EML Payments Limited

EML ASX

Weekly Report

EML Payments Limited closed at 1.0100 (-1.94% WoW) . Data window ends Mon, 15 Sep 2025.

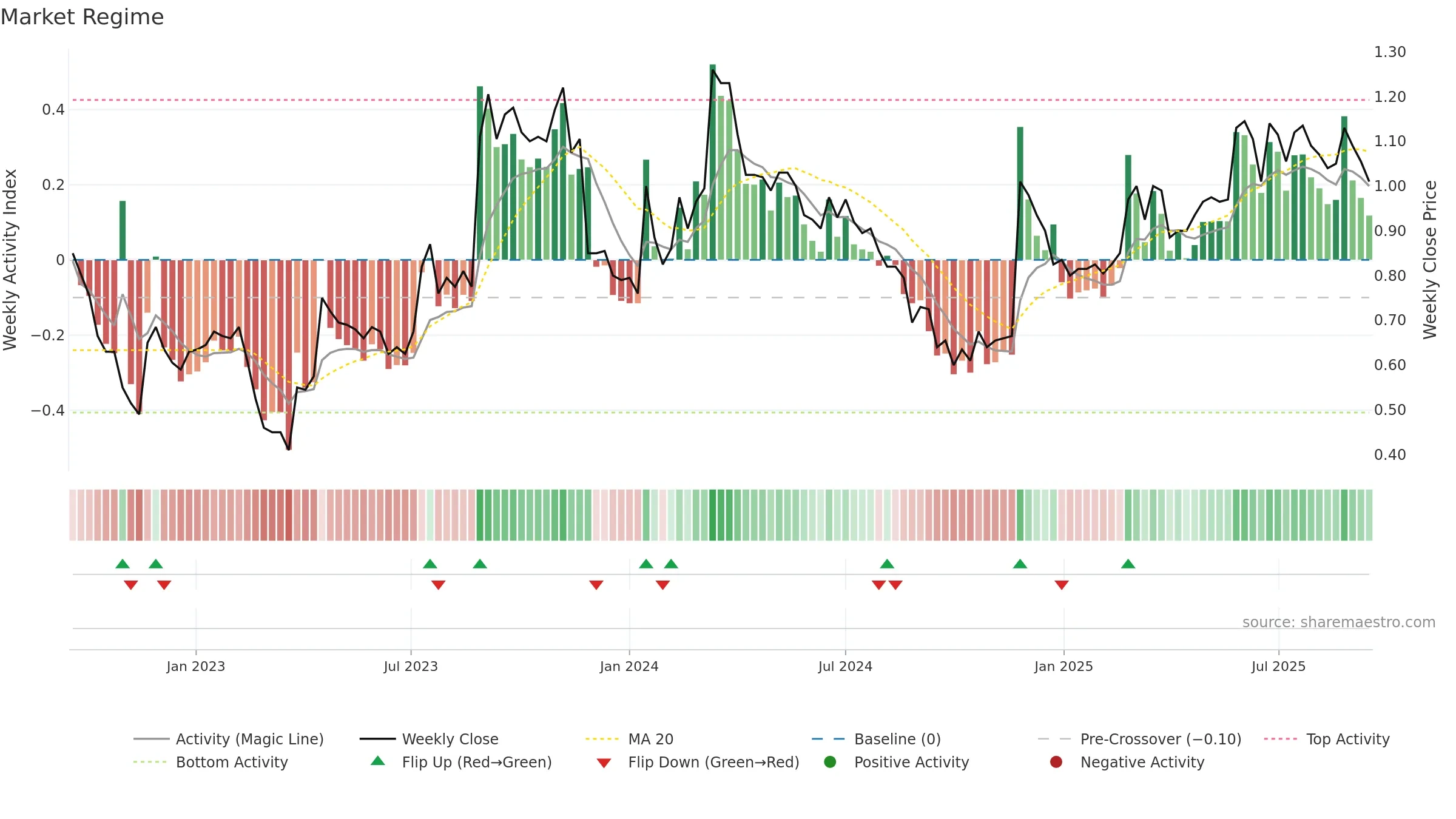

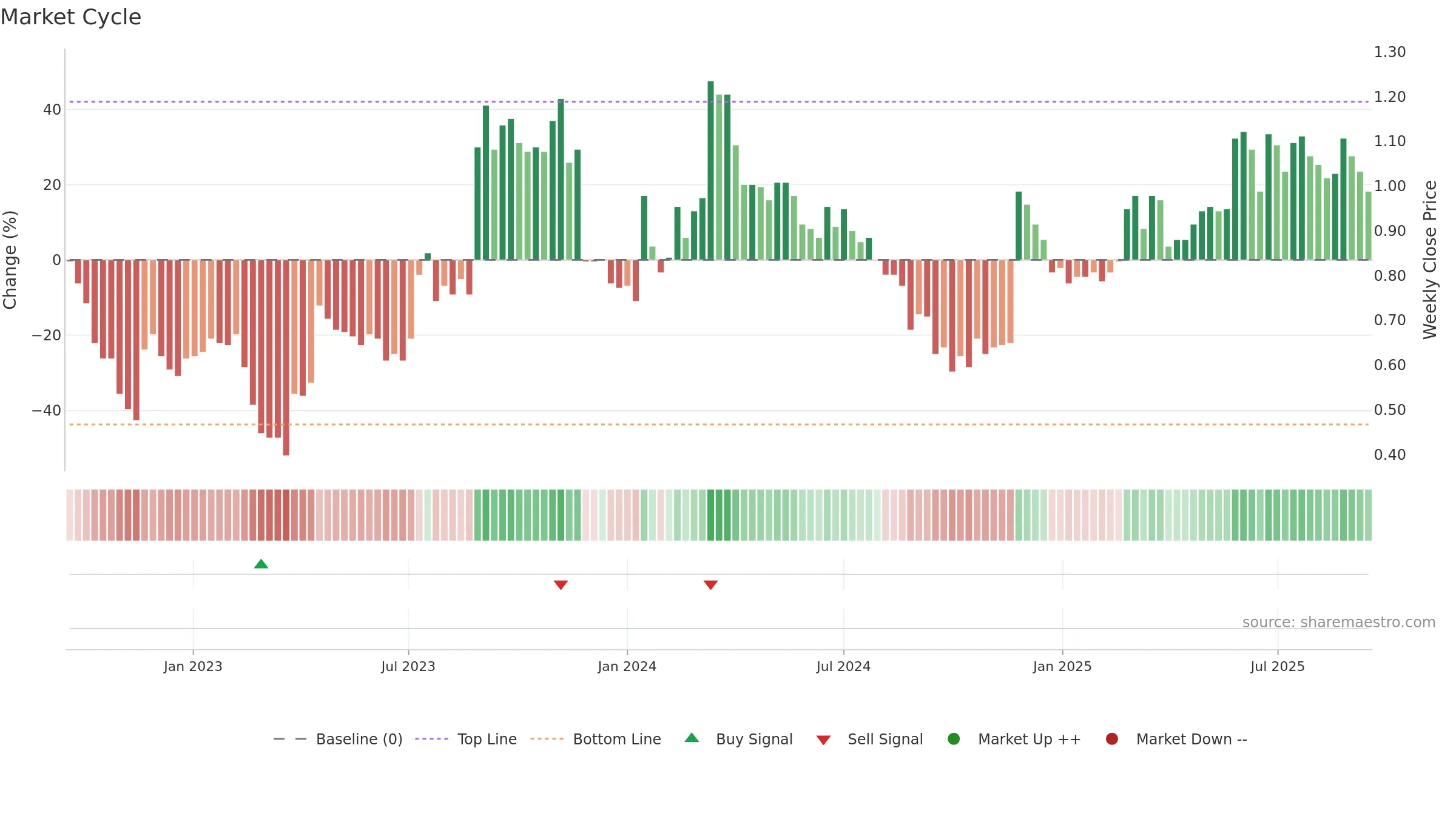

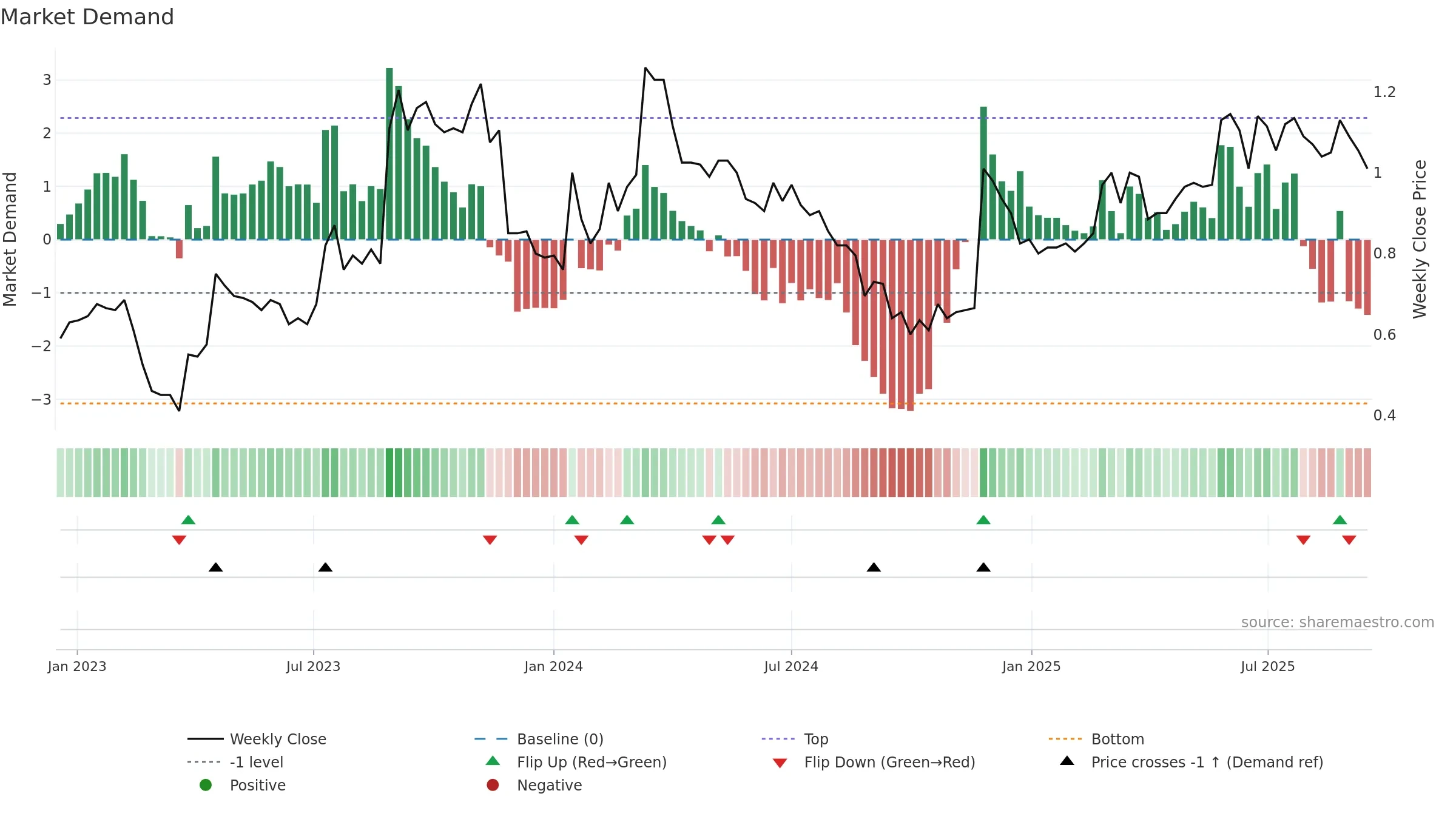

