Computer Age Management Services Limited

CAMS NSE

Weekly Summary

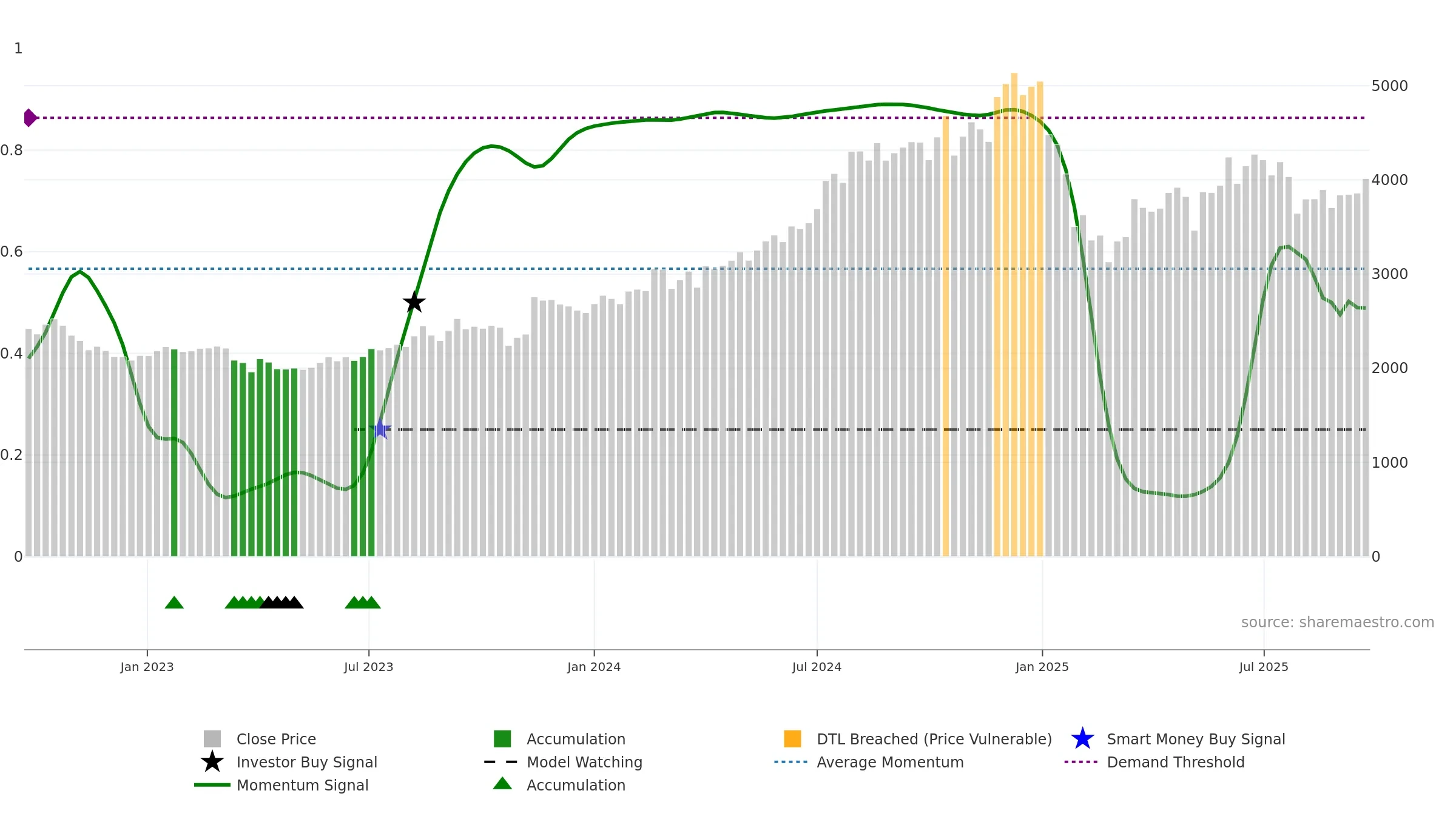

Computer Age Management Services Limited closed at 4014.0000 (-2.12% WoW) . Data window ends Mon, 22 Sep 2025.

