Beijing Tongrentang Co., Ltd

600085 SHA

Weekly Report

Beijing Tongrentang Co., Ltd closed at 35.0300 (-0.43% WoW) . Data window ends Mon, 15 Sep 2025.

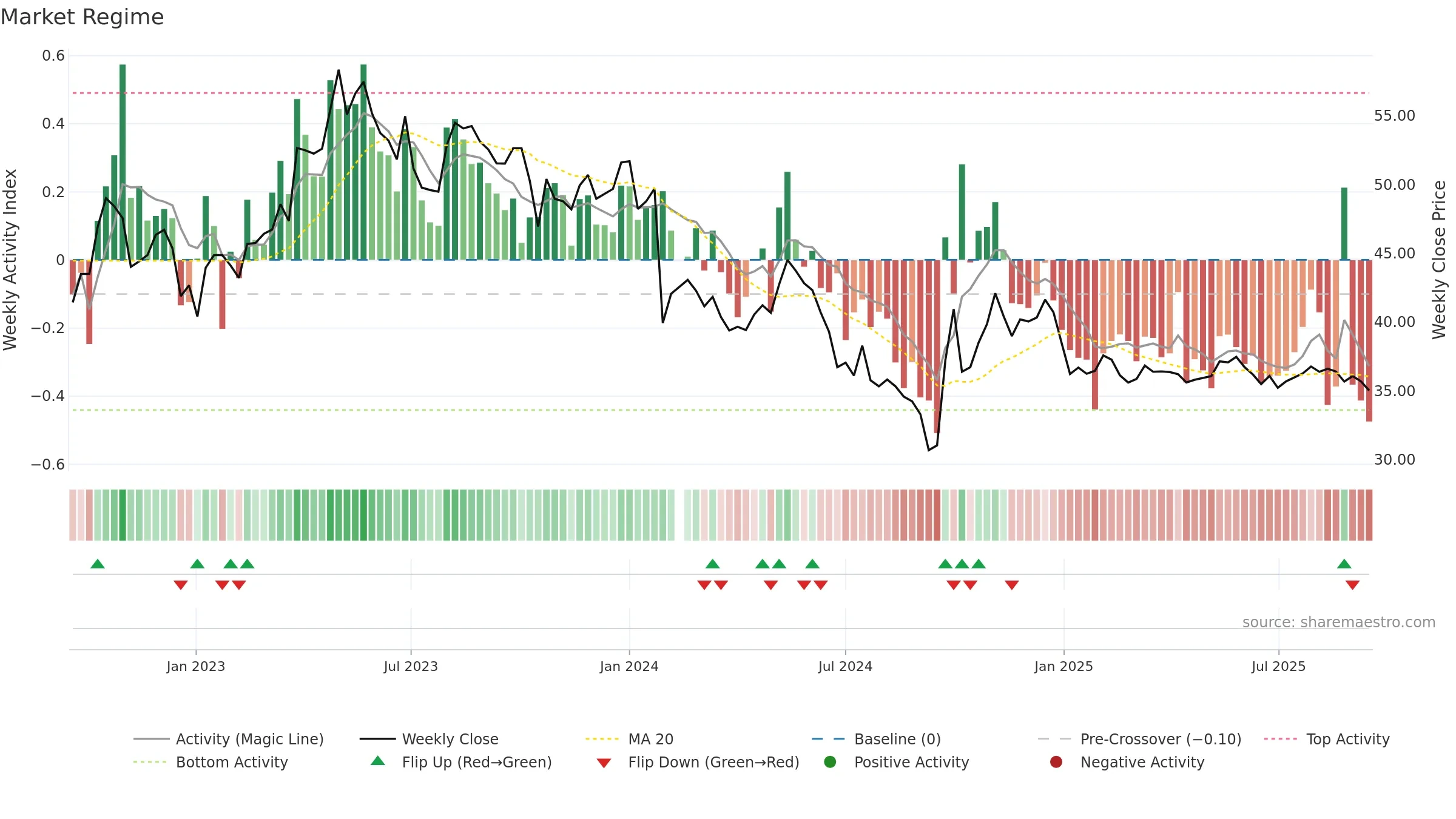

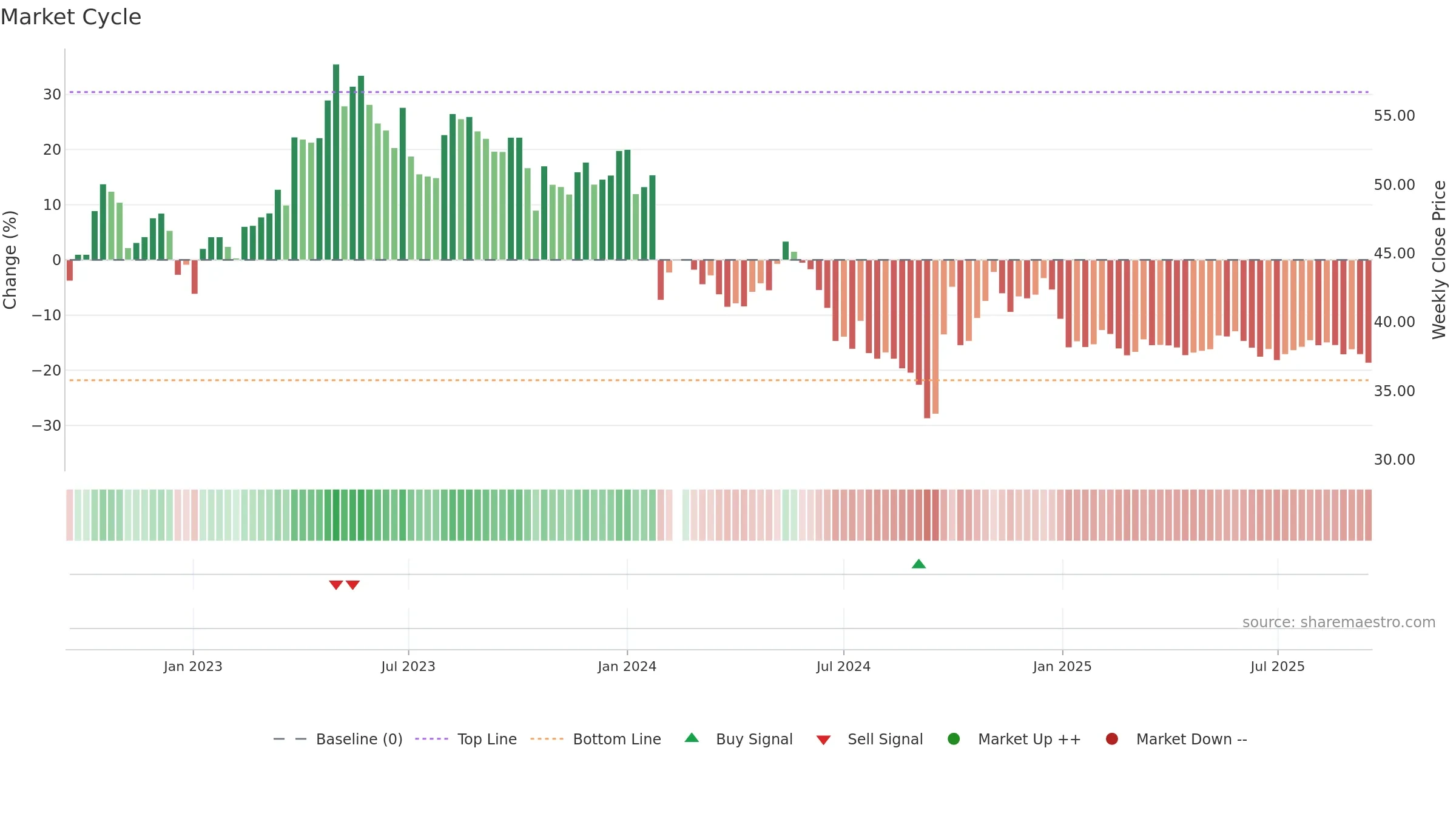

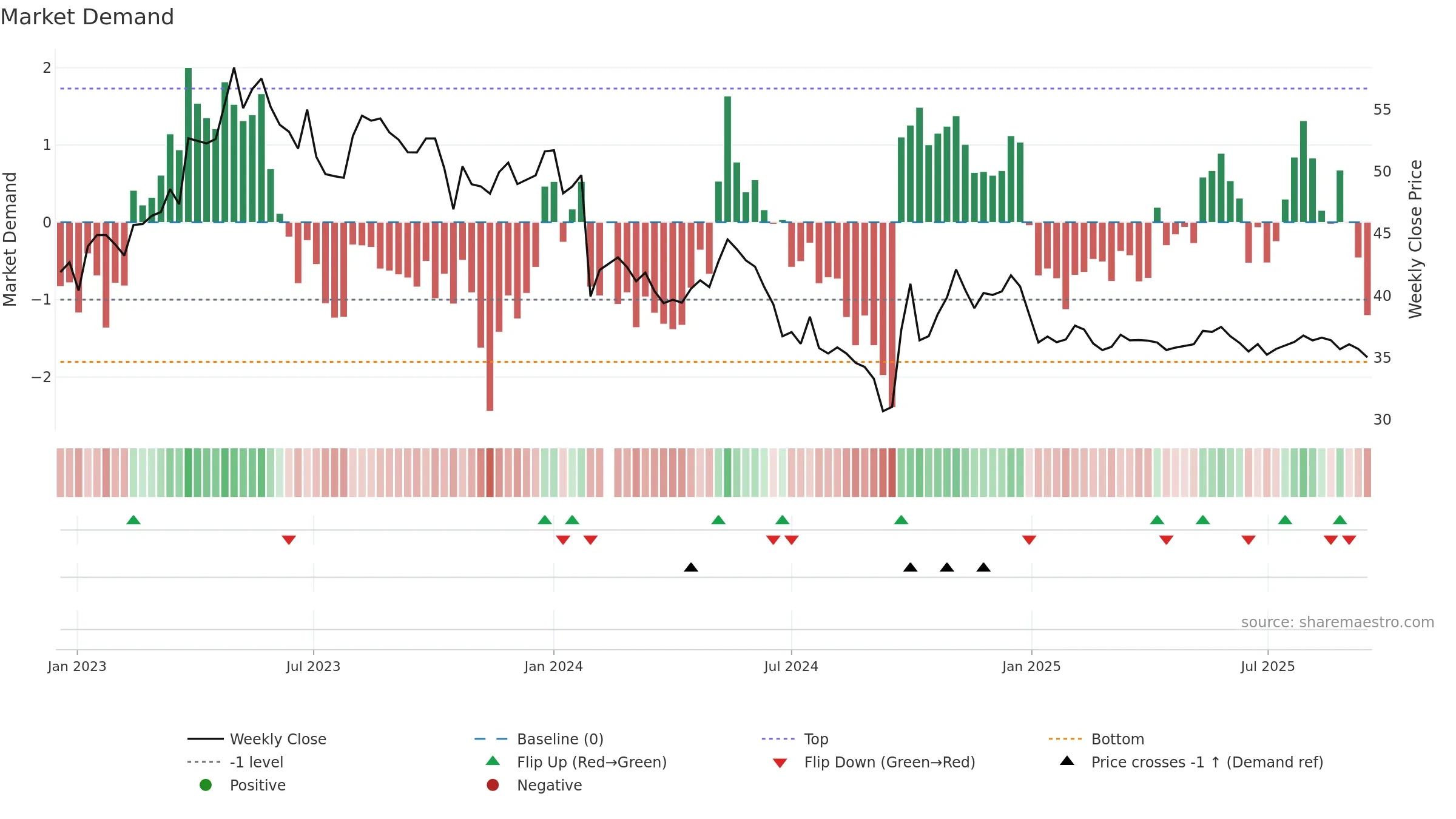

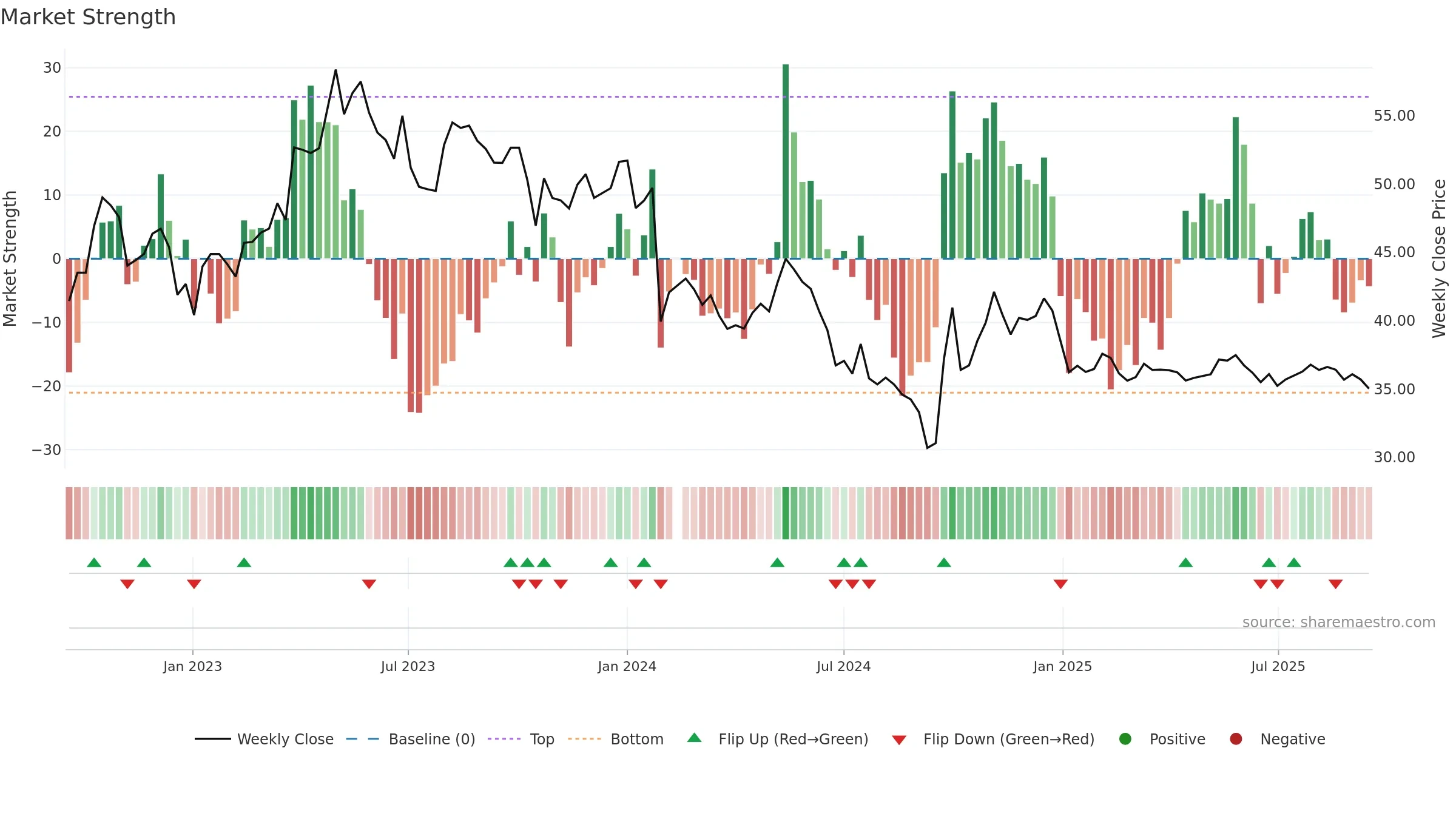

