Jinhai Medical Technology Limited

2225 HKG

Weekly Report

Jinhai Medical Technology Limited closed at 1.1500 (16.16% WoW) . Data window ends Mon, 15 Sep 2025.

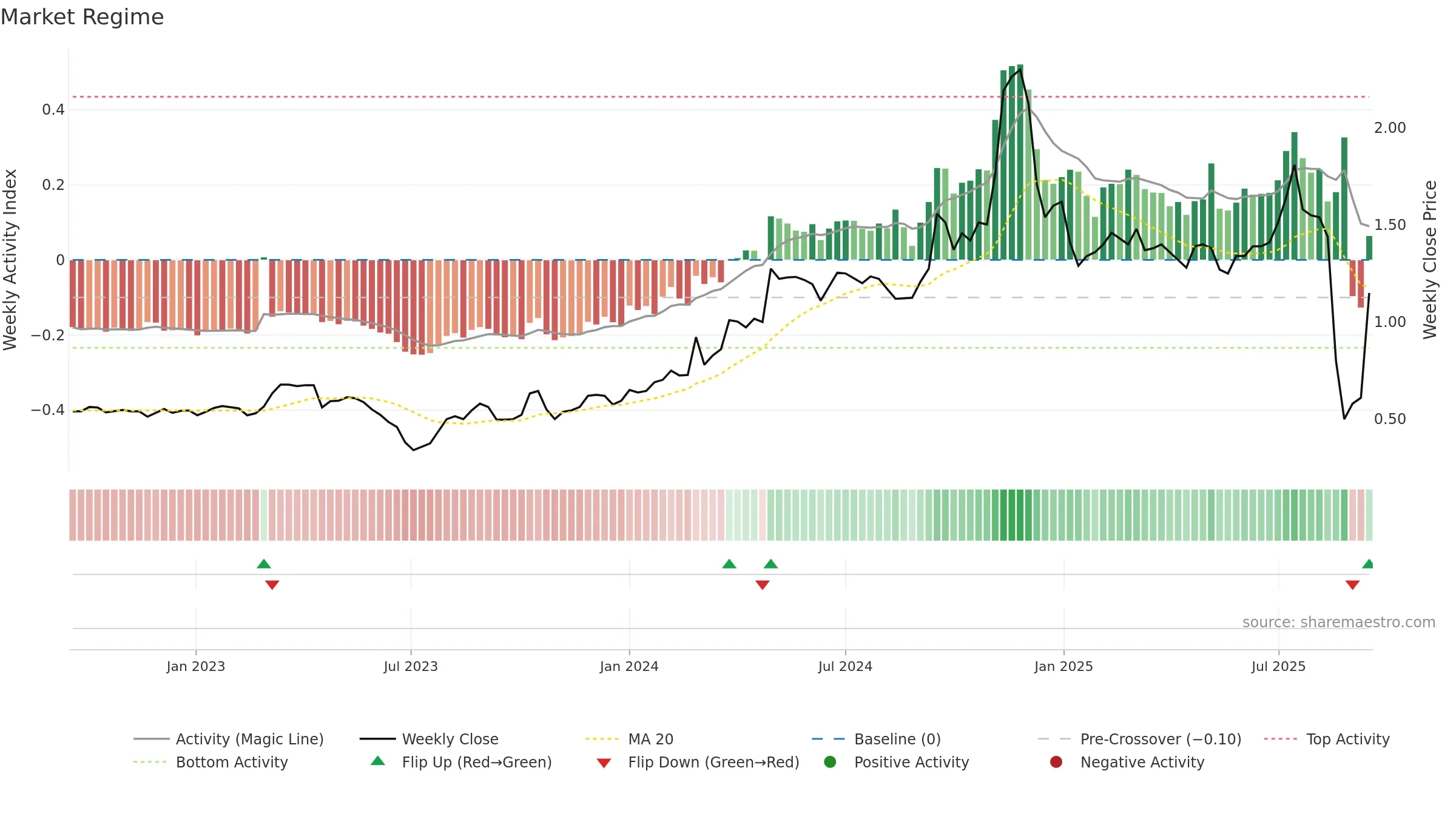

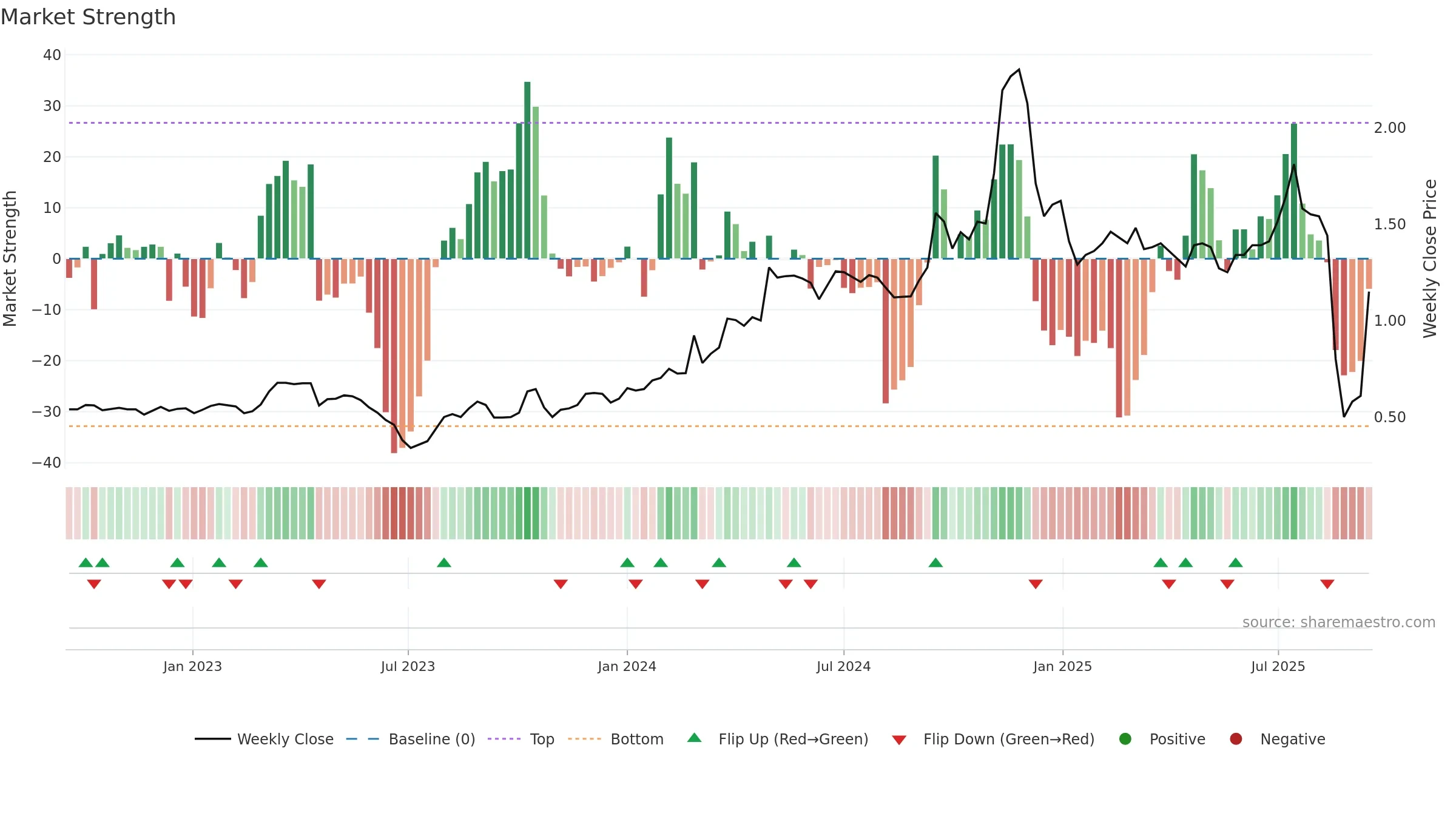

How to read this — Price slope is downward, indicating persistent supply pressure. Elevated weekly volatility increases whipsaw risk. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Weak MA stack argues for caution; rallies can fail near the 8–13 week region.