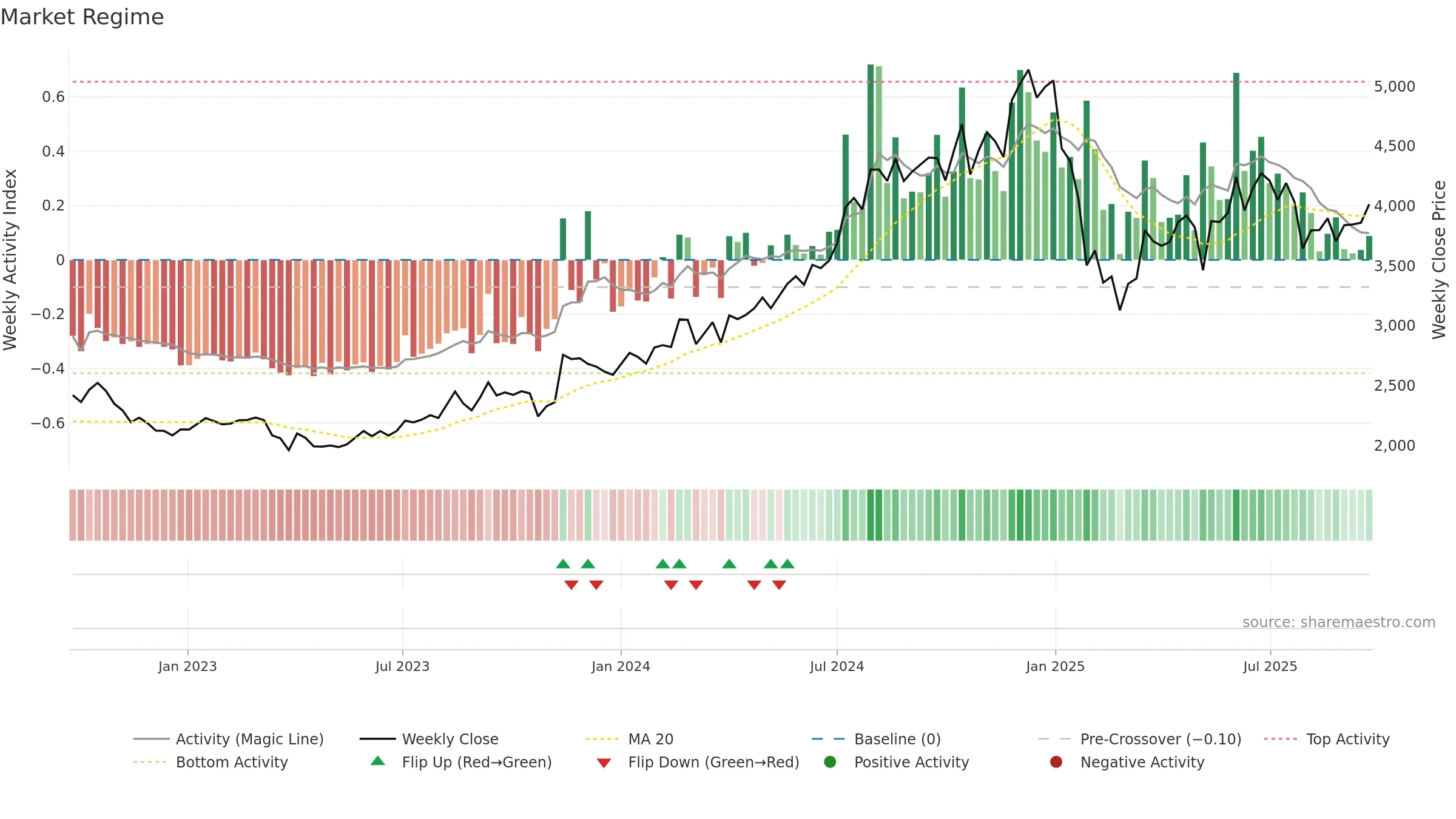

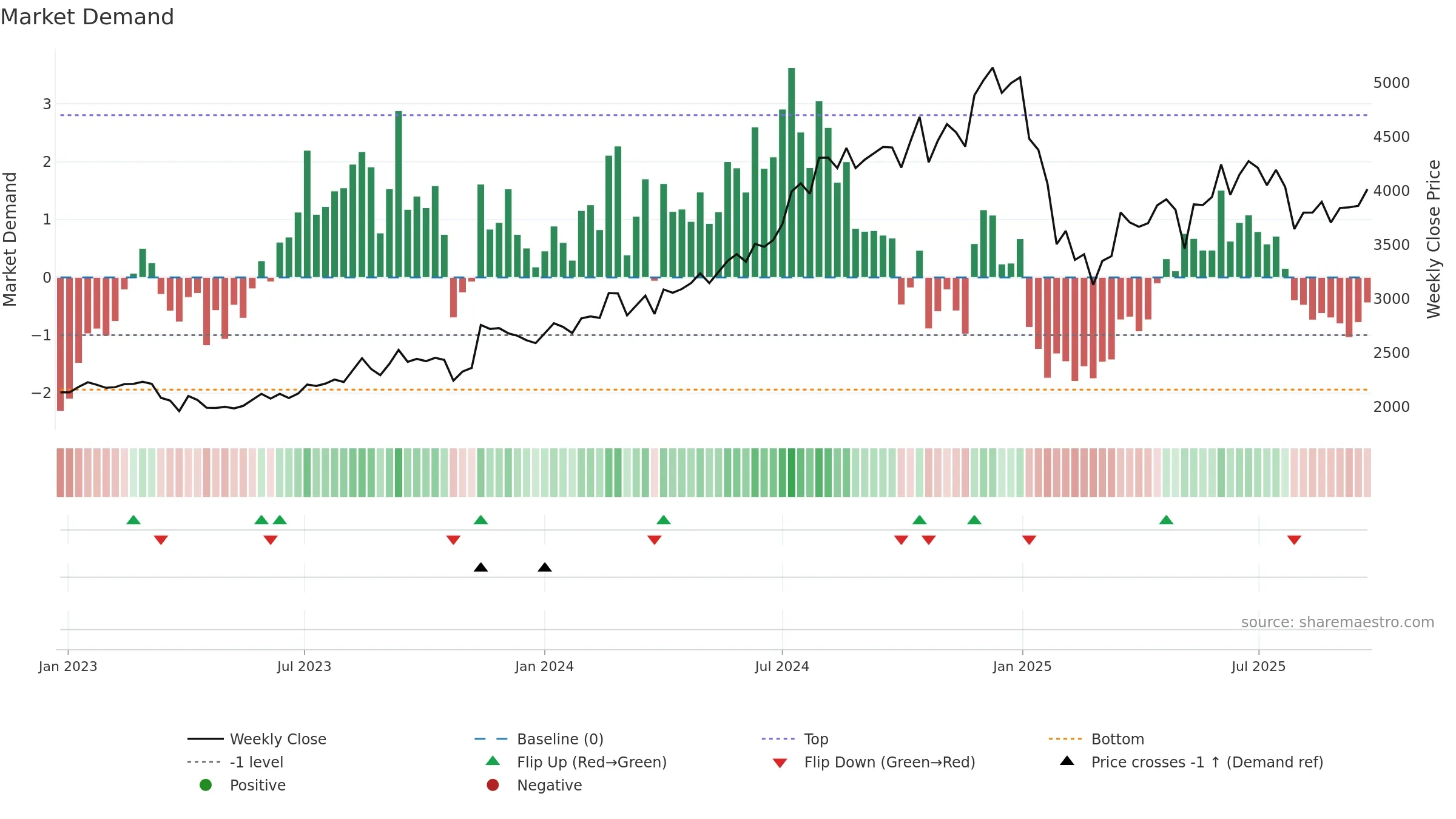

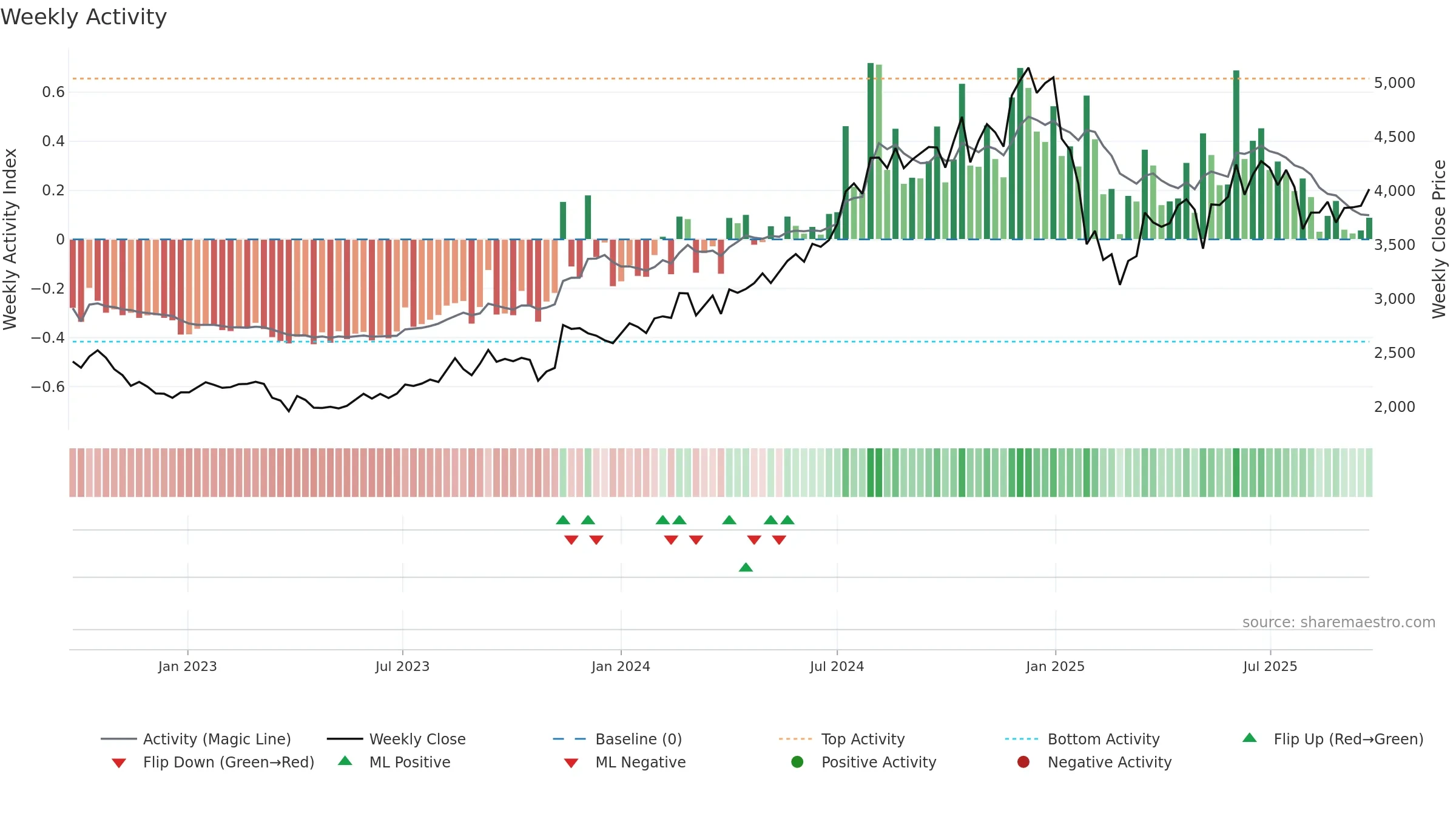

How to read this — Price slope is upward, indicating persistent buying over the window. Volume trend diverges from price — watch for fatigue or rotation. Distance to baseline is narrowing — reverting closer to its fair-value track. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

