Bravida Holding AB (publ)

BRAV STO

Weekly Report

Bravida Holding AB (publ) closed at 93.7500 (0.70% WoW) . Data window ends Mon, 15 Sep 2025.

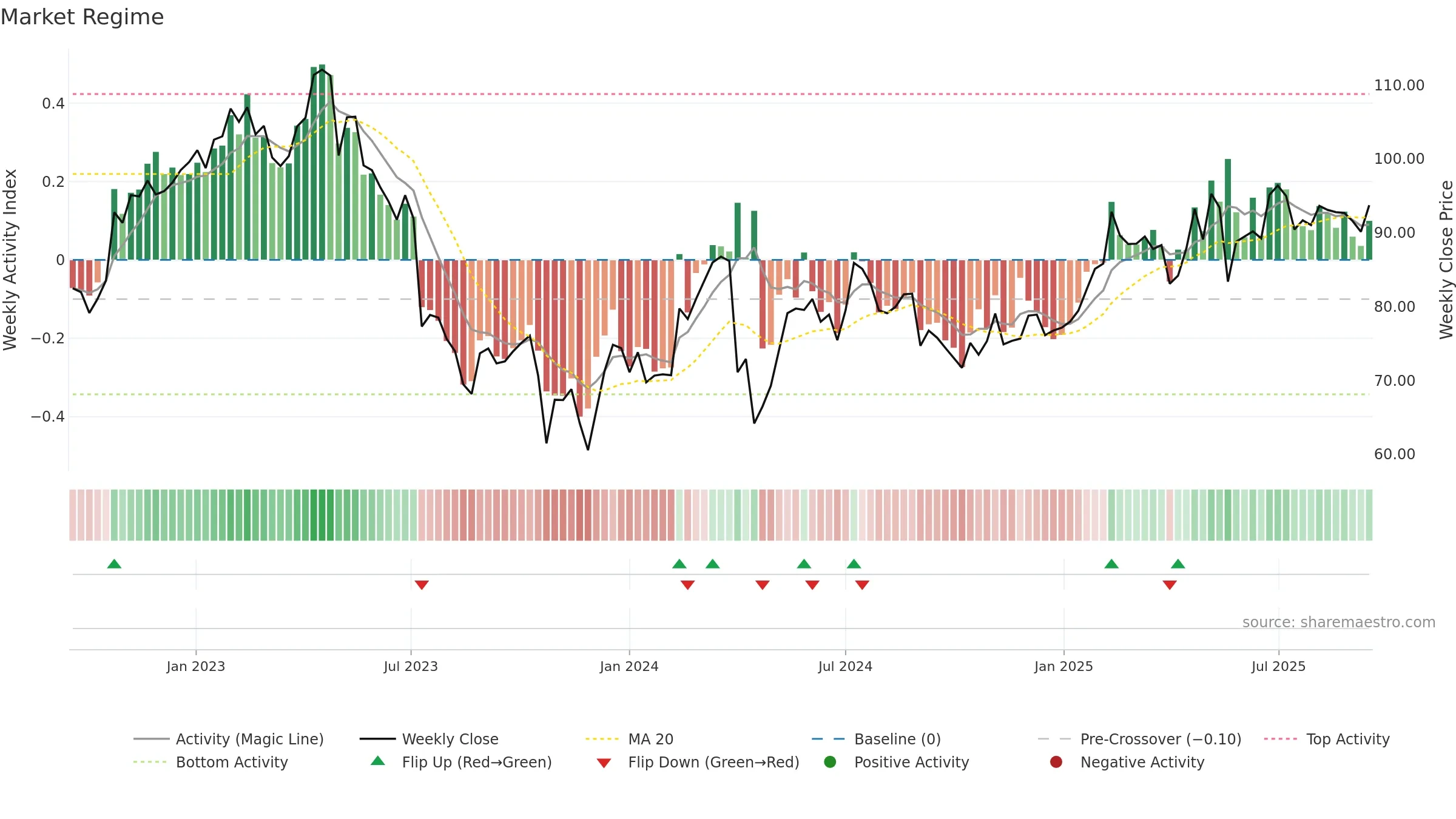

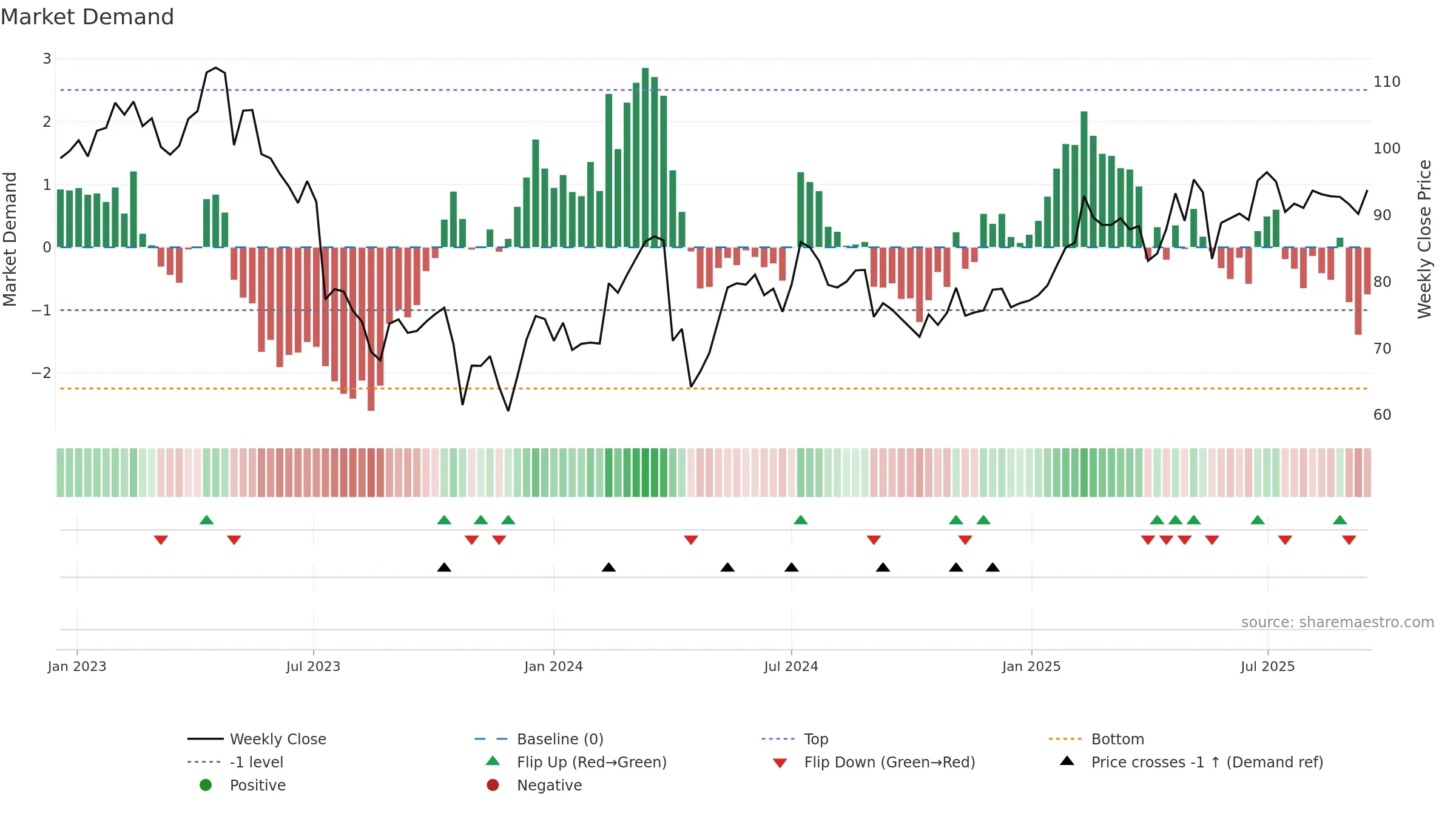

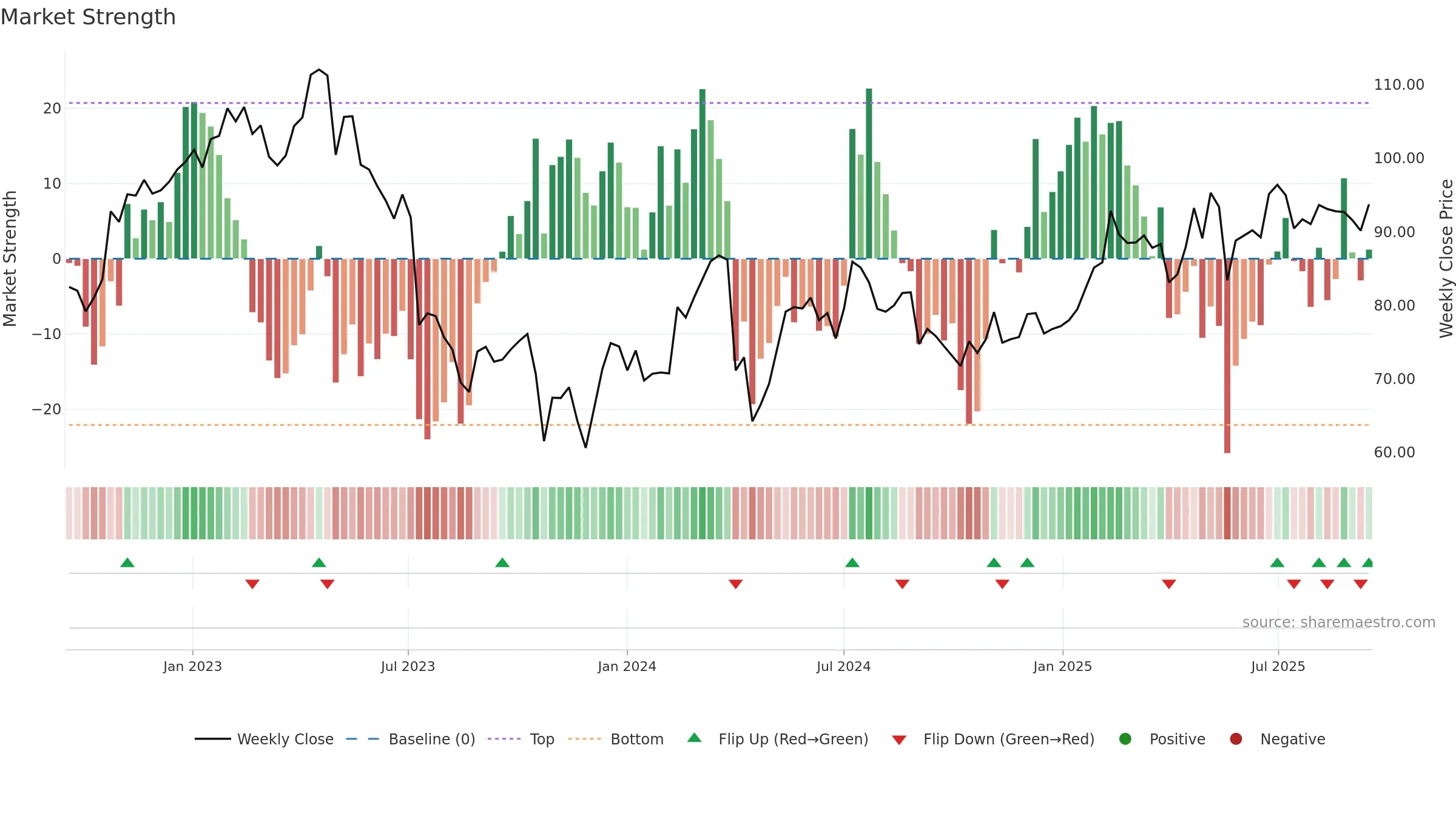

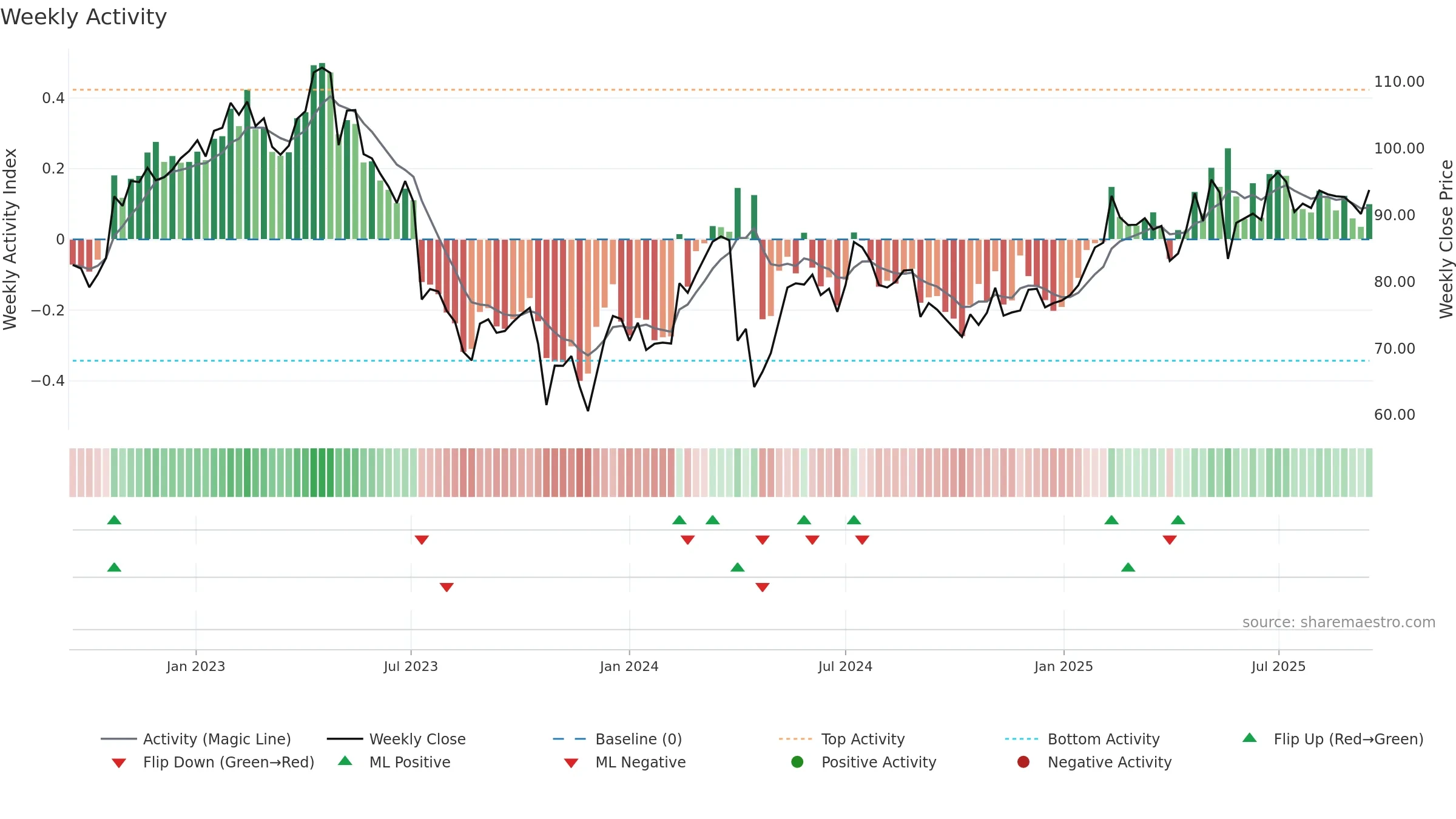

