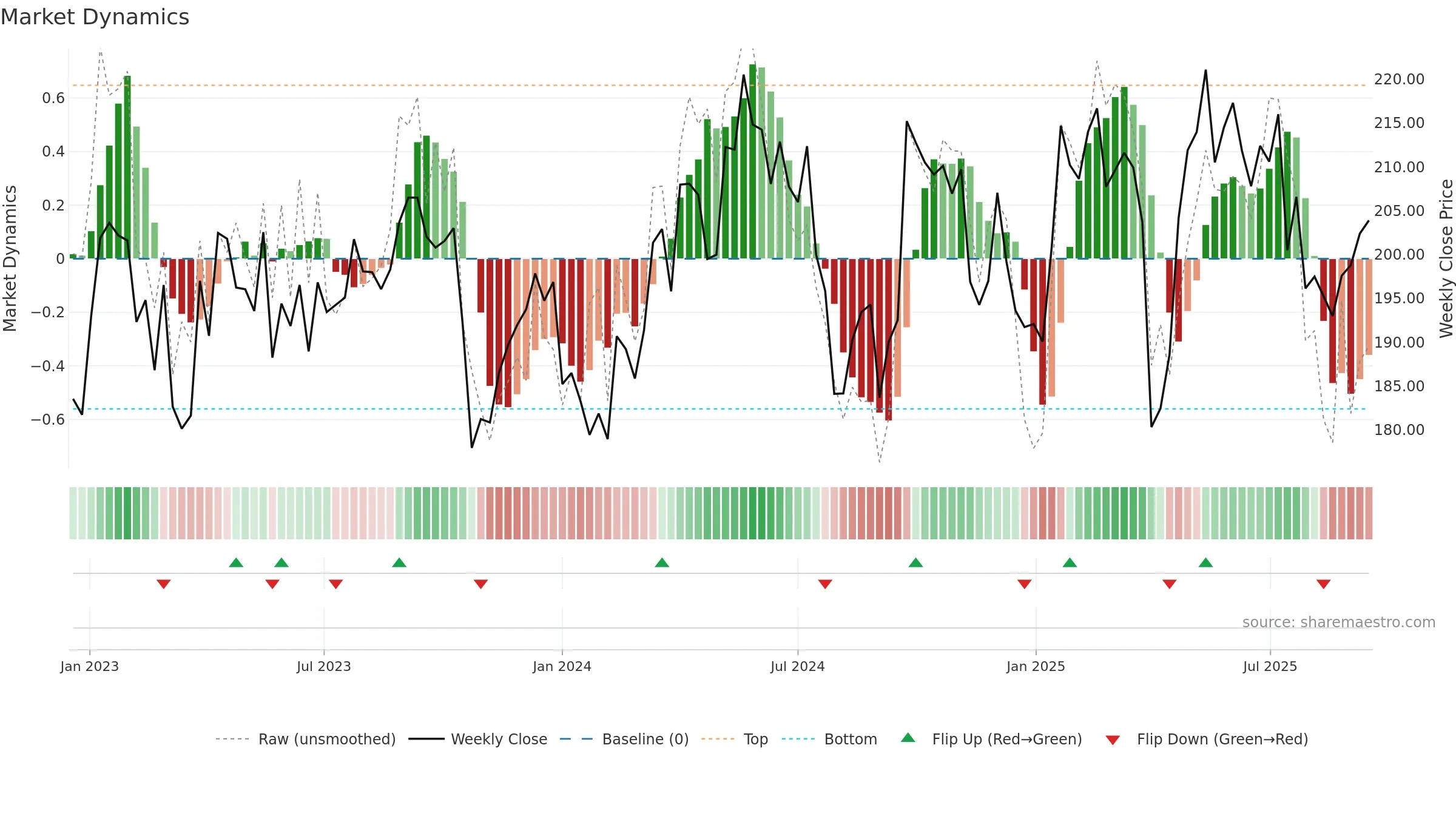

How to read this — Bearish zone with falling momentum — sellers in control. Sub-0.40 print confirms downside control.

Bias remains lower; rallies are suspect unless gauge reclaims 0.50/0.60.

Price is above fair value; upside may be capped without catalysts.