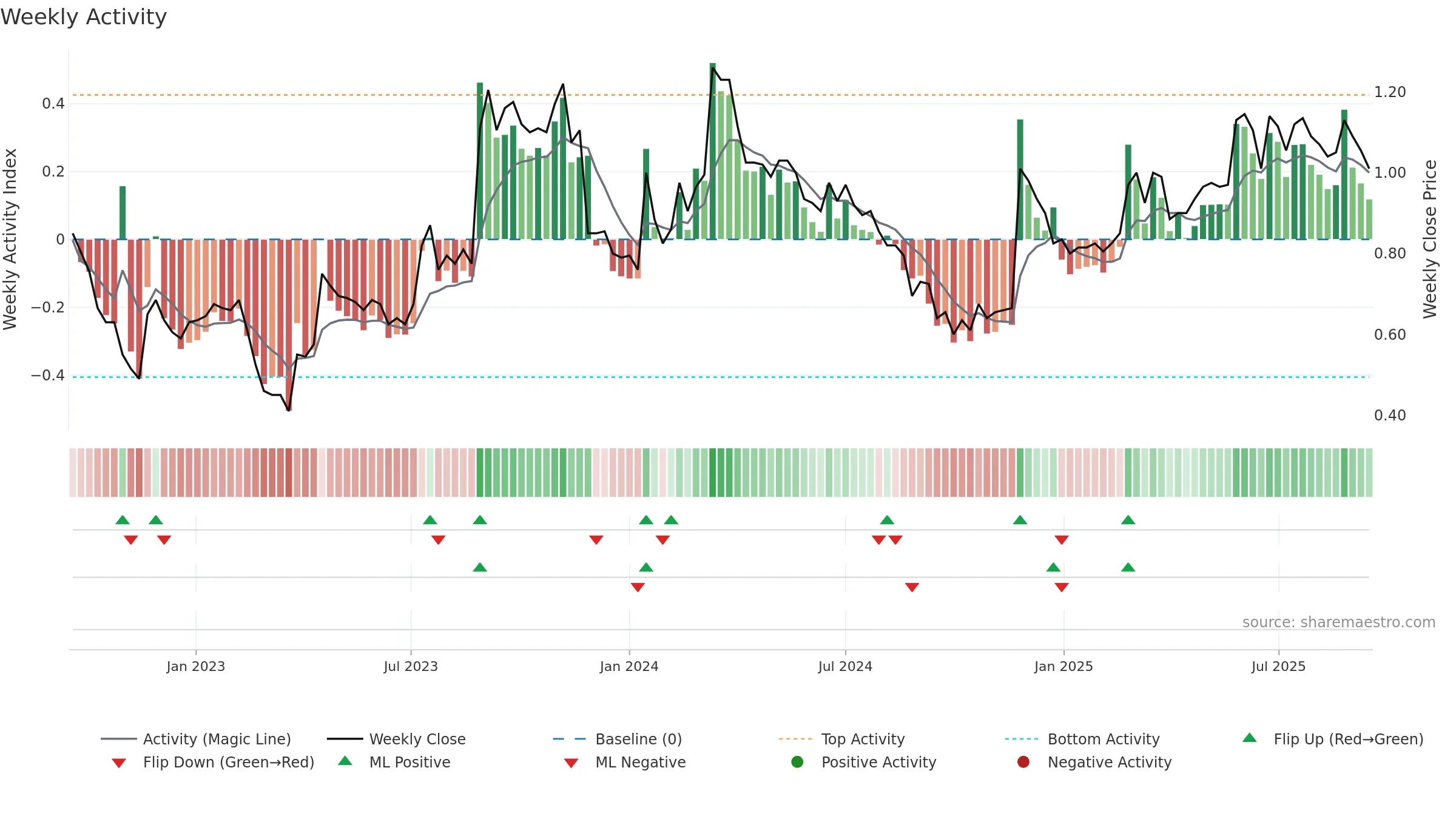

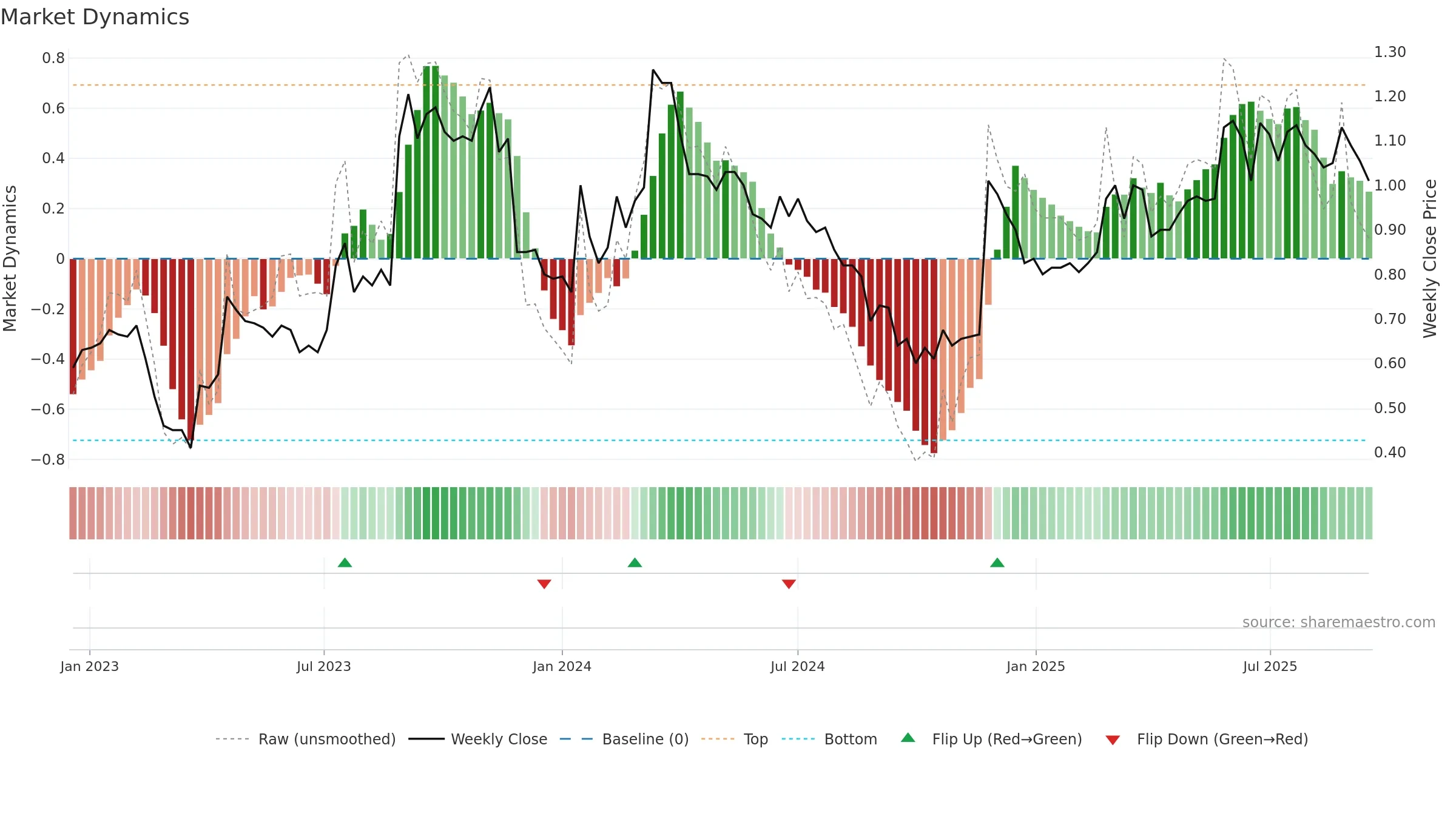

How to read this — Price slope is downward, indicating persistent supply pressure. Volume trend diverges from price — watch for fatigue or rotation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Fresh short-term crossover improves near-term tone. Price sits below key averages, keeping pressure on the tape.