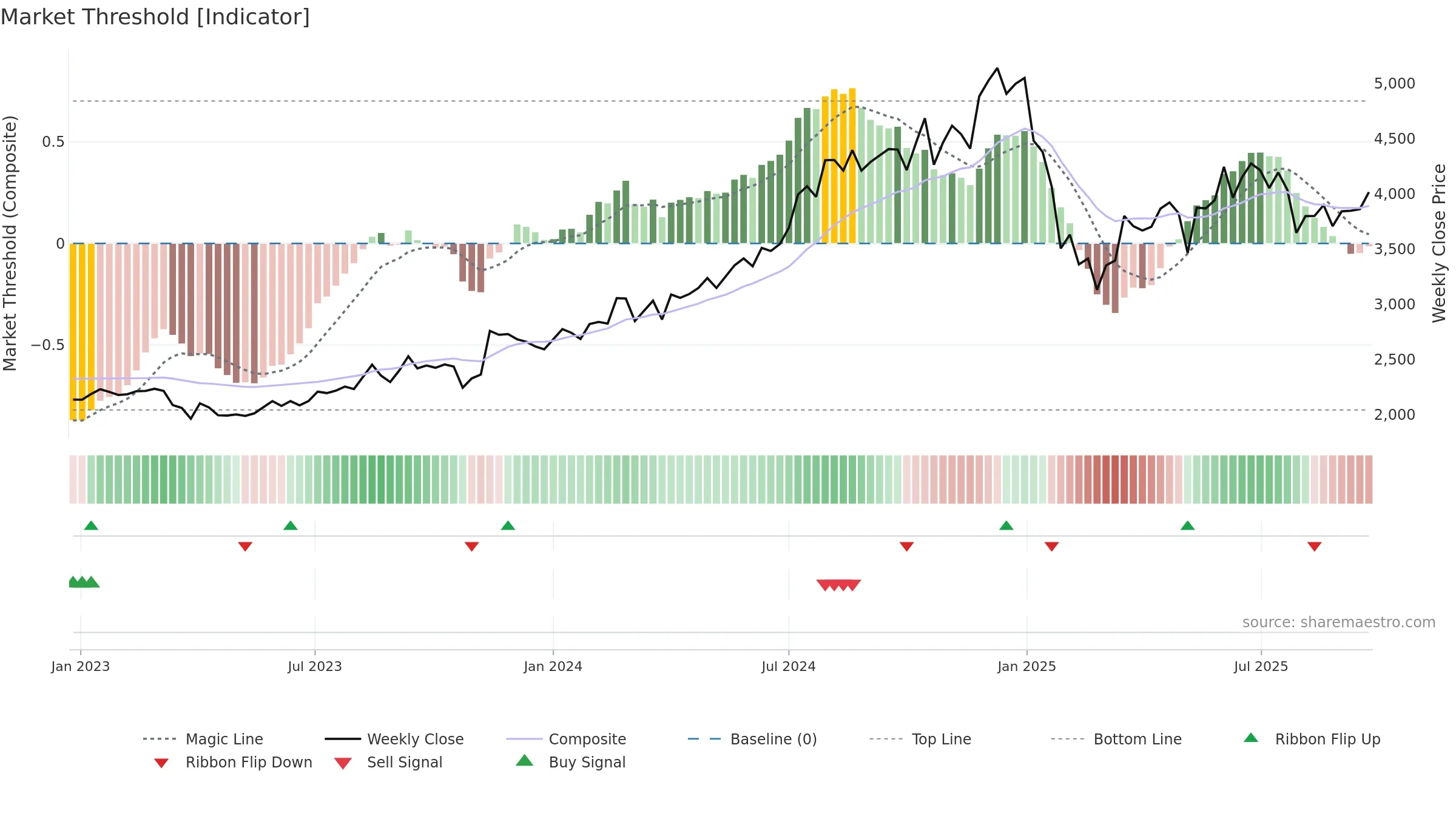

Gauge maps the trend signal to a 0–100 scale.

