Ambika Cotton Mills Limited

AMBIKCO NSE

Weekly Report

Ambika Cotton Mills Limited closed at 1479.3000 (-1.38% WoW) . Data window ends Mon, 22 Sep 2025.

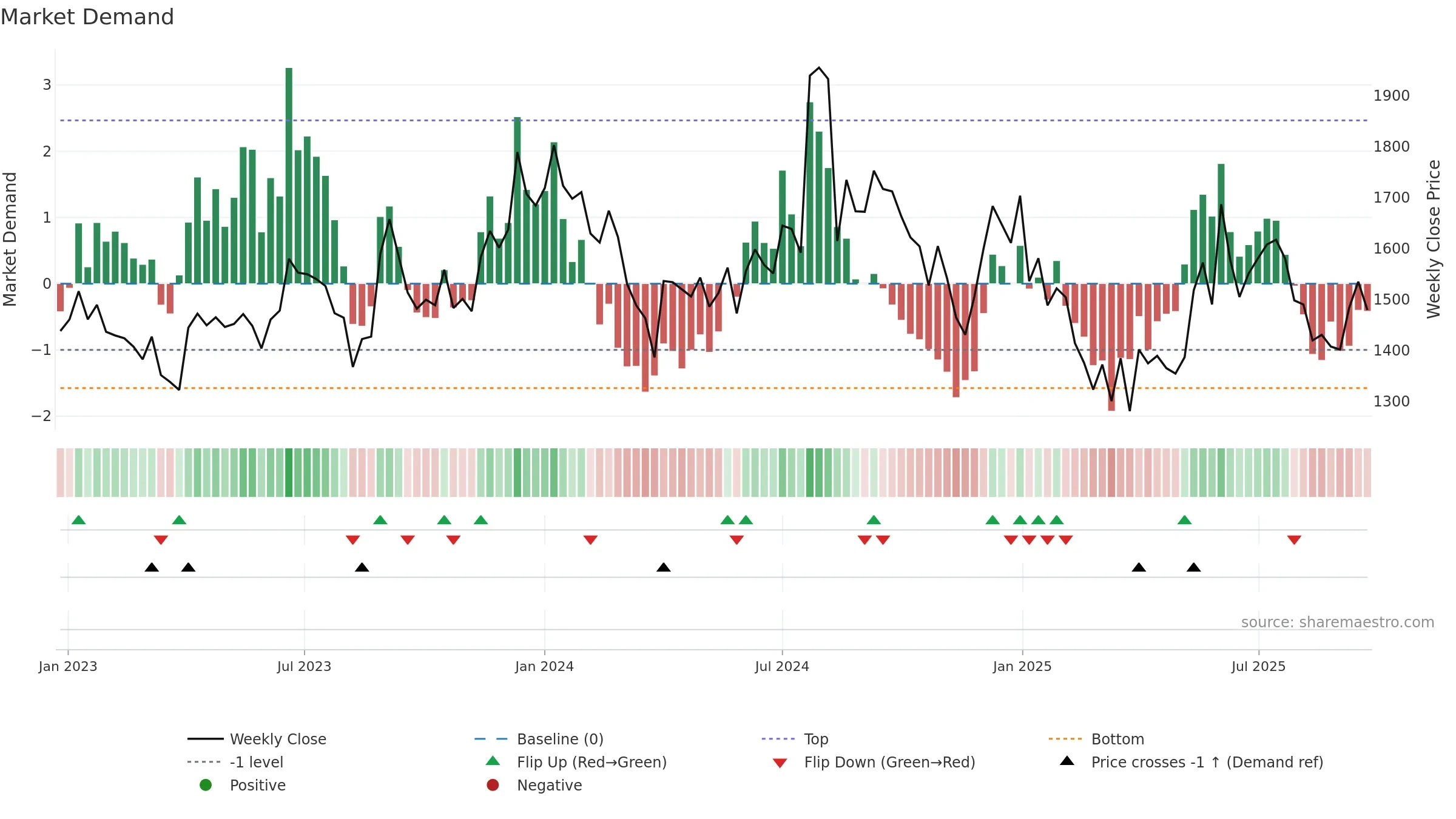

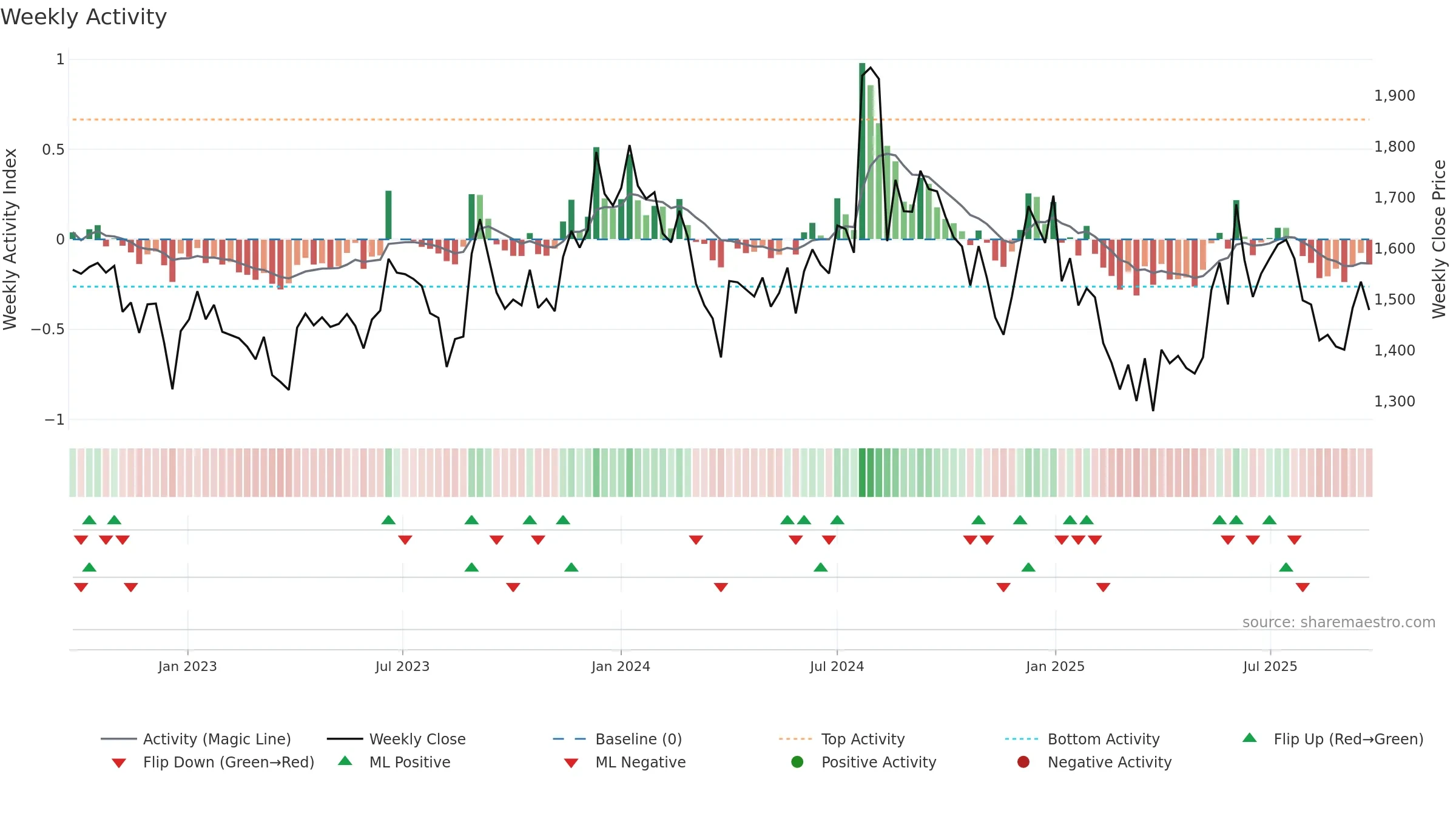

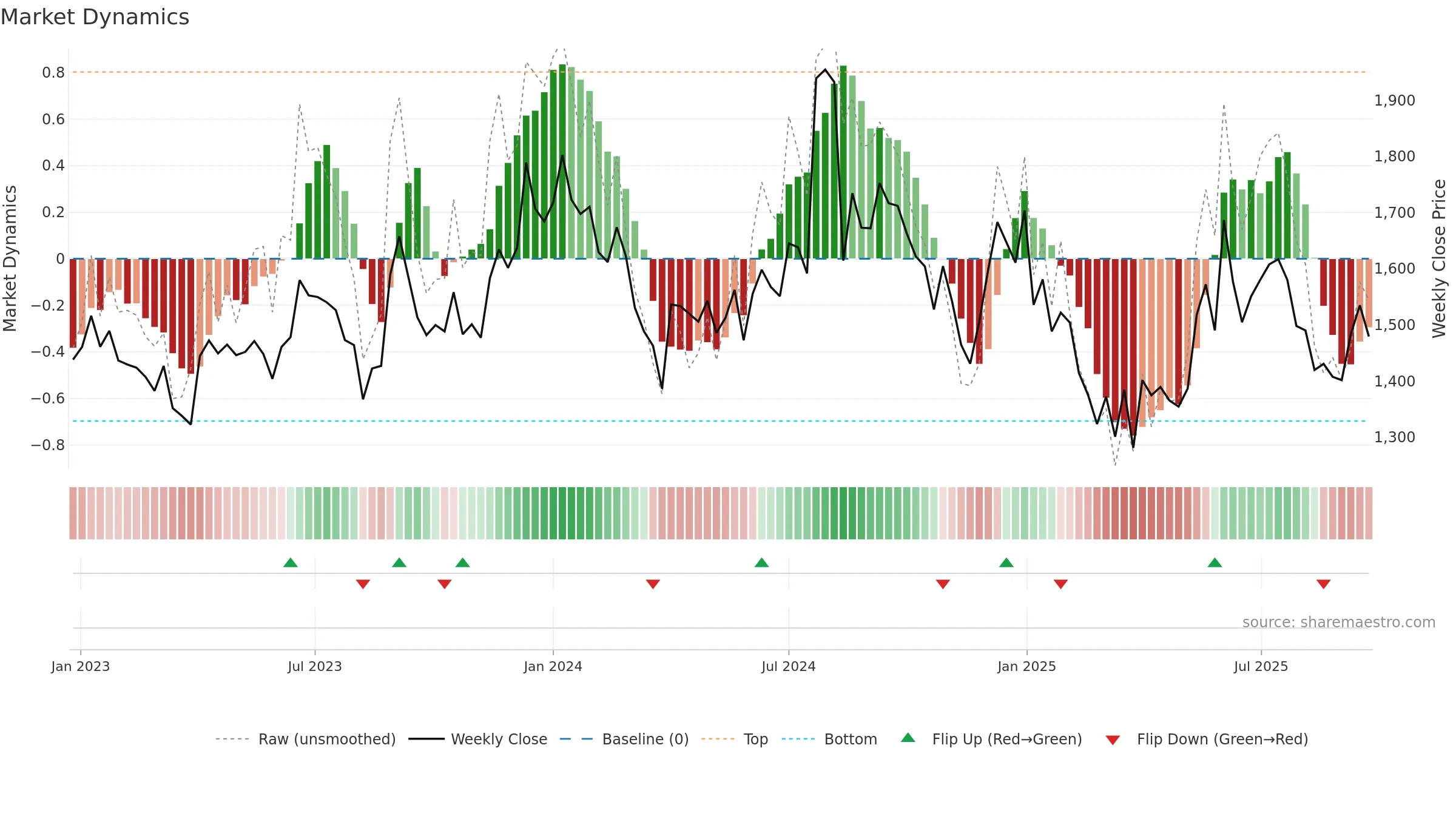

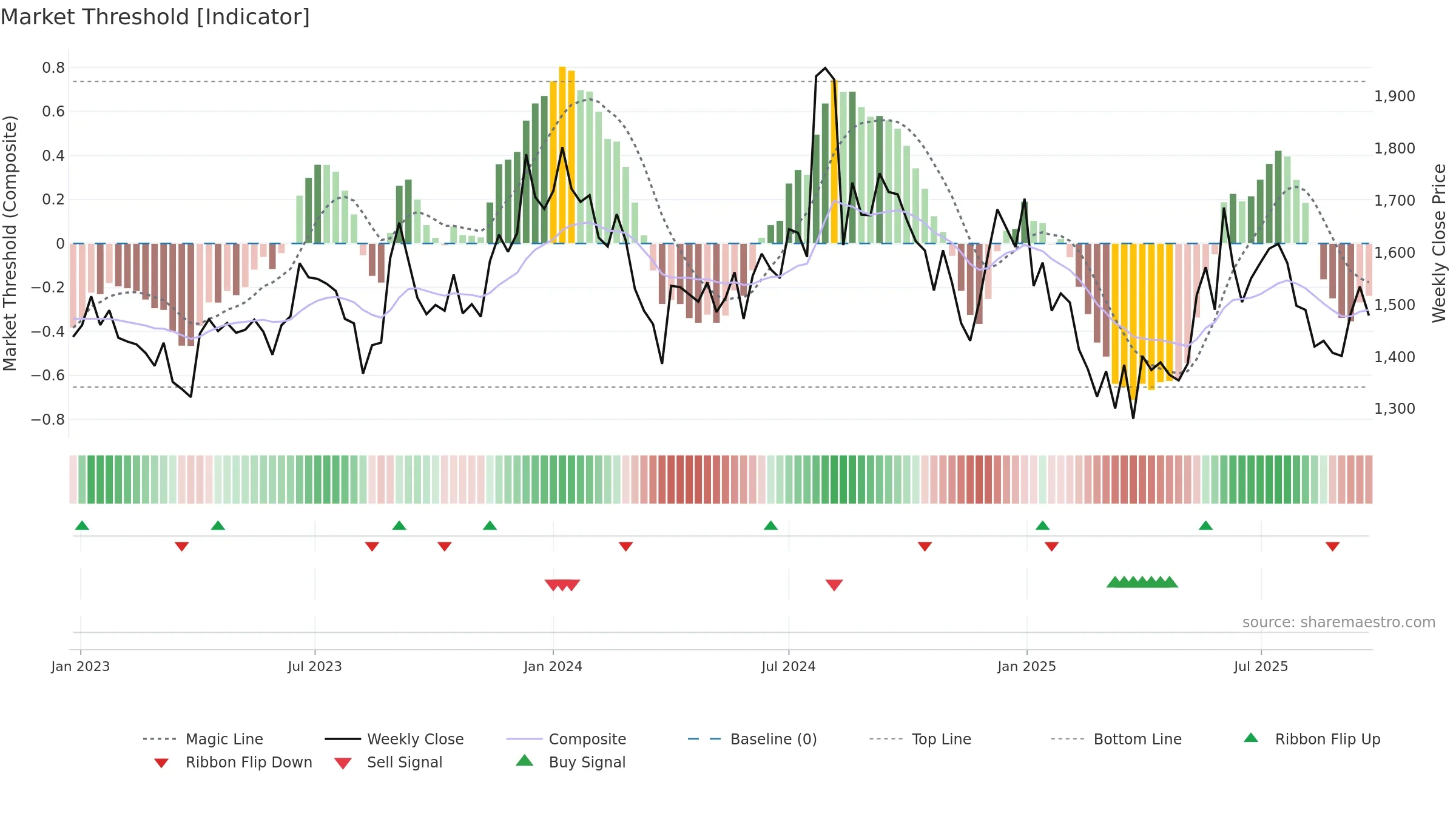

How to read this — Price slope is upward, indicating persistent buying over the window. Low weekly volatility favours steadier follow-through. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity. Fresh short-term crossover improves near-term tone.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

Gauge maps the trend signal to a 0–100 scale.