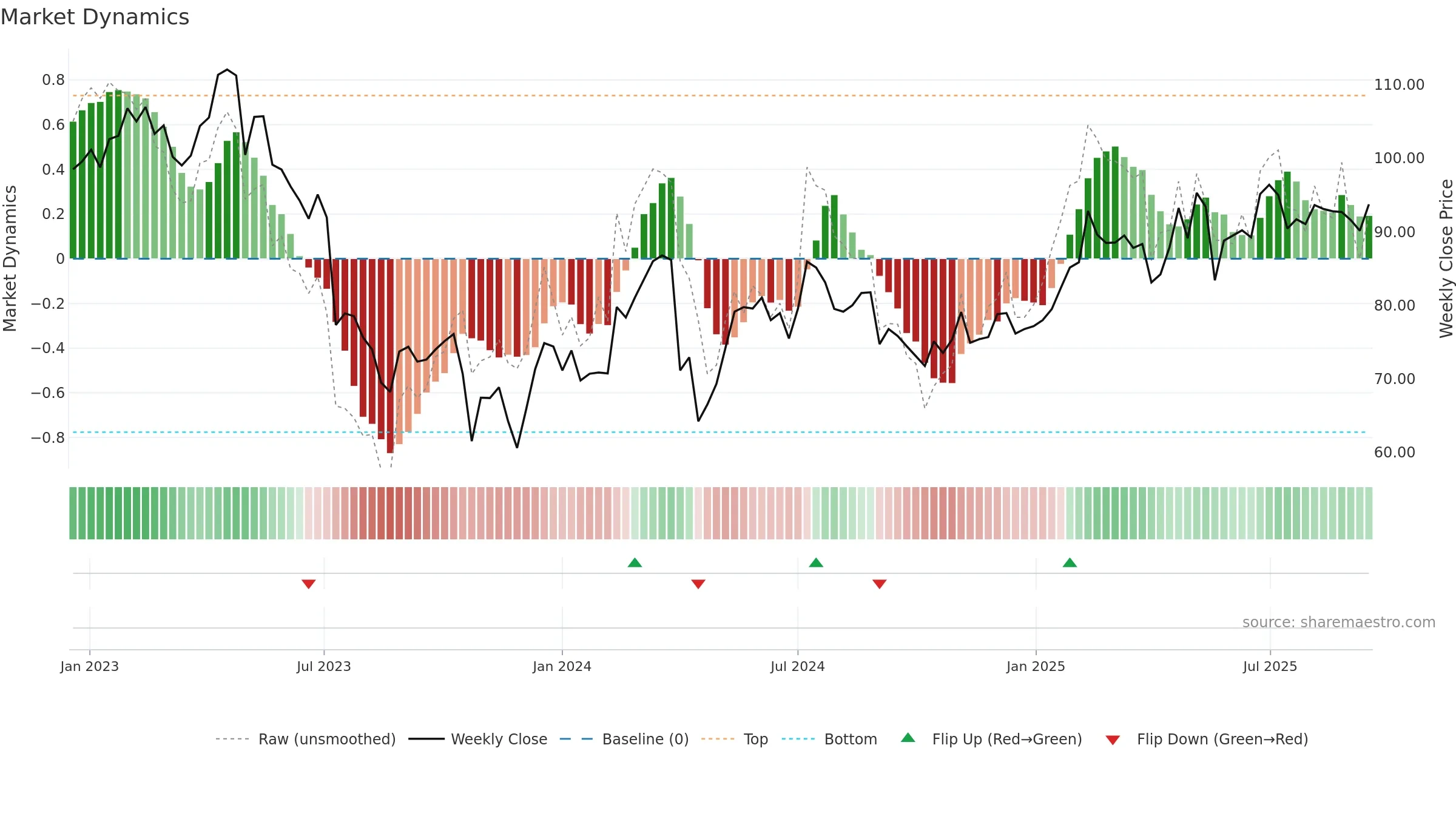

How to read this — Price slope is downward, indicating persistent supply pressure. Low weekly volatility favours steadier follow-through. Volume and price are moving in the same direction — a constructive confirmation. Price is stretched above its baseline; consolidation risk rises if activity fades. Price holds above key averages, indicating constructive participation.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