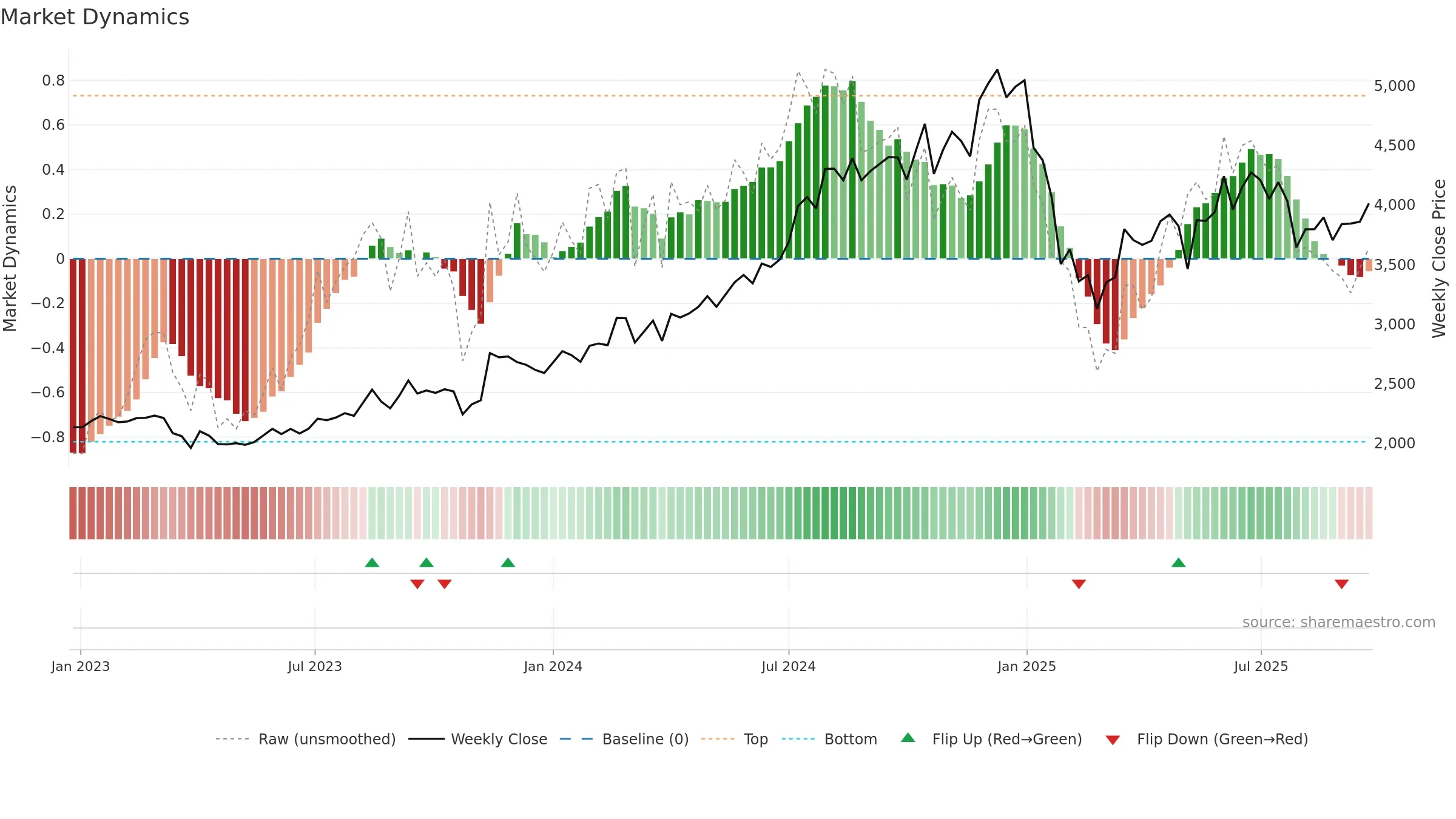

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

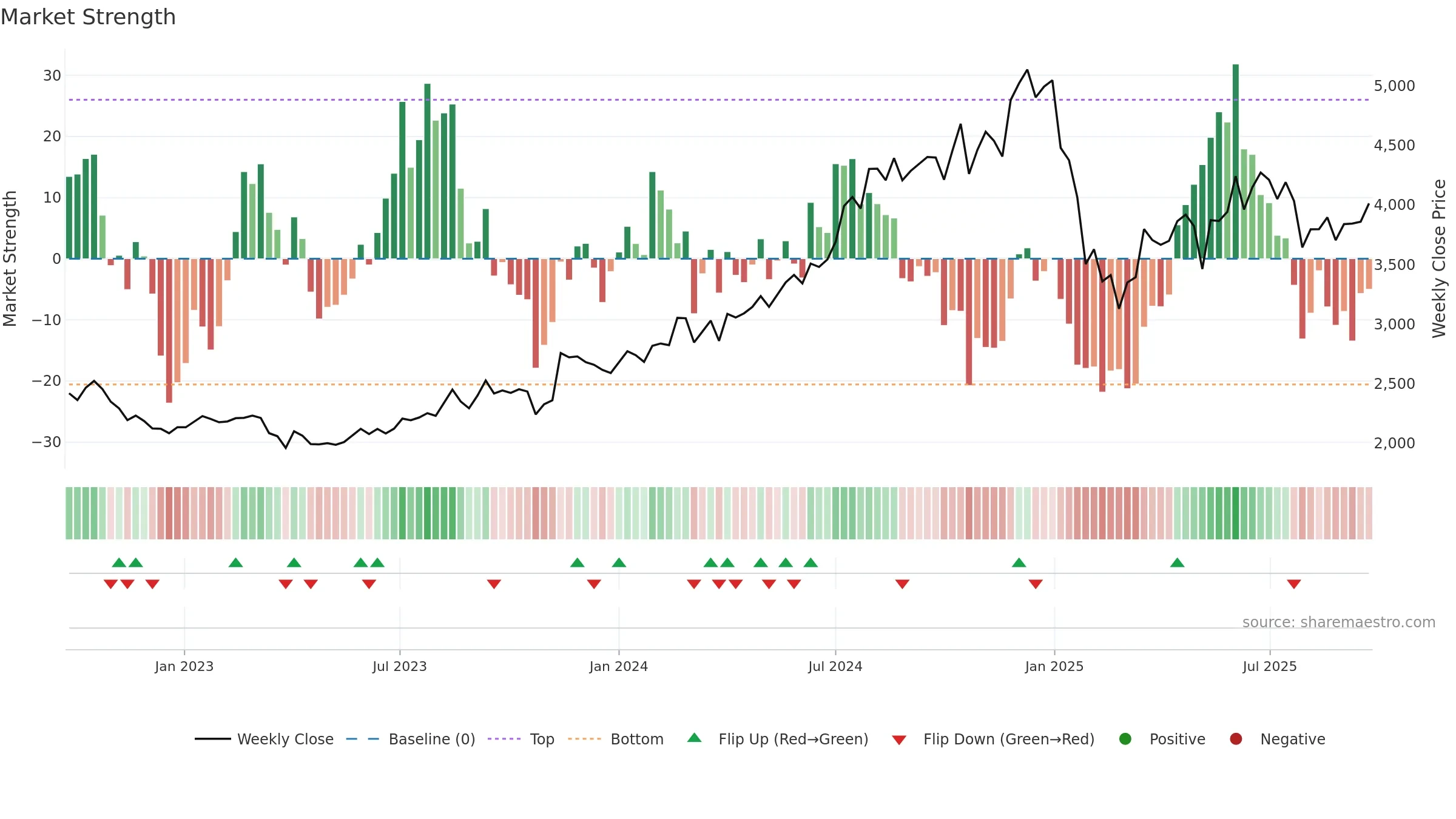