Down-slope argues for patience; rallies can fade sooner unless participation improves. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

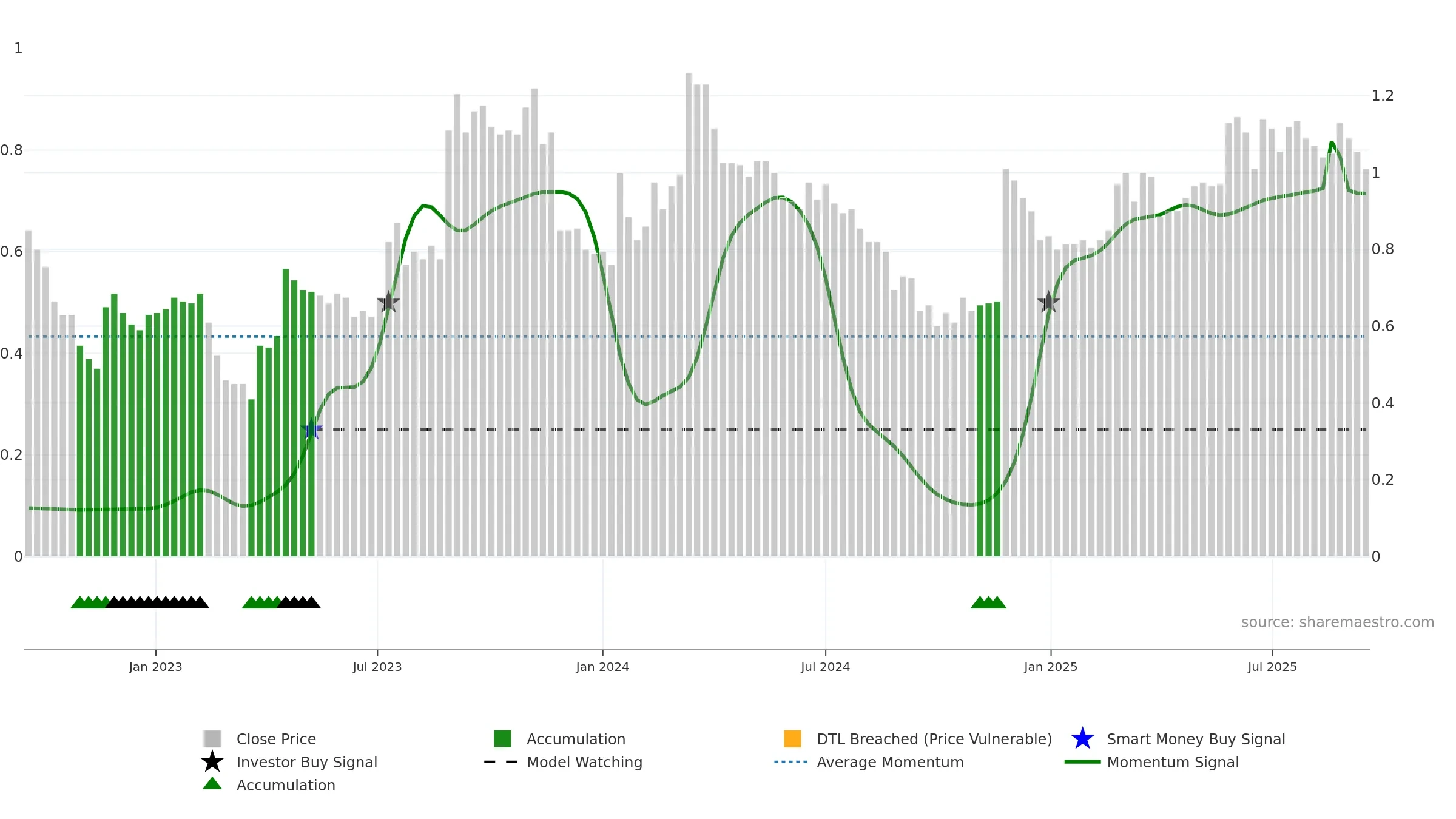

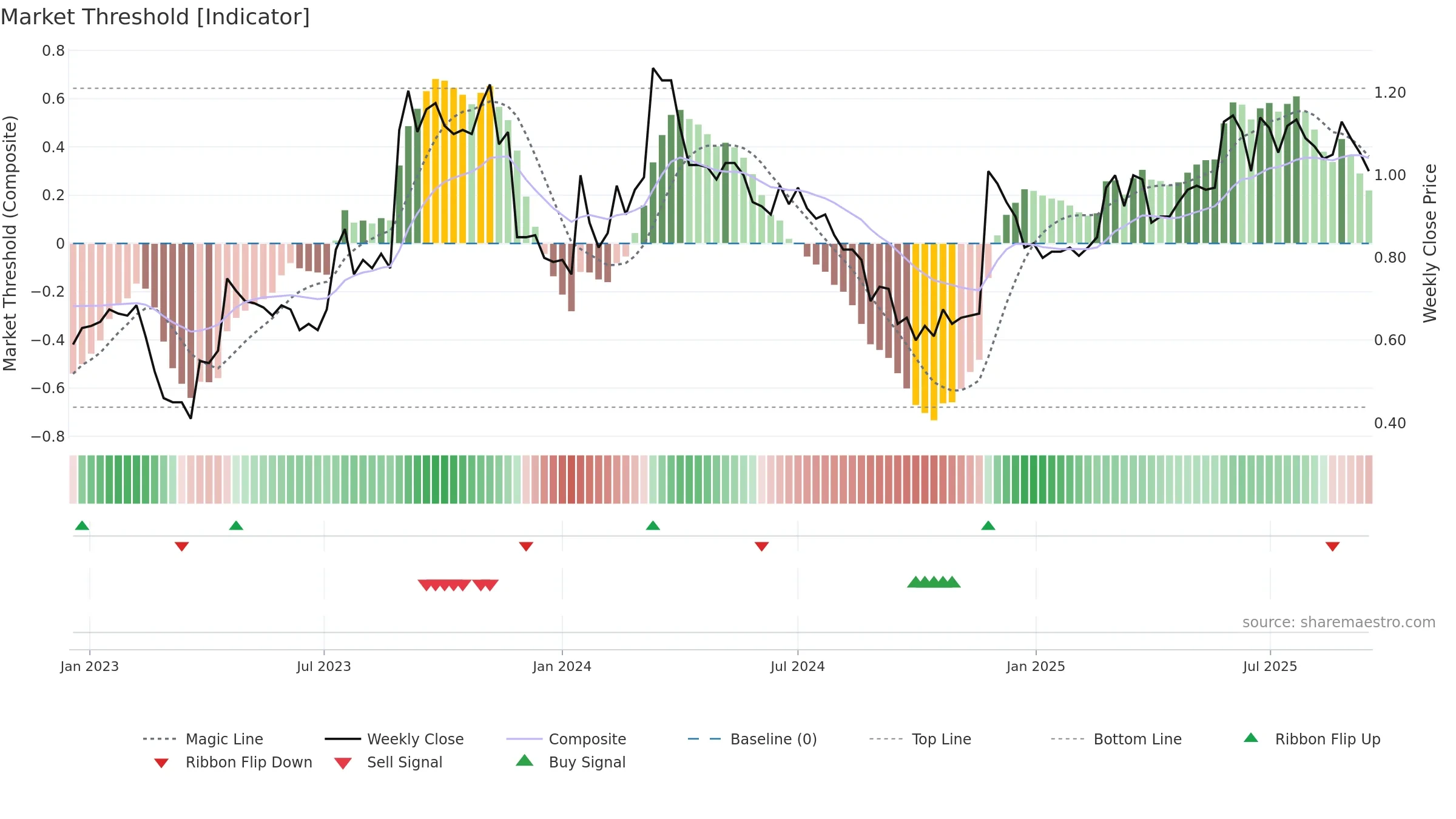

Gauge maps the trend signal to a 0–100 scale.

How to read this — Gauge is elevated but momentum is rolling over; topping risk is rising.

Stay alert: protect gains or seek confirmation before adding risk.

Price is above fair value; upside may be capped without catalysts.