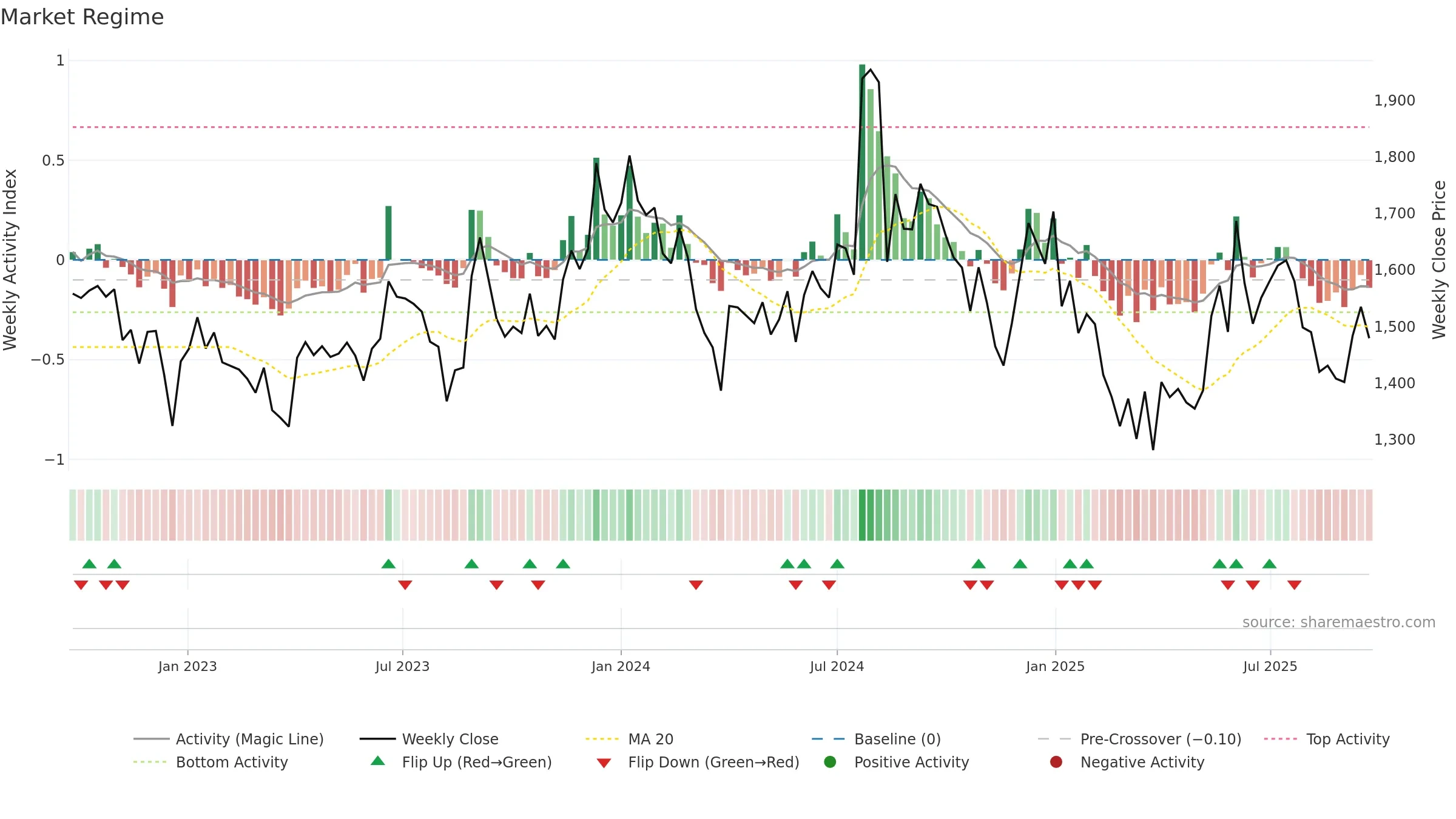

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

The flag is positive: favourable upside skew with supportive conditions.