Down-slope argues for patience; rallies can fade sooner unless participation improves. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

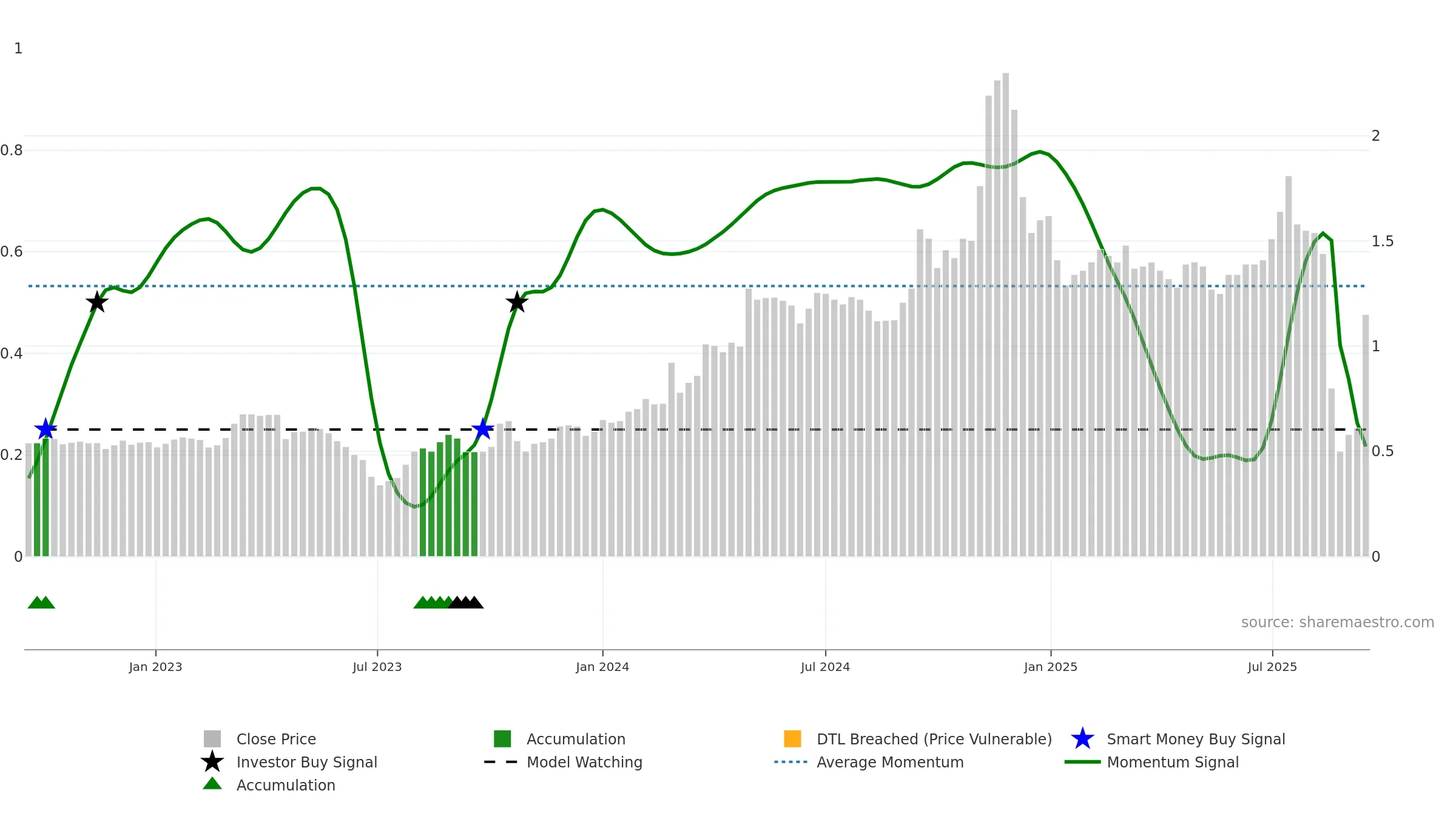