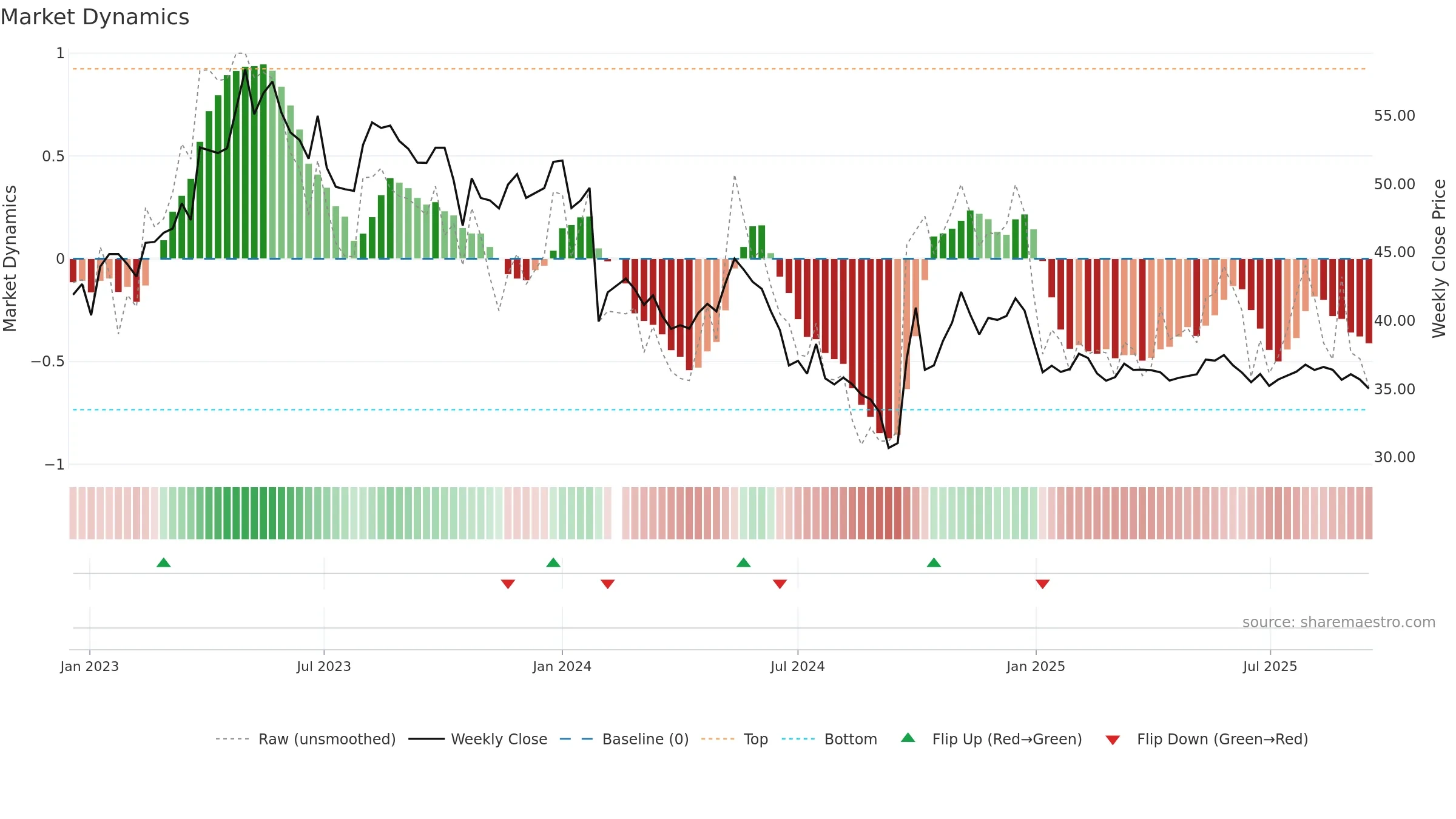

How to read this — Price slope is downward, indicating persistent supply pressure. Low weekly volatility favours steadier follow-through. Volume and price are moving in the same direction — a constructive confirmation. Returns are negatively correlated with volume — strength may come on lighter activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Price sits below key averages, keeping pressure on the tape.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

