Weekly Report

The Real Estate Select Sector SPDR Fund closed at 41.8500 (-0.59% WoW) . Data window ends Fri, 19 Sep 2025.

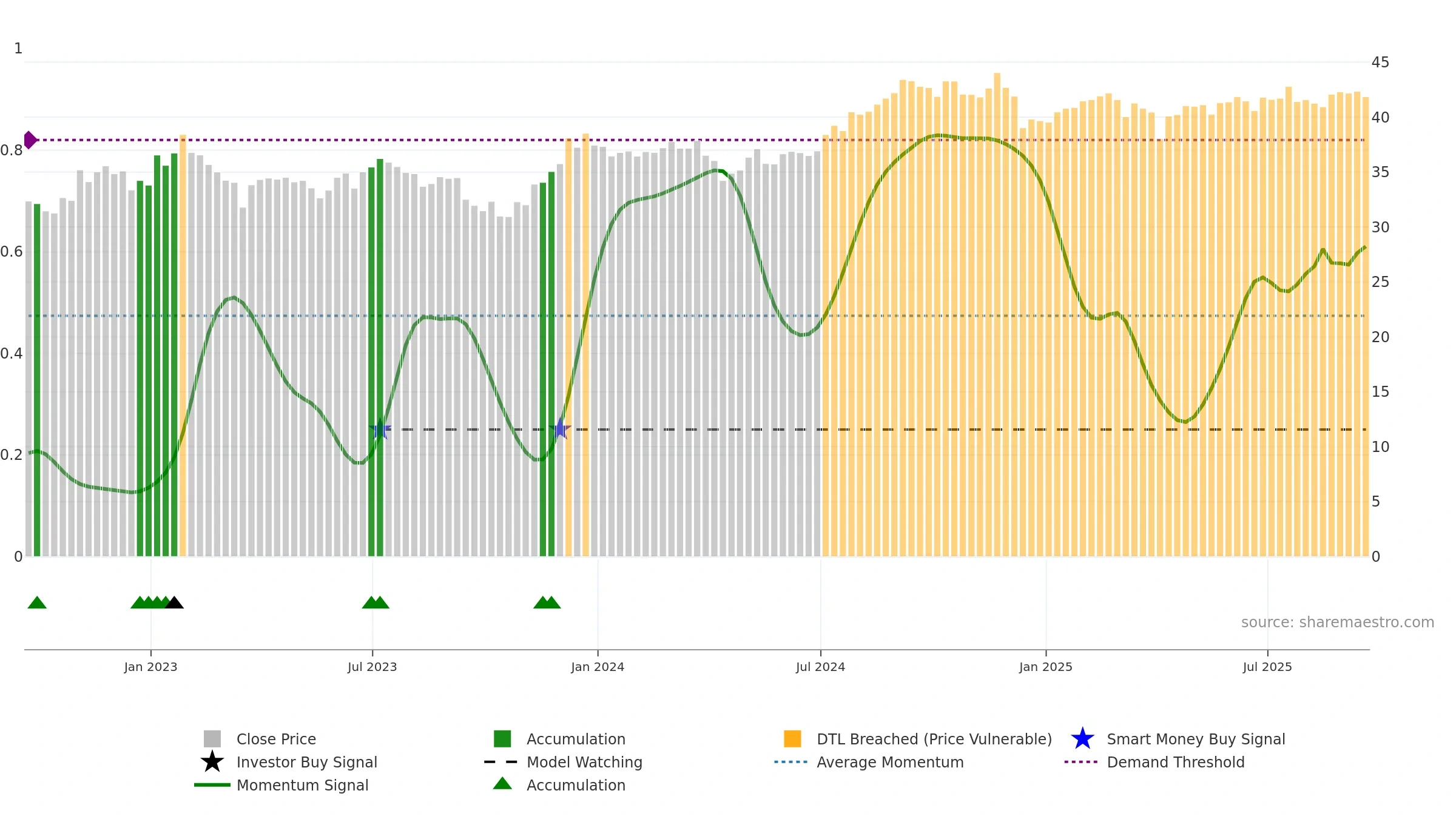