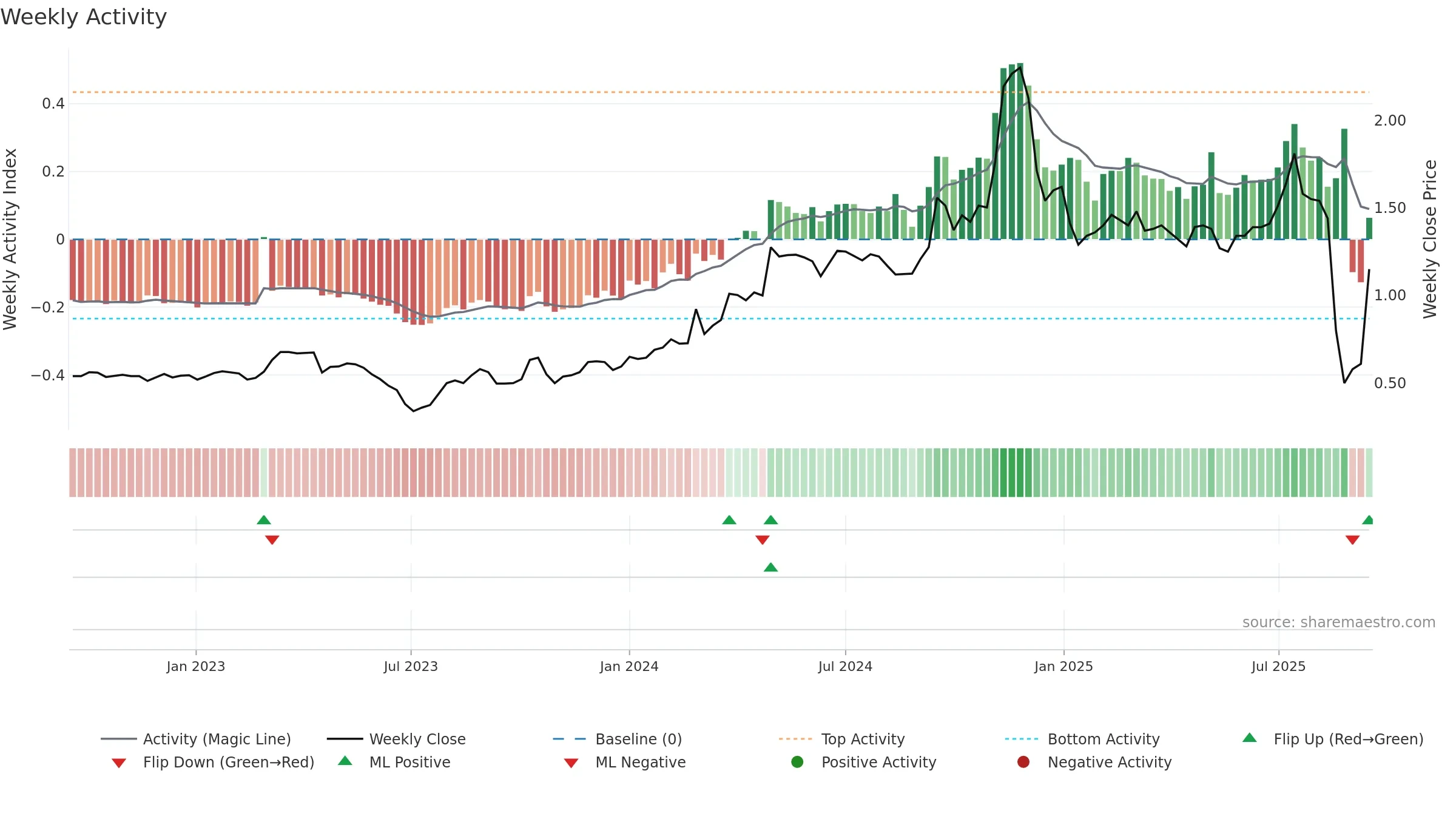

Gauge maps the trend signal to a 0–100 scale.

How to read this — Bearish zone with falling momentum — sellers in control. Sub-0.40 print confirms downside control.