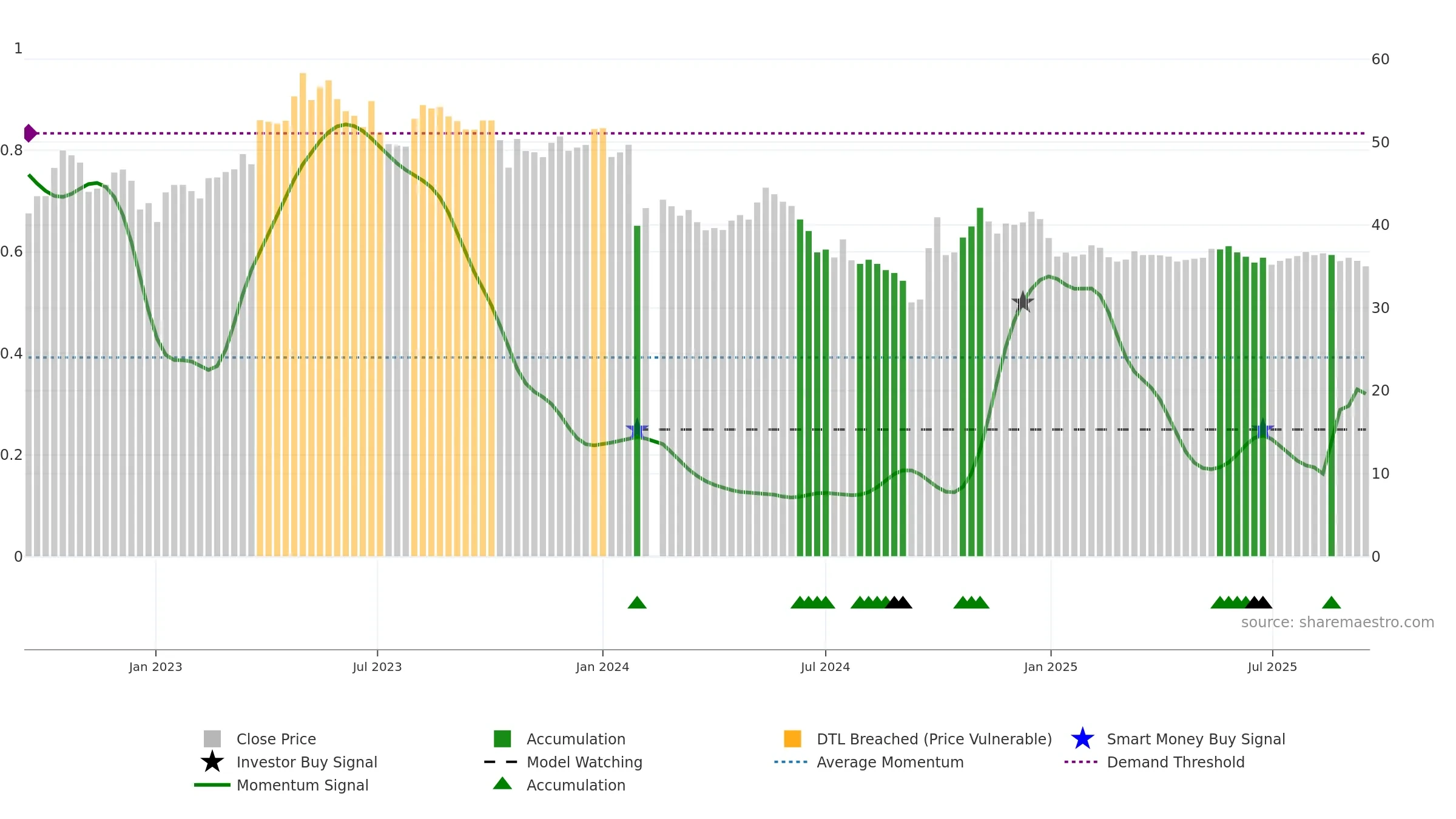

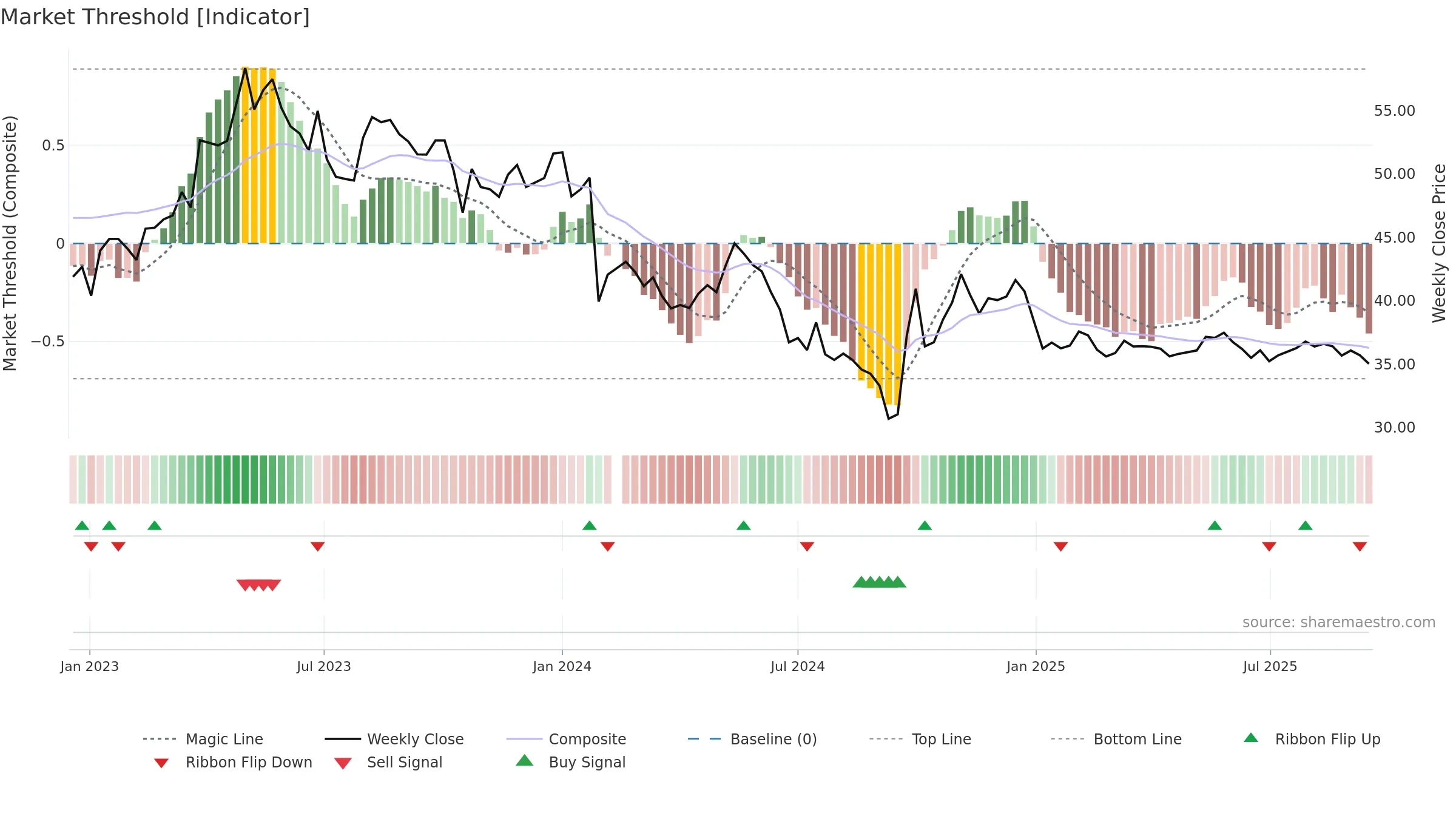

Gauge maps the trend signal to a 0–100 scale.