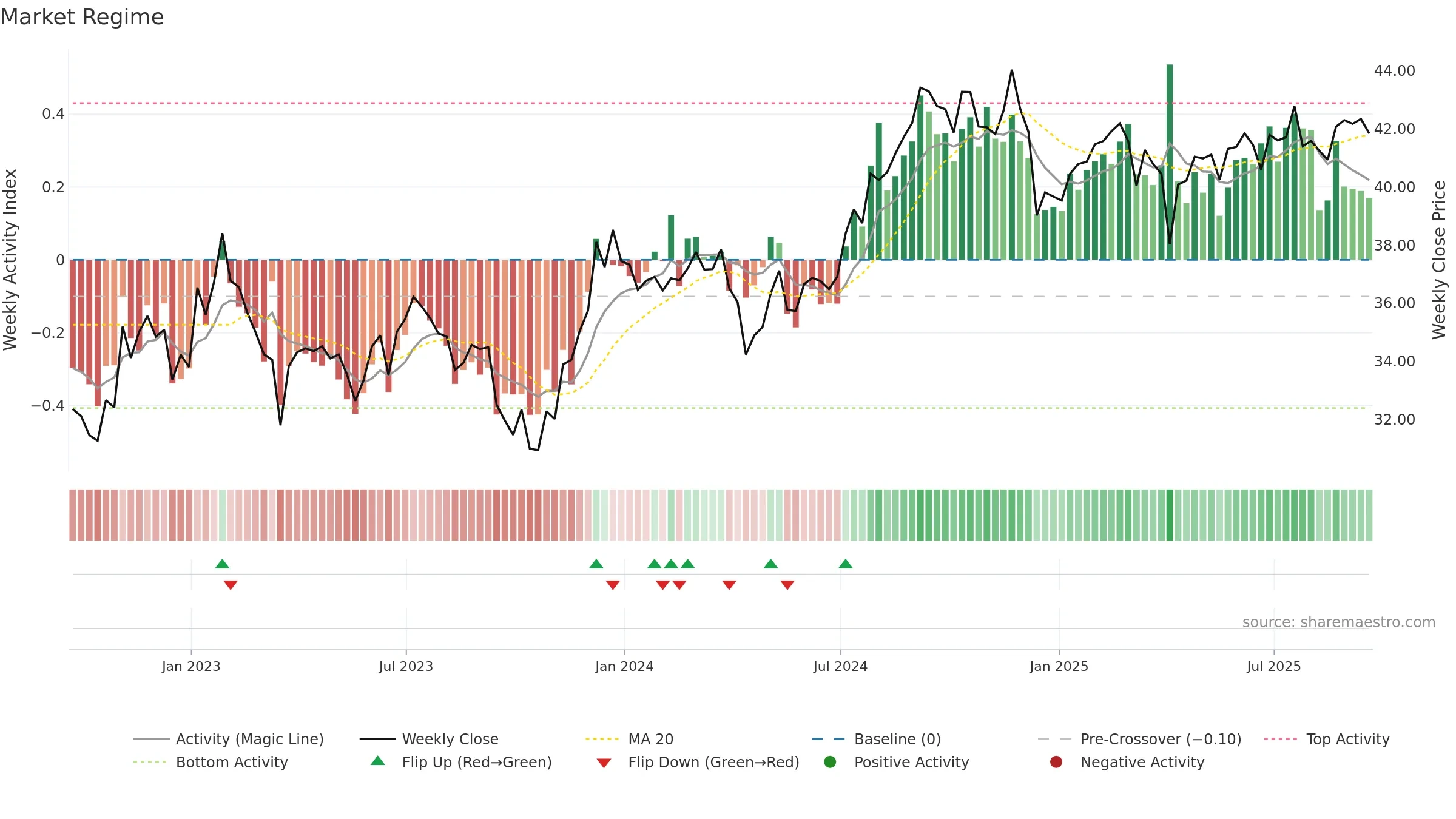

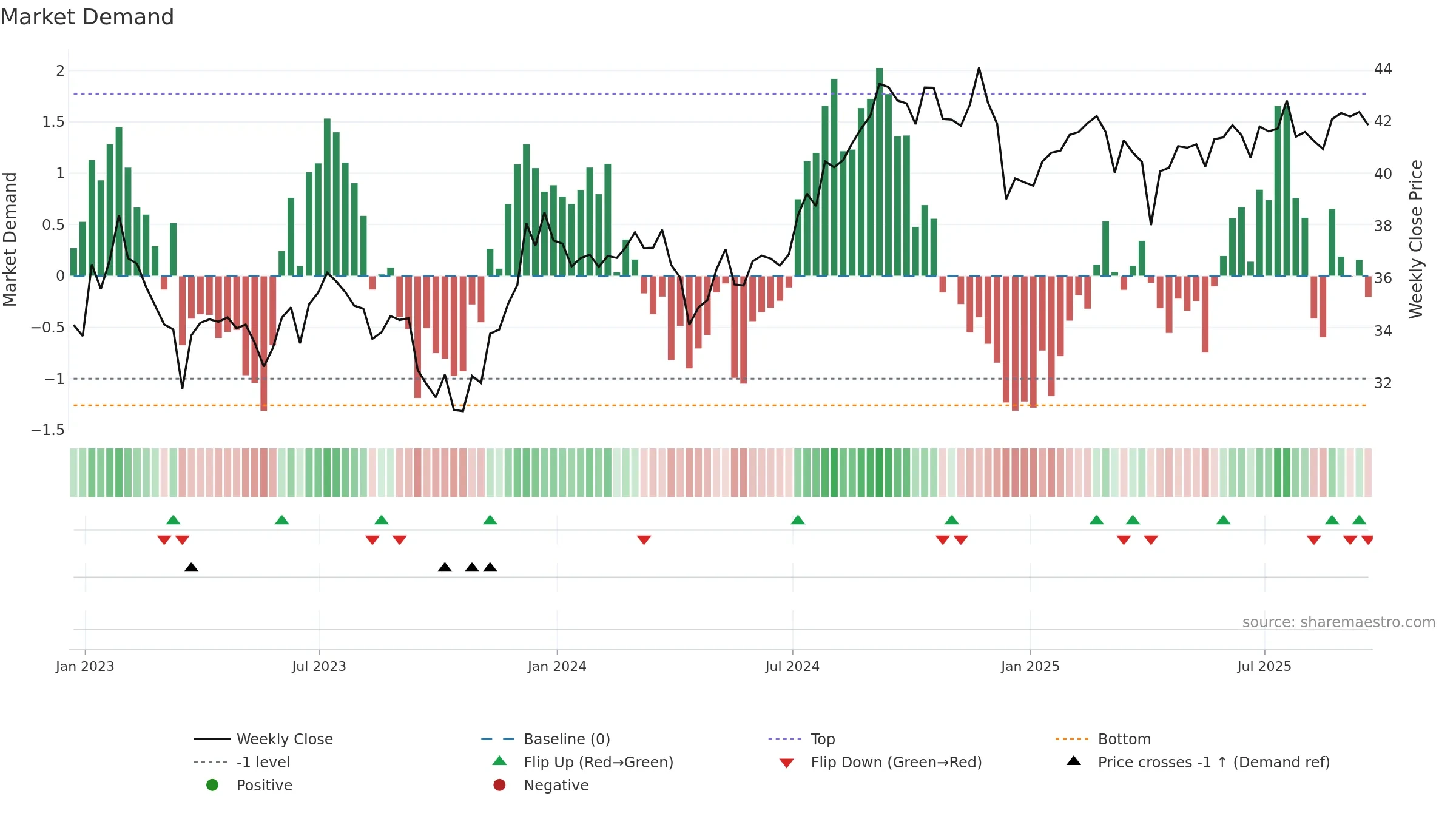

How to read this — Price slope is upward, indicating persistent buying over the window. Low weekly volatility favours steadier follow-through. Volume trend diverges from price — watch for fatigue or rotation. Accumulation weeks: 2; distribution weeks: 2. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