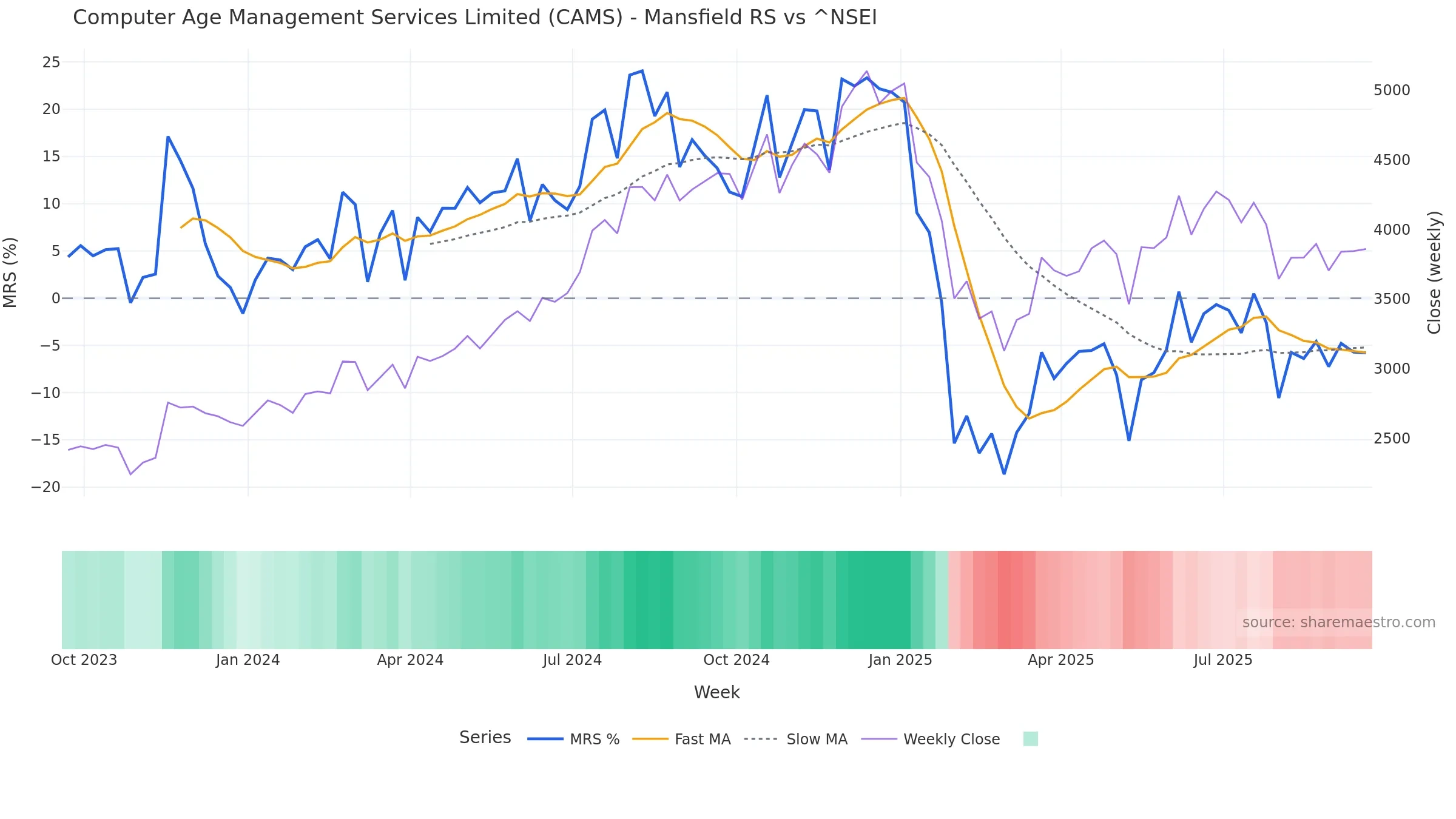

Relative strength is Negative

(< 0%, underperforming).

Latest MRS: -5.80% (week ending Fri, 19 Sep 2025).

Slope: Rising over 8w.

Notes:

- Below zero line indicates relative weakness vs benchmark.