Conclusion

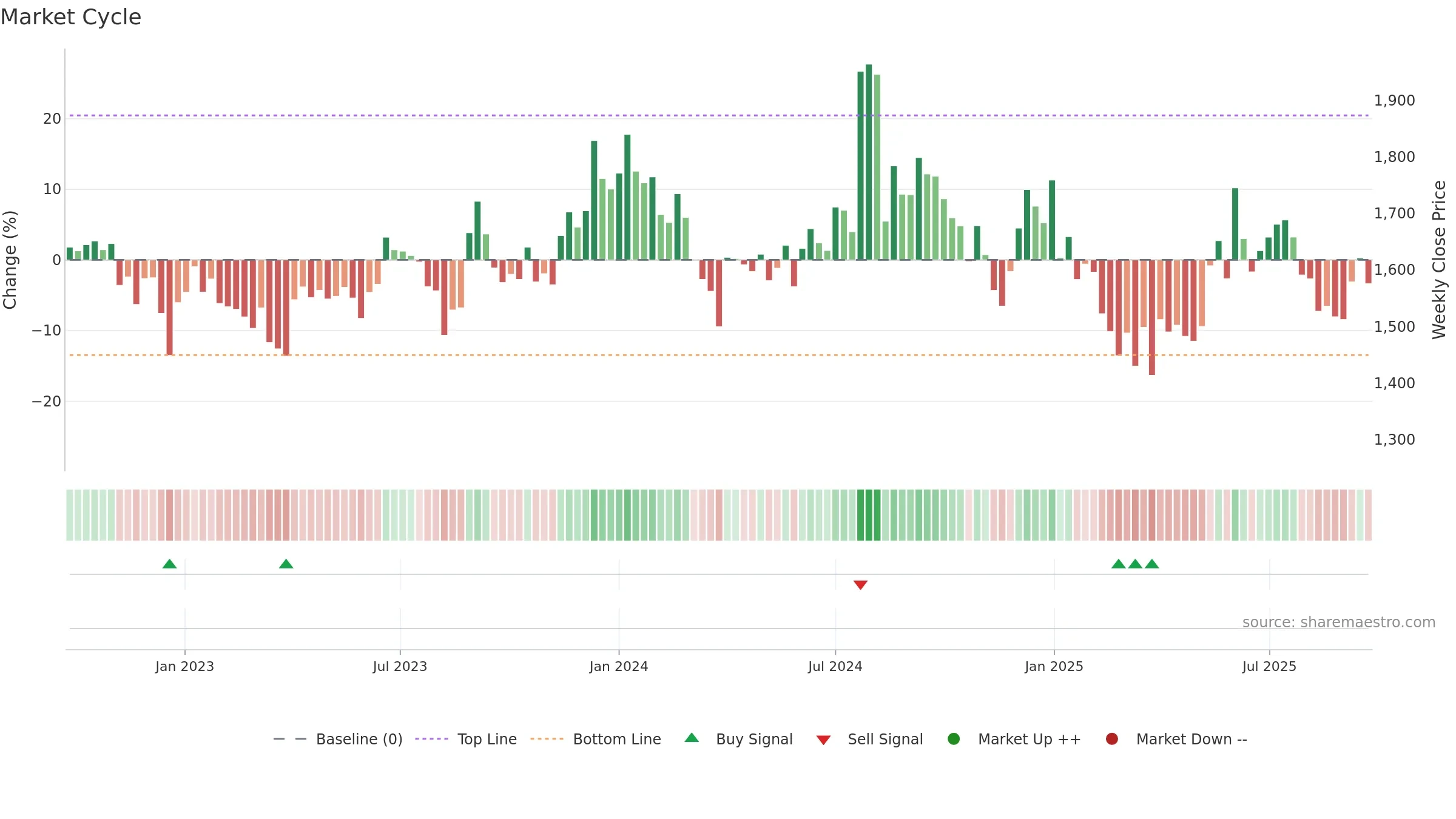

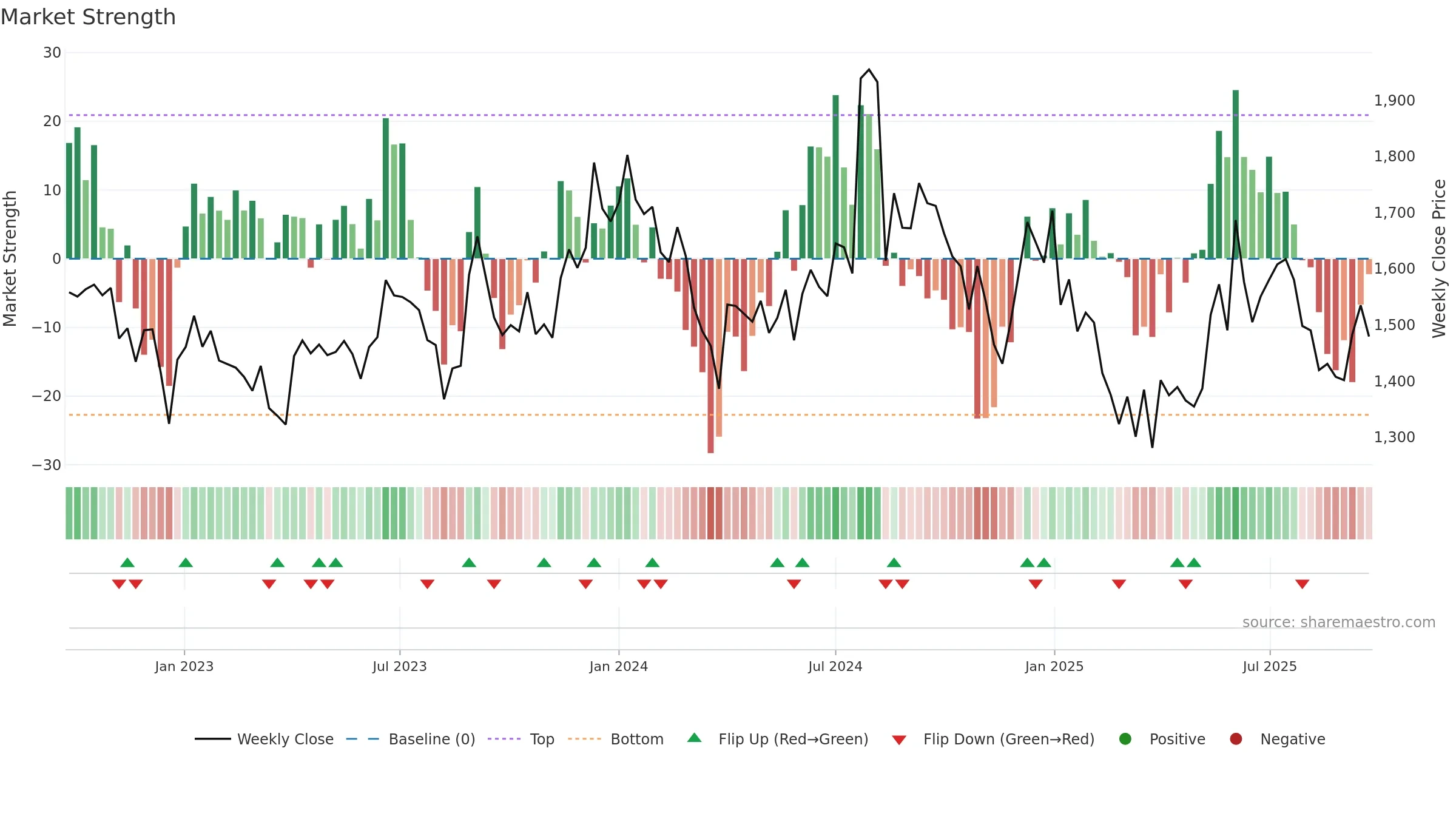

Negative setup. ★★☆☆☆ confidence. Price window: -0. Trend: Range / Neutral; gauge 50. In combination, liquidity diverges from price.