Conclusion

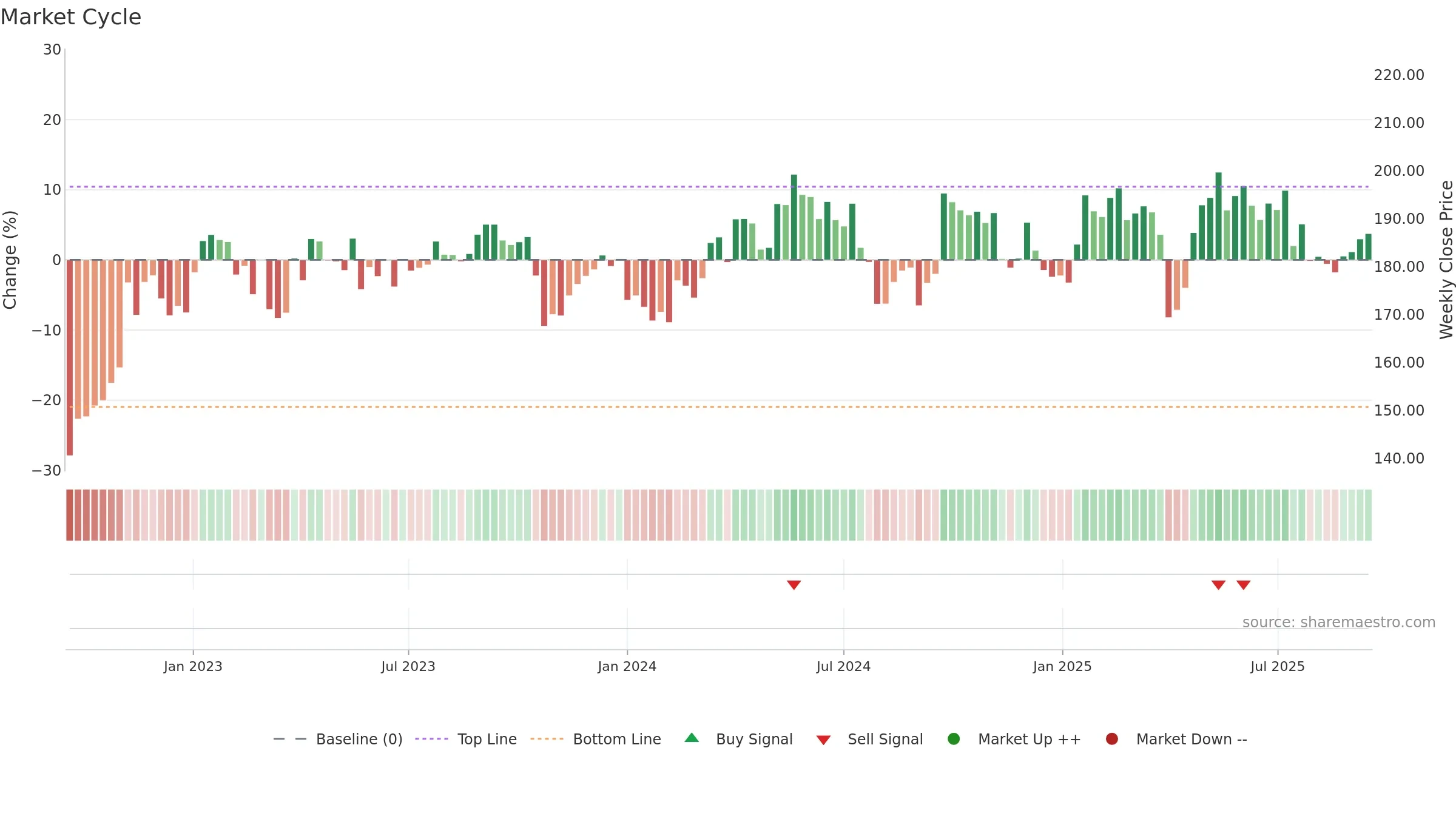

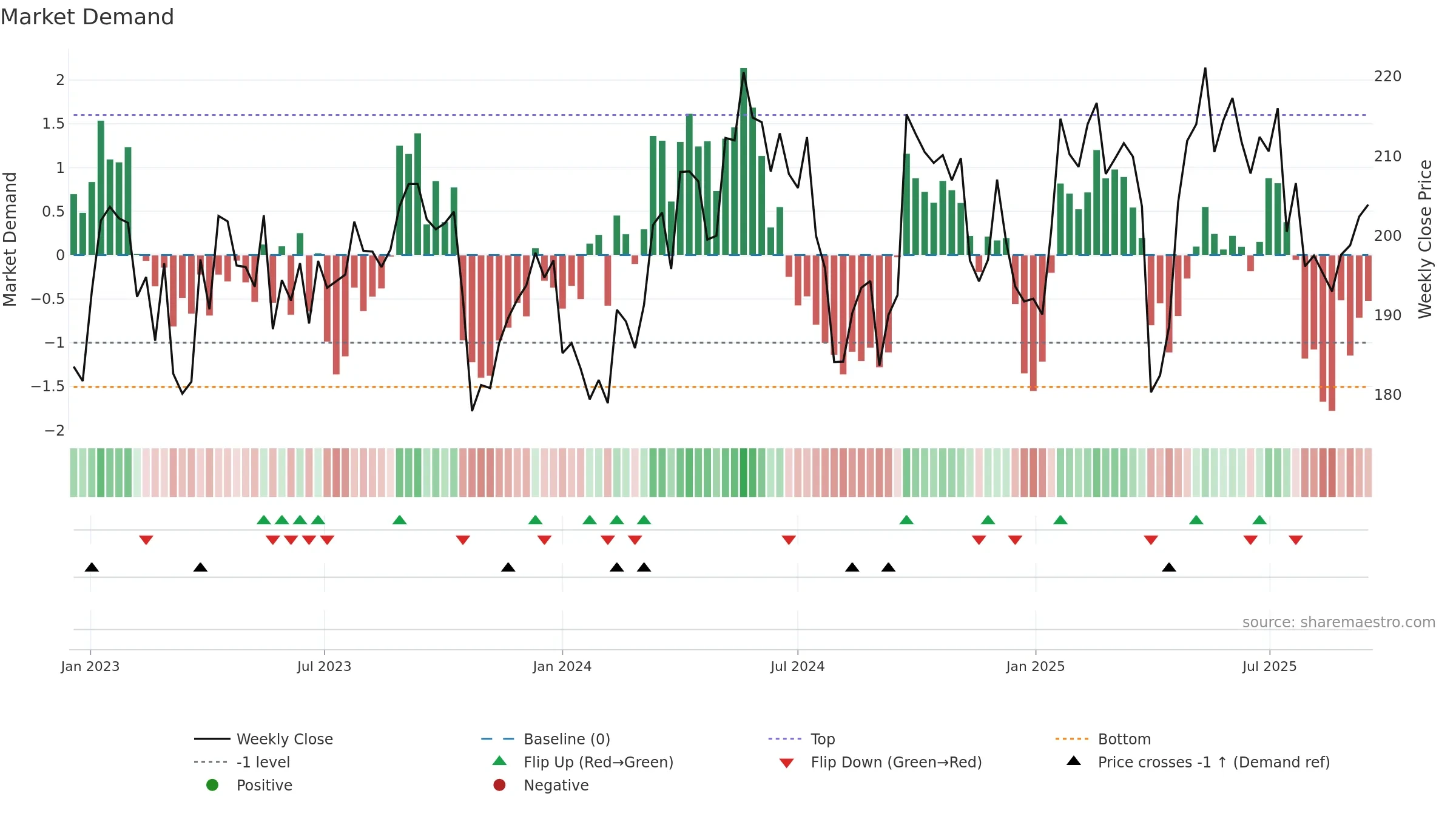

Negative setup. ★★☆☆☆ confidence. Price window: 3. Trend: Downtrend Confirmed; gauge 30. In combination, liquidity diverges from price.

- Price holds above 8w & 26w averages

- Bearish control with falling momentum

- Momentum is weak/falling

- Liquidity diverges from price

- Sub-0.40 print confirms bear control

Why: Price window 3.95% over 8w. Close is 0.74% above the prior-window high. Return volatility 2.19%. Volume trend falling. Liquidity divergence with price. Trend state downtrend confirmed. 4–8w crossover bullish. Momentum bearish and falling. Valuation limited upside without catalysts.

Tip: Most metrics include a hover tooltip where they appear in the report.