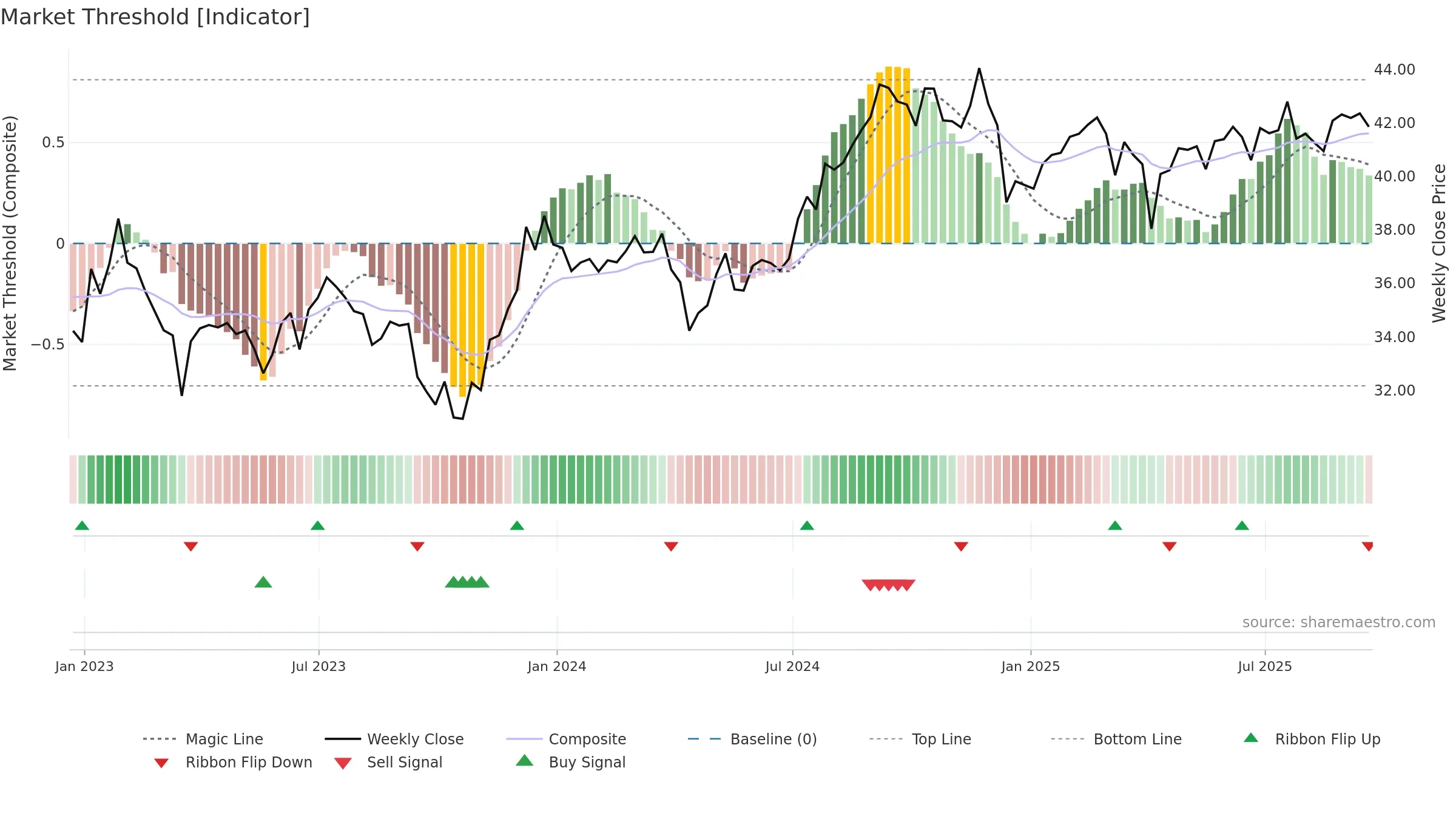

Gauge maps the trend signal to a 0–100 scale.