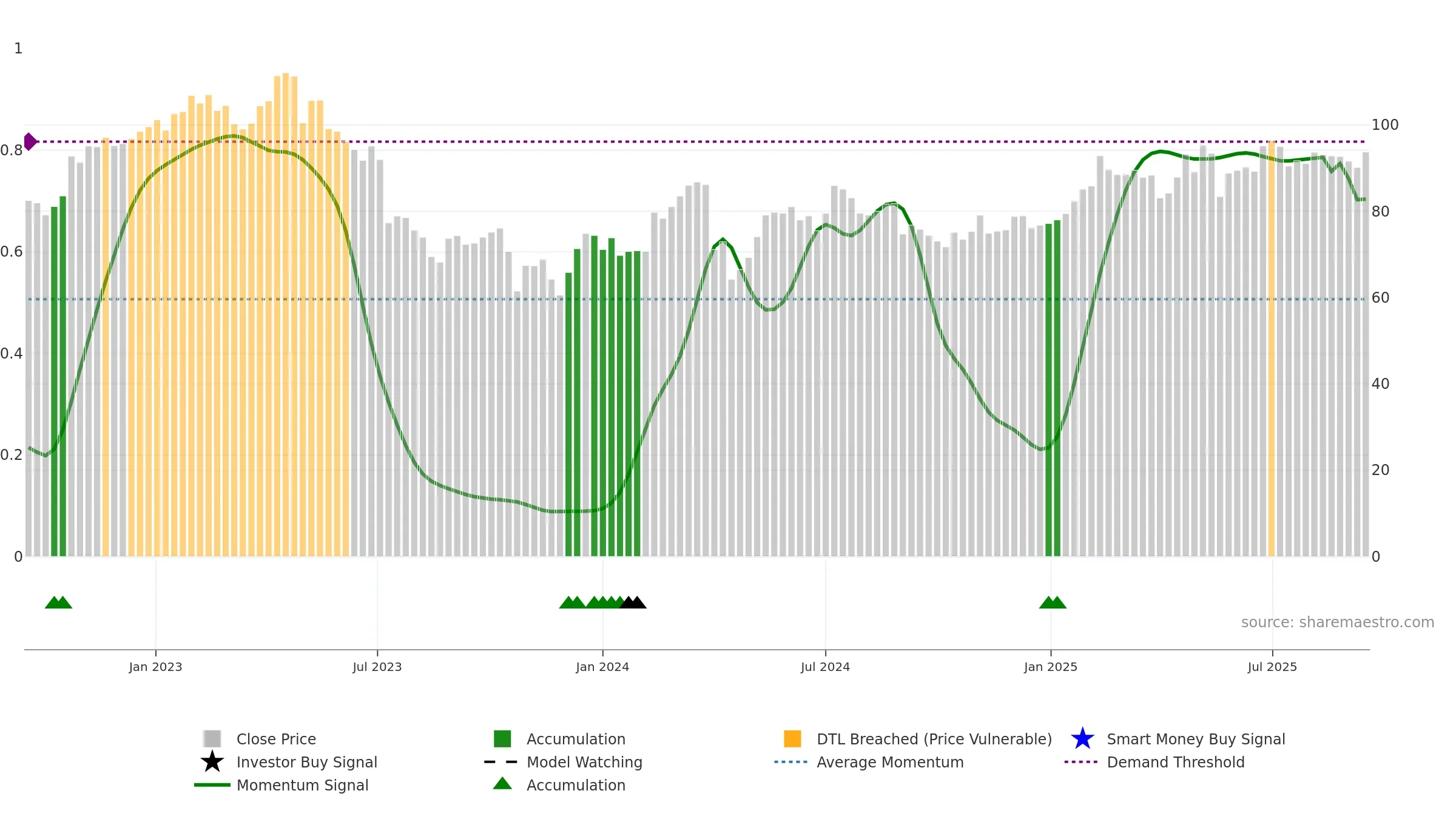

Gauge maps the trend signal to a 0–100 scale.