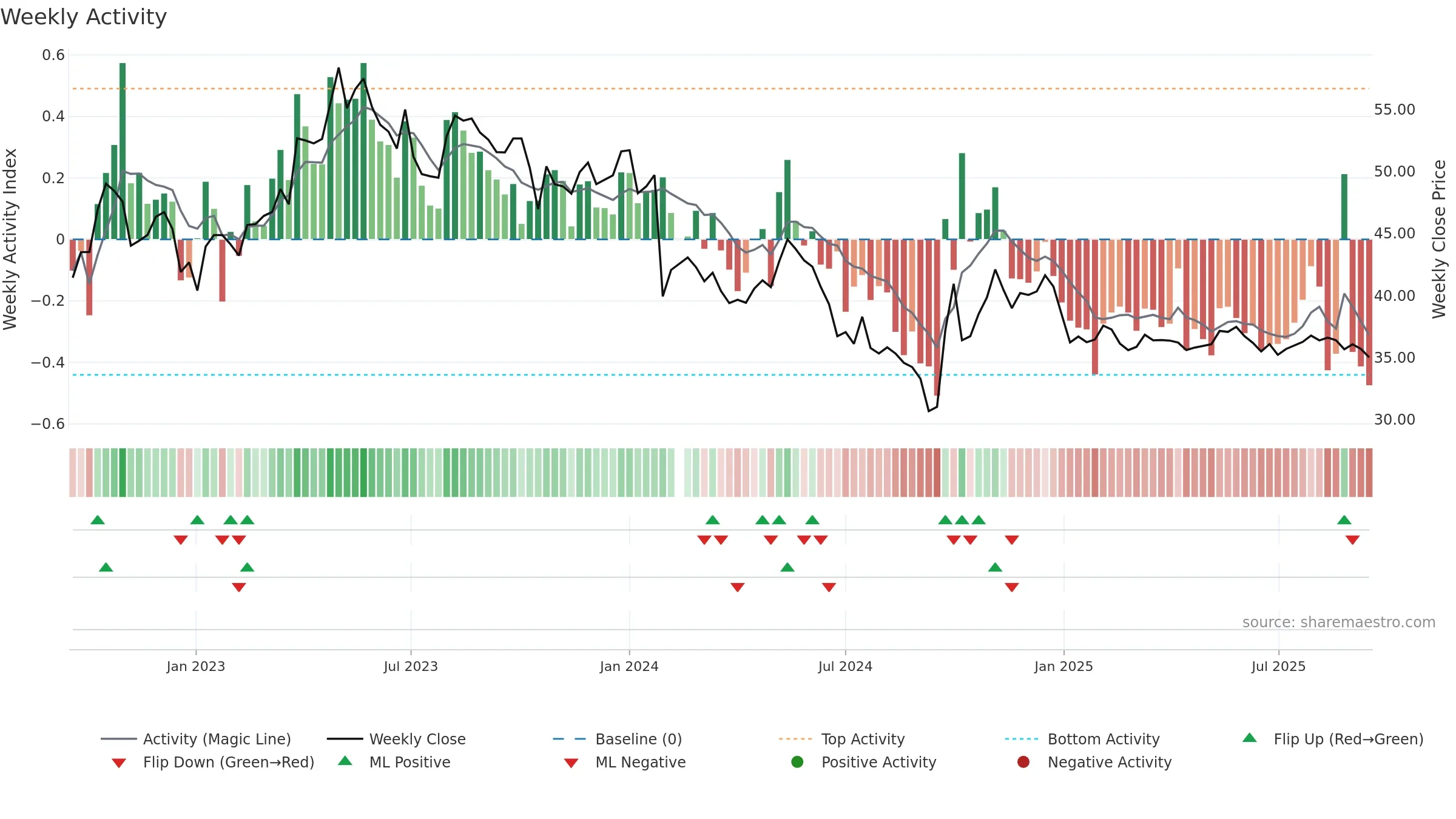

How to read this — Bearish backdrop but short-term momentum is improving; confirmation still needed.

Early improvement — look for a reclaim of 0.50→0.60 to validate.

The flag is positive: favourable upside skew with supportive conditions.

Conclusion

Positive setup. ★★★★☆ confidence. Price window: -4. Trend: Bottoming Attempt; gauge 32. In combination, liquidity confirms the move.

- Early improvement from bearish zone (bottoming attempt)

- Liquidity confirms the price trend

- Low return volatility supports durability

- Price is not above key averages

- Negative multi-week performance

Why: Price window -4.76% over 8w. Close is -4.76% below the prior-window high. Return volatility 1.72%. Volume trend falling. Liquidity convergence with price. Trend state bottoming attempt. Low-regime (≤0.25) upticks 2/4 (50.0%) • Distributing. Momentum neutral and rising. Valuation stance positive.

Tip: Most metrics include a hover tooltip where they appear in the report.