Bias remains lower; rallies are suspect unless gauge reclaims 0.50/0.60.

Conclusion

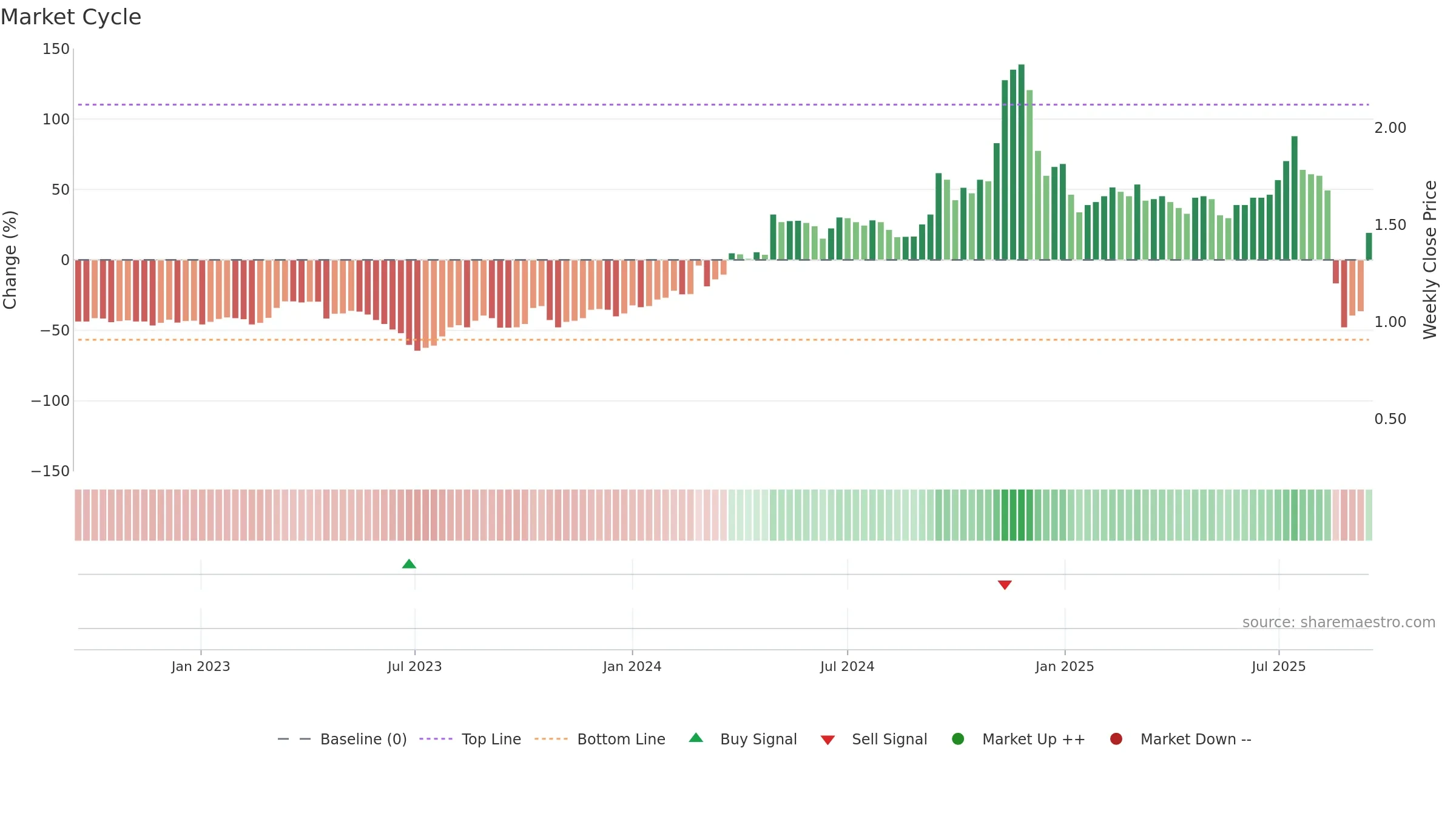

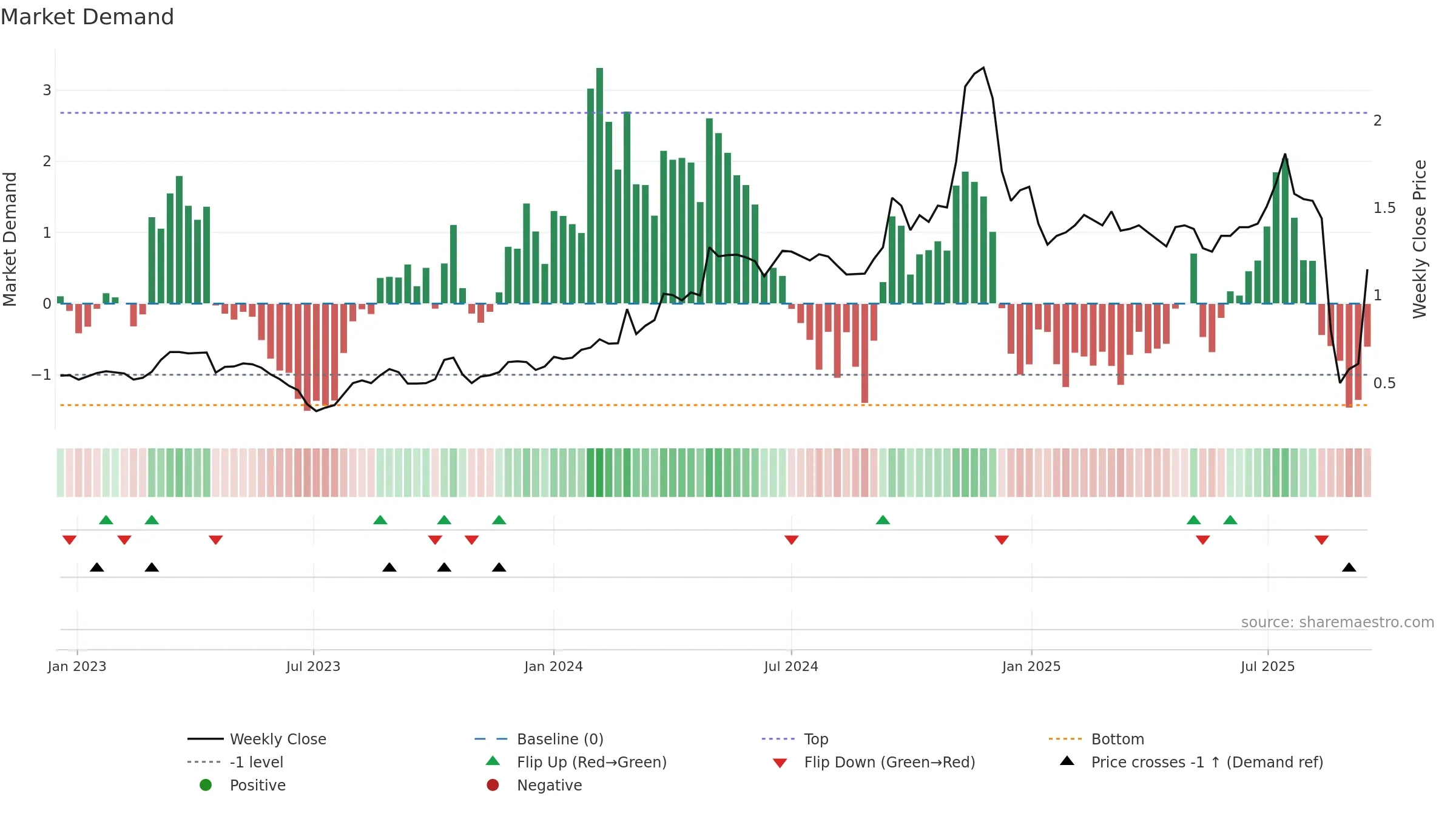

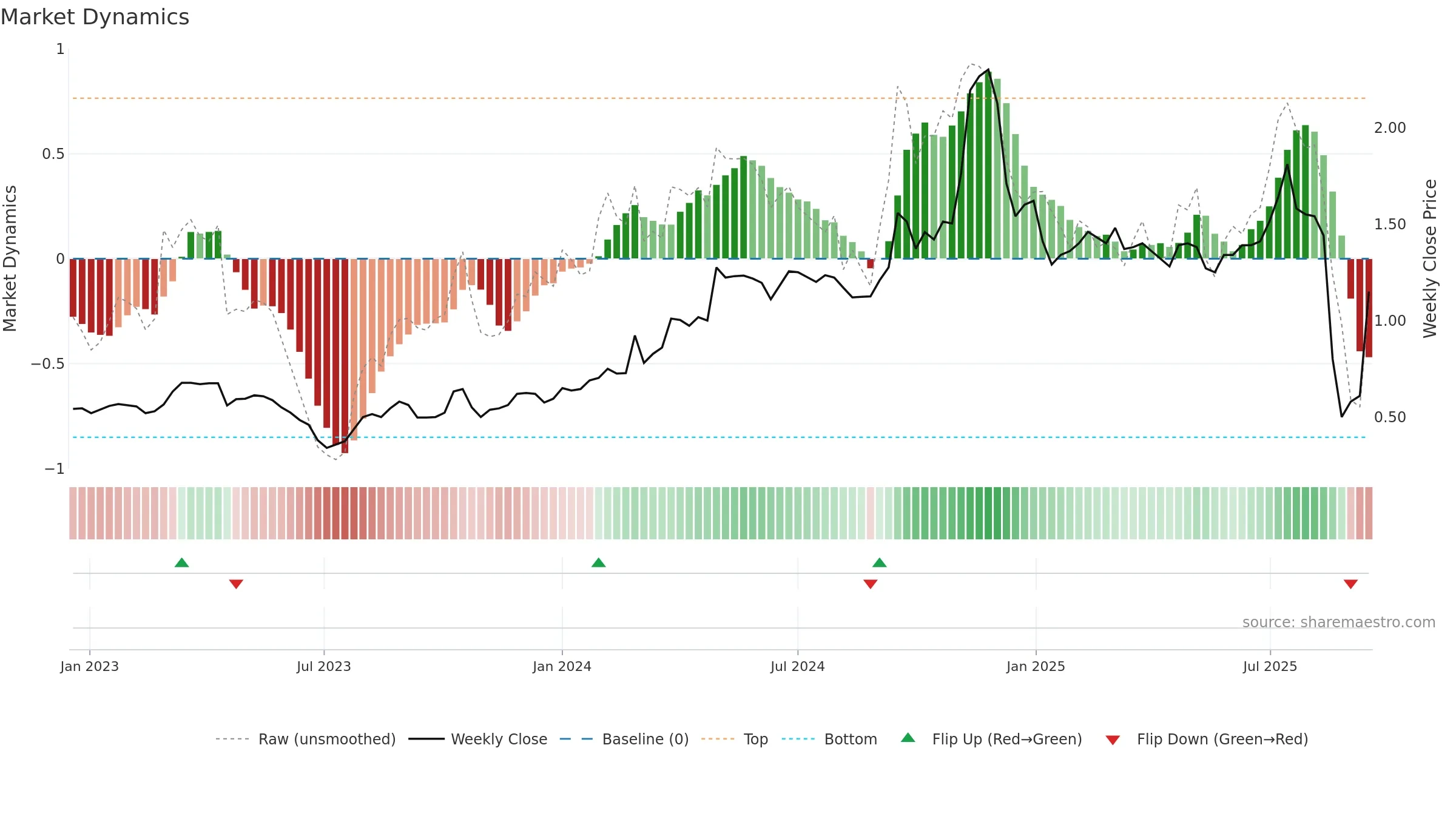