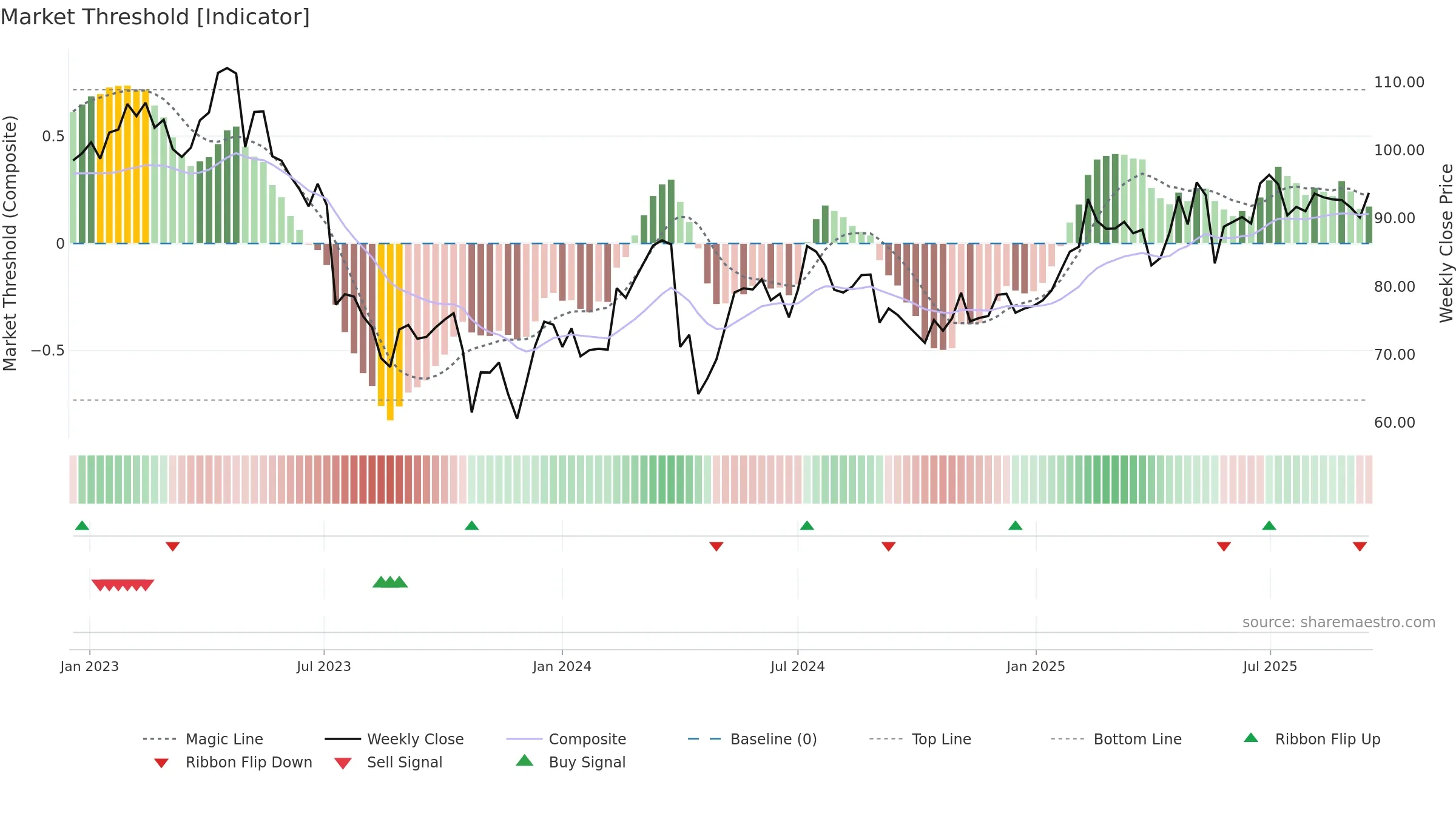

How to read this — Gauge is elevated but momentum is rolling over; topping risk is rising.

Stay alert: protect gains or seek confirmation before adding risk.

Price is below fair value; potential upside if momentum constructive.