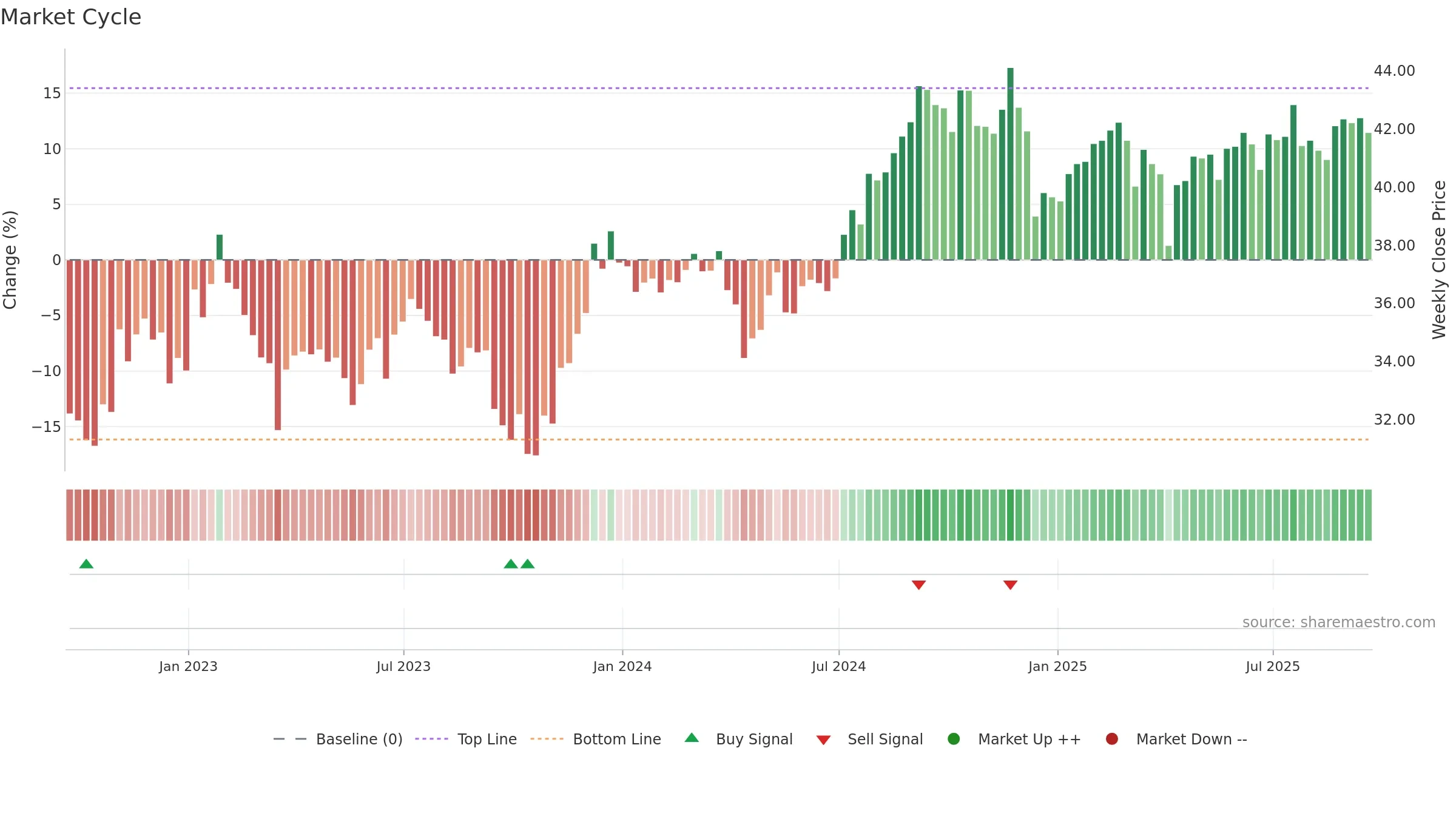

How to read this — Bullish gauge levels imply persistent upside pressure. A rising gauge shows momentum building rather than fading. Deceleration reduces the odds of persistence.

Constructive backdrop; dips are more likely to find support while the gauge stays high.

Conclusion

Positive setup. ★★★★☆ confidence. Price window: 0. Trend: Bullish @ 80. In combination, liquidity diverges from price.

Why: Price window 0.63% over 8w. Close is -1.18% below the window high. Return volatility 0.48%. Volume trend falling. Liquidity divergence with price. Accumulation 2; distribution 2. MA stack mixed. Baseline deviation 0.11% (widening). Momentum bullish and rising. Acceleration decelerating. Gauge volatility low.

Tip: Most metrics also include a hover tooltip where they appear in the report.