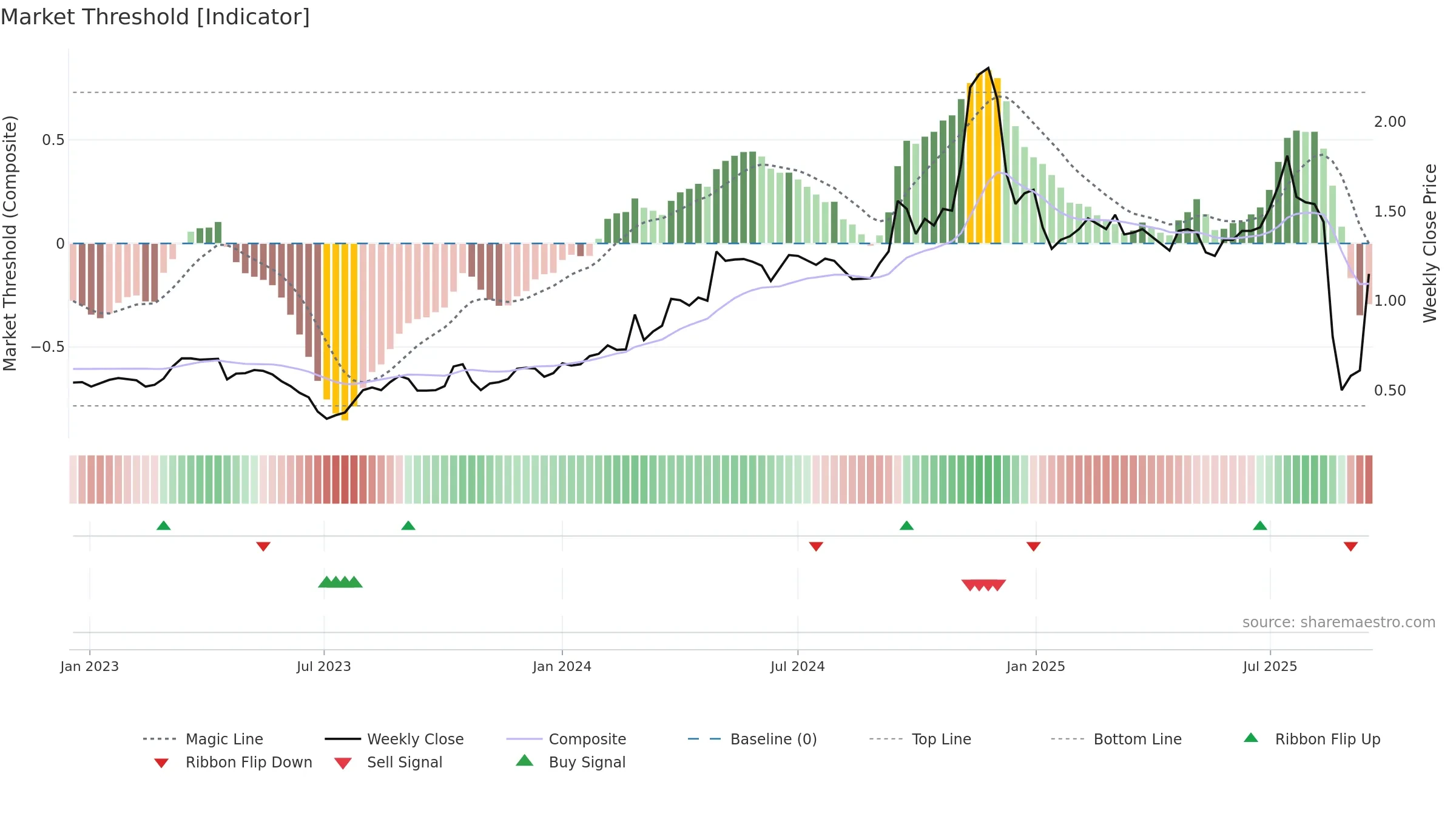

Negative setup. ★☆☆☆☆ confidence. Price window: -25. Trend: Downtrend Confirmed; gauge 21. In combination, liquidity diverges from price.

- Bearish control with falling momentum

- Momentum is weak/falling

- Price is not above key averages

- Weak moving-average stack

Why: Price window -25.81% over 8w. Close is -25.81% below the prior-window high. Return volatility 15.65%. Volume trend rising. Liquidity divergence with price. Trend state downtrend confirmed. MA stack weak. Momentum bearish and falling.

Tip: Most metrics include a hover tooltip where they appear in the report.