- MRS slope rising over ~8 weeks.

Price is below fair value; potential upside if momentum constructive.

Conclusion

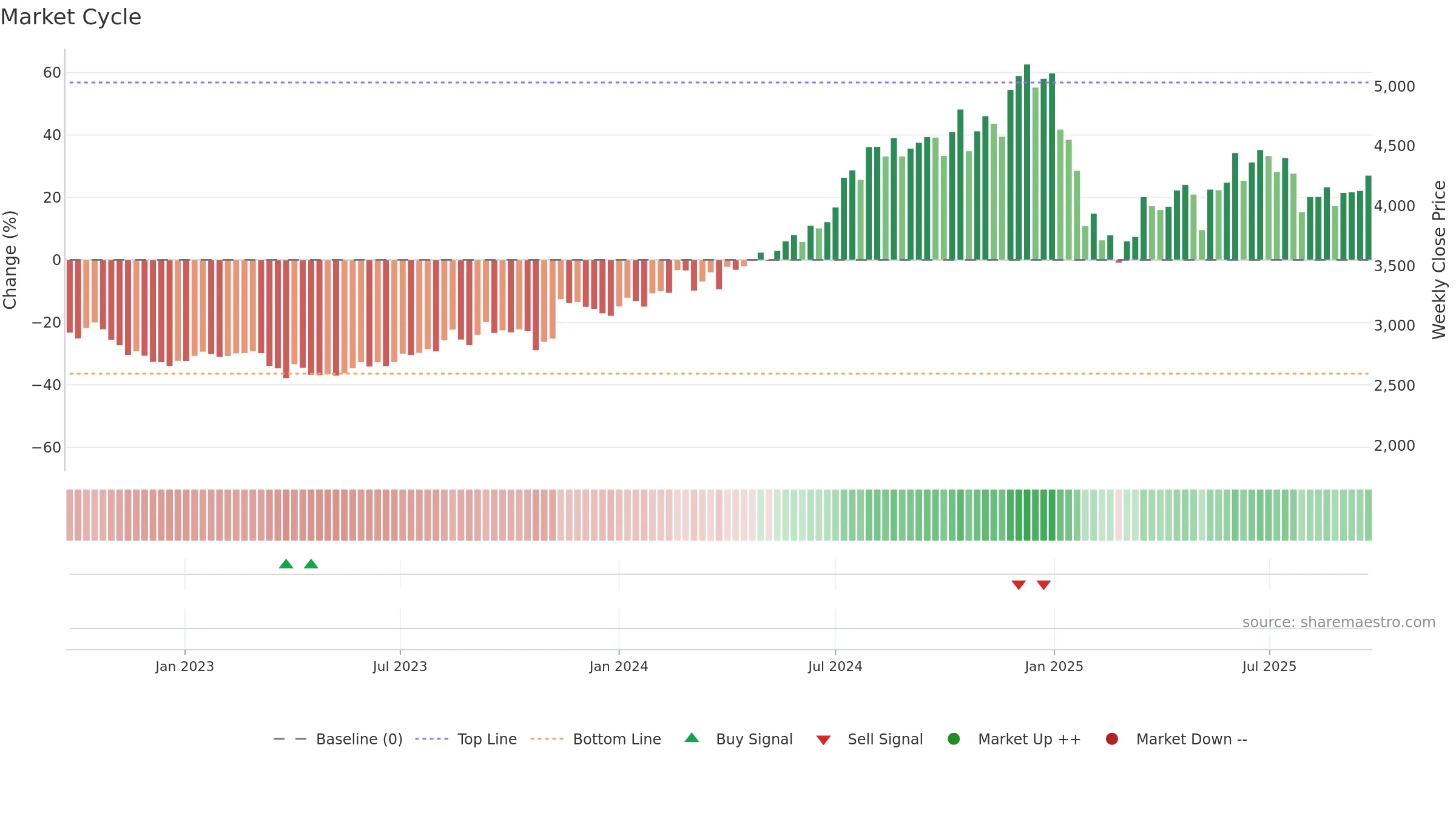

Neutral setup. ★★★⯪☆ confidence. Trend: Range / Neutral · 5.73% over window · vol 2.69% · liquidity divergence · posture above · leaning positive

- Price holds above 8–26 week averages

- Momentum is weak/falling

- Liquidity diverges from price

Why: Price window 5.73% over w. Close is 3.01% above the prior-window high. Volume trend falling. Liquidity divergence with price. Trend state range / neutral. Momentum neutral and falling. Valuation supportive skew.

Tip: Most metrics include a hover tooltip where they appear in the report.