- Low return volatility supports durability

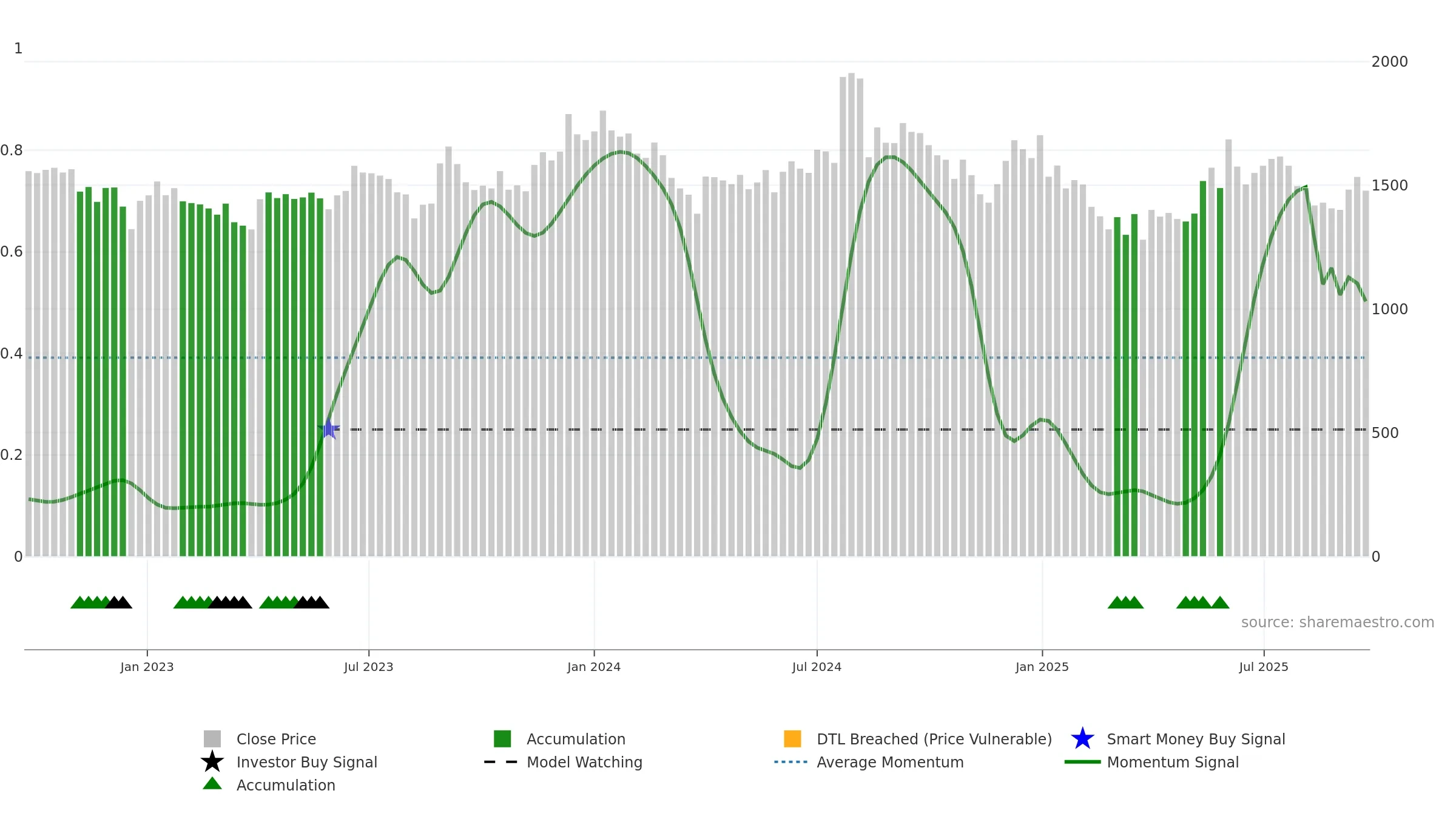

- Momentum is weak/falling

- Price is not above key averages

- Liquidity diverges from price

- Negative multi-week performance

Why: Price window -0.72% over 8w. Close is -3.62% below the prior-window high. Return volatility 1.84%. Volume trend falling. Liquidity divergence with price. Trend state range / neutral. 4–8w crossover bullish. Momentum neutral and falling. Valuation stance positive.

Tip: Most metrics include a hover tooltip where they appear in the report.