Conclusion

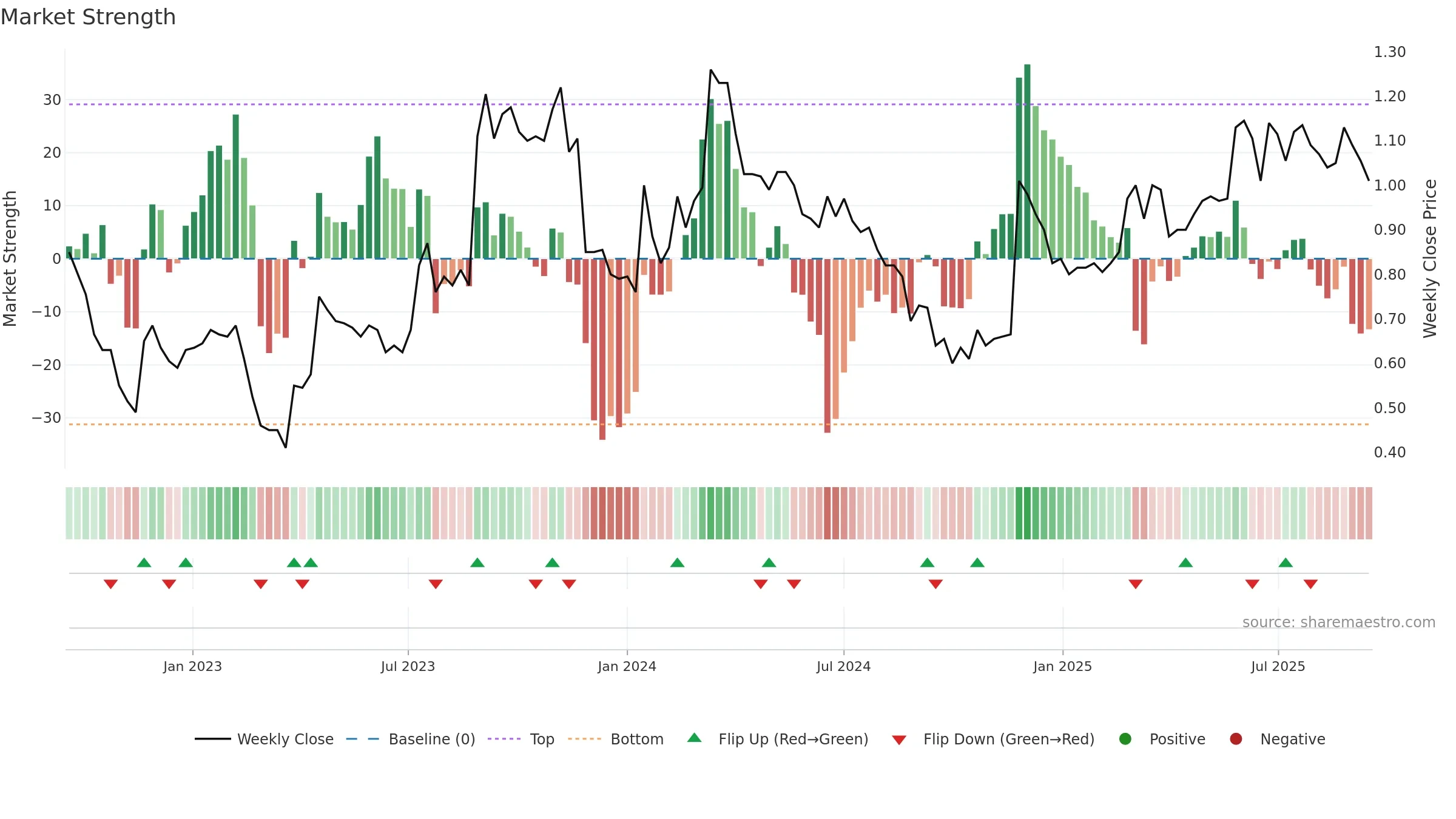

Negative setup. ★★☆☆☆ confidence. Price window: -7. Trend: Uptrend at Risk; gauge 71. In combination, liquidity diverges from price.

- High-level but rolling over (topping risk)

- Momentum is weak/falling

- Price is not above key averages

- Liquidity diverges from price

Why: Price window -7.34% over 8w. Close is -10.62% below the prior-window high. Volume trend rising. Liquidity divergence with price. Trend state uptrend at risk. 4–8w crossover bullish. Momentum neutral and falling. Valuation limited upside without catalysts.

Tip: Most metrics include a hover tooltip where they appear in the report.