Conclusion

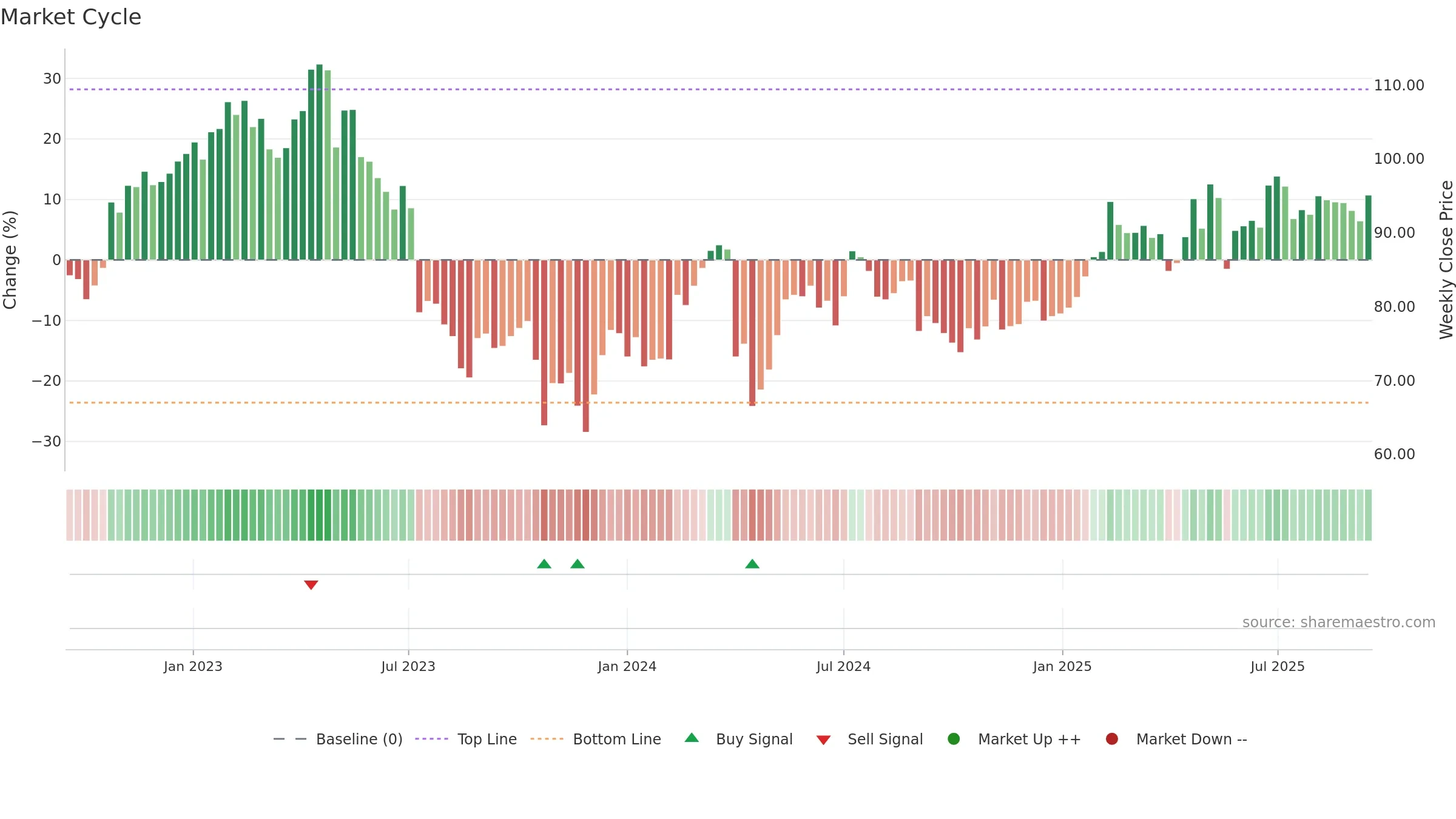

Neutral setup. ★★★☆☆ confidence. Price window: 2. Trend: Uptrend at Risk; gauge 70. In combination, liquidity confirms the move.

- Price holds above 8w & 26w averages

- Liquidity confirms the price trend

- Low return volatility supports durability

- High-level but rolling over (topping risk)

- Momentum is weak/falling

Why: Price window 2.97% over 8w. Return volatility 1.41%. Volume trend falling. Liquidity convergence with price. Trend state uptrend at risk. Momentum neutral and falling. Valuation supportive skew.

Tip: Most metrics include a hover tooltip where they appear in the report.